DOI:10.32604/iasc.2021.018170

| Intelligent Automation & Soft Computing DOI:10.32604/iasc.2021.018170 |  |

| Article |

Attitude Towards Adopting Cloud Computing in the Saudi Banking Sector

1Department of Computer Science, College of Computer Science and Information Systems, Najran University, KSA

2Department of Computer Information Systems, College of Computer Science and Information Systems, Najran University, KSA

3Department of Computer Skills, Najran University, Najran, KSA

4Department of Computer Science, Community College, Najran University, KSA

5Department of Information Systems, Sana’a University, Sana’a, Yemen

*Corresponding Author: Mokhtar M. Ghilan. Email: mmghilan@gmail.com

Received: 27 February 2021; Accepted: 02 April 2021

Abstract: Cloud computing plays a significant role in business organisations by offering many benefits and opportunities. However, the adoption of cloud computing involves some trepidation. The adoption of cloud computing in developing countries is still in the early phase. The bank sector in Saudi Arabia aims to benefit from opportunities offered by the cloud computing technology; however, some banks continue to hesitate in the implementation of this technology. Therefore, this study aims to investigate factors that influence the attitude of the Saudi Arabian bank sector towards adopting cloud computing. A model that incorporates factors derived from the literature is developed in this study to determine whether specific factors positively or negatively affect the attitude of the Saudi bank sector towards adopting cloud computing. A quantitative method is used and data are collected from decision makers and IT staff members in the Saudi bank sector. Results showed that factors of security and privacy exert a significant negative effect whilst factors of benefits and competition pressure demonstrate a significant positive effect on the Saudi bank sector attitude towards adopting cloud computing. Thus, cloud computing providers must focus more on negative influential factors to reduce the apprehension of the bank sector in adopting the cloud computing technology. In addition, the bank sector must also consider factors that can drive the adoption of cloud computing as well as opportunities and losses if this technology is rejected.

Keywords: Cloud computing; influential factors; attitude towards adoption; Saudi bank sector

Cloud computing is an important innovation in the technological field that offers a distinctive way of delivering IT services to organisations and individuals [1]. This technological model can provide on-demand access to different computing services [2], plays an important role in organisations by reducing the cost of information technology services and allows users access to paid services anytime and anywhere [3].

The term cloud computing was first used in 1997 and has been widely adopted in recent years [4]. Cloud computing is a paradigm shift for IT infrastructures and businesses [5–7] that has become an influential driver of technological and economic change in countries worldwide.

Several large and small organisations are reformulating their information technology strategies to embrace cloud computing. Organisations must consider the strategic importance of benefits, such as computational agility and scalability, provided by cloud computing [8–10].

Cloud computing nearly changed all systems in varying industries, including the banking sector. The banking sector can reap many benefits [11], such as the efficient use of resources [12] and achieving competitive advantage, with the adoption of cloud computing. [11]

Despite the many advantages of using cloud computing, the level of adoption differs for each country due to several challenges and threats associated with this technology [13–15]. Studies have indicated that some organisations are hesitant in adopting cloud computing [16,17]. Thus, organisations must consider benefits, risks and effects of cloud computing before making the decision to adopt this technology.

Saudi Arabia launched the National Transformation Programme 2020, which involves digital transformation, to build institutional capabilities required in accomplishing Vision 2030. Cloud computing is a key pillar of the digital transformation technology ecosystem [18] that encourages organisations to adapt to new technology strategies and offers additional choices on how to run their infrastructure, save costs and delegate liabilities [19,20]

The adoption of cloud computing in Saudi Arabia is still in its initial phase and the transformation from traditional technology to cloud computing faces many important challenges [21], such as security and privacy issues [6].

The Saudi bank sector may benefit from cloud computing due to its IT-heavy nature and on-going digitalisation changes [11]. Thus, this study aims to investigate factors that affect the attitude of the Saudi banking sector towards adopting cloud computing.

Although with the many benefits from using cloud computing, cloud computing in developing countries is still in its initial stages [22,23]. The bank sector in Saudi Arabia still hesitates to adopt cloud computing for many concerns. Studies on cloud computing adoption, particularly in the Saudi bank sector, are limited. Therefore, investigating factors that positively or negatively affect the attitude of the Saudi bank sector towards the adoption of cloud computing is necessary. The following research questions were formulated on the basis of this problem:

• What factors can positively influence the attitude of the Saudi bank sector towards adopting cloud computing?

• What factors can negatively influence the attitude of the Saudi bank sector towards adopting cloud computing?

Information technology can be a powerful tool in improving organisational performance and gaining competitive advantage [24]. Cloud computing is a new technological trend that has revolutionised the use of information technology [1].

Several definitions of the term cloud computing can be found in the literature. National Institute of Standards and Technology (NIST) defined cloud computing as ‘a model for enabling ubiquitous, convenient, on-demand network access to a shared pool of configurable computing resources (e.g., networks, servers, storage, applications and services) that can be rapidly provisioned and released with minimal management effort or service provider interaction’ [25].

NIST also explained the ways for providing cloud computing in the following deployment models:

1. Private cloud - A unique cloud designed particularly for a specific organisation.

2. Public cloud - Common type offered to the general public via the Internet.

3. Community cloud - Organisations with common goals and assignments share the same cloud.

4. Hybrid cloud - Organisation can combine public, private or community clouds. [25]

Five characteristics are required for a resource to be considered a cloud service, namely, resource pooling, on-demand self-service, measured service, broad network access and rapid elasticity. Software as a service (SaaS), platform as a service (PaaS) and infrastructure as a service (IaaS) are three versions of cloud service models [11,26].

Cloud computing is a paradigm that changes the way how hardware and software resources are used and managed and offers resources and capabilities as a service to customers through the Internet [27,28]. On-demand services are provided whilst performing operations that meet the unstable needs of the business [28]. The use of cloud computing can reduce the time and effort of applications and service maintenance and development of organisations [29–32]. Cloud computing has revolutionised numerous industries for several years [27] and changed information sharing and storage behaviour [32].

Many organisations still struggle with the successful adoption of cloud computing due to limited studies focusing on this technology [32,33].

3.1 Cloud Computing in the Banking Sector

The banking sector can be supported by acceptable cloud computing models that can be managed appropriately [34]. Financial institutions, such banks, can utilise cloud computing capabilities and features [28]. Cloud computing is a new trend that provides a novel way of managing different information systems, such as those used in the banking sector [35].

The banking sector operates in a highly competitive environment [11], and many banks typically incur high technology costs when their services change and they invest in technology to maintain competitiveness [36]. Therefore, cloud computing can motivate the banking industry to upgrade its system because the adoption of this technology allows the efficient on-demand access and upgrade of their hardware and software resources [36,37].

Cloud computing helps the bank sector enhance their performance [11] by completely changing their services and increasing the efficiency of the banking system [28]. Banks can benefit from the implementation of cloud computing [38] by responding to customer demands, interconnecting global financial systems and addressing economic uncertainties [11,12]. Despite the many benefits of cloud computing, the banking sector may face a number of key challenges, such as security and data location, which must be addressed before the adoption of this technology. [11,34,38]

3.2 Influential Factors of Cloud Computing Adoption

The emergence of cloud computing creates opportunities for many organisations to utilise cutting-edge information technologies [39]. The bank sector may adopt cloud computing to create a flexible banking environment that can respond rapidly to new business requirements and save costs because customers only need to pay for the functional consumption of services they use [24,40].

However, most studies have identified many issues, which become major hindrances in the adoption of cloud computing [24,29,30,32,41]. Security and privacy are key causes of delay in the adoption of cloud computing in the banking sector [11,27].

Although many large banks have confidently adopted the cloud technology, others are wary and have decided to wait until some challenges are solved [24]. Therefore, addressing different factors and critical issues related to the adoption of cloud computing is important [11].

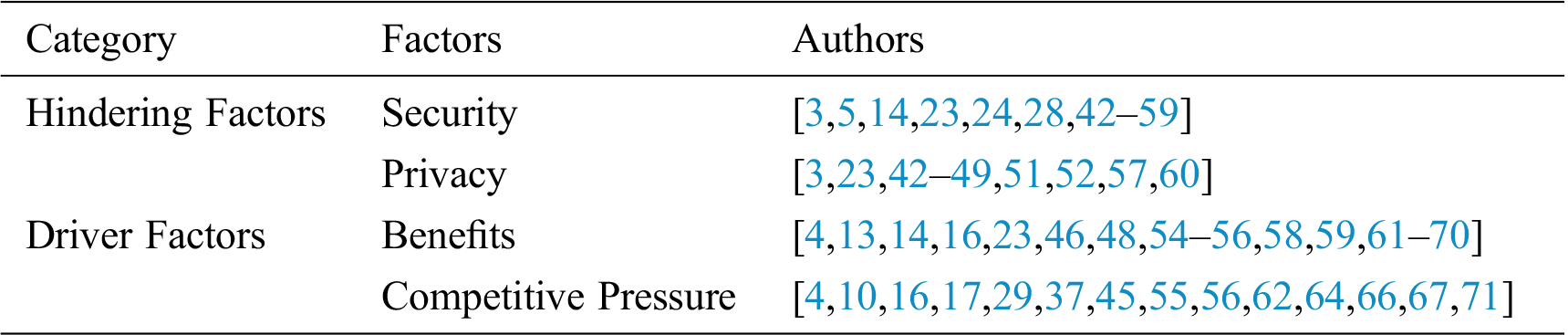

Many studies have indicated factors that negatively or positively influence the adoption of cloud computing in many industries, including the banking sector. Tab. 1 showing four factors that frequently have been indicated, by previous studies and were emphasized by consulting some experts in the banking sectors, as factors that may affect adopting cloud computing positively or negatively. We classified these factors as hindering and driver factors of cloud computing adoption according to their positive or negative influence.

Table 1: Factors affection adoption of cloud computing

4 Research Model and Hypotheses

The model in this work is developed on the basis of factors extracted from previous studies. These factors are divided into two fundamental categories, as shown in Tab. 1, to examine their effect on the attitude of the Saudi Arabian banking sector towards adopting the cloud computing technology. The proposed model is shown in Fig. 1.

Figure 1: Research model

• Security

Security is a problem that influences the global acceptance of cloud computing [3,14,24]. The social infrastructure of the cloud poses a serious security problem that may hinder the adoption of this technology in many organisations [5]. Building a secure environment for services offered in cloud computing is the main drawback [14]. Particularly, banks hesitate because they cannot risk the danger of a security break [28].

H1: The security factor will have a significant negative effect on the attitude of the Saudi bank sector towards adopting cloud computing.

• Privacy

Privacy is the confidentiality of data and a major concern for users [3]. The incomplete control of information when stored and managed by a third party, such as a cloud computing environment, increases the risk of privacy in organisations [23]. Privacy concerns affect the decision of organisations to adopt the cloud [23].

Therefore, diverse security and privacy issues that continue to emerge may hinder the rapid adoption of cloud computing although this new computing paradigm has gained popularity in recent years [57]

H2: The privacy factor will have a significant negative effect on the attitude of the Saudi bank sector towards adopting cloud computing.

• Benefits

Benefits of cloud computing increase its service market growth [13]. However, the knowledge level on benefits of cloud computing adoption is still low for different countries [68]. The adoption of cloud computing allows organisations to focus on their core business competencies [69] and improve the access of customers to advanced and efficient computing technology [13,70].

Many benefits can gain from adopting cloud computing [14], including the reduction of cost for the use of information technology services [23], fast completion of tasks and increased productivity and flexibility in organisations [8], can drive organisations to adopt cloud computing. Therefore, the perceived benefits of this new technology will positively affect an organisation’s intention to adopt cloud computing [23].

H3: The benefit factor will have a significant positive effect on the attitude of the Saudi bank sector towards adopting cloud computing.

• Competitive pressure

Organisations consider competition a significant factor in adopting IT innovations [17,29] and aim to adopt up-to-date technologies to increase their market share, reduce cost and improve service delivery [29]. Therefore, organisations may outsource their IT infrastructure to address competitive pressures [17].

Competitive pressure is related to the level of competitiveness of an organisation in its external environment [37]. The adoption of cloud computing becomes an important strategy to compete in the market under competitive pressure [10], and organisations can benefit from countless operational efficiencies [64]. Competitive pressure is considered an important driver for technology adoption [55,62].

H4: The competitive pressure factor will have a significant positive effect on the attitude of the Saudi bank sector towards adopting cloud computing.

This study aims to investigate factors that influence the attitude of the Saudi Arabian bank sector towards adopting cloud computing with a quantitative method. A questionnaire and convenience sample were used to gather data from respondents. The convenience sample is an approach that acquires easily accessed samples from respondents who are willing to participate [72]. The questionnaire was organised to obtain the respondent profile and use hindrance and driver factors as independent factors and attitude towards adopting cloud computing as the dependent factor. All independent and dependent variables were measured using a five-point Likert scale (1= strongly disagree, 2 = disagree, 3 = somewhat, 4 = agree and 5 = strongly agree). Objectives of the study were clearly explained to respondents using an information sheet at the beginning of the questionnaire. The SPSS tool was used to analyse data gathered from respondents.

Cronbach’s alpha was used to measure the reliability of this study. The questionnaire demonstrated an acceptable Cronbach’s alpha coefficient of over 0.75.

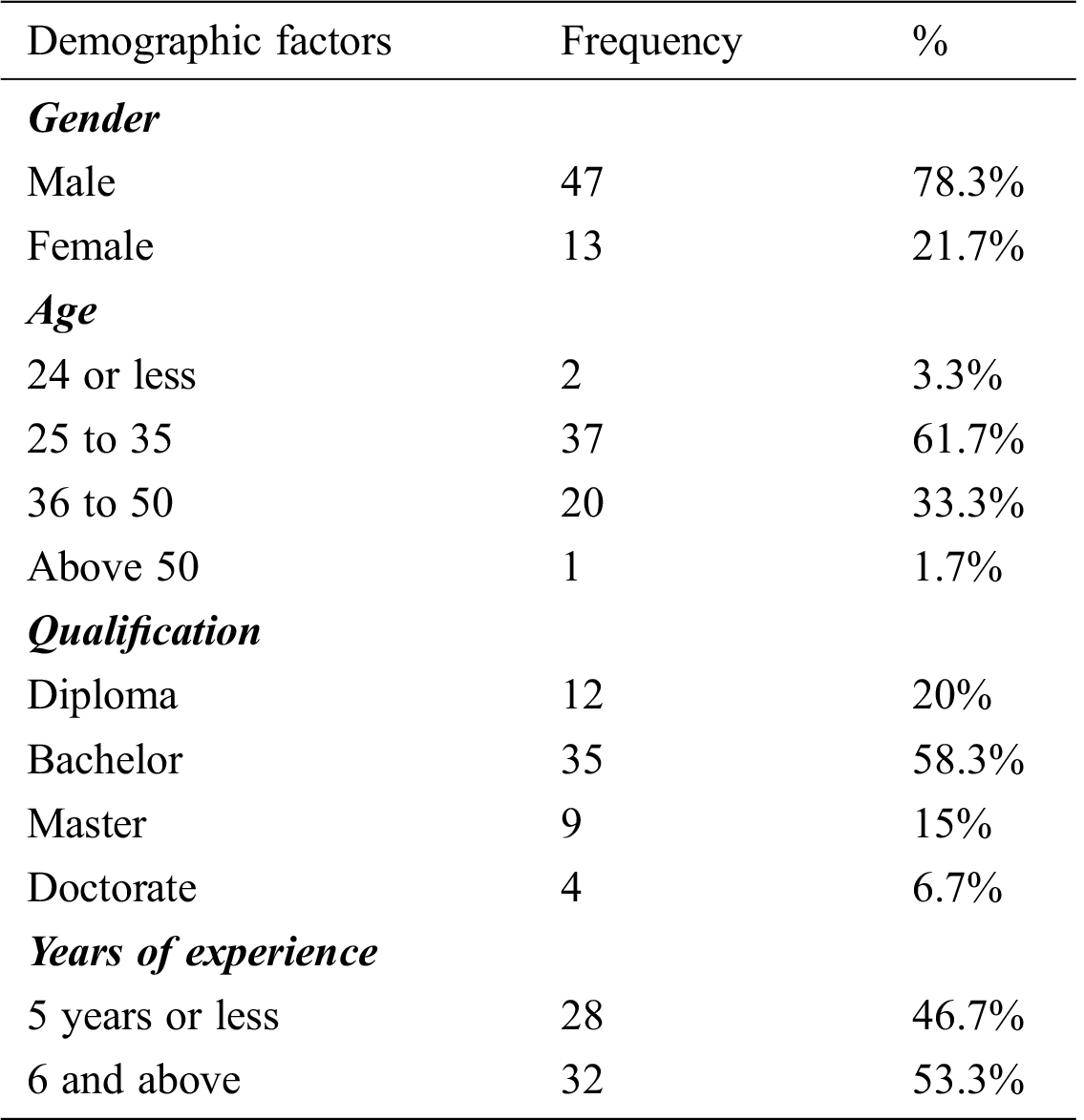

Table 2: Descriptive statistics of demographic factors

Sixty valid surveys were obtained from a sample size of 75. Approximately 78% and 22% of respondents were male and female, respectively. Nearly 62% of respondents were between 25 and 35 years of age. Around 58% and 53% of respondents held a bachelor’s degree and had at least 6 years of work experience. The demographic statistics of respondents is presented in Tab. 2.

6.2 Analysis of the Effect of Factors.

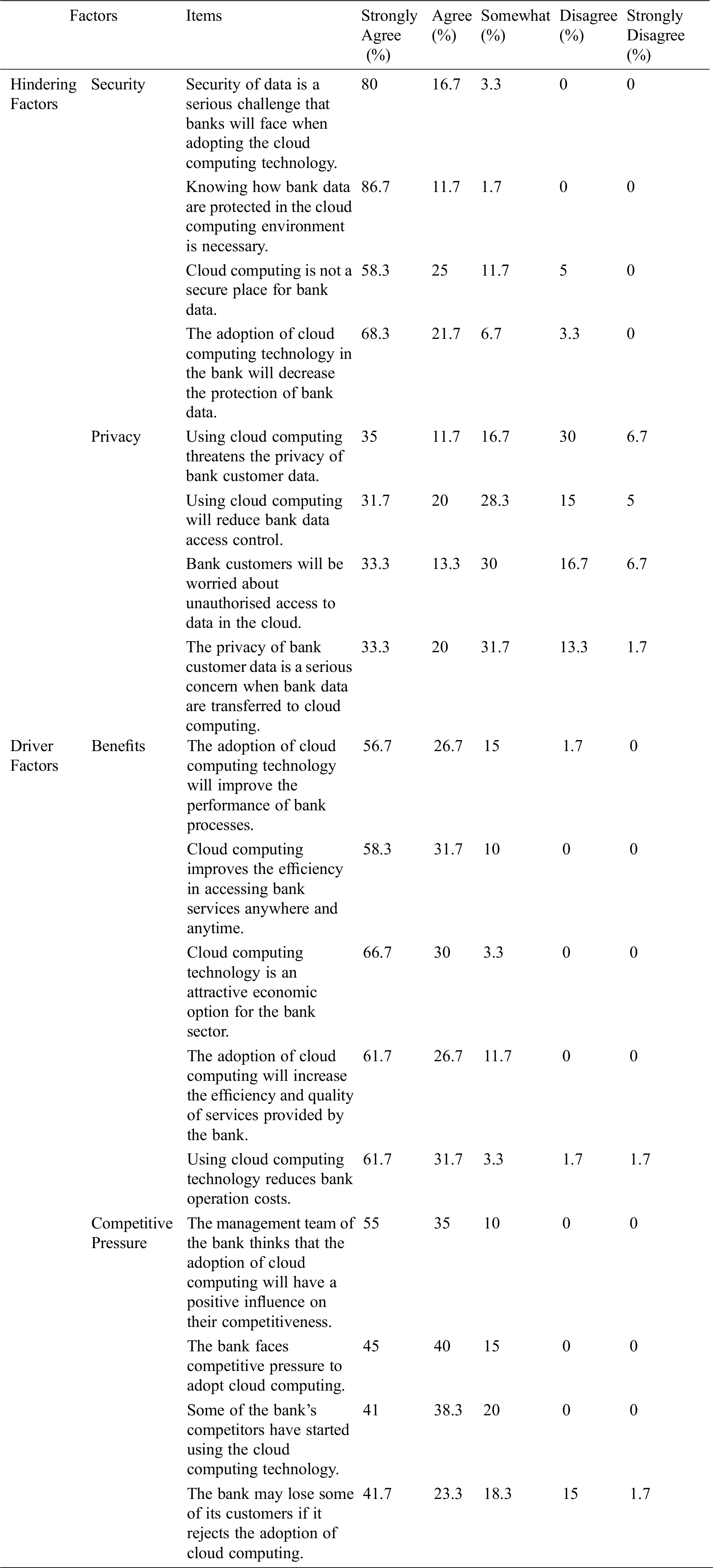

Table 3: Results of the analysis of the effect of research factors

Security

The respondent results related to security factors are presented in Tab. 3. The overall respondent consensus (87% to 95% agree with the four questions on the security factor) indicated that security is a problem that causes worry in the bank adoption of cloud computing. These results are consistent with the findings of previous studies which indicated that the security is a problem and remains a challenge for organizations that adopt cloud computing [14,5]. Security issue is a challenge that banks must address in adopting cloud computing because banks aim to avoid the danger of a security break [24,28]. This finding supports H1.

Privacy

Four questions related to the privacy factor are shown in Tab. 3. The respondent results related to these questions demonstrated that 46.6% to 53.3% of respondents have fears concerning privacy when cloud computing is adopted with a percentage between, whilst 16.7% to 31.7% were unsure and 14% to 37% disagree. More than 50% of respondents worried about privacy. This finding is consistent with the results of a previous study, which indicated that privacy is a key concern because users cannot have full control of information stored in the cloud computing environment [3]. The significant effect of privacy on the decision of organisations in adopting the cloud is a hindrance [23,57]. This finding supports H2.

Benefits

Five questions on the benefit factor are shown in Tab. 3. Approximately 83.4% to 96% of respondents to these questions agreed to the benefits of using cloud computing, whilst 3.3% to 15% were unsure and 1.7% to 3.4% disagreed. These results were consistent with those of previous studies such that many benefits can be gained from adopting cloud computing [14]. Cloud computing can help organisations accomplish tasks rapidly, reduce costs and increase productivity and flexibility [8]. Organisations tend to adopt a new technology due to its perceived benefits [23]. Therefore, the perception of benefits will likely exert a positive effect on an organisation’s intention to adopt cloud computing. This finding supports H3.

Competitive pressure

Four questions on competitive pressure are listed in Tab. 3. Around 65% to 90% of respondents agree to the importance of competition pressure, whilst 10% to 18.3% are unsure and 0% to 16.7% disagree. These findings are consistent with the results of a previous study, which emphasised the importance of competition pressure as a driver of cloud computing adoption (34). The adoption of cloud computing under competitive pressure becomes an important strategy in maintaining competitiveness in the market [10], and organisations can benefit from the improved efficiency in operational processes [64]. Hence, competitive pressure is an important driver for technology adoption [55,62]. This finding supports H3.

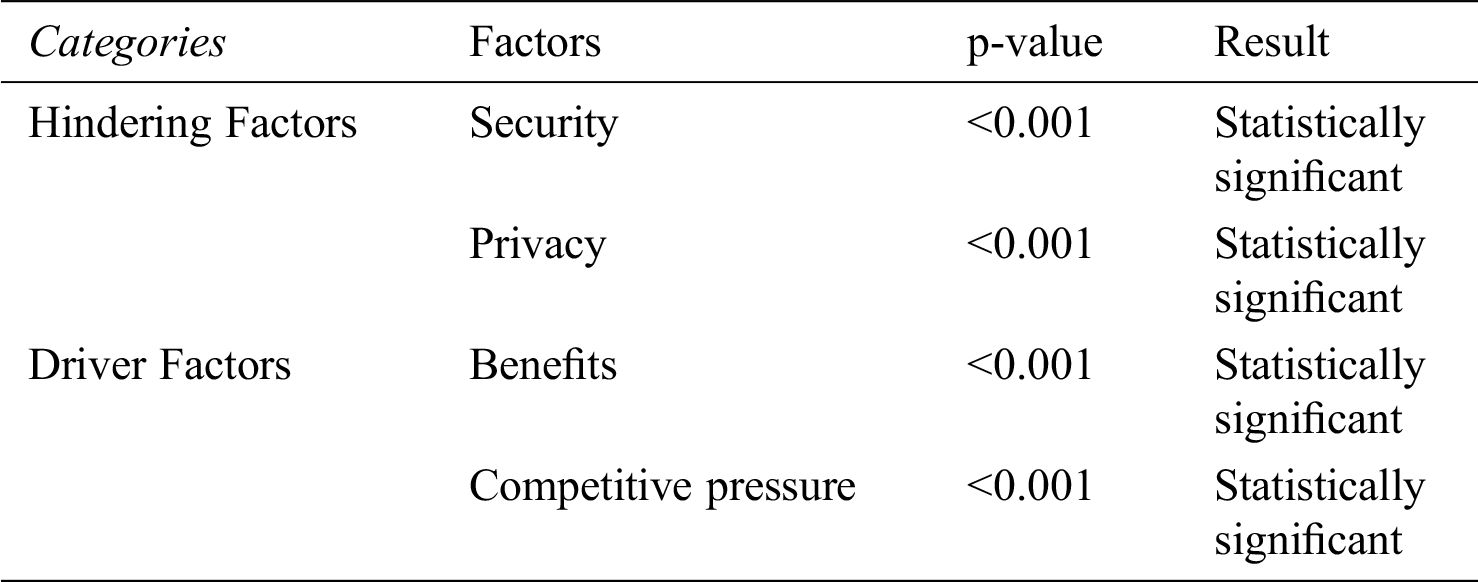

6.3 Results of Model Variables

The questionnaire was utilised to confirm which factors affect the attitude of the Saudi bank sector towards adopting cloud computing. SPSS software was applied to analyse data collected from respondents. The results of the one-sample t-test are shown in Tab. 4.

Table 4: Results of the one-sample t-test

Cloud computing is a new and advanced technology service that continuously evolves and demonstrates many potential benefits, but serious issues still persist. The banking sector may still be unable to benefit from the cloud computing technology due to such issues. A model was developed in this study to investigate influential factors that may drive or hinder the attitude of the Saudi bank sector towards adopting cloud computing. The results indicated that security and privacy are factors that may hinder whilst benefits and competition pressure are factors that may drive the attitude of the Saudi bank sector towards the adoption of cloud computing. Hence, the Saudi bank sector needs a clear understanding of these factors for the implementation of this technology to maintain competitiveness and gain competitive advantage as well as address security and privacy challenges by collaborating with service providers of this technology.

Acknowledgement: The authors would like to express their gratitude to the Ministry of Education and Deanship of Scientific Research of Najran University in the Kingdom of Saudi Arabia for their financial and technical support.

Funding Statement: This work is supported by the Deanship of Scientific Research of Najran University (Research Code No. NU/ESCI/17/107) in the Kingdom of Saudi Arabia.

Conflict of Interest: All authors declare no conflicts of interest.

1. M. A. Al-Sharafi, R. A. Arshah and E. A. Abu-Shanab, “Factors affecting the continuous use of cloud computing services from expert's perspective,” - 2017 IEEE Region 10 Conf., Penang, Malaysia, pp. 986–991, 2017. [Google Scholar]

2. P. Priyadarshinee, R. D. Raut, M. K. Jha and B. Gardas, “Understanding and predicting the determinants of cloud computing adoption: A two staged hybrid SEM - Neural networks approach,” Computers in Human Behavior, vol. 76, no. 1, pp. 341–362, 2017. [Google Scholar]

3. M. Alassafi, A. Alharthi, R. Walters and G. Wills, “A framework for critical security factors that influence the decision of cloud adoption by Saudi government agencies,” Telematics and Informatics, vol. 34, no. 7, pp. 996–1010, 2017. [Google Scholar]

4. A. Lin and N.C. Chen, “Cloud computing as an innovation: Perception, attitude, and adoption,” International Journal of Information Management, vol. 32, no. 6, pp. 533–540, 2012. [Google Scholar]

5. V. A. Nasir and M. Bayramusta, “A fad or future of IT? A comprehensive literature review on the cloud computing research,” International Journal of Information Management, vol. 36, no. 4, pp. 635–644, 2016. [Google Scholar]

6. A. Dutta, G. C. A. Peng and A. Choudhary, “Risks in enterprise cloud computing: The perspective of it experts,” Journal of Computer Information Systems, vol. 53, no. 4, pp. 39–48, 2015. [Google Scholar]

7. M. Carcary, E. Doherty, G. Conway and S. McLaughlin, “Cloud computing adoption readiness and benefit realization in Irish SMEs—An exploratory study,” Information Systems Management, vol. 31, no. 4, pp. 313–327, 2014. [Google Scholar]

8. M. Armbrust, A. Fox, R. Griffith, A. D. Joseph, R. Katz et al., “A view of cloud computing,” Communications of the ACM, vol. 53, no. 4, pp. 50–58, 2010. [Google Scholar]

9. G. Garrison, S. Kim and R. L. Wakefield, “Success factors for deploying cloud computing,” Communications of the ACM, vol. 55, no. 9, pp. 62–68, 2012. [Google Scholar]

10. R. Buyya, C. S. Yeo, S. Venugopal, J. Broberg and I. Brandic, “Cloud computing and emerging IT platforms: Vision, hype, and reality for delivering computing as the 5th utility,” Future Generation Computer Systems, vol. 25, no. 6, pp. 599–616, 2009. [Google Scholar]

11. M. Singh, K. S. Tanwar and V. M. Srivastava, “Cloud computing adoption challenges in the banking industry,” in 2018 In. Conf. on Advances in Big Data, Computing and Data Communication Systems, Durban, 2018. [Google Scholar]

12. A. Apostu, E. Rednic and F. Puican, “Modeling cloud architecture in banking systems,” Procedia Economics and Finance, vol. 3, pp. 543–548, 2012. [Google Scholar]

13. K. Vu, K. Hartley and A. Kankanhalli, “Predictors of cloud computing adoption: A cross-country study,” Telematics and Informatics, vol. 52, pp. 1–12, 2020. [Google Scholar]

14. Y. Sinjilawi, M. Al-Nabhan and E. Abu-Shanab, “Addressing security and privacy issues in cloud computing,” Journal of Emerging Technologies in Web Intelligence", vol. 6, no. 2, pp. 192–199, 2014. [Google Scholar]

15. G. Rani and A. Marimuthu, “A study on cloud security issues and challenges,” International Journal of Computer Technology & Applications, vol. 3, no. 1, pp. 344–347, 2012. [Google Scholar]

16. A. Abdollahzadehgan, A. R. C. Hussin, M. M. Gohary and M. Amini, “The organizational critical success factors for adopting cloud computing in SMEs,” Journal of Information Systems Research and Innovation, vol. 4, pp. 67–74, 2013. [Google Scholar]

17. S. Trigueros-Preciado, D. Pérez-González and P. Solana-González, “Cloud computing in industrial SMEs: Identification of the barriers to its adoption and effects of its application,” Electronic Markets, vol. 23, no. 2, pp. 105–114, 2013. [Google Scholar]

18. G. Briscoe and A. Marinos, “Digital ecosystems in the clouds: Towards community cloud computing,” in 3rd IEEE Int. Conf. on Digital Ecosystems and Technologies, Istanbul, Turkey, pp. 103–108, 2009. [Google Scholar]

19. G. Ramachandra, M. Iftikhar and F. Khan, “A Comprehensive survey on security in cloud computing,” Procedia Computer Science, vol. 110, no. 4, pp. 465–472, 2017. [Google Scholar]

20. M. Al-Ruithe, E. Benkhelifa and K. Hameed, “Key issues for embracing the cloud computing to adopt a digital transformation: A study of Saudi public sector,” Procedia Computer Science, vol. 130, no. 7, pp. 1037–1043, 2018. [Google Scholar]

21. N. Alkhater, G. Wills and R. Walters, “Factors affecting an organization's decision to adopt cloud services in Saudi Arabia,” in 3rd Int. Conf. on Future Internet of Things and Cloud, Rome, pp. 553–557, 2015. [Google Scholar]

22. N. Kshetri, “Cloud computing in developing economies,” IEEE Computer, vol. 43, no. 10, pp. 47–55, 2010. [Google Scholar]

23. N. Al khater, R. Walters and G. Wills, “An empirical study of factors influencing cloud adoption among private sector organisations,” Telematics and Informatics, vol. 35, no. 1, pp. 38–54, 2018. [Google Scholar]

24. S. Asadi, M. Nilashi, A. R. C. Husin and E. Yadegaridehkordi, “Customers perspectives on adoption of cloud computing in banking sector,” Information Technology and Management, vol. 18, no. 4, pp. 305–330, 2017. [Google Scholar]

25. K. E. Ali, S. A. Mazen and E. E. Hassanein, “A proposed hybrid model for adopting cloud computing in e-government,” Future Computing and Informatics Journal, vol. 3, no. 2, pp. 286–295, 2018. [Google Scholar]

26. A. Al-Masah and A. M. Al-Sharafi, “Benefits of cloud computing for network infrastructure monitoring service,” International Journal of Advances in Engineering & Technology, vol. 5, no. 2, pp. 46–51, 2013. [Google Scholar]

27. S. A. Bello, L. O. Oyedele, O. O. Akinade, M. Bilal, J. M. D. Delgado et al., “Cloud computing in construction industry: Use cases, benefits and challenges,” Automation in Construction, vol. 122, pp. 1–18, 2021. [Google Scholar]

28. A. Bejju, “Cloud computing for banking and investment services,” Advances in Economics and Business Management, vol. 1, no. 2, pp. 34–40, 2014. [Google Scholar]

29. A. Bhattacherjee and S. C. Park, “Why end-users move to the cloud: A migration-theoretic analysis,” European Journal of Information Systems, vol. 23, no. 3, pp. 357–372, 2017. [Google Scholar]

30. E. Park and K. J. Kim, “An integrated adoption model of mobile cloud services: Exploration of key determinants and extension of technology acceptance model,” Telematics and Informatics, vol. 31, no. 3, pp. 376–385, 2014. [Google Scholar]

31. V. Ratten, “A US-China comparative study of cloud computing adoption behavior: The role of consumer innovativeness, performance expectations and social influence,” Journal of Entrepreneurship in Emerging Economies, vol. 6, no. 1, pp. 53–71, 2014. [Google Scholar]

32. D. Alsmadi and V. Prybutok, “Sharing and storage behavior via cloud computing: Security and privacy in research and practice,” Computers in Human Behavior, vol. 85, no. 1, pp. 218–226, 2018. [Google Scholar]

33. J. Lansing and A. Sunyaev, “Trust in cloud computing: Conceptual typology and trust building antecedents,” ACM SIGMIS - Database for Advances in Information Systems, vol. 47, no. 2, pp. 58–96, 2016. [Google Scholar]

34. M. Modak and A. Walke, “Issues faced by banking sector in the world of cloud based computing to achieve high performance: A survey,” International Journal of Advances in Computer Science and Cloud Computing, vol. 1, no. 1, pp. 10–16, 2013. [Google Scholar]

35. F. M. Thabit, S. Alhomdy and S. Jagtap, “Toward a model for cloud computing banking in Yemen,” International Journal of Research in Advanced Engineering and Technology, vol. 5, no. 4, pp. 14–18, 2019. [Google Scholar]

36. M. Karthigainathan, “Cloud computing for rural banking,” International Journal of Engineering and Computer Science, vol. 5, no. 9, pp. 17880–17884, 2016. [Google Scholar]

37. K. Y. Sunami, “Ubiquitous banks: Cloud based design for core banking,” International Journal of Advanced Research in Computer Science, vol. 8, no. 2, pp. 77–79, 2017. [Google Scholar]

38. S. Rani and A. Gangal, “Security issues of banking adopting the application of cloud computing,” International Journal of Information Technology and Knowledge Management, vol. 5, no. 2, pp. 243–246, 2012. [Google Scholar]

39. S. Sharma, A. Al-Badi, S. Govindaluri and M. Al-Kharusi, “Predicting motivators of cloud computing adoption: A developing country perspective,” Computers in Human Behavior, vol. 62, no. 2, pp. 61–69, 2016. [Google Scholar]

40. S. Patani, S. Kadam and P. Jain, “Cloud computing in the banking sector: A survey,” International Journal of Advanced Research in Computer and Communication Engineering, vol. 3, no. 2, pp. 5640–5643, 2014. [Google Scholar]

41. I. Arpaci, K. Kilicer and S. Bardakci, “Effects of security and privacy concerns on educational use of cloud services,” Computers in Human Behavior, vol. 45, no. 2, pp. 93–98, 2015. [Google Scholar]

42. S. Paquette, P. Jaeger and S. Wilson, “ Identifying the security risks associated with governmental use of cloud computing,” Government Information Quarterly, vol. 27, no. 3, pp. 245–253, 2010. [Google Scholar]

43. M. Lacity and P. Reynolds, “Cloud services practices for small and medium sized enterprises,” MIS Quarterly Executive, vol. 13, no. 1, pp. 31–44, 2014. [Google Scholar]

44. P. Senyo, J. Effah and E. Addae, “Preliminary insight into cloud computing adoption in a developing country,” Journal of Enterprise Information Management, vol. 29, no. 4, pp. 505–524, 2016. [Google Scholar]

45. J. Lian, D. C. Yen and Y. Wang, “ An exploratory study to understand the critical factors affecting the decision to adopt cloud computing in Taiwan hospital,” International Journal of Information Management, vol. 34, no. 1, pp. 28–36, 2014. [Google Scholar]

46. P. Gupta, A. Seetharaman and J. R. Raj, “The usage and adoption of cloud computing by small and medium businesses,” International Journal of Information Management, vol. 33, no. 5, pp. 861–874, 2013. [Google Scholar]

47. S. C. Park and S. Y. Ryoo, “An empirical investigation of end-users’ switching toward cloud computing: A two factor theory perspective,” Computers in Human Behavior, vol. 29, no. 1, pp. 160–170, 2013. [Google Scholar]

48. M. Nkhoma and D. Dang, “Contributing factors of cloud computing adoption: A technology-organisation-environment framework approach,” International Journal of Information Systems and Engineering, vol. 1, pp. 30–41, 2013. [Google Scholar]

49. M. Singh, K. S. Tanwar and V. M. Srivastava, “Cloud computing adoption challenges in the banking industry,” in Int. Conf. on Advances in Big Data, Computing and Data Communication Systems (icABCDDurban, pp. 1–5, 2018. [Google Scholar]

50. P. Rieger, H. Gewald and B. Schumacher, “Cloud-Computing in banking influential factors, benefits and risks from a decision maker's perspective,” in Proc. of the Nineteenth Americas Conf. on Information Systems, Chicago, Illinois, pp. 1–12, 2013,August 15-17. [Google Scholar]

51. P. Sun, “Security and privacy protection in cloud computing: Discussions and challenges,” Journal of Network and Computer Applications, vol. 160, no. 2, pp. 102642, 2020. [Google Scholar]

52. S. Sahmim and H. Gharsellaoui, “Privacy and security in internet-based computing: Cloud computing, internet of things, cloud of things: A review,” Procedia Computer Science, vol. 112, pp. 1516–1522, 2017. [Google Scholar]

53. E. O. Yeboah-Boateng and K. A. Essandoh, “Factors influencing the adoption of cloud computing by small and medium enterprises in developing economies,” International Journal of Emerging Science and Engineering, vol. 2, no. 4, pp. 13–20, 2014. [Google Scholar]

54. L. Morgan and K. Conboy, “Key factors impacting cloud computing adoption,” Computer, vol. 46, no. 10, pp. 97–99, 2013. [Google Scholar]

55. O. Tiago, T. Manoj and E. Mariana, “Assessing the determinants of cloud computing adoption: An analysis an analysis of the manufacturing and services sectors,” Information & Management, vol. 5, no. 5, pp. 497–510, 2014. [Google Scholar]

56. H. Al-Mascati and A. H. Al-Badi, “Critical success factors affecting the adoption of cloud computing in oil and gas industry in Oman,” in 3rd MEC Int. Conf. on Big Data and Smart City (ICBDSCMuscat, pp. 1–7, 2016, 2016 [Google Scholar]

57. Y. Liu, Y. Sun, J. Ryoo and S. Rizvi, “A survey of security and privacy challenges in cloud computing: Solutions and future directions,” Journal of Computing Science and Engineering, vol. 9, no. 3, pp. 119–133, 2015. [Google Scholar]

58. A. Gutierrez, E. Boukrami and R. Lumsden, “Technological, organisational and environmental factors influencing managers’ decision to adopt cloud computing in the UK,” Journal of Enterprise Information Management, vol. 28, no. 6, pp. 788–807, 2015. [Google Scholar]

59. H. Gangwar, H. Date and R. Ramaswamy, “Understanding determinants of cloud computing adoption using an integrated TAM-TOE model,” Journal of Enterprise Information Management, vol. 28, no. 1, pp. 107–130, 2015. [Google Scholar]

60. A. Elzamly, N. Messabia, M. Doheir, A. Mahmoud, A. H. Basari et al., “Adoption of cloud computing model for managing e-banking system in banking organizations,” International Journal of Advanced Science and Technology, vol. 28, no. 1, pp. 318–326, 2019. [Google Scholar]

61. Y. Alshamaila, S. Papagiannidis and F. Li, “Cloud computing adoption by SMEs in the north east of England: A multi-perspective framework,” Journal of Enterprise Information Management, vol. 26, no. 3, pp. 250–275, 2013. [Google Scholar]

62. C. Low, Y. Chen and M. Wu, “Understanding the determinants of cloud computing adoption,” Industrial Management & Data Systems, vol. 111, no. 7, pp. 1006–1023, 2011. [Google Scholar]

63. A. Benlian and T. Hess, “Opportunities and risks of software-as-a-service: Findings from a survey of IT executives,” Decision Support Systems, vol. 52, no. 1, pp. 232–246, 2011. [Google Scholar]

64. Y. Liu, S. Dong, J. Wei and Y. Tong, “Assessing cloud computing value in firms through socio-technical determinants,” Information & Management, vol. 57, no. 8, pp. 1–17, 2020. [Google Scholar]

65. P. K. Senyo, J. Effah and E. Addae, “Preliminary insight into cloud computing adoption in a developing country,” Journal of Enterprise Information Management, vol. 29, no. 4, pp. 505–524, 2016. [Google Scholar]

66. K. Njenga, L. Garg, A. Bhardwaj, V. Prakash and S. Bawa, “The cloud computing adoption in higher learning institutions in Kenya: Hindering factors and recommendations for the way forward,” Telematics and Informatics, vol. 38, no. 292, pp. 225–246, 2019. [Google Scholar]

67. Y. Liang, G. Qi, K. Wei and J. Chen, “Exploring the determinant and influence mechanism of e-Government cloud adoption in government agencies in China,” Government Information Quarterly, vol. 34, no. 3, pp. 481–495, 2017. [Google Scholar]

68. P. K. Senyo, E. Addae and R. Boateng, “Cloud computing research: A review of research themes, frameworks, methods and future research directions,” International Journal of Information Management, vol. 38, no. 1, pp. 128–139, 2018. [Google Scholar]

69. A. Mitra, N. O'Regan and D. Sarpong, “Cloud resource adaptation: A resource based perspective on value creation for corporate growth,” Technological Forecasting and Social Change, vol. 130, no. 4, pp. 28–38, 2018. [Google Scholar]

70. S. Marston, Z. Li, S. Bandyopadhyay, J. Zhang and A. Ghalsasi, “Cloud computing—The business perspective,” Decision Support Systems, vol. 51, no. 1, pp. 176–189, 2011. [Google Scholar]

71. S. Yoo and B. Kim, “A decision-making model for adopting a cloud computing system,” Sustainability, vol. 10, no. 8, pp. 2952, 2018. [Google Scholar]

72. C. Teddlie and F. Yu, “Mixed methods sampling: A typology with examples,” Journal of Mixed Methods Research, vol. 1, no. 1, pp. 77–100, 2017. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |