Energy Engineering

Energy Engineering

Energy Engineering Energy Engineering |  |

DOI: 10.32604/EE.2021.013734

ARTICLE

Demand Responsive Market Decision-Makings and Electricity Pricing Scheme Design in Low-Carbon Energy System Environment

1School of Economics and Management, School of Electrical and Information Engineering, Hunan Provincial Engineering Research Center of Electric Transportation and Smart Distribution Network, International Joint Laboratory of Energy Internet Operation and Planning Based on Distributed Photovoltaic-Storage Energy of Ministry of Education, Changsha University of Science and Technology, Changsha, 410114, China

2Zhangjiakou Power Supply Company, State Grid JiBei Electric Power Company Limited, Zhangjiakou, 075000, China

3Zigong Power Supply Company, State Grid Sichuan Electric Power Company Limited, Zigong, 643002, China

*Corresponding Author: Hongming Yang. Email: yhm5218@163.com

Received: 18 August 2020; Accepted: 12 October 2020

Abstract: The two-way interaction between smart grid and customers will continuously play an important role in enhancing the overall efficiency of the green and low-carbon electric power industry and properly accommodating intermittent renewable energy resources. Thus far, the existing electricity pricing mechanisms hardly match the technical properties of smart grid; neither can they facilitate increasing end users participating in the electricity market. In this paper, several relevant models and novel methods are proposed for pricing scheme design as well as to achieve optimal decision-makings for market participants, in which the mechanisms behind are compatible with demand response operation of end users in the smart grid. The electric vehicles and prosumers are jointly considered by complying with the technical constraints and intrinsic economic interests. Based on the demand response of controllable loads, the real-time pricing, rewarding pricing and insurance pricing methods are proposed for the retailers and their bidding decisions for the wholesale market are also presented to increase the penetration level of renewable energy. The proposed demand response oriented electricity pricing scheme can provide some useful operational references on the cooperative operation of controllable loads and renewable energy through the feasible retail and wholesale market pricing methods, and thereby enhancing the development of the low-carbon energy system.

Keywords: Controllable load; demand response; low-carbon; energy system; optimal decision; retail pricing; renewable energy; smart grid; wholesale pricing

As one of the most important fundamental infrastructure, electric power system affects various industries and thousands of households. In faced with the ever-growing load demand and emergent energy shortage, smart grid technologies become significant development trend in the 21st century [1]. The smart grid features omni-directional informatization, digitization and intelligent technologies of integrating all components in the process of power generation, transmission, distribution and electricity consumption [2–4].

As a bridge connecting electricity supply and demand, electricity price is a key factor in maintaining the balance between generation and consumption. It shall not only follow the basic laws of market economy, but also be subject to the inherent and complex physical and technical characteristics of the power network. For example, electricity is not easy to be stored, the system must keep real-time (seconds or even milliseconds) balance among generation and load, and the power flow in the network must be governed by the Kirchhoff’s law. It is difficult to artificially control and track the power flow, and so on. Therefore, electricity pricing decision should comply with these complex physical characteristics and unique transaction attributes, which are different from the ones in the general commodity markets.

For a long time, the electrical energy in China has been priced and regulated by the government according to the production cost [5]. The existing pricing mechanism is unable to effectively reflect the market relationship between supply and demand, the scarcity of resources and the production cost [6]. In 2015, the Chinese government issued a series of policies to further deepen the reform of electric power industry, since then a new round of electricity market development has begun in China [7]. The trading rights have been exercised on the two sides of generation and demand in some provinces. By the end of 2018, 33 provincial trading centers and the 2 regional trading centers (i.e., the ones in Beijing and Guangzhou) have been established. The transmission and distribution prices for provincial power grids have been fully realized. On September 3, 2018, Guangdong’s first spot market started trial operation [8]. At present, China’s power market reform is still in its infancy, and there still exist a large gap as compared to the mature electricity markets in e.g., United States and Britain [9].

The two-way interaction between smart grid and customers plays a more and more important role in improving the overall efficiency of power system [10]. The technical characteristics of smart grid and the market participant and demand response bring new challenges to decision-makings on electricity pricing. Therefore, the technical constraints of power network, active participation of controllable loads, rational use and feedback of electric power should all be taken into account [11,12]. However, the existing electricity pricing mechanisms can hardly match the technical characteristics of smart grid; neither can they facilitate the ever-growing controllable loads in the electricity market.

In this paper, several relevant models and novel methods are proposed for pricing scheme design as well as to achieve optimal decision-makings for market participants, in which the mechanisms behind are compatible with demand response operation of the end users in smart grid. In our study, the electric vehicles and relevant prosumers are considered to enable the two-way energy interaction with the smart grid. Towards this end, the methods on real-time pricing, rewarding pricing and insurance pricing for the retailers are comprehensively proposed in this paper.

2 Demand Response Decision-Making of Controllable Loads

After receiving the signals of direct compensation or price adjustment sent by the operator, the end users adjust their electricity consumption behaviors accordingly [13]. By means of marketization, the two kinds are the price-based and incentive-based demand response, i.e., PBDR and IBDR, respectively. By deploying the PBDR and IBDR, the end users can be stimulated to adjust the electricity consumption mode to improve the overall economy and efficiency of the power system. The former mainly refers to the situation where the users spontaneously change the electricity consumption mode that is responsive to different electricity price, e.g., time-of-use (TOU) price, peak price and real-time price. The latter one mainly refers to the situation where the dispatch organization implements the specific incentive schemes to directly control the power load in the system operation [14].

In PBDR, by taking the market price as an incentive, the end users spontaneously adjust the time and quantity of electricity consumption. Thus, the system load power is reduced during the peak period with high price, and the system load power is increased during the valley period with low price. The peak-cutting and valley-filling smooth the system load curve, thus improving energy efficiency, reducing and postponing generation investments.

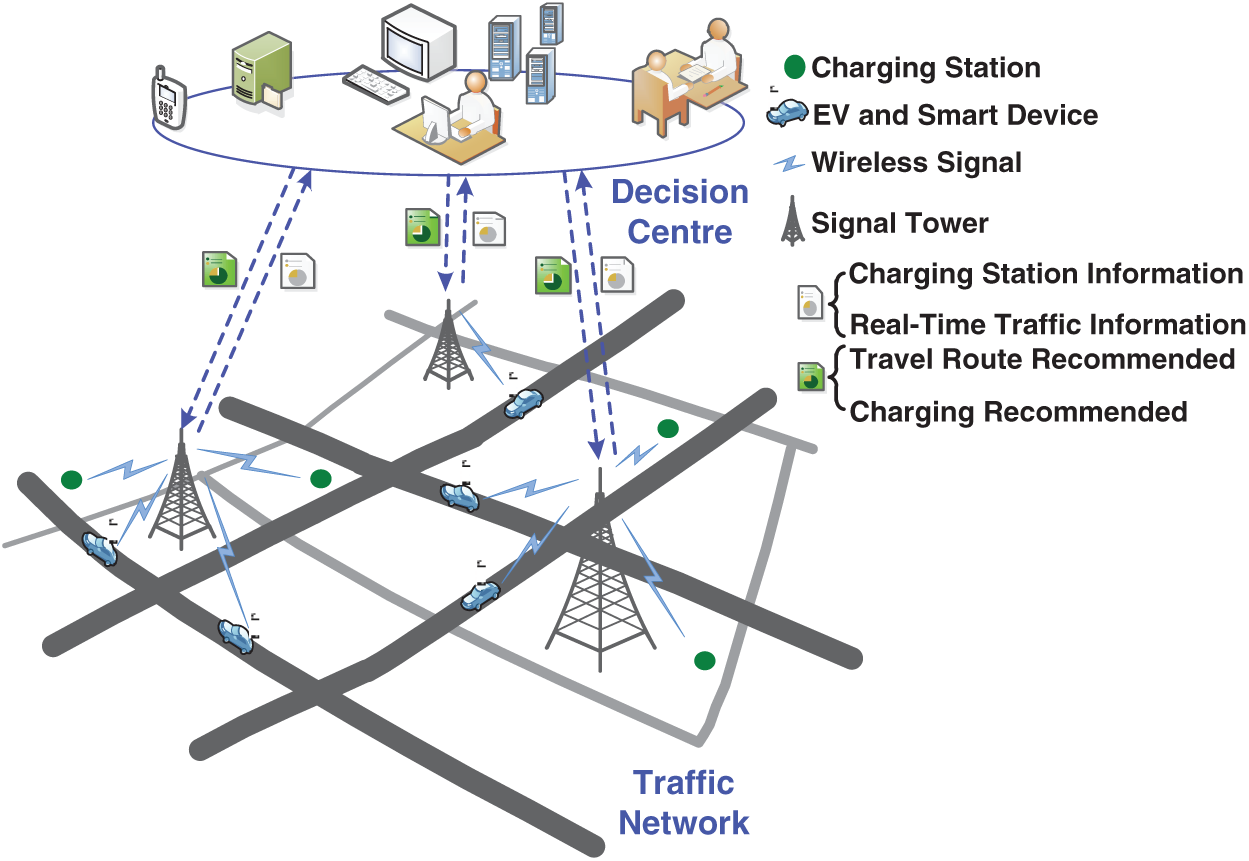

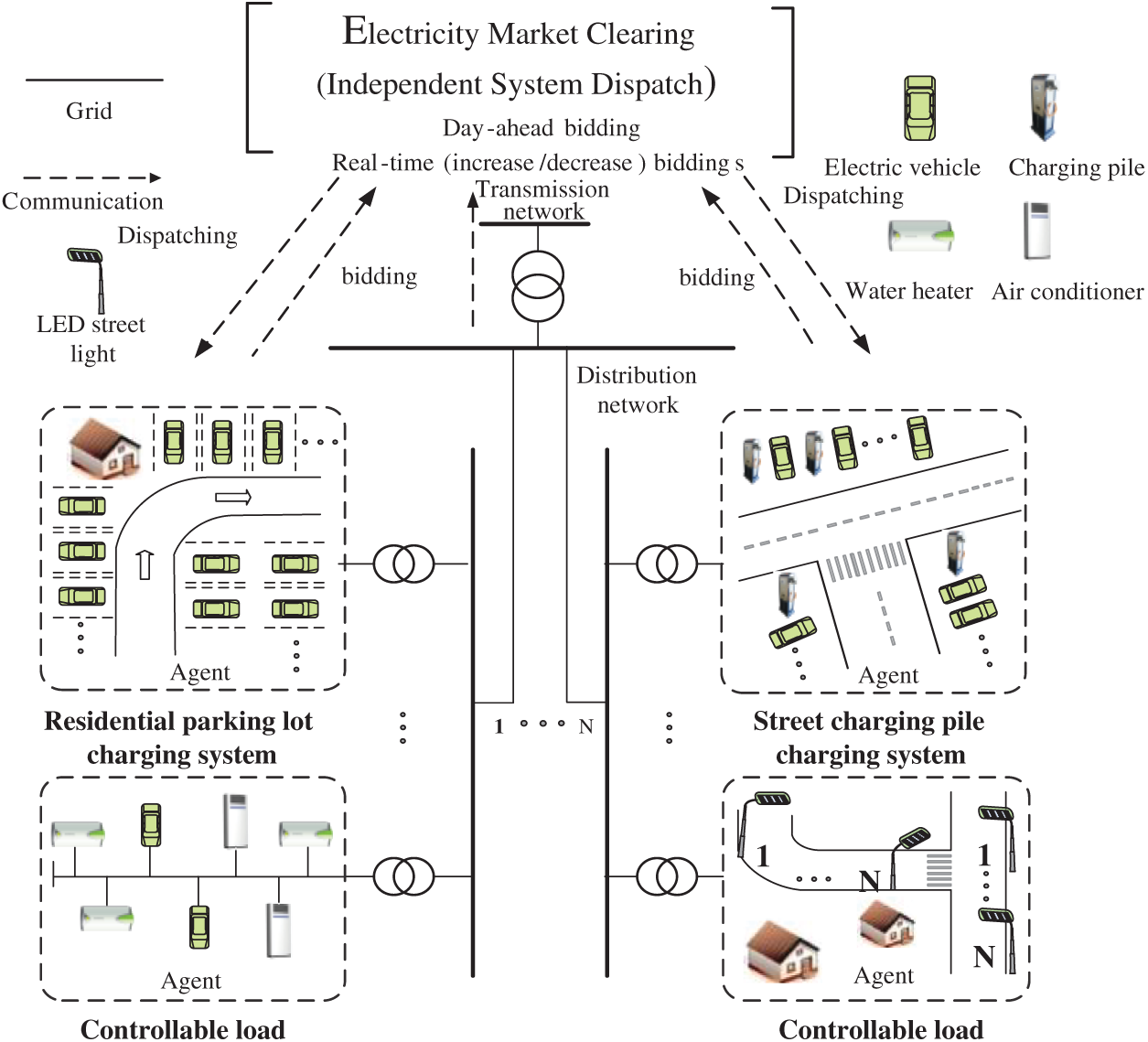

In IBDR, during the peak load period, the electric power operation organization interferes and controls the system load by the incentive means of economic compensation and price rebate [15]. In the market environment, the controllable loads, such as washing machines, refrigerators, electric vehicles (EV) and prosumers will actively respond to the incentive means. The two-way interaction of the controllable loads in smart grid operation is shown in Fig. 1.

Figure 1: Demand response of controllable load to smart grid

As a kind of controllable load, EVs participate in the power system operation through Vehicle to Grid (V2G) technology. The randomness on EV charging and discharging would eventually cause a series of problems, such as power loss, line overload and voltage fluctuations in the power system. Hence, the safety and stability of smart grid operation will be greatly affected. Therefore, it is important to devise the charging/discharging strategies of large-scale EVs to facilitate the overall system integration.

This section will investigate the demand response decision-making of controllable loads considering their participation behavior into the smart grid. The following work is presented. 1) Route optimization and charging/discharging arrangement of EVs under TOU price; 2) Route and charging optimization of EVs by the means of crowd sensing; 3) Optimal generation and consumption decision of multi-energy prosumers.

2.1 Route Optimization and Charging/Discharging Arrangement of EVs under TOU Price

Dantizing and Ramser firstly proposed the vehicle routing problem (VRP) [16]. As shown in Fig. 2, an EV with full battery capacity leaves the distribution point (depot) and delivers a batch of goods to N customers, and simultaneously picks up the goods from the N customers and returns to the distribution point. The VRP is aimed to minimize the total driving costs, route length and driving time, which are subject to the constraints such as the time window, the vehicle type and the overall loading [17–19].

Figure 2: Illustration of EV route optimization

In [20], a VRP model for alternative fossil fuel-driven vehicles was proposed, with the objective of minimizing the driving distance while maximizing fuel capacity and alternative energy supply. In [21], the driving characteristics of EVs are taken into account and the charging decisions of fast charging stations are formulated by satisfying the electrical energy constraints (such as EV battery capacity and routing) and the regular VRP constraints.

The optimization problem is formulated to take the minimum number of electric vehicles and the shortest route as the objectives. It should be noted that the battery degradation cost and fast charging cost are not considered in this study. Furthermore, an optimization model of EV routing concerning the slow charging in the park and the fast charging on the road is proposed with TOU electricity price [22]. The sum of the total costs, covering the slow/fast charging cost and the battery loss costs during fast charging, is minimized. The best navigation route and the charging station with the shortest charging time are simultaneously selected by satisfying these constraints, i.e., charging time, battery capacity and path selection in charging modes. As compared to the existing models, the impact of large-scale charging can be effectively reduced by considering the safety operation of power distribution system, while improving the efficiency of EVs by participating in system-level logistics.

Obviously, this model is a highly non-linear, discrete and non-convex problem, which is difficult to find tractable solutions based on the traditional Newton and descent gradient algorithms. Therefore, a deep-learning intelligent optimization algorithm incorporating the traditional intelligent algorithms and the knowledge models is proposed, which is shown in Fig. 3. The expert knowledge in EV routing and charging station selection is established in the database of algorithm. Based on the constantly updated solutions, it can effectively guide the subsequent searching process to efficiently obtain accurate EV path [23].

Figure 3: Deep-learning intelligent algorithm structure of EV route optimization

The numerical simulation tests on the systems comprising of customers, charging stations and depots demonstrate that the fast charging frequency and time of electric vehicles are crucial for the logistics distribution [22]. As illustrated in Fig. 4, in considering the cost, the decision under the discounted price curve e(3) is the best, and the night delivery can reduce the distribution cost. In considering the route length, the decision under the fixed electricity price curve e(2) is optimal. Under the TOU price, curve e(1), the fast charging does not increase the peak load of the system, and the slow charging mode fills the valley load of the system. The proposed model is conducive to the EV users by improving the driving efficiency, reducing the driving costs and alleviating the impact of simultaneous charging of a great amount of EVs on the operation of power distribution system.

Figure 4: Three different electricity price profiles

2.2 EVs’ Charging Navigation and Route Selection Based on Real-Time Information Collection

In actual transportation system, traffic information (e.g., vehicle density, driving speed and traffic flow) is dynamically changing in real time. However, the traffic information obtained from historical data cannot effectively reflect real-time traffic conditions, thus deviation from the optimal routing remains. Furthermore, the data of traffic information cannot be uploaded in time to the control center, which impacts the operational capacity of intelligent transportation system [24]. Therefore, it is important for the EV users to accurately acquire real-time traffic information in actual navigation system.

In [25], an optimal model of charging navigation and electric vehicle route selection based on real-time information collection is proposed, as shown in Fig. 5. The dynamic charging and traffic information is transmitted to the dispatch center via wireless communication network. For example, the number of electric vehicles arriving at and charging at the charging station can be directly collected through existing sensors or devices. The best EV driving and charging navigation route will be determined by minimizing the vehicle’s charging and navigation time, energy consumption. The EV drivers receive the best decisions on routes and charging navigation through smart mobile devices such as tablet computers and mobile phones. Since traffic flow and charging station queuing are dynamically updated, the decision of the dispatch center should also be made in real time.

Figure 5: Framework of EV charging navigation and route selection based on real-time information collection

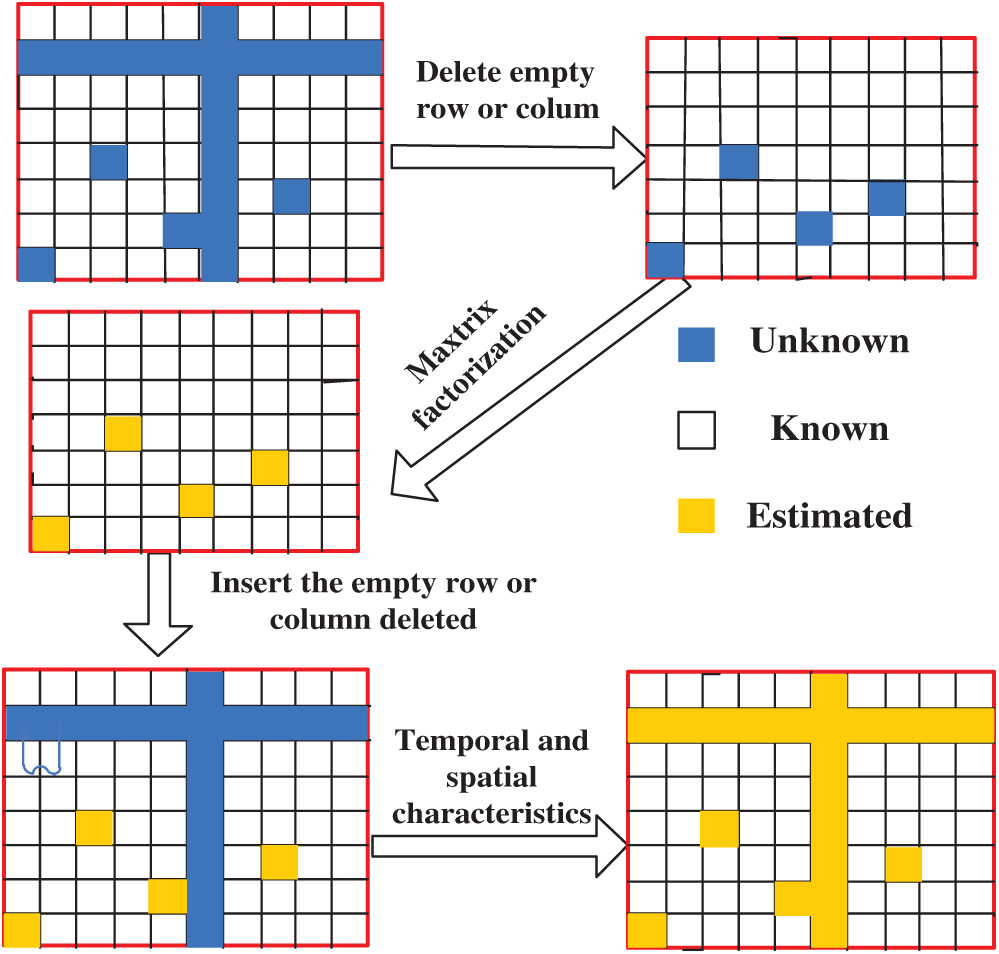

In the early stages of data acquisition on EVs, if no EV user providing location information within a certain interval and time period, blank lines will exist in the EV speed matrix. If the communication network fails, the empty columns exist in the road speed matrix. For a road speed matrix containing empty columns or rows, the errors in the matrix will increase due to the lack of a large amount of EV speed information.

To ensure the accuracy of matrix factorization, a method for recovering the empty columns or rows in the velocity matrix is proposed, as shown in Fig. 6. A matrix factorization method is used to improve the traffic information matrix. Under the conditions of mutually exclusive constraints, the EV driving time, battery capacity, route selection and charging and discharging time are considered. The charging navigation strategies and EV path selection are presented under TOU electricity pricing scheme with three different decision goals: shortest driving time, minimum charging cost and minimum comprehensive cost.

Taking driving time, battery capacity, path selection, and node voltages of distribution system as constraints, a charging navigation and path selection optimization model is developed to minimize the total cost of EV charging and driving time. Based on the results of the numerical simulation of an IEEE 33-node urban power distribution system with four charging stations [25], the proposed strategies optimize the driving time and charging cost in the process of charging navigation and path selection.

Figure 6: Missing data restoration in road speed matrices based on matrix factorization

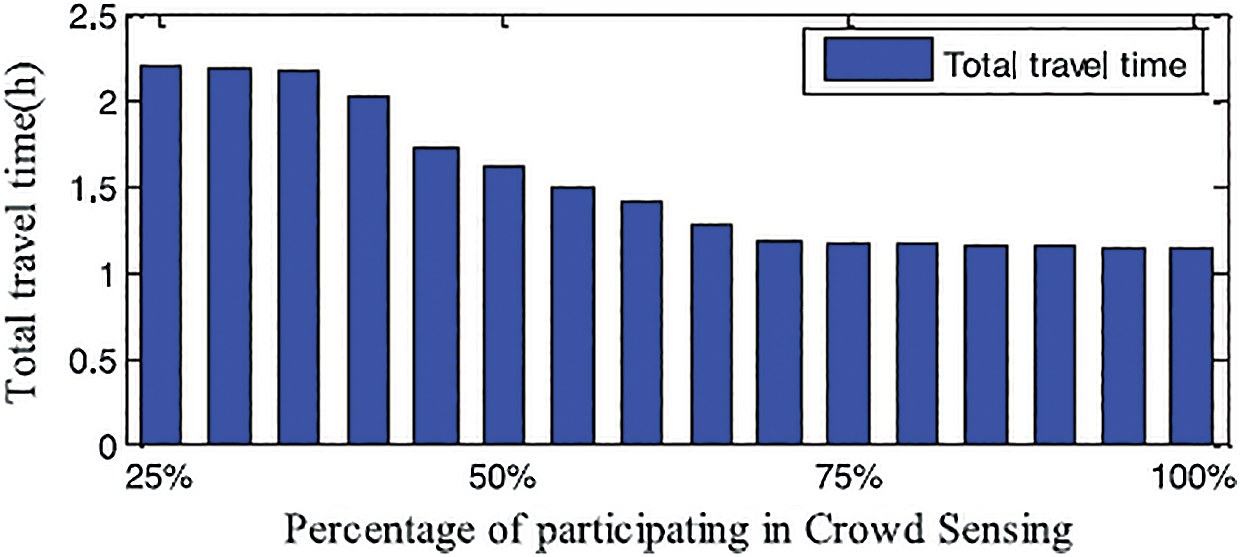

When the dispatch center receives more real-time traffic information about the waiting time of charging station, traffic speed, as shown in Fig. 7, the dispatch center will make more correct decisions and reduce the total EV driving time. Meanwhile, this proposed method can reduce the peak-to-valley difference of distribution system, thereby increase the operating efficiency of the overall system.

Figure 7: Varying curve of driving time with percentage of EVs taking part in real-time information collection

2.3 Optimal Generation and Consumption Decision-Making of Multi-Energy Prosumers

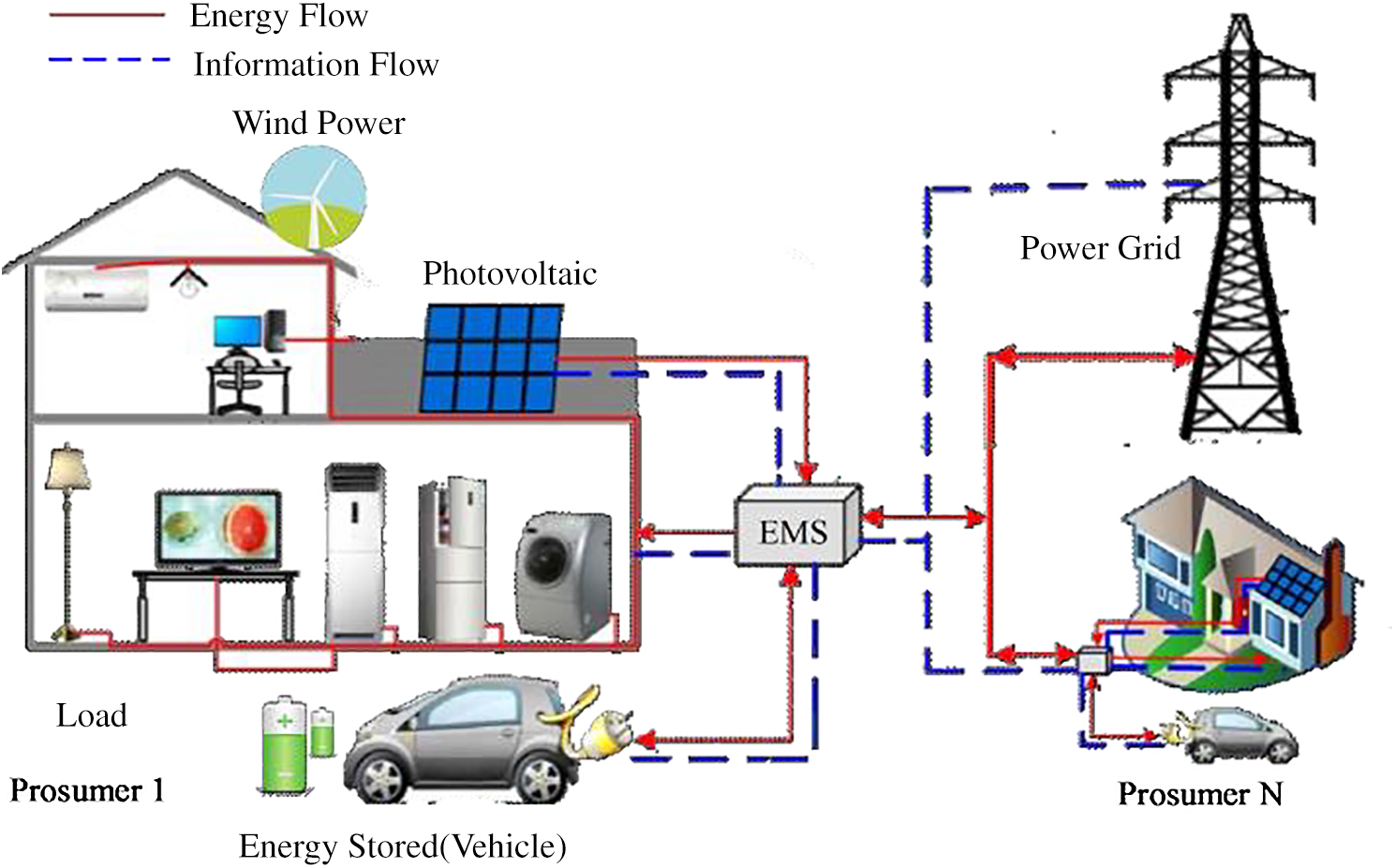

As illustrated in Fig. 8, the prosumers achieve demand response through the energy management system (EMS) by changing the energy habits and automatically adjusting the generation and load according to the real-time price in electricity market. The demand response of the prosumers can effectively facilitate peak clipping and valley filling and increase permeation of distributed wind and solar energy in the low-carbon power system.

Figure 8: Demand response of prosumers in smart grid

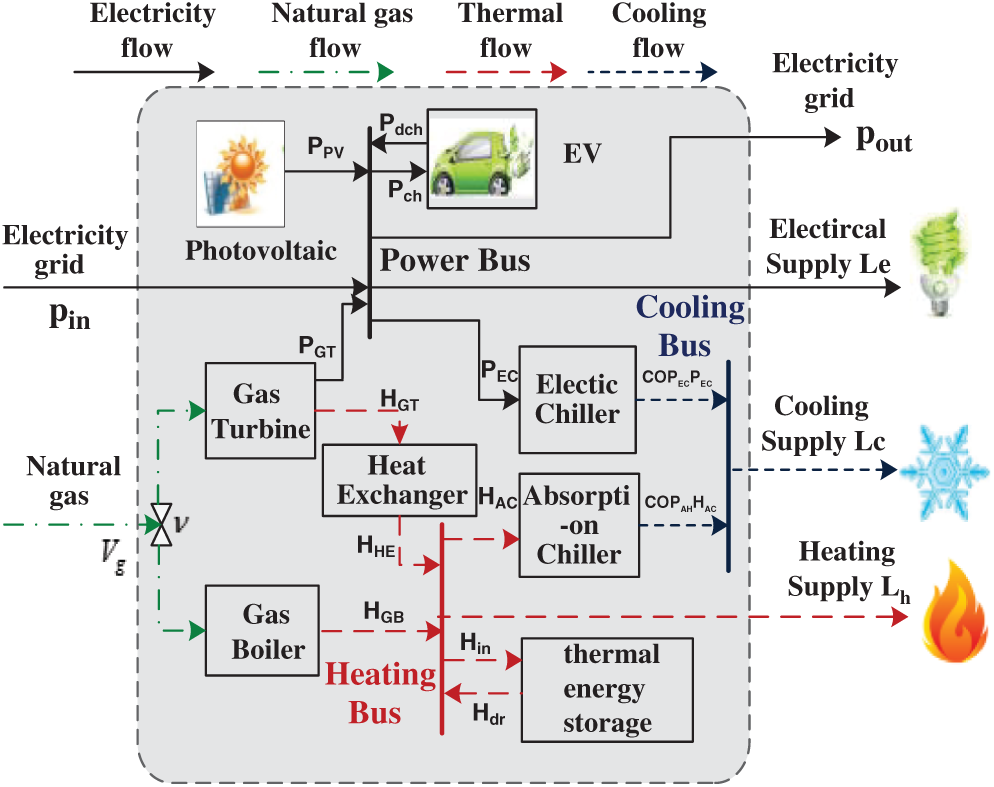

An energy hub of prosumers with distributed energy systems (DES) and combined cooling, heating and power (CCHP) is proposed as shown in Fig. 9. The multi-energy prosumers integrates the networks of natural gas and electricity to enable integrated utilization and mutual backup. The operating efficiency of DES/CCHP is about 60%–80%, which is much higher than those of traditional energy systems [26]. By coordinating the operation of DES/CCHP, the peak-shaving and valley-filling of distribution system can be achieved in the region, while minimizing the costs of energy supply and carbon emission. Thus, some researches have been investigated on the coordination and optimization of multi-network system operation. In [27], by using the natural gas, electricity, photovoltaic power generation and energy storage as the source end, the energy hub produces, distributes, consumes and stores multiple distributed energy. Therefore, the coordinated operation of integrated energy systems and external networks should be considered.

Figure 9: Energy hub of prosumers with DES/CCHP

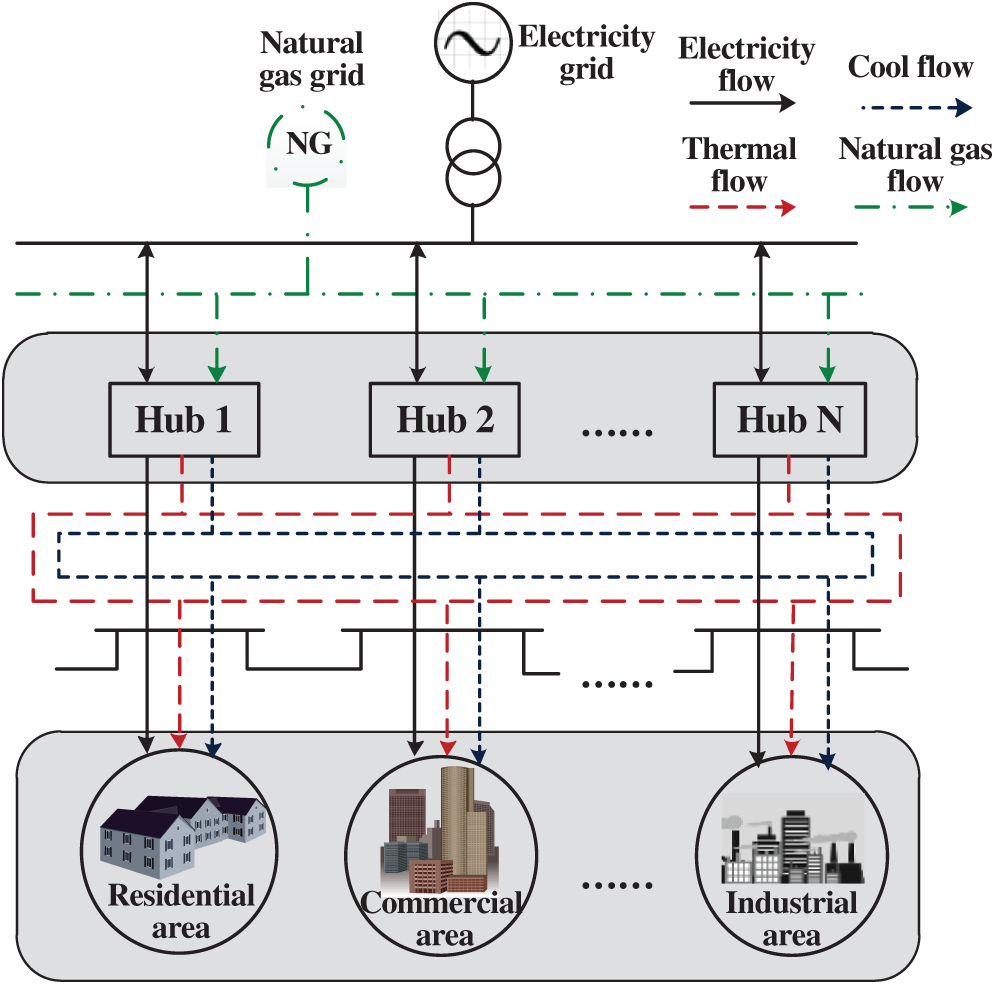

The concept of regional multiple-energy prosumer (RMEP) is proposed in [28] with a demonstration of multiple energy hubs combining renewable DES, CCHP and energy storage. As shown in Fig. 10, the electrical energy is transmitted to the prosumer through a radioactive electricity network in each energy hub, and the prosumer can feed back excess power to the smart grid. Meanwhile, the prosumer receives the natural gas via the gas network. Also, the network of cooling and heating pipes provides the heat and cold energies.

Figure 10: Framework of prosumer with interconnected multiple energy hubs

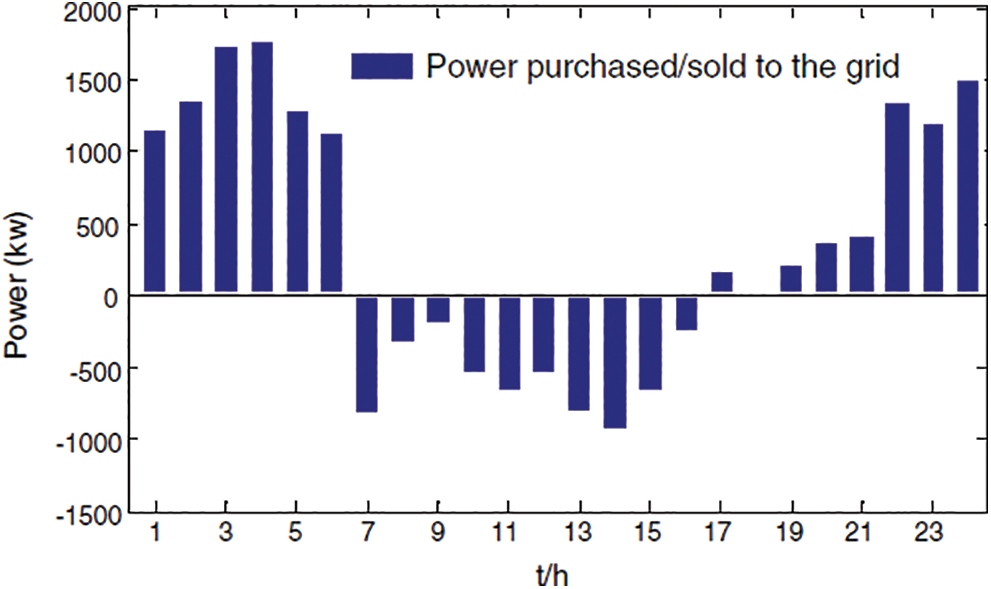

The multiple-energy prosumer uses natural gas, electric power, and photovoltaic power generation as the main sources. In considering the EV charging and discharging functions, the energy hub structure outputs the cold/heat and electrical energy. A two-way energy flow is achieved through the form of a bus between the multiple energy hubs and the smart grid. By concerning the price of electricity and natural gas during different time periods, the incentive measures are applicable to renewable DES. The optimized scheduling model of prosumer with demand response is proposed to meet the needs of different types of electricity, heat, and cold loads in different seasons and thus reduce the overall greenhouse gas emissions. Through numerical simulation based on IEEE 15-bus system, the case study results in Fig. 11 shows that the multi-energy prosumer can not only reduce the system operational costs, but also increase the power feed-back to the smart grid [28]. Therefore, the RMEP can effectively improve the flexibility, reliability and efficiency of energy supply.

Figure 11: Power purchased and sold by multi-energy prosumer on typical summer day

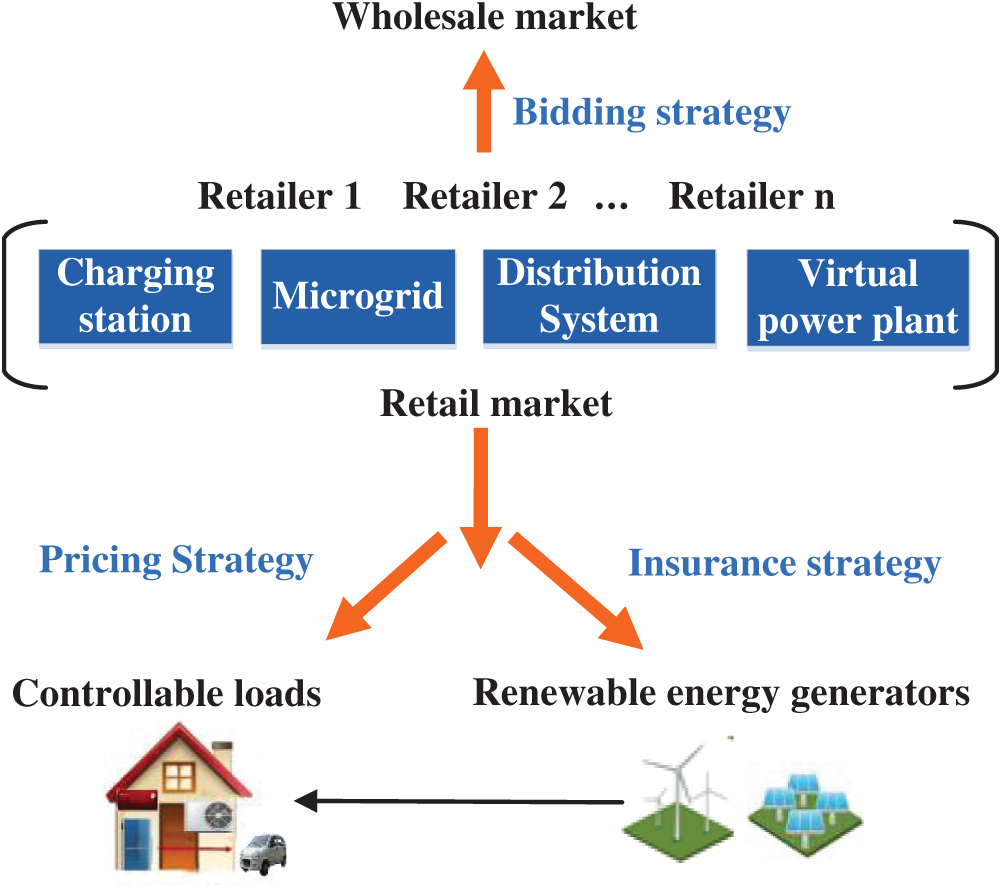

3 Pricing Decision of Retail and Wholesale Markets

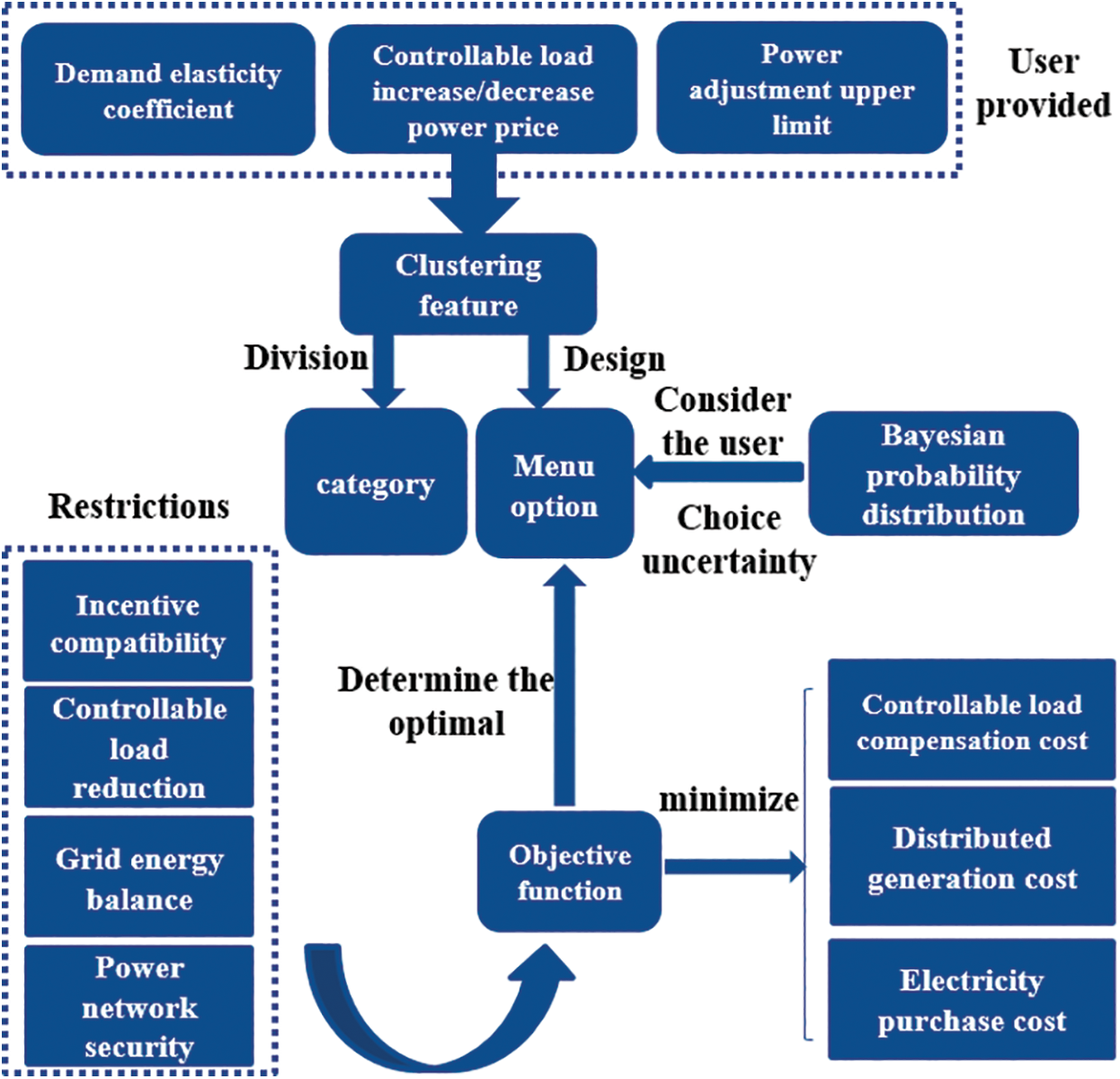

With the deep integration of power system and information technology, more and more consumers are involved in the operation and management of smart grid. It is important for different types of consumers to respond efficiently to the time-varying electricity price with the satisfaction of load requirements. Intelligent demand response will bring about a series of new problems to the system scheduling and pricing. This section will summarize some research results on the design of electricity pricing scheme from three aspects, including pricing method, bidding strategy and insurance strategy in the retail and wholesale markets. The framework of pricing decision based on smart response of controllable loads is illustrated in Fig. 12.

Figure 12: Framework of pricing decision in retail and wholesale markets based on smart response of controllable loads

3.1 Retail Market Pricing Based on Smart Response of Controllable Loads

With the widespread utilization of advanced metering infrastructure, the consumers can collect the real-time loading power and distributed generation data. The smart response of controllable loads, as one of the important adjustable power ways in the demand sides dispatched by the system operator, has the advantages of quick response, friendly environment and relatively low scheduling costs. It can effectively smoothen the fluctuation of load power and distributed generation, thereby significantly improve the economic benefits of the consumers. Therefore, it is necessary to formulate the reasonable prices and policies to promote more controllable loads to take part in balancing market.

In the literature, several research attempts on pricing schemes based on TOU rates, day-ahead and real-time rates, compensation rates for interruptible loads have been implemented. However, the existing pricing models assume that the operators have complete and accurate the consumers’ information. When analysing the impact of different pricing plans on the consumers, different types of consumers’ uncertainties and behaviours are not considered. The consumers’ information is limited in practice. Thus the designed models should reflect the response of different types of controllable loads to differential prices.

In order to promote a great amount of controllable loads scattered around to participate in the power market operations, the retailers have designed a pricing scheme with multiple choice plans to encourage more controllable loads to respond to multiple options [29]. Based on the quotes and price elastic coefficient of controllable loads, the categories of smart response are deduced based on data clustering and classification, thereby reducing the requirements on the consumers’ information. Based on a list of options, the controllable loads can accurately respond to different types of prices.

Furthermore, by using the Bayesian discrete probability distribution function, a comprehensive pricing framework that takes into account consumers’ behaviour uncertainty is proposed, as shown in Fig. 13. The information (e.g., the increase and decrease of power and quotes, the power adjustment limit and the demand elasticity coefficient by the controllable loads) is exacted as the certain features to achieve accurate clustering. Then, the corresponding menu options are designed and the compensation prices of power adjustment of controllable loads are determined to minimize the system power supply cost. The proposed menu pricing method effectively promotes demand-side smart response and reasonable profit return.

Figure 13: Framework of menu pricing scheme in smart response

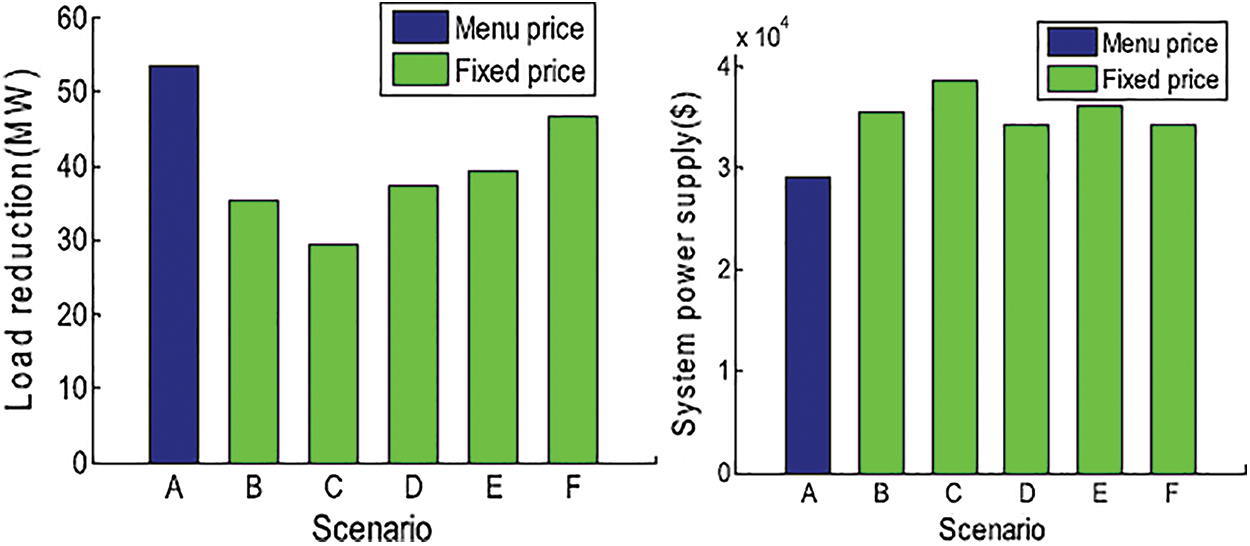

The IEEE 30-node and 118-node systems have been adopted to verify the effectiveness of the proposed menu pricing model [29]. As illustrated in Fig. 14, the research results show that the pricing method ensures that different types of consumers choose the most suitable menu pricing, which effectively stimulates more demand-side resources to adjust the load power and thus reduce the overall power supply cost of the system.

Figure 14: Power supply cost and load reduction under menu price and fixed price

3.2 Wholesale Market Bidding Decision of Retailers with Controllable Loads

As intermittent and unpredictable renewable energies are embedded in the power system, more controllable loads need to be dispatched to ensure the stable and safe operation of system [30]. The renewable energy producers, which are served as price takers, generally make their own biggest profits by setting a rationale generation power plan [31]. In order to enhance the returns in the day-ahead market and real-time balance market, and make investment profitable, the renewable energy producer develops effective bidding strategies. The risk constrained model is proposed to express the risk of profit fluctuations due to the bidding of competitors [32].

In the above research work on bidding decisions, it is assumed that electricity prices were known in the day-ahead market. The deviations due to unpredictable fluctuations in the generation and load power are eliminated through the real-time market. In these researches, the influence of market price uncertainty on retailers’ bidding strategies in real-time market operations is ignored. In addition, through the use of a scheme tree to identify events that may occur in the electricity market, the complexity of the retailer’s bidding decision increases exponentially. Therefore, it is necessary to coordinate the inflexible and flexible biddings in different electricity markets, and to reformulate the alternatives to deal with the stochastic optimization problems with conditional expectation.

Therefore, according to the retailers’ trading schemes, the flexible up-regulation or down-regulation bidding in the real-time market and the inflexible bidding in the day-ahead market should be coordinated for the controllable loads. According to the probabilistic relationship between the derived bid price and the market clearing price, a bidding decision model with minimum purchase cost under conditional expectations is proposed [33], as shown in Fig. 15. In the cost function, the penalty caused by the deviation of the bidding amount in the real-time and the day-ahead markets is added to avoid the retailer's arbitrage interests in the two markets and eliminate a large power balance problem in the system.

Figure 15: Framework of bidding of controllable loads participating in wholesale market

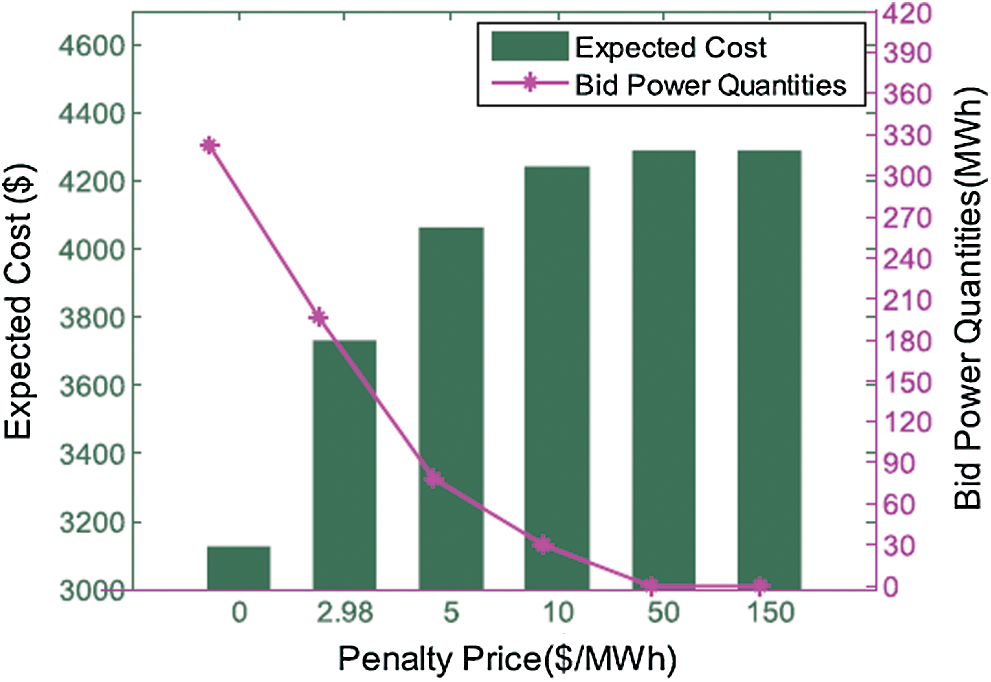

Based on the PJM (Pennsylvania-New Jersey-Maryland) price data in the USA electricity market, the numerical simulations, as shown in Fig. 16, shows that the proposed bidding decision model of retailers can reveal the nonlinear relationship between the bidding quantity and price, the expected purchase cost and the successful probability of bidding. The flexible up-regulation or down-regulation bidding provides an optimal decision-making reference method for the retailers with frequently fluctuating renewable energy.

Figure 16: Varying of bidding quantities and expected costs with different penalty prices

3.3 Insurance Pricing of Retailer Considering Uncertainty Risk of Renewable Energy Generation

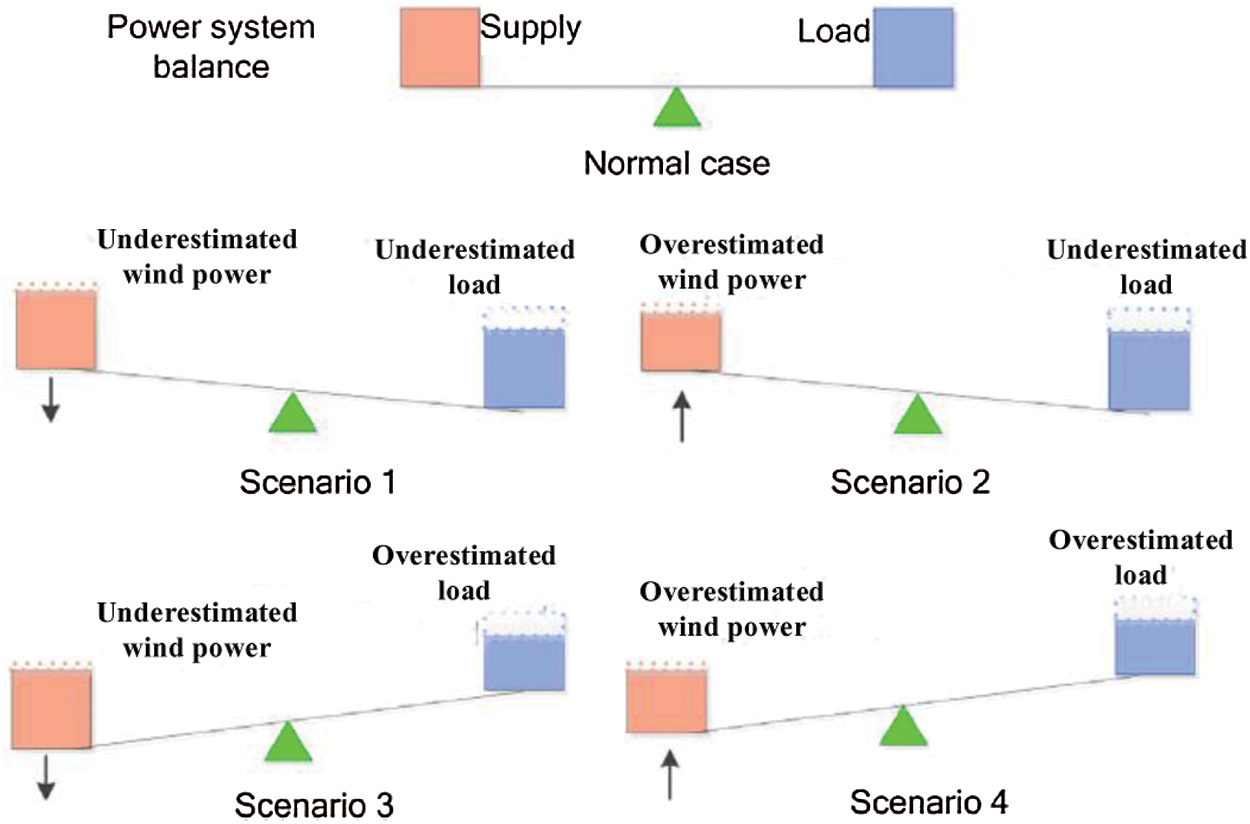

Due to the random fluctuation of grid-connected power of renewable energy and end users, the bidding power of the retailer deviates from the actual power, resulting in penalties for the imbalanced settlement in the electricity market. The retailers will face the risk of penalties from trading centres. It is critical to accurately forecast renewable energy generation on different time scales for market trading and portfolio management. The prediction errors and imbalances for the supply and load power are shown in Fig. 17.

Figure 17: Forecast errors and imbalance for supply and load power

Although the renewable energy forecasting technologies have been continuously improved in recent years, there exist relatively large prediction errors in case that the generation power of renewable energy has high-speed fluctuations [34]. Currently, in addition to setting up the reserve market and installing the energy storage systems, there are three measures to avoid the uncertainty risk of generation power prediction of renewable energy [35,36].

1. Risk reduction: the current forecasting methods are improved for renewable energy generation based on operational experience and historical data. The bidding strategies are adjusted by considering the cost of power imbalances.

2. Risk aversion: the renewable energy producers indirectly participate in the power market, which can choose the retailers to sell electricity. The retailers have more controllable power to perform the bidding in the real-time market [37].

3. Risk transfer: the risk of deviation penalties is transferred to the insurance company. An insurance company collects premiums from a number of the retailers. When a retailer pays the penalties for deviations, it will obtain the compensation fee from the insurance company [38].

The retailers with renewable energy generation transfer the risk of grid-connected power fluctuations to the insurance companies by the insurance purchase and payment methods. The establishment of insurance mechanism can effectively reduce the economic losses of retailers when facing the events with the low probability and high loss, thus ensuring the sustainable development of renewable energy industry [39]. There are many factors to be considered in the insurance pricing, such as a large number of historical operating data of renewable energy units. As compared to the traditional methods such as installing energy storage equipment or improving the prediction accuracy of renewable energy generation, it is becoming more and more important to effectively utilize the insurance strategies to resolve the contradiction between the stability and economy of electric system. The impacts of prediction errors of renewable energy generation are effectively reduced in the system scheduling and control.

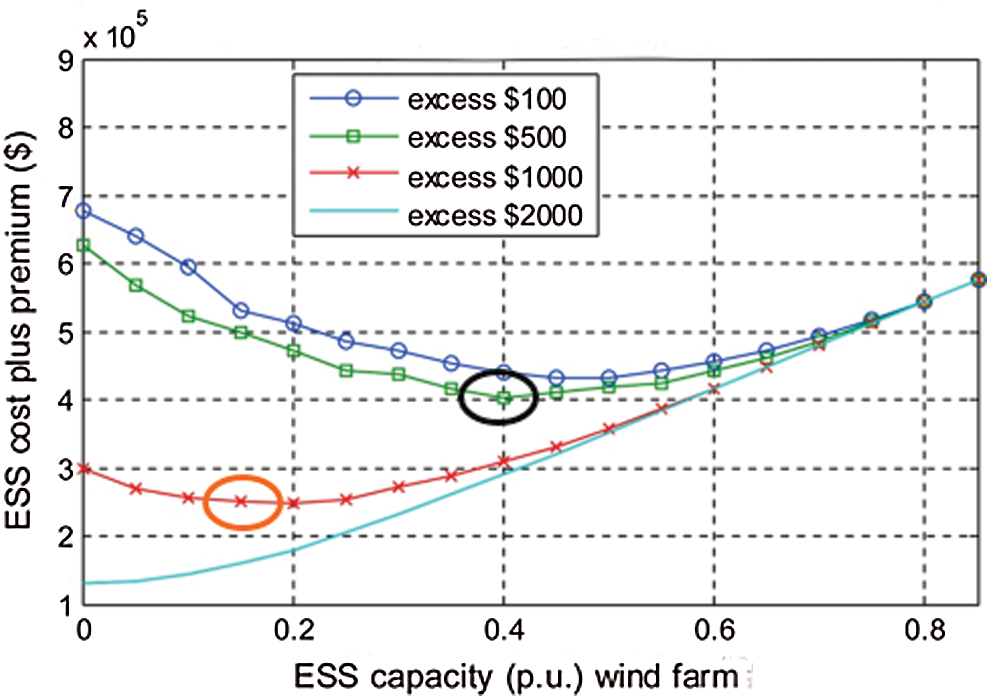

In [40], an insurance strategy method of retailer is proposed to quantitatively consider the risk of prediction errors of renewable energy generation and load power. Based on Monte Carlo simulation method, the statistical scenarios for power output of renewable energy generation and loading power are established and the penalty costs of retailer can be quantified. The simulation results in Fig. 18 demonstrate that through the combination of insurance strategy and energy storage system (ESS), the risk of penalty costs of retailer is alleviated in the spot market. The insurance strategy method is used to compensate the imbalanced penalty costs under the large fluctuations of renewable energy generation, while the energy storage device is used to balance the small fluctuations.

Figure 18: Varying of annual cost of an energy storage system plus insurance with different excess insurances for renewable energy generation

The controllable loads (e.g., electric vehicles, air conditioners and washing machines) can be effectively utilized to participate in demand side management in power system. The demand responsive decision-makings in the electricity market and electricity pricing schemes that are conducive to peak shaving and valley filling, frequency and voltage regulation are comprehensively reviewed. The retail market and wholesale market pricing decision can assist in stimulating more demand-side resources to adjust load and generation power to participate in market transaction and system dispatch. This paper summarizes and analyses the key issues of demand responsive market decision-makings and pricing scheme design in the context of smart grid, thus providing some useful operational references on the cooperative operation of controllable loads and renewable energy through the feasible retail and wholesale market pricing methods, and enhancing the development of the low-carbon energy system.

Funding Statement: This work was funded by the National Natural Science Foundation of China (71931003); the Science and Technology Projects of Hunan Province and Changsha City (2018GK4002, 2019CT5001, 2019WK2011, 2019GK5015, kq1907086).

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

1. Ipakchi A., Albuyeh F. (2009). Grid of the future. IEEE Power and Energy Magazine, 7(2), 52–62. DOI 10.1109/MPE.2008.931384. [Google Scholar] [CrossRef]

2. Gong, G., Sun, Y., Cai, M., Wu, Z., Tang, L. (2011). Research of network architecture and implementing scheme for the Internet of Things towards the smart grid. Power System Protection and Control, 39(20), 52–58. [Google Scholar]

3. Lu, B., Ma, Y. (2013). Research on communication system of advanced metering infrastructure for smart grid and its data security measures. Power System Technology, 37(8), 2244–2249.

4. Yu, Y., Liu, Y. (2015). Challenging issues of smart grid. Automation of Electric Power System, 39(2), 1–5. [Google Scholar]

5. National Development and Reform Commission of the People’s Republic of China. (2015). Several opinions of the central committee of the communist party of china and the state council on further deepening the reform of the electric power system. http://tgs.ndrc.gov.cn/zywj/201601/t20160129_773852.html. [Google Scholar]

6. Ge, R., Cheng, X., Wang, Y. (2017). Optimization and design of China’s power market construction path. Automation of Electric Power Systems, 41(24), 10–15. [Google Scholar]

7. Wang, T., Zhang, L. (2016). Summary and research on the trading mode of electricity market under the background of new electricity reform. Electrical and Energy Efficiency Management Technology, 23(6), 76–81. [Google Scholar]

8. National Development and Reform Commission of the People’s Republic of China. (2018). South china (starting in guangdong) power spot market trial operation kick-off meeting. http://www.ndrc.gov.cn/dffgwdt/201809/t20180905_897807.html. [Google Scholar]

9. Ma, L., Huang, L., Xue, S. (2017). Key issues for the orderly operation of China’s new round of power market reform pilot. China Power, 50(4), 17–22. [Google Scholar]

10. Wang, B., Li, Y., Gao, C. (2009). Demand side management outlook under smart grid infrastructure. Automation of Electric Power System, 33(20), 17–22. [Google Scholar]

11. Chen, H., Zhang, S., Zhang, Y. (2008). Research on transaction mode of direct power purchase by large consumers in electricity market. Power System Technology, 32(21), 85–90. [Google Scholar]

12. Chen, X., Hu, J. (2008). Preliminary discussion on the straight power transactions between large power users and generation enterprises. Automation of Electric Power System, 32(24), 100–103. [Google Scholar]

13. Liu, B., Wang, D., Zeng, M. (2005). Form DSM to demand side response. Power Demand Side Management, 7(5), 10–13. [Google Scholar]

14. Zhang, Z., Wang, X., Li, H., Peng, D., Ren, B. (2017). Ability model of the influence of demand response on electricity demand. Proceedings of the CSU-EPSA, 29(4), 115–121. [Google Scholar]

15. Huang, H. X., Deng, L., Zhang, L. (2015). Review of real-time pricing based on demand response. Electrical Technology, 15(11), 1673–3800. [Google Scholar]

16. Dantzig, G. B., Ramser, J. H. (1959). The truck dispatching problem. Management Science, 6(1), 80–91. DOI 10.1287/mnsc.6.1.80. [Google Scholar] [CrossRef]

17. Marinakis, Y., Marinaki, M., Dounias, G. (2010). A hybrid particle swarm optimization algorithm for the vehicle routing problem. Engineering Applications of Artificial Intelligence, 23(4), 463–472. DOI 10.1016/j.engappai.2010.02.002. [Google Scholar] [CrossRef]

18. Zhang, Q., Liu, Y., Cheng, G., Wang, Z., Hu, H. et al. (2008). Improved genetic algorithm for variable fleet vehicle routing problem with soft time window. Logistics Science and Technology, 2008(2), 20–23.

19. Prins C. (2004). A simple and effective evolutionary algorithm for the vehicle routing problem. Computers & Operations Research, 31(12), 1985–2002. DOI 10.1016/S0305-0548(03)00158-8. [Google Scholar] [CrossRef]

20. Erdoğan, S., Miller-Hooks, E. (2012). A green vehicle routing problem. Transportation Research Part E: Logistics and Transportation Review, 48(1), 100–114. DOI 10.1016/j.tre.2011.08.001. [Google Scholar] [CrossRef]

21. Michael, S., Andreas, S., Dominik, G. (2014). The electric vehicle-routing problem with time windows and recharging stations. Transportation Science, 48(4), 465–449. DOI 10.1287/trsc.2014.0570. [Google Scholar] [CrossRef]

22. Yang, H., Yang, S., Xu, Y., Cao, E., Lai, M. et al. (2015). Electric vehicle route optimization considering time-of-use electricity price by learnable partheno-genetic algorithm. IEEE Transactions on Smart Grid, 6(2), 657–666. DOI 10.1109/TSG.2014.2382684. [Google Scholar] [CrossRef]

23. Xing, L., Yao, F. (2012). Learnable genetic algorithm to double-layer CARP optimization problems. Systems Engineering and Electronics, 34(6), 1187–1192. [Google Scholar]

24. Tao, S., Manolopoulos, V., Rodriguez, S., Rusu, A. (2012). Real-time urban traffic state estimation with A-GPS mobile phones as probes. Journal of Transportation Technologies, 2(1), 22–31. DOI 10.4236/jtts.2012.21003. [Google Scholar] [CrossRef]

25. Yang, H., Deng, Y., Qiu, J., Li, M., Lai, M. et al. (2017). Electric vehicle route selection and charging navigation strategy based on crowd sensing. IEEE Transactions on Industrial Informatics, 13(5), 2214–2226. DOI 10.1109/TII.2017.2682960. [Google Scholar] [CrossRef]

26. Bullock, D., Weingarden, S. (2006). Combined heat and power (CHP) in the gulf coast region: Benefits and challenges. Houston Advanced Research Center. http://files.harc.edu/sites/gulfcoastchp/reports/gulfcoastchpbenefitschallenges.pdf. [Google Scholar]

27. Amirhossein, H., Claudio, C., Michael, F., Martin, G., Goran, A. (2007). Optimal energy flow of integrated energy systems with hydrogen economy considerations. 2007 iREP Symposium-Bulk Power System Dynamics and Control-VII. Revitalizing Operational Reliability, 10(11), 19–24. [Google Scholar]

28. Yang H., Xiong T., Qiu J., Qiu D., Dong Z. Y. (2016). Optimal operation of DES/CCHP based regional multi-energy prosumer with demand response. Applied Energy, 167, 353–365. DOI 10.1016/j.apenergy.2015.11.022. [Google Scholar] [CrossRef]

29. Yang, H. M., Zhang, J., Qiu, J., Zhang, S. H., Lai, M. Y. et al. (2018). A practical pricing approach to smart grid demand response based on load classification. IEEE Transactions on Smart Grid, 9(1), 1949–3053. [Google Scholar]

30. Fahrioglu, M., Alvarado, F. L. (2000). Designing incentive compatible contracts for effective demand management. IEEE Transactions on Power Systems, 15(4), 1255–1260. DOI 10.1109/59.898098. [Google Scholar] [CrossRef]

31. Giannitrapani, A., Paoletti, S., Vicino, A., Zarrilli, D. (2016). Bidding wind energy exploiting wind speed forecasts. IEEE Transactions on Power Systems, 31(4), 2647–2656. DOI 10.1109/TPWRS.2015.2477942. [Google Scholar] [CrossRef]

32. Baringo, L., Conejo, A. J. (2016). Offering strategy of wind-power producer: A multi-stage risk-constrained approach. IEEE Transactions on Power Systems, 31(2), 1420–1429. DOI 10.1109/TPWRS.2015.2411332. [Google Scholar] [CrossRef]

33. Yang, H., Zhang, S., Qiu, J., Qiu, D., Lai, M. et al. (2017). CVaR-constrained optimal bidding of electric vehicle aggregators in day-ahead and real time markets. IEEE Transactions on Industrial Informatics, 13(5), 2555–2565. DOI 10.1109/TII.2017.2662069. [Google Scholar] [CrossRef]

34. Swinand, G. P., O’Mahoney, A. (2015). Estimating the impact of wind generation and wind forecast errors on energy prices and costs in Ireland. Renewable Energy, 75, 468–473. DOI 10.1016/j.renene.2014.09.060. [Google Scholar] [CrossRef]

35. Moghaddam, I. G., Nick, M., Fallahi, F., Sanei, M., Mortazavi, S. (2013). Risk-averse profit-based optimal operation strategy of a combined wind farm-cascade hydro system in an electricity market. Renewable Energy, 55, 252–259. DOI 10.1016/j.renene.2012.12.023. [Google Scholar] [CrossRef]

36. Bludszuweit, H., Dominguez-Navarro, J. A., Llombart, A. (2008). Statistical analysis of wind power forecast error. IEEE Transactions on Power Systems, 23(3), 983–991. DOI 10.1109/TPWRS.2008.922526. [Google Scholar] [CrossRef]

37. Abbey, C., Strunz, K., Joos, G. (2009). A knowledge-based approach for control of two-level energy storage for wind energy systems. IEEE Transactions on Energy Conversion, 24(2), 539–547. DOI 10.1109/TEC.2008.2001453. [Google Scholar] [CrossRef]

38. Yao, F., Dong, Z. Y., Meng, K., Xu, Z., Herbert, H. et al. (2012). Quantum-inspired particle swarm optimization for power system operations considering wind power uncertainty and carbon tax in Australia. IEEE Transaction on Power Systems, 8(4), 880–888. [Google Scholar]

39. Matevosyan, J., Soder, L. (2006). Minimization of imbalance cost trading wind power on the short-term power market. IEEE Transaction on Power Systems, 21(3), 1396–1404. DOI 10.1109/TPWRS.2006.879276. [Google Scholar] [CrossRef]

40. Yang, H., Qiu, J., Meng, K., Zhao, J. H., Dong, Z. Y. et al. (2016). Insurance strategy for mitigating power system operational risk introduced by wind Power forecasting uncertainty. Renewable Energy, 89, 606–615. DOI 10.1016/j.renene.2015.12.007. [Google Scholar] [CrossRef]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |