| Energy Engineering |  |

DOI: 10.32604/ee.2022.020472

ARTICLE

Effects of Hydrogen Storage System and Renewable Energy Sources for Optimal Bidding Strategy in Electricity Market

School of Management, Jinan University, Guangzhou, 510632, China

*Corresponding Author: Can Li. Email: canlee1992@stu2016.jnu.edu.cn

Received: 25 November 2021; Accepted: 30 December 2021

Abstract: This work suggested a novel model for obtaining optimum bidding/offering strategy to improve the benefits in case of big users. Aiming this regard, several electrical energy resources including: micro turbines, green power sources (wind turbine and photovoltaic system), power storage unit such as Hydrogen storage system with fuel cell, as well as mutual treaties are taken into account in offered model. Considering various models for uncertain parameters based on their natures such as power demand, electricity market tariffs, solar irradiation, temperature and wind speed is one of the contributions of the proposed model. Uncertainty of power demand is modeled by robust optimal method whereas remain uncertain parameters are incorporated in model by stochastic method. Considering of wind speed cased is made by Weibull distribution. While, normal distribution is utilized for production of cases for electricity market tariffs, solar irradiation and temperature. In order to reduce the bidding error loss, the storage devices are corporate with green energy in power unbalanced conditions. Combined-integer linear programming method is applied for handling of pricing method profiles that have strength against considered uncertainties on power demand of big user. The obtained results confirm, the entire electrical energy supplement expenditure of big user in absence of demand uncertainty is $39.63 whereas it is augmented up to $49.47 to achieve robustness vs. demand uncertainty. Also, using of hydrogen storage system by considering the reliability index is reduced the bidding price of the system.

Keywords: Bidding; uncertain constrains; bilateral contracts; renewable energy; reliability

Nomenclature

| Abbreviations | |

| WT | Wind turbine |

| PV | Photovoltaic |

| IGDT | Information gap decision theory |

| ESS | Electric storage systems |

| BC | Bilateral contracts |

| MT | Micro turbine |

| MILP | Mixed-integer linear program |

| RMILP | Robust mixed-integer linear program |

| PM | Power market |

| MPPT | Maximum power point tracking |

Indices

| cost function of micro-turbines index | |

| minimum ON and OFF-time limits running modelling | |

| micro-turbines index | |

| bilateral contracts | |

| scenario index | |

| time (hour) index |

Parameters

| bilateral contracts no | |

| function to calculate the scenarios s and s/ of a random variable distance. | |

| battery storage operation cost at time t [$/MWh] | |

| wind-turbine operation cost at time t [$/MWh] | |

| PV system operation cost at time t [$/MWh] | |

| time t in scenario s insulation | |

| the standard condition Insulation (W/m2) | |

| jth micro-turbine Minimum up/down time of [hour] | |

| Generation blocks of micro-turbines no | |

| micro-turbines no | |

| scenarios no | |

| PV system normal operating cell temperature | |

| sth scenario probability after the scenario reduction | |

| hth block Output size of jth micro-turbines unit [MWh] | |

| lth contract maximum capacity at time t [MW] | |

| lth contract minimum capacity at time t [MW] | |

| wind-turbine rated power [MW] | |

| wind turbine maximum power at time t in scenario s | |

| PV system maximum available power at time t in scenario s | |

| charging/discharging maximum power at time t in scenario s | |

| standard condition maximum power | |

| rate limit of ramp up/down of jth micro-turbine [MW/hour] | |

| times number | |

| time t in scenario s temperature | |

| standard condition of module temperature | |

| MUT/ MDT constraints variables | |

| wind speed | |

| cut-in and cut-out wind speed rated values [m/s] | |

| energy of battery storage maximum/minimum value | |

| battery storage charge/discharge efficiency | |

| energy price at time t in scenario s [$/MWh] | |

| price of contracts |

Variables

| Load demand (time t, scenario s) | |

| Purchased power of bilateral contract l (time t) | |

| Total purchased power of bilateral contracts (time t) | |

| Power market Purchased power (time t, scenario s) | |

| Power market sold power (time t, scenario s) | |

| jth unit of the micro-turbine produced power (time t, scenario s) | |

| Retad power of block | |

| Charge and discharge power of storage (time t, scenario s) | |

| Wind-turbine production (time t, scenario s) | |

| PV system production (time t, scenario s) | |

| Wind-turbine purchased power (time t, scenario s) | |

| PV system purchased power (time t, scenario s) | |

| Binary variable for lth bilateral agreement | |

| Binary variable for jth start of micro-turbine | |

| Binary variables of charge/discharge of battery storage | |

| Energy of storage [J] |

Providing energy with min expenditure is a significant problem in restricted power market, chiefly for large consumers [1]. In order to deal with tariff variation of market, various power sources can be used. Accordingly, mutual treaties, electricity market and self-owned production units are most significant units [2]. Wind turbines [3] and PV systems [4] can be regarded as production systems for cooling load of users. Besides, coalition of synthetic WT and photovoltaic unit with power storage unit can be regarded for handling of uncertainty effects of green sources [5].

Unlike to small users that must purchase their needed power just from retail sellers or retail market, main users can utilize various methods for providing of their required power [6]. These methods are parted to three general classes including: pool market, mutual treaties and internal production [7]. In [8], a model of pool tariffs variation to benefit of large users is proposed. Also, in [9] an improved model for large consumers in order to obtain optimal reserve bids in a security limited power market is presented. Authors in [10], are discussed around electrical energy supplement of large consumer in a power market covering of pool market as well as mutual contracts. Moreover, Fang et al. [11] modeled an auction for a contract among competitive production units and large consumers, aiming to determine power price among them. In [12], in order to deal with requirement of large consumers by various generators including: photovoltaic units, fuel cell (FC) and upper grid, a multi objective (MO) method is suggested. Heating and energy hub (EH) models are suggested for providing of energy for an industrial user in [13].

Various stochastic models of power supplement problem based on meta heuristic [14], multi objective HBMO [15], imperialist competitive algorithm [16] and firefly technique [17] are proposed in pervious works. Authors in [18] proposed a new stochastic model-based power supplement method for large consumers with containing of distributed generations (DGs), mutual treaties and pool market purchase in presence of demand response program (DRP). Also, Hartmann et al. [19] utilized a power storage system in an industrial/commercial user and evaluated its impacts. Equal work is made in [20] for large consumer by information gap decision theory (IGDT) method where 2 standards are utilized covering decision robustness vs. facing high supplement expenditures, and opportunity of taking benefit of low supplement expenditures. In addition, a test system is offered in [21], for depicting of IGDT approach. As well, equal approach is suggested in [22], to cope bidding method in day-ahead yield of a large consumer. In [23], an optimization is made for long-term power supplement of large consumer with regarding of long-term transactions and uncertain parameters. Also, the risk-limited bidding method is formulized in [24] for large consumers with considering of DRP. Authors in [25] studied a mid-term programing for big industrial power utilities with second-order stochastic dominance. Moreover, MO demand optimization method is presented in [26] for industrial utilizes with DR through blending of stochastic, quadratic, and evolutionary scheduling with MO optimization and continuous simulations. Furthermore, a decision-making method based on fuzzy system for power supplement is suggested in [27] by green sources. The authors in [28], has considered the influence of demand, price, and wind uncertainties on total costs with reliability in the structure of energy hub. In [29], the wind power and coal chemical based on the hydrogen storage system is combined, as a result the penetration ability of wind energy is improved and total cost is minimized.

In [30], an integrated model of offering strategy for microgrid management considering day-ahead, intra and unbalanced market is proposed. The model is applied for microgrid with demand and various generation to achieve optimal management of microgrid components. A novel combined dynamic and emission dispatch model for electric vehicles, wind turbines using multi objective function is proposed in [31]. A multi stage model based optimal dispatch for wind turbine, thermal and energy storage is modeled in [32], which the offering strategy is done in energy and reserve markets. In [33], an optimal bidding strategy in daily market and real-time market for microgrid based on two-stage framework is proposed. Ac power follow, hourly reconfiguration of microgrid, hydrogen energy modelling, using multiple shiftable loads are the suggested model’s primary benefits. An optimal participation of HPP with considering risk-averse strategies [34] is considered to achieve best benefits using three-stage decision making model. Also, some improved uncertainties model such as robust-stochastic approach [35] and uncertainties in deregulated electricity market [36] are proposed to achieve the best benefits in bidding problem modellings.

This work studied bidding/offering optimization methods for electricity supplement problem of big electricity utilities with including photovoltaic systems, wind turbines and hydrogen storage system with considering uncertainty on demand, reliability index, electricity market tariff and outlet power of wind turbine and photovoltaic units. Synthetic robust-stochastic method is suggested. In this method, robust method is regarded for modeling of demand uncertainty whereas remain uncertain parameters are modeled by stochastic optimization.

1.2 Novelty and Contributions of This Paper

According to the literature review, there is no work that combined stochastic and robust methods for achieving to optimum offering/bidding methods in case of large consumer’s power supplement in presence of alternative power resources and power storage units. Respect to this description, novelties of this work can be represented by:

a) Bidding/offering optimization approaches for large consumer energy supplement are proposed.

b) Stochastic and robust power supplement expenditure functions are combined.

c) Some uncertain parameters, i.e., demand, market tariff and outlet energy of WT and PV systems are considered.

d) The hydrogen storage system with fuel cell has been exploited in hub energy.

e) Evaluation criteria for optimal scheduling, reliability matrices are considered.

Rest of this work is structured as: Section 2 provides power supplement problem for large consumers by considering green generators and storage devices. Following that, Section 3 introduces artificial uncertain-robust method and used it to suggested model. Section 4 describes the results of proposed method in test system. Eventually, conclusion of paper is presented in Section 5.

Cost effective energy supplement of large consumer is studied in this work. Deterministic models of generators are linearized and also the cost function is suggested in this part of paper. Also, the assumptions of this paper are considered as:

• This problem is formulated as an integer linear model.

• In order to prediction, the market price, wind speed, sun irradiation and temperature are available and applied to system as input data.

• Several electrical energy resources including: micro turbines, wind turbine, photovoltaic system, hydrogen storage and fuel cell offering model are formulated together.

• The problem is formulated as uncertain problem and based on the nature of parameters, the suitable model is applied for them

Considered large consumer of this work is procured by means of various resources and using bilateral contracts (BC), electricity market, MT, photovoltaic units, wind turbines and batteries. This work suggested following objective that must be minimized:

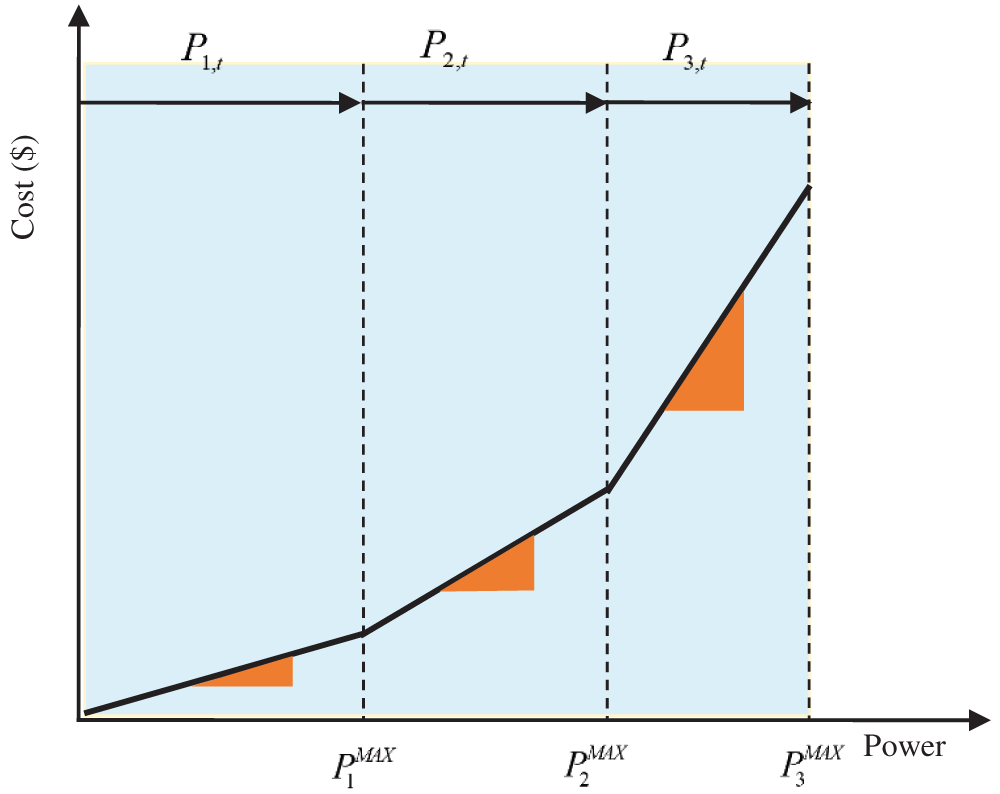

where, first part of formula is the power supplement expense by bilateral contracts. Second part represents the provided power by PM, MT as well as operational expense of storage devices, wind turbines and photovoltaic systems. Also, 3-block piece-wise linear function is considered in order to model the operational expenditure of MT.

The provided energy by various sources must cope total demand power. Aiming this regard, provided energy by PM, MT, bilateral contract, solar power, wind turbine and batteries must be equal to power demand in every time t. this constraint is represented by following equation:

Modeling of provided electrical energy by bilateral contracts is made using Eq. (3). This equation shows that the total of the bilateral contracts at any time is equal sum of all contracts in that time. It is remarkable, supplied electrical energy is bounded by relation (4). Also, this equation shows each contract should be limited to maximum and minimum amount.

As illustrated in Fig. 1, objective function of MT is presented by 3-block piece-wise linear curve. Mathematically expressing of this figure is provided by Eq. (5). As well, the related limitations are presented with Eqs. (6)–(11), in which, provided power by MT is bounded to max potential of blocks that is denoted in (6) and (7). Moreover, ramp up/down proportions constraint is expressed by (8) and (9). At last, Eqs. (10) and (11) are respectively provided the min up and min down time limitations. For modeling of min up and min down time for micro turbines, ancillary parameters of and are introduced in relation (12) [37].

Figure 1: Operation cost model of MT

Respect to [38], Eq. (13) provides the max outlet electrical energy of WT at each time t.

Provided power for a big power user in time t is bounded by following relation:

In present work, regarding to maximum power point tracking (MPPT), photovoltaic modules are utilized at their max energy for big power utilities. MPPT guarantees that photovoltaic system generates most possible electrical energy in case of whole every temperatures and irradiations. The max accessible energy of photovoltaic unit at each time t is expressed in following equation [39]:

Provided power for big power utilities by photovoltaic unit is bounded by Eq. (16).

2.7 Power Storage Device Model

Following relations express the ESS limitations [39]. Starting power of battery is expressed in (17). Also, Eqs. (18) and (19) are respectively bounded the charging and discharging energy at time t. Moreover, saved power level of battery is presented in Eq. (20). Furthermore, Eq. (21) ensures that charging and discharging of battery are not in a same time. Finally, relation (22) represents the dynamical model of storage device.

2.8 Hydrogen Storage System Model

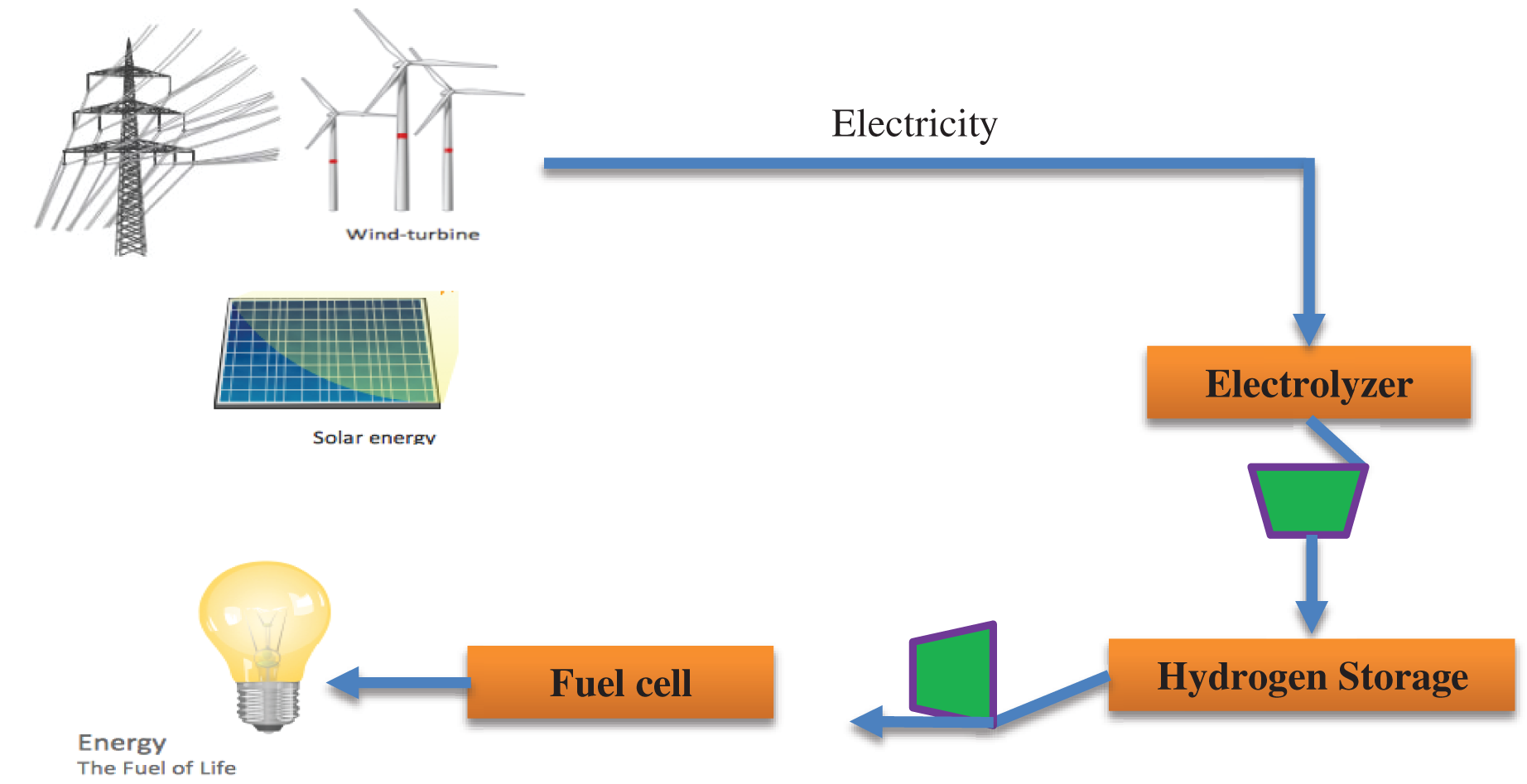

Since hydrogen can be stored as a gas, liquid and solid material, it is a suitable carrier for energy. One of the most suitable storage sources is hydrogen storage system. The hydrogen storage system consists of three parts:

• an electrolyzer

• a fuel cell

• a hydrogen storage tank

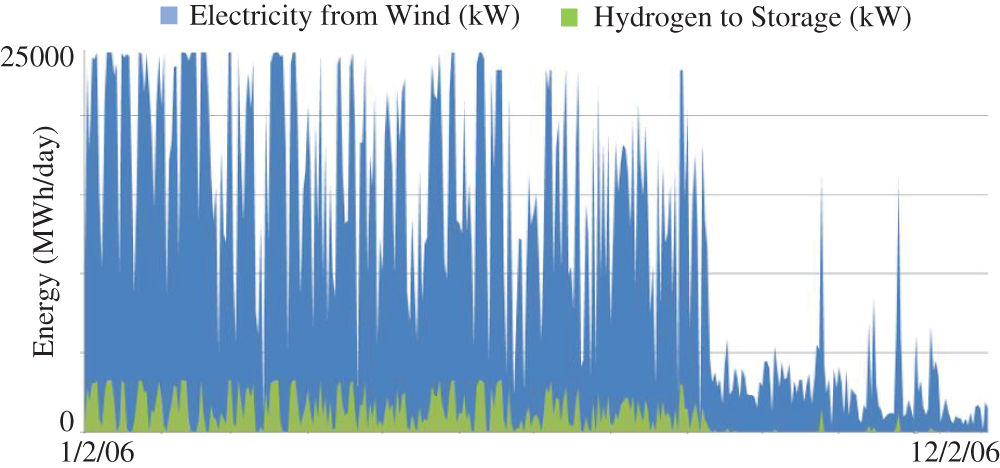

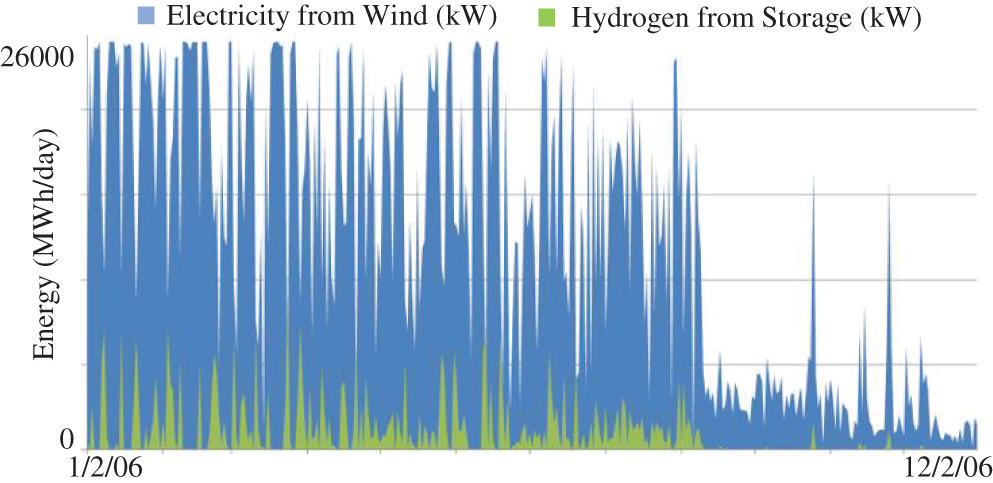

The structure of a hydrogen storage is shown in Fig. 2. Also, in Fig. 3, the amount of hydrogen injected to storage in comparison of achieved electricity from wind form is shown. In Fig. 4, the amount of hydrogen obtained from storage which is converted to electricity in fuel cell is shown.

Figure 2: The structure of hydrogen storage in network

Figure 3: Wind farm and hydrogen storage for storage-hydrogen to storage

Figure 4: Wind farm and hydrogen storage for storage constrained case-hydrogen from storage

In this part, the process of decomposition of water molecules is carried out to H2 and O2. Using Eq. (23), electrolyzer input power concentrate is defined [40].

In this equation, the upper and lower amount of electrolyzer input power are represented through

In this part, the produced hydrogen is saved in the hydrogen tank. Input and output hydrogen molar injected to the tank and their upper values are formulated via Eqs. (14)–(17), respectively.

Input and output molar of hydrogen storage are represented by

Pressure of hydrogen tank and primary pressure of hydrogen tank are show by Eqs. (28) and (29). Also, pressure level of hydrogen tank is defined via Eq. (30), in order to avoid the charge and discharge of hydrogen storage tank at the same time, Eq. (31) is formulated.

In this equation, hydrogen pressure tank is defined by

In this part the stored hydrogen in hydrogen tank is converted to electricity via fuel cell. Eq. (32) indicates the output energy concentrate.

In this equation, the upper and lower amount of electrolyzer input power are represented through

3 Combined Stochastic-Robust Model

In achieved system model in Eqs. (1)–(22), there exists some uncertain parameters including: energy price, required power, radiation, temperature and wind speed. According to these uncertain parameters, the optimal intelligence strategy is suggested in this paper.

In the proposed strategy, demand takes value inside of a robust method, while modeling of uncertainties of market tariffs, radiation, temperature as well as wind speed are made via a collection of scenarios. Uncertainty of demand power is expressed considering sum of limited uncertain parameters to achieve a RMILP and in order to be solved for a collection of price cases (stochastic programing).

The suggested strategy is defined in next section.

3.1 Evaluating Hub Energy in the Presence of Reliability Limitation

In this section, some reliability indicates, such as expected energy not supplied (EENS), Expected load not supplied (ELNS), and loss of load expectation (LOLE), have been used to evaluate the reliability and stability of the energy hub, which is defined as follows:

It should be noted that operating calculations are hour-based, and calculating ELNS in a time period will result in achieving EENS in this block. Finally, ELNS is computed using Eq. (37) (Refer to [41,42] for more detail).

The limitation of ELNS is determined using Eq. (38).

where

Then, in order to verify the reliability of the energy hub, PCβ is defined as a penalty coefficient which is formulated by Eq. (5) that the hub operator should pay because not being able to supply some β loads.

where

Another reliability parameter (

In this equation,

The optimal robust method is a venture management technique that is less computationally intensive than other techniques. The criteria MILP formulation of the proposed representational model in (1)–(22) may be written as follows:

s.t.:

In these equations, the variables of problem are denoted by

In this paper, a control variable

s.t.

In which,

It is remarkable, in Eqs. (27)–(31), parameters of

Equivalent robust combined-integer linear model to represented problem in (46)–(50) in presence of uncertain parameters and reliability index in right side terms can be expressed by:

s.t.:

where

The required power in each time (

Subject to:

Where, robustness variable amount is in range of 0–1 once the power demand has uncertainty (

3.3 Synthetic Stochastic-Robust Formulization

This part of paper suggests some cases by stochastic programing frame for modeling of uncertain parameters including: yield prices, solar radiation, temperature and wind speed in robust Eqs. (60)–(67). Also, Weibull distribution is utilized for modeling wind speed uncertainty in electricity yield works. In this way, a set of scenarios for wind speed are created respect to Weibull distribution profile of wind speed. As well, ordinary distribution is employed for modeling some unknown variables, such as temperature, market tariffs, solar radiation, and reliability index which is defined in second part of the Eq. (68). Combined stochastic-robust model can be formulized by:

Subject to:

Eq. (68) represents the cost function of this optimization, and limitations (69)–(74) express the equivalent constraints to (51)–(59) of robust model in each price case. Also, Eqs. (75)–(93) denote the corresponding constraints to (3)–(22) in deterministic linear problem, except that, replicated for each case.

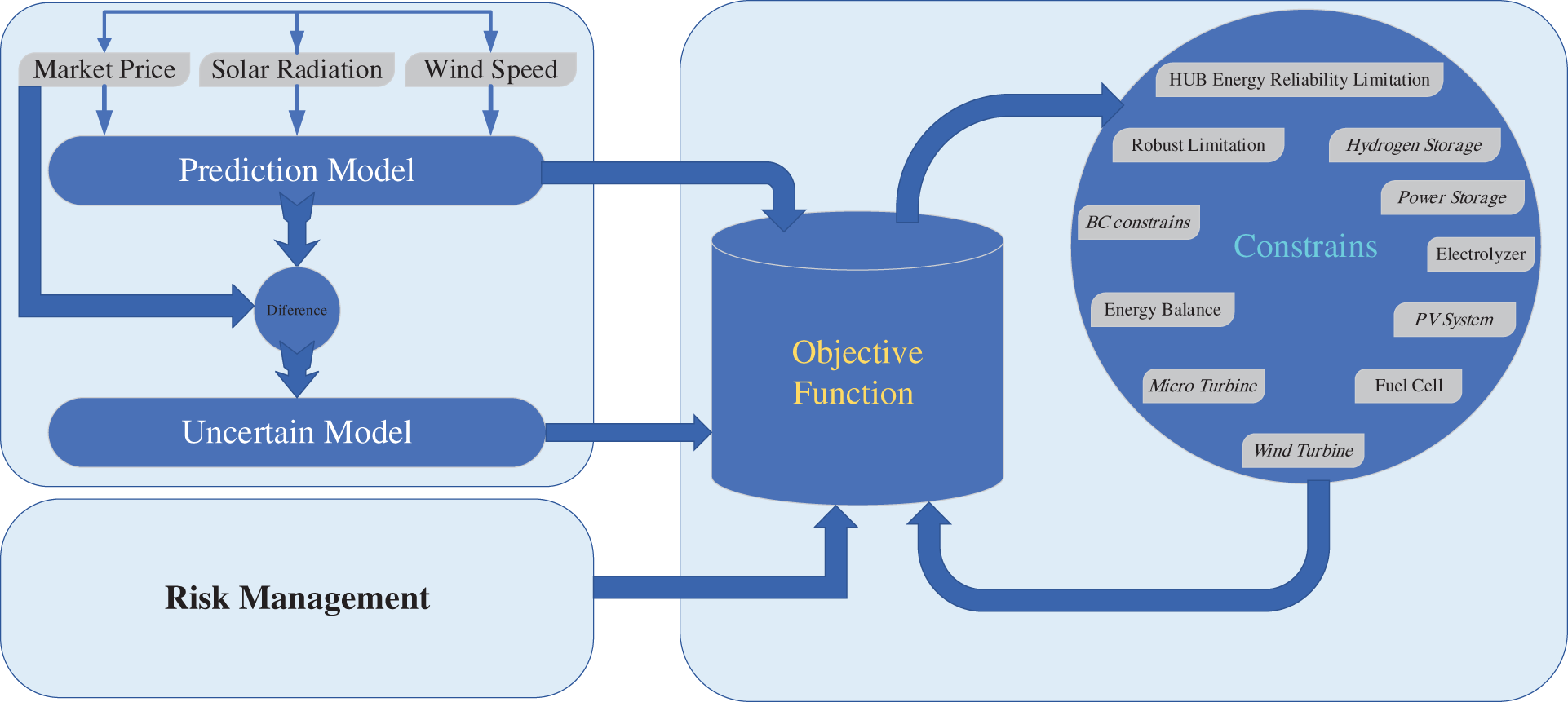

The expressed limitations in (94) and (95) guarantee, offering and offering profiles are continually growing and dipping that is a normal necessity in power markets. Eq. (94) illustrates, that given an equal-time offering profile, the energy outlet equivalent to a case with high price related to another one must be greater than or equal to the second case’s channel energy. This is also true in reverse for Eq. (95), which is used to create bidding profiles. The flowchart of the proposed model based on the problem formulation is shown in Fig. 5.

Figure 5: The flowchart of the proposed model

This section proposes a synthetic stochastic-robust approach, applies it to a test system, and discusses the findings obtained.

Whole needed data for original load amount, BCs, wind turbine, photovoltaic system as well as daily wind speed are quoted that [1] whereas predicted load and market tariff data are considered as [6].

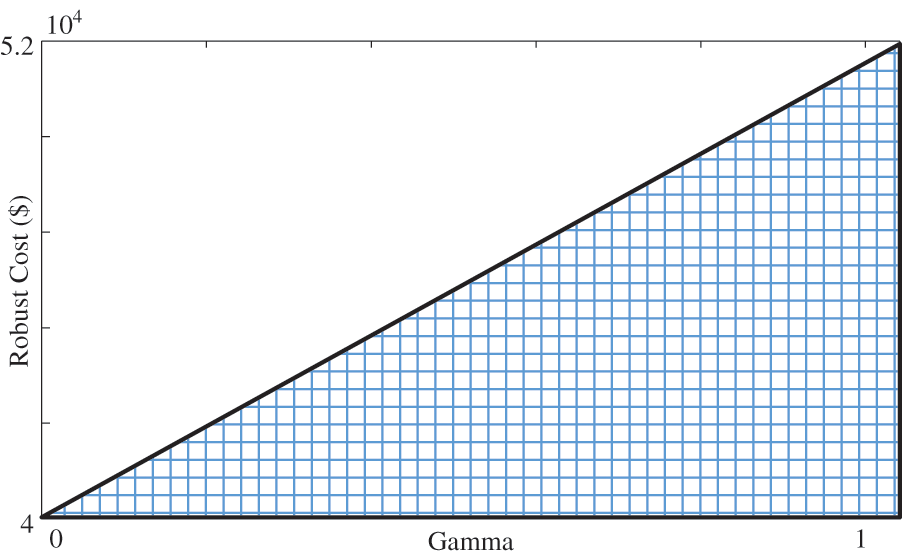

For the purpose of attaining optimal bidding and offering profiles of presented model by (68)–(95), the presented optimization is resolved by means of CPLEX solver [43] in GAMS [44] software. The electrical energy supplement expenditure by robust method for big utilities vs. gamma (control variable) is illustrated by Fig. 6. It is remarkable, there is 11 repetition respect to gamma amounts from 0 to 1 with 0.1 step size. Growth of amount of this parameter leads to increasing of conservatism. Robust expense for

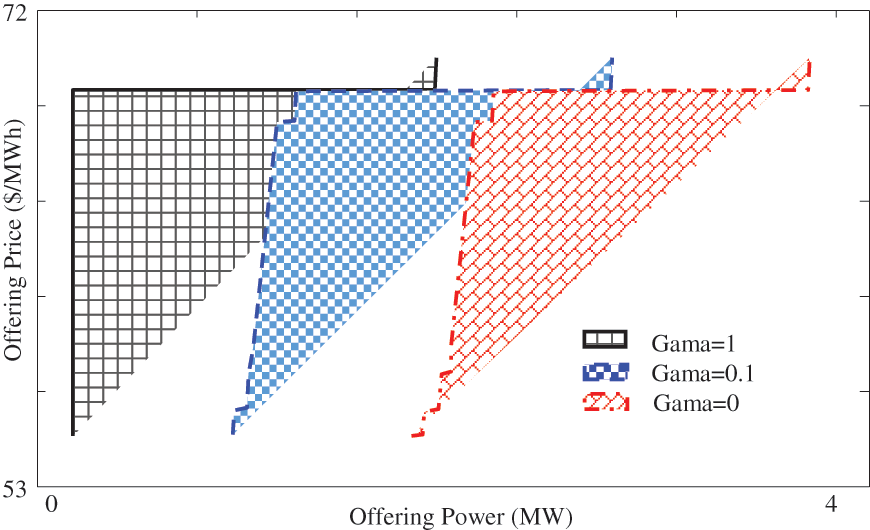

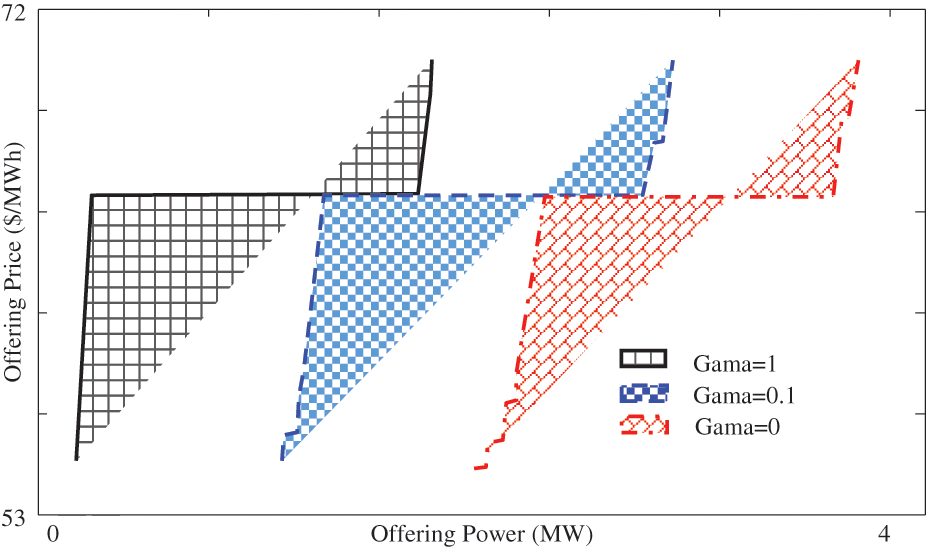

The optimum offering profiles at 1–2 and 24 h are depicted in Figs. 7–9 which gained for various control parameter amounts. Respect to this figure, with greatest amount of gamma, large power utility has not shared in offering profile due to that be conservative vs. demand uncertainty. As shown in Fig. 7, for first time intervals of curve, big power utility has not taken part until the energy tariff augmented more than $70/MW. Also, Fig. 8 shows offering profile at time 4 where the large power utility has not suggested once control variable value is in greatest level whereas once it is 0.5, with achieving the marker tariff to $64.59, large power utility has begun to bid energy to market. Moreover, Fig. 9 shows the offering profile at 24 h. As shown in this figure, growth of gamma amount results in decrement in suggested energy to market.

Figure 6: Robust cost against gamma value

Figure 7: Persuade curve in first h in various gamma amount

Figure 8: Offering of 2nd h for various gamma amount

Figure 9: Offering of a day for various gamma amount

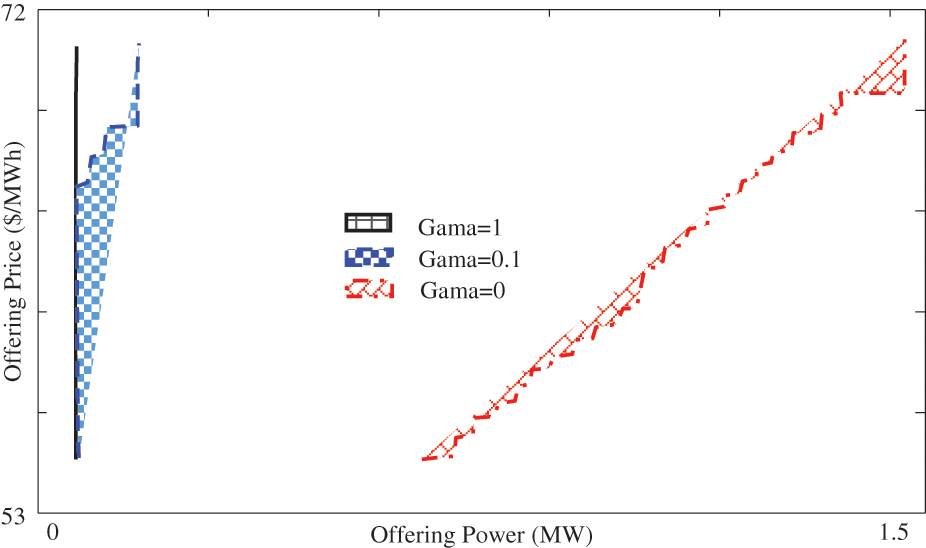

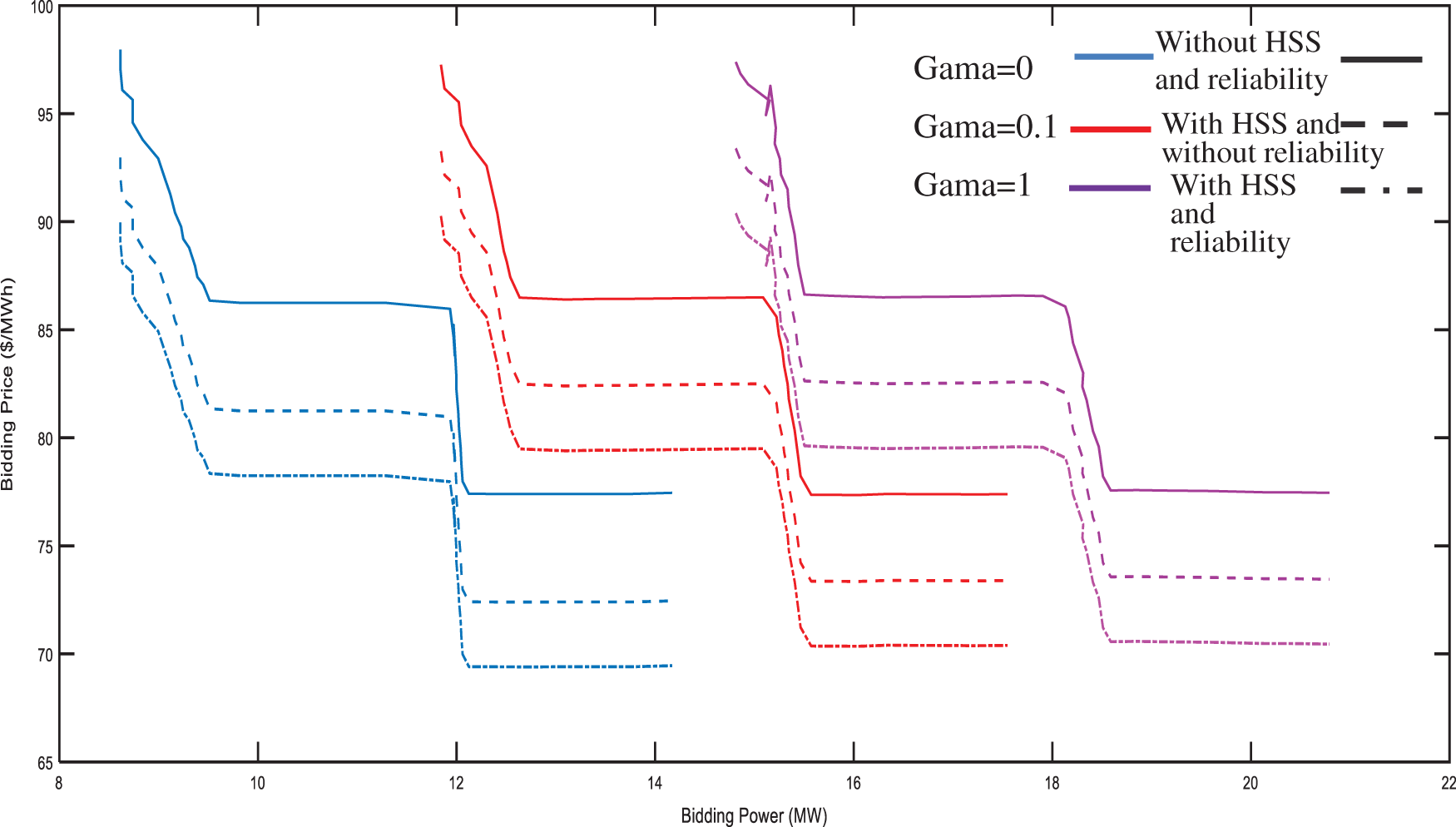

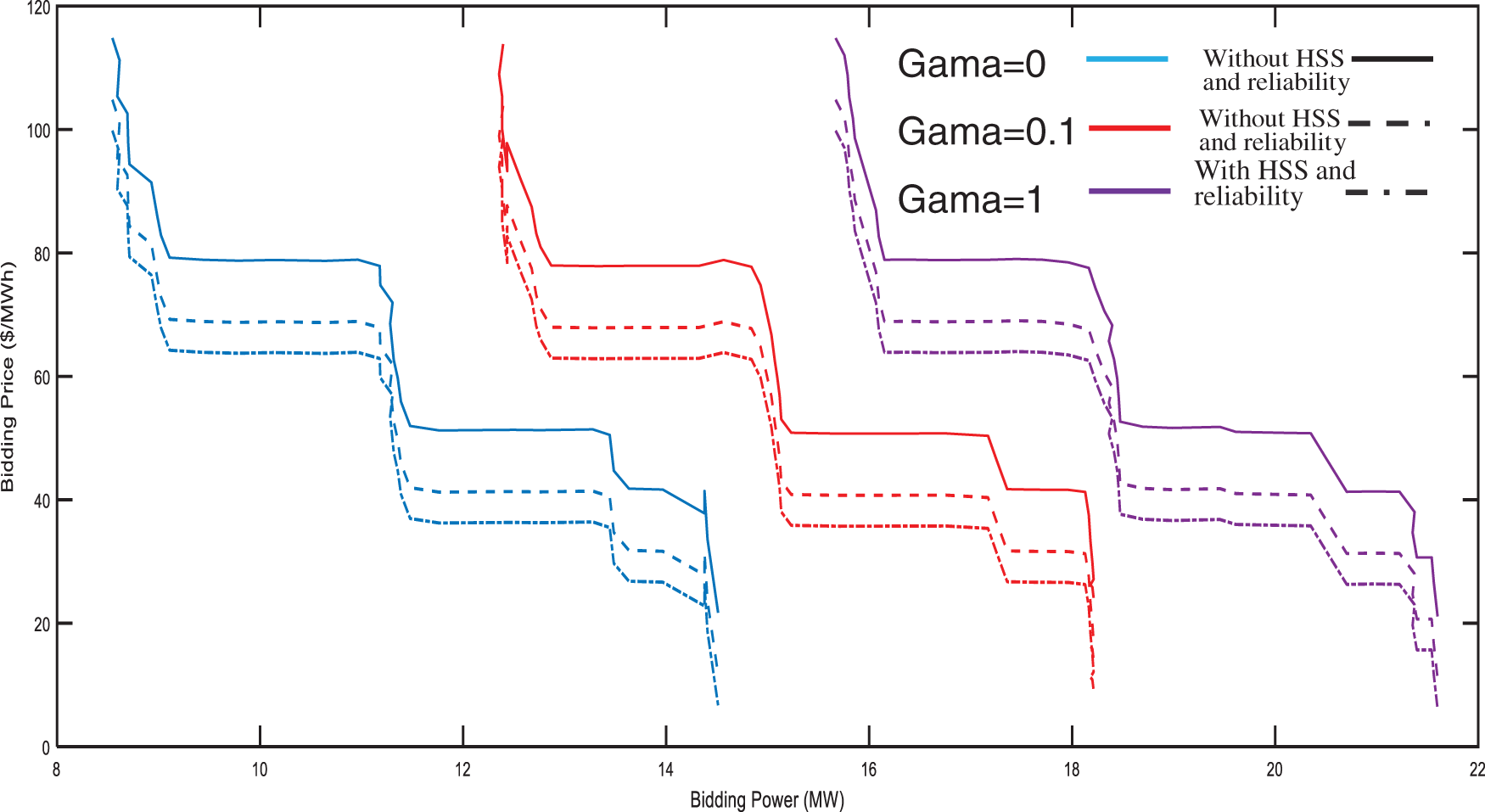

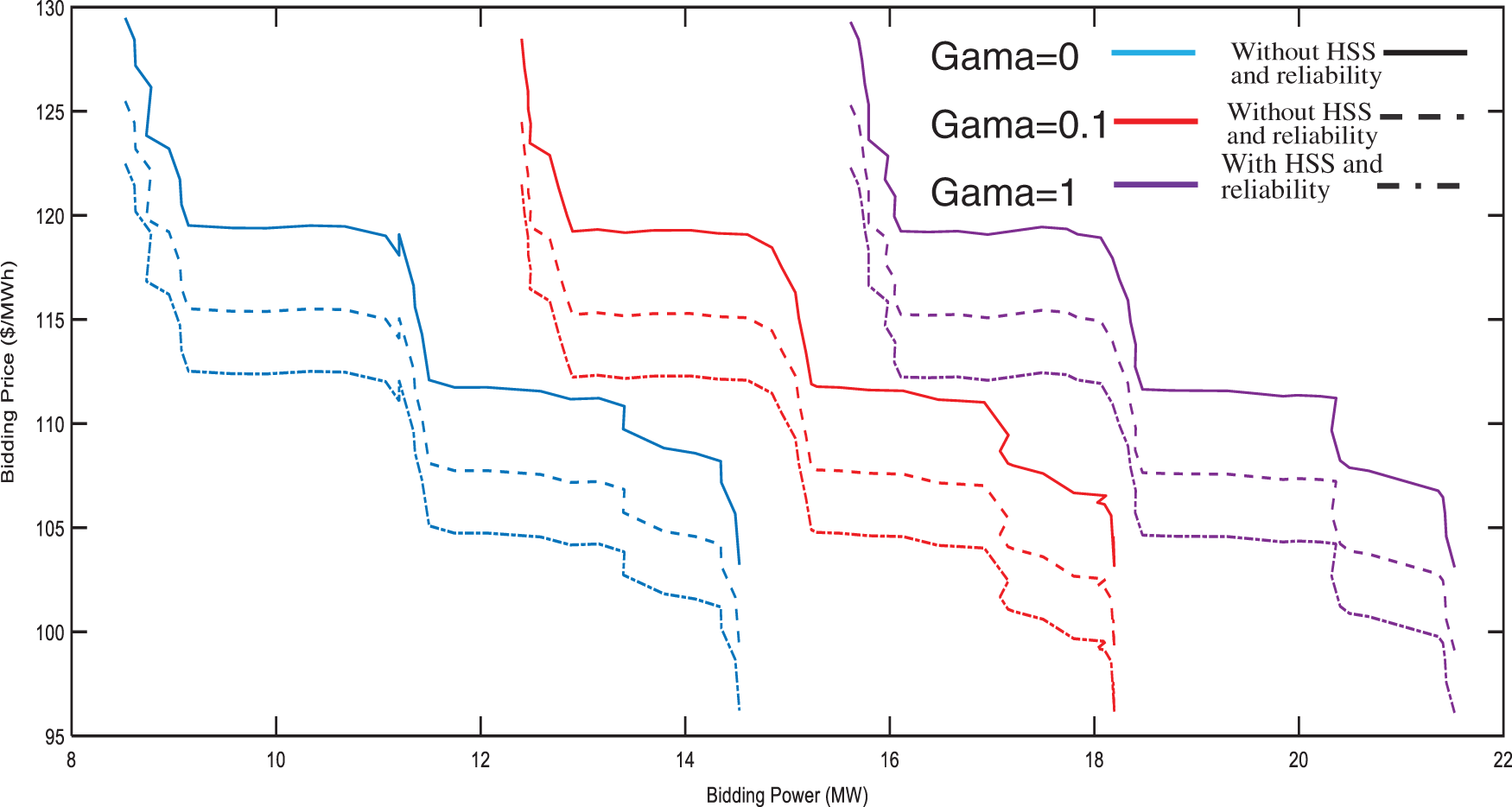

Figs. 10–12 illustrate achieved optimum bidding results for 16, 20 and 24 time steps for various control parameter amounts. As expected, increasing this parameter results in a growth in the quantity of bidding energy for increasing of robustness vs. demand uncertainty. In this scenario and according to Fig. 10 which shows the bidding profile of 16th h, bidding electrical energy is augmented with growth of uncertain control variable, for equal price. It is true also about Fig. 9, which depicts the profile of bidding for 7th h. In case of Fig. 12, by assuming zero value for gamma, bidding energy is 0 once electrical energy tariff is greater than $80, whereas in case of

Figure 10: Bidding curve of 16th h for various gamma amount (presence of HSS and reliability)

Figure 11: Bidding curve of 20th h in various gamma amount in presence of HSS and reliability

Figure 12: Bidding of a day for various gamma amount

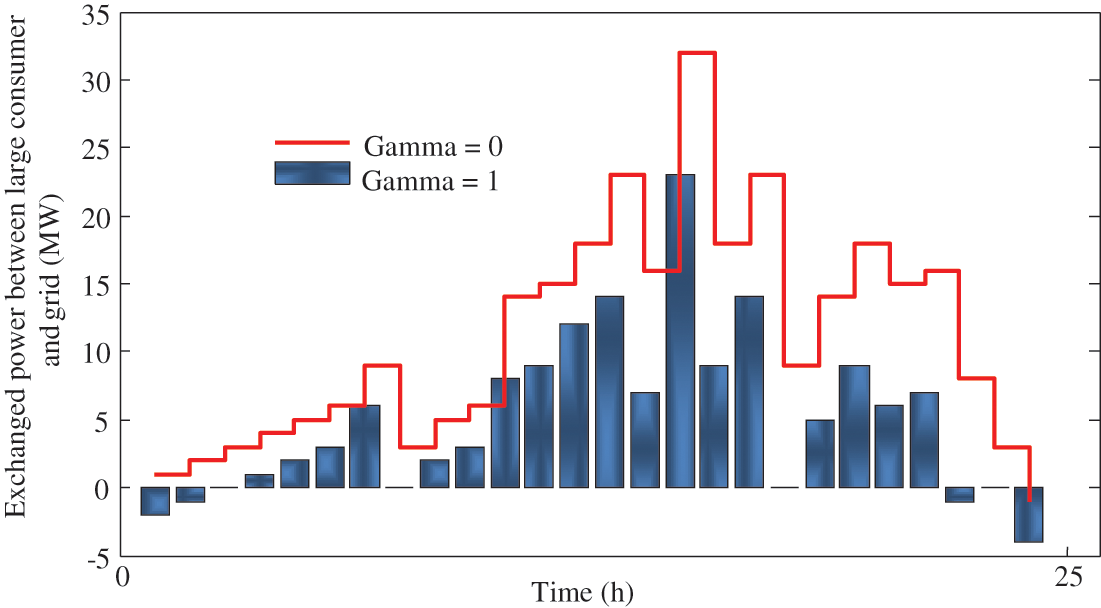

The interchanged electricity among big power utility and upper grid is depicted in Fig. 13 for case 47, where positive numbers express provided energy than upper grid whereas minor ones are sold electrical energy to upstream grid. As could be anticipated, provided energy is augmented once the control parameter reaches to its max amount (

Figure 13: Power swapped between high demand and grid

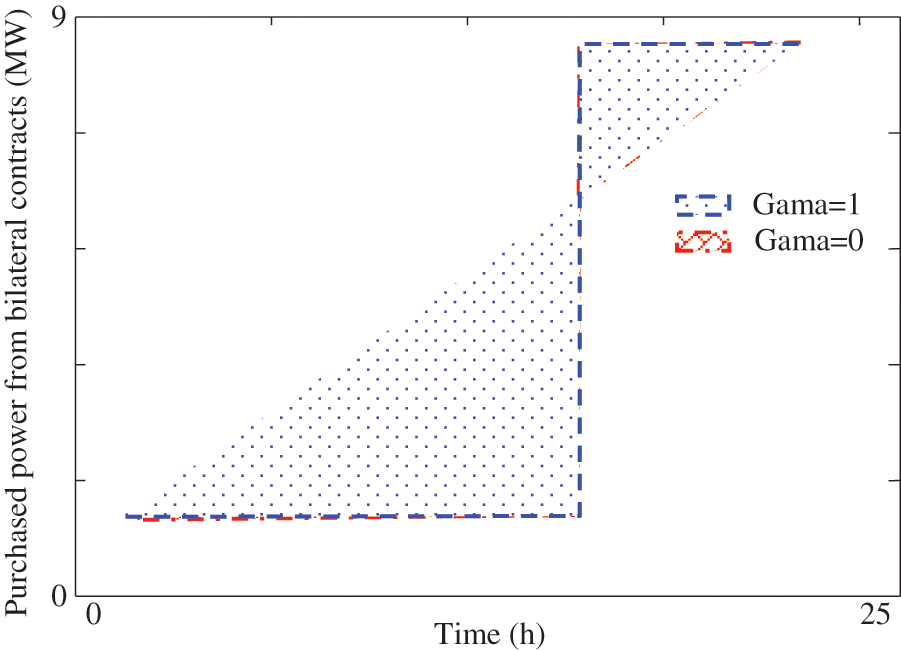

This work presented 40 case for modeling of uncertainty on market tariff, solar radiation, temperature and wind speed. Association of provided energy from 12 BCs for case 35 is shown in Fig. 14. As seen in Fig. 10, this amount is nearly equal for both the bottom and upper values of gamma.

Figure 14: 35th scenario procured power for bilateral contracts

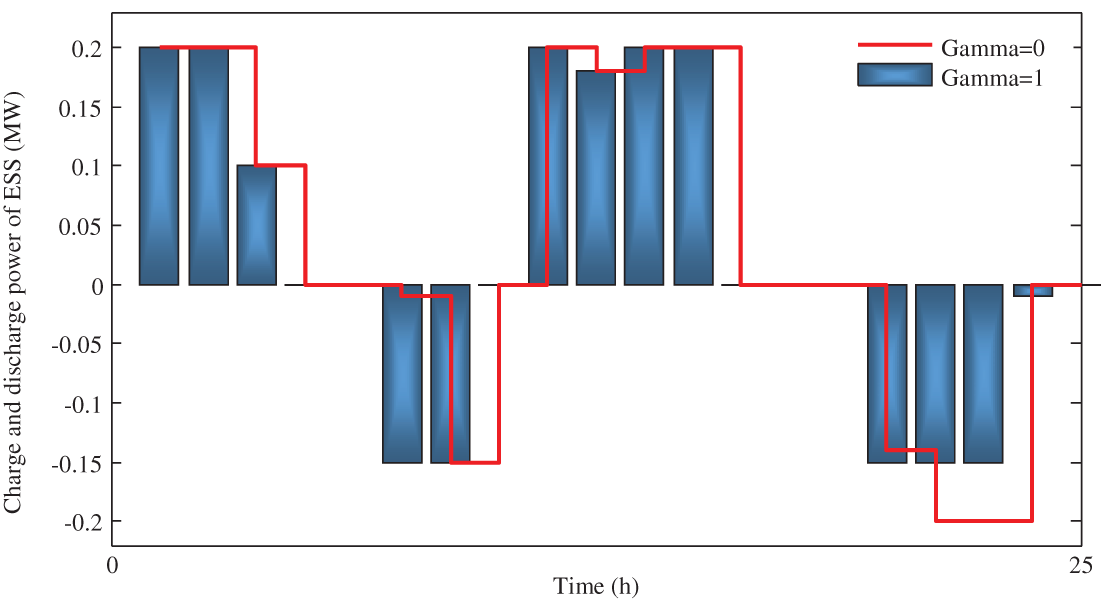

Also, Fig. 15 shows charging/discharging of battery, in which positive ones are charged energy whereas negative ones are utilized to present discharged electricity. Respect to this figure, once

Figure 15: 46th scenarios charge and discharge power results

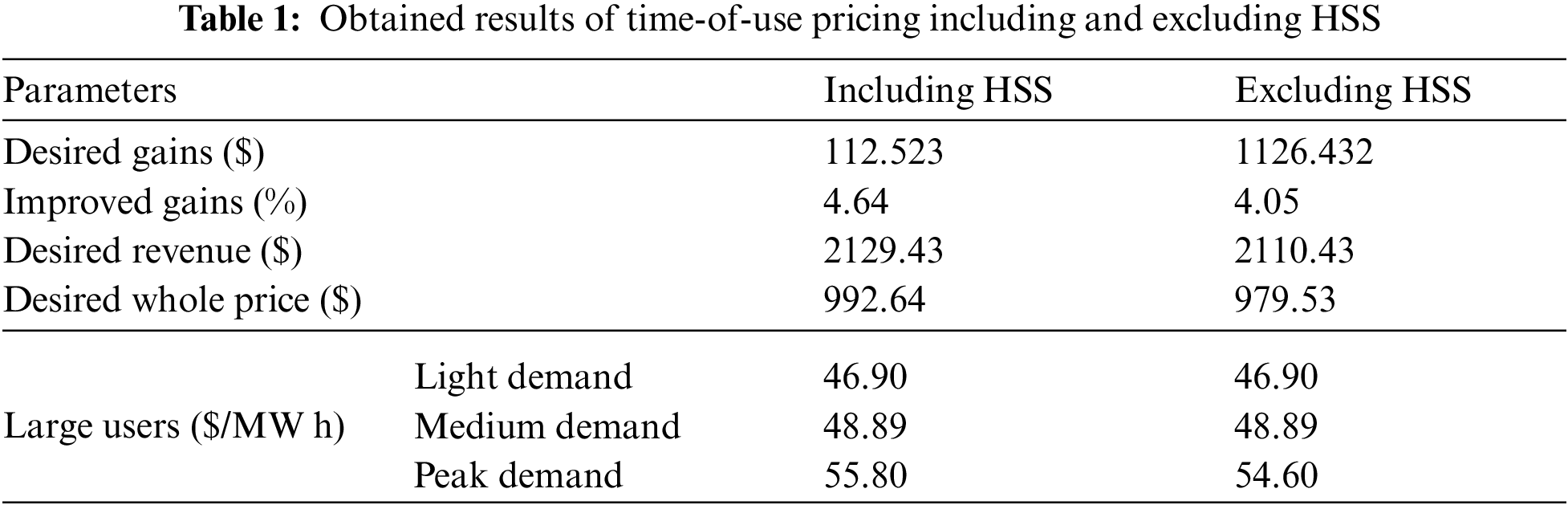

4.3 Supplementary Analysis: Time-of-Use Pricing Determination

In this model, the energy seller controls the selling cost as low, medium and peak demands. This approach ban be close to real price and market. In this approach, the system is analyzed including and excluding HSS. Obtained results are presented in Table 1, for two model of including and excluding the HSS.

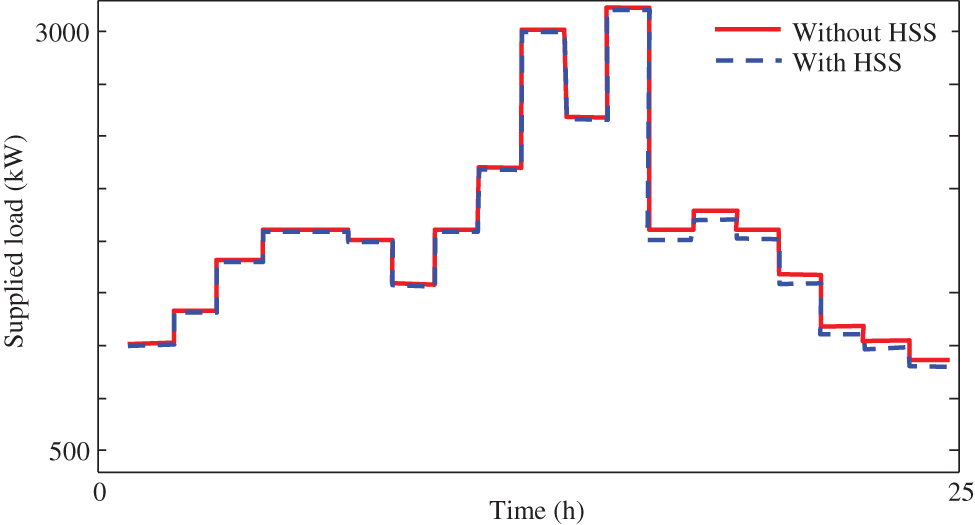

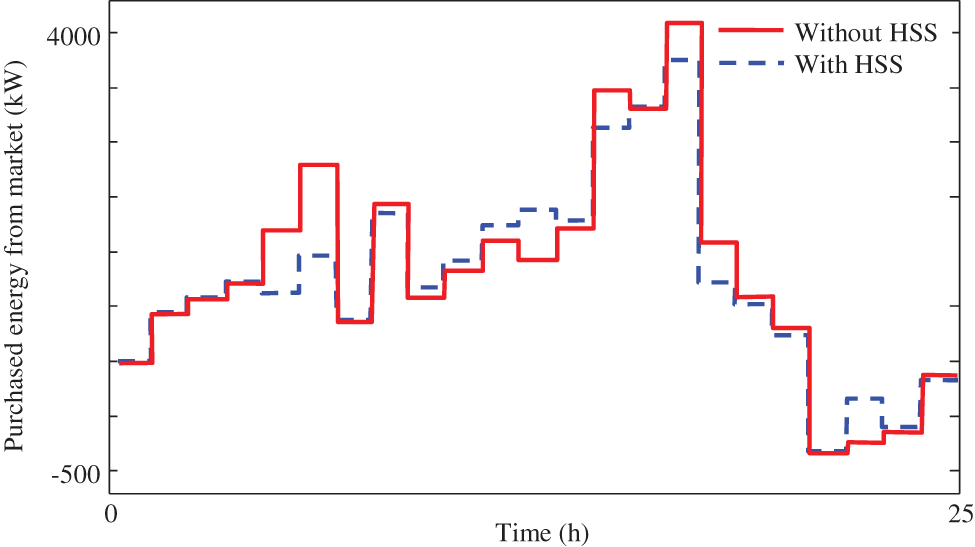

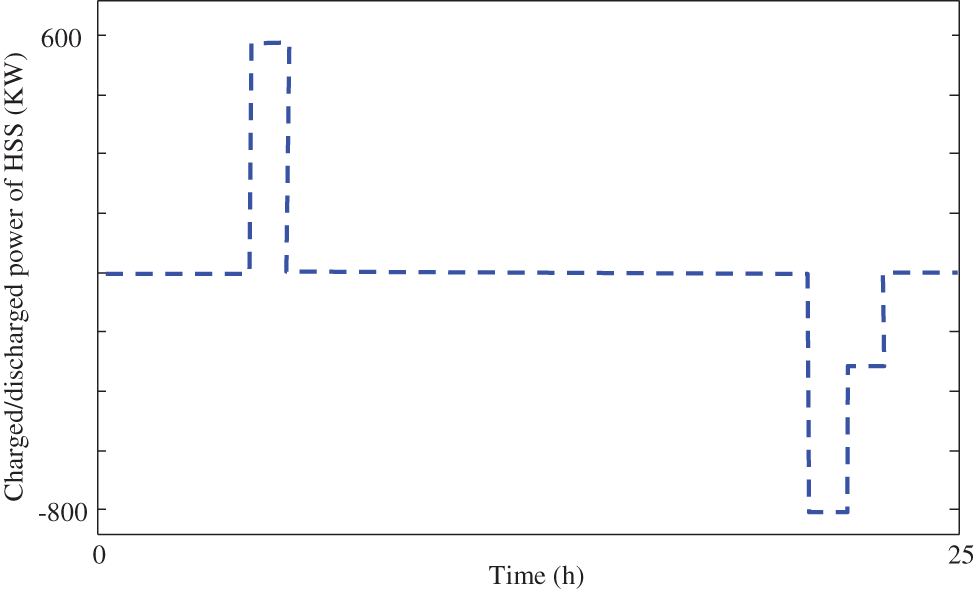

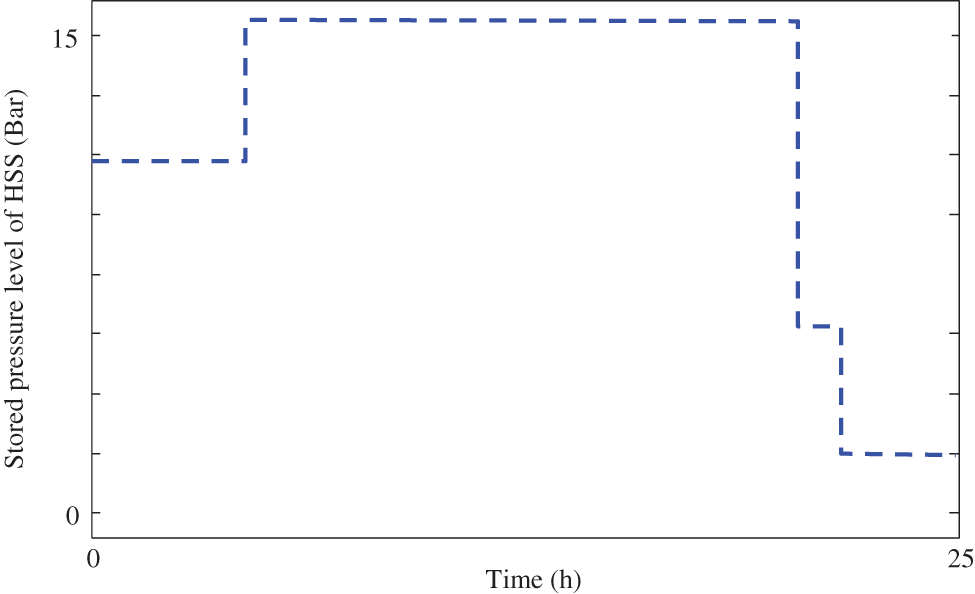

By considering to this table, it can be said that more profits are provided in utilizing the HSS which can be suitable for retailers as well as end-user consumers. The retailer’s provided demand is presented in Figs. 16 and 17 in two models of including and excluding HSS. In Figs. 18 and 19 the charge and discharge energy and stored pressure level of hydrogen storage system is presented as well.

Figure 16: Demand power of results of retailer in time-of-use pricing

Figure 17: Energy procurement from market in time-of-use pricing

Figure 18: Charge of HSS in time-of-use pricing

Figure 19: The level of HSS pressure storage in time-of-use pricing

This article suggested a novel model of bidding strategy in power markets for various generation contains; Micro turbines, wind turbine, PV, energy storage and, etc., in big power utilities. It is worthy to note, market tariff, solar radiation, temperature, and wind speed are regarded as unknown factors and their modeling is made by means of stochastic method whereas modeling of demand uncertainty is done by robust method. In this work, the uncertainty of power demand is modeled by robust optimal method whereas remain uncertain parameters are incorporated in model by stochastic method. The unbalanced amount of power between generation and bidding value of green energies are compensated by storage devices and the loss of unbalanced loss become minimum. Also, a control variable

Funding Statement: The authors received no specific funding for this study.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

References

1. Vallés, M., Bello, A., Reneses, J., Frías, P. (2018). Probabilistic characterization of electricity consumer responsiveness to economic incentives. Applied Energy, 216, 296–310. DOI 10.1016/j.apenergy.2018.02.058. [Google Scholar] [CrossRef]

2. Kim, H. J., Kim, M. K. (2021). Risk-based hybrid energy management with developing bidding strategy and advanced demand response of grid-connected microgrid based on stochastic/information gap decision theory. International Journal of Electrical Power and Energy Systems, 131, 107046. DOI 10.1016/j.ijepes.2021.107046. [Google Scholar] [CrossRef]

3. Khalilzadeh, S., Nezhad, A. H. (2020). Using waste heat of high capacity wind turbines in a novel combined heating, cooling, and power system. Journal of Cleaner Production, 276, 123221. DOI 10.1016/j.jclepro.2020.123221. [Google Scholar] [CrossRef]

4. Luerssen, C., Gandhi, O., Reindl, T., Sekhar, C., Cheong, D. (2020). Life cycle cost analysis (LCCA) of PV-powered cooling systems with thermal energy and battery storage for off-grid applications. Applied Energy, 273, 115145. DOI 10.1016/j.apenergy.2020.115145. [Google Scholar] [CrossRef]

5. Cao, Y., Wang, Q., Fan, Q., Nojavan, S., Jermsittiparsert, K. (2020). Risk-constrained stochastic power procurement of storage-based large electricity consumer. Journal of Energy Storage, 28, 101183. DOI 10.1016/j.est.2019.101183. [Google Scholar] [CrossRef]

6. Aalami, H. A., Nojavan, S. (2016). Energy storage system and demand response program effects on stochastic energy procurement of large consumers considering renewable generation. IET Generation, Transmission and Distribution, 10(1), 107–114. DOI 10.1049/iet-gtd.2015.0473. [Google Scholar] [CrossRef]

7. Soroudi, A., Ehsan, M. (2012). IGDT based robust decision making tool for DNOs in load procurement under severe uncertainty. IEEE Transactions on Smart Grid, 4(2), 886–895. DOI 10.1109/TSG.2012.2214071. [Google Scholar] [CrossRef]

8. Kazempour, S. J., Conejo, A. J., Ruiz, C. (2014). Strategic bidding for a large consumer. IEEE Transactions on Power Systems, 30(2), 848–856. DOI 10.1109/TPWRS.2014.2332540. [Google Scholar] [CrossRef]

9. Cleland, N., Zakeri, G., Pritchard, G., Young, B. (2016). Integrating consumption and reserve strategies for large consumers in electricity markets. In: Computational management science, pp. 23–30. Cham: Springer [Google Scholar]

10. Conejo, A. J., Fernandez-Gonzalez, J. J., Alguacil, N. (2005). Energy procurement for large consumers in electricity markets. IEE Proceedings-Generation, Transmission and Distribution, 152(3), 357–364. DOI 10.1049/ip-gtd:20041252. [Google Scholar] [CrossRef]

11. Fang, D., Wu, J., Tang, D. (2012). A double auction model for competitive generators and large consumers considering power transmission cost. International Journal of Electrical Power and Energy Systems, 43(1), 880–888. DOI 10.1016/j.ijepes.2012.05.041. [Google Scholar] [CrossRef]

12. Rezaeipour, R., Zahedi, A. (2017). Multi-objective based economic operation and environmental performance of PV-based large industrial consumer. Solar Energy, 157, 227–235. DOI 10.1016/j.solener.2017.08.022. [Google Scholar] [CrossRef]

13. Soudmand, B. M., Esfetanaj, N. N., Mehdipour, S., Rezaeipour, R. (2017). Heating hub and power hub models for optimal performance of an industrial consumer. Energy Conversion and Management, 150, 425–432. DOI 10.1016/j.enconman.2017.08.037. [Google Scholar] [CrossRef]

14. Bekravi, M., Abedinia, O. (2013). A new multi-objective meta heuristic algorithm based on environmental/economic load dispatch with wind effect. Technical and Physical Problems of Engineering, 5(2), 15. [Google Scholar]

15. Abedinia, O., Amjady, N., Izadfar, H. R., Shayanfar, H. A. (2012). Multi-machine power system oscillation damping: Placement and tuning PSS VIA multi-objective HBMO. International Journal of Technical and Physical Problems of Engineering, 4(3), 12. [Google Scholar]

16. Kaveh, A., Talatahari, S. (2010). Optimum design of skeletal structures using imperialist competitive algorithm. Computers & Structures, 88(21–22), pp. 1220–1229. [Google Scholar]

17. Abedinia, O., Amjady, N., Naderi, M. S. (2012). Multi-objective environmental/economic dispatch using firefly technique. 2012 11th International Conference on Environment and Electrical Engineering, pp. 461–466. DOI 10.1109/EEEIC.2012.6221422. [Google Scholar] [CrossRef]

18. Shayanfar, H. A., Ghasemi, A., Amjady, N., Abedinia, O. (2012). Optimal sizing and placement of distribution generation using imperialist competitive algorithm. Proceedings on the International Conference on Artificial Intelligence (ICAI). http://worldcomp-proceedings.com/proc/p2012/ICA2728.pdf. [Google Scholar]

19. Hartmann, B., Divényi, D., Vokony, I. (2018). Evaluation of business possibilities of energy storage at commercial and industrial consumers--A case study. Applied Energy, 222, 59–66. DOI 10.1016/j.apenergy.2018.04.005. [Google Scholar] [CrossRef]

20. Zare, K., Moghaddam, M. P., Sheikh-El-Eslami, M. K. (2011). Risk-based electricity procurement for large consumers. IEEE Transactions on Power Systems, 26(4), 1826–1835. DOI 10.1109/TPWRS.2011.2112675. [Google Scholar] [CrossRef]

21. Zare, K., Moghaddam, M. P., El Eslami, M. K. S. (2010). Electricity procurement for large consumers based on information gap decision theory. Energy Policy, 38(1), 234–242, DOI 10.1016/j.enpol.2009.09.010. [Google Scholar] [CrossRef]

22. Zare, K., Conejo, A. J., Carrión, M., Moghaddam, M. P. (2010). Multi-market energy procurement for a large consumer using a risk-aversion procedure. Electric Power Systems Research, 80(1), 63–70. DOI 10.1016/j.epsr.2009.08.006. [Google Scholar] [CrossRef]

23. Zhang, Q., Bremen, A. M., Grossmann, I. E., Pinto, J. M. (2018). Long-term electricity procurement for large industrial consumers under uncertainty. Industrial & Engineering Chemistry Research, 57(9), 3333–3347. DOI 10.1021/acs.iecr.7b04589. [Google Scholar] [CrossRef]

24. Kazemi, M., Mohammadi-Ivatloo, B., Ehsan, M. (2014). Risk-based bidding of large electric utilities using information gap decision theory considering demand response. Electric Power Systems Research, 114, 86–92. DOI 10.1016/j.epsr.2014.04.016. [Google Scholar] [CrossRef]

25. Zarif, M., Javidi, M. H., Ghazizadeh, M. S. (2012). Self-scheduling of large consumers with second-order stochastic dominance constraints. IEEE Transactions on Power Systems, 28(1), 289–299. DOI 10.1109/TPWRS.2012.2197831. [Google Scholar] [CrossRef]

26. Abdulaal, A., Moghaddass, R., Asfour, S. (2017). Two-stage discrete-continuous multi-objective load optimization: An industrial consumer utility approach to demand response. Applied Energy, 206, 206–221. DOI 10.1016/j.apenergy.2017.08.053. [Google Scholar] [CrossRef]

27. Zarif, M., Javidi, M. H., Ghazizadeh, M. S. (2012). Self-scheduling approach for large consumers in competitive electricity markets based on a probabilistic fuzzy system. IET Generation, Transmission and Distribution, 6(1), 50–58. DOI 10.1049/iet-gtd.2011.0308. [Google Scholar] [CrossRef]

28. Levitin, G., Lisnianski, A. (2000). Optimization of imperfect preventive maintenance for multi-state systems. Reliability Engineering & System Safety, 67(2), 193–203. DOI 10.1016/S0951-8320(99)00067-8. [Google Scholar] [CrossRef]

29. Panahandeh, B., Bard, J., Outzourhit, A., Zejli, D. (2011). Simulation of PV-Wind-hybrid systems combined with hydrogen storage for rural electrification. International Journal of Hydrogen Energy, 36(6), 4185–4197. DOI 10.1016/j.ijhydene.2010.07.151. [Google Scholar] [CrossRef]

30. Shayeghi, H., Sobhani, B. (2014). Integrated offering strategy for profit enhancement of distributed resources and demand response in microgrids considering system uncertainties. Energy Conversion and Management, 87, 765–777. DOI 10.1016/j.enconman.2014.07.068. [Google Scholar] [CrossRef]

31. Zou, Y., Zhao, J., Ding, D., Miao, F., Sobhani, B. (2021). Solving dynamic economic and emission dispatch in power system integrated electric vehicle and wind turbine using multi-objective virus colony search algorithm. Sustainable Cities and Society, 67, 102722. DOI 10.1016/j.scs.2021.102722. [Google Scholar] [CrossRef]

32. Khaloie, H., Abdollahi, A., Shafie-Khah, M., Anvari-Moghaddam, A., Nojavan, S. et al. (2020). Coordinated wind-thermal-energy storage offering strategy in energy and spinning reserve markets using a multi-stage model. Applied Energy, 259, 114168. DOI 10.1016/j.apenergy.2019.114168. [Google Scholar] [CrossRef]

33. Mirzaei, M. A., Hemmati, M., Zare, K., Abapour, M., Mohammadi-Ivatloo, B. et al. (2020). A novel hybrid two-stage framework for flexible bidding strategy of reconfigurable micro-grid in day-ahead and real-time markets. International Journal of Electrical Power and Energy Systems, 123, 106293. DOI 10.1016/j.ijepes.2020.106293. [Google Scholar] [CrossRef]

34. Khaloie, H., Mollahassani-Pour, M., Anvari-Moghaddam, A. (2020). Optimal behavior of a hybrid power producer in day-ahead and intraday markets: A bi-objective CVaR-based approach. IEEE Transactions on Sustainable Energy, 12(2), 931–943. DOI 10.1109/TSTE.2020.3026066. [Google Scholar] [CrossRef]

35. Oskouei, M. Z., Mirzaei, M. A., Mohammadi-Ivatloo, B., Shafiee, M., Marzband, M. et al. (2021). A hybrid robust-stochastic approach to evaluate the profit of a multi-energy retailer in tri-layer energy markets. Energy, 214, 118948. DOI 10.1016/j.energy.2020.118948. [Google Scholar] [CrossRef]

36. Khaloie, H., Abdollahi, A., Shafie-Khah, M., Siano, P., Nojavan, S. et al. (2020). Co-optimized bidding strategy of an integrated wind-thermal-photovoltaic system in deregulated electricity market under uncertainties. Journal of Cleaner Production, 242, 118434. DOI 10.1016/j.jclepro.2019.118434. [Google Scholar] [CrossRef]

37. Conejo, A. J., Carrión, M., Morales, J. M. (2010). Decision making under uncertainty in electricity markets, vol. 1, pp. 376--384. New York: Springer. [Google Scholar]

38. Karami, M., Shayanfar, H. A., Aghaei, J., Ahmadi, A. (2013). Scenario-based security-constrained hydrothermal coordination with volatile wind power generation. Renewable and Sustainable Energy Reviews, 28, 726–737. DOI 10.1016/j.rser.2013.07.052. [Google Scholar] [CrossRef]

39. Nguyen, D. T., Le, L. B. (2014). Optimal bidding strategy for microgrids considering renewable energy and building thermal dynamics. IEEE Transactions on Smart Grid, 5(4), 1608–1620. DOI 10.1109/TSG.2014.2313612. [Google Scholar] [CrossRef]

40. Kholardi, F., Assili, M., Lasemi, M. A., Hajizadeh, A. (2018). Optimal management of energy hub with considering hydrogen network. 2018 International Conference on Smart Energy Systems and Technologies (SEST), pp. 1–6. IEEE. DOI 10.1109/SEST.2018.8495664. [Google Scholar] [CrossRef]

41. Shahmohammadi, A., Moradi-Dalvand, M., Ghasemi, H., Ghazizadeh, M. S. (2014). Optimal design of multicarrier energy systems considering reliability constraints. IEEE Transactions on Power Delivery, 30(2), 878–886. DOI 10.1109/TPWRD.2014.2365491. [Google Scholar] [CrossRef]

42. Nojavan, S., Mohammadi-Ivatloo, B., Zare, K. (2015). RETRACTED: Robust optimization based price-taker retailer bidding strategy under pool market price uncertainty. International Journal of Electrical Power & Energy Systems, 73, 955--963. DOI 10.1016/j.ijepes.2020.106482. [Google Scholar] [CrossRef]

43. Brooke, A., Kendrick, D., Meeraus, A. (1990). GAMS user’s guide. Redwood City (CAThe Scientific Press. [Google Scholar]

44. The GAMS Software Website (2018). http://www.gams.com/dd/docs/solvers/cplex.pdf. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |