| Energy Engineering |  |

DOI: 10.32604/EE.2022.017709

ARTICLE

Energy-Related Services as a Business: Eco-Transformation Logic to Support the Low-Carbon Transition

1Naftogaz of Ukraine, Kyiv, 01601, Ukraine

2Interregional Academy of Personnel Management, Kyiv, 02000, Ukraine

3Institute of Engineering Thermophysics, Kyiv, 03057, Ukraine

*Corresponding Author: Oleksandr~Novoseltsev. Email: anovos@i.com.ua

Received: 31 May 2021; Accepted: 18 September 2021

Abstract: The transition to low-carbon development has been recognized as one of the most important directions for the transformation of national economies in most countries. Today we can identify two of the most common service-oriented logical models of this transition. These are models of Service-Dominant Logic and Product-Service Systems that are used in this study to create a service-oriented platform for stimulating business development in the field of energy-related (ER) services. The establishment of such a platform is being considered based on the conceptual provisions of the global business ecosystem. Such a platform has been found to be a powerful tool for systemic coordinated cooperation between actors in the ER-services market and the relevant actors in the energy sector as well as in other industrial markets, unleashing the benefits of synergies, resulting from such cooperation. The logical models of attracting energy services companies to the creation of virtual communities (centers) for large-scale implementation of measures in the field of energy efficiency and renewable energy sources are presented in detail. The advantages of the practical implementation of logical models are confirmed by calculations performed on mathematical model adapted for engineering use in the field of ER-services.

Keywords: Energy services market; service-oriented logic; performance contracting

Environmental pollution during the combustion of fossil fuels, which largely causes radical changes in the behavior of the global ecosystem, and which is increasingly affecting the socio-economic situation and human health, indicate the urgent need to engage service-oriented business to accelerate the large-scale implementation of measures in energy efficiency (EE), renewable energy sources (RES) and environmental protection. This task is relevant all over the world, but it primarily concerns countries with energy-intensive economies that emit significant amounts of CO2. The analysis shows that the top 10 emitting countries now collectively emit approximately 65% of the world’s total CO2 emissions. They are: China–9717 (10911) Mt, USA–4405 (5083) Mt, India–2191 (2425) Mt, Russia–1619 (1738) Mt, Japan–979 (1199) Mt, Iran–619 (650) Mt, Germany–617 (777) Mt, Korea–570 (655) Mt, Indonesia–566 (532) Mt, Canada–516 (578) Mt (data for 2020 and in brackets for comparison—for 2017) [1,2].

The challenge of reducing CO2 emissions is complex and needs to be addressed both globally and nationally. The actual situation with CO2 emissions in the world confirms this, generally maintaining negative trends. According to IEA energy survey, the expected increase in coal consumption in 2021 exceeds the growth of renewable energy by almost 60%. More than 80% of the projected increase in coal consumption is expected to occur in Asia, led by China. In the same time, the share of coal in electricity generation in the European Union has declined almost three-percentage points from 2019 to 2021. In the US, the largest contribution to CO2 emissions has the use of oil, which in 2021 will remain almost 6% below the level of 2019, and coal is expected to be almost 12% below 2019. Natural gas demand in the world is set to grow by 3.2%, propelled by increasing demand in Asia, the Middle East and the Russia [2].

To expand international cooperation in overcoming the climate crisis and strengthen support for the low-carbon transition, the US Department of Energy announced in April 2021 new initiatives to meet the ambitious national goals of 100% clean electricity by 2035 and net-zero carbon emissions by 2050, while creating new businesses, and puts millions of Americans to work. As an integral part of these initiatives, the creation of consolidating service mechanisms to coordinate and balance the efforts of the international community is declared. Such service mechanisms, in order to be successful, on the one hand, have to coordinate not only technological, but also financial, economic and social activities of their adherents. On the other hand, such activities should be based on the principles of economic incentives, that is, on a carrot-and-stick approach.

Service industry are a growing part of the global economy, where the share of services in GDP increased in 1980–2015 from 61% to 76% in developed countries and from 42% to 55% in developing countries (47% in Ukraine). Percentage added by service industry to the GDP of the USA in 2020 approached 77%, Germany–71%, China–55%, Ukraine–47%. Services also prevalent in foreign green investment and, moreover, they have been growing faster than investment in the primary and manufacturing sectors for the last 10 years [3,4]. Thus, the service type of economy predominates in developed countries, in contrast to countries with economies in transition, where the production of raw materials and agricultural products prevails among the main types of business activity.

Energy services are paramount to supporting the low-carbon transition of economies and to social welfare. The scope of their application covers two main fields of engineering business: core energy services and energy-related (ER) services [5]. The core energy services are related to the transportation, transmission and distribution of energy resources. The scope of ER-services includes consulting in virtually all fields of energy use, especially in EE, energy conservation and RES, construction and maintenance of equipment, energy management, accounting and billing of saved energy, etc.

Despite the importance of ER-services for business, the pace of their implementation around the world is considered unsatisfactory. This is primarily due to technological complexity and diversity of types and forms of energy and goods, as well as the need for their long time use (repair, maintenance, modernization, etc.) during both the life cycle and utilization stage in order to mitigate the impact on the environment. Among the other obstacles to the development of ER-services market are low competitive pressures that stimulate innovation and performance, slow productivity growth, a shortage of cross-border investments, and low labor mobility [3,6].

Concretizing the current situation with the creation of ER-services business on the basis of the dominants of low-carbon innovation-and-investment development, first identify the following obstacles:

• Lack of systemic interaction between ER-service providers, each of which operates in the market independently in its narrow field of business;

• Lack of coordination mechanisms aimed at achieving a systemically attractive consumer result, covering the entire chain of ER-services from manufacturers of equipment and materials (suppliers, etc.) to consumers;

• Uncertainty of policies, rules, regulations, etc. of the functioning of the modern market of ER-services to ensure its sustainable innovation-and-investment development.

It is clear that overcoming these obstacles requires, first, the development of a methodological platform (framework) to justify the creation of consolidating business mechanisms at the local and national levels and for determine their relationships to promote markets for goods and services. Such a platform should be based on harmonized national regulations, which allows for effective using the potential of local business contributions, involving national infrastructures and interconnections, as well as by creating ER-services markets that facilitate the cross-border cooperation.

Within the service-oriented business platform proposed for further consideration, mentioned above shortcomings are eliminated by establishing mutually beneficial interaction (coordination of interaction) between all organizationally involved participants in the service-oriented market, where customer relations are a priority. This approach requires expanding the scope of customer-centric or client-centric services. Such services should include measures, means and resources aimed at improving the efficiency (productivity, quality, etc.) of system-coordinated processes of production, transmission, distribution, supply and final consumption of service-oriented goods and services. This, in turn, will ensure the creation of a chain of additional added value (i.e., profitability, benefit, usefulness, etc.) by improving the consumer properties of goods and services in each link of this chain.

2 Business Logic of Eco-Transformation

2.1 Fundamentals of the Business Ecosystem

The scale of environmental pollution during the burning of fossil fuels has been steadily growing since the beginning of the industrial revolution and has already reached a critical level. Thus, the eco-logic of service-oriented business should be designed to minimize the damage caused to nature by economic entities, while creating new prospects for environmentally friendly interaction of business with the environment.

In this study, the implementation of such an approach is proposed to be carried out on the basis of methodological provisions of the fundamental concept “business ecosystem”, the principles of formation and operation of which are determined by analogy with the biological ecosystem. With this approach, the business ecosystem is viewed as an organizational-and-technological structure that connects the participants of the business ecosystem (producers, suppliers, distributors and consumers, state and local authorities, regulators, etc.), which are directly or indirectly involved in the creation (production, supply, use) and disposal of specific products, goods or services through competition and mutually agreed, flexible cooperation. Accordingly, the business ecosystem is actually a community, which, depending on the level of its consideration, can cover the global, national, sectoral, and local business levels. The latter can also be detailed at the technological level and even at the level of control of separate units of energy-intensive equipment. Among the main types of interaction between business ecosystem participants are the spheres of exchange of products, goods and services, money and loans, information, knowledge and intangible assets.

The main purpose of the business ecosystem of any level is to minimize the costs of each of its participants, which is carried out due to the overall synergy effect obtained by the system from the results of interaction between participants and the environment. In this case, the coordination of interaction is usually carried out by creating centers of coordination and balancing based on hierarchical, vertically integrated (or network, etc.) organizational-and-technological structures. These structures usually operate on the basis of market principles of mutually agreed (mutually beneficial, etc.) combination and use of resources of each system participant, and where the creation and realization of value added occurs at all levels of the structure [7–10]. In any case, this imposes special requirements on the organizers (coordinators) of the system, given the high level of their responsibility to ensure the economic profitability of all its participants in conditions of limited controllability of the system.

It can be stated that the business ecosystem from the point of view of management theory is a complex organizational-and-technological system that combines legally independent economic, managerial and regulatory entities (participants of the business ecosystem), each of which creates separate, but systemically consistent with all other entities, products, goods or services that together form a holistic solution. The business ecosystem formed by this approach due to the flexibility and stability of its modular structure with clearly defined interfaces that allow easy scaling of the system, will function as a whole, providing competitive advantages to participants over other ways of structural-and-technological organization of production of complex products, goods or services (for details see [8]).

2.2 Logic Models of Service-Oriented Transformation

The economic feasibility of structural-and-functional transformation of global and national economies from commodity-production economy to service economy was realized by the business of developed countries several decades ago [11,12]. Among the models (mechanisms) of such transformation the most common are models based on the concepts of Product-Service Systems (PSS) [13,14] and Service-Dominant Logic (SDL) [15].

2.2.1 Logic Models of Product-Service Systems

Within the PSS models, business conditions are created for innovative solutions, in which manufacturing companies add service components to their offerings and service companies integrate products into their services. Under these conditions, PSS establish closer and longer-term relationships with consumers, and thus achieve a better understanding of them and more profitable commodity-money transactions. With this, unlike traditional services that added to goods (for example, guarantees), services within PSS bring to all participants of system and, first of all, consumers, additional material profit (see, for example [13,16–19]). This result is achieved through a systemically agreed set of services that reduces the amount of resources consumed to produce a unit of products, goods, services, etc., by meeting consumer demand through less resource-intensive goods, and encourages the service provider to reduce initial investment and operating costs.

The following types of PSS are often distinguished [20–22]:

• Product-oriented, where the tangible product plays a leading role, and the services provided are aimed at maintaining this product and guaranteeing its functionality;

• Use-oriented or shared utilization services, where products still play a more prominent role than services, and suppliers of which sell the availability and use of specific goods, for example, by leasing, renting, sharing, etc.;

• Result-oriented, when companies do not sell products, but the results of their use, combined with the professional knowledge (competence) of service providers. The synergy of this interaction is focused on the final needs of consumers, such as providing optimal technological parameters of lighting, heating, cooling, etc., and where the organizer (coordinator) of the PSS system becomes responsible for all costs aimed at achieving the result;

• Demand management services (low cost planning, integrated resource management, etc.), which originated in the US energy sector to implement the provision that it is often more economical to reduce energy demand than to increase generating capacity. The latter often involves switching to alternative fuels or purchasing energy from renewable sources.

2.2.2 Logic Models of Service-Dominant Logic

A characteristic attribute of the application of SDL in the process of forming the service-oriented business is that the core role in this business is played by added value created by providing services, while goods (products) play a secondary role. This is in contrast to the “commodity” market, which is based on the paramount importance of the value created during the production process, and where the service is considered as a “secondary” (associated) value. As a result, under the SDL concept, service consumers are seen as full market participants together with producers and suppliers of goods and services, and goods become a means of providing services [23–26].

In this way, SDL shifts the focus of trade-and-exchange operations, operating on the number of units of sold (purchased) goods, to the procedures of providing comprehensive services, which, due to the interaction of participants, create value chains of marketable goods. To implement comprehensive services, an SDL-market is created, which facilitates the efficient exchange, coordination and distribution of resources, goods and services, reduce business costs, as well as supports competition and encourages investment, and therefore—is consumer-oriented, providing the necessary goods and services to customers at the right time.

Closely related to the SDL and PSS models, the Service Ecosystems Approach (SEA) is considered, whose participants also integrate their own resources, linked by the common institutional logic of the ecosystem and the collective creation of added value, through the exchange of services. By combining the SEA approach with the provisions of SDL and PSS logic, it becomes a powerful tool for the development of marketing business, covering both domestic (national) markets for goods and services and international cooperation markets [9,15].

3 Base Components of a Service-Oriented Business

3.1 General Requirements to the Initiator of Service-Oriented Business

The above logic models of business eco-transformation are inherently flexible and scalable, but their practical implementation requires the development of rules and mechanisms for organizing the interaction of service-oriented business participants with the surrounding business and eco-environments, which must be consistent, forming a holistic system-wide configuration [27,28].

To do this, as the first step in building your own business you should find answers to the following questions, formulated based on the analysis of more than 100 business ecosystems [29]:

• What is the problem that you want to solve?

• Who needs to be part of your business?

• What should be the initial governance model of your business ecosystem?

• How can you capture the value of your business?

• How can you solve the chicken-or-egg problem during launch?

• How can you ensure evolutionary flexibility and the long-term viability of your business?

Another urgent issue that needs separate consideration is to take into account the impact of environmental taxes on the development of your business in the short and long term [30].

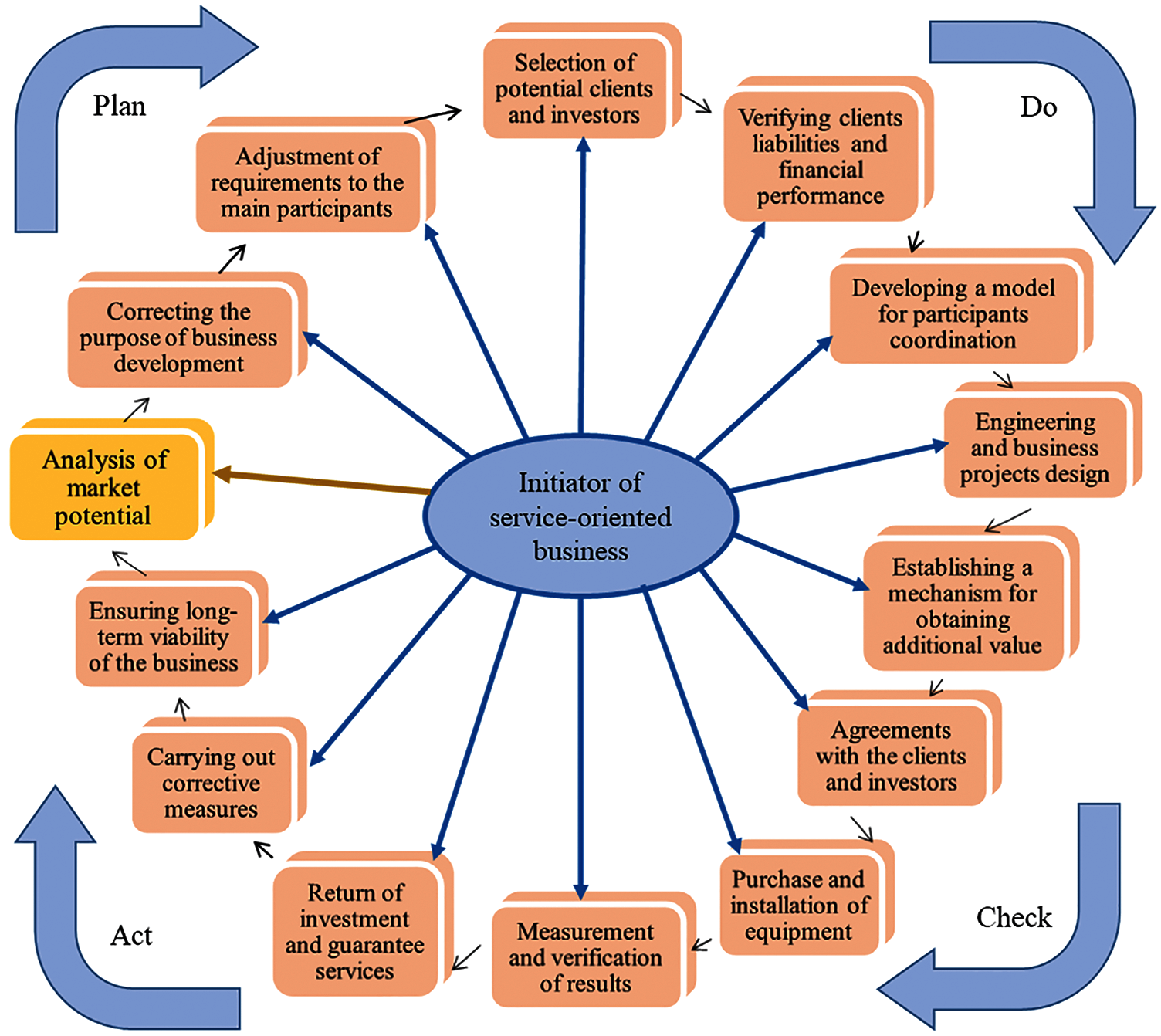

You need to understand that building own service-oriented business is a process of continuous improvement of business models and tools for their implementation. We suggest doing this based on a continuous quality improvement model known as Deming or PDSA cycle, which consists of a logical sequence of four stages: plan, do, check, and act [31,32]. For practical use, we have developed a detailed model shown in Fig. 1.

Figure 1: Model of continuous quality improvement of service-oriented business

As you can see, a decisive role in the development and implementation of a service-oriented business is played by the initiator (orchestrator), a potential applicant for which must meet the following basic requirements [29,32]:

• Have a stable relationship with many other participants in the service-oriented market and occupy a central place in its organizational structure;

• Have a business need and the ability to coordinate effectively the interaction between its participants;

• Be able to control the resources needed to ensure market viability;

• Be perceived by other participants as a fair and neutral partner, and not as a threat to competition;

• Have a stable level of income during its business activities, which meets the criteria for attracting third-party investments;

• Have experience in overcoming the risks of joint innovations and risks of joint implementation of investment projects.

As for the involvement of other business participants, the main incentives for them are a relative increase in profit or reduce the risks of their loss due to participation, limited own investment opportunities and obstacles to self-development, etc.

3.2 Services of Coordination and Balancing Centers

Coordination is one of the main functions of ecosystem management, which ensures the unity of action and integration of system resources (human, logistical, financial, etc.) in order to use those most effectively to achieve common organizational and functional goals of the system. Herewith, the balancing of resources, tasks and activities between the constituent elements, participants, etc., of the business, which is an integral part of the coordination mechanisms, is defined as a process and/or procedure for maintaining dynamic equilibrium in a relatively independent and unstable over time species and parametric changes of its elements.

Accordingly, the services of the Center of coordination and balancing (further—the Center) are aimed at ensuring the unity of individual and group efforts of business ecosystem participants, growth of added value and profits of each of them, integration and optimal use of their resources. Provision of services is carried out based on appropriate methods and means of coordinating management by establishing stable bilateral communication channels and improving the technique of participant’s cooperation with an effective format of their interaction [33,34]. The interest of participants in purchasing service-oriented services of Center will be largely determined by the usefulness of these services, the provision and logistics of which must coincide in time with the process of its consumption, unlike products that can be stored or transported for a long time.

The role functions of coordination and balancing as a task of organizing joint work (cooperation) have been studied in many scientific papers. Among the closest to the service-oriented theme, we note [35,36], where the tasks of cooperation are considered in three areas: exploration, experimentation and execution. Among the main tasks of the Center in this publication is the creation of coalition (community) of participants taking into account their diverse interests, integrating the ideas of participants on a single platform, promoting joint projects in development and dissemination of best practices. In general, this creates favorable conditions for the implementation of multiplier effects of interaction of participants (chain reactions by domino effect).

In general, the Center should play a supportive role, without direct intervention in the management of innovation processes at the participants’ sites, using the modular principle of project implementation, facilitate bilateral exchange of ideas and solutions, thus expanding the impact of multiplier effects. At the same time, system participants must subordinate their local purposes and production programs to achieve system-wide goals, even adapting their technologies, and the success of their activities should be assessed by contributing to the system-wide effect.

In this sense, the organizational-and-functional features of the business activities in the service-oriented markets can be compared with the corresponding functions of coordination and balancing in the markets of production and consumption of electricity, described in detail in many scientific papers, such as [34,37]. Their use, by analogy with the results obtained in the field of energy management [38,39], reflects the process of providing services for coordination and balancing of organizational, logistical and financial interests of participants. This is often implemented in the form of functionally integrated structural units, for which the continuous in time and space improvement of consumer properties of goods and services is carried out.

4 Features of Energy Services Business

4.1 Energy Services and Energy Services Companies (ESCO)

It should be reminded that the category of energy services (ESs) in the commonly used definition has a double interpretation. On the one hand, this includes activities, tools and resources related to energy supply to consumers. On the other hand, they are related to improvement of efficiency (productivity, quality, etc.) of any energy transformation processes at all or some stages of energy production, transmission, distribution, supply and final consumption. In the introduction, we have indicated this field of activity as energy-related services [5,40]. Their main future is to provide additional added value (profitability, benefit, utility, etc.) by combining energy with EE technology and/or operation, including maintenance and control procedures required to provide services [39,41–43]. As a rule, ER-services include a range of turnkey activities such as marketing, energy analysis, due diligence and investment audits, project design and implementation, maintenance and operation, measurement and verification of savings, return on investment and guarantee services [5]. More detailed features of ER-services can be found in [44–46]. However, to be align with a common practice and given the fact that the ER-services are applicable on the supply side, we will use the term energy services in our further study for both interpretations considered.

ESCO is one of the most efficient, widespread commercial organizations focused on the provision of ESs that cover technical, economic, financial and legal aspects of design, engineering, installation, commissioning, monitoring, and verification of energy saving measures (projects) based on EE and RES [47–50]. The fundamental difference between ESCO services and the services of other service companies is as follows. (1) ESCO must guarantee the technical, economic, social and environmental parameters of the production processes required by customers in heating, lighting, ventilation, compressed air, etc., with less energy. (2) ESCO must ensure that the savings in fuel and other energy resources obtained by it as a result of the implementation of turnkey energy service projects exceed the payments to cover the project costs for the payback period. (3) ESCO invests its own funds (in whole or in part) in the implementation of ESs projects. If the savings guaranteed by him do not materialize, the difference is compensated at the expense of the ESCO.

4.2 Energy Performance Contracting

Energy service providers (ESCOs) operate under ESs contracts, the most common types of which are the Energy Performance Contract (EPC), the Energy Supply Contract (ESC), Chauffage and Full Management Contract (FMC), the business content of which are discussed in detail in numerous publications [48,51–54].

EPC in European legislation means a contractual arrangement between the beneficiary and the provider of an EE measure, verified and monitored during the whole term of the contract. Investments (work, supply or service) in that measure are paid for in relation to a contractually agreed level of EE improvement or other agreed energy performance criterion, such as financial savings [41]. Among the variety of EPC models are:

• Shared savings model, in which the ESCO assumes responsibilities for financing the capital expenditures of the project, i.e., assumes responsibility and risks for attracting and returning the funds provided by investors. A common modification of the Shared savings model is the First Out Contract model, according to which 100% of the savings resulting from the project remains in the ESCO until the payback of the project;

• Guaranteed savings model, in which the customer (client) assumes responsibility and risks for project financing, attraction and return of investments, and ESCO—all technical risks for project development and implementation, and guarantees the customer the level of savings provided by the contract. If the level of savings is lower, the ESCO must pay the difference to the client and, conversely, if the savings exceed the guaranteed level, then the client pays the ESCO the agreed percentage of savings.

Under “Chauffage” contracts, ESCOs typically cover both aspects of customer’s EE management (energy supply and use), thereby systemically combining the provisions of Shared savings and Guaranteed savings models to achieve greater technical and economic impact. A feature of “Chauffage” contracts is the focus on providing quality characteristics of energy use, for example, to ensure a given level of temperature, humidity, comfort and more. Financing of ESs measures under this contract is usually provided by ESCO, which remains the owner of energy-saving equipment until the expiration of the contract. Contracts of this type work effectively under conditions of free choice of suppliers of energy resources, the prices of which are the subject of the contract between the supplier and the client. Because of competition, suppliers have incentives to reduce prices, and ESCOs have incentives to reduce the client’s energy costs by implementing energy saving measures.

Under Full Management Contracts, ESCOs are usually also aimed at improving the efficiency and quality of meeting the final needs of customers in lighting, heating, ventilation, air conditioning, water supply, drainage, etc. Under this contract, the ESCO usually acts as a management organization/company, which concludes contracts on behalf of the client with all other project participants, including energy supply organizations. Settlements between ESCOs and the client are made based on the volumes of energy consumption fixed at the time of concluding the contract, and between ESCOs and suppliers—based on the volumes of energy actually consumed. Herewith, ESCO income, which is determined by the difference between fixed and actual energy consumption, is used to implement energy saving measures, pay off debts under the project and generate own profit.

It is not difficult to see that the basic components of all types of ESs contracts correspond to the scheme of causal chains of interaction of ESCOs with the clients and other project participants (subcontractors, banks, support funds, etc.). In accordance, the difficulties in implementing ESCO projects, whose payback period is usually measured in years, are due to the need to ensure a guaranteed level of energy saving in an uncertain business environment. This, in turn is significantly slows down EE funding worldwide. One solution has been insurance services provided by specialized financial institutions and other private companies, such as equipment manufacturers, as a way to reduce the risks of ESCO projects, but such services have not yet become widespread. Other difficulties in implementing ESCO projects are compounded by the relatively high level of transaction costs that arise from the interaction of ESCOs with other project participants and although they are not directly related to the production of goods and services, they ensure their most efficient use [44,46,55]. The list of ESCOs transaction costs also includes the costs of concluding contracts, measuring and verifying the results achieved, protection of property rights, compensation for possible cases of opportunistic behavior of some clients and subcontractors, and so on.

Accounting for ESCO transaction costs are especially important in the case of international cooperation aimed at attracting foreign investment in the modernization and innovative development of client infrastructure. Transboundary cooperation of ESCOs is realized through their interaction with international and local financial institutions, national and foreign equipment manufacturers, state and local authorities. Herewith, the effectiveness of international cooperation largely depends on the ability of ESCOs to take into account the absolute and comparative advantages of participants located in different countries and economic zones [55,56].

4.3 The Logic of Energy Services Eco-Transformation

As can be seen from the above analysis, the properties of ESs under ESCO projects have much in common with the services considered within the service-dominant logic and product-service systems. The closeness of these properties in a more or less explicit form is emphasized by several authors [45,46,57,58]. It is important for energy services business to realize the synergy of system combination (interaction) of these services to expand the scope of their use and increase the volume of systemically created added value. This, of course, will require the improvement of the conceptual provisions for the implementation of ESs, which will provide more favorable conditions for ESCO interaction with other market participants, especially with clients and consumers of goods and services.

This can be done by identifying the main directions of such improvement, aimed at providing end users with comprehensive services to achieve a certain result or expand their functionality. In practice, this is realized primarily by improving comfort, mobility, environmental friendliness, reducing material consumption, etc., without the need for consumers to purchase equipment or materials (fuel, etc.) [22]. The end result of such modernization is achieved not only through the use of more energy-efficient equipment and environmentally friendly materials, but also by increasing the level of their load (using), for example, by creating collective business centers (networks) of energy services. This reduces the amount of equipment and materials required and the costs of their operation and disposal. It is important that collective centers have the opportunity to use more efficient (and more profitable) methods and measures to provide comprehensive services to individual consumers (clients), for example, through the use of alternative fuels, the use of heat recovery, cogeneration plants and more. Under these conditions, services for maintenance, repair, reuse, disposal and recycling of used equipment and materials become widespread. The use of smart management in such systems is becoming one of the most promising fields of ESs business, which provides new content and meaning to existing methods and tools for EE and RES management, such as demand side management, least-cost analysis, integrated resource planning, etc.

Markets have always played (and continue to play) a central role in the formation and development of any business. However, the practical implementation of the mechanisms of their functioning based on well-known principles of market theory meets many uncertainties and requires further development of both the theoretical platform and applied tools for the implementation of these mechanisms in practice [25,59,60].

A list of market types adapted for use as infrastructure for a low-carbon transition can be found in [5,51,61]. The activities of economic entities of all forms of ownership and functional purpose in these markets have been significantly intensified due to the significant growth of the role of EE and RES in the low-carbon restructuring of the modern economy [11,12,62,63]. It is important that in addition to ESCOs, other economic entities are actively involved in this activity, first of all, manufacturers of EE and RES equipment and materials, suppliers of primary fuel and energy resources, utilities, investors, representatives of trading platforms, state and local authorities and regulators [64,65].

In other words, we must consider the ESs market as an open business ecosystem, which is in a state of constant interaction (exchange) with the environment and improves EE at all stages of energy transformation—from production (generation) to final consumption. Configuration of such a structure that integrates the markets of primary and secondary energy resources (oil, natural gas, renewables, electricity, heating and cooling) with markets of energy services, producers (suppliers) of energy efficient equipment and energy consumers of various forms of ownership (private, state, municipal, cooperative, etc.) is presented in [5,32].

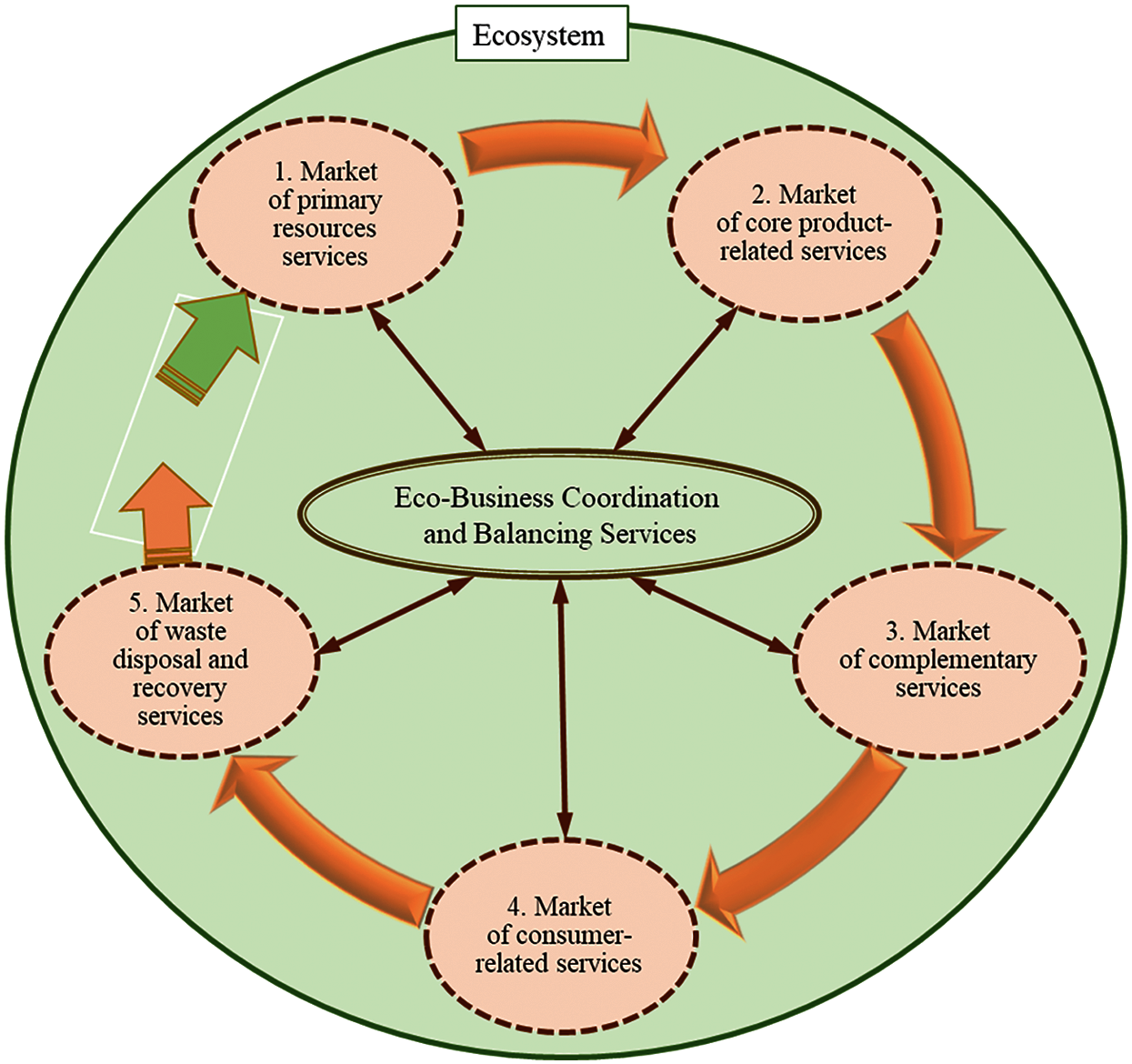

It should be added that the effective functioning of environmentally balanced business in the ESs markets requires the organization of closed cycles of continuous improvement of the quality of products and services realized, for example, according to the scheme presented in Fig. 1. Accordingly, the model of environmentally balanced functioning of such a market, adapted to the service-oriented business, is presented in Fig. 2.

The business ecosystem, which is reflected in the proposed model, consists of a number of services sub-markets. 1) Primary fossil and renewable resources services market, 2) Core-product-related services market, 3) Complementary services market that accompany the core product (or service) and support its acquisition, installation, use, maintenance and disposal, 4) Consumer-related services market, 5) Pre-contractual and post-contractual services market accompanying waste disposal and recovery services.

The combination of these sub-markets into an inseparable chain allows to organize a single technological process of providing services for the transformation of primary and secondary resources up to their final consumption and utilization (i.e., throughout the product life cycle), ensuring the maximum achievable efficiency of each service provider and the business system as a whole. Coordination and balancing services, related to the elimination of inconsistencies and imbalances in the process of improving the consumer properties of goods and services [10], occupy a central place in the model. It is important that closed cycles of continuous quality improvement (see Fig. 1) surround each of the sub-markets in Fig. 2.

Special attention should be given business activities in the sub-market of waste disposal and recovery services. Most importantly, the structural schemes and mechanisms that implement these activities remain the same as for the core service-oriented business described above. For example, waste resources obtained from the core activities in Stage 5 (Fig. 2) will also be sold on the market of primary resources services, but on a waste resources sub-market, which will form Stage 1 of a separate closed cycle, and so on up to Stage 5 of this cycle. However, the operating principles and technologies for the implementation of service-oriented projects in the field of waste disposal and recycling will be fundamentally different, which explains the need for the separate cycle. For example, the waste resources can be burned in a heating boiler or used to produce building materials or fertilizers and so on. Herewith, at every stage, where waste and pollutants cannot be disposed or recycled at this phase of development of the material-and-technical base of production, they will be subject to removal (burial), or today are even discharged into the environment.

Figure 2: Closed cycle of environmentally balanced functioning of the ESs market

5 Mathematical Model and Engineering Calculations

The practical implementation of the above logic models of business eco-transformations requires the development of mathematical models adapted for engineering use in the energy services business. Such models must correctly represent the coordination procedures and balancing the joint efforts of the participants in energy services aimed at increasing the value added and profit of each of them by integrating and optimal use of their combined resources.

Difficulties in creating such models are associated with the need to take into account the different interests of the participants united on a single platform into a business coalition to realize the multiplier effects (advantages) of cooperation. At the same time, participants should subordinate their local goals and production programs to the achievement of system-wide goals and even adapt some of their technologies.

Overpassing these challenges from a modeling perspective is not easy, since it requires solving the problem of finding the optimal management parameters for a hierarchically structured system center—participants in service-oriented business, where the center should ensure effective attraction, distribution and use of coalition resources. Herewith, do it based on objective differences in the target interests of participants (business entities). This requires the use of specialized computer simulation tool for system coherent management by energy services projects. Its software should provide a solution to a set of coordinated optimization problems with different target criteria that are input by each of the participants, and use them to determine a systemic solution based on iterative procedures and concessions between the cooperating parties. As a whole, the structure of such a tool is a hierarchically organized system with technical, economic and environmental sub-blocks.

The formulated optimization problem is formalized as follows:

a) at the center level

b) at the level of participants

where:

The iterative process of coordination and balancing the interaction of the center with the participants is carried out by implementing the following steps: 1) Finding optimal solutions for the target functions

Among the main factors that determine the efficiency and effectiveness of cooperation between the center and participants, the model first takes into account the following: Basic power of energy-consuming equipment; Energy efficiency and efficiency of its functioning; Limitations on the number of available types of fuel and energy resources, renewable energy sources as well; Prices (tariffs) for their actually used types; Prices (tariffs) for goods and services produced and provided to consumers; The rates of the main taxes and fees on emissions of pollutants and greenhouse gases.

Based on the numerical values of these factors, the modeling tool primarily calculates such indicators: Volumes of actually used energy resources and CO2 emissions; Energy intensity and energy efficiency of fuel and energy use; Expenses of financial resources for used fuel, energy and CO2 emissions; The volume of attracted investments in energy efficiency measures (EE-projects); Profitability and profit from their implementation. Note that the calculations of all economic indicators according to the model are based on the methods of discounting cash flows over time, since the payback period of EE-projects is, as a rule, several years.

Considering investment activity is a priority for each of the participants in the energy services business, below shows the results of using the above-formalized iterative process of coordination and balancing the joint efforts of the participants aimed at integrating and making optimal use of the pooled investment resources.

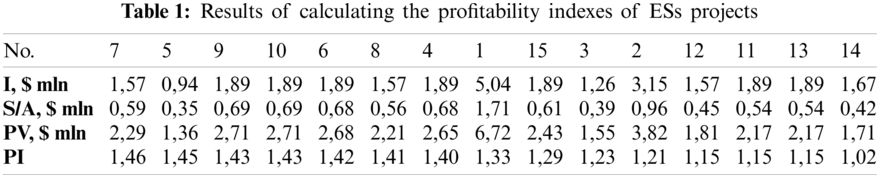

Let the participants of business coalition submitted n ESs projects to the center for consideration, among which, taking into account the $30.00 million cap on available investments, it is necessary to select m projects (m ≤ n), which will provide an optimally-integrated effect (energy, economy and ecology) from their implementation. Let the center selected and coordinated with participants 15 of them by optimizing the profitability index (PI), which measures the ratio between the present value of future cash flows (PV) and the initial investment (I) for each of these projects. The results of optimization calculations are presented in Table 1, where No. is the number of the selected ESs project, S/A—their energy savings per annum:

Suppose that for the implementation of ESs projects, each of the participants took out a bank loan at 10% per annum. Then, pooled loan payments calculated under the annuity scheme will amount to $38.25 million. That is, the overpayment on pooled loans will be $8.25 million. For example, if the participants will be able to take a loan at 5% per annum, then the pooled loan payments will be $33.97 million and the overpayment will be $3.97 million.

The center usually offers participants additional options for improving these outcomes. For example, the following:

1. Using the economic and social benefits of implementing the participant’s projects, united in a coalition one-piece design, the center can attract investments from various sources at lower interest rates. These are state and local budgets, international and local banks, technical assistance funds, etc. Detailed calculations based on the optimization of the structure and volumes of attracted investment resources from various sources at various interest rates show that the estimated size of the annual interest rate of 10% can be reduced to 7.5%, and the amount of overpayment–to $6.07 million. Thus, the total savings of the coalition on interest payments alone will amount to $2.18 million in this case, and on the loan at 5% per annum–to $0.82 million.

2. The center can receive discounts for wholesale purchases from manufacturers and suppliers of energy efficient equipment and materials in the form of both a deferred payment and a reduction in their cost, which allows participants to reduce the volume of initial investments and not take them for the entire payback period of projects. Let the center have agreed with manufacturers and suppliers a commodity loan for $20.00 million at 2% per annum for a period of 6 months with monthly repayment. Then the monthly annuity payment on this loan will be $3.35 million and the overpayment–$0.12 million. Considering that the coalition’s monthly energy savings amount to $0.82 million, the center can take a loan from a commercial bank for $14.86 million at 7.5% per annum for a period of 6 months to repay the commodity loan for $20.00 million. The amount of overpayment on this loan will be $0.33 million and the total overpayment–$0.45 million (analogically, $0.18 million and $0.29 million on a loan from a commercial bank at 4% per annum). Thus, the total savings of the coalition on interest payments in this case will amount to $1.73 million for the loan at 7.5% per annum and $0.53 million on the loan at 4% per annum.

6 Conclusions and Recommendations

The eco-transformation of ESs business is one of the priority targets in ensuring the low-carbon transition of the global economy. The logic of such a transformation, according to which the consumer (client) directly influences the production, distribution and further consumption of environmentally friendly goods and services, is presented in this study as a conceptual guide for current and potential ESs market participants to improve their EE and RES business results.

Our basic proposal for participants, both for current and potential, is to consider the eco-transformation of a service-oriented business as a complex, systemically organized process, all components (stages) of which are to be built and operate according to the principles of a closed business ecosystem. Herewith, special attention should be paid to logical models of product-service and service-dominant systems, as well as to the formation of requirements for the initiator of the service-oriented business and the selection of services provided by the coordination and balancing centers.

It is also clear that ESCOs, operating on the basis of performance contracting, play and will play a key role in eco-transformation of the ESs business. In this case, potential participants in ESs market should first pay attention to such features of ESCO projects as obligations to guarantee the projects parameters (energy, economic, environmental), to ensure that the savings exceed payments to cover project costs, and to invest own funds (in whole or in part) in the implementation of ESs projects.

As seen, solving the formulated above issues of developing the ESs business requires a radical change in the business models of both manufacturing and service companies, taking into account the peculiarities of their virtual interaction and changes in consumer behavior, which are part of the value chain. System-wide integration of mechanisms and actions through which each value chain participant optimizes the process and, most importantly, the result of the use of systemically available resources, allows the expansion of service-oriented business, attracting new producers, service providers and consumers.

Recall that co-creation of value through interaction between the consumer and the service provider has always been (and remains) an integral part of the service sector. What is new in the energy service-oriented business is that total value is created and determined by joint efforts of producers, service providers and consumers, which are carried out regularly in exchange processes (transfer, sale) and subsequent use of goods and services, often throughout their life cycle. The main thing is that service-oriented business became the main and integral factor of successful promotion of complex (complementary) goods. Such a business is based on the systemic implementation of EE and RES measures, therefore, a closed cycle of energy management as a tool to manage this process should become an integral part of realizing the benefits of service-oriented logic.

The practical implementation of such logic requires the development of simulation models, which correctly reflect the procedures for coordinating and balancing the joint efforts of participants in energy services, allowing them to test different strategies. The represented model is a productive instrument to inform management decisions as to the most cost-effective investments to be included in implementation of ESs projects, and the results of calculating the two scenarios clearly show this.

In completion, it should be stated that, despite the complexity of eco-transformation of the ESs business, there is no alternative to its replacement by other logic aimed at improving EE and the introduction of RES, as evidenced by the active efforts worldwide towards a low carbon economy.

Funding Statement: The authors received no specific funding for this study.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

1. Gilfillan, D., Marland, G. (2021). CDIAC-FF: Global and national CO2 emissions from fossil fuel combustion and cement manufacture: 1751–2017. Earth System Science Data, 13(4), 1667–1680. DOI 10.5194/essd-13-1667-2021. [Google Scholar] [CrossRef]

2. IEA (2021). Global energy review 2021: Assessing the effects of economic recoveries on global energy demand and Co2 emissions in 2021. France: IEA Publications. [Google Scholar]

3. United Nations (2017). The role of the services economy and trade in structural transformation and inclusive development. Conference on Trade and Development, Geneva. [Google Scholar]

4. Anderson, K., Ponnusamy, S. (2019). Structural transformation to manufacturing and services: What role for trade? Asian Development Review, 36(2), 32–71. [Google Scholar]

5. Eutukhova, T., Kovalko, O., Novoseltsev, O., Woodroof, E. (2020). Energy services: A proposed framework to improve results. Energy Engineering, 117(3), 99–110. DOI 10.32604/EE.2020.010864. [Google Scholar] [CrossRef]

6. European Commission (2017). European semester thematic factsheet: Services markets. Belgium: Publication Office of the European Union. [Google Scholar]

7. Porter, M. E. (1985). Competitive advantage: Creating and sustaining superior performance. USA: The Free Press. [Google Scholar]

8. Pidun, U., Reeves, M., Schussler, M. (2019). Do you need a business ecosystem? USA: BCG Henderson Institute. [Google Scholar]

9. Akaka, M. A., Vargo, S. L., Lusch, R. F. (2013). The complexity of context: A service ecosystems approach for international marketing. Journal of International Marketing, 21(4), 1–20. DOI 10.1509/jim.13.0032. [Google Scholar] [CrossRef]

10. Kovalko, O. M., Kovalko, N. M., Novoseltsev, O. V. (2018). Result-oriented investment management system for targeted energy efficiency programs. Scientific Bulletin of National Mining University, 3(165), 160–166. DOI 10.29202/nvngu/2018-3/20. [Google Scholar] [CrossRef]

11. Alatorre Frenk, C., Backhaus, M., Bauer, N., Bazilian, M., Blank, T. K. et al. (2017). Perspectives for the energy transition: Investment needs for a low-carbon energy system. Germany: IEA & IRENA Publications. [Google Scholar]

12. IEA. (2018). Energy efficiency 2018: Analysis and outlooks to 2040. France: IEA Publications. [Google Scholar]

13. Tukker, A. (2015). Product services for a resource-efficient and circular economy–A review. Journal of Cleaner Production, 97(3), 76–91. DOI 10.1016/j.jclepro.2013.11.049. [Google Scholar] [CrossRef]

14. Haase, R. P., Pigosso, D. C. A., McAloone, T. C. (2017). Product/service-system origins and trajectories: A systematic literature review of PSS definitions and their characteristics. Procedia CIRP, 64, pp. 157–162. DOI 10.1016/j.procir.2017.03.053. [Google Scholar] [CrossRef]

15. Lusch, R. F., Nambisan, S. (2015). Service innovation: A service-dominant logic perspective. MIS Quarterly, 39(1), 155–175. DOI 10.25300/MISQ/2015/39.1.07. [Google Scholar] [CrossRef]

16. Diehl, J. C., Christiaans, H. (2015). Product service systems: The future for designers? The changing role of the industrial designer. Proceedings of International Design Conference, South Korea: Kwangju. [Google Scholar]

17. Beuren, F. H., Ferreira, M. G., Cauchick, M. (2013). Product-service systems: A literature review on integrated products and services. Journal of Cleaner Production, 47(17), 222–231. DOI 10.1016/j.jclepro.2012.12.028. [Google Scholar] [CrossRef]

18. Gaiardelli, P., Resta, B., Martinez, V., Pinto, R., Albores, P. (2014). A classification model for product-service offerings. Journal of Cleaner Production, 66(2), 507–519. DOI 10.1016/j.jclepro.2013.11.032. [Google Scholar] [CrossRef]

19. Pawar, K. S., Beltagui, A., Riedel, J. (2009). The PSO triangle: Designing product, service and organization to create value. International Journal of Operations & Production Management, 29(5), 468–493. DOI 10.1108/01443570910953595. [Google Scholar] [CrossRef]

20. Tukker, A., Tischner, U. (2006). Product-services as a research field: Past, present and future. Reflections from a decade of research. Journal of Cleaner Production, 14(17), 1552–1156. DOI 10.1016/j.jclepro.2006.01.022. [Google Scholar] [CrossRef]

21. Martinez, V., Bastl, M., Kingston, J., Evans, S. (2010). Challenges in transforming manufacturing organizations into product-service providers. Journal of Manufacturing Technology Management, 21(4), 449–469. DOI 10.1108/17410381011046571. [Google Scholar] [CrossRef]

22. Roy, R. (2000). Sustainable product-service systems. Futures, 32(3), 289–299. DOI 10.1016/S0016-3287(99)00098-1. [Google Scholar] [CrossRef]

23. Vargo, S. L., Lusch, R. F. (2004). Evolving to a new dominant logic for marketing. Journal of Marketing, 68(1), 1–17. DOI 10.1509/jmkg.68.1.1.24036. [Google Scholar] [CrossRef]

24. Vargo, S. L., Lusch, R. F. (2008). Service-dominant logic: Continuing the evolution. Journal of the Academy of Marketing Science, 36(1), 1–10. DOI 10.1007/s11747-007-0069-6. [Google Scholar] [CrossRef]

25. Vargo, S. L., Lusch, R. F. (2015). Institutions and axioms: An extension and update of service-dominant logic. Journal of the Academy of Marketing Science, 44(1), 5–23. DOI 10.1007/s11747-015-0456-3. [Google Scholar] [CrossRef]

26. Karpen, I. O., Bove, L. L., Lukas, B. A., Zyphur, M. J. (2015). Service-dominant orientation: Measurement and impact on performance outcomes. Journal of Retailing, Elsevier, 91(1), 89–108. DOI 10.1016/j.jretai.2014.10.002. [Google Scholar] [CrossRef]

27. Kindstrom, D., Kowalkowski, C. (2016). Service-driven business model innovation organizing the shift from a product-based to a service-centric business model. UK: Oxford University Press. [Google Scholar]

28. Raddats, C., Kowalkowski, C., Benedettini, O., Burton, J., Gebauer, H. (2019). Servitization: A contemporary thematic review of four major research streams. Industrial Marketing Management, 83, 207–223. DOI 10.1016/j.indmarman.2019.03.015. [Google Scholar] [CrossRef]

29. Pidun, U., Reeves, M., Schussler, M. (2020). How do you design a business ecosystem? USA: BCG Henderson Institute. [Google Scholar]

30. Kwilinski, A., Ruzhytskyi, I., Patlachuk, V., Patlachuk, O., Kaminska, B. (2019). Environmental taxes as a condition of business responsibility in the conditions of sustainable development. Journal of Legal, Ethical and Regulatory Issues, 22(S2), 1–6. [Google Scholar]

31. Deshko, V. I., Kovalko, O. M., Novoseltsev, O. V., Yevtukhova, M. Y. (2020). Energy services market: Conceptual framework and mechanism of forming. International Journal of Civil, Mechanical and Energy Science, 6(6), 48–55. DOI 10.22161/ijcmes.66.4. [Google Scholar] [CrossRef]

32. Chupryna, L., Kovalko, O., Novoseltsev, O., Woodroof, E. (2020). Virtual organization of energy management: Service-oriented framework to improve results. International Journal of Energy Management, 2, 47–63. [Google Scholar]

33. Osifo, O. C. (2013). The effects of coordination on organizational performance: An intra and inter perspective. Asian Journal of Business and Management, 1(4), 149–162. [Google Scholar]

34. Schraeder, M., Self, D. R., Jordan, M. H., Portis, R. (2014). The Functions of management as mechanisms for fostering interpersonal trust. Advances in Business Research, 5, 50–62. [Google Scholar]

35. Nambisan, S. (2009). Platforms for collaboration. Stanford Social Innovation Review, 43–49. [Google Scholar]

36. Pylypiv, N., Piatnychuk, I., Halachenko, O., Maksymiv, Y., Popadynets, N. (2020). Balanced scorecard for implementing united territorial communities’ social responsibility. Problems and Perspectives in Management, 18(2), 128–139. DOI 10.21511/ppm.18(2). 2020.12. [Google Scholar] [CrossRef]

37. van der Veen, R. A. C., Hakvoort, R. A. (2016). The electricity balancing market: Exploring the design challenge. Utilities Policy, 43(6), 186–194. DOI 10.1016/j.jup.2016.10.008. [Google Scholar] [CrossRef]

38. ISO 50001:2018 (2018). Energy Management Systems. Requirement with Guidance for Use. Geneva, Switzerland: ISO Central Secretariat. [Google Scholar]

39. ISO 50007:2017 (2017) Energy Services–Guidelines for the Assessment and Improvement of the Energy Service to Users. ISO/TC 301. Switzerland. [Google Scholar]

40. WTO (1998). Energy Services: Background Note by the Secretariat. Switzerland: World Trade Organization. [Google Scholar]

41. Directive 2012/27/EU of the European Parliament and of the Council of 25 October 2012 on Energy Efficiency (2012). Official Journal of the European Union, L 315, 1–56. [Google Scholar]

42. EN 15900:2010. (2010). Energy efficiency services–Definitions and requirements. Germany: Beuth Verlag GmbH. [Google Scholar]

43. Larsen, P. H., Goldman, C. A., Satchwell, A. (2012). Evolution of the U.S. Energy Service Company industry: Market size and project performance from 1990–2008. Energy Policy, 50(1), 802–820. DOI 10.1016/j.enpol.2012.08.035. [Google Scholar] [CrossRef]

44. Sorrell, S. (2007). The economics of energy service contracts. Energy Policy, 35(10), 507–521. DOI 10.1016/j.enpol.2005.12.009. [Google Scholar] [CrossRef]

45. Benedetti, M., Cesarotti, V., Holgado, M., Introna, V., Macchi, M. (2015). A proposal for energy services’ classification including a product service systems perspective. Procedia CIRP, 30, 251–256. DOI 10.1016/j.procir.2015.02.121. [Google Scholar] [CrossRef]

46. Nolden, C., Sorrell, S., Polzin, F. (2016). Catalysing the energy service market: The role of intermediaries. Energy Policy, 98, 420–430. DOI 10.1016/j.enpol.2016.08.041. [Google Scholar] [CrossRef]

47. Stuart, E., Larsen, P. H., Carvallo, J. P., Goldman, C. A., Gilligan, D. (2016). U.S. Energy Service Company (ESCO) industry: Recent market trends. USA: Ernest Orlando Lawrence Berkeley National Laboratory. [Google Scholar]

48. Boza-Kiss, B., Bertoldi, P., Economidou, M. (2017). Energy service companies in the EU-status review and recommendations for further market development with a focus on energy performance contracting. Luxembourg: Publications Office of the European Union. [Google Scholar]

49. Hansen, S. J., Bertoldi, P., Langlois, P. (2009). ESCOs around the world: Lessons learned in 49 countries. USA: The Fairmont Press. [Google Scholar]

50. Hofer, K., Limaye, D., Singh, J. (2016). Fostering the development of ESCO markets for energy efficiency. USA: World Bank. [Google Scholar]

51. Kim, J. I., Jain, N., Lee, H., Nieto, M. T., Husband, D. et al. (2015). Business models to realize the potential of renewable energy and energy efficiency in the greater mekong subregion. Philippines: Asian Development Bank. [Google Scholar]

52. Econoler (2011). IFC energy service company market analysis. Canada: Econoler. [Google Scholar]

53. Carbonara, N., Pellegrino, R. (2018). Public-private partnerships for energy efficiency projects: A win-win model to choose the energy performance contracting structure. Journal of Cleaner Production, 170(7), 1064–1075. DOI 10.1016/j.jclepro.2017.09.151. [Google Scholar] [CrossRef]

54. Ilchuk, M., Reminska, O., Shapovalenko, V., Kyrychok, O. (2015). Energy service contracts: Opportunities and prospects in Ukraine. Germany: Publication of Deutsche Gesellschaft für Internationale Zusammenarbeit. [Google Scholar]

55. Novoseltsev, O., Kovalko, O., Evtukhova, T. (2013). Cross-border cooperation of energy service companies as a factor enhancing energy and economic safety. Great Britain: Taylor & Francis Group, CRC Press. [Google Scholar]

56. Kovalko, O. M., Novoseltsev, O. V., Boublik, V. V. (2013). The ricardian model of energy service companies transboundary cooperation. Socio-Economic Research Bulletin, 49(1), 202–209. [Google Scholar]

57. Mourtzis, D., Boli, N., Alexopoulos, K., Rozycki, D. (2018). A framework of energy services: From traditional contracts to product-service system (PSS). Procedia CIRP, 69(2), 746–751. DOI 10.1016/j.procir.2017.11.118. [Google Scholar] [CrossRef]

58. Nolden, C., Sorrell, S. (2016). The UK market for energy service contracts in 2014–2015. Energy Efficiency, 9(6), 1405–1420. DOI 10.1007/s12053-016-9430-2. [Google Scholar] [CrossRef]

59. Jackson, W. A. (2007). On the social structure of markets. Cambridge Journal of Economics, 31(2), 235–253. DOI 10.1093/cje/bel031. [Google Scholar] [CrossRef]

60. Diaz Ruiz, C. A. (2012). Theories of markets: Insights from marketing and the sociology of markets. The Marketing Review, 12(1), 61–77. DOI 10.1362/146934712X13286274424316. [Google Scholar] [CrossRef]

61. Hofer, K., Limaye, D., Singh, J. (2016). Fostering the development of ESCO markets for energy efficiency. USA: World Bank. [Google Scholar]

62. IRENA (2019). Global energy transformation: A roadmap to 2050. United Arab Emirates: International Renewable Energy Agency. [Google Scholar]

63. Secretariat Energy Charter (2019). China energy efficiency report. Belgium: Spotinov Print, Ltd. [Google Scholar]

64. Grazer Energieagentur (2016). Report on the European EPC market. Germany: Grazer Energieagentur GmbH. [Google Scholar]

65. Szomolanyiova, J., Keegan, N. (2018). European report on the energy efficiency services market and quality. Austria: QualitEE. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |