DOI:10.32604/cmc.2022.027293

| Computers, Materials & Continua DOI:10.32604/cmc.2022.027293 |  |

| Article |

Factors Affecting Internet Banking Adoption: An Application of Adaptive LASSO

1Department of Banking and Finance, Eastern Mediterranean University, Famagusta, Mersin 10, 99628, Turkey

2Finnprints Inc., Lefkosa, Mersin 10, Turkey

*Corresponding Author: Siamand Hesami. Email: siamand.hesami@emu.edu.tr

Received: 14 January 2022; Accepted: 30 March 2022

Abstract: This research investigates a broad range of possible factors affecting the adoption of new technology in the banking industry using adaptive LASSO and a standard logit model. The research integrated the adoption of the innovation framework and the technology acceptance theory to develop a conceptual framework for the analysis. Primary data was collected from 400 bank customers in North Cyprus. Risk perception and other customer-specific factors such as perceived risk index and negative attitude toward new technologies index were formulated for the proposed conceptual model. The findings indicated that individuals with a negative attitude toward new technology are least likely to adopt internet banking. In addition, the logit model suggested that age, education level, and general (innate) innovativeness significantly impact the adoption of internet banking. However, gender, income, occupation, perceived risk, familiarity with the internet, and social inclusion have no significant impact on internet banking adoption in North Cyprus.

Keywords: E-banking; business technology; internet banking adoption; adaptive LASSO method

The banking industry has become one of the leading sectors to adopt new technologies and create self-service delivery channels [1]. Internet banking and digital payments were developed as new financial delivery channels, enabling speedy and flexible transactions [2]. Despite the rise in the number of internet banking users, banks have faced resistance from many doubtful clients unwilling to embrace internet banking [3]. Therefore, the banking sector needs to understand the factors determining whether their customers will adopt internet banking. Taking North Cyprus as a case study, this research provides essential findings on what determines internet banking adoption and ranks them according to their significance in customers’ decision making. Despite a small potential market and the high cost of internet banking in North Cyprus, domestic banks have adopted internet banking to respond to the competition stimulated by foreign banks [4]. Although all commercial banks had adopted internet banking by 2005, its usage remains low among bank customers.

According to previous research, customers’ internet banking adoption may vary depending on their demographic characteristics, familiarity, personality, and psychological attributes, such as social influence, risk perception, innovativeness, and attitudes toward new technologies [5–8]. Several theories have attempted to explain the adoption of new technologies through individuals’ characteristics, behaviors, beliefs, attitudes, intentions to use the technology, or expected degree of benefits from using the latest technology. Among them, the innovation diffusion theory (IDT) explores how adoption decisions are affected by the characteristics of the innovation itself, by individuals’ perceptions of these characteristics, and by the character of adopters and their social environment [9–11]. According to [12], the main aspects affecting the adoption of any innovation are relative advantages (economic gains or perceived convenience), complexity (free of effort to use or try), compatibility (consistency with past experiences), observability (evaluation of implication), and trialability (tested with earlier users). IDT is widely used to determine the adoption of new technology and its effects on behavioral intention to adopt [13–15].

Another widely used theory, the technology acceptance model (TAM), is the most applicable in technology adoption and use [16]. According to this theory, consumers’ attitudes toward adapting technological innovations depend on the perceived usefulness and the perceived ease of use. Moreover, compared with other models, TAM is a superior theory in technology adoption [17,18]. According to the literature, TAM’s main two constructs often fail to explain or predict customers’ intention to use technology [19]. To overcome this drawback, some studies have focused on extending TAM by integrating extra variables to develop its explanatory power [20–22].

This study contributes to the literature by integrating the perceived risk (PR) factor with other customer-specific factors, namely demography, familiarity with the internet (FI), innovativeness, attitude toward new technologies, and social interaction (SI). The conceptual framework of this research is based on the integrated models of the adoption of the innovation framework and the extended TAM. Although TAM uses behavioral intention measures to predict actual use, the current research, unlike previous studies, uses the actual internet banking adoption behavior (self-reporting usage) instead of the intentional behavior of internet banking usage (prediction). A principal component analysis (PCA) is conducted to generate a set of indices and create a parsimonious model to understand better the factors affecting consumers’ adoption of online banking. The extant research investigates whether the threat of fraudulent activity can create a negative perception of internet-based services and hence discourage customers’ adoption and use of internet banking [23–25]. As another contribution to the literature, the current study investigates how individuals’ decision to adopt internet banking is affected if they know someone who has been defrauded via internet banking.

Furthermore, we use nonlinear models that outperform linear regression models as they can generate both nonlinear and linear relationships via logistic functions [26]. To the best of our knowledge, this is the first study to explore factors driving internet banking adoption in a nonlinear form based on variable ranking methods. By incorporating a shrinkage methodology, this research is also unique in dealing with the problem of overfitting in regression analysis. Hence, identifying the determinants of internet banking adoption, this method also allows us to rank the determinants according to their order of importance in internet banking adoption.

Following well-known theories in technology adoption, many empirical studies have been conducted to identify the factors affecting the adoption of online banking in diverse country contexts. The most widely examined factors that impact online banking adoption in the previous literature are the demographic characteristics of the customers. Although empirical findings and research methodologies vary from country to country, these studies show that customers’ demographic characteristics are essential for understanding the acceptance and adoption of internet banking. For example, [6] found that gender, education, age, and income significantly impacted electronic banking adoption in India. However, according to an empirical study conducted by [27], age had a significant influence, while gender, income, education, and occupation did not significantly influence electronic banking adoption in Ethiopia. In contrast, using factor and covariance analysis, [7] found that individuals of all ages were equally interested in internet banking conducted on devices other than cell phones, and relatively young users were more interested in mobile banking.

Furthermore, the impact of customers’ general (innate) innovativeness (GI) and their attitudes toward new technologies on the adoption of online banking has gained considerable empirical support in the previous literature. GI identifies innovativeness as a general personality trait, while attitude reflects customers’ positive or negative opinions or feelings about new technologies. For instance, [23] and [28] found that consumer innovativeness directly correlated with the adoption of internet banking in Spain and Hong Kong, respectively. Similarly, [5], using structural equation modeling, found that customers’ innate innovativeness was positively related to their technology readiness and that innovative customers were more inclined to adopt internet banking in Yemen. Using the same methodology, [29] found that customers’ positive attitudes toward internet banking positively influenced their behavioral intention to adopt internet banking in India. Similarly, [30] used the product-indicator approach and found that customers’ openness regarding new technologies significantly influenced internet banking adoption in the United States.

Compatibility with technologies also plays a vital role in adopting innovations. Previous studies concluded that individuals with the self-assured skill to use computers and the internet were more likely to adopt online banking [27,31]. Thus, it is plausible to assume that individuals’ computer literacy and work- and non-work-related internet experience may lessen the perceived complexity of accessing online banking. Therefore, customers will have a greater inclination to use innovations. For example, using binomial logistic regression analysis, [25] found that experience with the internet for work and shopping was an essential determinant of internet banking adoption in Poland.

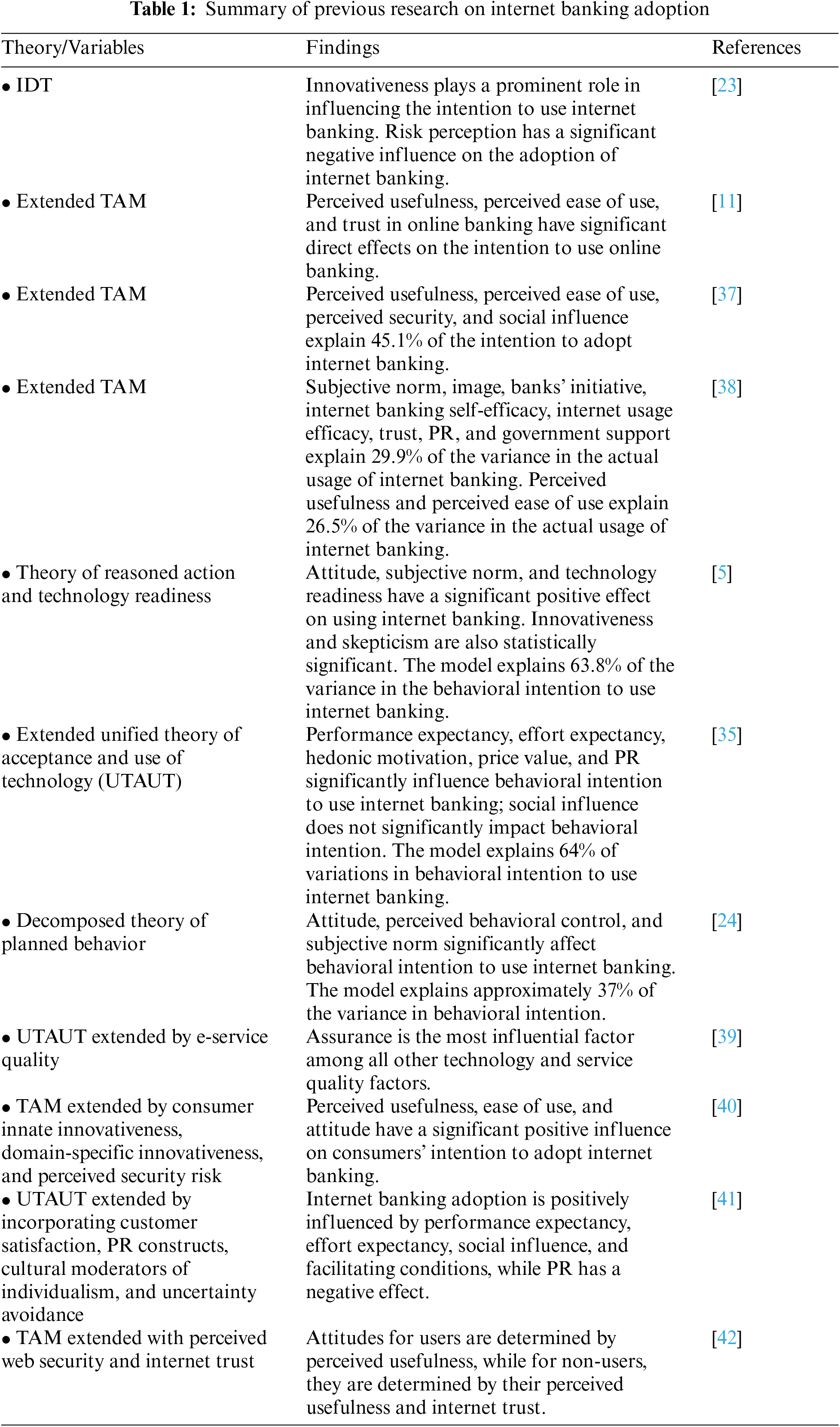

Research conducted by [32] and [33] investigated the influence of interpersonal networks, social media, mass media, and ‘word of mouth’ on users’ attitudes toward the use of mobile banking. Furthermore, [34] and [35] investigated the impact of social influence on customers’ intention to adopt online banking. These studies, however, concentrated only on the motivating effects of interpersonal communications on online banking adoption. Meanwhile, [36] highlighted the importance of psychological determinants in adopting innovation, but this is not discussed or presented in the existing literature. Tab. 1 summarizes some of the other primary research on internet banking adoption and its findings and indicates which technology adoption theory was used in each study.

3 Sampling and Data Collection

The financial sector of North Cyprus is dominated by its banking sector, while non-bank financial institutions are underdeveloped. Therefore, most people conduct their financial affairs through banks. In addition to the Central Bank and the State Development Bank, 21 commercial banks actively operate in North Cyprus. Of these 21 commercial banks, 15 are privately owned domestic banks, five are foreign branch banks from Turkey, and one is a state-owned commercial bank. The banking sector has 221 bank branches and 640 ATMs in major cities and towns. Currently, all commercial banks offer internet banking services to their customers.

Since the current study aims to explore the factors that affect customers’ adoption of internet banking, regardless of the characteristics of the internet banking service offered by a particular bank, it is essential to reduce a possible sampling bias by maintaining the heterogeneity of the respondents. Hence, the stratified sampling method covers every region in North Cyprus.

The survey questions were designed, and determinant indices generated accordingly based on the arguments in the extant literature. The questionnaire was divided into four main sections. The first section consisted of questions that revealed respondents’ demographic characteristics, such as age, gender, education level, and income. The second section consisted of GI, attitude toward new technologies, FI, and compatibility with relevant technologies. The third section consisted of questions on SI. Both internet banking adopters and non-adopters answered the first three sections. The fourth section involved questions relating to the PR of internet banking usage. This section was further divided into two subsections: the first was answered by internet banking adopters, and the second by non-adopters. Index questions (general personality traits, FI, GI, and PR) were measured on a five-point Likert scale ranging from 1 (strongly disagree) to 5 (strongly agree). All determinants other than demographic variables were measured using close-ended questions.

A pilot study consisting of ten questionnaires was conducted to eliminate incoherent questions and ‘garden path’ sentences and assure the validity and adequate reliability of the research instrument. A total of 425 questionnaires were completed face to face with various bank customers in five regions. The number of surveys conducted in each area was proportional to the population living in these five respective areas. Out of 425 completed questionnaires, 25 were excluded from the study due to incomplete and unreliable answers. Thus, a total of 400 responses were valid for further analysis.

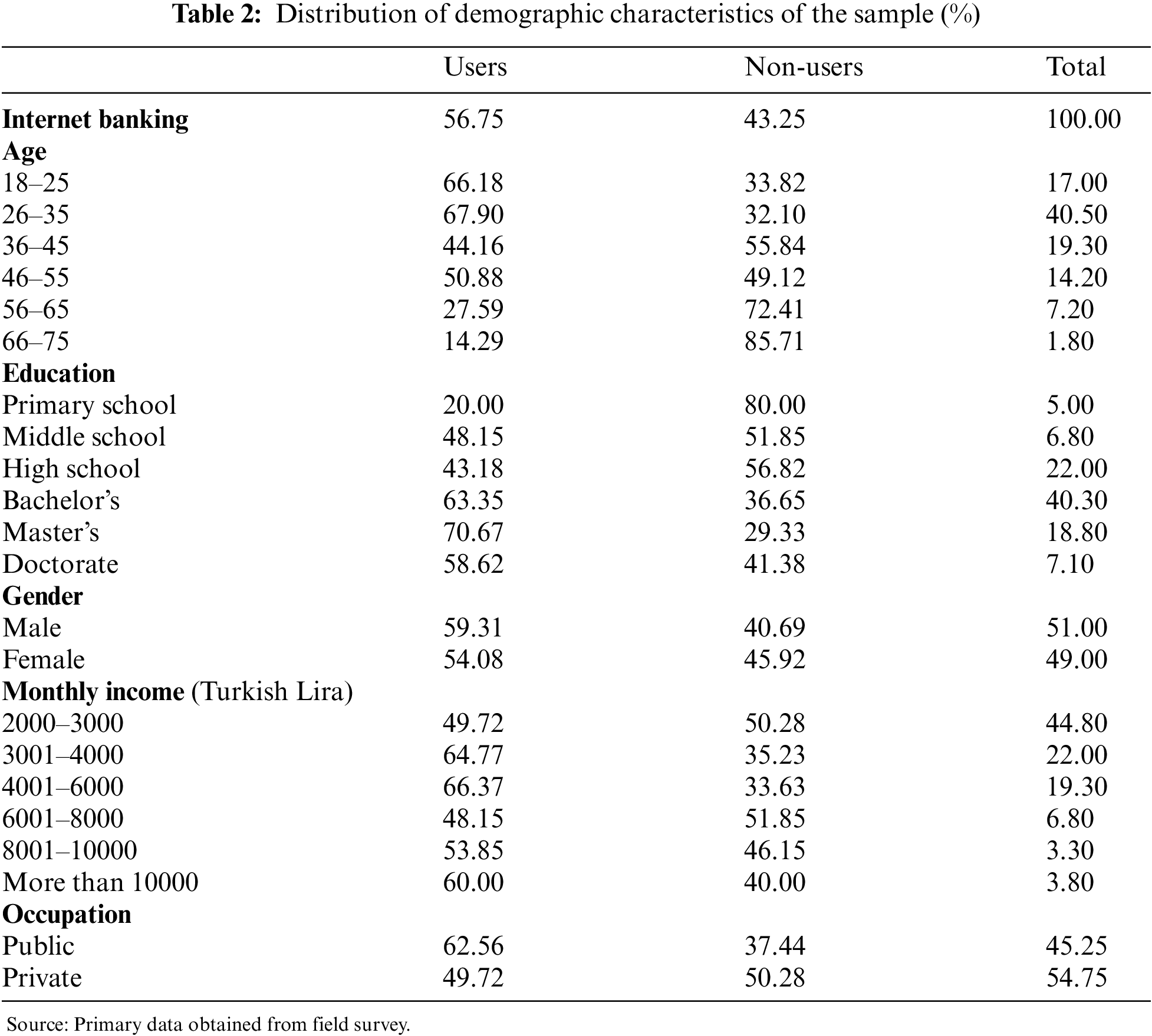

The demographic characteristics of the respondents are presented in Tab. 2. Online banking usage is highest among respondents aged between 26 and 35 who have a master’s level of education. Moreover, the percentage of actual online banking adoption is higher among male respondents, those who work in public institutions, and those with a monthly income between 4000 and 6000 Turkish Lira. Of the 400 respondents, 56.8% are online banking users and 43.2% are not.

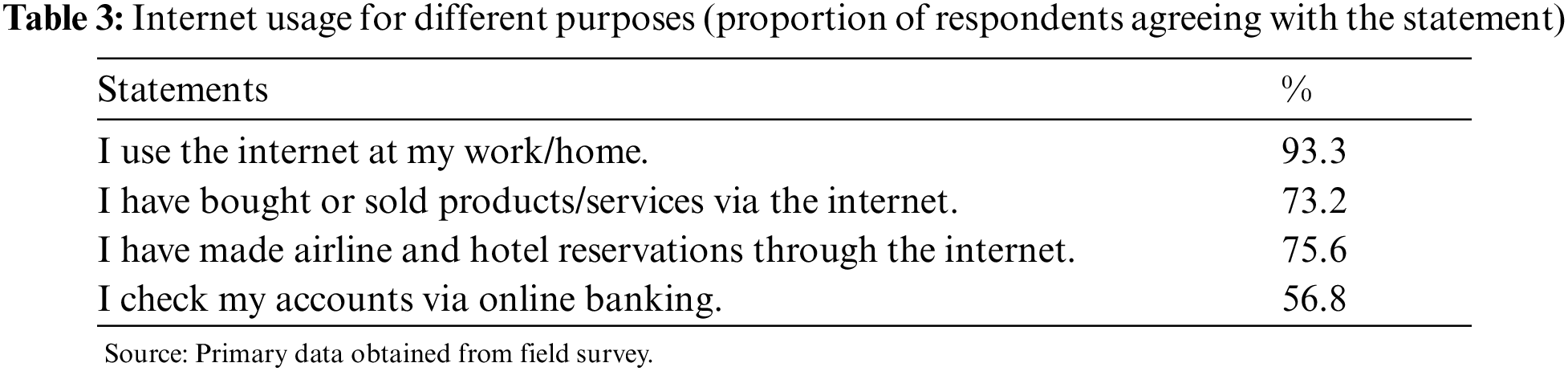

Although most people use the internet in their workplaces and homes, a relatively small number of people use internet banking in North Cyprus. As shown in Tab. 3, 93.3% of the sample use the internet in their workplaces and homes, 73.2% had bought and sold products and services via the internet, and 75.6% had made airline and hotel reservations online. However, only 56.8% of the sample use the internet to check their bank accounts. Our research utilized primary data and sophisticated quantitative methodologies to identify different sets of factors that may impact individuals’ acceptance and resistance decisions about internet banking usage.

4 Model Building and Research Hypotheses

This study combined different methodologies to investigate the factors driving online banking adoption. First, a new set of indices was created using PCA. PCA is strictly applicable to a set of measurements that are either quantitative or have an ordinal scale. Hence, it is optimal for index creation in survey analysis [43]. Before applying PCA, we measured the internal consistency between Likert questions using Cronbach’s alpha methodology. All indices satisfied the level of reliability. Results are available from the authors on request. The online banking adoption model was then developed as follows:

where y as a binary variable denotes the self-reported usage of online banking, and

It is well established in the literature that online banking users tend to be more innovative, relatively more receptive to new ideas, and more likely to adopt innovations than other members of society [44–47]. Reference [48] defined these individuals as “risk-tolerant, dynamic, communicative, curious, venturesome, stimulation seeking, and able to cope with higher levels of uncertainty.” We designed our survey questions and generated a GI index reflecting customers’ innovativeness as a general personality trait according to these definitions. Furthermore, innovative individuals are less likely to be affected by other people’s experiences while making decisions about adopting new technologies [49]. Therefore, we propose that the relatively more innovative bank customers will be more inclined to use online banking.

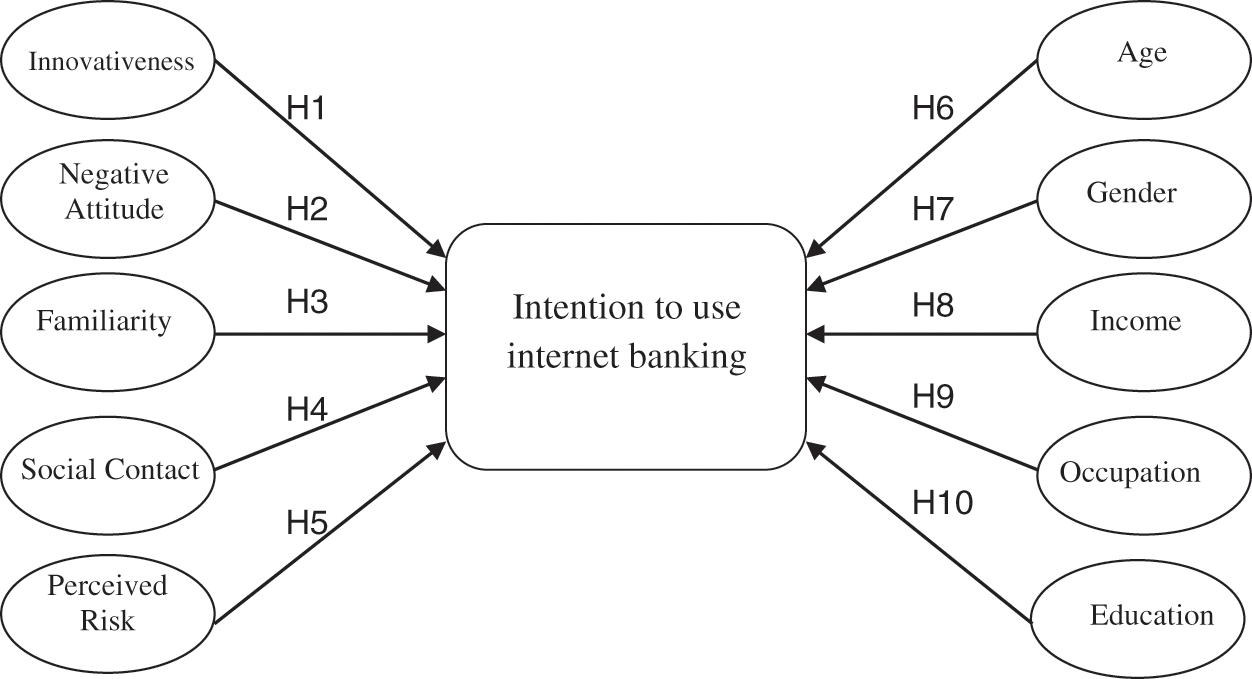

Hypothesis 1: The innovativeness of bank customers is positively related to online banking adoption.

According to TAM, an individual’s attitude or overall feelings toward technology-based innovations are the key determinants of using such innovations [50]. The “perceived usefulness” variable has tested this argument in previous studies. Perceived usefulness was defined as the degree to which a person believed the adoption of new technology would enhance or improve their performance [50]. It has been evidenced that the perception of usefulness is a significant factor in customers’ intention to adopt internet banking. This study defined “attitude” as customers’ negative perceptions or feelings toward new technologies. If individuals have a more favorable attitude toward new technologies, they are more likely to use them than other members of society [27,30]. However, if they deem new technologies unnecessary or see no benefit in using them, they are less likely to use them [51–53]. Thus, we expect that if customers deem learning the technologies a waste of time, they will be less likely to adopt online banking.

Hypothesis 2: NATNT will negatively affect internet banking adoption.

Since online banking is delivered through the medium of the internet, online banking users are expected to be familiar with the internet for work- and non-work-related activities and compatible with complementary technologies such as computers and web search engines [25,27,38,54]. It is plausible to assume that individuals’ computer literacy and FI may lessen the perceived complexity of accessing online banking. Therefore, customers will have a greater inclination to use such technologies. Furthermore, we would expect that customers who are familiar with the internet for shopping and sufficiently experienced in conducting financial transactions will be more likely to adopt online banking [27]. In an attempt to capture respondents’ familiarity, several variables suggested by [27] and [55] were constructed. Hence, we propose that FI and complementary technologies and experience in conducting financial transactions (other than online banking) via the internet positively influence online banking adoption.

Hypothesis 3: FI and complementary technologies will positively influence online banking adoption.

Previous studies analyzed the SI construct as a critical determinant of online banking adoption from interpersonal communications. Suppose individuals’ social environment (friends, relatives, or workmates) favorably suggests online banking. In that case, it is expected that the individuals will be more likely to adopt it to meet the expectations of their ascribed roles. However, most studies failed to support this argument [6,31,35,38]. Studies in the existing literature excluded those individuals who pay particular attention to negative information and have a greater propensity to use this rather than positive information in their decision processes [56]. This could be attributed to the bad news (negativity) bias: bad news has a greater impact on human behavior and attitude than neutral and positive news, enabling individuals to notice danger and avoid harm [57]. Thus, we expect that if individuals know someone who has been defrauded via online banking and are aware of the consequences through their communications with the online fraud victim, they will worry that the same may happen to them and, hence, will avoid using online banking.

Hypothesis 4: Customers’ adoption of internet banking will be negatively affected if they know an internet banking fraud victim through their social contacts.

The extant literature highlights that in online banking adoption, security and privacy issues are the two main areas perceived as risky by bank customers because lack of security and privacy can lead to more online fraud that results in monetary loss for bank customers [23,37]. Accordingly, if customers perceive online banking as risky, they will avoid using it. Thus, the PR index captures respondents’ PR of online banking usage constructs suggested by [58] and [59]. Furthermore, in line with the negativity bias, news about online fraud in the media may increase customers’ concerns about security and privacy issues and monetary loss. For example, risks such as identity fraud are classified as an avoidance motivation that potentially concerns many users of online financial services [60,61]. Thus, the influence of news about online fraud on online banking adoption decisions is also incorporated into the PR index. Therefore, we propose that news about internet fraud will increase customers’ PR of online banking and discourage them from using it.

Hypothesis 5: Bank customers who are satisfied with internet banking security and the level of protection of their personal information will adopt internet banking.

4.6 Demographic Characteristics of the Respondents

The relationship between demographic characteristics of bank customers (age, gender, education, income level, occupation) and their adoption of internet banking has been the subject of numerous pieces of research in recent years [6,8,62]. In the extant literature, it is often argued that the older the bank customers, the less likely they are to use internet banking. It is further argued that income and education level positively impact the acceptance and usage of internet banking. Similarly, gender and occupation often significantly affect internet banking adoption. Following the earlier research, we included these demographic characteristics in our model to capture their impact on internet banking adoption.

Hypothesis 6: The age of bank customers will be negatively related to internet banking adoption.

Hypothesis 7: The gender of bank customers will be positively related to internet banking adoption.

Hypothesis 8: The income level of bank customers will be positively related to internet banking adoption.

Hypothesis 9: The occupation of bank customers will be positively related to internet banking adoption.

Hypothesis 10: The level of bank customers’ formal education will be positively related to internet banking adoption (Fig. 1).

Figure 1: Conceptual model

This research employs the adaptive LASSO (least absolute shrinkage and selection operator) procedure of [63] to identify the factors that play a significant role in adopting internet banking and to rank these factors according to their importance. The adaptive LASSO methodology benefits from the improved variable selections algorithm through the LASSO-Type penalty. This method is built based on the LASSO framework of [64] and, by using a two-stage procedure, tries to find the optimal subset model. The LASSO method is regarded as one of the most powerful methods for regularization and feature selection tasks. To carry out such an important task, a shrinking (regularization) process is applied that penalizes the coefficients of the regression variables to zero. Following completion of the shrinking task, those variables that still have a non-zero coefficient become the targets in the feature selection process. This task is carried out to reduce the estimation error and the tuning parameter (λ), which attempts to manage the power of the penalty. Coefficients are forced to be zero if λ is sufficiently large; therefore, dimensionality will be reduced. It can be inferred that the larger λ will lead to a higher number of coefficients that are shrunk to be exactly equal to zero, and if the λ is equal to zero, an ordinary least square (OLS) regression will be derived. The advantage of using the LASSO method is that it can provide adequate predictions through the shrinking and removal of coefficients that can reduce variance without any substantial increase in bias. In tuning the parameter, as λ increases, the bias will also rise while the variance decreases. There is a trade-off between these two variables that needs to be noted. LASSO also improves the interpretation of the model by removing the irrelevant features. In this process, overfitting is regarded as a reduced variable, and it is the focus of this paper.

Given the binary nature of the response variable in this study, the generalized linear model (GLM) was also considered. This model originated from the usual linear model, and it captures a different variety of distributions. The model can be formulated using the following three components: Random Component

Using the LASSO method, a fixed upper bound on the accumulated absolute values of the model parameters can be fixed. In the case of GLM, this constraint can also be represented by penalizing the negative log-likelihood with

The LASSO estimator for a logistic regression model is then defined as:

Given the estimated coefficients from Eq. (3), a consistent variable selection procedure can be derived using the adaptive LASSO as:

where

6 Empirical Findings and Discussion

To investigate which factors significantly affect bank customers’ adoption of internet banking, we used customers’ actual internet banking usage as a dependent variable and utilized adaptive LASSO with ten determinant variables. These ten determinant variables are age, sex, education level, occupation, and income level, and the SI, GI, NATNT, FI, and PR indices. The authors developed all these indices with primary data collected from the respective questions asked in the questionnaire.

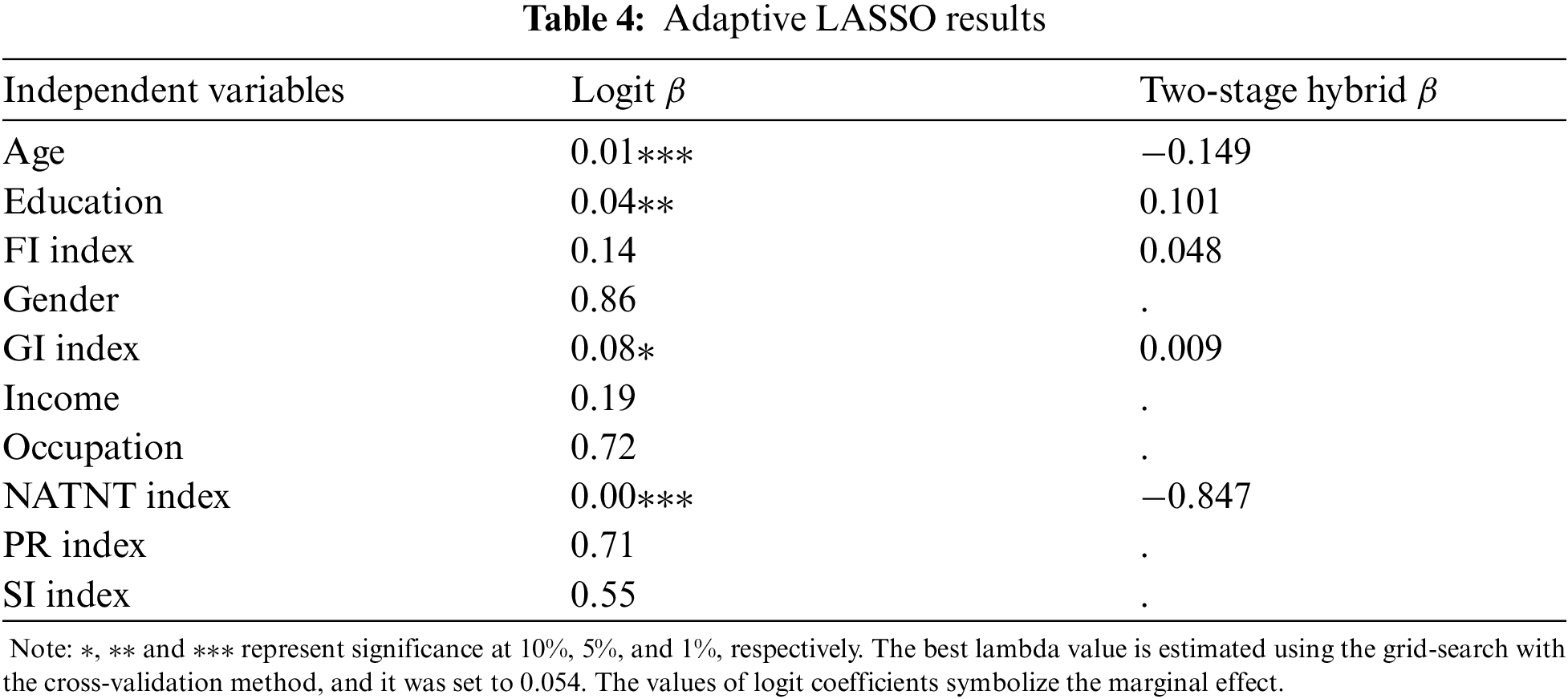

Although our main method was the adaptive LASSO model, we also performed the standard logit model for the sake of comparability. Tab. 4 reports the logit model results (column 2) and the adaptive LASSO based on the two-stage procedure (column 3).

The findings of the logit model suggest that age, education level, GI index, and NATNT index significantly impact the adoption of internet banking. However, gender, income, occupation, PR index, FI index, and SI index have no significant impact on internet banking adoption in North Cyprus. The logit model results are also in line with the findings of the two-stage hybrid method that indicate the significance of age, education, GI index, and NATNT index as the determinants of internet banking adoption.

As shown in Tab. 4, empirical results suggest that the respondents’ age level negatively influences online banking adoption behavior. This supports our hypothesis that internet banking adoption rates decrease among respondents as age increases. This finding may suggest that relatively older individuals have fewer banking transaction needs. It may also indicate that with an increase in age, there may be a reduction in individuals’ physical and cognitive abilities, such as their clarity of vision, or that they may have learning difficulties that make it challenging to use information technologies. This finding is consistent with earlier studies by [62] and [54], who confirmed that age negatively influences internet banking adoption in Poland and Ethiopia.

Furthermore, the education level of respondents positively influences internet banking adoption behavior. As the education level of respondents increases, the rate of adoption of internet banking also increases. As individuals become more educated, their ability to understand complex technologies such as internet banking increases. Although less educated individuals use computers and mobile phones in their daily tasks, their ability to understand them decreases as the complexity of technologies increases [6]. Therefore, this finding may suggest that education reduces the perceived complexity of online banking usage and hence accelerates online banking adoption. This empirical finding supports our hypothesis and aligns with earlier study by [65], who observed a positive association between education and electronic banking adoption.

FI positively relates to online banking adoption behavior, leading to our acceptance hypothesis. The rate of online banking adoption is higher among respondents familiar with the internet and with complementary technologies over the internet. Individuals’ related experiences may reduce the perceived technical complexity of online banking usage; hence, they consider it easy to use and adapt. This finding is consistent with studies by [6] and [27], who investigated whether FI and compatibility with complementary technologies positively influence online banking adoption behavior. This finding also supports the argument of [25], who stated that respondents in Poland who conduct financial transactions other than online banking over the internet are more inclined to adopt internet banking.

Moreover, GI positively relates to online banking adoption behavior. This finding indicates that internet banking usage is higher among more innovative individuals, who are more inclined to try out innovations than other members of society. This positive association is in line with previous studies by [5,23,28,29], who stated that consumers’ personal or innate innovativeness increases the likelihood of online banking adoption. Finally, our research results show that the NATNT index negatively relates to online banking adoption behavior. The findings show that online banking usage is low among respondents who consider learning new technologies a waste of time. This finding is in line with the arguments of [30] and [27], who confirmed that individuals’ positive or negative overall feelings or attitudes toward innovations play a significant role in their adoption decision processes.

The remaining five determinant variables – gender, occupation, income level, SI index, and PR index – do not appear to significantly impact internet banking adoption. This result shows that being male or female, having a low or high income level, or having a specific type of occupation do not matter when it comes to internet banking usage. Furthermore, knowing someone who has been defrauded through internet banking, the SI index does not necessarily influence individuals’ decisions regarding internet banking usage. Similarly, bank customers’ risk perception regarding internet banking, including security concerns or hearing about internet fraud cases through the media or word of mouth, does not appear to affect their adoption of internet banking.

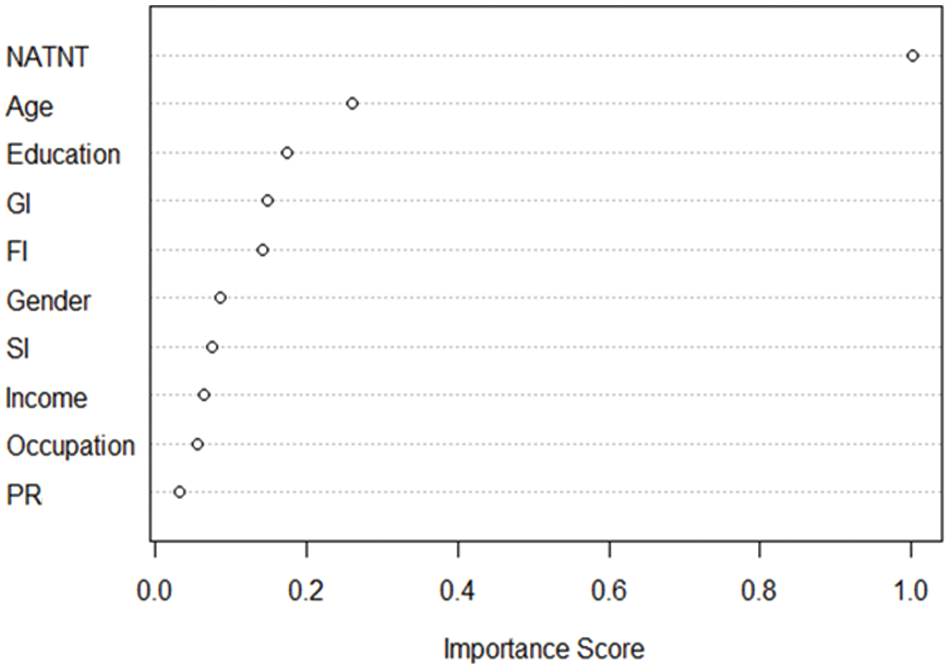

Given the five significant variables in the above analysis, we sought further insight into the variables’ comprehensive role and their ranking in online banking adoption. In doing so, we applied the bagging estimation procedure to our logistic model based on the LASSO method. We performed our analysis using the available R package (Sparse Learner). The method produces a joint estimation according to the regularized logistic regression model. It then utilizes a Monte Carlo cross-entropy algorithm to put together the ranks of a group of base-level LASSO regression models under consideration via a weighted aggregation to ascertain the optimal base-level model (for more detail, see [63]).

The result is shown in Fig. 2. Each determinant for internet banking adoption is ranked in order of importance. The age determinant ranked second, education level third, GI fourth, and FI fifth in the importance of the ten variables included in our model. The NATNT index had the highest rank, with a score close to 1, identifying its most significant negative impact on online banking usage in North Cyprus. This finding may partly explain why the adoption rate of internet banking is relatively low in North Cyprus.

Figure 2: Variable importance plot

7 Conclusions and Implications

Over 93% of bank customers residing in North Cyprus have access to the internet, through which they shop online, book hotels, and buy airplane tickets. However, many bank customers choose not to use the internet for their banking transactions. According to our sample, while 75.6% of bank customers use the internet to purchase tickets and book hotels, only 56.8% use internet banking.

The current study used the adaptive LASSO method to identify the determinants of internet banking adoption and rank them according to their significance level. The results obtained from the adaptive LASSO method show that out of ten determinant variables, only five are significantly associated with online banking usage in North Cyprus. According to the findings, these five determining factors are ranked from the most important to the least important: NATNT, age, education level, GI, and familiarity with new technologies. While education level, familiarity with new technologies, and GI positively influence online banking adoption, NATNT and age negatively influence it. Our research shows that NATNT is the most critical determinant that negatively affects bank customers’ decisions regarding internet banking adoption. An important factor in reducing NATNT could be training and improving the financial literacy of customers [66].

The current study is, to the best of our knowledge, the first research that integrates customers’ negativity bias as a psychological factor in adopting the online banking framework. A similar study by [35] also confirmed that individuals’ level of readiness plays a significant role in the acceptance and adoption of new technologies. Therefore, in their marketing strategies, banks might benefit from providing technical support and encouragement, particularly to customers who are prejudiced against internet banking services and older customers whose lack of technical knowledge makes them biased against internet banking usage. Hence, building a positive attitude toward online banking services should be the priority for banks in North Cyprus to increase the likelihood that their customers will adopt internet banking services.

Furthermore, banks could increase internet banking adoption by targeting younger and well-educated customers who are not currently internet banking users but are potential users. These are the bank customers most likely to adopt internet banking if they are exposed to banks’ targeted advertising on the benefits of internet banking. Meanwhile, older and less educated customers could be provided with technical assistance in the branches, where a designated bank employee could assist them in opening and using online banking services. According to our findings, GI is the fourth most important factor that affects online banking adoption. It is mainly argued that customers who adopt online banking are more innovative than those who do not. Therefore, banks could continuously improve the features of their existing online banking services to improve the satisfaction and retention of their current online banking customers and attract potential internet banking users who are looking for new and innovative ideas in bank services.

Finally, FI and compatibility with relevant technologies is the fifth significant factor that positively affects online banking adoption. Banks could offer online payment opportunities to make online shopping payments easier, to capture customers’ attention in this category and persuade them to adopt internet banking. Based on a country study on North Cyprus, this research contributes to the literature through its conceptual model, data, and methodology. Future studies could undertake similar research in different country contexts with larger sample sizes to draw comparisons and inferences. Furthermore, a similar methodology could investigate the factors influencing the adoption of the latest financial innovations in various countries.

Funding Statement: The authors received no specific funding for this study.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

1. T. Pikkarainen, K. Pikkarainen, H. Karjaluoto and S. Pahnila, “Consumer acceptance of online banking: An extension of the technology acceptance model,” Internet Research, vol. 14, no. 3, pp. 224–235, 2004. [Google Scholar]

2. L. Y. Leong, T. S. Hew, K. B. Ooi and J. Wei, “Predicting mobile wallet resistance: A two-staged structural equation modeling-artificial neural network approach,” International Journal of Information Management, vol. 51, pp. 102047, 2020. [Google Scholar]

3. N. Souiden, R. Ladhari and W. Chaouali, “Mobile banking adoption: A systematic review,” International Journal of Bank Marketing, vol. 39, no. 2, pp. 214–241, 2021. [Google Scholar]

4. H. Jenkins, “Adopting internet banking services in a small island state: Assurance of bank service quality,” Managing Service Quality: An International Journal, vol. 17, no. 5, pp. 523–537, 2007. [Google Scholar]

5. A. S. Al-Ajam and K. Md Nor, “Challenges of adoption of internet banking service in Yemen,” International Journal of Bank Marketing, vol. 33, no. 2, pp. 178–194, 2015. [Google Scholar]

6. S. Arora and S. Sandhu, “Usage based upon reasons: The case of electronic banking services in India,” International Journal of Bank Marketing, vol. 36, no. 4, pp. 680–700, 2018. [Google Scholar]

7. M. Harris, K. C. Cox, C. F. Musgrove and K. W. Ernstberger, “Consumer preferences for banking technologies by age groups,” International Journal of Bank Marketing, vol. 34, no. 4, pp. 587–602, 2016. [Google Scholar]

8. M. H. Ur Rashid, M. A. Hossain, A. Ahmad and Z. Ahmed, “Customers’ intention in internet banking adoption: The moderating effect of demographic characteristics,” International Journal of Innovation and Technology Management, vol. 18, no. 7, pp. 2150036, 2021. [Google Scholar]

9. J. Choudrie, C. O. Junior, B. McKenna and S. Richter, “Understanding and conceptualizing the adoption, use and diffusion of mobile banking in older adults: A research agenda and conceptual framework,” Journal of Business Research, vol. 88, pp. 449–465, 2018. [Google Scholar]

10. T. Laukkanen, “Consumer adoption versus rejection decisions in seemingly similar service innovations: The case of the internet and mobile banking,” Journal of Business Research, vol. 69, no. 7, pp. 2432–2439, 2016. [Google Scholar]

11. A. R. Montazemi and H. Qahri-Saremi, “Factors affecting adoption of online banking: A meta-analytic structural equation modeling study,” Information & Management, vol. 52, no. 2, pp. 210–226, 2015. [Google Scholar]

12. I. M. Al-Jabri and M. S. Sohail, “Mobile banking adoption: Application of diffusion of innovation theory,” Journal of Electronic Commerce Research, vol. 13, no. 4, pp. 379–391, 2012. [Google Scholar]

13. Y. F. Kuo and S. N. Yen, “Towards an understanding of the behavioral intention to use 3G mobile value-added services,” Computers in Human Behavior, vol. 25, no. 1, pp. 103–110, 2009. [Google Scholar]

14. C. L. Miltgen, A. Popovič and T. Oliveira, “Determinants of end-user acceptance of biometrics: Integrating the ‘Big 3’ of technology acceptance with privacy context,” Decision Support Systems, vol. 56, pp. 103–114, 2013. [Google Scholar]

15. T. Oliveira, M. Thomas, G. Baptista and F. Campos, “Mobile payment: Understanding the determinants of customer adoption and intention to recommend the technology,” Computers in Human Behavior, vol. 61, pp. 404–414, 2016. [Google Scholar]

16. F. Hussain Chandio, Z. Irani, M. S. Abbasi and H. Z. Nizamani, “Acceptance of online banking information systems: An empirical case in a developing economy,” Behavior & Information Technology, vol. 32, no. 7, pp. 668–680, 2013. [Google Scholar]

17. M. L. Khan and I. K. Idris, “Recognize misinformation and verify before sharing: A reasoned action and information literacy perspective,” Behavior & Information Technology, vol. 38, no. 12, pp. 1194–1212, 2019. [Google Scholar]

18. F. T. Lin, H. Y. Wu and T. N. N. Tran, “Internet banking adoption in a developing country: An empirical study in Vietnam,” Information Systems and e-Business Management, vol. 13, no. 2, pp. 267–287, 2015. [Google Scholar]

19. C. D. Chen, Y. W. Fan and C. K. Farn, “Predicting electronic toll collection service adoption: An integration of the technology acceptance model and the theory of planned behavior,” Transportation Research Part C: Emerging Technologies, vol. 15, no. 5, pp. 300–311, 2007. [Google Scholar]

20. M. AlKailani, “Factors affecting the adoption of internet banking in Jordan: An extended TAM model,” Journal of Marketing Development & Competitiveness, vol. 10, no. 1, pp. 39–52, 2016. [Google Scholar]

21. O. Isaac, Z. Abdullah, T. Ramayah and A. M. Mutahar, “Internet usage within government institutions in Yemen: An extended technology acceptance model (TAM) with internet self-efficacy and performance impact,” Science International, vol. 29, no. 4, pp. 737–747, 2017. [Google Scholar]

22. S. Singh and R. K. Srivastava, “Understanding the intention to use mobile banking by existing online banking customers: An empirical study,” Journal of Financial Services Marketing, vol. 25, no. 3, pp. 86–96, 2020. [Google Scholar]

23. J. Aldás-Manzano, C. Lassala-Navarré, C. Ruiz-Mafé and S. Sanz-Blas, “The role of consumer innovativeness and perceived risk in online banking usage,” International Journal of Bank Marketing, vol. 27, no. 1, pp. 53–75, 2009. [Google Scholar]

24. K. M. Nor and J. M. Pearson, “An exploratory study into the adoption of internet banking in a developing country: Malaysia,” Journal of Internet Commerce, vol. 7, no. 1, pp. 29–73, 2008. [Google Scholar]

25. M. Polasik and T. P. Wisniewski, “Empirical analysis of internet banking adoption in Poland,” International Journal of Bank Marketing, vol. 27, no. 1, pp. 32–52, 2009. [Google Scholar]

26. C. W. Chu and G. P. Zhang, “A comparative study of linear and nonlinear models for aggregate retail sales forecasting,” International Journal of Production Economics, vol. 86, no. 3, pp. 217–231, 2003. [Google Scholar]

27. E. J. Lee, K. N. Kwon and D. W. Schumann, “Segmenting the non-adopter category in the diffusion of internet banking,” International Journal of Bank Marketing, vol. 23, no. 5, pp. 414–437, 2005. [Google Scholar]

28. C. S. Yiu, K. Grant and D. Edgar, “Factors affecting the adoption of internet banking in Hong Kong—implications for the banking sector,” International Journal of Information Management, vol. 27, no. 5, pp. 336–351, 2007. [Google Scholar]

29. I. Bashir and C. Madhavaiah, “Consumer attitude and behavioral intention towards internet banking adoption in India,” Journal of Indian Business Research, vol. 7, no. 1, pp. 67–102, 2015. [Google Scholar]

30. H. S. Yoon and L. M. B. Steege, “Development of a quantitative model of the impact of customers’ personality and perceptions on internet banking use,” Computers in Human Behavior, vol. 29, no. 3, pp. 1133–1141, 2013. [Google Scholar]

31. Y. Y. Shih and K. Fang, “The use of a decomposed theory of planned behavior to study internet banking in Taiwan,” Internet Research, vol. 14, no. 3, pp. 213–223, 2004. [Google Scholar]

32. H. T. T. Tran and J. Corner, “The impact of communication channels on mobile banking adoption,” International Journal of Bank Marketing, vol. 34, no. 1, pp. 78–109, 2016. [Google Scholar]

33. D. Mehrad and S. Mohammadi, “Word of mouth impact on the adoption of mobile banking in Iran,” Telematics and Informatics, vol. 34, no. 7, pp. 1351–1363, 2017. [Google Scholar]

34. J. Arenas Gaitán, B. Peral Peral and M. Ramón Jerónimo, “Elderly and internet banking: An application of UTAUT2,” Journal of Internet Banking and Commerce, vol. 20, no. 1, pp. 1–23, 2015. [Google Scholar]

35. A. A. Alalwan, Y. K. Dwivedi, N. P. Rana and R. Algharabat, “Examining factors influencing Jordanian customers’ intentions and adoption of internet banking: Extending UTAUT2 with risk,” Journal of Retailing and Consumer Services, vol. 40, pp. 125–138, 2018. [Google Scholar]

36. E. M. Rogers, “Diffusion of Innovations: Modifications of a model for telecommunications.” in Die Diffusion von Innovationen in der Telekommunikation, Berlin, Heidelberg: Springer, pp. 25–38, 1995. [Google Scholar]

37. K. J. Patel and H. J. Patel, “Adoption of internet banking services in gujarat: An extension of TAM with perceived security and social influence,” International Journal of Bank Marketing, vol. 36, no. 1, pp. 147–169, 2018. [Google Scholar]

38. B. Marakarkandy, N. Yajnik and C. Dasgupta, “Enabling internet banking adoption: An empirical examination with an augmented technology acceptance model (TAM),” Journal of Enterprise Information Management, vol. 30, no. 2, pp. 263–294, 2017. [Google Scholar]

39. R. Samar, M. M. Othman Mansour, M. Alghizzawi and F. Mi Alnaser, “Integration of UTAUT model in internet banking adoption context: The mediating role of performance expectancy and effort expectancy,” Journal of Research in Interactive Marketing, vol. 13, no. 3, pp. 411–435, 2019. [Google Scholar]

40. V. Chauhan, R. Yadav and V. Choudhary, “Analyzing the impact of consumer innovativeness and perceived risk in internet banking adoption: A study of Indian consumers,” International Journal of Bank Marketing, vol. 37, no. 1, pp. 323–339, 2019. [Google Scholar]

41. R. Sharma, G. Singh and S. Sharma, “Modelling internet banking adoption in Fiji: A developing country perspective,” International Journal of Information Management, vol. 53, pp. 102116, 2020. [Google Scholar]

42. K. Safari, A. Bisimwa and M. B. Armel, “Attitudes and intentions toward internet banking in an under developed financial sector,” PSU Research Review, vol. ahead-of-print, no. ahead-of-print, 2020. [Google Scholar]

43. R. S. Pomeroy, R. B. Pollnac, B. M. Katon and C. D. Predo, “Evaluating factors contributing to the success of community-based coastal resource management: The central visayas regional project-1, Philippines,” Ocean & Coastal Management, vol. 36, no. 1–3, pp. 97–120, 1997. [Google Scholar]

44. E. M. Rogers, A. Singhal and M. M. Quinlan, in Diffusion of Innovations, New York, NY: Routledge, pp. 432–448, 2014. [Google Scholar]

45. J. W. C. Arts, R. T. Frambach and T. H. A. Bijmolt, “Generalizations on consumer innovation adoption: A meta-analysis on drivers of intention and behavior,” International Journal of Research in Marketing, vol. 28, no. 2, pp. 134–144, 2011. [Google Scholar]

46. A. V. Citrin, D. E. Sprott, S. N. Silverman and D. E. Stem, “Adoption of internet shopping: The role of consumer innovativeness,” Industrial Management and Data Systems, vol. 100, no. 7, pp. 294–300, 2000. [Google Scholar]

47. W. Kim, C. A. Di Benedetto and J. M. Hunt, “Consumer innovativeness and consideration set as antecedents of the consumer decision process for highly globalized new products: A three-country empirical study,” Journal of Global Scholars of Marketing Science, vol. 22, no. 1, pp. 1–23, 2012. [Google Scholar]

48. C. Kim, M. Mirusmonov and I. Lee, “An empirical examination of factors influencing the intention to use mobile payment,” Computers in Human Behavior, vol. 26, no. 3, pp. 310–322, 2010. [Google Scholar]

49. D. F. Midgley and G. R. Dowling, “Innovativeness: The concept and its measurement,” Journal of Consumer Research, vol. 4, no. 4, pp. 229–242, 1978. [Google Scholar]

50. F. D. Davis, “Perceived usefulness, perceived ease of use, and user acceptance of information technology,” MIS Quarterly, vol. 13, no. 3, pp. 319–340, 1989. [Google Scholar]

51. H. Wu, C. Lin, C. Li and H. Lin, “A study of bank customer’s perceived usefulness of adopting online banking,” Global Journal of Business Research, vol. 4, no. 3, pp. 101–108, 2010. [Google Scholar]

52. A. Jalal, J. Marzooq and H. A. Nabi, “Evaluating the impact of online banking factors on motivating the process of e-banking,” Journal of Management and Sustainability, vol. 1, no. 1, pp. 32–42, 2011. [Google Scholar]

53. L. Tipi, Y. Xiao, A. Sukumar and D. Edgar, “Factors influencing people’s intention to adopt e-banking: An empirical study of consumers in shandong province, China,” Asian Journal of Computer and Information Systems, vol. 5, no. 3, pp. 26–43, 2017. [Google Scholar]

54. T. S. Szopiński, “Factors affecting the adoption of online banking in Poland,” Journal of Business Research, vol. 69, no. 11 pp. 4763–4768, 2016. [Google Scholar]

55. P. Gerrard and J. Barton Cunningham, “The diffusion of internet banking among Singapore consumers,” International Journal of Bank Marketing, vol. 21, no. 1, pp. 16–28, 2003. [Google Scholar]

56. A. Vaish, T. Grossmann and A. Woodward, “Not all emotions are created equal: The negativity bias in social-emotional development,” Psychological Bulletin, vol. 134, no. 3, pp. 383–403, 2008. [Google Scholar]

57. T. A. Ito, J. T. Larsen, N. K. Smith and J. T. Cacioppo, “Negative information weighs more heavily on the brain: The negativity bias in evaluative categorizations,” Journal of Personality and Social Psychology, vol. 75, no. 4, pp. 887–900, 1998. [Google Scholar]

58. M. S. Featherman and P. A. Pavlou, “Predicting e-services adoption: A perceived risk facets perspective,” International Journal of Human-Computer Studies, vol. 59, no. 4, pp. 451–474, 2003. [Google Scholar]

59. N. O. Ndubisi and Q. Sinti, “Consumer attitudes, system’s characteristics and internet banking adoption in Malaysia,” Management Research News, vol. 29, no. 1/2, pp. 16–27, 2006. [Google Scholar]

60. A. B. Jibril, M. A. Kwarteng, R. K. Botchway, J. Bode and M. Chovancova, “The impact of online identity theft on customers’ willingness to engage in e-banking transaction in Ghana: A technology threat avoidance theory,” Cogent Business & Management, vol. 7, no. 1, pp. 1832825, 2020. [Google Scholar]

61. A. B. Jibril, M. A. Kwarteng, M. Pilik, E. Botha and C. N. Osakwe, “Towards understanding the initial adoption of online retail stores in a low internet penetration context: An exploratory work in Ghana,” Sustainability, vol. 12, no. 3, pp. 854, 2020. [Google Scholar]

62. B. M. Teka and D. Sharma, “Influence of demographic factors on users’ adoption of electronic banking in Ethiopia,” Journal of Internet Banking and Commerce, vol. 22, no. 7, pp. 1–17, 2017. [Google Scholar]

63. P. Guo, F. Zeng, X. Hu, D. Zhang, S. Zhu et al., “Improved variable selection algorithm using a LASSO-type penalty, with an application to assessing hepatitis B infection relevant factors in community residents,” PLOS One, vol. 10, no. 7, pp. e0134151, 2015. [Google Scholar]

64. R. Tibshirani, “Regression shrinkage and selection via the lasso,” Journal of the Royal Statistical Society. Series B (Methodological), vol. 58, no. 1, pp. 267–288, 1996. [Google Scholar]

65. W. Nasri, “Factors influencing the adoption of internet banking in Tunisia,” International Journal of Business and Management, vol. 6, no. 8, pp. 143–160, 2011. [Google Scholar]

66. P. C. Andreou and S. Anyfantaki, “Financial literacy and its influence on consumers’ internet banking behaviour,” Bank of Greece, Working Paper no. 275, 2019. Available at https://www.bankofgreece.gr. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |