Open Access

Open Access

ARTICLE

An Integrated FCEM-AHP Approach for Borrower’s Satisfaction and Perception Analysis of Microfinance Institution

1 College of Agriculture Economics and Management, Jilin Agricultural University, Changchun, 130118, China

2 School of Economics and Statistics, Guangzhou University, Guangzhou, 510006, China

3 School of Mathematics, Thapar Institute of Engineering & Technology, Deemed University, Patiala, 147004, India

4 College of Information, Science, and Technology, Zhongkai University of Agriculture and Engineering, Guangzhou, 510225, China

* Corresponding Authors: Harish Garg. Email: ; Yunxian Yan. Email:

(This article belongs to the Special Issue: Extension, Modeling and Applications of Fuzzy Set Theory in Engineering and Science)

Computer Modeling in Engineering & Sciences 2023, 134(1), 559-584. https://doi.org/10.32604/cmes.2022.021385

Received 11 January 2022; Accepted 04 March 2022; Issue published 24 August 2022

Abstract

The main objective of this paper is to present an integrated approach to evaluate the level of satisfaction of borrowers with the products and services of microfinance institutions (MFI) at different criterion levels. For this, the study adopts the concept of FCEM (Fuzzy Comprehensive Evaluation Method) in concurrence with the AHP (Analytical Hierarchy Process). In our day-to-day situation, the researchers have made many efforts to assess the impact of Microfinance on poverty reduction, but borrowers’ satisfaction is always overlooked. Since the multiple factors impact the borrower’s satisfaction, each factor is made of different items. Thus, as the factors items increase, many uncertainties are created, and hence this will make the decision making unsmooth or imprecise. To describe this, the FCEM method deals with the vagueness in the collection information phase. However, the AHP has been utilized to determine the objective weights of each factor. The presented integrated framework has been illustrated with a case study and presented their results. The study’s managerial benefit is also reported to address the situation.Keywords

Microfinance has been regarded as a savior in the developing world while it is only a tool to help poor people live more comfortably in their communities [1,2]. Microfinance has been recognized over the past half-century as a protective shield against poverty, an instrument for poverty alleviation [3,4], and the main armament of financial strategies to tackle poverty [5] in less developed and developing countries. Microfinance is as widespread [6] in Pakistan as in other countries. Microfinance has become the focus of attention [7,8], especially for the 1.9 billion poor who make up about 36% of the world’s population. Microfinance provides strength, boosts the economic activities of low-income group people, and highlights the vital role in reducing the sufferings of the poor. Because of the success of microfinance in Bangladesh, most developing countries have turned to it for assistance. Microfinance has had similar success in India, where approximately 50 million microfinance customers have received approximately Rs. 2 trillion in loans.

Even though the expectations attached to microfinance have not been fully met to date [9], the literature does not provide sufficient information about it [10]. Microfinance began initially been to reduce poverty [11] and empower women [12]. In contrast, the prevalent literature advocates that microfinance has transitioned from a non-profit to a profit-oriented organization [12–14] and that there is no longer any intention of reducing poverty [15–17]. Evidence shows that a microfinance company in the United States profited approximately $33 billion from a poor household [18], a Mexican microfinance bank named Compart Amos Banco tricked $400,000, and an Indian SKS microfinance scammed $350 million [19]. Likewise, the World Bank report shows that the microfinance industry received $60–100 billion from 200 million customers from 2000 to 2015, but microfinance remains committed to serving the poor [20]. In short, MFIs are financially crippling millions of people [21] and also pushing them into the well of poverty and mounting a culture of debt [13,22] in developed, developing, and least-developed countries. Besides adding a dependency, strain borrowers undermine the poor by saddling them with unsustainable debt [23] instead of easing poverty [10].

Numerous studies have found that microfinance has not increased income [24,25] instead led poor households into debt traps [13,18]. Similarly, several studies in 18 countries suggest no substantial advantages found for the well-being of the poor with microfinance [26]. A comprehensive review of existing evidence supported by the Department for International Development [13] indicates that the microfinance craze was built on sand foundations. There is no clear indication yet that microfinance programs have significant outcomes [10]. Moreover, there is still no significant evidence to support the argument that microfinance is a viable method of poverty alleviation, while poverty reduction [27] and well-being are still curable [13,28]. Even though many studies have found a significant impact on poor design, the reality is that microfinance makes poverty worse [29]. Previous studies demonstrated that borrowers’ well-being is not concerned [26].

MFIs worsen poverty because microfinance loans are generally used to buy necessities that a person needs to survive [10] and precautionary demands such as medical expenses [30] that the poor cannot afford. To fulfill such demands, borrowers spend the borrowed sums, stimulating demand for new borrowing to repay the old ones. In this way, the poor are captured in the debt cycle [22]. When small businesses were intended to be funded, they were widely seen to struggle due to a lack of market experience and inadequate customer demand, resulting in business losses and borrowers being trapped in over-indebtedness [31]. In this situation, however, MFIs are taking advantage of the opportunity to charge an interest rate overprice [31,32]. In short, it can be seen that “microfinance is an organization that has widely accepted a method that accumulates money from the poor people [33] irrespective of their welfare [34]. The above controversies prove that the debtors are not satisfied [35] with the MFIs even though they are stalemated because of their poverty and inability to take loans.

The microfinance industry is experiencing significant growth: “commercial banks have begun to target MFIs’ traditional customers, new MFIs have continued to be established in the microfinance industry, and the microfinance clientele is becoming more sophisticated in terms of the quality of service they require or expect”. These factors may hurt the MFIs. Since the microfinance industry has focused on aggressive competition and profit maximization, it has lost its ability to control its customers. This straightforward explanation demonstrates why financial institutions are concerned about customer satisfaction and consideration. To survive in a competitive environment, MFIs pay attention to understand their customers’ preferences and priorities. Researchers claimed a contradiction between MFI’s objectives and actual activities because MFI’s had become a profit-earning organization [13] rather than a promising role in focusing on poverty [14]. The most pressing problem of profit-oriented microfinance is striking a balance between institutions and the borrowers because commercialization [13] of microfinance is getting away from its social purpose and affecting client satisfaction [36,37]. Borrower satisfaction is allied with the desired amount of loan, lower cost of loan easy access of loan and the polite behavior of MFIs’ employees, which has been overlooked.

Similarly, the evaluation of Borrowers’ satisfaction from the microfinance loans’ outcomes like economic impact, social impact, and socio-economic improvement are also ignored. The only thing that has been unheeded so far in the previous studies is whether consumers are happy with microfinance services [36], and if so, what is their level of happiness? Several consumer issues need to be addressed with the strenuous efforts of researchers. The study of microfinance desperately needs to determine whether the products and services provided to the consumers meet their needs or satisfy them [38]. Borrowers’ satisfaction means that borrowers get the desired loan amount.

The interest rate & the other charges are affordable, borrowers are happy with the MFI’s services, and the loan easily meets the social and economic needs and improves their socio-economic lives.

Furthermore, the attitude adopted during the delivery of these goods and services does not hurt the borrower’s self-esteem. Researcher reveals that studies about borrowers’ satisfaction with the services of microfinance institutions are found to be very infrequent [39]. Poverty remains incurable worldwide, and the poor borrowers appear unsatisfied and disappointed until multiple MFIs operate in developed, emerging, and developing nations. In addition, MFIs plan to issue a loan to a group of women or individuals who already have fair sources of income [13] and less to poor borrowers [39]. Similarly, MFIs intend to monitor borrowers’ savings instead of their business growth or lone usage monitoring, which is the primary objective of MFIs [40]. They do not care where borrowers have used the money they have borrowed or what the borrower’s business needs are. What money does the lender take from them? It is only possible to determine how poor people were stuck in an endless debt cycle through an actual study. Poor people in debt traps have long endured and been exploited [41] because of political power, policy support, lack of awareness, lack of accountability, and poor law and order.

The technique of analysis (FCEM and AHP) and this study’s subject matter are significant aspects of this research (borrower satisfaction). The fuzzy evaluation method is the most effective way to describe the complex concept of borrower satisfaction. Multiple factors contribute to borrower satisfaction, and each factor is made up of different items that imprecise the information collected. FCEM is the best solution for dealing with vagueness. Furthermore, this study is being conducted because microfinance institutions do not care whether borrowers are satisfied. However, to deliver financial goods and services to consumers, institutions must ensure that the goods and services they provide are in line with the consumer’s preferences. By its very nature, this study holds a unique position in the literature because the factors described for the satisfaction of microfinance consumers have not been worked on before.

Such a study sets a new direction for investigators and highlights borrowers’ problems being exploited by microfinance institutions. This study is also essential for countries like Pakistan because most borrowers are illiterate; MFIs are exploitive, harsh, or abusive due to their weakness. In addition, the rights of millions of people worldwide have been emphasized, especially the people from countries like Pakistan who are borrowers of microfinance institutions. The proposed study makes a clear distinction between the objective and practice intention of MFIs. The study invites the government to revise policy regarding microfinance because poverty is still mend able in the region. It is also a pathway for policymakers and researchers to review the problems and deal with facts. This study would boost and improve the researcher’s information and encourage them to redefine the objective. This study has rich information for both who have or have not been trapped by MFIs. For MFIs, this study also has helpful information on borrowers’ assessment regarding the quality and services of products.

1.3 Socio-Economic Reasoning of Borrowers’ Satisfaction

The study sets out a five-pronged approach to borrowers’ satisfaction, including all factors directly linked to the satisfaction of consumers using microfinance loans. This study measures the borrowers’ satisfaction with the MFIs products, services, and the loans’ outcomes. Since the poor are powerless and have no choice but to take loans because of their poverty [42]. They can uplift their income and living standard, drag away from the poverty line, improve their socio-economic life and enhance their participation in social and economic activities. Borrowers’ satisfaction is therefore directly linked with the socio-economic factors, products, and services of MFI [43–45]. The product of the MFI is defined as the “amount of loans,” defined as the amount of money lent and the terms of the loan like interest rate and service charges [46–49]. At the same time, services include loan application, pre-lending check, loan approval, and loan recovery actions, all performed by loan officers. It means the behavior adopted by MFI staff, such as access to loan [50], before a lending check, after loan approval, and “behavior during loan recovery” associated with borrowers’ satisfaction. Five criteria levels cover seventeen factors that describe borrowers’ satisfaction associated with microfinance. Fig. 1 is one of the most effective representations of the relationship between borrowers’ satisfaction with these factors in terms of conceptual representations.

Figure 1: Relationship chart of borrower’s satisfaction with the microfinance institutions

The product is the most important and primary factor determining borrowers’ satisfaction. A quality product possesses the ability to satisfy its users. Borrowers’ satisfaction will increase if a quality product is available at an affordable price; otherwise, it unsatisfied its users. Similarly, microfinance institutions also possess a product called Microloan or Microcredit, a combination of three components: amount of loan, interest rate, and transaction or processing charges. The most critical determinant of borrower satisfaction is the loan cost, including the institution’s interest rate and service charges. According to the researcher, a borrower is paying about 60% of the cost of the loan as interest and other charges collectively [46]. All these three factors define the quality of a product and determine the level of satisfaction of its users. As the marginal utility of money for a poor person is always higher than that of a rich person, a higher loan, lower interest rate, and fewer other charges are more satisfactory for a borrower.

Services of microfinance institutions refer to the behavior of employees of microfinance institutions that are adopted during the provision of a loan to the borrower. MFIs’ services are categorized into four categories: access to the loan, before the lending check, after loan approval, and recovery of the loan. The simple terms and conditions of MFI’s loan services quickly get the borrowers’ attention [47]. Good behaviors of employees of MFIs during disbursement and recovery of loans also raised the degree of the serenity of the borrowers. The institution’s tight and strict policies discourage poor borrowers and increase their disappointment. Numerous authors have reported harassment, suicides, and defaults worldwide that are directly or indirectly related to the behaviors of employees of microfinance institutions [45].

The economic impact is another essential dimension of Borrowers’ satisfaction with microfinance. Economic impact comprises three items: Increase income, save money, and pay the due payment. The primary objective of MFIs is to increase borrowers’ income through micro financing and make them able to save money for preventive use [47,48]. Income is the only factor that describes a person’s economic status, and access to income enables him to save money for precautionary demands. Suppose the provided credit enables the borrowers to save access income for emergency use and efficiently manage the due payment. In that case, that will increase the degree of the serenity of poor borrowers.

It is also a complicated task to participate in social activities to fulfill children’s education expenses and the family’s health expenses for borrowers. These factors are part of another dimension of borrowers’ satisfaction besides the product and services of Microfinance institutions. There is no doubt that when the product and services provided by the MFIs fulfill the desire of social factors described, they will satisfy the borrowers [49]. However, much research described that most borrowers cannot correctly participate in social activities and cannot save enough money to cover their health and children’s education expenses [50].

Finally, the borrower’s satisfaction is momentously associated with the socio-economics improvements. This dimension covers four essential factors that contribute to a borrower’s satisfaction regarding the outcomes of the loans from MFIs. Fulfillment of necessities, improvement in living standards, and economic improvement indicate that the borrower is getting away from the poverty line and is satisfied with the availed products and services of MFIs [7]. It is the prime desire of every human being to fulfill the basic requirements of life. Everyone wants to grow and improve their economic situation after obtaining the necessities. Economic improvement indicates the development of social and economic requirements as a whole.

2.1 Procedure for Collection of Information and Analysis

A questionnaire has been prepared to approach our research objectives. Information has been collected from the borrowers of 10 MFIs, including one interest-free microfinance institution (Akhowat Foundation) in the low-profile district of Panjab, Pakistan. Questions were asked about all the socio-economic factors directly related to the borrower’s satisfaction with the MFIs’ product. A questionnaire has taken opinions from both men (about 62%) and women (about 38%). Assessment of Borrowers was divided into three categories, which are listed below:

1) Borrowers’ perceptions about the intentions of MFIs

2) Borrower’s satisfaction with the MFIs’ available product and services

3) Borrower’s satisfaction with the outcomes of MFIs’ product and services

A questionnaire was completed from 646 borrowers of 10 MFIs, including 106 from one interest-free MFI (Akhowat) and 540 borrowers of 9 MFIs, 60 from each. Borrowers’ information was gathered when they came to pay their loan installments at the microfinance institutions on a predetermined day. Questionnaires were distributed first, and then they were educated on each section of the questionnaire before being asked to fill out their responses to each question. Borrowers provided feedback on ten factors under category 1, while categories 2 and 3 are further subdivided into five dimensions covering 17 factors regarding the borrower’s satisfaction with the MFI’s products and services.

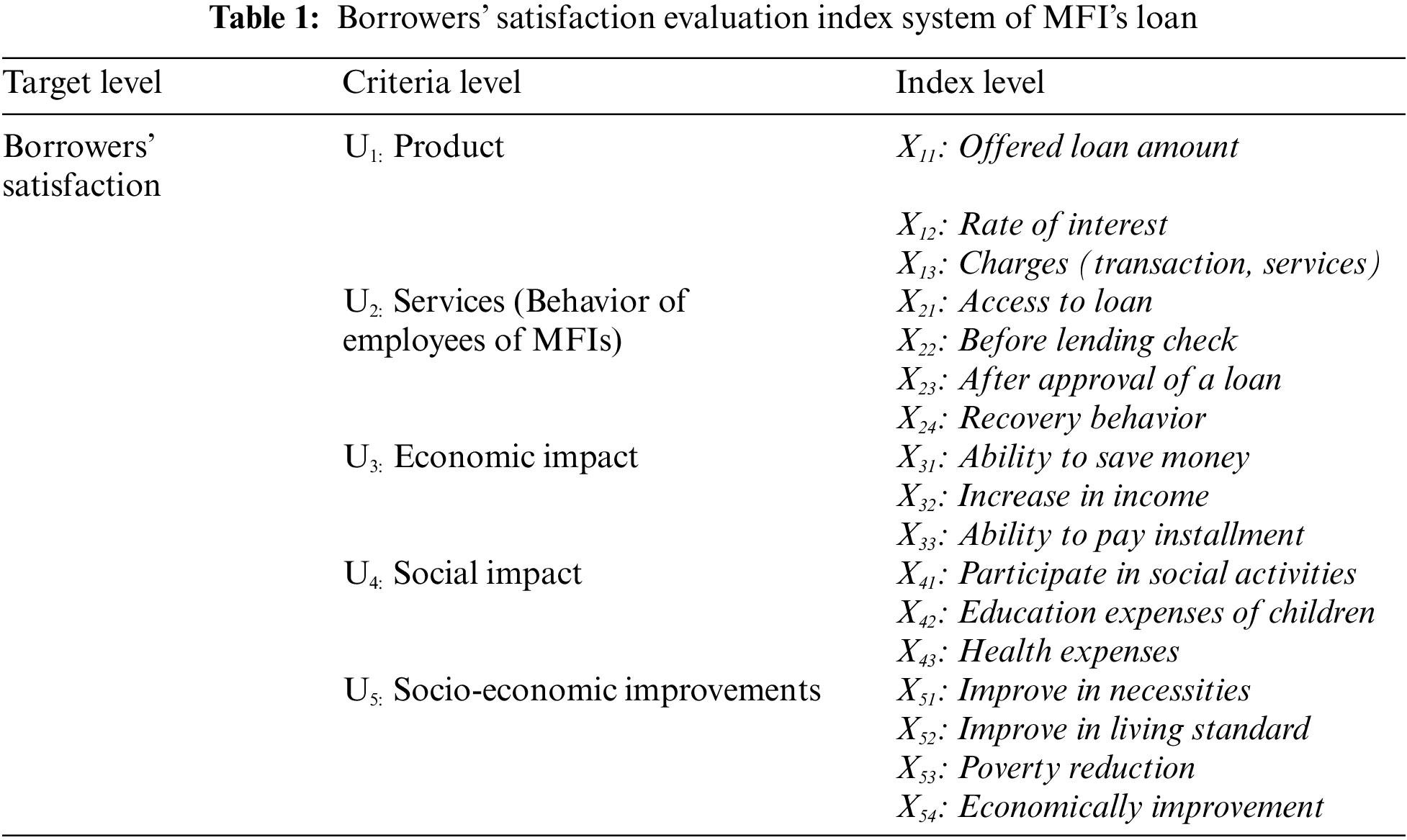

2.2 Index System of MFI’s Products and Services about Borrower’s Satisfaction

The borrowers’ satisfaction index system comprises targets, criteria, and index levels. The first target or objective level shows the borrowers’ satisfaction. Secondly, at the criterion level, dimensions are described for borrowers’ satisfaction regarding the five-pronged factors in Fig. 1. Thirdly, the index level prescribes various indicators that determine borrowers’ satisfaction. The final form of the Borrower’s Satisfaction Index System of MFI’s product and services, the outcomes of utilizing loan, is constructed in Table 1 and further described.

Product: A loan as a “product” is the first step toward the target level of borrowers’ satisfaction. The loan amount defines the derived level of satisfaction because a higher amount of the loan becomes challenging to manage and a lower amount of the loan fulfills basic operational expenses [51]. The loan price in terms of interest rate is another factor of “product” that determines borrowers’ satisfaction. A higher interest rate discourages customers from availing of this product, while low-interest rates significantly reduce poverty [52,53] and increase satisfaction. Similarly, fewer charges like services & transactions enhance borrowers’ ability to avail of this credit facility.

Services (Behavior of employee of MFI): Firm, organization, or institutional behavior by employees toward customers plays a significant role, especially in the banking sector. Polite, motivational, encouraging, heartening, and enhancing behavior from microfinance institutions impacts acknowledgment by borrowers. Inspiring behavior raises borrowers’ comfort, pleasure, and satisfaction and enhances their ability to get the gladly available loan [52] of the MFIs. Borrowers’ satisfaction level can be measured by observing an aspect of the behavior of MFIs through a pre-lending check post-landing monitoring.

Economic impact: After the loan disbursement, the essential aspect for a borrower’s satisfaction is the economic impact, designed with three factors: saving money for emergency use, income level, and ability to pay loan installment. If the Borrowers can save some money for the future and manage installment easily, it will be satisfactory for him. Still, it is only possible if he earns a reasonable income. Therefore, these three factors are important indicators for measuring borrowers’ satisfaction under the economic impact criteria.

Social impact: Social impact is another crucial aspect for measuring borrowers’ satisfaction. It also has three indicators from which the provided loan of MFIs can energize a borrower. If the loan quenches the borrower’s health, educational and social activities expenses, that will not raise satisfaction. Borrowers’ responses were also recorded for these factors (health, children’s education, and socially embedded expenses) to measure borrowers’ satisfaction.

Socio-economic improvement: The final aspect of borrower satisfaction is a socio-economic improvement, which comprises four factors: basic needs, living standards, poverty reduction, and economic improvement. A borrower can adequately define the improvement of the described elements. The fulfillment of basic needs and better living conditions clearly distinguish between satisfied and dissatisfied people. A man with an empty pocket is an image of poverty; no money, no economic activity. However, if MFI facilities affect borrowers’ lives, it will manifest itself in the form of socio-economic improvement.

2.3 The Fuzzy Comprehensive Evaluation System

It is logical to measure vagueness and qualms in human assessment [53]. It also delivers a cohesive basis that combines the ambiguous finding from numerous purposed factors that were needed comprehensive evaluation [54,55]. The fuzzy comprehensive evaluation method is a technique that uses fuzzy mathematics to solve complex and ambiguous behavioral qualitative problems [56]. Fuzzy mathematics utilizes the set theory of mathematics, which has potential to solve evaluation and pattern recognition issues in every field of life [57]. The fuzzy comprehensive evaluation index system also adopted fuzzy set theory and artificial intelligence system [58]. Such an index system has been measurable and comparable. It also possesses human assessment and human factor filtration. A Fuzzy Comprehensive Evaluation index system is developed in Table 1.

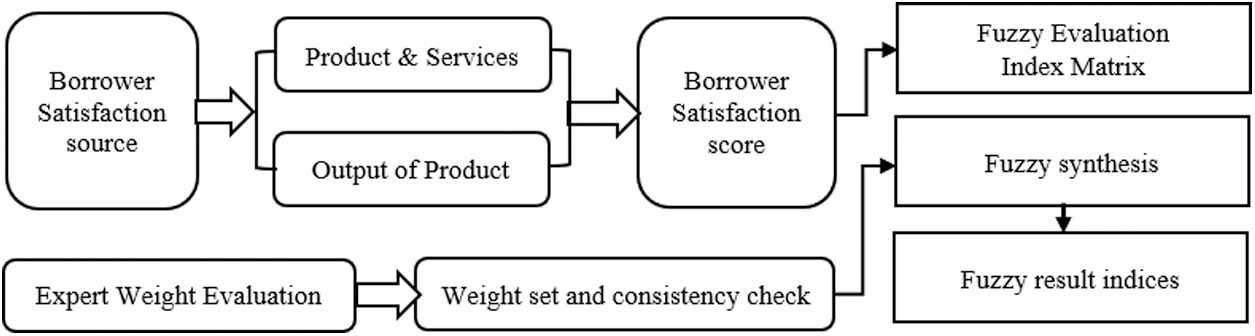

In a comprehensive evaluation of borrower satisfaction, employing a system comprised of multiple individual indicators can be viewed as a comprehensive approach which is highly recommended [51]. The study intends to use Fuzzy logic to ensure the accuracy, viability, and sustainability [59] of Borrower satisfaction evaluations with microfinance by incorporating expert opinion [59]. Borrower satisfaction is associated with multiple quantitative and qualitative factors whose evaluation needs several steps and phases. Borrowers’ satisfaction is directly associated with the product and services of MFIs. FCEM is the best fit to evaluate such fragmented borrower satisfaction because it works appropriately [60], resulting in fewer delays, less duplication of effort, and accurate customer satisfaction [61]. To assess borrowers’ satisfaction, we use the phases of the comprehensive evaluation system and selected indicators to create our evaluation index system. Fig. 2 illustrates the evaluation of borrowers’ satisfaction.

Figure 2: Borrowers’ satisfaction evaluation flow chart

The first step of the fuzzy index system is to define the first-level factor set about the overall evaluation required. This set is named U and possible factor denoted by u1, u2, …, un. So, the factor set for the evaluation index system is defined as follows:

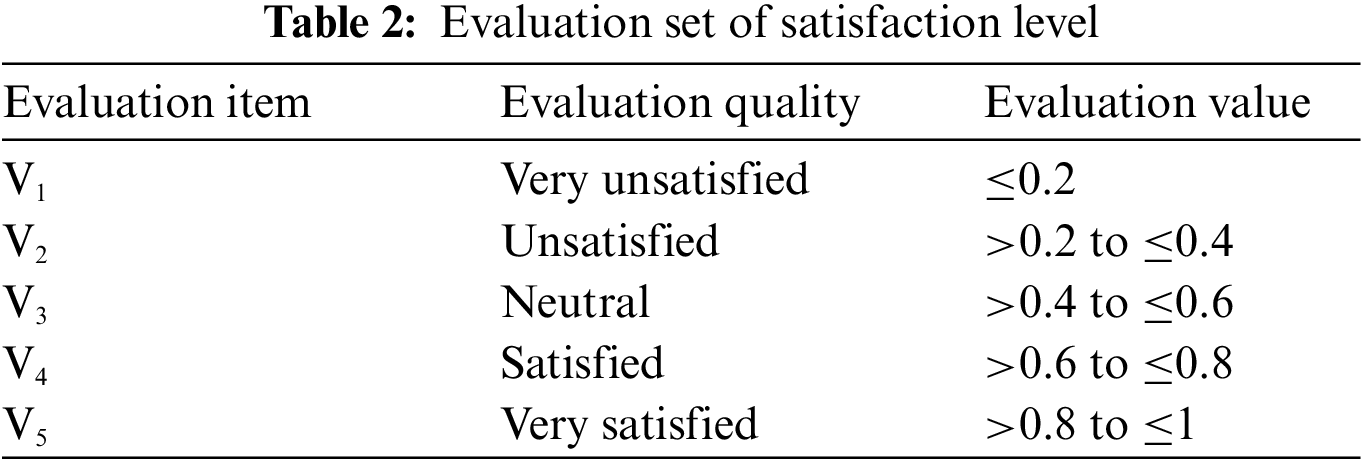

2.3.2 Evaluation or Comment Set

The second step of the fuzzy evaluation system is to determine the comments set or define human judgment degrees of perceived factors. Such an evaluation set is named V and is denoted by v1, v2, …, vm as a degree of evaluation. So, the comment set is described below and in Table 2.

The third step is to construct an evaluation matrix R of (n × m). The matrix elements are denoted by

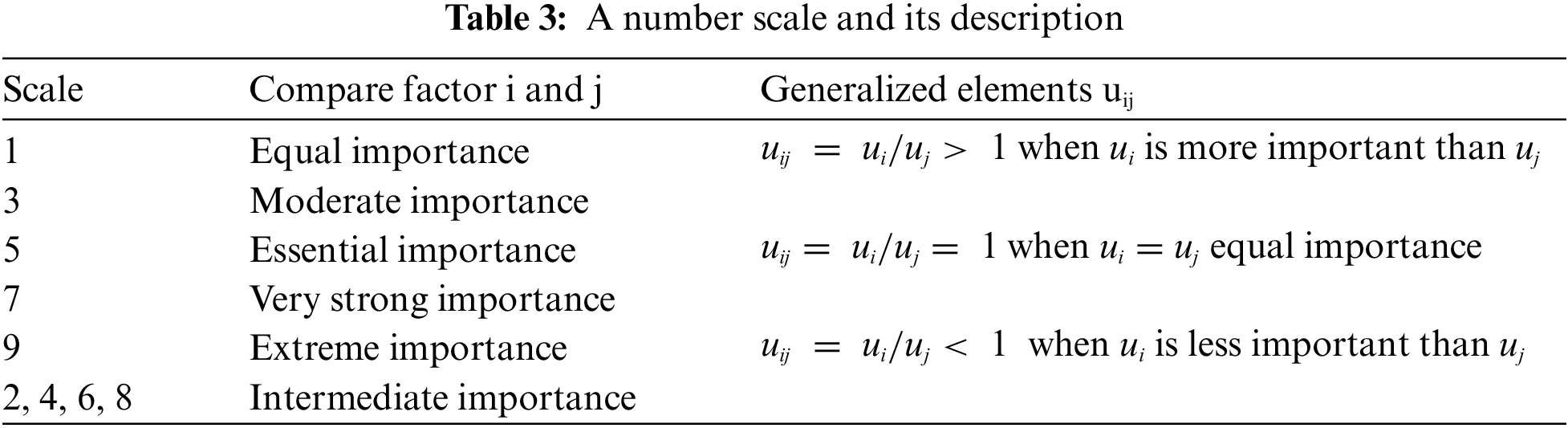

A researcher can adopt several ways of determining a weight set for the criteria level and the index level, such as questionnaire or survey method [62], the mathematical or statistical formula method, expert opinion [63,64], the combined weight method [65] and the analytical hierarchy process. This paper determines the weight of the factors with AHP due to its objectivity.

2.3.5 Analytical Hierarchy Process

It is a comprehensive technique to evaluate complex decisions using behavioral and factual information. Researchers often use this method to determine the weight and judge for multiple criteria [66]. AHP also provides consistency of judgment, priority between criteria and alternative, and factor preferences through pairwise comparison. Prof. Thomas L. Saaty introduced this method in 1977. The AHP adopts several steps to construct a weight matrix for each level of indices. First of all, factors are aligned hierarchically into the row and column. Then pairwise comparison matrix is constructed for each level of criteria, like for the first level of a factor set U = {u1, u2, …, un}, pairwise comparison matrix A can be constructed as follows:

where

The corresponding weight for each factor can be calculated with the help of the judgment of the pairwise comparison matrix. For this purpose, the weight vector needs to construct by using a simple method of an average of normalized column (ANC). The formula for ANC is given as follows:

Thus, generally, weight vector is described as

It is mandatory to check consistency for a pairwise comparison matrix. It needs to calculate the consistency ratio obtained by using the following formula:

where C.R stands for Consistency Ratio, CI is consistency index obtained by as follows:

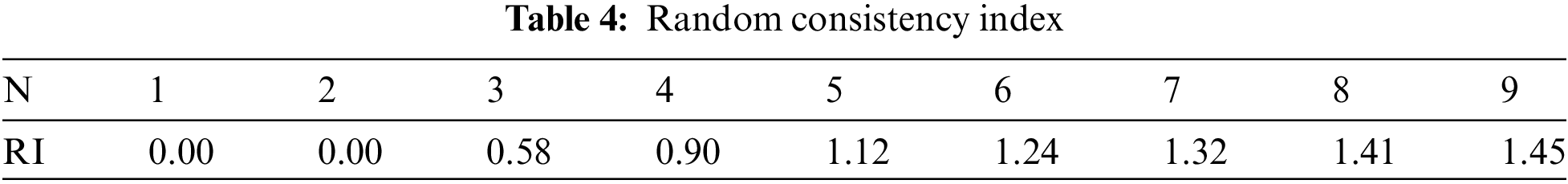

where λ is the total value of the consistency vector while the consistency vector is the product of the total of pairwise comparison vector of each factor with the inverse of weight vector W. It turns out that if and only if λ equals the number of factors of the judgment matrix then matrix A will be most consistent. Usually, the value of λ is greater than n (the number of factors of the judgment matrix). Still, as well as it approaches n, then the value of the consistency ratio approaches zero, which means it travels toward consistency of the judgment matrix. RI is the average random consistency index taken from Table 4 of the random index. If the value of consistency ratio is less than 0.1 (Cr < 0.1), then the pairwise matrix’s judgment value will be consistent and reliable, otherwise not.

2.3.6 Comprehensive Evaluation Result Set

A fuzzy Comprehensive evaluation result set for factor or index level, criteria level, and target level can be evaluated in the final step of fuzzy compressive evaluation by applying fuzzy mathematical operation on the weight set of the prescribed each level with corresponding comments evaluation matrix for each level. First of all, the fuzzy matrix Bi of the index level, composed of the AHP weight of the index level and the score of the evaluation set of the index level, gives us helpful information about each criterion level. Each factor can be evaluated separately and gives us a level of borrower’s satisfaction for each factor. Similarly, the result vector for criteria level leads to describing overall borrowers’ satisfaction, composed of the AHP weight of the criteria level and the result matrix of the factor level. Generally, the comprehensive evaluation set is expressed as follows:

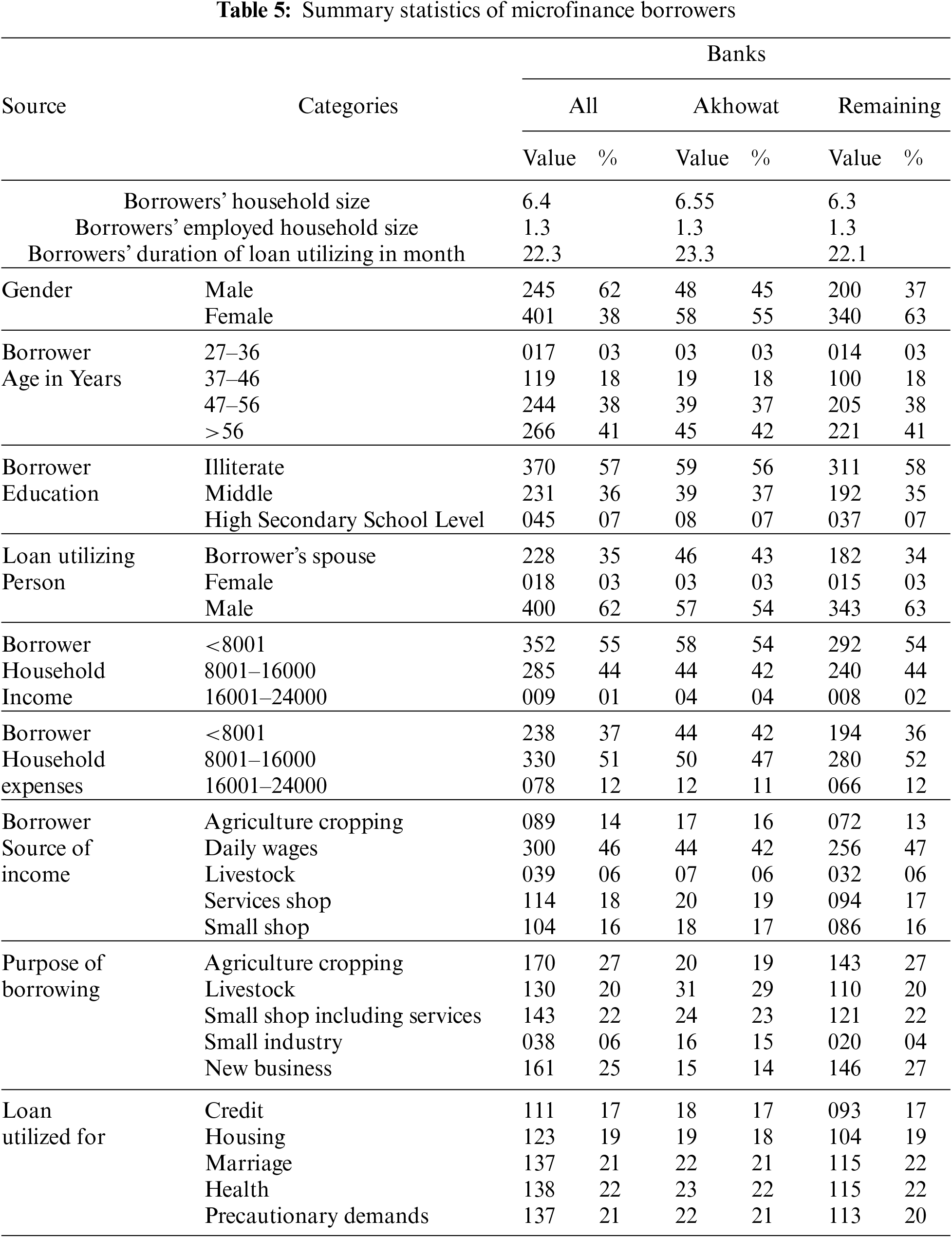

3.1 Summary Statistics of Descriptive Analysis

The majority of the borrowers belong to the older age group. The borrowers’ average household size is six persons, while the average employed person of the household is one. Only 7% of 38% of women borrowers were utilizing loan amount themselves, 93% husbands of women borrower were taken loan amount from their wives while 62% male borrower uses loan amount themselves. Collected information has been taken from the borrowers who have been using MFIs facilities for the last year. Overall, the borrowers are taking facilities ranging from 1 to 3 years while the average duration of the loan utilizing is about one year and ten months.

Basic information of Borrowers is summarized in Table 5. The majority of the borrowers were illiterate [52] or below the primary level of education. Unfortunately, none of the borrowers go to college. Only 7% of the borrowers have a higher secondary school level of education, and 93% of the borrowers in the sample possess a middle-level education or below. Average monthly household income and expenses are about Rs.14500 and Rs.16000. This average difference of Rs.1500 access expenses, the borrowers fulfill from MFI borrowing Majority of the borrowers’ household income (46%) come from daily wages, 14% household earn from agriculture cropping and 6% from Livestock while only 18% and 16% household collect their income from services shop and small shop, respectively. Some exciting information discloses the difference between the purpose of borrowing and the utilization of the loan. MFI disburses loans to the borrowers for some specific investment or business purpose. According to collected information, 27% of respondents (borrowers) spent the loan on Agriculture cropping, 20% for Livestock, 22% for small shops including services, 6% for small industry, and 25% for new businesses.

On the contrary, 17% of borrowers reported that they used to pay informal credit, 19% utilized in house construction or repairing, 22% have health emergencies, 21% need to spend on their children’s marriages, while 21% used to meet their Precautionary demands. Table 5 illustrates the summary statistics of the same information for Akhowat microfinance foundation and remaining institutions separately in columns 5 to 8. There are tiny differences in the percentage values of responses of borrowers of interest-free microfinance institutions (Akhowat microfinance) and remaining all microfinance institutions collectively.

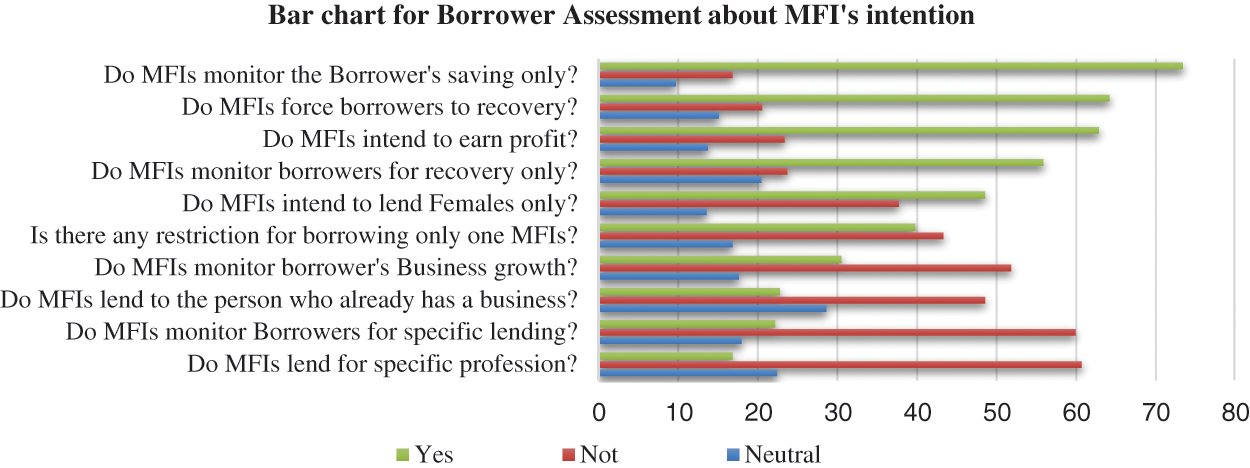

3.2 Intentions of Microfinance Institution

Borrowers also assess the intention of microfinance institutions and their staff. All possible questions were listed on the vertical axis of the bar chart in Fig. 3. The length of the bar shows the percentage score of Borrowers’ responses. More than 50% of borrowers answered “No or Neutral” for the first five Questions, while the rest of the questions also scored more than 50%, but here borrower judgment is “yes”. Interpretation of the following results is not sympathetic with the borrowers because those questions recorded more than 50% as “No or Neutral”. It depicted that MFIs have no concern with the borrower’s interest. On the other hand, those questions recorded scored more than 50% as “yes” it portrayed that MFIs have only trepidation about their benefits. Our findings strengthen the previous study.

Figure 3: Borrower’s assessment about the intension of microfinance institution

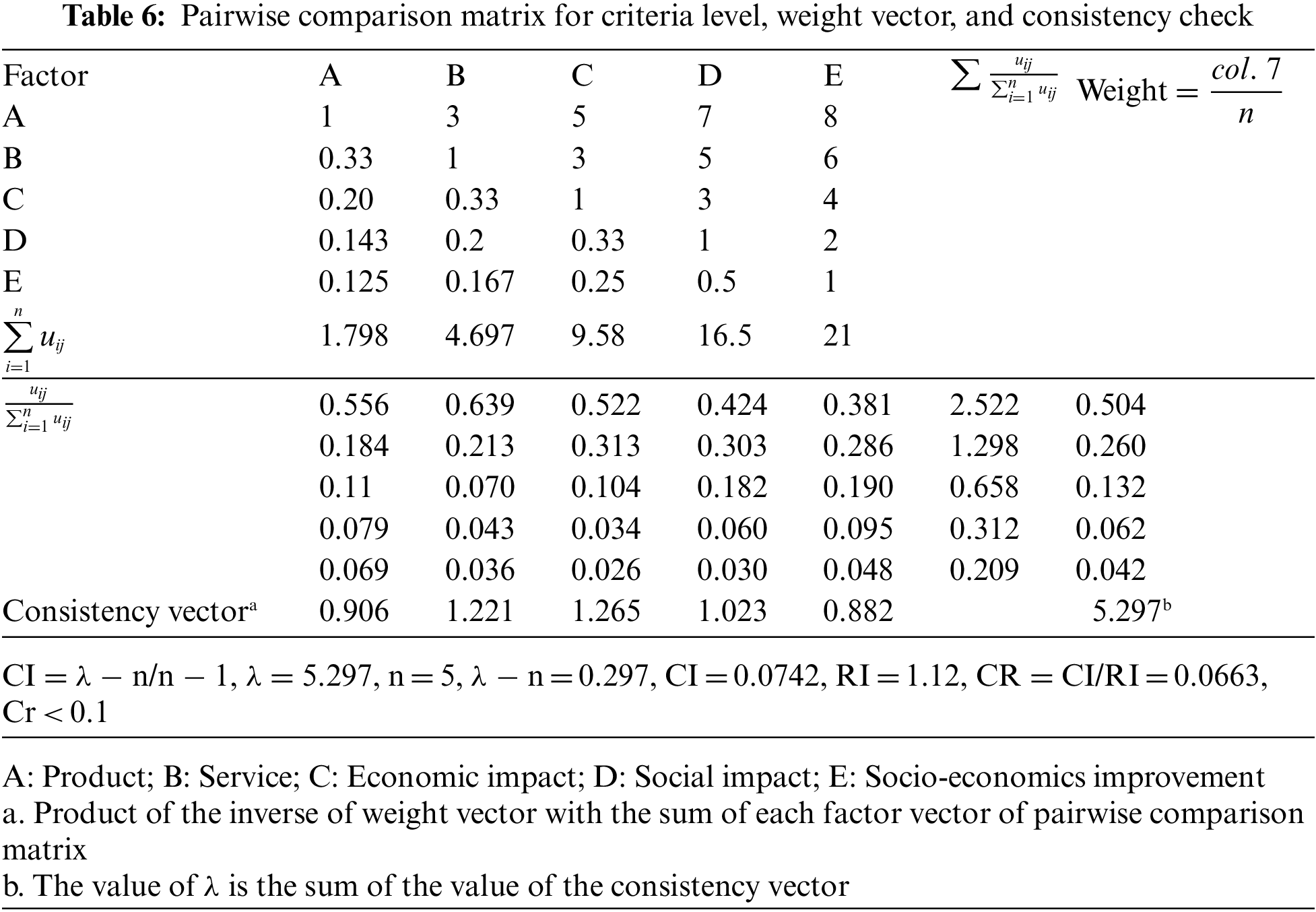

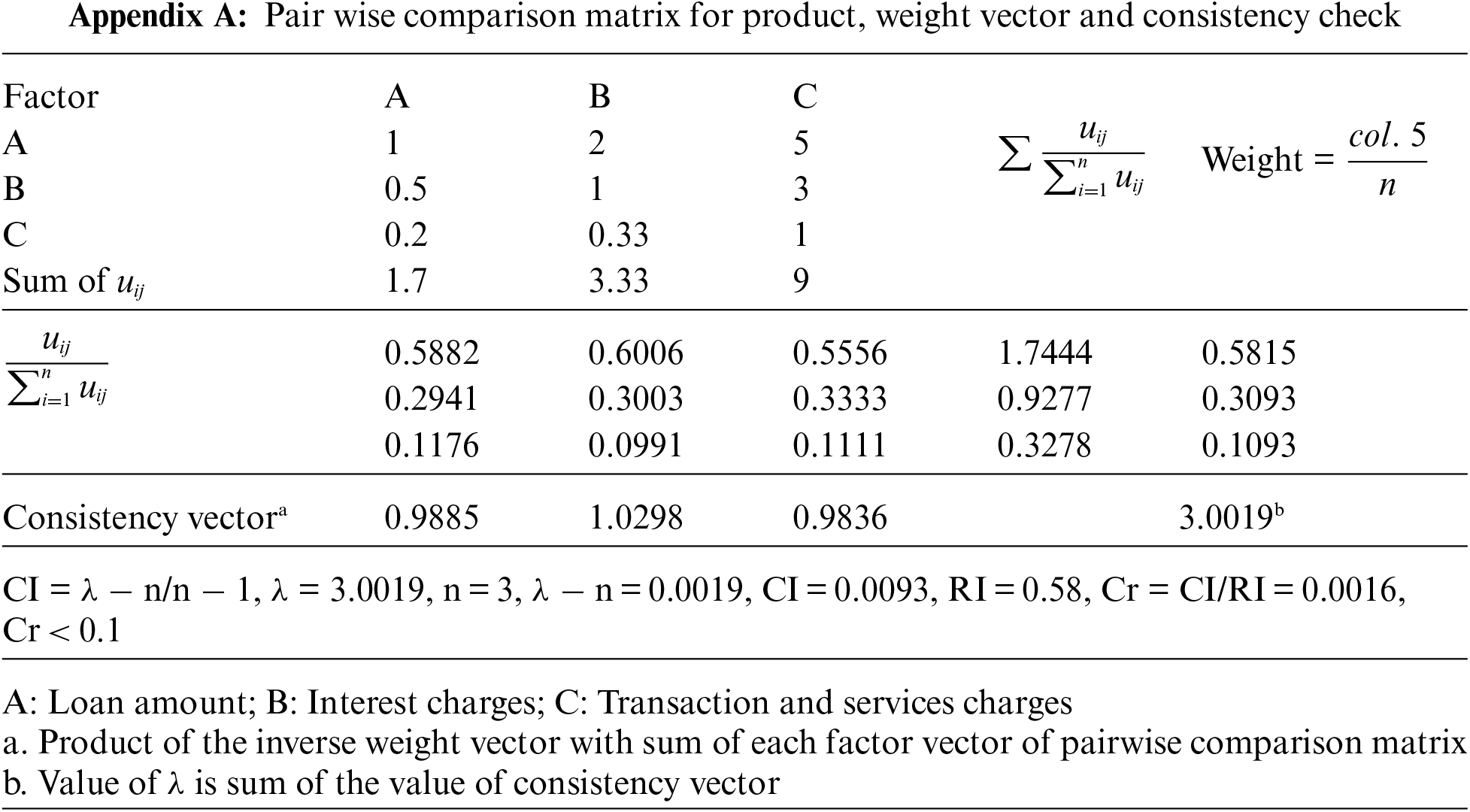

3.3 Result for Pairwise Comparison Matrix, Weight, and Consistency Check by AHP

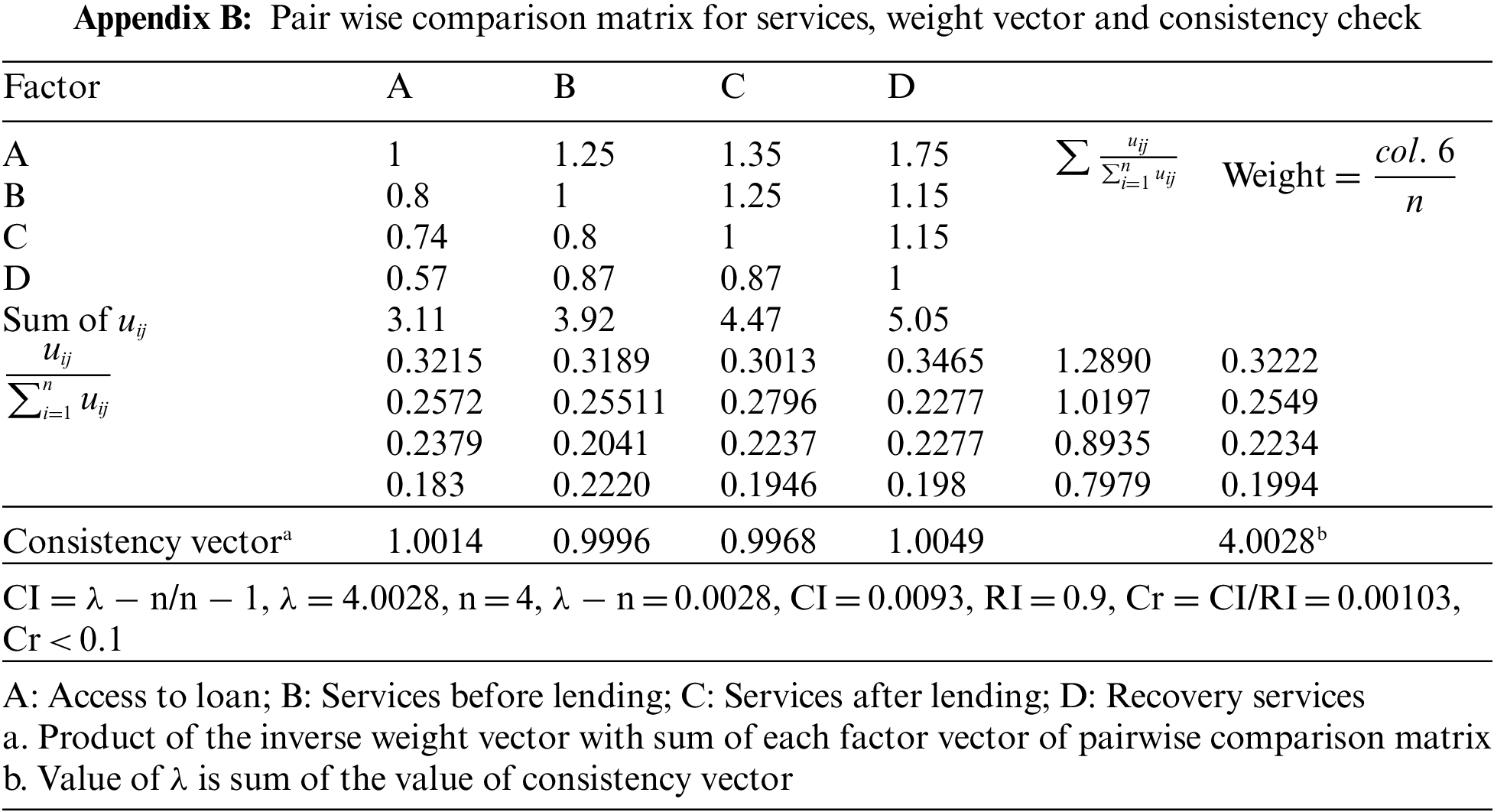

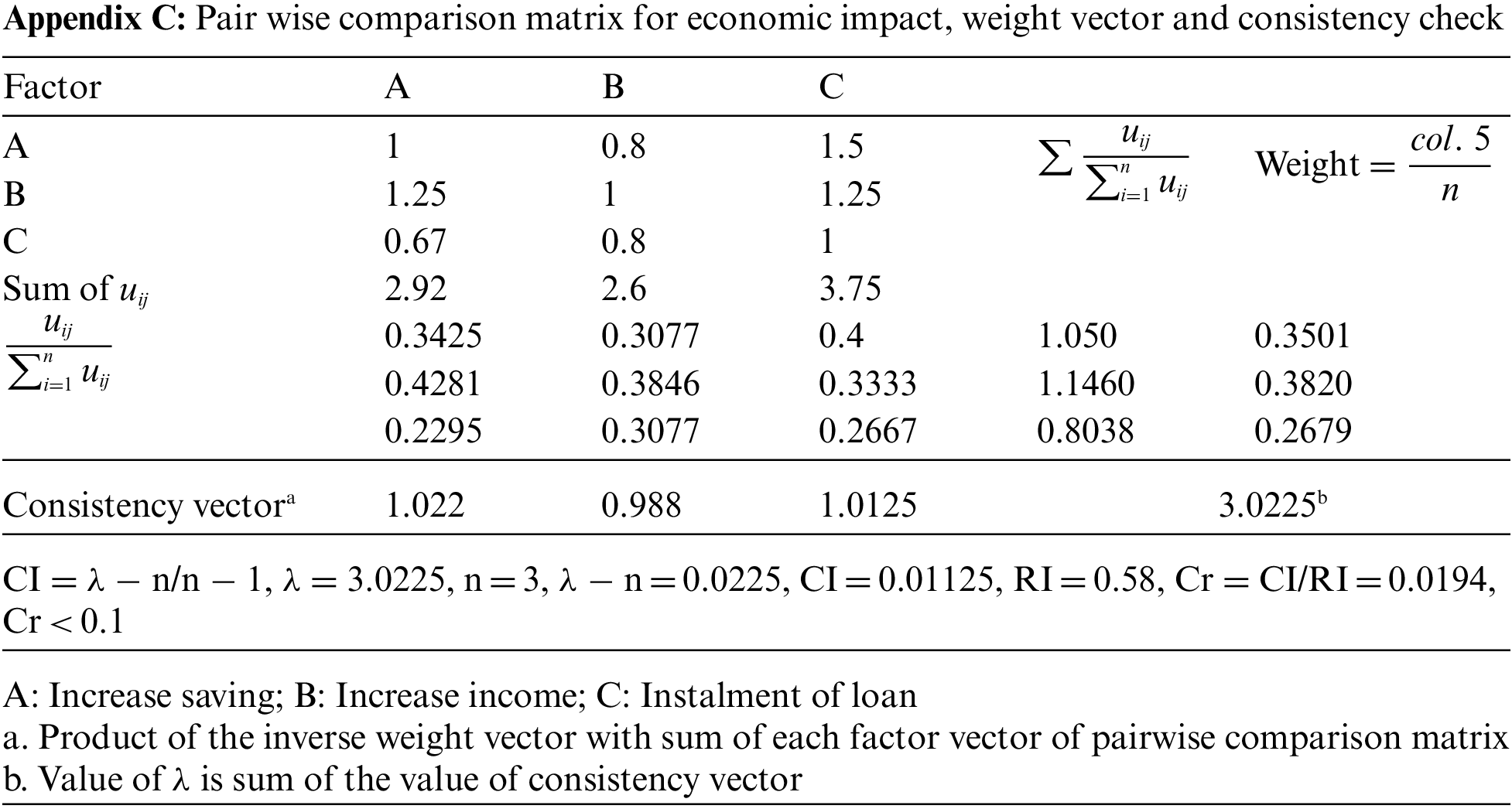

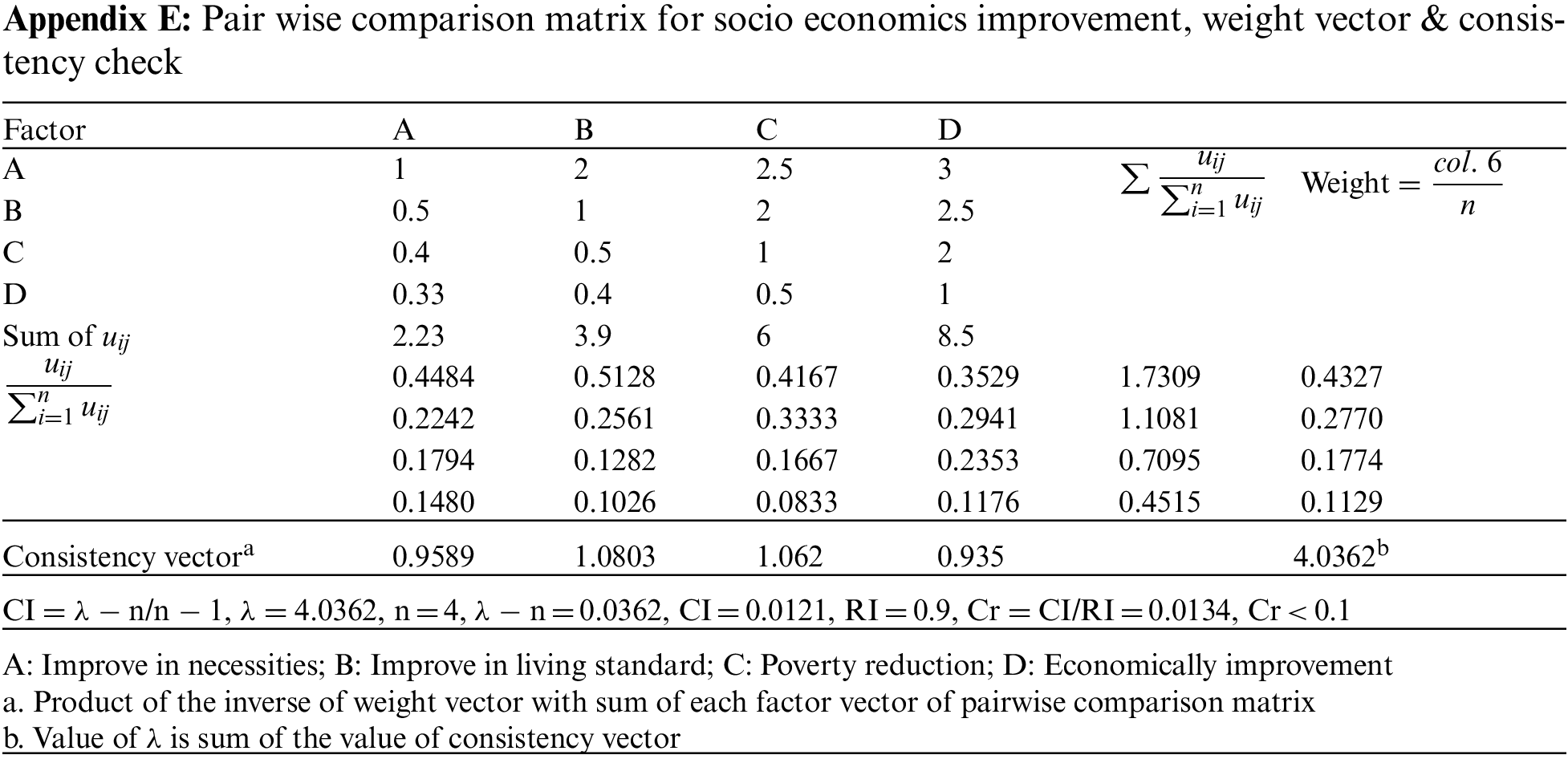

A pairwise human judgment matrix is constructed for factor level (Table 6). The goal is to calculate weight for criterion level of borrowers’ satisfaction comprehensive evaluation. The relative importance of each factor is evaluated in Table 6. Like factor product (A) is three times more important than Service (B), five times more important than Economic impact (C), seven times more important than Social impact (D), and eight times more important than Socio-economic improvement (E). The further relative importance of the remaining factors can be perceived in Table 6 rows 2, 3, 4 and 5 below. A pairwise comparison matrix is the first step to calculate the weight for each factor, and a pairwise comparison matrix is solved according to the procedure prescribed in the methodology. Consistency check found pairwise comparison matrix values are consistent and reliable for weight calculation. The sum of the weight vector values is one; therefore, the weight vector is no longer needed to normalize the weight vector. The same procedure is adopted to calculate weight for the index level of borrowers’ satisfaction evaluation system. The same procedure is adopted to calculate weight for index level of borrowers’ satisfaction evaluation system (see Appendixes A to E).

3.4 Result Evaluation System of Borrowers’ Satisfaction of Microfinance Institution

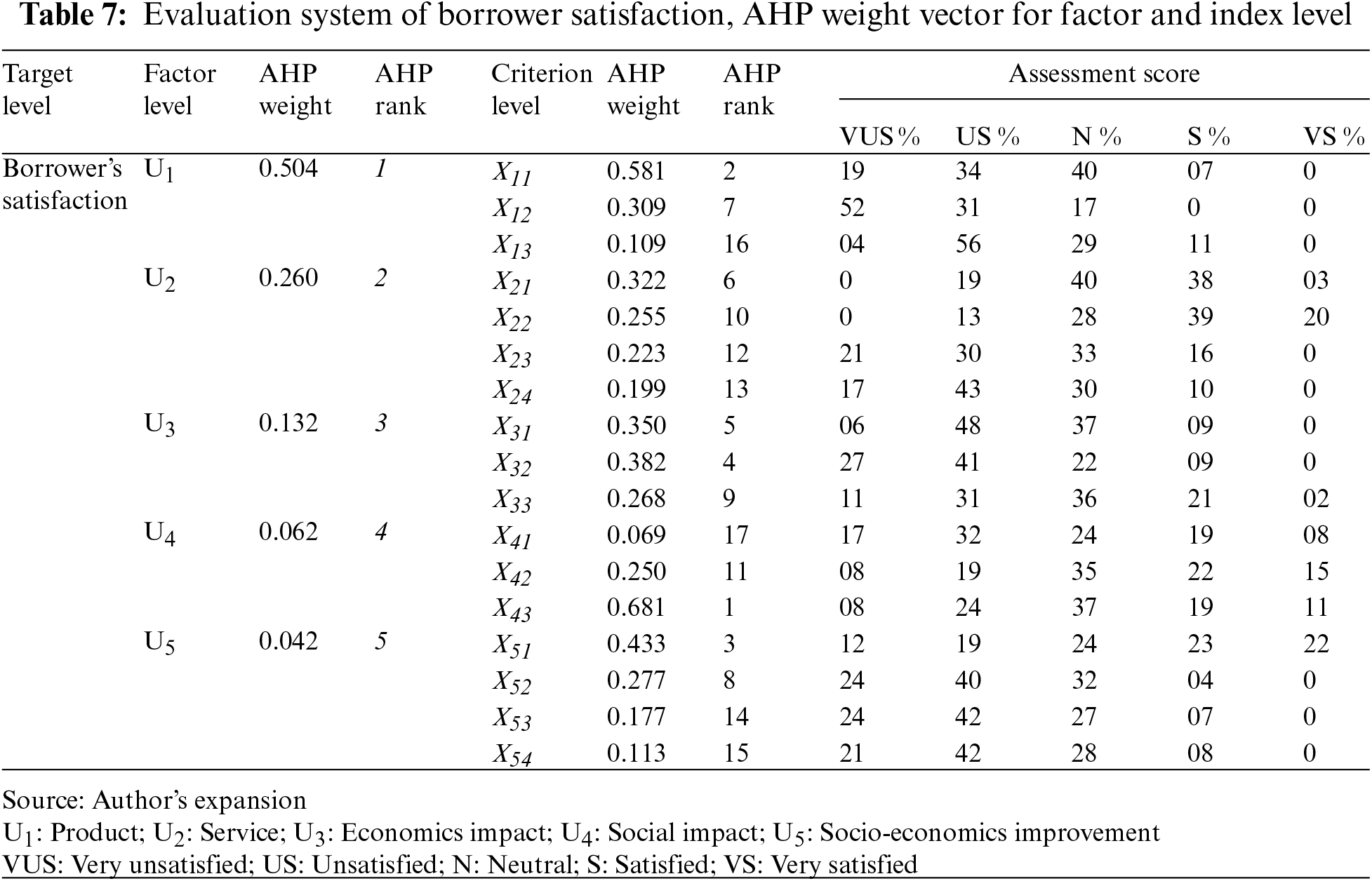

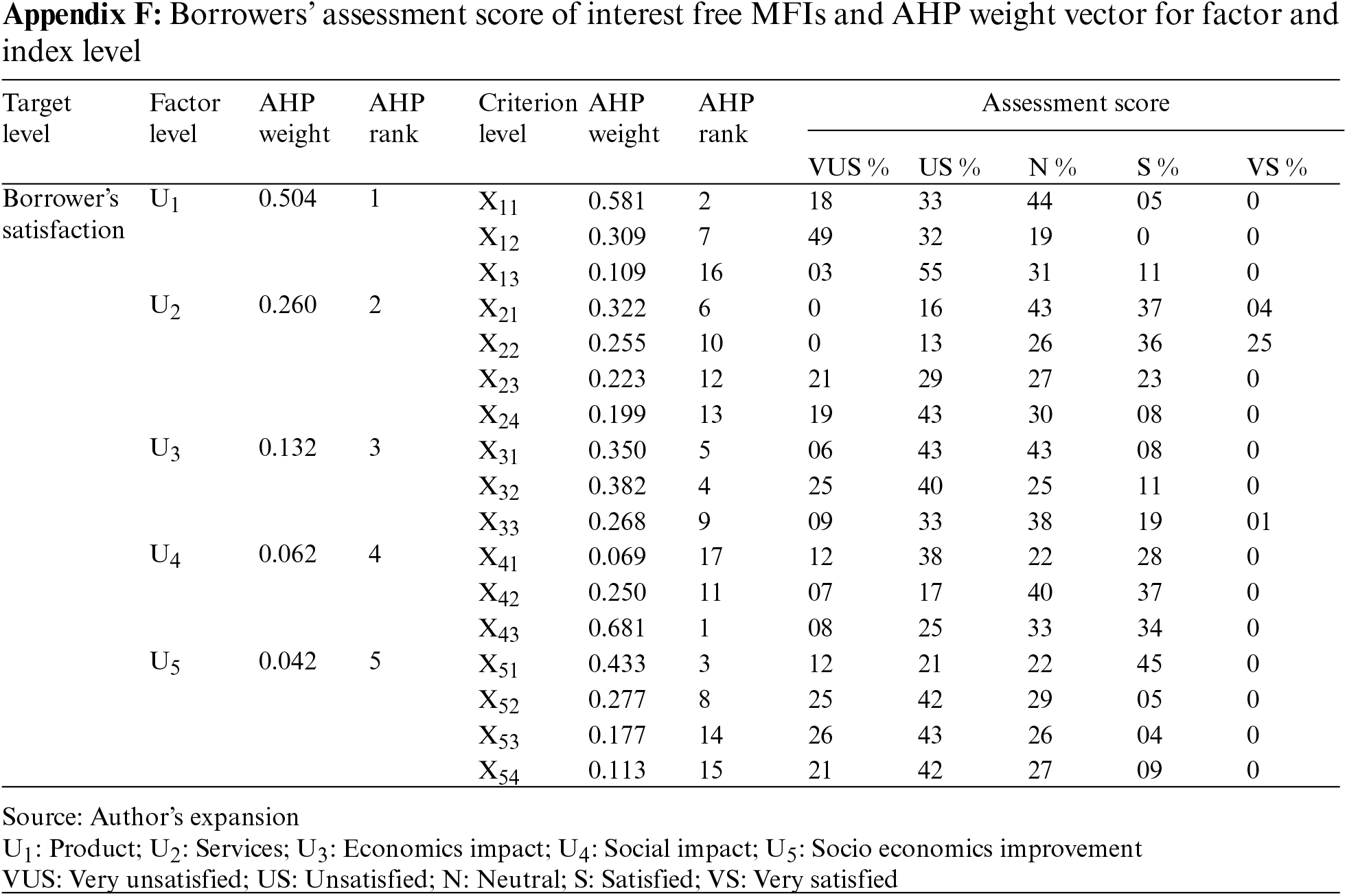

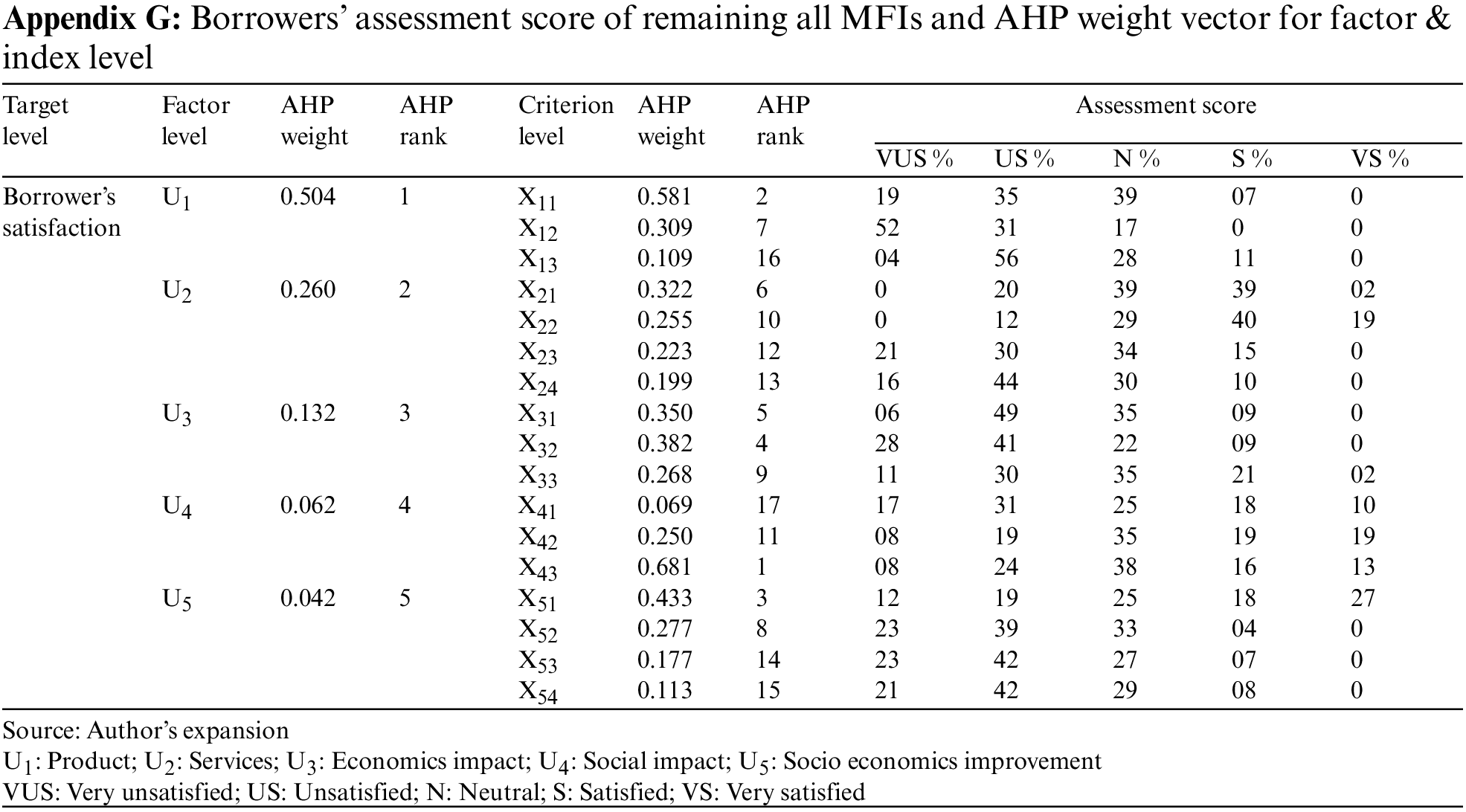

Borrowers’ satisfaction evaluation system comprises multiple fragments like borrowers’ assessment response, expert determination of weight and calculation by AHP, calculation of fuzzy comprehensive evaluation, and interpretation of results. Data were collected through face-to-face questionnaires from borrowers. Questionnaire information is divided into three parts; the first part includes basic information of borrowers, the second part consists of borrowers’ assessment about MFIs’ intention, and the last part possesses assessment score of evaluation matrix (Table 7) for each factor of index level. A listed score of borrower assessment in Table 7 is collective information of microfinance institutions. Similarly, separate data for interest-free microfinance and remaining MFIs are listed in Appendixes in F and G.

The AHP method calculates the weight for the criteria and index level of the borrower’s satisfaction evaluation system. Weights at the criterion level describe the importance of each factor concerning the others. The dimension “Product” has the highest importance and bear weight (0.504) while indicator “service” tolerates lower weight (0.260), other criterion places weight at a lower rank. Similarly, the index level of borrowers’ satisfaction evaluation system also bears weight according to prescribed rules. The weight for the index level is listed in Table 7 col.6 and rank is listed in col.7.

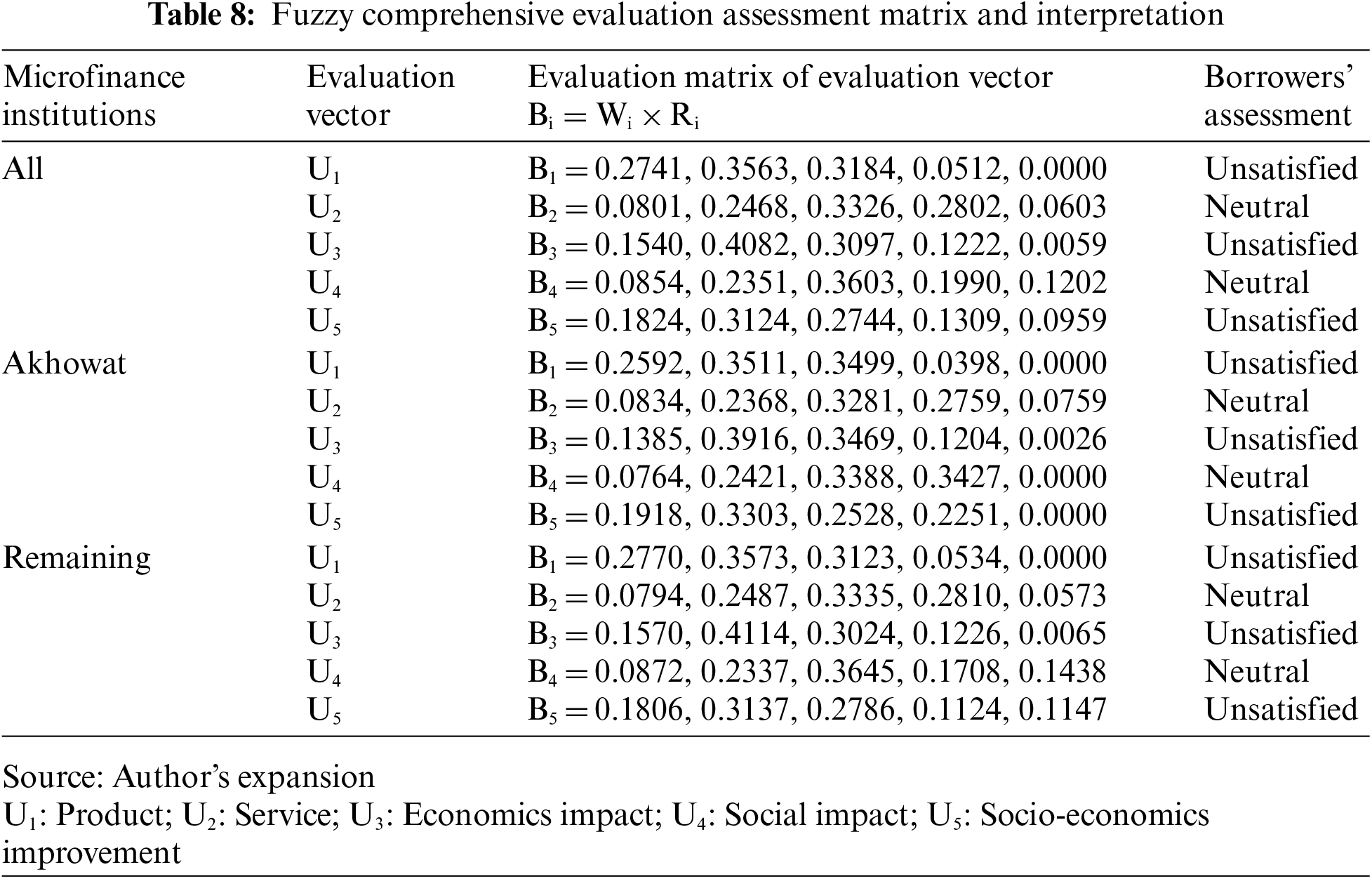

3.5 1st Level Fuzzy Comprehensive Evaluation for Borrowers’ Assessment

A first-level fuzzy comprehensive evaluation is quantified in the third column of Table 8 for all MFIs collectively, Akhowat Foundation MFI and remaining MFIs, respectively. The fuzzy evaluation response matrix and corresponding weight vector are given in Table 7 produces results for evaluation vector B in Table 8. Evaluation vectors B1, B2, B3, B4, and B5 give us helpful information. The second item of vector B1 is a bigger one, the second item of the evaluation vector corresponds to unsatisfied, so the criteria level, “Product,” bears result unsatisfied. In other words, we can interpret that Borrowers are not satisfied with the indexes (Amount of loan, Interest Rate of loan and transaction or services Charges) of criterion Product. However, criteria level service (Behavior of employees of MFIs) was found to be Neutral because the indexes (Access to loan and MFI’s employee behavior with borrowers before lending) assessed satisfactorily by the borrower, but indexes (MFI’s employees’ behavior with borrowers after lending and recovery in loan) assessed unsatisfactory by the borrower, therefore, collectively factor “Behavior of employees of MFIs” produce result neutral. The vectors B3, B4, and B5 interpretations are summarized in col.4 Table 8. Coincidentally, all MFIs results are identical with the Akhowat and remaining MFIs.

3.6 The Second Level Fuzzy Comprehensive Evaluation for Borrower’s Satisfaction

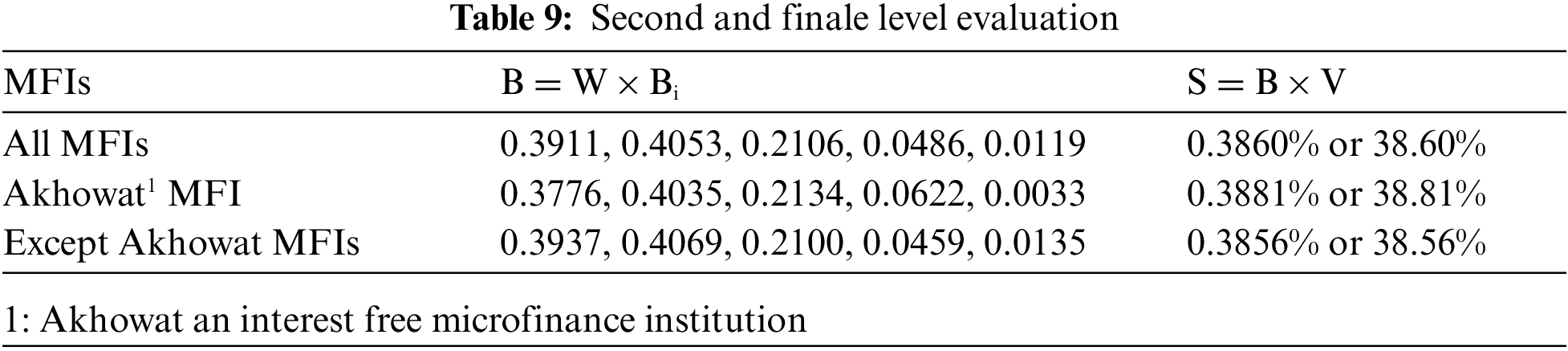

A second-level fuzzy comprehensive evaluation is the most important decision step for borrowers’ satisfaction, describing average and concluding explanations about factor level. Here we can make an overall judgment of satisfied and unsatisfied borrowers of microfinance institutions about all factors. This judgment is calculated as follows:

The second level fuzzy evaluation is calculated by the result matrix of the first level fuzzy evaluation and produces vector B. The maximum value in the result vector B for all microfinance institutions is 0.4053; for Akhowat microfinance, it is 0.4035, and for the remaining microfinance institutions, it is 0.4069 in Table 9 col.2. These maximum values of the result vector corresponding to the evaluation set (very unsatisfied, unsatisfied, neutral, satisfied, very satisfied) are projected as an unsatisfied result. This maximum number indicates that the maximum number of the respondents (borrowers) is unsatisfied with the products and services of microfinance institutions.

The final comprehensive evaluation “S” of the borrower’s assessment of microfinance institutions has been calculated by multiplying vector “B” of the second level fuzzy comprehensive evaluation with the evaluation vector “V” as in Table 9 col.3. The final score of the fuzzy comprehensive evaluation for all MFI lies somewhere between 0.2 and 0.4. This value indicates that the level of satisfaction of the borrower is 0.3860, or 38.60%, which corresponds to unsatisfied (Table 2). Similarly, the results of interest-free microfinance (0.3881) and remaining MFIs (0.3856) show that borrowers are unsatisfied with the products and services too. Microfinance institutions needed to revise their policies, redesign their products and improve their services regarding lending to facilitate poor borrowers.

Borrowers’ satisfaction with the product and services of microfinance institutions is seldom a debated topic in the literature [39]. The present study was exceptionally equipped for borrower assessment and perception about microfinance institutions. There are some similarities between the summary statistics of borrower information and previous studies, such as the fact that the majority of borrowers are illiterate [67] or have a lower level of education [52,68], a significant portion of women’s loans is controlled by their spouse [69], the monthly income level is also low [52,68], and the loan was not used for the intended purpose [24,70]. However, in response to multiple questions about the intentions of MFIs, borrowers percept that MFIs intend to earn profit only [67]. MFIs do not have any concern with the borrowers’ interests because MFIs stop monitoring borrowers’ business until the monitoring of loan usage can improve the performance of MFIs [40].

FCEM results for interest-free microfinance institutions describe that microfinance clients are not satisfied with the product and services of MFIs [71]. Results of the present study demonstrate that microfinance borrowers are not satisfied with the product of microfinance because the loan amount is not sufficient for any small-scale business [23,46]. While the cost of the loan, such as interest rate and other fees, are satisfactory to the borrower, the overall result makes the factor “product” unsatisfactory because the borrowers expected more than they got [72]. Interest-free microfinance institutions’ “services” are neutral because “access to loan and pre-lending checks “are unsatisfactory, whereas “after loan approval and loan recovery “generate a satisfactory assessment [17,73]. The factor “economic impact” is once again unsatisfactory for borrowers of interest-free microfinance institutions because, as previously stated, a small loan amount is insufficient for micro-enterprises. Micro enterprises with a small amount of loan cannot increase their income or save money because their earnings are only enough to meet their basic needs [7,17]. Consequently, the assessment of borrowers of interest-free microfinance institutions for the factor of “social impact” is neutral because microfinance meets their educational and health needs. On the contrary, the factor “socio-economic improvement” is also rated unsatisfactorily by the borrowers. The inability to reduce poverty and the failure to achieve economic improvement are the root causes of dissatisfaction.

The outcomes of microfinance institutions that charge interest rates are similar to those of interest-free financial institutions. Because of the high-interest rate and other charges, the factor “Product “received an unsatisfactory rating. In this case, although the amount of loan borrowed is in accordance with demand, the potential of small-scale businesses is insufficient to cover the costs of the loan (interest rate and other charges). The same issue has been addressed by numerous studies [74,75]. The services of microfinance institutions are also unsatisfactory for microfinance borrowers, as MFI employees become extremely harsh and abusive with the borrower after the loan has been disbursed [76,77]. It has been very difficult for borrowers to get by economically and socially up until a substantial percentage of them received loans from microfinance institutions. Several borrowers are taking advantage of loans across the world, but no persuasive proof has yet been discovered that characterizes the happiness of the response [78,79].

Measuring the satisfaction level of MFI borrowers was the prime objective of this study, which adopted a comprehensive evaluation method. The borrower’s intensity of satisfaction can be judged by the borrower’s response to unfussy statistics. Respondents have been utilizing MFI loan products for the last 1–3 years, but their average monthly household income is less than their average monthly expenditure. Furthermore, there is a flaw in the borrower’s source of income, the purpose of the loan, and the loan’s use of essential. Moreover, in this study, respondents also shared their experiences and assessed the intention of MFI. Based on the MFI borrower’s judgment, we conclude that microfinance institutions do not concern the customer or borrower’s benefits. MFI employees only monitor borrowers for saving and loan recovery. They never ask about the purpose of borrowing or business growth. Simply, we can say that MFI intended to earn a profit only because most respondents (borrowers) reported that MFI intended to reimburse their lending amount and interest amount.

A fuzzy comprehensive evaluation method is adopted in conjunction with the analytical hierarchy process for the borrower’s satisfaction. In the literature, ignoring factors has been identified as necessary for determining borrowers’ satisfaction. MFI’s hard and soft services have five dimensions: (1) product, (2) services of employees of MFIs, (3) economic impact, (4) social impact, and (5) socio-economic improvement. These dimensions further comprise 17 items, undoubtedly associated with borrower satisfaction. Contemporary ailments of microfinance products and services are not satisfactory, even though interest-free microfinance foundations are also not performing nicely because the result of all the items in the five dimensions is assessed as unsatisfactory.

The results show that different items or criteria of index level produce some mixed responses. The average result of factor level “product” shows that borrowers are unsatisfied with the microfinance institutions. Still, item of factor level like the loan amount is unsatisfactory for borrowers because the offered loan amount is bare. Except for interest-free MFI, the interest rate is also unsatisfactory for MFI borrowers. Transaction and services charges are unsatisfactory again for the borrower because they make the loan expensive. The index level of the second factor (Services of employees of MFIs) was evaluated as neutral because borrower responses were satisfactory for two items (Access to loan and behavior of employees of MFI before approval) and dissatisfactory for the other two items of this factor. It is common for MFIs to adopt polite behavior and give easy access to customers who are willing to borrow, but they become strict and harsh with the customers after the loan is released. Criterion. The economic impact is also unsatisfactory for borrowers because they do not earn enough income to save money and pay a monthly installment of the loan. Borrowers’ satisfaction is not significant for the indexes of social impact, but borrowers are not satisfied regarding socio-economic improvement factors. Most Borrowers complain that it has become challenging to maintain their necessities and living standards. Borrowers’ dreams of economic improvement and escaping poverty become impossible. Microfinance institutions needed to revise their policies, redesign their product and improve lending services to facilitate poor borrowers. Government should play its role in the betterment of poor borrowers because microfinance institutions are not facilitating the poor and exploiting them, even though microfinance institutions intend to concern their benefits.

Borrowers’ satisfaction can be increased if and only if microfinance institutions increase the loan amount, lower interest rate, decrease processing or transaction charges, hire polite and professional staff, proper monitoring of borrower’s business, and training sessions for staff and borrowers. Simply, both the government and MFIs can enhance their performance and modify their policies in the best interests of borrowers. It is necessary for societies to gradually shift away from investing in microfinance and toward supporting large, labor-intensive businesses if they are to be effective in assisting the poor. Because market-based solutions will never be sufficient on their own, governments must ensure that they meet their obligations under the agreement between now and the signing of the agreement.

Acknowledgement: Special thanks to the participant, contemporaries and instructors regarding inspiration, direction and assistance to accomplish this milestone. The third author (Harish Garg) is grateful to DST-FIST Grant SR/FST/MS-1/2017/13 for providing technical support.

Funding Statement: The authors received no specific funding for this study.

Conflicts of Interest: The authors declare that they have no conflicts of interest to report regarding the present study.

References

1. Matin, I., Hulme, D., Rutherford, S. (2002). Finance for the poor: From microcredit to micro financial services. Journal of International Development, 14(2), 273–294. DOI 10.1002/jid.874. [Google Scholar] [CrossRef]

2. Elahi, E., Abid, M., Zhang, L., Haq, S. U., Sahito, J. G. M. (2018). Agricultural advisory and financial services; farm level access, outreach and impact in a mixed cropping district of Punjab, Pakistan. Land Use Policy, 71, 249–260. DOI 10.1016/j.landusepol.2017.12.006. [Google Scholar] [CrossRef]

3. Mahmud, K. T. (2011). Small credit for big hope: A case study on bangladesh. Republic of Moldova: AP Lambert Academic Publishing. [Google Scholar]

4. Peng, B., Zhang, X., Elahi, E., Wan, A. (2022). Evolution of spatial–temporal characteristics and financial development as an influencing factor of green ecology. Environment, Development and Sustainability, 24, 789–809. DOI 10.1007/s10668-021-01469-y. [Google Scholar] [CrossRef]

5. Zhang, Q. (2017). Does microfinance reduce poverty? Some international evidence. The B.E. Journal of Macroeconomics, 17(2), 20160011. DOI 10.1515/bejm-2016-0011. [Google Scholar] [CrossRef]

6. Weber, O. (2013). Impact measurement in microfinance: Is the measurement of the social return on investment an innovation in microfinance? Journal of Innovation Economics & Management, 1, 149–171. DOI 10.3917/jie.011.0149. [Google Scholar] [CrossRef]

7. Al-Shami, S. S. A., Majid, I. B. A., Mokhtar, S. H., Rashid, N. A., Hamid, M. S. R. B. A. (2013). The role of microfinance services on the wellbeing of poor clients: Cases studies from Malaysia and Yemen. Asian Social Science, 10, 230–242. DOI 10.5539/ass.v10n1p230. [Google Scholar] [CrossRef]

8. Mecha, N. S. (2017). Effect of microfinance on poverty reduction: A critical scrutiny of theoretical literature. Global Journal of Commerce & Management Perspective, 6, 16–33. [Google Scholar]

9. Montgomery, H., Weiss, J. (2005). Great expectations: Microfinance and poverty reduction in Asia and Latin America. Oxford Development Studies, 33(3--4), 391--416. [Google Scholar]

10. Jason, H. (2015). The microfinance delusion who really win? https://blogs.lse.ac.uk/internationaldevelopment/2015/06/11/jason-hickel-the-microfinance-delusion-who-really-wins/. [Google Scholar]

11. Khan, T. A., Khan, F. A., Violinda, Q., Aasir, I., Jian, S. (2020). Microfinance facility for rural women entrepreneurs in Pakistan: An empirical analysis. Agriculture, 10, 1–17. DOI 10.3390/agriculture10030054. [Google Scholar] [CrossRef]

12. Khan, W., Shaorong, S., Ullah, I. (2017). Doing business with the poor: The rules and impact of the microfinance institutions. Economic Research-Ekonomska Istrazivanja, 30, 951–963. DOI 10.1080/1331677X.2017.1314790. [Google Scholar] [CrossRef]

13. Uddin, A. (2018). Microfinance and poverty nexus: Leverage spillover. Chittagong: University of Creative Technology. DOI 10.13140/RG.2.2.30272.43528. [Google Scholar] [CrossRef]

14. Roberts, P. W. (2013). The profit orientation of microfinance institutions and effective interest rates. World Development, 41, 120–131. DOI 10.1016/j.worlddev.2012.05.022. [Google Scholar] [CrossRef]

15. Daas, Y., Leuven, K. (2018). Cons of microfinance: A case study of Andhra Pradesh. Development Actors and Paradigms, 23(14), 1–23. [Google Scholar]

16. Attanasio, O., Augsburg, B., De, H. R., Fitzsimons, E., Harmgart, H. (2015). The impacts of microfinance: Evidence from joint-liability lending in Mongolia. American Economic Journal: Applied Economics, 7(190–122. DOI 10.1257/app.20130489. [Google Scholar] [CrossRef]

17. Terberger, E. (2013). The microfinance approach: Does it deliver on its promise? In: Microfinance 3.0, pp. 181–195. Springer, Berlin, Heidelberg. DOI 10.1007/978-3-642-41704-7. [Google Scholar] [CrossRef]

18. Banerjee, S. B., Jackson, L. (2017). Microfinance and the business of poverty reduction: Critical perspectives from rural Bangladesh. Human Relations, 70, 63–91. DOI 10.1177/0018726716640865. [Google Scholar] [CrossRef]

19. Elizabeth, M. (2016). Why the microfinance model won. https://www.worldfinance.com/special-reports/why-the-microfinance-model-wont-solve-the-global-poverty-crisis. [Google Scholar]

20. Cull, R. (2015). Does microfinance still hold promise for reaching the poor? https://www.worldbank.org/en/news/feature/2015/03/30/does-microfinance-still-hold-promise-for-reaching-the-poor. [Google Scholar]

21. Jahiruddin, A. T. M., Short, P., Dressler, W., Khan, M. A. (2011). Can microcredit worsen poverty? Cases of exacerbated poverty in Bangladesh. Development in Practice, 21, 1109–1121. DOI 10.1080/09614524.2011.607155. [Google Scholar] [CrossRef]

22. Myhre, D., Remenyi, J. (1992). Where credit is due: Income-generating programs for the poor in developing countries (Book review). Rural Sociology, 57(1), 114. [Google Scholar]

23. James, M. (2010). Microcredit a death trap for poor. https://www.bbc.com/news/business-11664632. [Google Scholar]

24. Mahmood, T., Bakhsh, A. (2020). Microfinance is a non-productive and expensive source of borrowing: A case study of District Sargodha (Pakistan). Journal of Economic Impact, 2, 1–5. DOI 10.52223/jei0201201. [Google Scholar] [CrossRef]

25. Ali, S., Asghar, M., Ayaz, M., Yousuf, M. U. (2015). The economic impact of microfinance: A comparative analysis of small enterprises. Journal of Applied Environmental and Biological Sciences, 5(5), 280–287. [Google Scholar]

26. Maitrot, M., Nino-Zarazua, M. (2017). Poverty and wellbeing impacts of microfinance: What do we know? WIDER Working Paper, 190, 1–39. DOI 10.2139/ssrn.3076781. [Google Scholar] [CrossRef]

27. Bateman, M. (2014). The rise and fall of muhammad younus and the microcredit model. International Development Studies, 1(1), 1–36. DOI 10.2139/ssrn.2385190. [Google Scholar] [CrossRef]

28. Tambe, S., Patnaik, S., Bisaria, J., Pandey, A., Sarma, U. K. et al. (2017). How does government microfinance impact the rural poor? Evidence from Madhya Pradesh. Economic and Political Weekly, 52(52), 81–87. [Google Scholar]

29. Wykstra, S. (2019). Microcredit, explained: How microcredit can help the world’s poorest. https://www.vox.com/future-perfect/2019/1/15/18182167/microcredit-microfinance-poverty-grameen-bank->yunus. [Google Scholar]

30. Sooryamoorthy, R. (2007). Microcredit for microenterprises or for immediate consumption needs? Sociological Bulletin, 56, 401–413. DOI 10.1177/0038022920070305. [Google Scholar] [CrossRef]

31. Five Talents (2017). Five reasons microcredit fails in the fight against poverty. https://fivetalents.org/blog/2017/8/15/five-reasons-microcredit-fails-in-the-fight-against-poverty. [Google Scholar]

32. Bollinger, B., Yao, S. (2018). Risk transfer versus cost reduction on two-sided microfinance platforms. Quantitative Marketing and Economics, 16(3), 251–287. DOI 10.1007/s11129-018-9198-0. [Google Scholar] [CrossRef]

33. Kato, M., Kratzer, J. (2013). Empowering women through microfinance: Evidence from Tanzania. ACRN Journal of Entrepreneurship Perspectives, 2(1), 31–59. [Google Scholar]

34. Kiiru, J. M. M. (2007). Microfinance: Getting money to the poor or making money out of the poor? Finance & Bien Commun, 2(27), 63–73. [Google Scholar]

35. Bhuiyan, M. F., Ivlevs, A. (2019). Micro-entrepreneurship and subjective well-being: Evidence from rural Bangladesh. Journal of Business Venturing, 34, 625–645. DOI 10.1016/j.jbusvent.2018.09.005. [Google Scholar] [CrossRef]

36. Yaseen, G., Masood, V., Ahmed, F., Muzammi, R. (2020). Analysis of client satisfaction–A case of customers’ containment availing services from micro finance institutions. International Journal of Experiential Learning & Case Studies, 5(2), 281–292. DOI 10.22555/ijelcs.v5i2.52. [Google Scholar] [CrossRef]

37. Field, E., Pande, R., Papp, J., Rigol, N. (2013). Does the classic microfinance model discourage entrepreneurship among the poor? Experimental evidence from India. American Economic Review, 103, 2196–2226. DOI 10.1257/aer.103.6.2196. [Google Scholar] [CrossRef]

38. Sophy, P. U. M., Valantina, T. (2010). Assessing clients’ satisfaction of microfinance institutions in Cambodia–A case study of AMK. Environmental and Rural Development, 1(1), 80–87. [Google Scholar]

39. Kanyurhi, E. B. (2017). Customer satisfaction with the services of microfinance institutions: Scale development and validation. Strategic Change, 26, 563–574. DOI 10.1002/jsc.2168. [Google Scholar] [CrossRef]

40. Imai, K. S., Azam, M. S. (2012). Does microfinance reduce poverty in Bangladesh? New evidence from household panel data. Journal of Development Studies, 48, 633–653. DOI 10.1080/00220388.2012.661853. [Google Scholar] [CrossRef]

41. Yaidoo, L. I. K., Vishwanatha, K. (2018). Microfinance: A review of the literature-development strategy recommendations for improving low income and poverty reduction in Ghana. International Research Journal of Social Sciences, 7, 6–20. [Google Scholar]

42. Chambers, R. (1995). Poverty and livelihoods: Whose reality counts? Environment and Urbanization, 7, 173–204. DOI 10.1177/095624789500700106. [Google Scholar] [CrossRef]

43. Veesar, G. Y., Rahman, M., Hassan, M. (2020). A comparative study of customers satisfaction of microfinance in Sindh, Pakistan. Global Management Journal for Academic & Corporate Studies, 10, 106–118. [Google Scholar]

44. Agyei-Boapeah, H., Adu-Boakye, S., Amankwah-Amoah, J., Brodmann, J. (2020). Customer satisfaction in microfinance institutions: Insights from Ghana. Enterprise Development and Microfinance, 31(3), 164–193. DOI 10.3362/1755-1986.19-00016. [Google Scholar] [CrossRef]

45. Ashraf, M. A., Noor, M. S. I. (2010). Microfinance customer (Borrower) experience towards the effectiveness of MFIs in Bangladesh: An exploratory analysis. ABAC, 30, 12–25. [Google Scholar]

46. Kingsbury, K. (2007). Microfinance: Lending a hand. Time. http://content.time.com/time/subscriber/article/0,33009,1607256,00.html. [Google Scholar]

47. Bakhtiari, S. (2006). Microfinance and poverty reduction: Some international evidence. International Business & Economics Research Journal, 5(12), 125–137. DOI 10.19030/iber.v5i12.3550. [Google Scholar] [CrossRef]

48. Drašarová, M., Srnec, K. (2016). Microfinance as a tool for poverty reduction: A study in Mexico. Mediterranean Journal of Social Sciences, 7(5), 1–18. DOI 10.5901/mjss.2016.v7n5p18. [Google Scholar] [CrossRef]

49. Nawaz, S. (2010). Microfinance and poverty reduction: Evidence from a village study in Bangladesh. Journal of Asian and African Studies, 45(6), 670–683. DOI 10.1177/0021909610383812. [Google Scholar] [CrossRef]

50. Chawla, S. (2013). Microfinance: A tool for poverty alleviation. Ijress, 3, 157–167. [Google Scholar]

51. Alaoui, Y. L., Tkiouat, M. (2017). Assessing the performance of microfinance lending process using AHP-fuzzy comprehensive evaluation method: Moroccan case study. International Journal of Engineering Business Management, 9, 1–11. DOI 10.1177/1847979017736692. [Google Scholar] [CrossRef]

52. Luqman, M., Xu, S., Wen, Y., Yaseen, M., Gao, L. (2016). Impact of micro-credit on livelihoods of rural poor in the Punjab, Pakistan. Open Journal of Social Sciences, 4, 305–313. DOI 10.4236/jss.2016.45034. [Google Scholar] [CrossRef]

53. Iqbal, S., Zhang, C. (2020). A new hesitant fuzzy-based forecasting method integrated with clustering and modified smoothing approach. International Journal of Fuzzy Systems, 22, 1104–1117. DOI 10.1007/s40815-020-00829-6. [Google Scholar] [CrossRef]

54. Iqbal, S., Zhang, C., Arif, M., Hassan, M., Ahmad, S. (2020). A new fuzzy time series forecasting method based on clustering and weighted average approach. Journal of Intelligent and Fuzzy Systems, 38, 6089–6098 DOI 10.3233/JIFS-179693. [Google Scholar] [CrossRef]

55. Hassan, S. G., Iqbal, S., Garg, H., Hassan. H., Shuangyin et al. (2020). Designing intuitionistic fuzzy forecasting model combined with information granules and weighted association reasoning. IEEE Access, 8, 141090–141103. DOI 10.1109/Access.6287639. [Google Scholar] [CrossRef]

56. Wan, S., Dong, J., Chen, S. M. (2021). Fuzzy best-worst method based on generalized interval-valued trapezoidal fuzzy numbers for multi-criteria decision-making. Information Sciences, 573, 493–518. DOI 10.1016/j.ins.2021.03.038. [Google Scholar] [CrossRef]

57. Ünver, M., Olgun, M., Türkarslan, E. (2022). Cosine and cotangent similarity measures based on Choquet integral for spherical fuzzy sets and applications to pattern recognition. Journal of Computational and Cognitive Engineering, 1(1), 21–31. DOI 10.47852/bonviewJCCE2022010105. [Google Scholar] [CrossRef]

58. Muhiuddin, G., Mahboob, A., Elnair, M. E. (2022). A new study based on fuzzy bi-Γ-ideals in ordered-Γ-semigroups. Journal of Computational and Cognitive Engineering, 1(1), 42–46. DOI 10.47852/bonviewJCCE19919205514. [Google Scholar] [CrossRef]

59. Bennouna, G., Tkiouat, M. (2018). Fuzzy logic approach applied to credit scoring for microfinance in Morocco. Procedia Computer Science, 127, 274–283. DOI 10.1016/j.procs.2018.01.123. [Google Scholar] [CrossRef]

60. Lamrani Alaoui, Y., Tkiouat, M. (2019). Modeling customer satisfaction in microfinance sector: A fuzzy Bayesian networks approach. International Journal of Engineering Business Management, 11, 1–13. DOI 10.1177/1847979019869533. [Google Scholar] [CrossRef]

61. Shi, B., Chen, N., Wang, J. (2016). A credit rating model of microfinance based on fuzzy cluster analysis and fuzzy pattern recognition: Empirical evidence from Chinese 2, 157 small private businesses. Journal of Intelligent & Fuzzy Systems, 31, 3095–3102. DOI 10.3233/JIFS-169195. [Google Scholar] [CrossRef]

62. Zhou, R., Chan, A. H. S. (2017). Using a fuzzy comprehensive evaluation method to determine product usability: A proposed theoretical framework. Work, 56(1), 9–19. DOI 10.3233/WOR-162474. [Google Scholar] [CrossRef]

63. Zhao, X., Li, X., Yue, Q. (2011). Application of fuzzy comprehensive evaluation method in the equipment supply support effectiveness evaluation. Communications in Computer and Information Science, 227, 700–705. DOI 10.1007/978-3-642-23226-8. [Google Scholar] [CrossRef]

64. Tong, L., He, K., Zhang, Q., Liu, S. (2020). Survey of urban greenway satisfaction based on a fuzzy comprehensive evaluation. E3S Web of Conferences. 2nd International Symposium on Architecture Research Frontiers and Ecological Environment (ARFEE 2019), vol. 1, pp. 1–9. DOI 10.1051/e3sconf/202014301010. [Google Scholar] [CrossRef]

65. Yang, M., Hou, D., Wang, C. (2010). The fuzzy comprehensive evaluation model for highway service satisfaction. International Conference on Optoelectronics and Image Processing, vol. 2, pp. 552–556. DOI 10.1109/ICOIP.2010.179. [Google Scholar] [CrossRef]

66. Dong, J., Wan, S., Chen, S. M. (2021). Fuzzy best-worst method based on triangular fuzzy numbers for multi-criteria decision-making. Information Sciences, 547, 1080–1104. DOI 10.1016/j.ins.2020.09.014. [Google Scholar] [CrossRef]

67. Mitra, S. K. (2009). Exploitative microfinance interest rates. Asian Social Science, 5(5), 87–93. DOI 10.5539/ass.v5n5p87. [Google Scholar] [CrossRef]

68. Medatwal, C. (2013). Role of microfinance in empowerment of women: A study of selected experiments in Rajasthan. Pacific Business Review International, 5, 22–31. [Google Scholar]

69. Brau, J. C., Woller, G. M. (2004). Microfinance: A comprehensive review of the existing literature. Journal of Entrepreneurial Finance, 9, 1–28. [Google Scholar]

70. Hossain, M. (1993). Credit for alleviation of rural poverty: The grameen bank in Bangladesh. International Food Policy Research Institute, 65(1), 1–94. [Google Scholar]

71. Aziza, G. D. (2013). The role of microfinance in poverty reduction: The case of specialized financial promotion institute. Addis Ababa: Addis Ababa University. [Google Scholar]

72. Reifner, U. (2004). Micro-lending in affluent societies: Truths and misconceptions. Finance and Bien Communication, 3, 24–32. DOI 10.3917/fbc.020.0024. [Google Scholar] [CrossRef]

73. Mosley, P. (2001). Microfinance and poverty in Bolivia. Journal of Development Studies, 37(4), 101–132. DOI 10.1080/00220380412331322061. [Google Scholar] [CrossRef]

74. Wickramasinghe, V., Fernando, D. (2017). Use of microcredit for household income and consumption smoothing by low-income communities. International Journal of Consumer Studies, 41, 647–658. DOI 10.1111/ijcs.12378. [Google Scholar] [CrossRef]

75. Hudon, M., Sandberg, J. (2013). The ethical crisis in microfinance: Issues, findings, and implications. Business Ethics Quarterly, 23(4), 561–589. DOI 10.5840/beq201323440. [Google Scholar] [CrossRef]

76. Ali, I., Hatta, Z. A., Azman, A., Islam, S. (2017). Microfinance as a development and poverty alleviation tool in rural Bangladesh: A critical assessment. Asian Social Work and Policy Review, 11, 4–15. DOI 10.1111/aswp.12106. [Google Scholar] [CrossRef]

77. Ganle, J. K., Afriyie, K., Segbefia, A. Y. (2015). Microcredit: Empowerment and disempowerment of rural women in Ghana. World Development, 66, 335–345. DOI 10.1016/j.worlddev.2014.08.027. [Google Scholar] [CrossRef]

78. Karnani, A. (2007). Microfinance misses its mark. In: Stanford social innovation review, pp. 33–40. [Google Scholar]

79. Milana, C., Ashta, A. (2020). Microfinance and financial inclusion: Challenges and opportunities. Strategic Change, 29(3), 257–266. DOI 10.1002/jsc.2339. [Google Scholar] [CrossRef]

Cite This Article

Copyright © 2023 The Author(s). Published by Tech Science Press.

Copyright © 2023 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools