DOI:10.32604/iasc.2021.018011

| Intelligent Automation & Soft Computing DOI:10.32604/iasc.2021.018011 |  |

| Article |

On Parametric Fuzzy Linear Programming Formulated by a Fractal

1School of Mathematical Sciences, University Sciences Malaysia 11800 USM, Penang, Malaysia

2IEEE: 94086547, Kuala Lumpur, 59200, Malaysia

3Department of General Sciences, Prince Sultan University, Riyadh, Saudi Arabia

*Corresponding Author: Rafida M. Elobaid. Email: robaid@psu.edu.sa

Received: 21 February 2021; Accepted: 26 May 2021

Abstract: Fractal strategy is an important tool in manufacturing proposals, including computer design, conserving, power supplies and decorations. In this work, a parametric programming, analysis is proposed to mitigate an optimization problem. By employing a fractal difference equation of the spread functions (local fractional calculus operator) in linear programming, we aim to analyze the restraints and the objective function. This work proposes a new technique of fractal fuzzy linear programming (FFLP) model based on the symmetric triangular fuzzy number. The parameter fuzzy number is selected from the fractal power of the difference equation. Note that this number indicates the fractal parameter, denoting by λ ε [0, 1]. Accordingly, we specify the objective function to the fractional case, utilizing the fractal difference equation. We apply the suggested model in an application under the oil market. Based on the fractal fuzzy set theory, the fuzzy demand, transportations, management, inventory and buying cost are explained and formulated in a unique fractal fuzzy linear programming model. This model is presented to obtain a maximal profit production approach with an evaluation. The costs indicate that the proposed model can bring valued solutions for developing profit-effective oil refinery methods in a fuzzy fractal situation. Some examples are illustrated in the sequel.

Keywords: Parametric fuzzy; linear programming; objective function; fractal; fractional calculus; fractal difference equation

The idea of a fuzzy linear programming (FLP) problem is the most important method for decision making [1]. In 1986, Carlsson and Korhonen suggested the parametric method of fuzzy linear programming [2]. They presented a parametric model to get the optimal solution. The parameter space is the environment of probable constraint values that clarifies certain mathematical modeling, which could typically be a subset of finite-dimensional Euclidean space. Normally, the parameters are suggested in a formula (or function) in which the condition is a domain of the function. The benefit of the parameter spaces is its capability to create profitable yet flexible strategies. The mathematical representations offer a massive variety of procedures to assess the system.

Recently, researchers have explored the FLP by utilizing the parametric analysis and parametric spaces. Payan et al. [3] presented a linearization development to determine the multi-objective linear fractional programming problem with fuzzy parameters. Ghaznavi et al. [4] categorized the notion of parametric analysis in FLP, though the objective function quantities are parameterized. Ebrahim [5] introduced a training of parametric analysis to optimize the solution of many problems. He carried a PFLP to define the optimal outcome and the fuzzy optimal detached values as a function of parameters, when the fuzzy cost factors are unsettled alongside an original fuzzy cost function. Meanwhile, Hesamian et al. [6] introduced a partial PFLP system for a similar study, which has been further improved by Hesamian et al. [7]. Recently, Zaire et al. [8] formulated a hybrid system concerning non-parametric system and paramedic system simultaneously. Lastly, Singh et al. [9] proposed a parametric analysis of the usefulness in a multi-objective linear programming problem to create the fuzzy set solution.

In this work, we utilize the concept of fractal derivative to present a parametric set for solving a fuzzy linear system. A fractal derivative [10] is a subclass of the local fractional calculus for which the fractal measurement strictly exceeds the topological measurement. This study suggests a new system of fractal fuzzy linear programming (FFLP) model based on the symmetric triangular fuzzy number and, consequently, the objective function. We employ the suggested model in the oil market. Based on the parametric fuzzy set theory, the fuzzy demand and cost have been clarified, and an FFLP model has been developed to obtain a maximal profit production approach. Overall, it is concluded that the model brings valuable information for developing oil refinery methods in a parametric fuzzy situation.

One or more of the following uncertainties can occur in the refinery industry: the cost of oils alternates depending on the international oil reserve. In such cases, the factors that may increase the oil price include global political issues, military pressure, periodic demand, and/or cold (or hot) issues. Similarly, environmental security problems have tempted dogmatic discussions on valuing rules for oil, which has led to additional uncertainties [11–15]. Consequently, the manufacturing price is diverse, as well as the unit inventory price. Diverse unit transportation price (such as the oil transporter, whether trains or tankers) is utilized to provide oil from the port to the refinery to filling locations. These transporters also face a number of uncertainties. Finally, the management price is the amount of the electricity of the factories, conservation, taxation, and damage across the different stages of oil production, all of which imply a fuzzy cost. Based on the above issues, we present a fuzzy system describing each of the uncertainties.

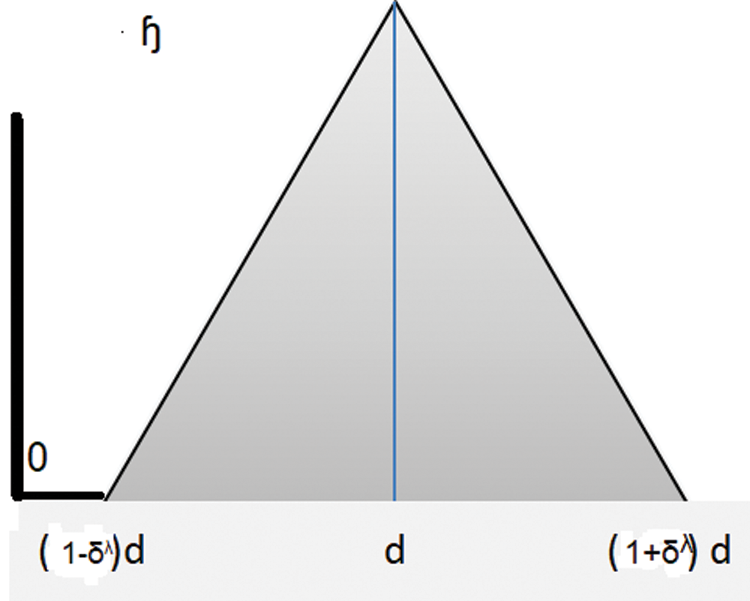

Here, we consider a fuzzy demand

Figure 1:: The symmetric triangle fractal fuzzy value of

where

(for some constants

We proceed to define another item in the parametric space, which is the fuzzy buying cost, as follows:

where

where

2.2 Local Fractional Difference Operator

Yang presented the local fractional derivative (fractal) of the function

where

Now, by using the concept of a fractal, we introduce a generalization of the spread function

where

where

3 Mathematical Modeling System

Under a fuzzy economic situation and constraints on manufacturing ability, inventory and operations, we propose a mathematical model to sustain a master buying and manufacturing proposal such that when the fluctuating demand is achieved, the maximum gain can be attained at an acceptable flat value.

The aim is to maximize the

where

We have the following list of constraints inequalities:

• Invention of manufacturing in a month plus the previous manufacturing inventory must be larger than or equal to the fluctuating demand (variation demand) for the manufacturing. Therefore, we suggest the average by using

• The invention of every manufacturing at all refineries should be no less than the economical manufacture quantity of every manufacture at all refineries. Consequently, we obtain the following inequality

• The manufacturing at all refineries is controlled by the maximum production capability. Thus, we conclude the following inequality

• The quantity of every category of oil produced should be greater than or equal to the minimum monthly buying amount of every category of oil by agreements. Hence, we obtain the next inequality

• The total sum of oil purchases rendering to agreements is at least a positive fraction

• The total of manufactured material transported from a refinery by any type of transportation (trains, pipelines or trucks) is less than or equal to the maximum permissible amount of the transportation

• The overall sum of manufactured material transported from refineries ought to be less than or equal to the refineries’ overall manufacturing output. Hence, we get the inequality

• The overall sum of manufactured material transported from refineries has to be greater than or equal to the fluctuating (changing) demand for the manufacturing process. Connected to what has been mentioned above, we have the following constrain

• Overall, the variables must be non-negative

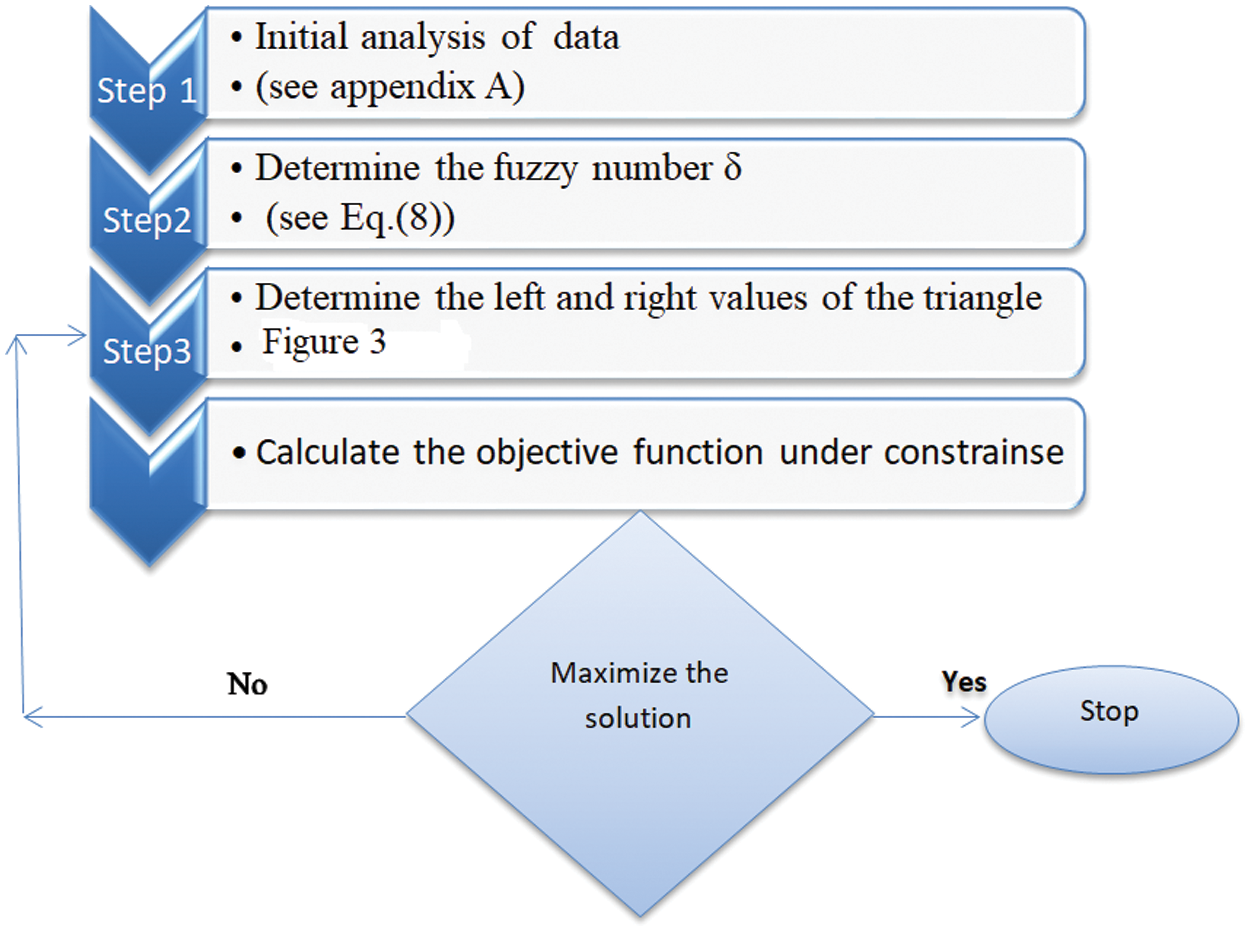

The following steps represent our technique, respectively:

4.1 The Result of the Objective Function

We aim to maximize the objective function

Based on the 3-D parametric space, we represent the objective function by the 3-multi-objective system, as follows:

where

and the following system for the upper bound

Following the membership function of

where we aim to maximize

where

We formulate the multiple objective functions

where

Next, we proceed to convert the fuzzy inequality constraints as it is implied by Eqs. (11) and (18):

and

Finally, we combine the multi-objective functions to maximize the following:

taking in account that inequalities (12)-(17) and (19) are all achieved.

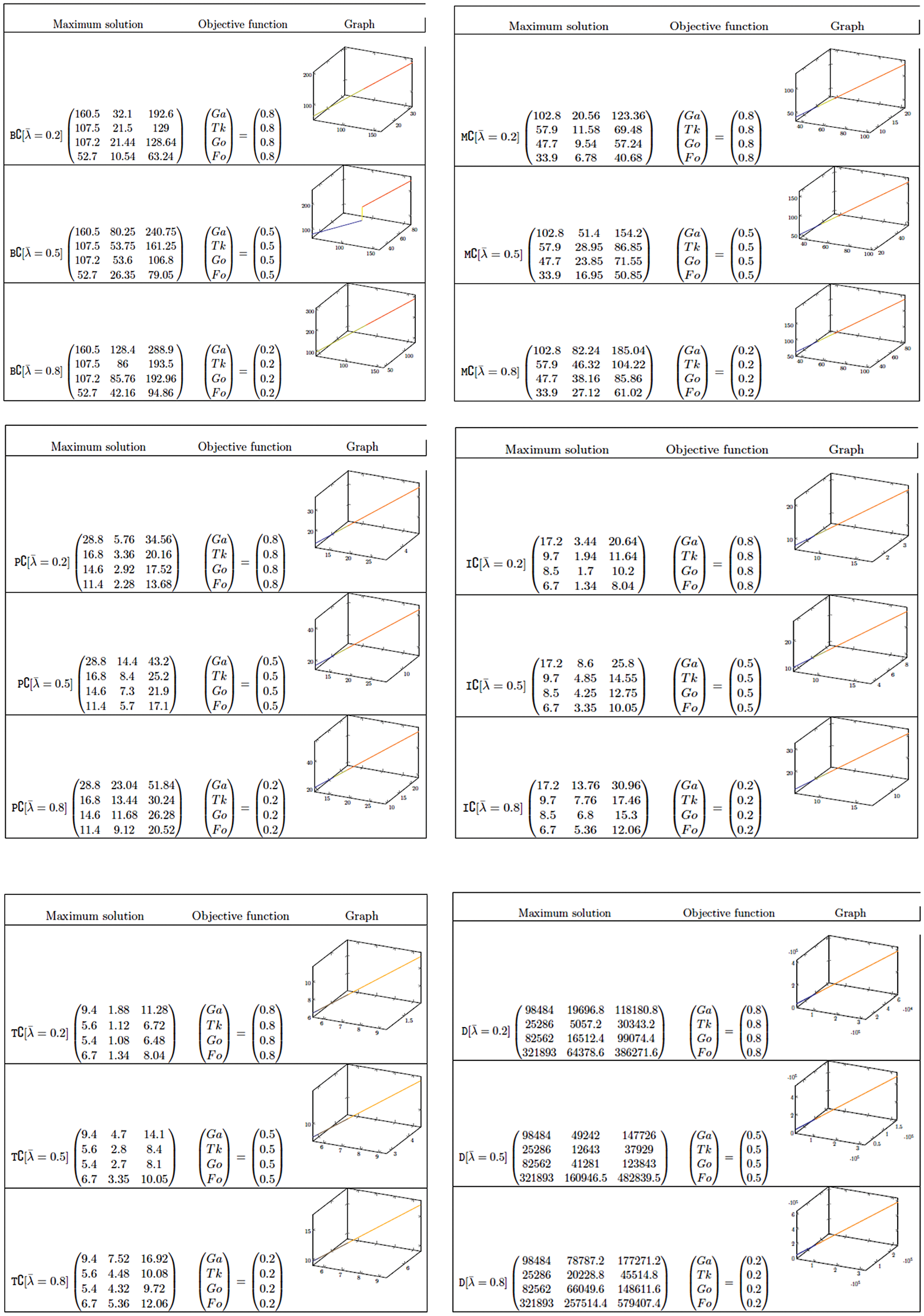

We applied the above mentioned model in the Iraqi Patrol Company (IPC). IPC is the major oil manufacturing firm in Iraq. This company has one part located in Kirkuk city in northern Iraq, and another in Basrah city in southern Iraq. While there are four sub-companies in the middle of Iraq: Al-Doura, Al-Samawa, Al-Najaf and Al-Diwaniya (all have four yields) correspondingly. In this study, we dealt with the primary materials, specifically Gasoline (Ga), Kerosene (Tk), Gas oil (Go) and Fuel oil (Fo). The types of plain oils were limited to the four types mentioned above, and the planning and manufacturing period was set to

To ensure an acceptable oil source, the IPC must come to an agreement with industrial oil countries. Relevant to our work, each group of basic oil

To find the optimal solution, we collected our data as in Appendix A from its sources. Fig. 3 provides symmetric triangle values based on the parameter values

For

• Step 1: we obtained the upper bounds

• Step 2: we determine the vector

• Step 3: Using the vector in step two, we estimate the interval or the value of

• Step 4: By employing the vector in step two, we calculate the interval or the value of

Figure 2:: Steps to maximize the solution and find the best interval of ϒ

Since the hypotheses and incomes are time irregular, several mathematical tests can describe the impact of uncertainty of the recent model. By shifting both demand and the price factors, as well as the estimate of the systems (see Fig. 3) with various symmetric triangular fuzzy number, the demand

We point out the following facts for our data that is collected in Appendix A.

• Modeling system: The fuzzy system can compute variables such as the selling and demand. This system has the ability to consider the relation between the selling amount and demand is investigated in three cases (real, upper and lower). The consequence limits the accumulative profit rule of gathering, buying amount, and selling value at the same average, while minimizing both at the same rate gives the least profit. The significance of a membership takes back to first principles of elastic and broader requests; it also provides a current systematic method with beneficial outcomes.

• Study case: This analysis illustrates that when there is more manufacturing yield, the total price will be lower, and vice versa. Nonetheless, the manufacturing design must trade-off demand and output, and the maximum market demand controls it. A study on IPC recognized uncertain market demand and different prices in the indefinite setting. The dynamics and outcomes indicate that the developed system is capable of delivering valuable data for increasing profit-effective oil refinery approaches under different settings.

Figure 3:: From the top, Selling block costs, Management block costs, Product costs, Inventory costs, transportation costs and demand costs with

Acknowledgement: The authors would like to express their thanks to the Iraqi Patrol Company to provide us with all the data under document number 783 in 2018-2019. The authors also would like to acknowledge Prince Sultan University for paying the Article Processing Charges (APC) of this publication. Finally, we would like to thank the editor and reviewers for their valuable comments.

Author Contributions: All authors have contributed to, read and agreed to the published version of the manuscript.

Availability of Data and Materials: Please contact authors for data requests.

Funding Statement: This research received no external funding.

Conflicts of Interest: The authors declare that they have no competing interests.

1. H. Tanaka and K. Asai, “Fuzzy linear programming problems with fuzzy numbers,” Fuzzy Sets and Systems, vol. 13, no. 1, pp. 1–10, 1984. [Google Scholar]

2. C. Christer and P. Korhonen, “A parametric approach to fuzzy linear programming,” Fuzzy Sets and Systems, vol. 20, no. 1, pp. 17–30, 1986. [Google Scholar]

3. A. Payan and A. A. Noora, “A linear modelling to solve multi-objective linear fractional programming problem with fuzzy parameters,” International Journal of Mathematical Modelling and Numerical Optimisation, vol. 65, no. 3, pp. 210–228, 2014. [Google Scholar]

4. G. Mehrdad, F. Soleimani and N. Hoseinpoor, “Parametric analysis in fuzzy number linear programming problems,” International Journal of Fuzzy Systems, vol. 18, no. 3, pp. 463–477, 2016. [Google Scholar]

5. A. Ebrahimnejad, “Cost parametric analysis of linear programming problems with fuzzy cost coefficients based on ranking functions,” International Journal of Mathematical Modelling and Numerical Optimisation, vol. 8, no. 1, pp. 62–91, 2017. [Google Scholar]

6. H. Gholamreza, M. G. Akbari and M. Asadollahi, “Fuzzy semi-parametric partially linear model with fuzzy inputs and fuzzy outputs,” Expert Systems with Applications, vol. 71, no. 1, pp. 230–239, 2017. [Google Scholar]

7. A. M. Ghasem and G. Hesamian, “Elastic net oriented to fuzzy semiparametric regression model with fuzzy explanatory variables and fuzzy responses,” IEEE Transactions on Fuzzy Systems, vol. 27, no. 12, pp. 2433–2442, 2019. [Google Scholar]

8. R. Zarei, M. G. Akbari and J. Chachi, “Modeling autoregressive fuzzy time series data based on semi-parametric methods,” Soft Computing, vol. 24, no. 10, pp. 7295–7304, 2020. [Google Scholar]

9. S. K. Singh and S. P. Yadav, “Intuitionistic fuzzy multi-objective linear programming problem with various membership functions,” Ann. Oper. Res, vol. 269, no. 1, pp. 693–707, 2018. [Google Scholar]

10. X. J. Yang, D. Baleanu and H. M. Srivastava, Local Fractional Integral Trans- forms and Their Applications. New York: Academic Press, 2016. [Google Scholar]

11. H. F. Wang and K. W. Zheng, “Application of fuzzy linear programming to aggregate production plan of a refinery industry in Taiwan,” Journal of the Operational Research Society, vol. 64, no. 2, pp. 169–184, 2013. [Google Scholar]

12. S. S.Mitra and B. Avittathur, “Application of linear programming in optimizing the procurement and movement of coal for an Indian coal-fired power-generating company,” Decision, vol. 45, no. 3, pp. 207–224, 2018. [Google Scholar]

13. T. Lu and S. T. Liu, “Fuzzy nonlinear programming approach to the evaluation of manufacturing processes,” Engineering Applications of Artificial Intelligence, vol. 72, no. 1, pp. 183–192, 2018. [Google Scholar]

14. A. Mansoori and S. Effati, “An efficient neurodynamic model to solve nonlinear programming problems with fuzzy parameters,” Neurocomputing, vol. 334, no. 1, pp. 125–133, 2019. [Google Scholar]

15. A. Kumar, R. Kothari, S. K. Sahu and S. I. Kundalwal, “Selection of phase-change material for thermal management of electronic devices using multi-attribute decision-making technique,” International Journal of Energy Research, vol. 45, no. 2, pp. 2023–2042, 2021. [Google Scholar]

| This work is licensed under a Creative Commons Attribution 4.0 International License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited. |