DOI:10.32604/cmc.2021.019969

| Computers, Materials & Continua DOI:10.32604/cmc.2021.019969 |  |

| Article |

Big Data Knowledge Pricing Schemes for Knowledge Recipient Firms

1School of Economy and Management, Changsha University of Science & Technology, Changsha, China

2Peter B. Gustavson School of Business, University of Victoria, Canada

3College of Business Administration, University of Nebraska, Omaha, 68182, USA

4College of Business, University of Central Arkansas, 72035, USA

*Corresponding Author: Chuanrong Wu. Email: wuchuanrong01@126.com

Received: 02 May 2021; Accepted: 03 June 2021

Abstract: Big data knowledge, such as customer demands and consumer preferences, is among the crucial external knowledge that firms need for new product development in the big data environment. Prior research has focused on the profit of big data knowledge providers rather than the profit and pricing schemes of knowledge recipients. This research addresses this theoretical gap and uses theoretical and numerical analysis to compare the profitability of two pricing schemes commonly used by knowledge recipients: subscription pricing and pay-per-use pricing. We find that: (1) the subscription price of big data knowledge has no effect on the optimal time of knowledge transaction in the same pricing scheme, but the usage ratio of the big data knowledge affects the optimal time of knowledge transaction, and the smaller the usage ratio of big data knowledge the earlier the big data knowledge transaction conducts; (2) big data knowledge with a higher update rate can bring greater profits to the firm both in subscription pricing scheme and pay-per-use pricing scheme; (3) a knowledge recipient will choose the knowledge that can bring a higher market share growth rate regardless of what price scheme it adopts, and firms can choose more efficient knowledge in the pay-per-use pricing scheme by adjusting the usage ratio of knowledge usage according to their economic conditions. The model and findings in this paper can help knowledge recipient firms select optimal pricing method and enhance future new product development performance.

Keywords: Big data knowledge; knowledge transfer; subscription pricing; pay-per-use pricing; new product development performance

The rapid development of information technology, Internet of Things, social networking, and cloud computing has ushered in a new era of big data. Against this unprecedentedly available data as a backdrop, the knowledge extracted from big data can help firms guide decision-making, cut costs and increase sales [1,2]. Big data knowledge, such as customer demands and user preferences, is among the important external knowledge that firms need for new product development in the hyper-competitive market. The general practice for firms to get big data knowledge is through knowledge transactions. In essence, the knowledge transaction is a process of knowledge transfer, in which knowledge sources own “exclusive” control of knowledge and then obtain economic benefits from the knowledge transaction [3]. The general agreement is that transaction of knowledge is different from that of ordinary commodities inasmuch as the value of knowledge can only be calculated after it is used, and the price of knowledge cannot be determined by the new product development cost [4].

Scholars have researched extensively from the perspective of pricing strategies for private knowledge such as private intellectual property licensing [4–6]. Nonetheless, the characteristics of big data knowledge including open-source, dynamic and multi-source heterogeneity, make its transaction and pricing methods different from that of the private knowledge [7,8]. Prior studies have also introduced an array of pricing schemes for big data knowledge (e.g., cloud services), such as value-based pricing, cost-based pricing, customer-based pricing, competition-based pricing, pay-for-resources pricing, subscription pricing, pay-as-you-go pricing and other dynamic pricing methods [4,9,10]. To date, the most popular pricing schemes for big data knowledge transactions are subscription pricing and pay-per-use pricing [11]. However, these pricing methods mainly focus on firms’ profitability from a big data knowledge provider’s standpoint rather than from that of a knowledge recipient. In the big data environment, firms need big data knowledge for new product development to survive in the marketplace, especially customer demands and consumer preferences knowledge garnered from a host of sources. To our knowledge, prior research has not examined the pricing schemes in big data knowledge transactions from the perspective of firms as knowledge recipients—a theoretical gap addressed by the present research and with practical implications for their knowledge transaction and new product development. More specifically, this study uses theoretical and numerical analysis to compare the profitability of two widely-employed pricing schemes among big data knowledge recipients: subscription pricing and pay-per-use pricing. The present research findings help knowledge recipient firms select the optimal time of knowledge transactions and consequently enhance their future new product performance.

The rest of the paper proceeds as follows. Section 2 discusses the conceptual model and hypotheses for pricing schemes of big data knowledge in new product development. A price-making model of big data knowledge is presented in Section 3. Simulation experiments and comparative analysis of the price schemes are described in Section 4. Section 5 concludes and discusses the limitations and future research directions.

2 Conceptual Model and Model Hypotheses

2.1 Conceptual Model for Pricing Schemes of Big Data Knowledge

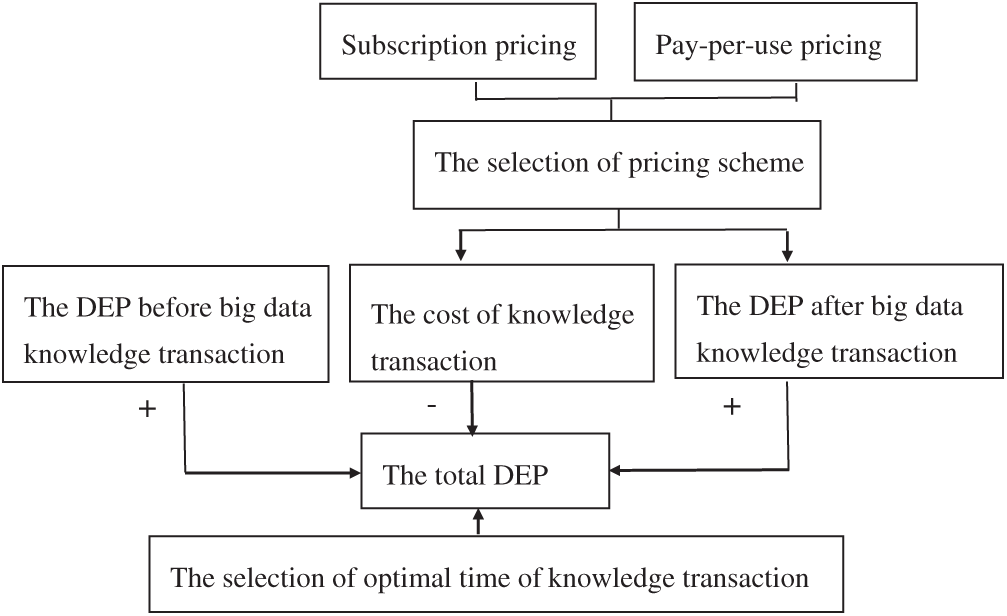

Knowledge transaction is a process of knowledge transfer [3]. Therefore, we could employ the decision model of knowledge transfer for the price decision of the knowledge recipient. Suppose a firm needs to purchase one type of big data knowledge from a big data knowledge provider for its new product development. It would face two major decisions. One is which pricing scheme to choose, and the other is when to carry out new product development with the acquired big data knowledge. The selection of a pricing scheme requires a firm to take a comparative analysis of alternative pricing schemes. Meanwhile, the timing of new product development denotes the selection of optimal time of knowledge transactions.

To compare pricing scheme and select optimal time of knowledge transactions for new product development, a pricing decision model can be established based on the maximization of the discounted expected profit (DEP) of a knowledge recipient firm, which buys one type of big data knowledge from a big data knowledge provider for new product development. The total DEP includes the DEP before knowledge transfer, the DEP after knowledge transfer, and the transfer cost. The pricing scheme of modeling is shown in Fig. 1.

Figure 1: Conceptual model for pricing schemes of big data knowledge

Hypothesis 1.

Hypothesis 2.

Hypothesis 3.

Hypothesis 4. The cost of big data knowledge transaction

Hypothesis 5. The update rate of big data knowledge at the starting point is

Hypothesis 6.

Hypothesis 7.

We keep the same assumptions and variables unchanged in order to verify the validity of the proposed model and compare it with the research results of previous models. Some other assumptions and variables are as follows: the total market volume of the new product is

3 Pricing Decision Model of Big Data Knowledge Transaction

3.1 DEP Before Big Data Knowledge Transaction and New Product Development

Given there is no knowledge transaction and new product development at this stage,

3.2 Cost of Knowledge Transaction

From hypotheses 2–4, the cost of knowledge transaction

According to hypotheses 3 and 5,

After discounting the fixed cost and the variable cost to the starting point, the total cost of big data knowledge transaction can be expressed as Eq. (4).

3.3 DEP After Big Data Knowledge Transaction and New Product Development

According to hypotheses 3 and 6,

If

From hypothesis 5, the update rate of big data knowledge is

Substitute

For a firm that buys a certain type of big data knowledge and utilizes that knowledge for its new product development, its goal oftentimes is to maximize the present value of the expected profit of the new product. Therefore, this given firm’s choice of pricing scheme and optimal time of knowledge transaction is to find the maximum of the total DEP

4.1 Model Solution and Parameter Setting

Similar to a previous research model of knowledge transfer in a big data environment [13–15], we set some parameters in our model at the same values as follows. The total product sales

4.2.1 Simulation with the Usage Ratio of the Big Data Knowledge

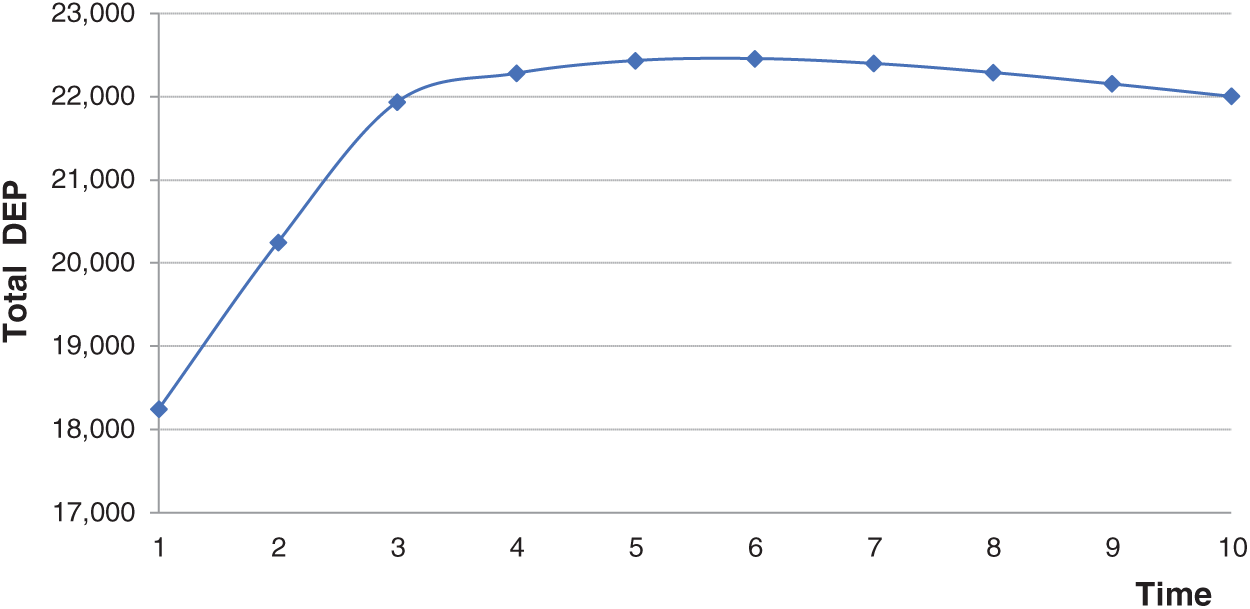

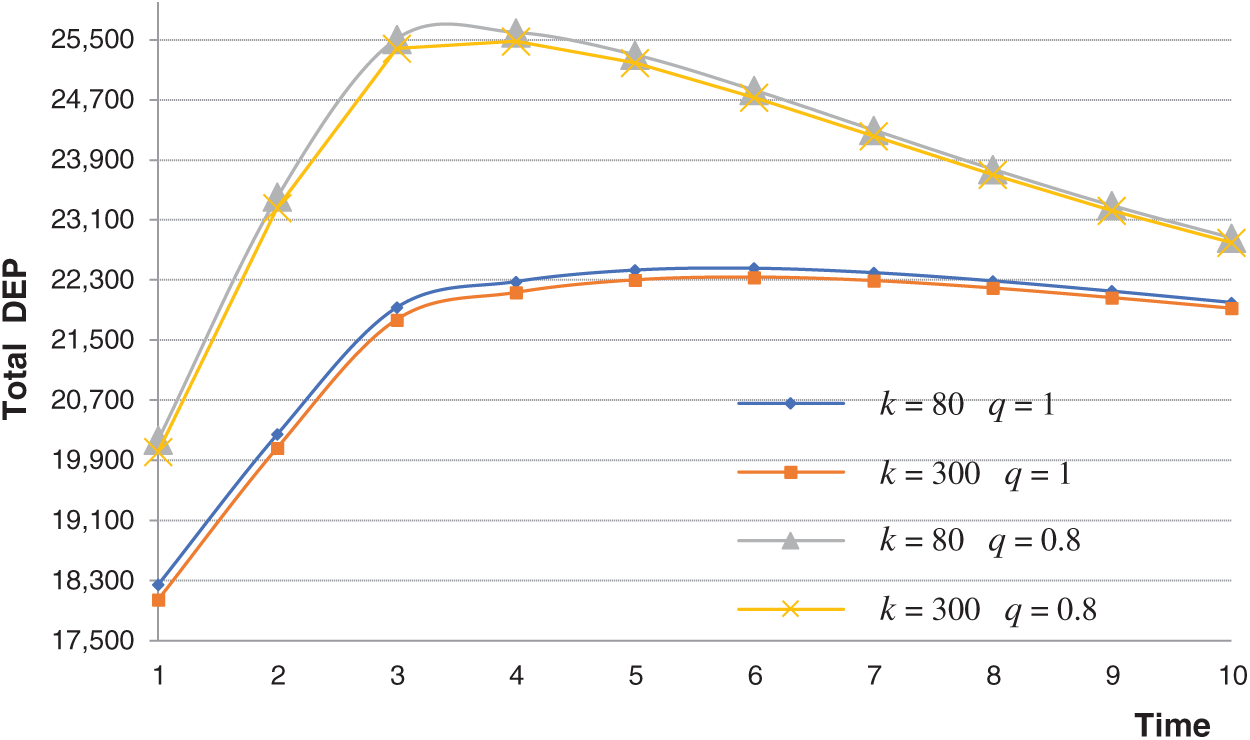

According to prior assumptions and hypotheses,

Figure 2: Changes of total DEP with

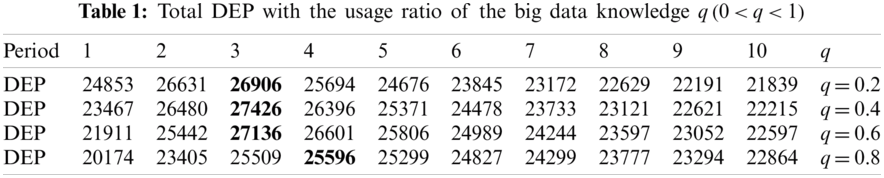

4.2.2 Simulation with the Usage Ratio of the Big Data Knowledge

When

From the experimental results in Tab. 1 and Fig. 3, we can also find that the optimal time of big data knowledge transaction change from

Figure 3: Changes of total DEP with

Let

Comparing the two pricing schemes, it is suggested that the subscription price of the big data knowledge has no effect on the optimal time of knowledge transaction in the same pricing scheme, yet the usage ratio of the big data knowledge affects the optimal time of knowledge transaction. We infer that this is because the big data knowledge price holds the same for all firms in the same pricing scheme regardless of the subscription price increases or decreases. However, a caveat is that the increase in subscription price will reduce the total profit for the knowledge recipient firm.

Figure 4: Changes of total DEP with k and q

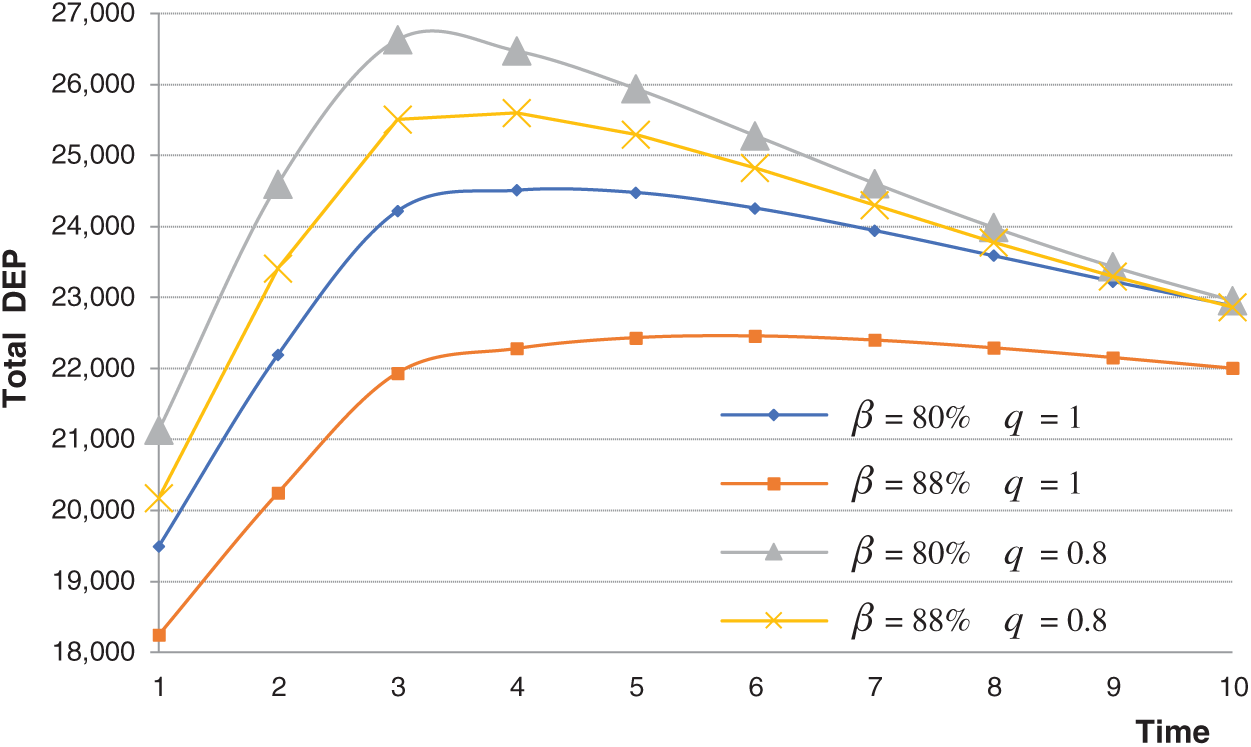

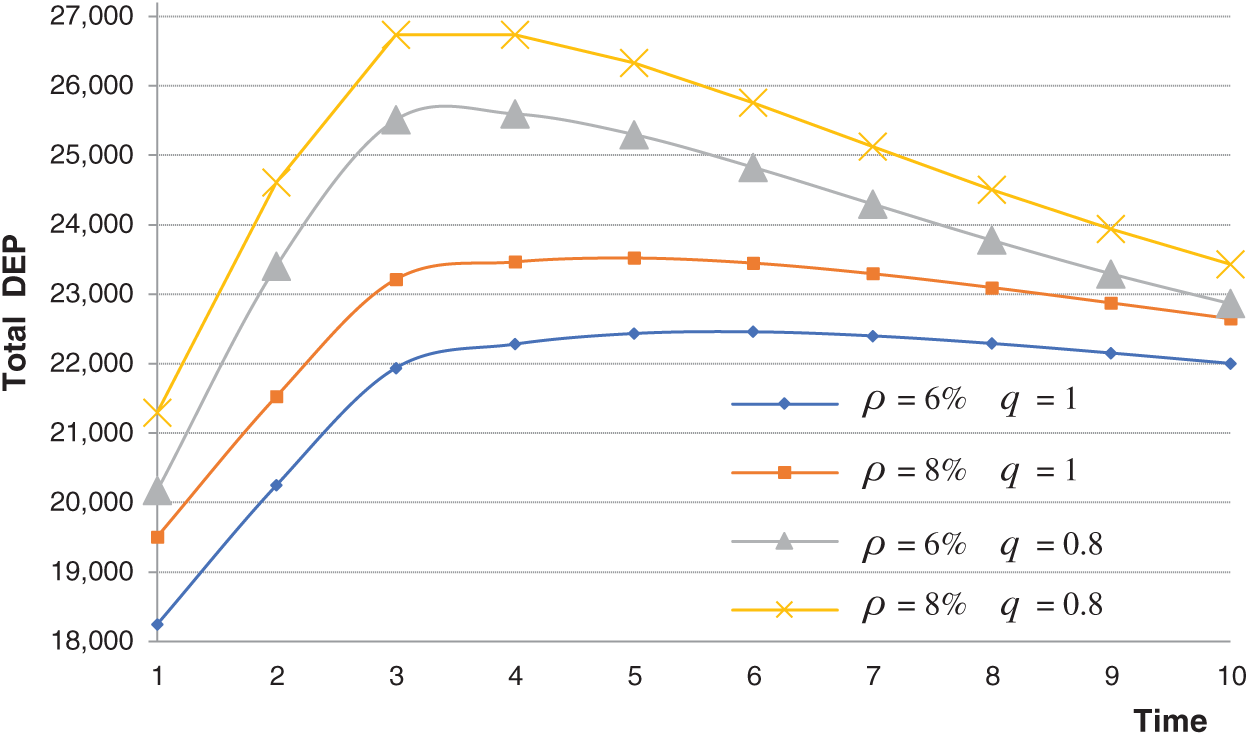

4.2.4 Simulation with Big Data Knowledge Update Rate

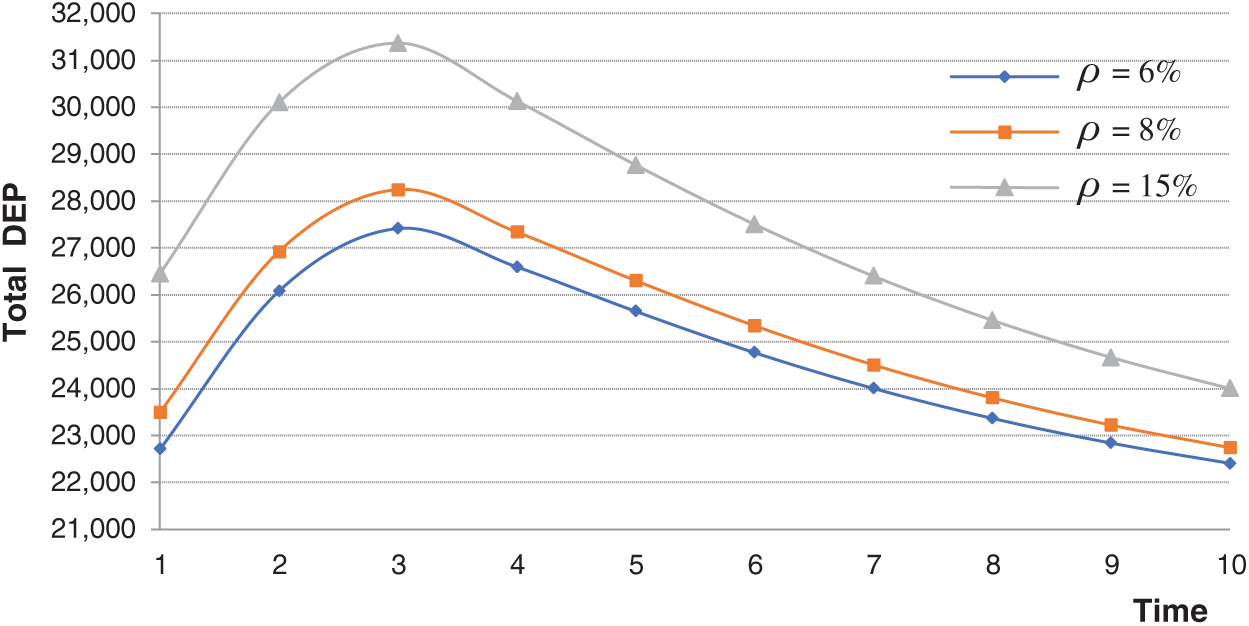

To explore the influence of update rate of big data knowledge

Let

Figure 5: Changes of total DEP with

Figure 6: Changes of total DEP with

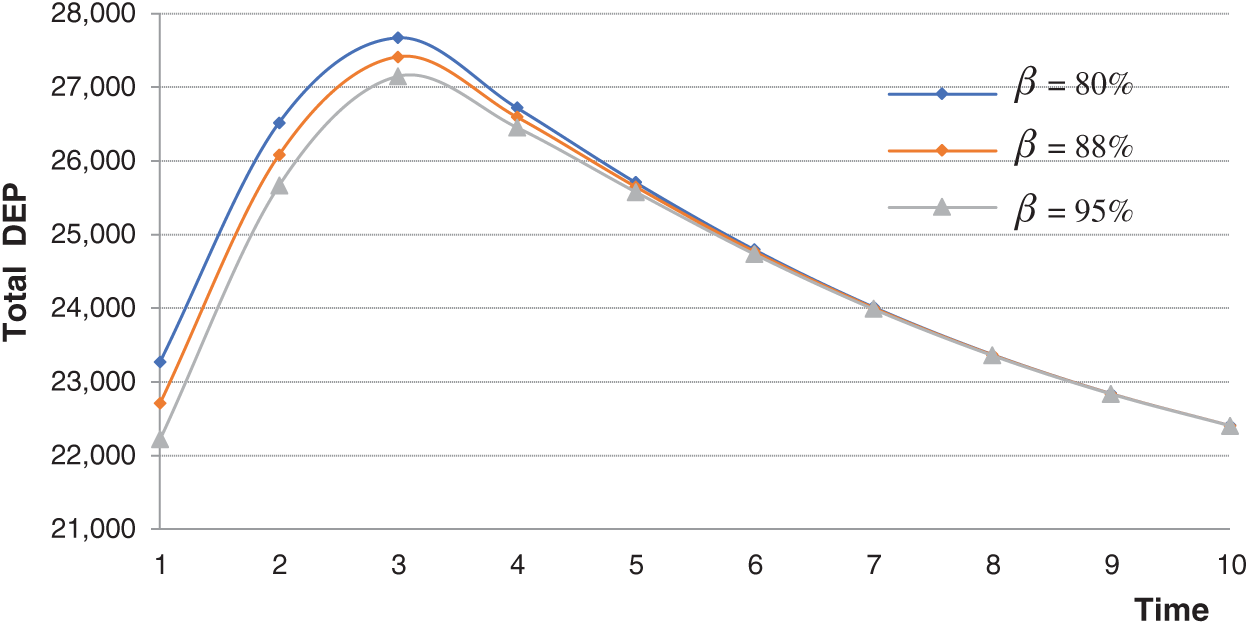

4.2.5 Simulation with the Market Share Growth Rate

To compare the influence of the market share growth rate

Figure 7: Changes of total DEP with

Let

Figure 8: Changes of total DEP with

Firms nowadays leverage external big data knowledge in their new product development. To facilitate more effective knowledge transactions from the perspective of firms as knowledge recipients, this present research developed a model that compares two pricing schemes commonly used by knowledge transactions recipients: subscription pricing and pay-per-use pricing. With solid theoretical and numerical analysis, we gauge and compare the two pricing schemes’ profitability in a novel and rigorous way. The theoretical model in this paper can help firms as knowledge recipients select a more suitable pricing method and forecast its effect on future new product performance.

Several important conclusions can be drawn from this research. First, the experimental result shows that the subscription price of the big data knowledge has no effect on the optimal time of knowledge transaction in the same pricing scheme, but the usage ratio of big data knowledge affects the optimal time of knowledge transaction. The smaller the usage ratio of big data knowledge the earlier the big data knowledge transaction conducts. Although the subscription price of big data knowledge has no effect on the optimal time of knowledge transaction in the same subscription pricing scheme, the increase in subscription price will make the cost of knowledge transaction increase and the firm’s total profit decrease. Second, knowledge with the higher update rate will bring greater profits to firms in these two pricing schemes. More specially, when a firm adopts the pay-per-use pricing scheme at a relatively low usage ratio, the profits brought by different update rates of knowledge are roughly the same in the later stages of the product life cycle. In addition, a firm that takes a lower knowledge usage ratio in a pay-per-use pricing scheme is suggested to conduct knowledge transactions and new product development as soon as it finds the market share begins to decline. Third, no matter what price scheme a firm adopts, the firm should choose the knowledge that can bring higher market share growth rate, so the optimal time of knowledge transaction will be earlier. Firms can choose more efficient knowledge in the pay-per-use pricing scheme by adjusting the usage ratio of knowledge usage according to their economic conditions.

However, due to the complexity of big data knowledge pricing methods, this paper’s model is subjected to a few limitations. First, we did not consider the two-part tariff pricing, albeit some scholars think it as the most profitable pricing scheme for firms [16]. Future research can take into account the two-part tariff pricing scheme. Second, the process of knowledge transactions always co-occurs with the transfer of free knowledge. Therefore, the influence of free knowledge on knowledge transactions and new product performance will be an important research avenue for further research. In addition, new product development usually requires not only big data knowledge but also private knowledge in the big data environment. Future research on pricing schemes of multiple knowledge sources is warranted.

Acknowledgement: This research was supported by the National Natural Science Foundation of China, Grant Number 71704016, the Key Scientific Research Fund of Hunan Provincial Education Department of China, Grant Number 19A006, and the Enterprise Strategic Management and Investment Decision Research Base of Hunan Province (19qyzd03).

Funding Statement: This research was funded by (the National Natural Science Foundation of China) Grant Number (71704016), (the Key Scientific Research Fund of Hunan Provincial Education Department of China) Grant Number (19A006), and (the Enterprise Strategic Management and Investment Decision Research Base of Hunan Province) Grant Number (19qyzd03).

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

1. S. Lohr, “The age of big data,” The New York Times, 2012. [Online]. Available: http://www.nytimes.com/2012/02/12/sunday-review/big-datas-impact-in-the-world.html?_r=1&scp=1&sq=Big%20Data&st=cse. [Google Scholar]

2. F. Xhafa, “Advanced knowledge discovery techniques from big data and cloud computing,” Enterprise Information Systems, vol. 10, no. 9, pp. 945–946, 2016. [Google Scholar]

3. D. Teece, “Technology transfer by multinational firms: The resource cost of transferring technological know-how,” The Economic Journal, vol. 87, no. 346, pp. 242–261, 1977. [Google Scholar]

4. E. Chantrel, A. Grimaud and F. Tournemaine, “Pricing knowledge and funding research of new technology sectors in a growth model,” Journal of Public Economic Theory, vol. 14, no. 3, pp. 493–520, 2012. [Google Scholar]

5. E. Henry and C. J. Ponce, “Waiting to imitate: On the dynamic pricing of knowledge,” Journal of Political Economy, vol. 119, no. 5, pp. 959–981, 2011. [Google Scholar]

6. M. San Martín and A. I. Saracho, “Optimal two-part tariff licensing mechanisms,” The Manchester School, vol. 83, no. 3, pp. 288–306, 2015. [Google Scholar]

7. C. R. Wu, Y. W. Chen and F. Li, “Decision model of knowledge transfer in big data environment,” China Communications, vol. 13, no. 7, pp. 100–107, 2016. [Google Scholar]

8. C. R. Wu, V. Lee and M. E. Mcmurtrey, “Knowledge composition and its influence on new product development performance in the big data environment,” Computers, Materials & Continua, vol. 60, no. 1, pp. 365–378, 2019. [Google Scholar]

9. C. Weinhardt, A. Anandasivam, B. Blau and J. Stößer, “Business models in the service world,” IT Professional, vol. 11, no. 2, pp. 28–33, 2009. [Google Scholar]

10. A. K. Edinat, “Cloud computing pricing models: A survey,” International Journal of Scientific and Engineering Research, vol. 6, no. 9, pp. 22–26, 2019. [Google Scholar]

11. S. H. Chun and B. S. Choi, “Service models and pricing schemes for cloud computing,” Cluster Computing, vol. 17, no. 2, pp. 529–535, 2014. [Google Scholar]

12. C. R. Wu and D. M. Zeng, “Knowledge transfer optimization simulation for innovation networks,” Information Technology Journal, vol. 8, no. 4, pp. 548–594, 2009. [Google Scholar]

13. Y. H. Farzin, K. Huisman and P. Kort, “Optimal timing of technology adoption,” Journal of Economic Dynamics and Control, vol. 22, no. 5, pp. 779–799, 1998. [Google Scholar]

14. U. Doraszelski, “Innovations, improvements, and the optimal adoption of new technologies,” Journal of Economic Dynamics and Control, vol. 28, no. 7, pp. 1461–1480, 2004. [Google Scholar]

15. C. R. Wu, E. Zapevalova, Y. W. Chen and F. Li, “Time optimization of multiple knowledge transfers in the big data environment,” Computers, Materials & Continua, vol. 54, no. 3, pp. 269–285, 2018. [Google Scholar]

16. S. H. Chun, “Cloud services and pricing strategies for sustainable business models: Analytical and numerical approaches,” Sustainability, vol. 12, no. 49, pp. 1–15, 2020. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |