DOI:10.32604/cmc.2022.026568

| Computers, Materials & Continua DOI:10.32604/cmc.2022.026568 |  |

| Article |

Blockchain-based Distributed Power Market Trading Mechanism

1Capital Power Exchange Center Co., Ltd., Beijing, 100031, China

2Beijing Jiaotong University, Beijing, 100093, China

3State Grid Sichuan Electric Power Company, Chengdu, 610041, China

4Hokkaido University, Hokkaido, 060-0808, Japan

*Corresponding Author: Dongjun Cui. Email: 19801116781@163.com

Received: 30 December 2021; Accepted: 07 February 2022

Abstract: Distributed power market trading has the characteristics of large number of participants, scattered locations, small single trading scale, and point-to-point trading. The traditional centralized power trading model has the problems of large load, low efficiency, high cost, reliance on third parties and unreliable data. With the characteristics of decentralization and non-tampering, blockchain can establish a point-to-point trusted trading environment and provide effective solutions to the above problems. Therefore, this paper proposed a distributed power market trading framework based on blockchain. In this framework, the distributed power supply characteristics and trading needs of each participant are analyzed, a complete distributed trading process based on blockchain is designed. In addition, we have studied the key technologies of distributed power market trading. With the goal of power service reputation and maximum revenue of distributed power providers, we have established a matching degree model, a distributed power market trading optimization model, and designed a smart contract-based power market trading optimization strategy and power trading settlement strategy. Finally, we designed experiments to verify the performance of the proposed framework.

Keywords: Blockchain; distributed power trading; smart contract; market trading

With the rapid development of new energy, all kinds of green renewable energy are connected to the power grid as distributed generation, gradually changing the trading system structure of the power market and forming a “multipoint to multipoint” distributed power trading mode. In the distributed power trading model, distributed power generation is located at or near the power consumption site, the generated power does not require long-distance and buck-boost transmission, which has significant advantages compared with centralized power generation and power supply. In the traditional centralized power market, power trading is processed through a centralized management agency using a unified reporting, unified organization, and unified processing model. This kind of power trading mode has problems such as high trading pressure, lack of supervision of management mechanism, and single-point error risk. With the rapid development of renewable energy power generation and distributed power generation and power supply technology, the number of distributed trading is increasing rapidly. The existing power trading mechanism built with the goal of centralized power generation and power supply is gradually unable to meet the demand and adapts to the power market of distributed power generation and power supply. The new trading mechanism needs to be proposed urgently.

Nowadays, distributed energy trading has the characteristics of decentralization, small scale, and lots of buying and selling situations. The existing energy operation model uses traditional centralized institutions to manage trading and has the following problems. First, a large number of distributed energy trading in the future will lead to excessively high operating costs and reduce operating efficiency of trading center, making it difficult to meet the needs of real-time trading. Secondly, there is a trust issue among the trading center and trading party, so it is difficult to guarantee trading fairness, transparency and information validity. In addition, the centralized organization will cause the collapse of entire system after the attack or data damage occurs, and there is a risk of leakage or tampering of trading information. The decentralization, non-tampering, traceability and other characteristics of blockchain can guarantee the effective operation of distributed power trading [1]. By uploading information about market entities participating in distributed trading, volume and price information, trading contracts, consumption vouchers and other information to the blockchain, the technical characteristics of the blockchain can be used to break the information barriers between various entities in the energy market, give all subjects equal right to speak, and enhance the enthusiasm of all parties to participate. Distributed power trading users can read global information, trade on the chain, grasp the changes in the distributed and schedulable power resources in a timely manner, and adjust trading strategies in time to achieve nearby consumption at any time through the blockchain. Based on blockchain smart contract technology, it can provide distributed power trading users with a more flexible, autonomous, and automated trading mechanism. Traders dynamically adjust trading strategies according to distribution characteristics, energy output characteristics and market changes, they can be absorbed nearby, which is effective improve the efficiency of bilateral negotiation of power trading and reduce trading costs. Based on the blockchain consensus mechanism, Chen et al. proposed the non-tampering and traceability of trading information is guaranteed [2]. Combining blockchain technology with a distributed power trading system can achieve the effects of meeting the needs of trading subjects’ individualization and flexibility, simplifying the trading management process, and reducing trading costs. Wang et al. provided a safe and credible negotiation environment for power trading subjects. This promotes the nearby, fast and efficient consumption of power resources [3,4].

In the above context, this paper proposes a blockchain-based distributed power market trading framework and designs a complete distributed trading process based on blockchain. In addition, with the goal of power service reputation and distributed power provider benefits, a matching degree model is established, a distributed power market trading optimization model is constructed, and a distributed power market trading strategy and settlement strategy based on smart contracts are designed. Finally, the proposed scheme is simulated and verified.

In 2008, Bitcoin founder Satoshi Nakamoto (pseudonym) published a groundbreaking paper in the cryptography mail group-"Bitcoin: A Peer-to-Peer Electronic Cash System”, which combining peer-to-peer transmission, asymmetric encryption algorithms, distributed data storage. A number of existing technologies have been combined and innovated uniquely to achieve functional integration and put forward the basic concept of blockchain technology. As a universal underlying technology framework, blockchain can be widely used in different fields such as finance, insurance, and materials. The development of blockchain technology has roughly gone through three stages: the distributed ledger stage, the smart contract stage and the token deposit stage.

The distributed ledger stage: In the Bitcoin application, the blockchain is used as a distributed accounting technology to record all trading records of Bitcoin to ensure that the trading records cannot be tampered with. At this stage, the blockchain is used as a ledger for storing trading records, and the consistency of data in the network is enhanced by storing the same ledger by multiple parties, and the ledger data is not easily tampered with in a distributed network.

Smart contract stage: Smart contract is a business function executed on the blockchain. It is a kind of on-chain code and automatically executed business logic. Based on the smart contract, Cui et al. endowed the blockchain with programmable features, enabling the blockchain to run specific businesses and provide multiple services [5,6]. Blockchain technology with smart contract features can be used as a technology platform to directly provide developers with open services, that is, BaaS (Blockchain as a service). In the smart contract stage, the application of blockchain has been extended to many fields such as the Internet of Things, supply chain management, and digital asset trading.

Token deposit stage: In this stage, the application field of blockchain will be expanded beyond the financial industry, and blockchain technology will be used to build a trusted data sharing environment based on tokens (certificates), and no longer rely on a third party or institutions gaining trust or establishing credit can be applied in various fields including justice, medical care and logistics, so as to solve the trust problem, form an ecological environment based on the value system, and improve the operating efficiency of the entire system.

With the development of energy Internet, energy forms such as distributed photovoltaics, wind energy and energy storage batteries are in line with the transition and development of low-carbon energy in countries around the world, have gradually become important power generation resources. Compared with centralized renewable energy power generation, distributed power generation has the characteristics of large number, small capacity, low voltage level, greater output volatility and scattered distribution. It is not suitable for participating in the traditional power wholesale market. Therefore, the establishment of a power market suitable for high-penetration distributed power trading is of great significance for promoting the nearby consumption of renewable energy.

With the continuous increase in research and pilot projects of energy interconnection based on blockchain technology, many typical application scenarios have been formed, including the “Share&Charge” blockchain platform, blockchain e-wallet, Sonnen Community project, Scanergy project, Transactive Grid [7–11]. Blockchain technology has emerged in the field of clearing and settlement, including settlement applications such as the Linq platform, the T0 blockchain trading platform, and the SETLcoin system [12].

In 2015, the US energy company LO3 Energy and the blockchain company consensus cooperated with Transactive Grid. The project uses Ethereum for energy payment. Its core idea is that the voltage level of distributed photovoltaics is relatively low, and the power cannot withstand long-distance transportation consumption and can only be used for local consumption. Based on the local energy micro-grid, Dai et al. realized a point-to-point power trading between users and generators [13,14].

2.2.2 “Share&Charge” Blockchain Platform

German power company Rheinland Group and Slock.it have developed the “Share&Charge” blockchain platform on which drivers can handle clean energy vehicle-related operations, including allowing drivers to share their charging stations, pay tolls and charging an electric car. The platform relies on Ethereum to operate, especially the smart contract and distributed ledger technology supported by Ethereum, Giraldo et al. realized the transparency and trust of billing [15,16]. Specifically, it is to create a token on the blockchain and distribute the mobile value denominated in euros on the token. “Share&Charge” created a distributed market, subverting the traditional energy service model: third-party services from partners are shared without asking permission or using cumbersome application programming interfaces.

2.2.3 Sonnen Community Project

In the field of distributed smart grids, Tennet cooperated with battery supplier Sonnen to use IBM's blockchain software to operate Europe's first blockchain-controlled power stabilization program. Renewable energy may be clean and environmentally friendly, but due to the influence of climate and weather, it is not always available when needed. Kong et al. adopted a new method to better integrate scattered renewable energy and achieve safe supply, so as to encourage citizens to actively participate in the energy transition [17,18].

The Scanergy project launched by the European Energy Union uses NRGCoin as a lubricant for the renewable energy economy, aiming to realize direct trading of green energy for small users. On the one hand, the blockchain directly connects the production and consumption ends, on the other hand, it standardizes this new type of trading in the market [19–23].

2.2.5 WePower Green Energy Trading Platform

The WePower platform supports renewable energy producers to issue energy tokens to raise funds. Token holders can participate in the energy token auction on the platform first, and can purchase energy at a lower price after the energy producer is built [24–27].

On the whole, although the development of distributed power generation has gradually accelerated in recent years, issues related to distributed power trading, such as trading models and trading mechanisms, require further exploration. There is an urgent need to carry out research on the application of blockchain technology to distributed power trading, and to extend it to other fields when the technology matures.

3 Distributed Power Market Trading Framework

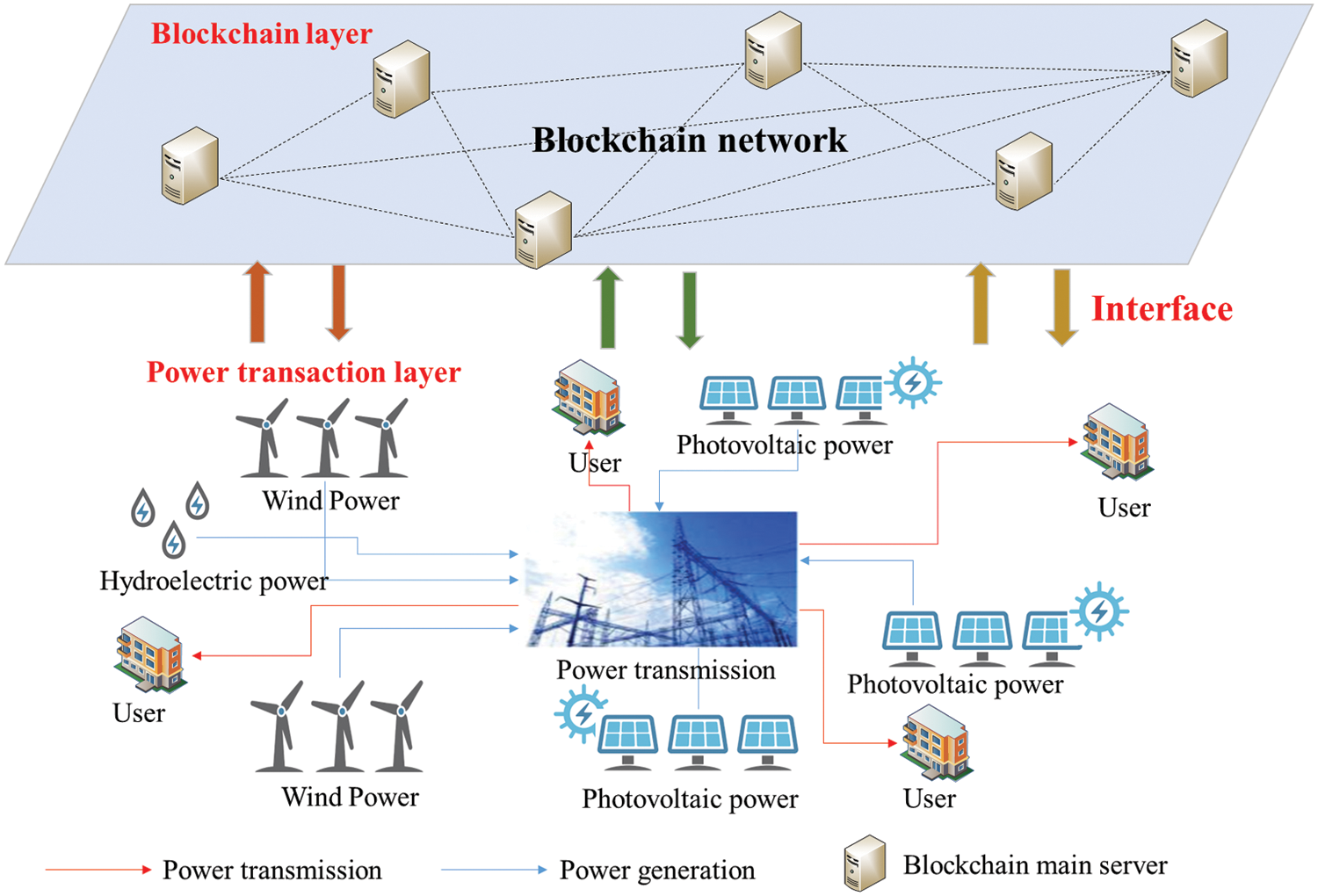

As shown in Fig. 1, we propose a distributed power market trading framework based on blockchain. The framework mainly includes two layers: the power trading layer and the blockchain layer. In power trading layer, it mainly includes two types of entities: users and distributed power providers. Distributed power providers supply power to users nearby to obtain revenue. Their power generation forms mainly include wind power, hydropower, and photovoltaic power generation. In blockchain layer, the main servers of the blockchain are connected to each other to form a reliable trading network without trust. Among them, the main server is maintained by the energy bureau, the power grid company, the notary office, and the trading center. Users and distributed power providers are connected to the blockchain server as a blockchain network node through the inter-layer interface to achieve access to the blockchain network and complete tasks including trading chaining, price negotiation, power transmission and distribution automatic realization of functions such as distribution and trading settlement. Among them, users and distributed power providers have a one-to-one correspondence with smart devices running blockchain nodes. As the main body of power trading, as participants in the blockchain network, they share resources and jointly maintain the stable operation of the blockchain network. And the effective execution of smart contracts. The “ledger” data maintained in the blockchain network mainly includes: trading records, user information (basic information), distributed power provider information (basic information, number of trading, reputation, power supply capacity, power price, etc.).

Figure 1: Blockchain-based distributed power market trading framework

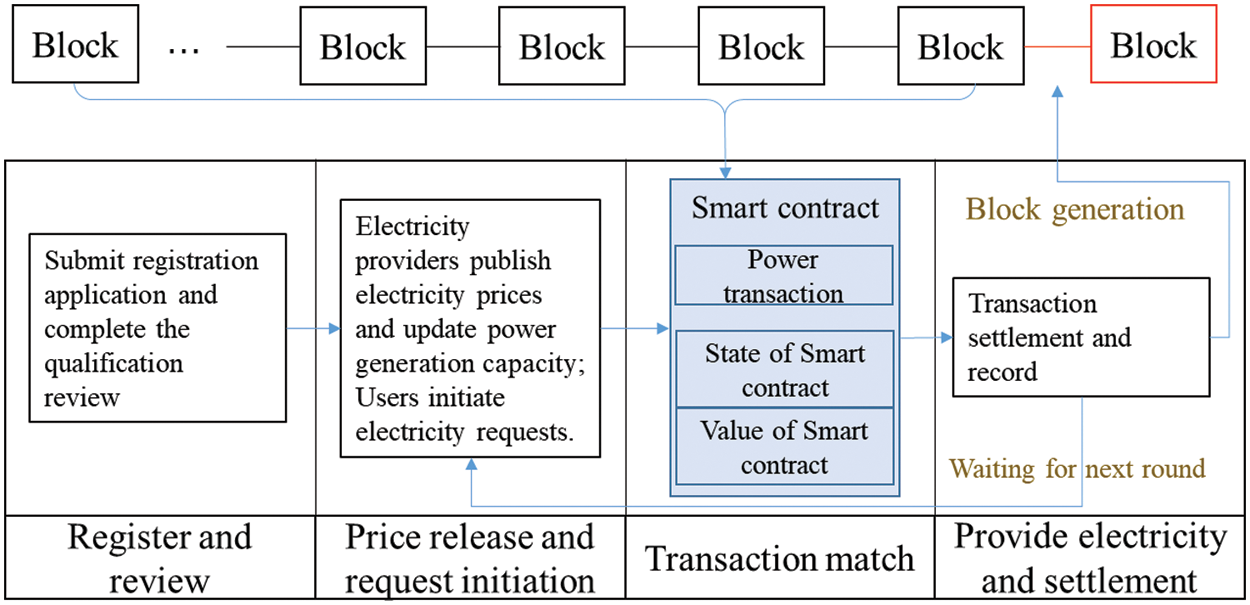

As shown in Fig. 2, in the distributed power market trading based on the blockchain, it mainly includes the following trading processes:

Figure 2: Procedure of distributed power trading

3.1 Registration and Qualification Review

Considering that distributed power trading relies on multi-party services to achieve, distributed power providers and users as the main initiators and participants need to submit registration applications and complete qualification reviews to obtain access to the network before power generation, power supply, and power consumption. The registration application information (basic information) of distributed power providers and users mainly includes: user name, meter ID, user/power supply address, trading settlement information (bank account number, etc.). In the system model, we complete automated trading registration processing and qualification approval by defining smart contracts.

3.2 Power Price Release and User Request Initiation

The distributed power provider that has completed the registration and qualification review will release the current trading cycle power price and update the power generation capacity to the blockchain network through the interface, and the user will initiate a power request and submit the power consumption.

The blockchain network receives user requests in the current trading cycle, calls smart contracts to analyze the power generation capacity and power prices of distributed power providers, completes trading matching, and generates electronic trading orders.

3.4 Power Supply and Trading Settlement

After the blockchain completes the trading matching and generates the electronic trading order, the matching result and the electronic trading order are sent to the user and the distributed power provider through the downlink interface, and the distributed power provider transmits power to the user through the grid according to the declared power generation capacity. After completing the agreed power delivery, a trading settlement application is initiated, the blockchain network completes the trading settlement, and the provider and user enter the next trading cycle respectively.

4.1 Blockchain Network Structure

In the distributed power market trading framework, the blockchain network forms a backbone network with a central main server node, and distributed power providers and users are connected to the network as edge nodes. Users and distributed power providers choose to configure as blockchain client nodes or blockchain peer nodes according to their computer computing capabilities. Among them, the blockchain client node only has the ability to initiate trading, does not store all the information of the blockchain ledger, and cannot provide a blockchain network access interface for other nodes. Blockchain peer nodes are a type of block chain complete nodes that store complete block chain data, have the ability to participate in block chain consensus, and can provide block chain network access interfaces for other nodes.

In the distributed power market trading based on the blockchain, the blockchain adopts the traditional chain structure, which is composed of blocks arranged in chronological order. These blocks are composed of a block header and a block body. The block header includes the block number, timestamp, hash index of the previous block, and trading Merkle tree root. The block body is formed by sequential trading, and these trading will store data including distributed power provider information, user information, trading records, smart contracts and other data. Among them, the smart contract is an executable control program, which is stored in the “ledger” in the form of blockchain data, and has the characteristics of non-tampering and automatic execution. The blockchain-based store market trading mechanism mainly includes three parts of smart contracts: user registration and approval, power trading matching, and power trading settlement.

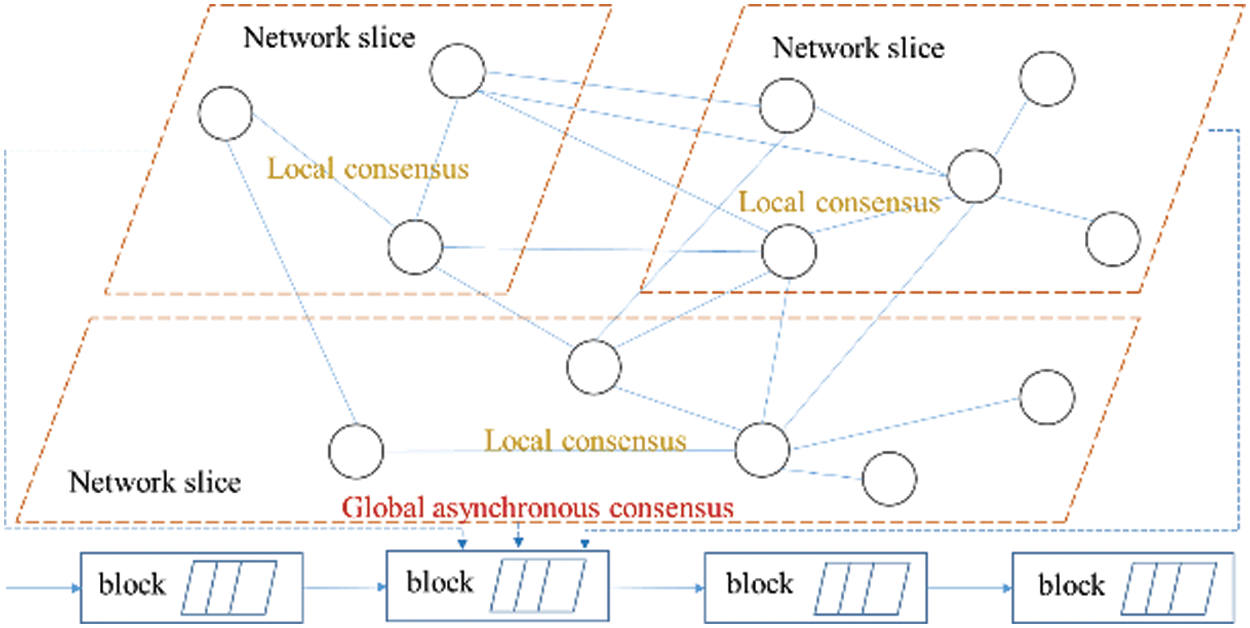

4.3 Multi-center Collaboration Consensus Mechanism Based on Sharding

The consensus algorithm is the key to ensuring the correct and reliable operation of the blockchain network. Considering the characteristics of large distributed power trading volume, in order to meet the real-time requirements of the power business system, a multi-center collaborative consensus mechanism based on sharding is designed as Fig. 3. The mechanism includes three parts: sharding network division, sharding regional consensus establishment, and global sharding asynchronous consensus establishment.

Figure 3: Multi-center collaborative consensus mechanism based on sharding

In the sharding network division part, first logically separate the trading networks in different geographic regions. They still belong to the same blockchain record range, but the range of consensus nodes is smaller and the scale of block synchronization is also smaller. In the process of establishing the sharding regional consensus, the sharding network consensus is first constructed within the sharding network. The consensus follows the PoW consensus mechanism to ensure that all parties involved complete the block generation more fairly. The blockchain nodes in the sharding network will select a proxy node in the network. This proxy node announces the consensus results of the shard network it represents, and communicates with the proxy nodes of other shard networks to reach a consensus on energy trading in the large network. In consideration of various factors such as performance, the regional consensus and the consensus of large network supply and demand are reached in an asynchronous manner. That is, each agent node in a large-scale blockchain node network first publishes the regional consensus reached by its agent node to all nodes in the network, and records other micronet consensus records issued by other nodes. Then, these records are confirmed on the chain in the big network. After that, the accuracy of all regional consensuses that have been on the chain will be verified and reflected in the next consensus. Inaccurate regional consensus records in the previous block will be corrected. Agents that provide incorrect regional consensus information will be punished by the consensus mechanism.

The consensus mechanism proposed in this section can reduce the degree of coupling between shards on the time scale of reaching a consensus, ensure that blockchain nodes reach consensus without requiring precise time synchronization, and support reliable distributed trading integration application blocks the bottom platform of the chain.

5 Distributed Power Market Trading Mechanism Based on Smart Contract

5.1 Distributed Power Market Trading Matching Strategy

In the entity model, we define the user participating in the trading as

Reputation is a quantitative assessment of the reliability of the entity's behavior. It quantifies the reliability of the behavior of the power provider entities participating in distributed power trading, that is, completes the reputation evaluation, which can provide an effective data reference for power trading matching. In order to evaluate the long-term reliability of power supply entities, we define the reputation model as two parts: current reputation and comprehensive reputation.

We define the past trading of power provider

Based on the current reputation in period T, we define the comprehensive reputation in period T as

where

After the power supply node completes power supply, it will provide income settlement. At this time, the settlement income is calculated based on its declared power price

where

5.1.4 Power Trading Matching Degree Model

Based on the comprehensive reputation of power providers and their income, we propose the power trading matching model as follows:

The greater the reputation value and profit, the higher the degree of matching. This is to ensure that users can obtain more reliable services when conducting power trading between users and power providers, and power providers can obtain greater benefits. In order to promote more participation of both parties in the distributed power trading market.

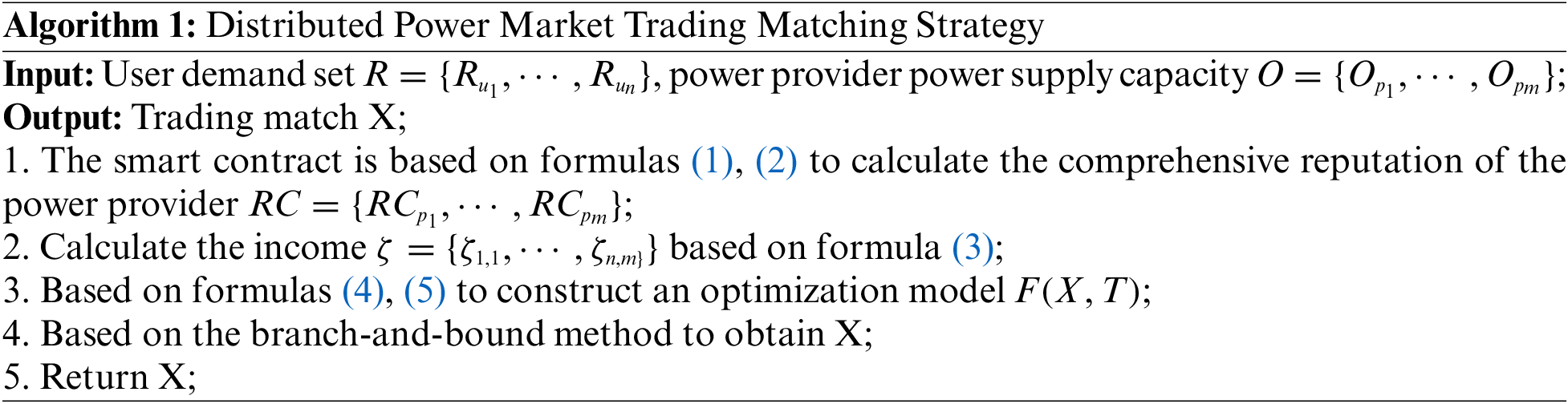

5.1.5 Power Trading Matching Strategy

In the power trading process, the blockchain is responsible for maintaining the relevant information required for trading matching, and accepting user requests to call smart contracts to complete the power trading matching, electronic trading contract signing and trading settlement in the current trading cycle, and complete recording of the power trading process.

Considering that the higher the matching degree, the higher the recognition of power trading by users and power trading providers, we define the optimization goal of power matching in the trading period T as

where

The summary of the distributed power market trading matching strategy is shown in Algorithm 1.

5.2 Distributed Power Market Trading Settlement Strategy

After the blockchain network completes the trading matching, an electronic contract will be signed for the selected trading parties. In this process, in order to prevent the user from failing to complete the trading payment after accepting the power supply service, and trading fraud, the blockchain settlement smart contract we designed will charge a predetermined amount, that is, the user needs to first transfer the pre-sale amount in blockchain tokens Send the form to the smart contract account for storage. The amounts of tokens is measured according to the market price of the tokens and the amount of power supplied. Define the current token market price as t token/cash currency, then the pre-sale amount is

Define the transmission power submitted by the equipment close to the power provider as

The power bill deducted by the penalty mechanism is:

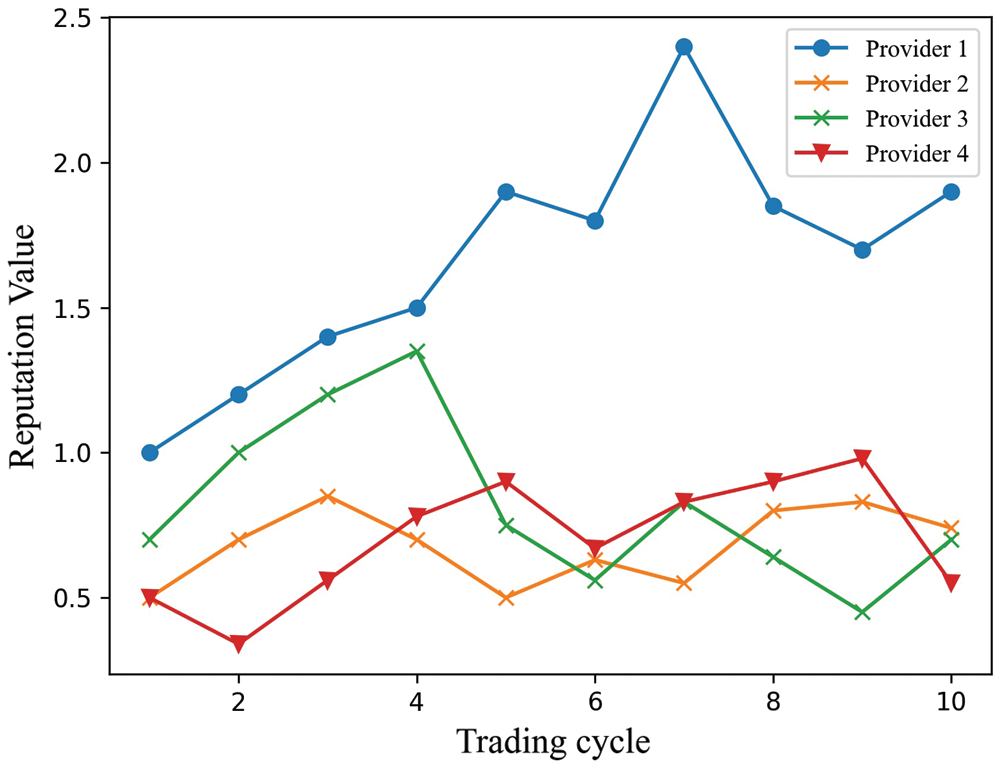

In the simulation, four distributed power providers are defined. Among them, provider 1 is an honest power supply node whose power supply capacity exceeds the power supply demand, and provider 2 is a dishonest provider node. Each time the power supply is less than the power supply demand, provider 3, 4 Unstable, honest power supply service is provided randomly. It is defined that each trading cycle completes 10 trading, a total of 10 cycles, and the time impact factor

Figure 4: Changes in reputation value

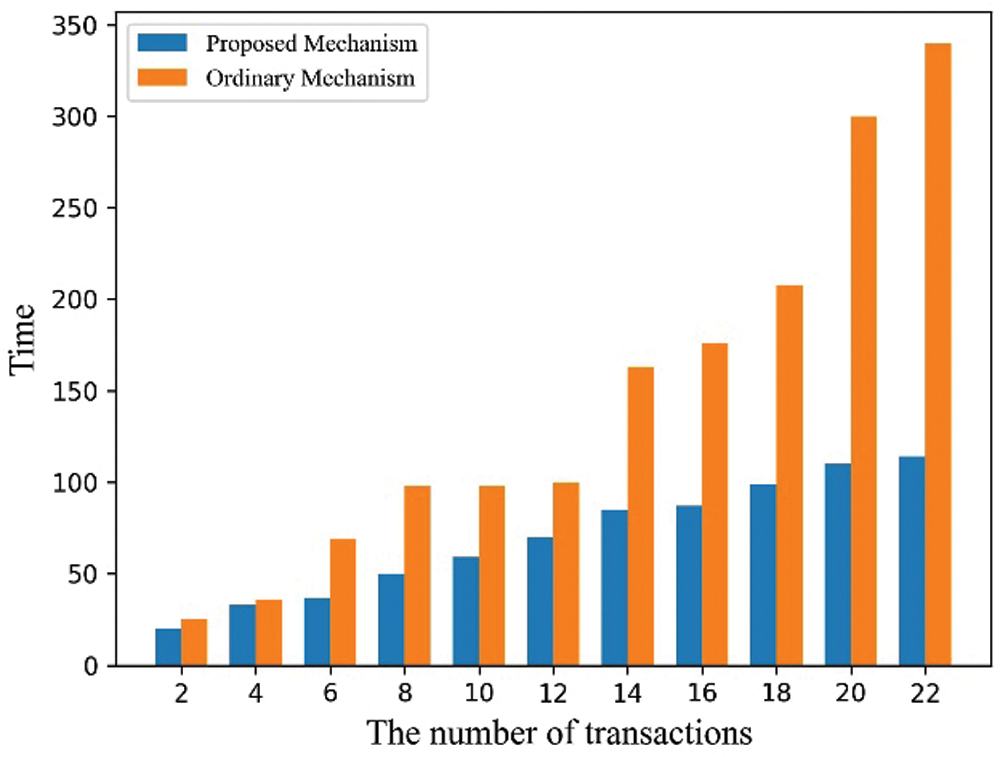

We define that there are 4 main service nodes of the blockchain, and a total of 12 distributed power providers and users are set. In the sharding consensus mechanism simulation experiment, 3 shards (shard 1, shard 2, and shard 3) are divided, and each shard is allocated 4 nodes to participate in the consensus. In the general consensus mechanism, there is no sharding, and 12 nodes participate in the consensus. It is defined that the data broadcasting speed between nodes is between [0, 20], and the solving time of the hash puzzle is between [20–40]. Fig. 5 shows the performance analysis of the consensus mechanism and general consensus mechanism proposed in this article as the number of trading increases. It can be seen from the figure that at the stage when the number of trading is small, the time required for the general consensus mechanism to complete the consensus is longer than the time required for the consensus mechanism mentioned in this article, and the gap is relatively stable. With the increase in the number of trading, the general consensus time spend increases faster, while the consensus mechanism proposed in this article maintains a relatively stable increase in time. This is because the general consensus mechanism and the proposed consensus mechanism can handle and complete the trading in a single consensus process in the case of a small trading volume in the early stage. As the number of trading increases, the network generally generates trading congestion, and it is necessary to wait for the next round of consensus to complete trading accounting. In the proposed consensus mechanism, trading can be processed in fragments, the trading size is smaller, and the time delay required for the consensus to wait for broadcast confirmation is smaller, and the consensus is faster.

Figure 5: Performance analysis of consensus mechanism

With the rapid development of new energy, the advantages of distributed power generation and power supply have become more prominent, which promotes the research demand for distributed power trading technology. Faced with the decentralization and small scale of distributed power exchanges, this paper proposes a blockchain-based distributed power trading market mechanism. First, a blockchain-based distributed power trading market framework is proposed. Based on this framework, a typical distributed power trading process is designed and a blockchain system is designed, including the definition of blockchain network, blockchain structure, and consensus algorithm. In addition, research on key technologies of distributed power market trading based on blockchain, including trading matching strategies and trading settlement strategies. And through simulation analysis, the effectiveness of the consensus algorithm and corresponding mechanism design is demonstrated. The multiple advantages of blockchain technology are well adapted to the needs of the distributed power trading market, but there are still some problems, including technical performance, security, etc., in the next step we will consider the blockchain in more detail Incentive mechanism and the influence of blockchain on the entire system to promote the application of distributed power trading mechanisms to real life.

Acknowledgement: Thanks for the technical support provided by the State Grid Sichuan Electric Power Company.

Funding Statement: The authors received no specific funding for this study.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

1. Y. Yan, J. H. Zhao, F. S. Wen and X. Y. Chen, “Blockchain in energy systems: Concept, application and prospect,” Electric Power Construction, vol. 38, no. 2, pp. 12–20, 2017. [Google Scholar]

2. W. L. Chen and Z. B. Zheng, “Blockchain data analysis: A review of status, trends and challenges,” Journal of Computer Research and Development, vol. 55, no. 9, pp. 1853–1870, 2018. [Google Scholar]

3. W. Wang, L. Liu, J. Liu and Z. Chen, “Energy management and optimization of vehicle-to-grid systems for wind power integration,” CSEE Journal of Power and Energy Systems, vol. 7, no. 1, pp. 172–180, 2020. [Google Scholar]

4. A. Miglani, N. Kumar, V. Chamola and S. Zeadally, “Blockchain for internet of energy management: Review, solutions, and challenges,” Computer Communications, vol. 151, no. 1, pp. 395–418, 2020. [Google Scholar]

5. P. Cui, U. Guin, A. Skjellum and D. Umphress, “Blockchain in IoT: Current trends, challenges, and future roadmap,” Journal of Hardware and Systems Security, vol. 3, no. 4, pp. 338–364, 2019. [Google Scholar]

6. H. Wang, S. Ma, C. Guo, Y. Wu and D. Wu, “Blockchain-based power energy trading management,” ACM Transactions on Internet Technology, vol. 21, no. 2, pp. 1–16, 2021. [Google Scholar]

7. L. Lin, B. Q. Xu and H. H. Wang, “Analysis and recommendations of typical market-based distributed generation trading mechanisms,” Dianli Xitong Zidonghua/Automation of Electric Power Systems, vol. 43, no. 4, pp. 1–8, 2019. [Google Scholar]

8. D. Yang, X. Zhao, Z. Xu, Y. Li and Q. Li, “Developing status and prospect analysis of blockchain in energy internet,” Zhongguo Dianji Gongcheng Xuebao/Proceedings of the Chinese Society of Electrical Engineering, vol. 37, no. 13, pp. 3664–3671, 2017. [Google Scholar]

9. A. Vangala, A. K. Sutrala, A. K. Das and M. Jo, “Smart contract-based blockchain-envisioned authentication scheme for smart farming,” IEEE Internet of Things Journal, vol. 8, no. 13, pp. 10792–10806, 2021. [Google Scholar]

10. Y. Zhang, S. Kasahara, Y. Shen, X. Jiang and J. Wan, “Smart contract-based access control for the internet of things,” IEEE Internet of Things Journal, vol. 6, no. 2, pp. 1594–1605, 2019. [Google Scholar]

11. F. Rahimi and A. Ipakchi, “Using a transactive energy framework: Providing grid services from smart buildings,” IEEE Electrification Magazine, vol. 4, no. 4, pp. 23–29, 2016. [Google Scholar]

12. A. S. Khan, X. Zhang, S. Lambotharan, G. Zheng, B. AsSadhan et al. “Machine learning aided blockchain assisted framework for wireless networks,” IEEE Network, vol. 34, no. 5, pp. 262–268, 2020. [Google Scholar]

13. Y. Dai, D. Xu, S. Maharjan, Z. Chen, Q. He et al., “Blockchain and deep reinforcement learning empowered intelligent 5G beyond,” IEEE Network, vol. 33, no. 3, pp. 10–17, 2019. [Google Scholar]

14. J. Kang, R. Yu, X. Huang, S. Maharjan, Y. Zhang et al., “Enabling localized peer-to-peer electricity trading among plug-in hybrid electric vehicles using consortium blockchains,” IEEE Transactions on Industrial Informatics, vol. 13, no. 6, pp. 3154–3164, 2017. [Google Scholar]

15. F. D. Giraldo, B. Milton C. and C. E. Gamboa, “Electronic voting using blockchain and smart contracts: Proof of concept,” IEEE Latin America Transactions, vol. 18, no. 10, pp. 1743–1751, 2020. [Google Scholar]

16. G. Liu, J. Wu and T. Wang, “Blockchain-enabled fog resource access and granting,” Intelligent and Converged Networks, vol. 2, no. 2, pp. 108–114, 2021. [Google Scholar]

17. M. Kong, J. Zhao, X. Sun and Y. Nie, “Secure and efficient computing resource management in blockchain-based vehicular fog computing,” China Communications, vol. 18, no. 4, pp. 115–125, 2021. [Google Scholar]

18. W. Viriyasitavat, L. D. Xu, Z. Bi and D. Hoonsopon, “Blockchain technology for applications in internet of things—mapping from system design perspective,” IEEE Internet of Things Journal, vol. 6, no. 5, pp. 8155–8168, 2019. [Google Scholar]

19. A. Saini, Q. Zhu, N. Singh, Y. Xiang, L. Gao et al., “A Smart-contract-based access control framework for cloud smart healthcare system,” IEEE Internet of Things Journal, vol. 8, no. 7, pp. 5914–5925, 2021. [Google Scholar]

20. X. Li, P. Russell, C. Mladin and C. Wang, “Blockchain-enabled applications in next-generation wireless systems: Challenges and opportunities,” IEEE Wireless Communications, vol. 28, no. 2, pp. 86–95, 2021. [Google Scholar]

21. T. Feng, H. Pei, R. Ma, Y. Tian and X. Feng, “Blockchain data privacy access control based on searchable attribute encryption,” Computers, Materials & Continua, vol. 66, no. 1, pp. 871–890, 2021. [Google Scholar]

22. Z. Qu, H. Sun and M. Zheng, “An efficient quantum image steganography protocol based on improved EMD algorithm,” Quantum Information Processing, vol. 20, no. 53, pp. 1–29, 2021. [Google Scholar]

23. Z. G. Qu, Y. M. Huang and M. Zheng, “A novel coherence-based quantum steganalysis protocol,” Quantum Information Processing, vol. 19, no. 362, pp. 1–19, 2020. [Google Scholar]

24. Z. Shahbazi and Y. Byun, “Blockchain and machine learning for intelligent multiple factor-based ride-hailing services,” Computers, Materials & Continua, vol. 70, no. 3, pp. 4429–4446, 2022. [Google Scholar]

25. M. Alwabel and Y. Kwon, “Blockchain consistency check protocol for improved reliability,” Computer Systems Science and Engineering, vol. 36, no. 2, pp. 281–292, 2021. [Google Scholar]

26. S. R. Khonde and V. Ulagamuthalvi, “Blockchain: Secured solution for signature transfer in distributed intrusion detection system,” Computer Systems Science and Engineering, vol. 40, no. 1, pp. 37–51, 2022. [Google Scholar]

27. F. Jamil, F. Qayyum, S. Alhelaly, F. Javed and A. Muthanna, “Intelligent microservice based on blockchain for healthcare applications,” Computers, Materials & Continua, vol. 69, no. 2, pp. 2513–2530, 2021. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |