Open Access

Open Access

ARTICLE

HNND: Hybrid Neural Network Detection for Blockchain Abnormal Transaction Behaviors

Henan Province Key Laboratory of Information Security, Information Engineering University, Zhengzhou, 450000, China

* Corresponding Author: Lifeng Cao. Email:

Computers, Materials & Continua 2025, 83(3), 4775-4794. https://doi.org/10.32604/cmc.2025.061964

Received 06 December 2024; Accepted 04 March 2025; Issue published 19 May 2025

Abstract

Blockchain platforms with the unique characteristics of anonymity, decentralization, and transparency of their transactions, which are faced with abnormal activities such as money laundering, phishing scams, and fraudulent behavior, posing a serious threat to account asset security. For these potential security risks, this paper proposes a hybrid neural network detection method (HNND) that learns multiple types of account features and enhances fusion information among them to effectively detect abnormal transaction behaviors in the blockchain. In HNND, the Temporal Transaction Graph Attention Network (T2GAT) is first designed to learn biased aggregation representation of multi-attribute transactions among nodes, which can capture key temporal information from node neighborhood transactions. Then, the Graph Convolutional Network (GCN) is adopted which captures abstract structural features of the transaction network. Further, the Stacked Denoising Autoencode (SDA) is developed to achieve adaptive fusion of thses features from different modules. Moreover, the SDA enhances robustness and generalization ability of node representation, leading to higher binary classification accuracy in detecting abnormal behaviors of blockchain accounts. Evaluations on a real-world abnormal transaction dataset demonstrate great advantages of the proposed HNND method over other compared methods.Keywords

Blockchain is a distributed encrypted ledger composed of consensus mechanisms, smart contracts and other techniques, which provides a secure platform for transactions among non-trusting participants [1–5]. In the ongoing digital transformation, blockchain technology, characterized by its inherent decentralization, transparency, and cryptographic security [6,7], is increasingly recognized as a cornerstone for next-generation digital infrastructures [8]. In recent years, blockchain technology has been widely and extensively used in areas such as finance [9], healthcare [10–12] and the internet of things [13,14]. In which, virtual digital cryptocurrencies have emerged in large numbers and entered the financial market, making it possible for users to conduct P2P anonymous transactions and securely store assets in a distributed manner. However, the substantial market value of blockchain cryptocurrencies has attracted the attention of malicious actors, leading to attacks that pose potential security risks to the blockchain ecosystem.

In recent years, an increasing number of criminals have exploited the anonymity of blockchain to conduct illegal activities in internet and financial domains [15]. Deceptive practices have proliferated in blockchain networks, as attackers lure users into investing in Ponzi schemes by promising attractive future returns. At present, a large number of nefarious blockchain accounts have been active and engaged in money laundering, phishing, and other unlawful behaviors [16,17]. According to a report from the SAFEIS Security Research Institute, the blockchain field experienced numerous security incidents in 2022 that caused significant economic damage on a global scale. These incidents included vulnerability exploits, data breaches, phishing attacks, and price manipulation, resulting in total losses exceeding $75.3 billion. These security concerns not only resulted in great financial setbacks for investors but also impeded the adoption and advancement of blockchain technology. Therefore, it is imperative to identify anomalous transactional behaviors in the blockchain network environment to ensure its regular and stable operation [18,19].

Blockchain technology employs a distributed ledger to publicly record transactions, ensuring transparency and easy access to data. The extensive availability of these data records offers sufficient samples for the detection of abnormal transaction behaviors. However, the large and anonymous user base poses challenges for anomaly detection. Hand-engineered features from the complex transaction network may overlook important information, such as temporal patterns and node interactions, thereby limiting the ability to accurately identify transaction behaviors. To address these limitations, network embedding-based detection methods have been developed. These methods combine various neural network modules to capture temporal and structural transaction features of malicious nodes [20]. Despite performing well when used individually, the integration among different modules sometimes fails to achieve optimal information sharing, which can instead lead to a decrease in detection accuracy. Therefore, by improving feature information fusion strategies, it is possible to more effectively uncover latent patterns within complex transaction networks, thereby enhancing the capability to identify abnormal transaction behaviors.

To overcome the above difficulties, this paper proposes a hybrid neural network detection method (HNND) with T2GAT, GCN and SDA to learn and optimize multiple types of node features to effectively detect abnormal transaction behaviors on the blockchain. Specifically, a T2GAT is devised to fully capture temporal information from the records of blockchain historical transactions, GCN is employed to learn network structure information, and SDA is proposed for adaptive fusion of different levels of features and improvement of node representation ability. These components collectively enhance the accuracy of abnormal transaction behavior detection on the blockchain. The main contributions of this paper are as follows:

1. A novel hybrid neural network detection method is developed to enhence blockchain abnormal transaction detection by learning node representations, such as general statistical features (GSFs), temporal transaction features (TTFs), and abstract structural features (ASFs).

2. SDA generates more robust embedding representations through the adaptive fusion of features learned from different modules to improve overall detection performance of the model.

3. Some extensive experiments on real-world blockchain abnormal transaction dataset are conducted and the experimental results show that HNND outperforms state-of-the-art methods on multiple evaluation metrics.

The remaining parts of this paper are organized as follows. Some related works are reviewed in Section 2. Section 3 presentes the HNND method in detail. Section 4 provides the details of the experiments followed by the conclusion in Section 5.

Money laundering, fraud, and other illicit transactions on blockchain pose significant challenges and risks to the stable operation of these systems. Therefore, it is imperative to promptly identify such malicious transactions and accounts. For the abnormal transaction behaviors detection problem on Blockchain, there are two main categories of existing methods: machine learning-based anomaly detection methods and network embedding-based anomaly detection methods.

2.1 Traditional Machine Learning-Base Blockchain Anomaly Detection Methods

Traditional machine learning-based blockchain anomaly detection methods automatically learn abnormal patterns in blockchain networks by leveraging datasets consisting of hand-engineered features. Researchers have extracted indicative features of transaction behaviors to judge whether blockchain exhibits abnormal activities. Farrugia et al. pointed out the three most influential features for detecting illicit Ethereum accounts [21] and Ibrahim et al. used attribute association evaluation to select six key transaction features from historical transactions [22]. These features include transaction amounts, balances, durations of activities, among others [23]. Moreover, Kumar et al. additionally developed a set of 18 features for smart contract accounts concerning contract creation and invocation [24].

From the perspective of graph neighborhood, Jourdan et al. leveraged discrete-time graphs to capture temporal features, centrality measures, and other transaction patterns of anonymous Bitcoin accounts [25]. Wu et al. introduced the concept of Attribute-Temporal Heterogeneous (ATH) motifs, and demonstrated the significance of ATH motif features in identifying transactions associated with Bitcoin mixing services [16]. Chen et al. captured the cascade statistical features of nodes and higher-order neighbors based on transaction graphs [26]. These transaction graph-based method consequently augmenting its capacity to detect illicit transaction nodes. However, conventional feature extraction methods are unable to uncover the deeper information on blockchain transaction network.

2.2 Network Embedding-Base Blockchain Anomaly Detection Methods

Blockchain anomaly detection applies some network embedding methods, such as Deepwalk [27], Node2Vec [28] and Graph Convolutional Networks (GCN) [29] to mine latent abstract features. These methods can capture network structural and attribute information from blockchain transaction graphs by transforming network structures into low-dimensional spaces to detect anomalous transaction behaviors. Yuan et al. proposed Node2Vec to uncover abnormal transaction activities [30]. It mainly defined an adjustable random walk strategy to obtain neighborhood vector of nodes. Wu et al. designed Trans2Vec, building upon Node2Vec, wherein the sampling process is not random but biased according to the most recent transaction between two nodes [31].

Chen et al. designed a graph neural network method called E-GCN, to detect anomalous account nodes [32]. The E-GCN learned structural features of transaction networks by drawing on techniques from VGAE [33] and DOMINANT [34]. Moreover, Sun et al. proposed the LSTM Transaction Tree Classifier (LSTM-TC) to identify mixed coin transactions in Bitcoin [35]. They extracted the temporal behavior features of transactions by constructing transaction trees. Some methods learned temporal behavior patterns in transaction sequences to enhance edge representation of nodes, utilizing an LSTM model [36] and a multi-head self-attention mechanism [17]. Specifically, Wang et al. employed time function encoding to capture periodicity features, enabling them to precisely discern the activity cycles and behavioral patterns of anomalous accounts [17]. Nonetheless, there have been few methods that learn graph-based node embedding of transaction networks from multiple angles to capture both temporal transaction information and network structural details. Meanwhile, existing methods inadequately address the issue of noise interference in the concatenation of embedding vectors across different levels.

Therefore, the method proposed in this paper facilitates the simultaneous learning of both node embedding and graph embedding for account transaction graphs. And it accounts for noise effects arising from the concatenation of features at distinct hierarchical levels. Our method can improve precision and robustness in blockchain anomaly transaction detection.

The blockchain anomaly detection method proposed in this paper employs a hybrid neural network to simultaneously learn diverse embedding representations that contain both temporal transaction patterns and network structural features. In the process of multi-level feature fusion, this method improves the generalization ability of the detection model by adaptively fusing features and adding noise interference to enhance feature robustness. This section introduces the proposed HNND method and analyzes from several aspects, including the overall framework, problem definition and data processing, features extraction (including GSFs, TTFs and ASFs), multi-feature fusion, and binary classification detection.

The hybrid neural network detection (HNND) framework for blockchain abnormal transaction behavior is presented in Fig. 1, which integrates the T2GAT, GCN, and SDA modules. HNND first constructs a temporal transaction multi-directed graph based on historical blockchain transaction data and randomly samples a certain number of subgraphs. It extracts general statistical features (GSFs), temporal transaction features (TTFs), and abstract structural features (ASFs) from each subgraph to judge whether an address exhibits abnormal behavior. In Fig. 1, the following content is mainly involved.

Figure 1: The HNND framework

• Data processing and sampling: It involves constructing and sampling transaction subgraphs based on blockchain transaction records, which reduces the difficulty and computational cost of learning large-scale networks.

• Extraction of GSFs: Aggregate functions are used for statistical analysis to extract four categories of statistical features: transaction features of nodes, basic structural features, regional features, and neighborhood features.

• Extraction of TTFs: The T2GAT model is utilized to learn the temporal transaction features of edges and bias-aggregate these features into the embedded representation of nodes.

• Extraction of ASFs: The GCN is employed to learn graph embedding representation vectors from the transaction subgraphs of nodes, which constitutes the abstract structural features.

• Multi-feature fusion: In the process of concatenating GSFs, TTFs, and ASFs, feature selection and weight allocation are automatically performed by SDA to eliminate data noise and learn key feature information at different levels.

• Binary classification detection: The HNND method uses a binary classifier to train the learned node representations to detect anomalies in the blockchain network.

3.2 Problem Definition and Data Processing

Based on the blockchain transaction records, a directed multi-edge transaction graph

Based on the acquired large amount of historical blockchain transaction data, a large-scale blockchain transaction network, namely MultiDiGraph (a directed graph with multiple edges), is constructed and continuously updated. In this transaction graph, nodes represent accounts, and edges represent transactions. There can be multiple edges between account nodes, and each edge carries attribute information related to the transaction, such as direction, timestamp, and amount.

To preserve the structural information of the graph while effectively reducing the complexity of learning large-scale networks, this paper adopts a random walk strategy to traverse neighbor relationships and extract sampled subgraphs with the same structural features. In this process, the MultiDiGraph is treated as a single-weighted undirected graph. A node in the graph is randomly selected as the starting node, and any of its neighboring nodes is reached with a certain probability until a subgraph of a fixed size is formed. This process is repeated to obtain a dataset of learnable sampled subgraphs.

3.3 Hand-Engineered Extraction of GSFs

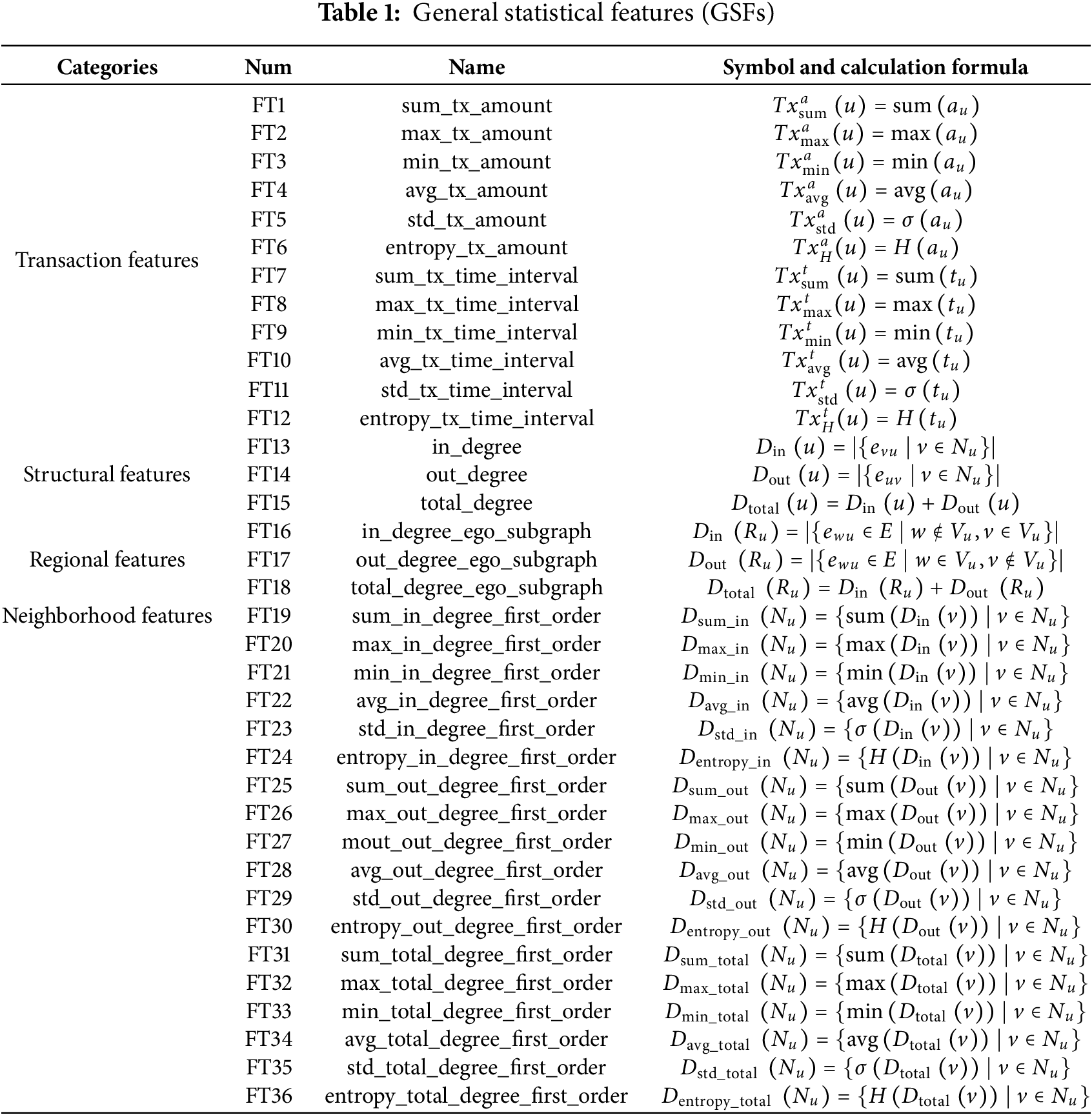

After the construction of the transaction graph, node feature information is further extracted from the subgraphs of transactions. While preserving the original account information to minimize information loss, it lays a foundation for subsequent neural network learning to derive multiple types of features. Due to the anonymous characteristic of blockchain accounts, which precludes direct access to any profiling information about the nodes, our method mainly relies on the basic properties of nodes and their transaction edges within the graph to build account features. Meanwhile, the GSFs for the blockchain accounts are derived by various aggregation functions, effectively characterizing account behavioral patterns. The GSFs are outlined in Table 1.

The GSFs are extacted from basic attribute information such as transaction amounts and timestamps of accounts, as well as various structural information between graph nodes, by employing a set of aggregate functions. The aggregate functions set Z is showed in Formula (1). The GSFs can be classified into four categories: transaction features, structural features, regional features, and neighborhood features.

FT1

FT13

FT16

FT19

To sum up, the GSFs of network nodes are expressed as

3.4 Extraction of TTFs by T2GAT

The T2GAT is designed to learn the information of transaction sequences sorted by timestamps and interactions among all neighboring transactions of nodes. As shown in Fig. 2, a temporal sequence neural network model GRU is first utilized to learn the temporal relationships of all transaction sequences between each pair of nodes from which the edge representation vectors are obtained. The representation of the edges between the node and all its adjacent nodes is then learned in a weighted manner by using a Graph Attention Network (GAT) to obtain the node representation for the account.

Figure 2: Extraction and aggregation of TTFs

3.4.1 Extraction of Edge Representations

To fully capture the temporal relationship and attribute information of account transactions, this paper introduces basic features such as transaction amount and direction as attributes of edges in the graph. Moreover, the GRU model is adopted to capture the behavioral patterns of multi-attribute transactions and obtain temporal transaction features.

The GRU model can address the issues of long-term dependency and gradient vanishing in Recurrent Neural Networks (RNNs) by introducing two gating mechanisms: the reset gate and the update gate [37]. Compared to LSTM, GRU has lower computational complexity and faster convergence speed. The basic structure of GRU consists of two gating units (i.e., reset gate and update gate) and a hidden state unit. Specifically, the reset gate

where W and U are weight matrices,

As demonstrated in (a) and (b) of Fig. 2, this paper sorts all transaction edges

3.4.2 Biased Aggregation of Edge Representations

Learning the temporal transaction features of nodes essentially involves aggregating all neighbor edge representation vectors of each node. To more effectively capture interaction relationships between nodes, this paper employs a Graph Attention Network (GAT) augmented with a multi-head attention mechanism. The GAT can facilitate biased learning of node representations, thereby focusing on significant interactions within the graph [29]. In this paper, the GAT model is utilized to dynamically assign different attention weights based on the importance of edge representations between nodes (as shown in (c) of Fig. 2). And the attention coefficients are employed to transform all the edge representation of a node into attribute features of that node (as shown in (d) of Fig. 2).

The attention coefficient of the edge representation between the node u and its neighbor node i is calculated and normalized as

where W represents the weight matrix, “∥” denotes the concatenation operation,

To enhance the model’s robustness, the GAT employs a multi-head attention mechanism that integrates the outputs from several independent single-head attention processes. Each head computes a weighted sum of the edge representations for a node based on its attention coefficients. By averaging the outputs across all heads, the temporal transaction features

where K represents the number of attention heads in the GAT.

3.5 Extraction of ASFs by Improved-GCN

Abstract structural features (ASFs) are obtained by reconstructing the transaction graph structure using an improved Graph Convolutional Network (GCN). The extraction method and included information for the ASFs differ from those for the structural features in the GSFs. The structural features are extracted by aggregation functions to obtain structural information from multiple aspects. But the ASFs are based on the potential structural features extracted by the enhanced neural network GCN, which can capture higher-order neighbor features and underlying topological relationships between nodes.

The GCN model performs convolutional operations in the spectral domain, where each operation can aggregate an additional layer of features. The spectral convolution function is represented as

where

The transaction subgraph is fed into the GCN for a single-layer convolution operation

where

3.6 Multi-feature Fusion by Stacked Denoising Autoencoder

Based on the aforementioned methods, three types of features are learned: general statistical feature vector

However, there exists data noise in the process of concatenating feature vectors of various types, and different types of features contain information of varying importance. Therefore, a Stacked Denoising Autoencoder (SDA) is utilized to adaptively integrate features of multiple types. By learning the key information of features at different levels, node representations that are more robust and have enhanced generalization capabilities are obtained. Specifically, during the training of each autoencoder in the SDA, Gaussian noise is injected to enable the network to recover the original signal from noisy data, thus learning more robust features. Meanwhile, multiple denoising autoencoders are stacked in a hierarchical structure for layered learning. An adaptive fusion of feature vectors of various types is achieved by automatically allocating weights and selecting key information from features at different levels. Each denoising autoencoder (DA) within the SDA consists of an encoder and a decoder, which are presented as

where W and W′ are the weight matrices,

The noisy feature vector a is obtained by introducing a corruption process c to the input feature vector. By adding specific forms of noise or perturbations to the input data, the robustness and generalization capability of the model can be enhanced.

Each DA approximates the reconstruction by minimizing the reconstruction error

Figure 3: Adaptive fusion of multi-features

3.7 Binary Classification Detection

This study aims to construct a hybrid neural network based on T2GAT, GCN, and SDA, to learn temporal sequence relationships, abstract structural features, and critical information from different types of features. It facilitates obtaining a more comprehensive and complete node representation to improve the accuracy of the binary classifier LightGBM in detecting abnormal blockchain accounts. The detailed procedure of the proposed HNND detection method is presented in Algorithm 1.

In Algorithm 1, a blockchain transaction network is first constructed by yielding an account transaction directed graph with multiple edges, where transaction edges have timestamps and monetary values as properties (Lines 1–6). Then, a random walk strategy is utilized to extract sampled subgraphs with a sample size of N, and the size of the subgraphs

To evaluate the effectiveness of the HNND method, experiments are conducted on a real-world blockchain dataset of abnormal account transactions. The experiment aims at three aspects.

RQ1: Evaluate the effectiveness of the HNND method in detecting abnormal addresses on the blockchain transaction network.

RQ2: Evaluate the contribution of each component of HNND on the final performance of blockchain anomaly detection.

RQ3: Evaluate the robustness of the HNND method by changing transaction sequence lengths and attention sizes.

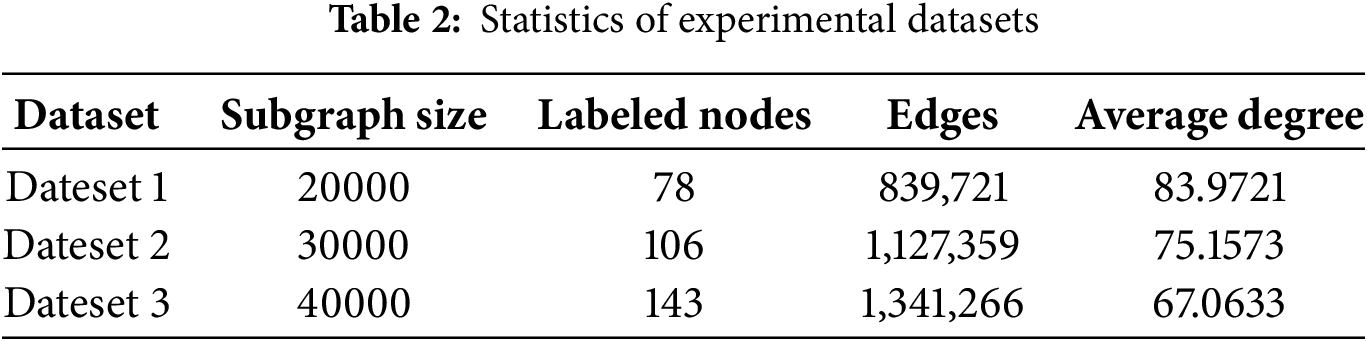

The historical transaction dataset of blockchain fraudulent accounts in [32] is used in the experiment. The dataset is constructed by harvesting fraudulent accounts (central nodes) from the Ethereum tag cloud on the authorized website Etherscan1. Then their first-order neighbors, second-order neighbors are extracted, and the transactions among them via APIs provided by the website. The dataset contains 2,973,382 nodes and 13,551,214 edges, including 1157 fraudulent accounts among the central nodes. Due to the large size of the original connected subgraph, a random walk strategy is used to sample subgraph datasets (i.e., Dateset 1, Dataset 2, Dataset 3) with different sizes (i.e., 20000, 30000, 40000). Each subgraph is sampled five times to ensure the validity of the method. The detailed information of experimental data is provided in Table 2.

For the class imbalance problem in the dataset, this paper eliminates obvious normal addresses to build a more efficient model. Addresses with less than five or more than 1000 transactions are removed because these addresses could be wallets or other normal types of accounts, as confirmed by data analysis. In addition, duplicate account addresses are deleted, and the latest transaction records among them are kept. After data cleaning, the average number of remaining nodes in each subgraph is 18,504, 27,973 and 37,542, respectively. In the course of training the model, 80% of the dataset is used as the training data and the remaining 20% as the testing data.

This section provides a detailed introduction to the baseline methods, evaluation metrics, and implementation details, all of which ensure the accuracy and reliability of the experiments.

To illustrate the validity of the HNND method, it is compared with the following blockchain anomaly detection methods.

• Original features [21]: A set of basic account features, including eight features such as degree, strength, etc., and the number of neighboring nodes, which are utilized and directly fed into the LightGBM model.

• Statistical features [16,23,26]: A set of general statistical features (GSFs) is designed and extracted, which involves basic transactional features [23] and structural features [16,26] related to account transactions. The machine learning algorithms are then employed to implement the binary classification task for anomaly detection.

• Node2Vec [30]: Node2Vec is a network representation learning method that simulates proximity relationships between nodes through random walks. It generates a series of node sequences, which are then mapped into a low-dimensional vector space through the word embedding model to obtain node embeddings.

• E-GCN [32] and GAT [29]: The two methods perform graph convolutional operations to capture the topological structure information and feature information of nodes in the transaction graph, including the neighbor relations of nodes, the weights of edges, etc. They can generate more expressive node representations for node classification.

• SCSGuard [38] and LSTM [39]: The two methods employ sequence learning neural network to learn key information from temporal transactions data. It can effectively capture behavioral patterns in the transaction records of abnormal accounts, thereby identifying transactions that significantly deviate from normal behaviors.

The detection of abnormal transaction behaviors in the blockchain is essentially a binary classification problem. Hence, the confusion matrix is utilized to evaluate the accuracy of classification. Three classification metrics that assess model performance are introduced: (1) Precision, (2) Recall, and (3) F1-score to objectively evaluate the performance of the HNND method in detecting abnormal transactions on the blockchain. In which, (1) Precision refers to the proportion of samples predicted by the model as abnormal accounts that are truly abnormal, which reflects the accuracy of the model’s prediction of abnormal accounts. (2) Recall indicates the proportion of all actual abnormal accounts that are predicted as abnormal by the model, which demonstrates the model’s ability to identify all abnormal accounts. (3) F1-score is the harmonic mean of precision and recall, and it is used to evaluate the model’s performance comprehensively.

In the context of blockchain abnormal account detection considered in this paper, the importance of recall outweighs precision. This is because the purpose of the detection model is to identify all abnormal accounts as many as possible, even if it may mistakenly label some normal accounts as abnormal. Since the potential harm caused by abnormal accounts is significant, overlooking some malicious accounts in the detection process could result in large economic and financial losses as well as system disruption. Meanwhile, mislabeling some normal accounts as abnormal may cause inconvenience to users, but this impact is acceptable compared to the consequences of missing abnormal accounts.

All methods are implemented based on the PyTorch framework in the experiment, with the output dimension of all models set to 8. The walk length, window size,

This paper conducts two groups of experiments and analyzes results from two aspects. One group of experiments evaluates the effectiveness of the proposed HNND method by comparing it with various baseline methods. The other group of experiments performs ablation studies by sequentially eliminating each module within HNND to determine the impact of the removed module on the detection results.

4.3.1 Effectiveness Results (RQ1)

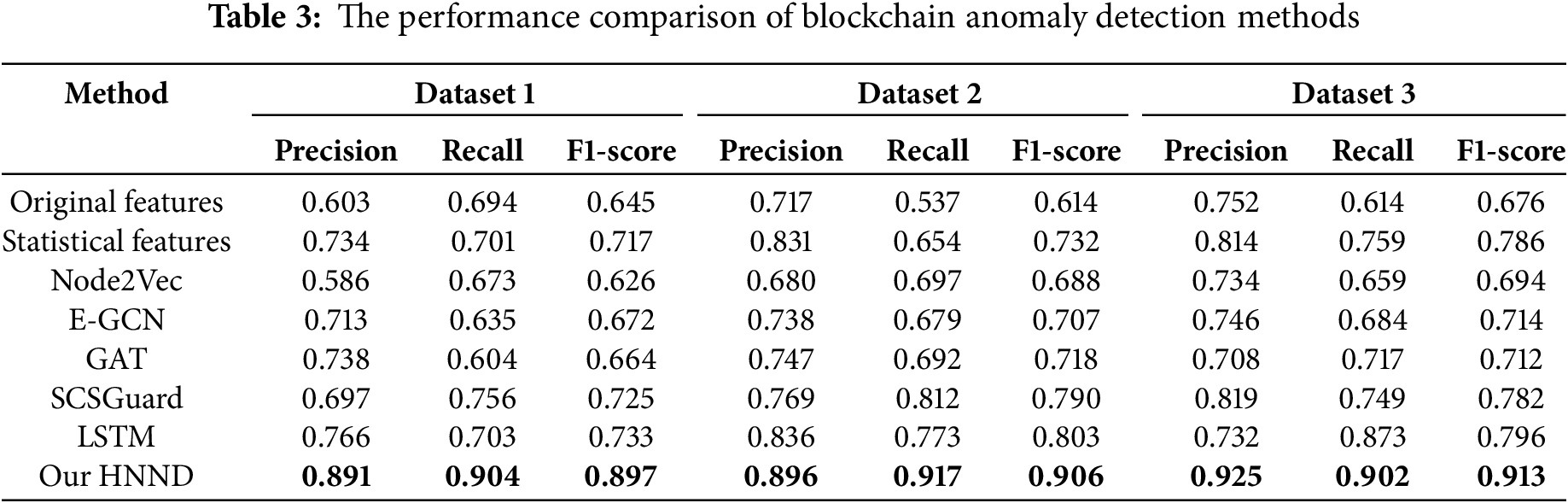

The performance of all the comparison methods for blockchain abnormal account transaction behavior detection is evaluated in this subsection. And the results are presented in Table 3. The following conclusions can be drawn.

• Our HNND method outperforms all other baseline methods in all three evaluation metrics. The HNND method achieves the best performance, with 92.5% precision, 90.2% recall, and 91.3% F1-score under Dataset 3. Deep learning methods exhibit comparable performance, with E-GCN and GAT achieving an F1-score of approximately 71%, while SCSGuard and LSTM achieving an F1-score of around 78%. Node2Vec demonstrates higher performance than the feature-based method, and its F1-score is 69.4%.

• Compared with the method based on the original features, the HNND method obtains about 23% higher values in all three evaluation metrics. Of all the compared methods, the method based on the original features performs the worst. It can be found that the parties based on the original features do not consider the timing and network structure of the blockchain data, the feature information obtained is very limited, and further data mining of the transaction information is lacking.

• Compared with the method based on statistical features, the F1-score of the HNND method improves by 12.7% on Dataset 3. Although the method based on statistical features fully utilizes the network structure information, it lacks learning from the temporal features of transaction data, so its detection effect is worse than that of the HNND method. Meanwhile, the method based on statistical features compared with the method based on original features increases by F1-score of 11%. The statistical method actually is a machine learning method, and can rely on aggregation functions to obtain statistical features containing structure information so its F1-score reaches 78.6%.

• The F1-score of Node2Vec is about 20% different from that of the HNND method. Node2Vec utilizes random walks to mine the neighborhood information of nodes, but it ignores learning the interaction relationships and transaction temporal information between nodes, leading to incomplete representation learning of nodes. The HNND method learns the feature information that Node2Vec fails to learn, so it exhibits the best detection performance. However, the difference in evaluation metrics between Node2Vec and Original feature-based methods is not significant. Though both can obtain rich network structure information through different methods, Node2Vec’s representation learning method can capture potential structures and patterns in the network without the need for manual feature design.

• The detection performance of the network representation method based on deep learning is greatly improved. E-GCN, GAT, SCSGuard, and LSTM all obtain good detection results. Compared with these deep learning methods, the three evaluation metrics of HNND increase by about 10%. Specifically, E-GCN and GAT can capture the topological structure information of the nodes in the transaction graph to generate a more expressive node representation. SCSGuard and LSTM can provide long-term memory and effectively capture the behavior patterns in the account temporal transaction data. The two types of methods have different focuses on feature extraction, and there is still much room for improvement in learning features. Our HNND method combines the advantages of both E-GCN and GRU methods and utilizes a hybrid neural network for representation learning. It fully exploits the temporal relationship in the transaction sequence and the interaction pattern information between the network nodes, thereby obtaining a more efficient node embedding representation.

4.3.2 Ablation Experiment (RQ2)

This subsection verifies the effectiveness of the TTFs extraction module (HNND/t), the ASFs extraction module (HNND/s), and the SDA module (HNND/d) in the proposed HNND method, respectively, as shown in Fig. 4. The following observations are obtained:

• Relative to HNND, the effectiveness of HNND/t significantly declines, with F1-scores that are 21.5%, 17.7%, and 19.6% less on Datasets 1–3, respectively. The main reason is that the eliminated T2GAT can fully extract the temporal pattern of the transaction interaction between nodes, and the bias aggregation learning can obtain expressive node embedding representation. This result indicates that it is crucial to fully learn the timely order features of transaction attributes among nodes in the transaction graph for the detection of abnormal account behaviors.

• The F1-score of HNND/s is only 9.4% lower than that of HNND on Dataset 3. It can be found that, to some extent, the extracted abstract structure features are not as important as the temporal transaction features, but they can also reflect the information of the topological network and further enrich the representation of nodes.

• The slightly lower performance of HNND/d compared to HNND demonstrates that SDA can improve the detection performance of anomalous transactions by denoising and adaptively integrating features obtained from different modules. The comparison results of the E-GCN and T2GAT modules with HNND/t and HNND/s also support this conclusion. And final fully implemented HNND method can reach F1-score of 91.3% on Dataset 3.

• The complete HNND method is superior to other ablation models in the three evaluation metrics on Dataset 1, Dataset 2, and Dataset 3, respectively, which proves that each model can provide effective improvement and enable HNND to achieve the best performance in the binary classification of abnormal transaction behaviors.

Figure 4: Precision, Recall, and F1-scores of HNND and its variants

4.3.3 Sensitivity Analysis (RQ3)

The robustness of the HNND method is evaluated by investigating its stability and reliability across varying transaction sequence lengths and attention sizes.

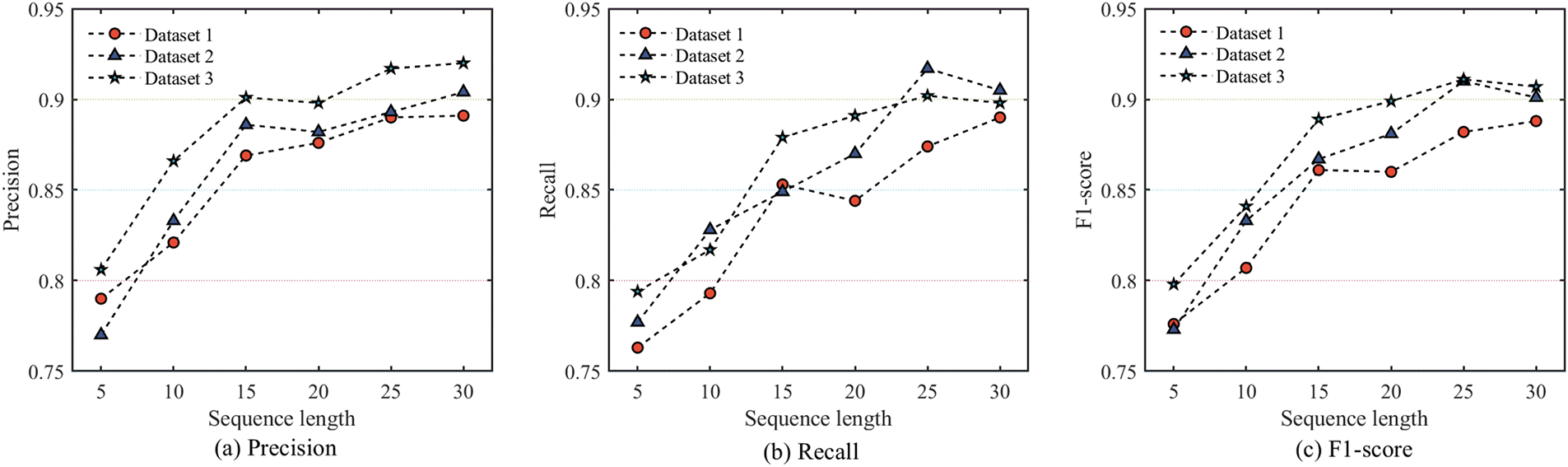

Figure 5 presents three metrics scores for the HNND model across varying transaction sequence lengths. The findings can be summarized as follows:

• Up to a certain point, the HNND model demonstrates improved performance on all datasets as the length of sequences fed into the GRU increases. This suggests that within an optimal range, longer sequences provide richer behavioral features.

• Occasionally, shorter sequences yield superior results, as they focus exclusively on critical transaction patterns and avoiding redundant information.

• Model performance deteriorates when sequence lengths exceed a threshold, potentially due to the introduction of noise or overfitting issues from excessively long sequences.

• Beyond approximately 15 time steps, while there are minor fluctuations, the evaluation metrics generally stabilize. This indicates that the model has effectively learned the primary behavioral patterns in the transaction sequences, with minimal gains from further lengthening the sequences.

• According to F1-scores in Fig. 5c, model performance improves with larger dataset sizes, highlighting the benefit of more high-quality data in capturing transaction behavior accurately.

Figure 5: Sensitivity analysis of HNND with different sequence lengths

These results underscore the importance of temporal transaction behavior features and demonstrate the robustness and adaptability of the HNND model in handling sequences of varying lengths.

Figure 6 illustrates the model’s performance across three evaluation metrics when varying the attention sizes of GAT. Key observations include:

• The HNND model exhibits minimal fluctuation in all evaluation metrics across different datasets and attention size settings. This stability is likely due to the multi-head attention mechanism of GAT, which provides sufficient temporal transaction features for nodes and allows each attention head to dynamically adjust the weight distribution of edge representations.

• Even with a smaller attention size (e.g., sizes = 2), HNND achieves relatively strong performance. This indicates that the model possesses good stability and maintains generalization capabilities on unseen data.

Figure 6: Sensitivity analysis of HNND with different attention sizes

These findings highlight the robustness of the HNND model in learning node features, particularly regarding the dimensions of TTFs (i.e., the attention sizes of GAT).

To address the challenge of detecting anomalous transaction behaviors in blockchain application networks, this study introduces a hybrid neural network-based detection method, called HNND. The proposed method utilizes T2GAT and GCN to effectively capture temporal patterns (TTFs) and structural features (ASFs) from transaction graphs, respectively. Subsequently, these abstract features are adaptively fused with hand-engineering features (GSFs) using SDA, resulting in enhanced node representations that significantly improve anomaly detection performance. In addition, our experimental analysis reveals that the detection performance of HNND is sensitive to the length of transaction sequences, indicating a limitation in handling varying sequence lengths. Future research should focus on enhancing the model’s robustness by improving its capability to process variable-length sequences. Potential directions for improvement include developing mechanisms for dynamically adjusting to sequence lengths or refining feature extraction techniques to better identify salient behavioral features within transaction sequences.

Acknowledgement: We would like to express our gratitude to the editors and reviewers for their detailed review and insightful advice.

Funding Statement: The authors received no specific funding for this study.

Author Contributions: The authors confirm contribution to the paper as follows: study conception and design: Jiling Wan; data collection: Jiling Wan, Lifeng Cao, Jinlong Bai; analysis and interpretation of results: Jiling Wan, Jinlong Bai, Jinhui Li; draft manuscript preparation: Jiling Wan, Lifeng Cao, Jinlong Bai, Jinhui Li, Xuehui Du. All authors reviewed the results and approved the final version of the manuscript.

Availability of Data and Materials: The data used in this paper can be requested from the corresponding author upon request.

Ethics Approval: Not applicable.

Conflicts of Interest: The authors declare no conflicts of interest to report regarding the present study.

1https://etherscan.io, accessed on 3 March 2025.

References

1. Eyal I, Gencer AE, Sirer EG, Van Renesse R. Bitcoin-NG: a scalable blockchain protocol. In: Proceedings of the 13th Usenix Conference on Networked Systems Design and Implementation (NSDI); Berkeley, CA, USA: USENIX Association; 2016 Mar. p. 45–59. [Google Scholar]

2. Gilad Y, Hemo R, Micali S, Vlachos G, Zeldovich N. Algorand: scaling byzantine agreements for cryptocurrencies. In: Proceedings of the 26th Symposium on Operating Systems Principles (SOSP); 2017 Oct. p. 51–68. [Google Scholar]

3. Han Y, Li C, Li P, Wu M, Zhou D, Long F. Shrec: bandwidth-efficient transaction relay in high-throughput blockchain systems. In: Proceedings of the 11th ACM Symposium on Cloud Computing (SOCC); Virtual Event, USA: ACM; 2020 Oct. p. 238–52. [Google Scholar]

4. Lewenberg Y, Sompolinsky Y, Zohar A. Inclusive block chain protocols. In: Böhme R, Okamoto T, editors. Proceedings of the Financial Cryptography and Data Security (FC); Curacao, Berlin/Heidelberg: Springer; 2015. p. 528–47. [Google Scholar]

5. Li C, Li P, Zhou D, Yang Z, Wu M, Yang G et al. A decentralized blockchain with high throughput and fast confirmation. In: Proceedings of the USENIX Annual Technical Conference (USENIX ATC); Virtual Event: USENIX Association; 2020. p. 515–28. [Google Scholar]

6. KokorisKogias E, Jovanovic P, Gasser L, Gailly N, Syta E, Ford B. OmniLedger: a secure, scale-out, decentralized ledger via sharding. In: Proceedings of the IEEE Symposium on Security and Privacy (SP); San Francisco, CA, USA: IEEE; 2018. p. 583–98. [Google Scholar]

7. Naumenko G, Maxwell G, Wuille P, Fedorova A, Beschastnikh I. Erlay: efficient transaction relay for bitcoin. In: Proceedings of the ACM SIGSAC Conference on Computer and Communications Security (CCS); London, UK: ACM; 2019 Nov. p. 817–31. [Google Scholar]

8. Yang P, Ren J. A blockchain-based data auditing scheme with key-exposure resistance for IIoT. Sci China Inf Sci. 2024 Jan;67(2):129102. doi:10.1007/s11432-023-3828-7. [Google Scholar] [CrossRef]

9. Chen H, Wei N, Wang L, Fawzy Mohamed Mobarak W, Ali Albahar M, Shaikh ZA. The role of blockchain in finance beyond cryptocurrency: trust, data management, and automation. IEEE Access. 2024;12(37):64861–85. doi:10.1109/ACCESS.2024.3395918. [Google Scholar] [CrossRef]

10. Krishankumar R, Dhruva S, Ravichandran KS, Kar S. Selection of a viable blockchain service provider for data management within the internet of medical things: an MCDM approach to Indian healthcare. Inf Sci. 2024 Mar;657(4):119890. doi:10.1016/j.ins.2023.119890. [Google Scholar] [CrossRef]

11. Oksuz O. A system for storing anonymous patient healthcare data using blockchain and its applications. Comput J. 2024 Jan;67(1):18–30. doi:10.1093/comjnl/bxac155. [Google Scholar] [CrossRef]

12. Salim MM, Yang LT, Park JH. Privacy-preserving and scalable federated blockchain scheme for Healthcare 4.0. Comput Netw. 2024 Jul;247:110472. doi:10.1016/j.comnet.2024.110472. [Google Scholar] [CrossRef]

13. Damaševičius R, Misra S, Maskeliūnas R, Nayyar A. Convergence of blockchain and internet of things: integration, security, and use cases. Front Inform Technol Electron Eng. 2024 Oct;25(10):1295–1321. doi:10.1631/FITEE.2300215. [Google Scholar] [CrossRef]

14. Joseph Antony A, Singh K. A blockchain-based public key infrastructure for IoT-based healthcare systems. Comput J. 2024 Apr;67(4):1531–7. doi:10.1093/comjnl/bxad079. [Google Scholar] [CrossRef]

15. Chen H, Pendleton M, Njilla L, Xu S. A survey on ethereum systems security: vulnerabilities, attacks, and defenses. ACM Comput Surv. 2020 Jun;53(3):1–43. doi:10.1145/3391195. [Google Scholar] [CrossRef]

16. Wu J, Liu J, Chen W, Huang H, Zheng Z, Zhang Y. Detecting mixing services via mining bitcoin transaction network with hybrid motifs. IEEE Trans Syst Man Cybern: Syst. 2022 Apr;52(4):2237–49. doi:10.1109/TSMC.2021.3049278. [Google Scholar] [CrossRef]

17. Wang L, Xu M, Cheng H. Phishing scams detection via temporal graph attention network in ethereum. Inf Process Manag. 2023 Jul;60(4):103412. [Google Scholar]

18. Anita N, Vijayalakshmi M. Blockchain security attack: a brief survey. In: Proceedings of the 10th International Conference on Computing, Communication and Networking Technologies (ICCCNT); Kanpur, India: IEEE; 2019 Jul. p. 1–6. [Google Scholar]

19. Wang Z, Jin H, Dai W, Choo K-KR, Zou D. Ethereum smart contract security research: survey and future research opportunities. Front Comput Sci. 2020 Oct;15(2):152802. doi:10.1007/s11704-020-9284-9. [Google Scholar] [CrossRef]

20. Ressi D, Romanello R, Piazza C, Rossi S. AI-enhanced blockchain technology: a review of advancements and opportunities. J Netw Comput Appl. 2024;225:103858. doi:10.1016/j.jnca.2024.103858. [Google Scholar] [CrossRef]

21. Farrugia S, Ellul J, Azzopardi G. Detection of illicit accounts over the ethereum blockchain. Expert Syst Appl. 2020 Jul;150:113318. [Google Scholar]

22. Ibrahim RF, Mohammad Elian A, Ababneh M. Illicit account detection in the ethereum blockchain using machine learning. In: Proceedings of the International Conference on Information Technology (ICIT); Amman, Jordan: IEEE; 2021 Jul. p. 488–93. [Google Scholar]

23. Poursafaei F, Hamad GB, Zilic Z. Detecting malicious ethereum entities via application of machine learning classification. In: Proceedings of the 2nd Conference on Blockchain Research & Applications for Innovative Networks and Services (BRAINS); Cham: Springer; 2020 Sep. p. 120–7. [Google Scholar]

24. Kumar N, Singh A, Handa A, Shukla SK. Detecting malicious accounts on the ethereum blockchain with supervised learning. In: Dolev S, Kolesnikov V, Lodha S, Weiss G, editors. Proceedings of the Cyber Security Cryptography and Machine Learning (CSCML); Cham: Springer; 2020. p. 94–109. [Google Scholar]

25. Jourdan M, Blandin S, Wynter L, Deshpande P. Characterizing entities in the bitcoin blockchain. In: Proceedings of the IEEE International Conference on Data Mining Workshops (ICDMW); Singapore: IEEE; 2018 Nov. p. 55–62. [Google Scholar]

26. Chen W, Guo X, Chen Z, Zheng Z, Lu Y. Phishing scam detection on ethereum: towards financial security for blockchain ecosystem. In: Proceedings of the 29th International Joint Conference on Artificial Intelligence (IJCAI); Yokohama, Yokohama, Japan: IJCAI Organization and AAAI Press;2020 Jul. p. 4506–12. [Google Scholar]

27. Perozzi B, AlRfou R, Skiena S. DeepWalk: online learning of social representations. In: Proceedings of the 20th ACM SIGKDD International Conference on Knowledge Discovery and Data Mining (KDD ’14); New York, NY, USA: ACM; 2014 Aug. p. 701–10. [Google Scholar]

28. Grover A, Leskovec J. Node2vec: scalable feature learning for networks. In: Proceedings of the 22nd ACM SIGKDD International Conference on Knowledge Discovery and Data Mining (KDD ’16); San Francisco, CA, USA: ACM; 2016 Aug. p. 855–64. [Google Scholar]

29. Veličković P, Cucurull G, Casanova A, Romero A, Liò P, Bengio Y. Graph attention networks. In: Proceedings of the International Conference on Learning Representations (ICLR); Vancouver, BC, Canada; 2018 Feb. [Google Scholar]

30. Yuan Q, Huang B, Zhang J, Wu J, Zhang H, Zhang X. Detecting phishing scams on ethereum based on transaction records. In: Proceedings of the IEEE International Symposium on Circuits and Systems (ISCAS); Seville, Spain: IEEE; 2020 Oct. p. 1–5. [Google Scholar]

31. Wu J, Yuan Q, Lin D, You W, Chen W, Chen C, et al. Who are the phishers? Phishing scam detection on ethereum via network embedding. IEEE Trans Syst Man Cybern: Syst. 2022 Feb;52(2):1156–66. doi:10.1109/TSMC.2020.3016821. [Google Scholar] [CrossRef]

32. Chen L, Peng J, Liu Y, Li J, Xie F, Zheng Z. Phishing scams detection in ethereum transaction network. ACM Trans Internet Technol. 2021 Feb;21(1):1–16. doi:10.1145/3450630. [Google Scholar] [CrossRef]

33. Ahn SJ, Kim M. Variational graph normalized autoencoders. In: Proceedings of the 30th ACM International Conference on Information & Knowledge Management (CIKM); New York, NY, USA: ACM; 2021 Oct. p. 2827–31. [Google Scholar]

34. Ding K, Li J, Bhanushali R, Liu H. Deep anomaly detection on attributed networks. In: Proceedings of the SIAM International Conference on Data Mining (SDM); Philadelphia, PA, USA: SIAM;2019 May. p. 594–602. [Google Scholar]

35. Sun X, Yang T, Hu B. LSTM-TC: bitcoin coin mixing detection method with a high recall. Appl Intell. 2022 Jan;52(1):780–93. doi:10.1007/s10489-021-02453-9. [Google Scholar] [CrossRef]

36. Li S, Gou G, Liu C, Hou C, Li Z, Xiong G. TTAGN: temporal transaction aggregation graph network for ethereum phishing scams detection. In: Proceedings of the ACM Web Conference (WWW); New York, NY, USA: ACM; 2022 Apr. p. 661–9. [Google Scholar]

37. Chung J, Gülcehre C, Cho K, Bengio Y. Empirical evaluation of gated recurrent neural networks on sequence modeling. arXiv:1412.3555. 2014. [Google Scholar]

38. Hu H, Bai Q, Xu Y. SCSGuard: Deep scam detection for ethereum smart contracts. In: Proceedings of the IEEE Conference on Computer Communications Workshops (WKSHPS); New York, NY, USA:IEEE; 2022 May. p. 1–6. [Google Scholar]

39. Hochreiter S, Schmidhuber J. Long short-term memory. Neural Comput. 1997 Nov;9(8):1735–80. doi:10.1162/neco.1997.9.8.1735. [Google Scholar] [PubMed] [CrossRef]

Cite This Article

Copyright © 2025 The Author(s). Published by Tech Science Press.

Copyright © 2025 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools