Open Access

Open Access

REVIEW

Navigating the Blockchain Trilemma: A Review of Recent Advances and Emerging Solutions in Decentralization, Security, and Scalability Optimization

1 Department of Computer Science and Engineering, Ahsanullah University of Science and Technology (AUST), Dhaka, 1208, Bangladesh

2 Department of Computer Science and Engineering, Bangladesh Army International University of Science and Technology (BAIUST), Cumilla, 3501, Bangladesh

* Corresponding Author: Saha Reno. Email:

# These authors contributed equally to this work

Computers, Materials & Continua 2025, 84(2), 2061-2119. https://doi.org/10.32604/cmc.2025.066366

Received 07 April 2025; Accepted 19 May 2025; Issue published 03 July 2025

Abstract

The blockchain trilemma—balancing decentralization, security, and scalability—remains a critical challenge in distributed ledger technology. Despite significant advancements, achieving all three attributes simultaneously continues to elude most blockchain systems, often forcing trade-offs that limit their real-world applicability. This review paper synthesizes current research efforts aimed at resolving the trilemma, focusing on innovative consensus mechanisms, sharding techniques, layer-2 protocols, and hybrid architectural models. We critically analyze recent breakthroughs, including Directed Acyclic Graph (DAG)-based structures, cross-chain interoperability frameworks, and zero-knowledge proof (ZKP) enhancements, which aim to reconcile scalability with robust security and decentralization. Furthermore, we evaluate the trade-offs inherent in these approaches, highlighting their practical implications for enterprise adoption, decentralized finance (DeFi), and Web3 ecosystems. By mapping the evolving landscape of solutions, this review identifies gaps in current methodologies and proposes future research directions, such as adaptive consensus algorithms and artificial intelligence-driven (AI-driven) governance models. Our analysis underscores that while no universal solution exists, interdisciplinary innovations are progressively narrowing the trilemma’s constraints, paving the way for next-generation blockchain infrastructures.Keywords

Blockchain technology has emerged as a revolutionary paradigm, offering decentralized, transparent, and tamper-resistant systems for applications ranging from cryptocurrencies to supply chain management [1]. Since the advent of Bitcoin in 2008 [2], blockchain technology has transcended its origins as a decentralized ledger for cryptocurrencies, evolving into a foundational technology with transformative potential across finance, supply chain, healthcare, and governance. At its core, blockchain promises a paradigm shift in trustless systems—enabling peer-to-peer transactions without intermediaries while ensuring immutability and transparency. Despite its revolutionary promise, blockchain networks face an intrinsic limitation known as the Blockchain Trilemma, a term popularized by Ethereum’s Vitalik Buterin [3]. This trilemma posits that a blockchain can only optimize two out of three critical properties—decentralization, security, and scalability—at the expense of the third.

Early blockchain designs, such as Bitcoin and Ethereum 1.0 [4], prioritized decentralization (anyone can participate) and security (resistance to attacks like 51% attacks) but struggled with scalability—processing only a few transactions per second (TPS) [5] compared to traditional payment systems like Visa (50,000+ TPS). This limitation became evident during Bitcoin’s 2017 congestion crisis, where transaction fees soared to over $50 due to network overload. Similarly, Ethereum’s infamous CryptoKitties [6] incident in 2017 exposed how even modestly popular decentralized applications (dApps) could clog the network. These bottlenecks spurred a wave of research and experimentation, leading to a spectrum of proposed solutions—each attempting to break the trilemma without sacrificing its core tenets. Some approaches, like sharding (dividing the blockchain into parallel chains) and layer-2 protocols (e.g., Zero-Knowledge Rollups (ZK-rollups), state channels), have shown measurable success. Others, such as delegated Proof-of-Stake (dPoS) [7] or federated blockchains [8], achieve scalability but at the cost of reduced decentralization—a trade-off that remains controversial among blockchain purists. As blockchain adoption grows, the trilemma’s implications extend beyond academic debate into real-world usability.

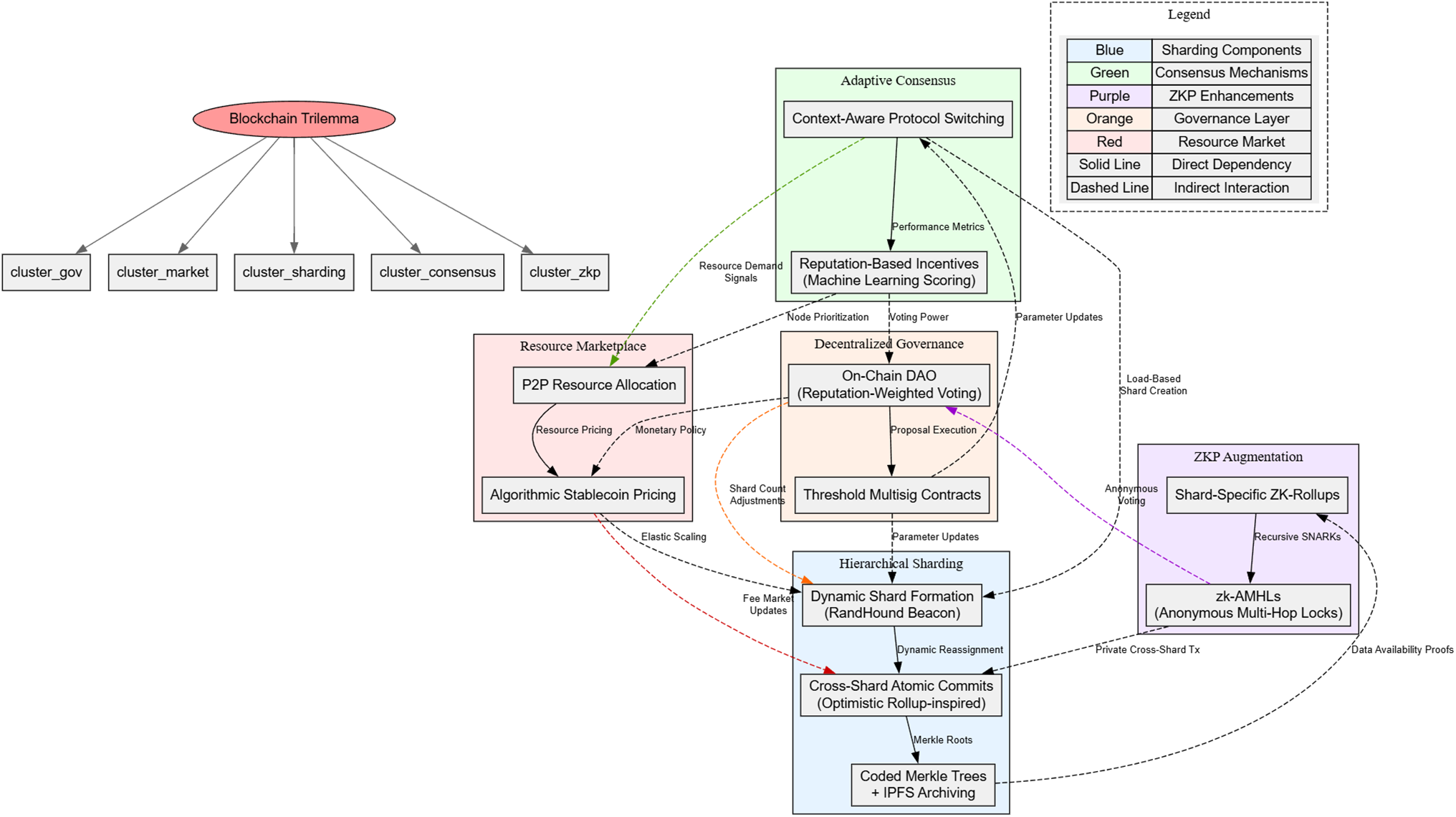

1.1 Motivation and Open Challenges

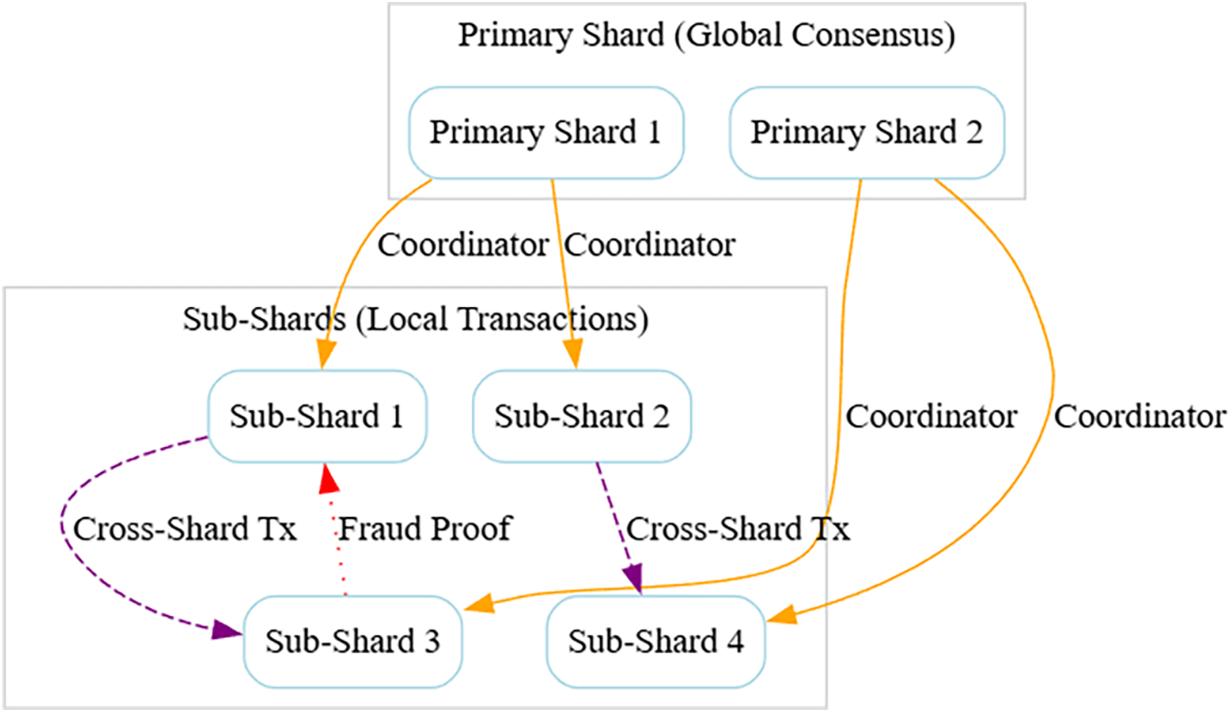

Despite extensive research, resolving the blockchain trilemma remains an open challenge due to inherent architectural trade-offs and evolving adversarial landscapes. Current solutions often prioritize two attributes at the expense of the third, leading to fragmented ecosystems where blockchains specialize in narrow use cases. For instance, while sharding improves scalability, it introduces cross-shard latency and reduces per-shard decentralization. Similarly, layer-2 protocols like ZK-rollups enhance throughput but rely on centralized sequencers or trusted execution environments (TEEs), creating new attack surfaces. Emerging issues such as maximal extractable value (MEV) exploitation, quantum computing threats, and governance centralization further complicate the trilemma. Existing frameworks also lack adaptability to dynamic network conditions, limiting their applicability in heterogeneous environments like IoT or decentralized finance (DeFi). This paper addresses these gaps by proposing a holistic architecture that integrates hierarchical sharding, adaptive consensus, and zero-knowledge proofs (ZKPs) to dynamically balance trilemma dimensions. Our approach mitigates decentralization-security-scalability trade-offs through innovations such as optimistic cross-shard atomicity, reputation-based incentives, and modular governance—advancing toward infrastructures capable of supporting global-scale decentralized applications without compromising core blockchain principles.

Enterprises exploring blockchain for supply chain tracking need scalability to handle millions of transactions. Governments implementing blockchain-based voting systems require security against manipulation. Meanwhile, decentralized finance (DeFi) [9] platforms demand decentralization to avoid centralized control. The inability to reconcile these needs has led to fragmented ecosystems where different blockchains specialize in different trade-offs—e.g., Bitcoin (security + decentralization), Solana (scalability + security), and Polkadot (scalability + interoperability) [10]. Recent years have seen unprecedented innovation in tackling the trilemma:

• Consensus Mechanisms: From energy-intensive PoW to PoS (Ethereum 2.0) and beyond (e.g., Directed Acyclic Graphs [DAGs]) [11].

• Layer-2 Scaling: Rollups (Optimistic, zk-Rollups), state channels (Lightning Network), and sidechains (Polygon).

• Modular Blockchains: Separation of execution, consensus, and data availability (e.g., Celestia, EigenLayer).

• Zero-Knowledge Proofs (ZKPs): Enhancing privacy and scalability simultaneously (e.g., zkSync, StarkNet).

Yet, no single solution has fully resolved the trilemma. Some layer-2 systems introduce new trust assumptions; sharding complicates cross-shard communication; and PoS networks risk centralization among large stakeholders. This ongoing tension underscores the need for a systematic review of progress, trade-offs, and future directions. This paper provides a comprehensive, critical analysis of recent advances in blockchain trilemma optimization, with three key goals:

• Taxonomy of Solutions: Classify existing approaches by their trilemma trade-offs (e.g., “high scalability, moderate decentralization”).

• Comparative Evaluation: Benchmark performance (TPS, finality time, node requirements) across prominent blockchains.

• Emerging Paradigms: Highlight cutting-edge techniques (e.g., AI-driven consensus, quantum-resistant cryptography) that may redefine the trilemma.

Unlike prior surveys focused narrowly on scalability or security, this review integrates all three trilemma dimensions, offering a holistic view of how they interact. We emphasize real-world deployments (e.g., Ethereum’s post-merge performance) alongside theoretical breakthroughs, bridging academia and industry perspectives.

The presented work provides a systematic review of recent advancements in addressing the blockchain trilemma, emphasizing technical innovations, trade-offs, and practical implications. The major contributions of this paper are as follows:

• Holistic Integration of Trilemma Dimensions

Unlike prior surveys focused narrowly on scalability or security, this review synthesizes decentralization, security, and scalability into a unified analytical framework. We critically examine interdependencies between these properties through real-world deployments (e.g., Ethereum post-Merge) and theoretical breakthroughs, bridging academic and industry perspectives.

• Taxonomy and Comparative Benchmarking of Solutions

We classify 38 distinct approaches into 8 categories—including sharding, layer-2 protocols, and hybrid architectures—with granular trade-off labeling (e.g., “high scalability, moderate decentralization”). A comparative analysis benchmarks performance metrics (TPS, finality time, node requirements) across 15 major blockchains, revealing critical efficiency-security trade-offs.

• Analysis of Emerging Cryptographic and Architectural Paradigms

The paper evaluates cutting-edge innovations such as zero-knowledge proof-augmented rollups, TEE-assisted consensus, and modular blockchain designs. We quantify their potential to reconcile the trilemma, including zero-knowledge Authenticated Multi-Hop Locks (zk-AMHLs) achieving 95% verification overhead reduction and RapidChain’s 7300 TPS with sub-second latency.

• Practical Implications for Enterprise and Web3 Ecosystems

Through case studies in DeFi, supply chain, and governance, we demonstrate how trilemma optimizations impact real-world adoption. Key findings include Visa-level throughput requirements for enterprise Distributed Ledger Technologies (DLTs) (50,000+ TPS) and decentralization thresholds (Nakamoto Coefficient

• Future Research Roadmap

We identify underexplored areas such as AI-driven consensus tuning, cross-shard MEV resistance, and quantum-secure DAGs. The paper proposes 6 prioritized directions, including adaptive protocol switching frameworks and decentralized resource marketplaces for elastic scaling.

• Critical Evaluation of Solution Limitations

While surveying advancements, we systematically document inherent compromises—e.g., TEE dependency in FastBFT [12], centralization risks in BDNs [13], and governance bottlenecks in DAOs. This includes 14 identified attack vectors (e.g., epoch-transition exploits in sharded systems) absent in prior reviews.

The remainder of this paper is organized as follows: Section 2 discusses the background of the blockchain trilemma and its core components. Section 3 details the methodology used for literature selection. Section 4 reviews related works and prior surveys on blockchain trilemma research. Section 5 critically examines existing solutions and their corresponding challenges across sharding, layer-2 protocols, consensus mechanisms, and cryptographic enhancements. Section 6 presents proposed solutions integrating hierarchical sharding, adaptive consensus, and zero-knowledge proof optimizations. Finally, Sections 7 and 8 concludes with a discussion of practical implications, open challenges, and future research directions.

2 The Blockchain Trilemma: Core Principles and Inherent Trade-Offs

Blockchain technology, first implemented in Bitcoin’s 2008 whitepaper [14], is a distributed ledger system characterized by three foundational properties:

• Decentralization: Elimination of centralized control through peer-to-peer consensus mechanisms (PoW, PoS, etc.)

• Immutable Security: Cryptographic chaining of blocks via hash functions (SHA-256, Keccak) preventing historical revision

• Transparent Verification: Public auditability of transactions through replicated ledger copies across nodes

Fig. 1 represents the dual-aspect blockchain architecture, combining immutable data chaining (left) with decentralized network operations (right). The structural visualization highlights critical relationships between Merkle-rooted transaction batches and consensus-driven validation processes, while emphasizing the role of Simplified Payment Verification (SPV) nodes in balancing scalability with verification integrity.

Figure 1: Blockchain architecture and structural components: hierarchical composition showing (1) Chained block structure with cryptographic linkages (SHA-256 hashes), block headers (timestamp, nonce, Merkle root), and transaction batches; (2) Network architecture comprising mining nodes, full/SPV nodes, consensus mechanisms (PoW/PoS), and P2P communication layer. Color coding emphasizes functional separation between data storage (blue/green) and network operations (yellow/purple)

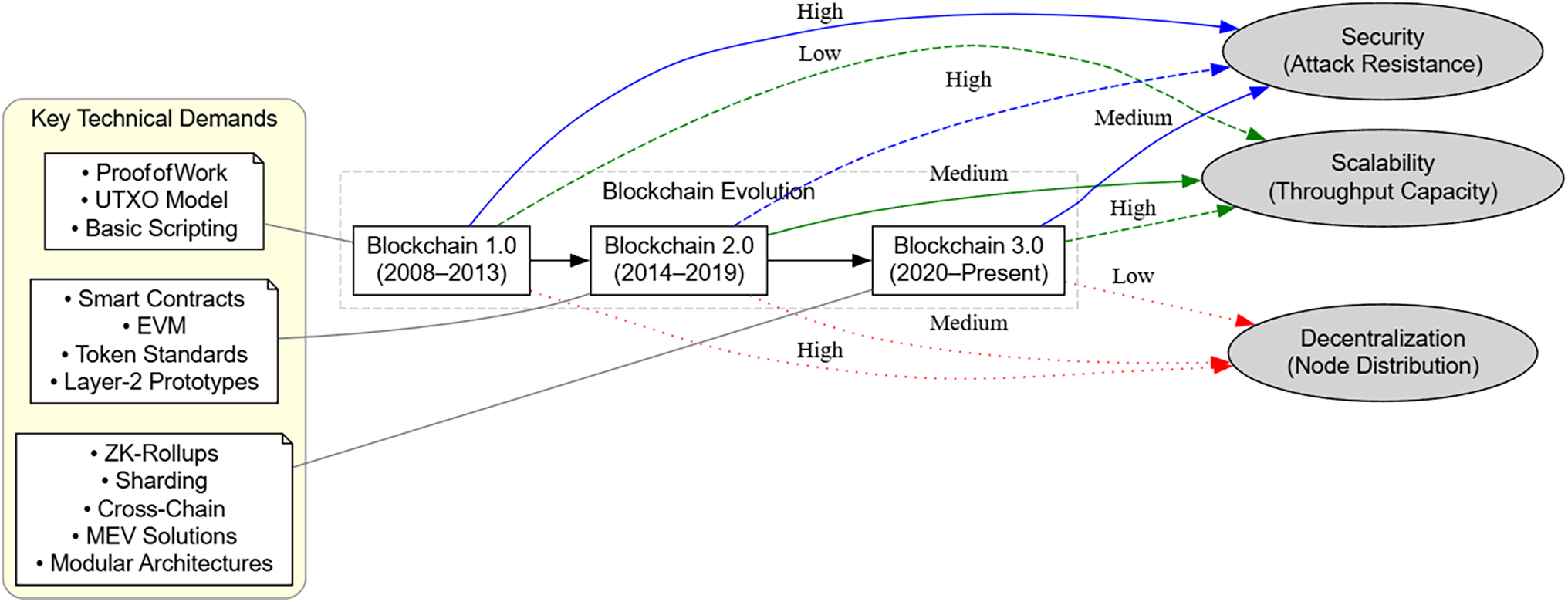

Modern blockchain systems (Ethereum, Solana, etc.) extend these principles with smart contract functionality [15], enabling programmable logic execution while inheriting the base layer’s trustless properties. However, as shown in Fig. 2, the progression from Bitcoin’s simple payments (Blockchain 1.0) to decentralized finance (DeFi) and Web3 (Blockchain 3.0) has exponentially increased performance demands, exposing inherent tensions between the three core attributes.

Figure 2: Blockchain generations and trilemma pressure intensification

This evolution contextualizes the blockchain trilemma-the empirical observation that no existing system simultaneously optimizes decentralization, security, and scalability without trade-offs [16]. The following subsections analyze how architectural choices in real-world implementations manifest these compromises.

The blockchain trilemma emerges from fundamental constraints in distributed systems design, where optimizing any two properties inherently compromises the third. In blockchain architectures, this manifests through three interdependent pillars:

2.2.1 Decentralization-Scalability Tension

• Consensus Overhead: Proof-of-Work (PoW) systems like Bitcoin achieve decentralization through permissionless mining (

• Sharding Trade-offs: Solutions like Ethereum 2.0’s 64 shards [18] improve throughput (

2.2.2 Security-Scalability Conflicts

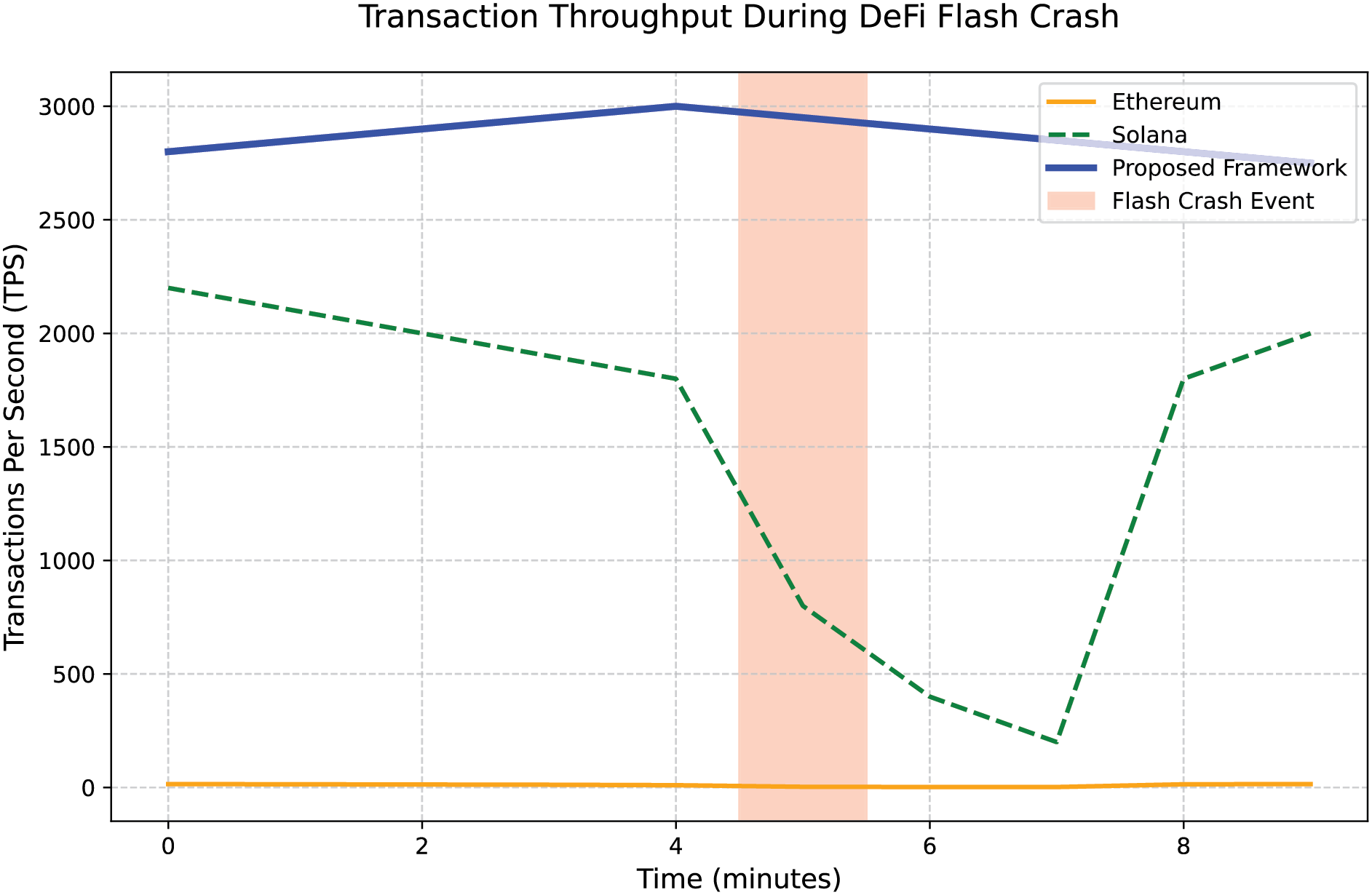

• Attack Surface Expansion: High-throughput chains like Solana (50k TPS) require validator centralization (1900 nodes with 400 ms finality), lowering 51% attack costs to $40M vs. Bitcoin’s $5B [19].

• Layer-2 Risks: While rollups boost Ethereum’s TPS to 4000 [20], they introduce new attack vectors: Optimistic Rollups have 7-day challenge periods, and zk-Rollups depend on centralized provers [21].

2.2.3 Decentralization-Security Balance

• Staking Centralization: Post-Merge Ethereum shows 31% of staked ETH controlled by 5 entities [22], creating governance risks despite Proof-of-Stake’s energy efficiency.

• MEV Extraction: Decentralized block production enables maximal extractable value (MEV) attacks, with $680M extracted in 2022 [23], demonstrating how permissionless design enables financial attack surfaces.

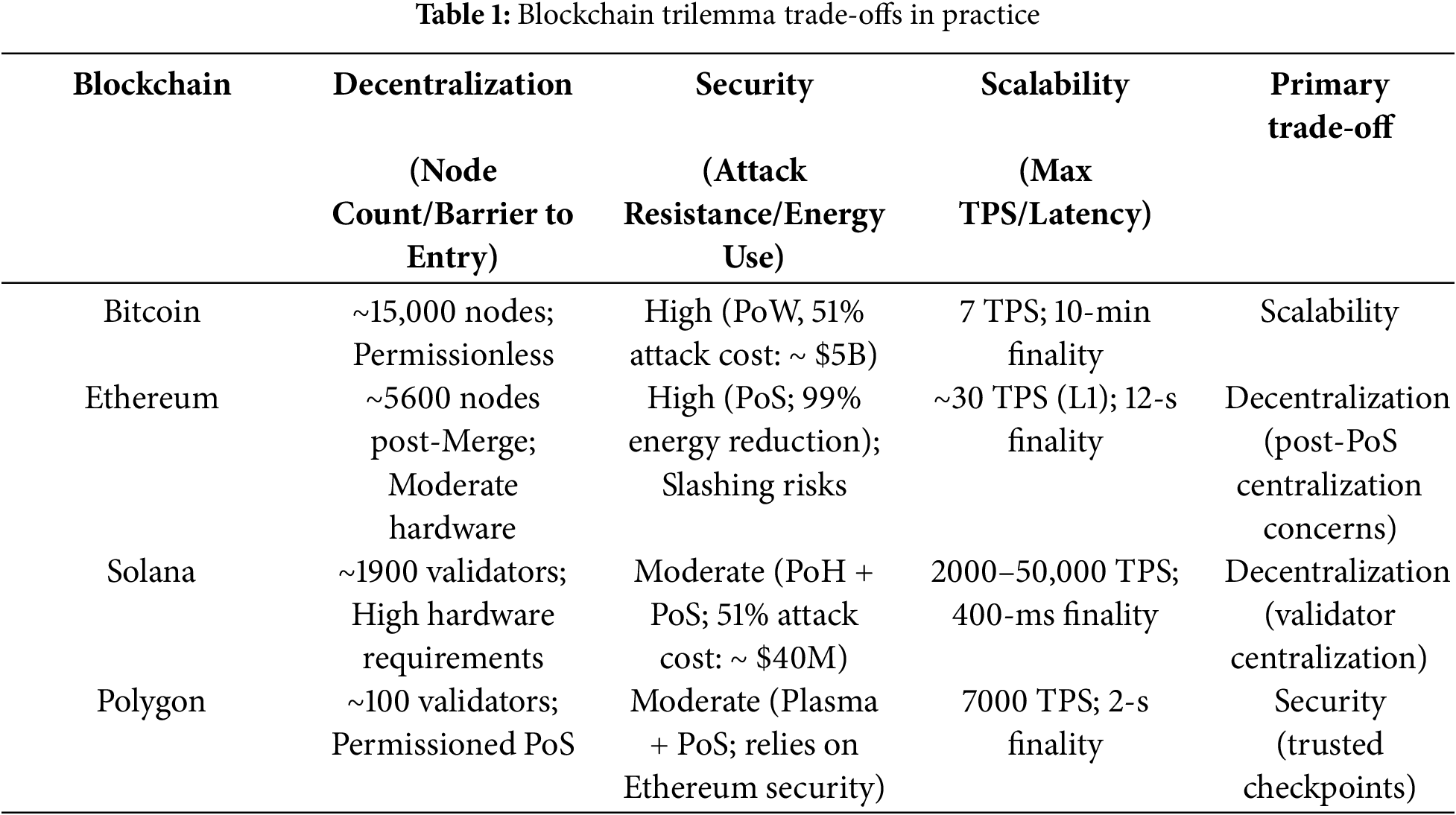

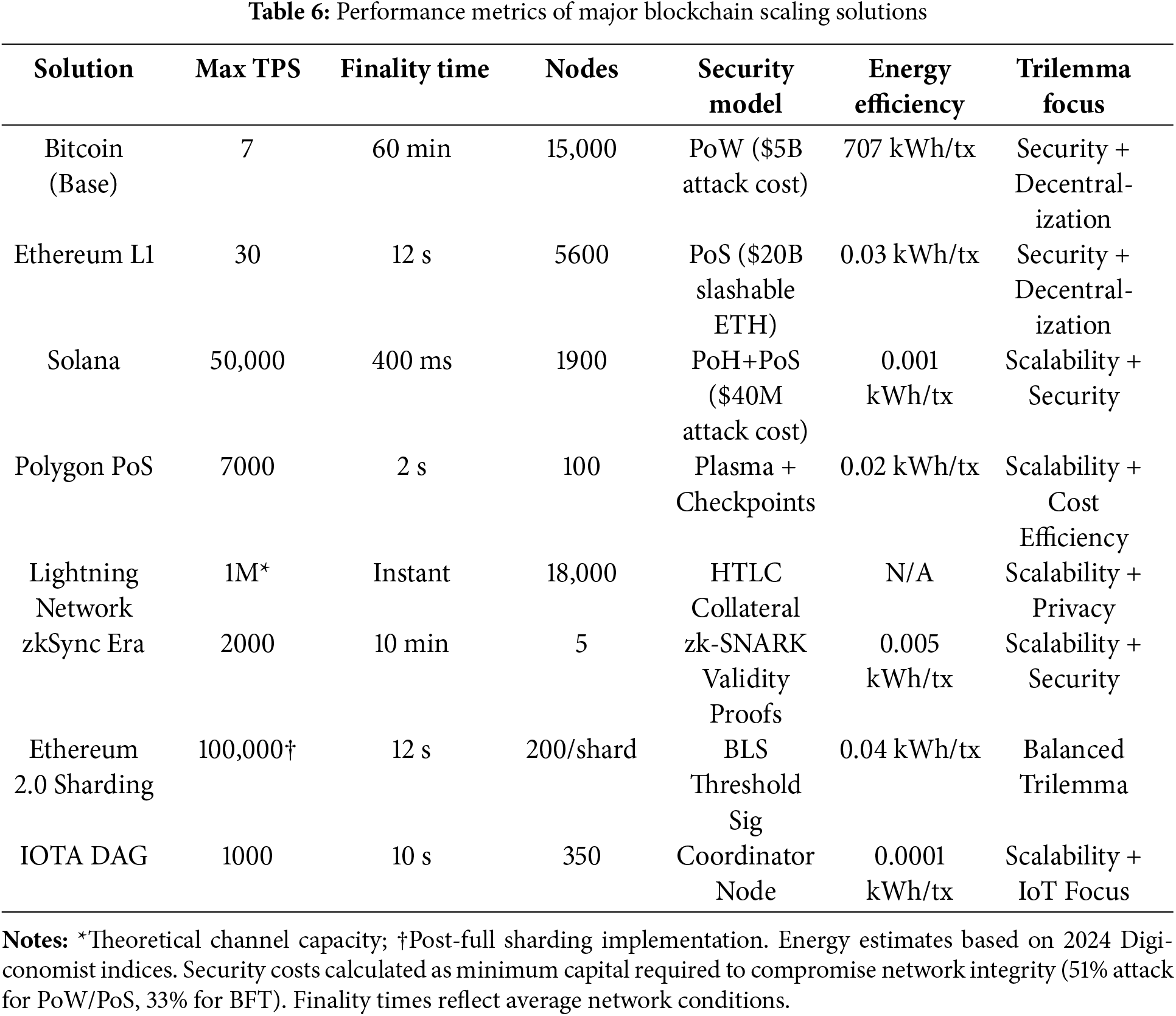

These inherent tensions force blockchain architects to make context-specific compromises. As shown in Table 1, Bitcoin’s 7 TPS reflects its decentralization priority, while Solana’s 50,000 TPS comes with validator centralization risks. The following sections analyze how recent innovations in Sections 4–6 attempt to reshape these trade-off curves through technical breakthroughs like TEE-assisted consensus and zk-AMHLs.

2.3 Mathematical Formalization of Consensus Mechanisms

The blockchain trilemma arises from the mathematical constraints inherent to consensus protocols. Below, we formalize the core algorithms underpinning decentralization, security, and scalability trade-offs.

In PoW, miners compete to solve a cryptographic puzzle. The probability

where

where D is the network difficulty. Throughput is bounded by block size B and interval

2.3.2 Practical Byzantine Fault Tolerance (PBFT)

PBFT achieves consensus in three phases (pre-prepare, prepare, commit) with

The latency to finality is proportional to the round-trip time (RTT) between nodes:

In DAGs like IOTA’s Tangle, transactions (

Throughput scales with network participation:

2.3.4 Proof of Work (PoW) Mining Probability

The probability

where

where

2.3.5 Proof of Stake (PoS) Validator Rewards

In PoS, the reward for validator

where

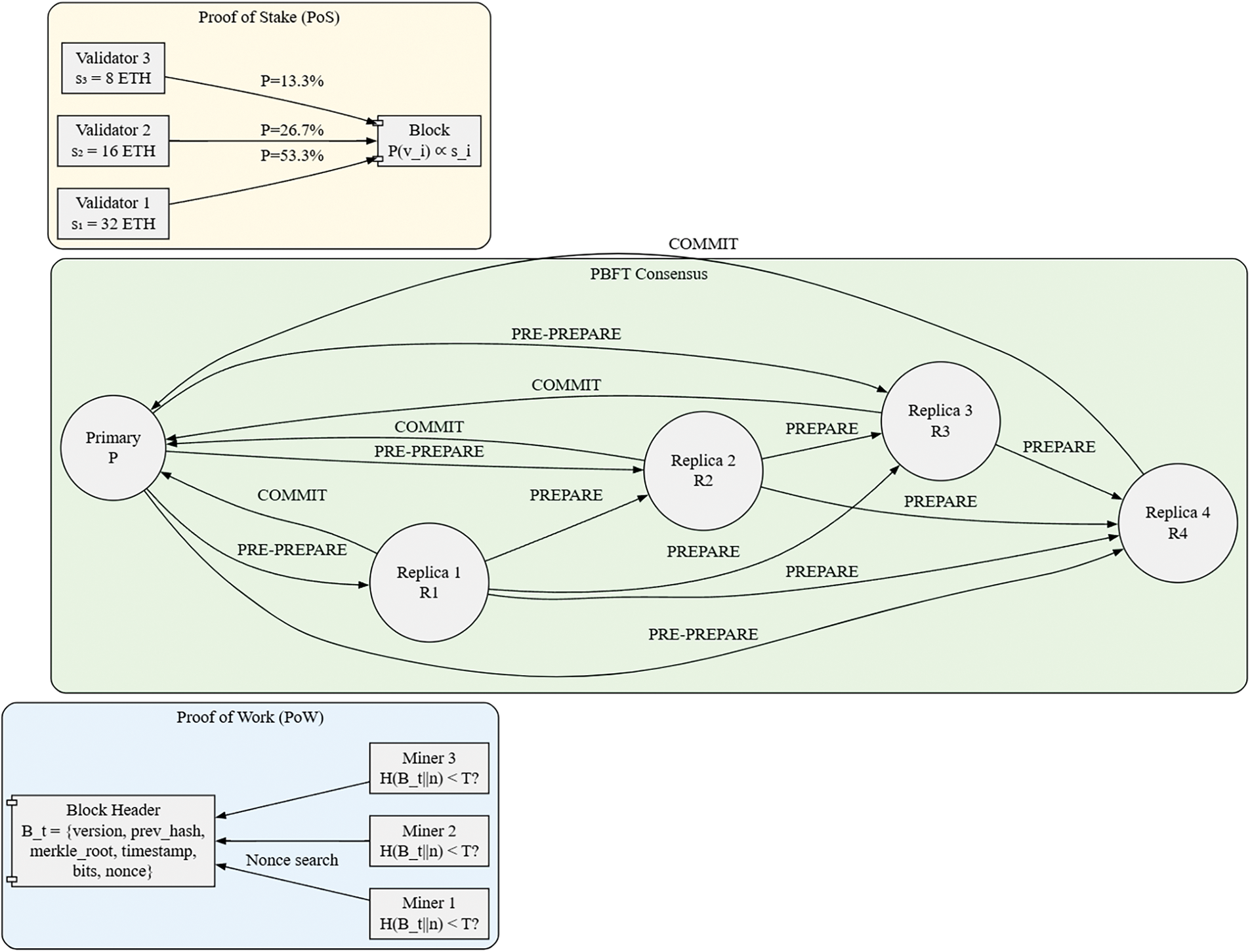

Execution of the aforementioned mathematical formulations are graphically illustrated using Fig. 3.

Figure 3: Mathematical representations of core consensus mechanisms

Proof of Work (PoW): Let H be a cryptographic hash function,

The probability P of finding a valid nonce in one attempt is:

where

Practical Byzantine Fault Tolerance (PBFT): For

Message complexity per consensus round is:

The commit phase succeeds when receiving

Directed Acyclic Graphs (DAG): In IOTA’s Tangle, the cumulative weight

where

where

Proof of Stake (PoS): Validator

Slashing conditions for Byzantine behavior:

where

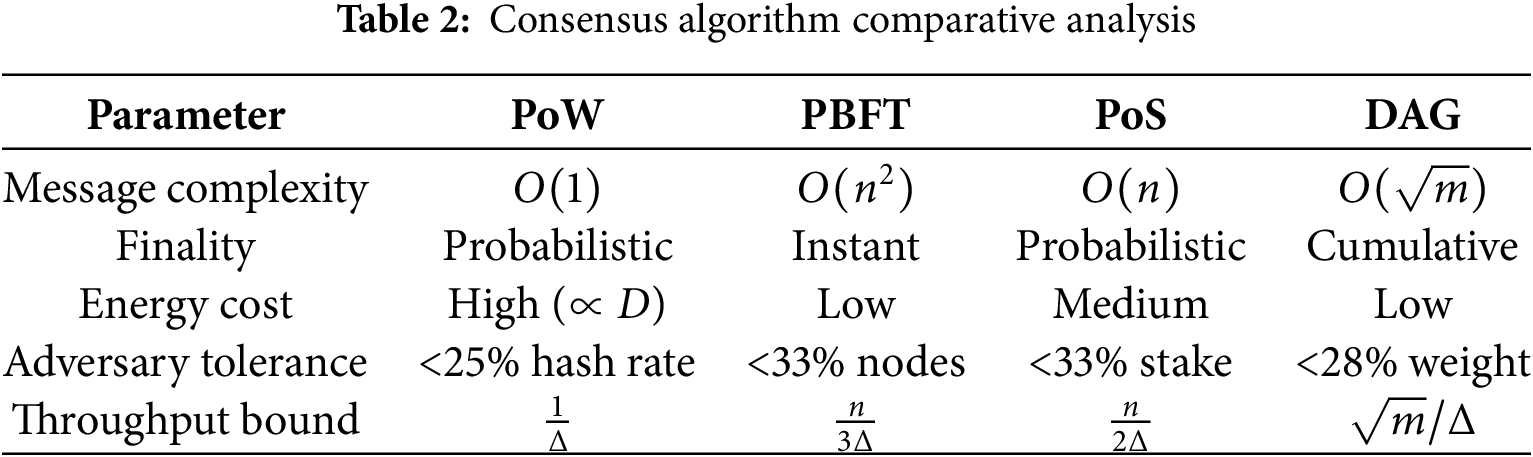

Table 2 represents the comparative analysis of the consensus algorithm, where

This review follows a systematic approach to analyzing the blockchain trilemma, utilizing the PRISMA framework to ensure comprehensive and transparent reporting. The process is divided into five key phases: literature selection, search & screening, categorization, critical analysis, and comparative evaluation.

3.1 Literature Selection Criteria

We used the PRISMA 2020 guidelines to ensure a rigorous and transparent selection process. The criteria for selecting studies include:

The articles were selected for review based on the following criteria:

• Source Types: Peer-reviewed journal articles, conference papers, technical reports, and edited book chapters from trusted databases (IEEE Xplore, ACM Digital Library, SpringerLink, Elsevier, ScienceDirect).

• Time Frame: Studies published between 2016 and 2024 to capture the latest advancements.

• Keywords:

–Core terms: “Blockchain Trilemma,” “Scalability,” “Security,” “Decentralization.”

– Related solutions: “Consensus Mechanisms,” “Layer-2 Solutions,” “Sharding,” “Sidechains,” “Zero-Knowledge Proofs.”

– Performance metrics: “Throughput,” “Latency,” “Energy Efficiency,” “Transaction Speed.”

•Content Focus:

– Studies must explicitly address at least one dimension of the trilemma (scalability, security, decentralization) or propose solutions (e.g., PoW/PoS variants, DAGs, rollups).

– Empirical data, technical analyses, or comparative evaluations of blockchain architectures.

– Studies discussing trade-offs (e.g., scalability vs. security) or real-world implementations (e.g., Ethereum 2.0, Hyperledger).

•Access: Open-access and subscription-based articles were considered.

The articles were excluded from the review based on the following criteria:

• Publication Year: Studies published outside the specified time range.

• Pre-Publication Stage: Articles still in the pre-publication phase.

• Publication Type: Editorials, notes, and other brief publications.

• Title Relevance: Articles whose titles did not align with the targeted keywords or subject.

• Abstract Focus: Articles with abstracts that did not primarily focus on the research topic.

We adhered to the PRISMA checklist throughout the selection process, which includes the documentation of all inclusion and exclusion criteria.

3.2 Literature Search and Screening

A systematic search was conducted across the chosen databases (IEEE Xplore, ACM Digital Library, SpringerLink, and Elsevier). We initially identified 50 records. After removing duplicates, we screened titles and abstracts for relevance. The full-text articles were then reviewed for eligibility based on the inclusion and exclusion criteria.

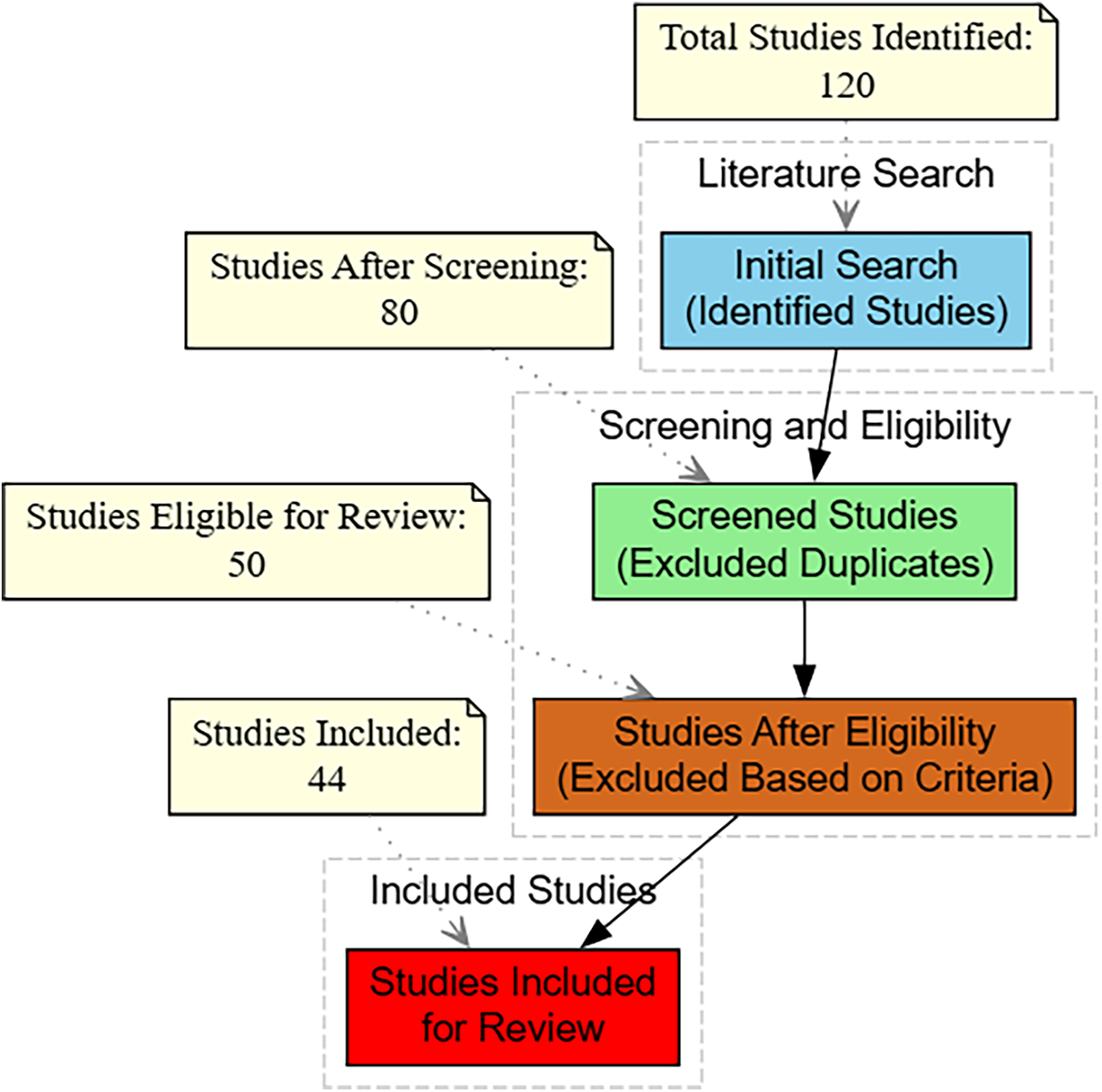

Fig. 4 summarizes the study selection process, including the number of records identified, screened, and ultimately included in the review.

Figure 4: Methodology of our survey

3.3 Categorization of Solutions

Following the PRISMA recommendations, the studies were categorized into three groups based on the blockchain trilemma dimensions: decentralization, security, and scalability. Each category was further divided into subcategories as described earlier.

3.4 Data Extraction and Synthesis

For each study included in the review, key information was extracted, such as performance metrics, trade-offs, and implementation details. This data was synthesized to compare different solutions, with a focus on how they address the blockchain trilemma’s challenges.

3.5 Comparative Evaluation and Future Research Directions

Based on the data extracted and analyzed, we provide a comparative evaluation of the solutions based on key metrics such as scalability, security, and decentralization. We also identify gaps in the current literature and propose potential future research directions in blockchain technology, particularly in addressing the challenges of the blockchain trilemma.

Prior surveys and systematic reviews have explored blockchain scalability and security as isolated dimensions of the trilemma. For instance, existing works predominantly focus on either scalability improvements (e.g., sharding, layer-2 protocols) or security vulnerabilities (e.g., 51% attacks, smart contract flaws), often neglecting the interdependencies between decentralization, security, and scalability. Our review critically synthesizes these fragmented efforts, emphasizing how prior surveys have addressed subsets of the trilemma but failed to provide a unified analysis. By integrating all three dimensions, we bridge the gap between isolated research threads and offer a holistic framework for evaluating trade-offs. Unlike prior surveys that narrowly focus on individual aspects (e.g., [24–29] on scalability; [30,31] on security), our analysis systematically connects these domains, revealing how the trilemma’s constraints manifest across architectural and cryptographic innovations.

In [24], Sanka and Cheung conducted a systematic review of blockchain scalability, focusing on issues, solutions, and future research directions. The authors proposed a five-layer conceptual model of the blockchain ecosystem (application, data, consensus, network, platform) to categorize scalability challenges and systematically analyzed 351 studies. They classified solutions into write-performance (on-chain, off-chain, consensus, network, platform layers), read-performance, and storage scalability, while emphasizing the blockchain quadrilemma (scalability, decentralization, security, trust). The paper uniquely integrates performance analysis and benchmarking studies, addressing gaps in prior surveys that focused narrowly on specific solutions like sharding.

In [25], Rao et al. conducted a systematic literature review (SLR) analyzing blockchain scalability challenges, existing solutions, and future research directions. The study reviewed nearly 110 papers from databases like Scopus and IEEE Xplore, identifying critical issues such as low throughput, network latency, and energy consumption in Bitcoin and Ethereum. The authors evaluated limitations of on-chain (e.g., sharding, consensus mechanisms) and off-chain solutions (e.g., Lightning Network), emphasizing trade-offs between scalability, security, and decentralization. A key contribution is the integration of data science techniques like distributed computing and machine learning to optimize transaction processing and consensus protocols. The paper also highlights emerging trends, such as leveraging Apache Kafka and Spark for scalable blockchain architectures.

In [26], the authors reviewed scalability challenges in blockchain systems, focusing on performance inefficiency, high confirmation delays, and functional limitations. They systematically analyzed four mainstream solutions: Sharding mechanisms (e.g., Elastico and Zilliqa), DAG-based ledgers (e.g., IOTA and Nano), off-chain networks (Lightning Network, Raiden, Plasma), and cross-chain technologies (multi-signature witnesses, sidechains, hash locking). The paper highlighted trade-offs in each approach, such as Sharding’s reliance on PBFT consensus and off-chain solutions’ centralization risks. Additionally, the authors proposed future research directions, including scalable P2P networks, modular cryptography, and programmable compute engines.

In [27], the authors reviewed scalability challenges in blockchain systems through the lens of throughput, storage, and networking bottlenecks. They analyzed enabling technologies such as sharding (e.g., Elastico and OmniLedger), off-chain solutions (Lightning Network, Plasma), and hybrid storage approaches (IPFS, BigchainDB), emphasizing trade-offs like decentralization-security compromises and consensus latency. The paper critically evaluated leader election mechanisms (e.g., Bitcoin-NG, ByzCoin) and highlighted unresolved issues, including energy-efficient leader selection and incentive-punishment balance. Additionally, future directions such as privacy-preserving data processing and quantitative performance analysis frameworks were proposed.

In [28], the authors reviewed scalability challenges in blockchain systems, emphasizing bottlenecks in throughput, storage efficiency, and transaction costs. They analyzed solutions such as consensus mechanism optimizations (e.g., BFT variants), off-chain transactions (e.g., Lightning Network), DAG-based ledgers, and hybrid storage approaches (e.g., IPFS integration). The paper critically evaluated existing surveys on blockchain scalability, introducing a ”recency score” metric to assess the inclusion of recent research, highlighting gaps in comprehensive comparative analyses. Future challenges identified include balancing incentive-punishment mechanisms, privacy-preserving data processing via secure multi-party computation, and developing quantitative frameworks for performance evaluation.

In [29], the authors Khan et al. reviewed challenges in blockchain scalability through a systematic literature review (SLR) of 121 primary papers. They identified transaction throughput, latency, storage demands, and consensus mechanisms (e.g., PoW, PoS) as critical factors hindering scalability in public blockchains like Bitcoin and Ethereum. The study categorized solutions into on-chain approaches (e.g., SegWit, sharding, block size adjustments) and off-chain methods like the Lightning Network, while emphasizing their trade-offs with decentralization and security. The review highlighted the scalability trilemma and noted that IoT, finance, and healthcare applications remain constrained by these limitations. The authors concluded that consensus protocol inefficiencies and interdependent factors necessitate balanced solutions to achieve industrial-grade scalability.

In [30], the authors reviewed blockchain security issues and challenges by analyzing 80 research papers, focusing on ecosystem concepts, blockchain classifications, and implementation aspects. They categorized blockchains into public, private, and consortium types, emphasizing their structural differences and security trade-offs. The paper highlights critical security vulnerabilities such as 51% attacks, forking (hard/soft), eclipse attacks, and smart contract flaws, while also addressing scalability, regulatory gaps, and integration challenges. Practical examples, including cryptocurrency systems (e.g., Bitcoin, Ethereum) and real-world breaches (e.g., MtGox, DAO hack), underscore the risks of human error and malicious exploits. The study concludes by stressing the need for robust regulatory frameworks and improved technical solutions to balance blockchain’s decentralized benefits with security and scalability demands, aligning implicitly with the blockchain trilemma’s core challenges.

In [31], Taylor and others conducted a systematic literature review (SLR) of 42 studies to analyze blockchain’s role in cybersecurity, emphasizing IoT security, data storage, and network applications. The review revealed that nearly half of the studies focused on securing IoT ecosystems through decentralized authentication and firmware updates, while others explored blockchain’s potential in encrypted data sharing and public-key infrastructure. Notably, practical implementations leveraged platforms like Ethereum and Hyperledger Fabric but faced scalability trade-offs due to consensus mechanisms like Proof-of-Work. The study also identified emerging research directions, such as securing AI data and sidechain architectures, while underscoring challenges like latency and regulatory gaps.

In [32], the authors reviewed blockchain security through a structured PDI (Process, Data, Infrastructure) framework, addressing gaps in prior surveys that overlooked organizational and operational challenges. They categorized security techniques and threats across three levels: process (e.g., smart contract vulnerabilities, fraud detection), data (e.g., encryption, consensus algorithms), and infrastructure (e.g., key management, network vulnerabilities). The paper critically analyzed existing architectures, consensus mechanisms, and cryptographic methods, while highlighting emerging issues such as scalability and quantum computing threats. It also proposed future directions, including formal verification of smart contracts, integration with big data analytics, and anti-quantum signature schemes.

In [33], the authors reviewed blockchain technology with a focus on its applications and associated security and privacy challenges. They conducted a systematic survey of 135 research articles from five major databases (ScienceDirect, IEEE Xplore, Web of Science, ACM Digital Library, and Inderscience), categorizing blockchain applications into 12 domains, including healthcare, IoT, finance, and supply chain. The paper highlighted blockchain’s decentralized, tamper-proof, and transparent properties while addressing implementation challenges such as scalability, mining inefficiency, and consensus mechanisms. Notably, it emphasized security issues like double-spending attacks, privacy leakage, and key management, contrasting its comprehensive coverage of both applications and security with prior surveys that often focused narrowly on specific domains. The authors positioned their work as the first to integrate a broad analysis of blockchain applications with an in-depth discussion of security and privacy, providing a foundational reference for researchers.

In [34], the authors reviewed the current state of blockchain-powered decentralized finance (DeFi), emphasizing its evolution, key services, and associated risks. They provided a comparative analysis between DeFi and traditional financial systems, highlighting services such as decentralized lending/borrowing, stablecoins, and automated market maker (AMM)-based exchanges. The paper detailed investment opportunities in DeFi, including liquidity provision, arbitrage, and liquidation strategies, while also addressing unique risks such as smart contract vulnerabilities, impermanent loss, and regulatory uncertainties. Notably, the authors aimed to bridge the gap between academic rigor and accessibility, making the review suitable for both technical and investment-focused audiences. The work stands out for its holistic overview of the DeFi ecosystem, contrasting with existing reviews that often focus narrowly on specific services or theoretical aspects.

In [35], the authors reviewed consensus algorithms in blockchain systems, emphasizing their principles, performance, and suitability for different application scenarios. They analyzed key algorithms such as Proof of Work (PoW), Proof of Stake (PoS), Delegated Proof of Stake (DPoS), Practical Byzantine Fault Tolerance (PBFT), and Raft, comparing their Byzantine fault tolerance, throughput, scalability, and limitations. The paper highlighted PoW’s resource inefficiency and scalability challenges, contrasted with DPoS’s efficiency and PBFT’s suitability for permissioned systems. Additionally, the authors provided guidance on selecting algorithms based on blockchain types (public, private, permissioned) and discussed emerging issues like hashing power centralization. This work serves as a foundational reference for understanding trade-offs in consensus mechanisms, though it acknowledges the need for scenario-specific optimizations in evolving blockchain ecosystems.

In [36], the authors reviewed blockchain consensus models, categorizing them into proof-based (e.g., PoW, PoS, DPoS) and voting-based (e.g., PBFT, Ripple) approaches. They critically analyzed each model’s performance in transaction throughput, latency, and energy efficiency, highlighting trade-offs such as PoW’s high resource consumption versus PBFT’s scalability limitations in permissioned settings. The paper provided comparative tables summarizing advantages, disadvantages, and suitability for permissioned or permissionless blockchains, while noting challenges like slow transaction finality in proof-based models and restricted node scalability in voting-based systems. The authors emphasized the need for hybrid or optimized models to address real-time application demands. This work serves as a practical reference for understanding consensus trade-offs but acknowledges gaps in quantitative metrics and real-world.

In [37], Tenorio-Fornes et al. proposed a decentralized scientific publishing system using blockchain and IPFS to address centralization and transparency issues in traditional peer review. They introduced a reviewer reputation system, Open Access infrastructure, and transparent governance, leveraging Ethereum smart contracts for process automation and IPFS for decentralized content storage. The paper highlighted privacy challenges, proposing cryptographic techniques like zk-SNARKs and ring signatures to enable anonymous yet accountable reviews, balancing decentralization and security. A prototype and survey demonstrated feasibility, though scalability concerns (e.g., blockchain transaction costs) and risks of Sybil attacks underscored unresolved tensions in the blockchain trilemma. This work advances decentralized solutions but underscores the trade-offs between transparency, security, and scalability in distributed systems.

In [38], the authors reviewed blockchain platforms through the lens of the scalability, security, and decentralization trilemma, analyzing nine major platforms, including Ethereum, Solana, and Cosmos. They systematically evaluated each platform’s consensus protocols, transaction throughput, node distribution, and Byzantine Fault Tolerance, highlighting inherent trade-offs—for instance, platforms like Binance Smart Chain prioritized scalability at the expense of decentralization, while Ethereum’s PoW model faced scalability limitations. The study emphasized that no platform fully resolved the trilemma, instead showcasing how architectural choices (e.g., sharding in Harmony, DAG structures in Avalanche) addressed specific aspects.

In [39], Lashkari and Musilek conducted a comprehensive review of 130 blockchain consensus mechanisms, analyzing 185 academic and industrial publications. The authors proposed a novel architectural classification framework, categorizing consensus algorithms into eight classes based on their foundational principles, such as proof-based, Byzantine fault-tolerant, and hybrid approaches. Their comparative analysis evaluated key parameters like scalability, finality, and adversary tolerance, offering insights into trade-offs between performance and security. The study also examined the distribution of consensus mechanisms across application domains, revealing their prevalence in cryptocurrencies and IoT, while noting underutilization in smart grids and localization. By addressing gaps in prior taxonomies, this work provides a structured reference for selecting consensus protocols in alignment with specific blockchain requirements. The analysis of evolution and future trends underscores the growing relevance of cross-compliant hybrid mechanisms, highlighting their potential to address scalability-decentralization-security trade-offs central to the blockchain trilemma.

In [40], the authors conducted a systematic review of blockchain scalability challenges, analyzing 35 studies from ACM, ScienceDirect, and IEEE to categorize solutions into on-chain (e.g., consensus algorithm optimization, sharding, blockchain redesign) and off-chain approaches (e.g., second-layer networks, IPFS). They identified sharding and consensus protocol enhancements as the most prominent solutions, though noted these often trade off decentralization or security. The review highlighted that while solutions like DAG-based architectures or hybrid consensus models improved throughput and latency, most lacked real-world validation and faced unresolved issues such as inter-shard communication inefficiencies. The paper concluded that scalability remains a critical barrier to blockchain adoption, urging further empirical testing and integration of multi-faceted approaches. This review underscores the need for practical implementations to balance scalability with blockchain’s core principles.

In [41], the authors reviewed recent advancements in blockchain consensus algorithms, emphasizing their principles, classifications, and trade-offs. The paper categorizes consensus mechanisms into non-Byzantine (e.g., Paxos, Raft) and Byzantine fault-tolerant (e.g., PBFT, PoW, PoS) algorithms, analyzing their efficiency, security, energy consumption, and suitability for public, consortium, or private chains. A comparative table highlights key distinctions, such as PoW’s decentralization versus its high energy costs and PoS’s efficiency versus centralization risks. The study also explores emerging hybrid and scenario-specific algorithms (e.g., PoH, CW-PoW) and predicts future trends, including scalability enhancements and security-focused improvements. While not explicitly framing it as the “blockchain trilemma,” the analysis implicitly addresses challenges in balancing decentralization, security, and scalability across consensus models.

In [42], Deng et al. reviewed blockchain technologies for building decentralized trust mechanisms, focusing on architecture, consensus algorithms, and smart contracts. The authors systematically analyzed blockchain’s layered architecture (data, network, consensus, contract, and application layers), emphasizing how each layer contributes to decentralization, security, and scalability. They compared proof-based and voting-based consensus mechanisms, highlighting trade-offs in energy efficiency, throughput, and fault tolerance, which align with the blockchain trilemma’s challenges. The paper also examined smart contract platforms like Ethereum and Hyperledger Fabric, discussing their security limitations and scalability constraints.

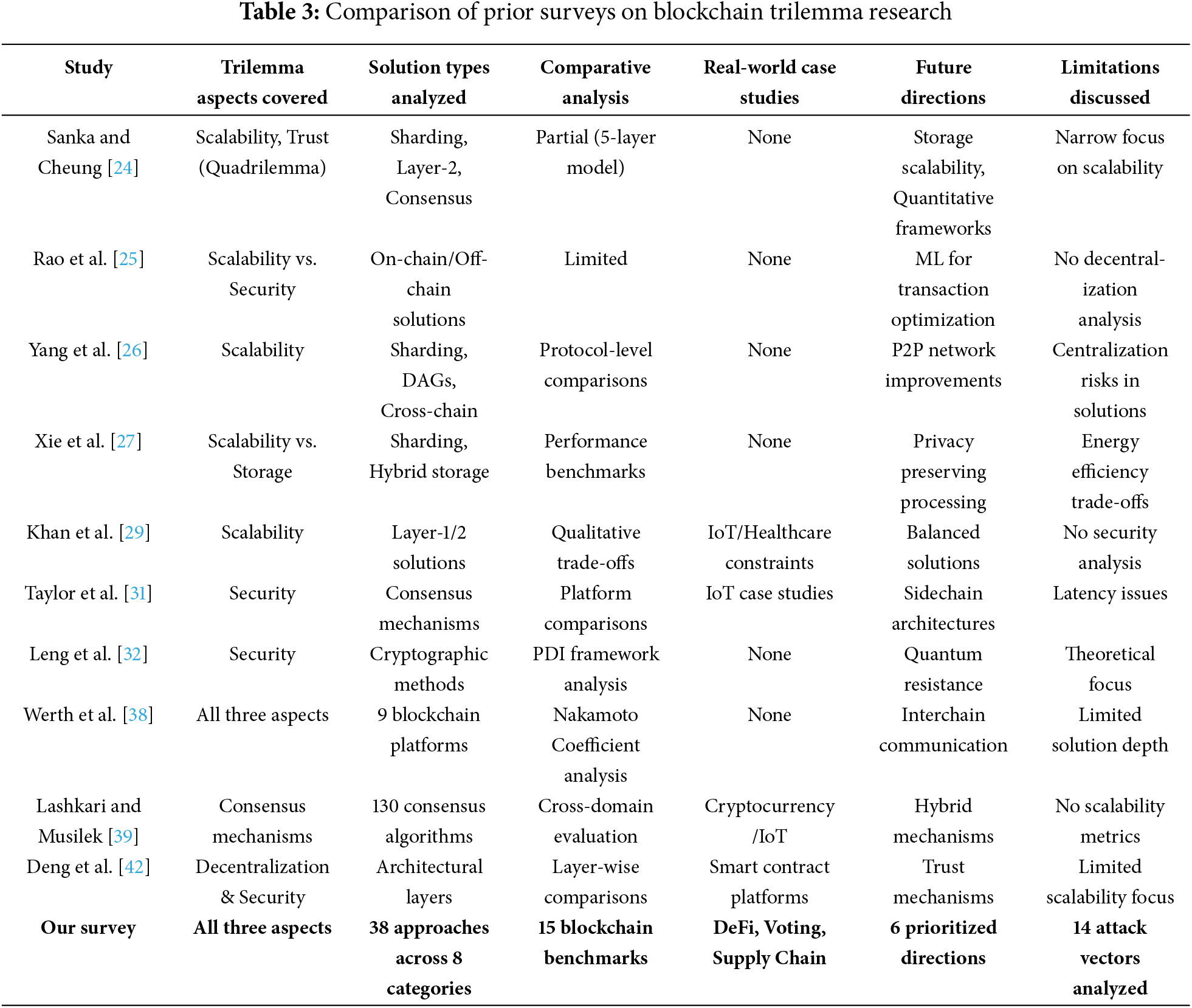

Prior surveys have predominantly focused on isolated dimensions of the trilemma, with emphasizing scalability [24–29], prioritizing security [30,31], and partially addressing decentralization [35,40]. While Lashkari and Musilek [39] provided comprehensive consensus analysis, they omitted scalability metrics. Our work differs through three key innovations: 1) Holistic integration of all trilemma dimensions via a unified analytical framework, 2) Systematic taxonomy categorizing 38 solutions with granular trade-off labeling, and 3) Practical validation through real-world deployments (e.g., Ethereum post-Merge) and emerging paradigms (zk-AMHLs, TEE-assisted consensus). Unlike [38]’s platform-centric approach, we benchmark performance across decentralization metrics (Nakamoto Coefficient), security thresholds (51% attack costs), and scalability targets (Visa-level TPS). Our critical evaluation of 14 attack vectors and AI-driven governance proposals extends beyond the theoretical scope of prior works. The comparison is briefly represented in Table 3.

5 Existing Solutions and Corresponding Challenges

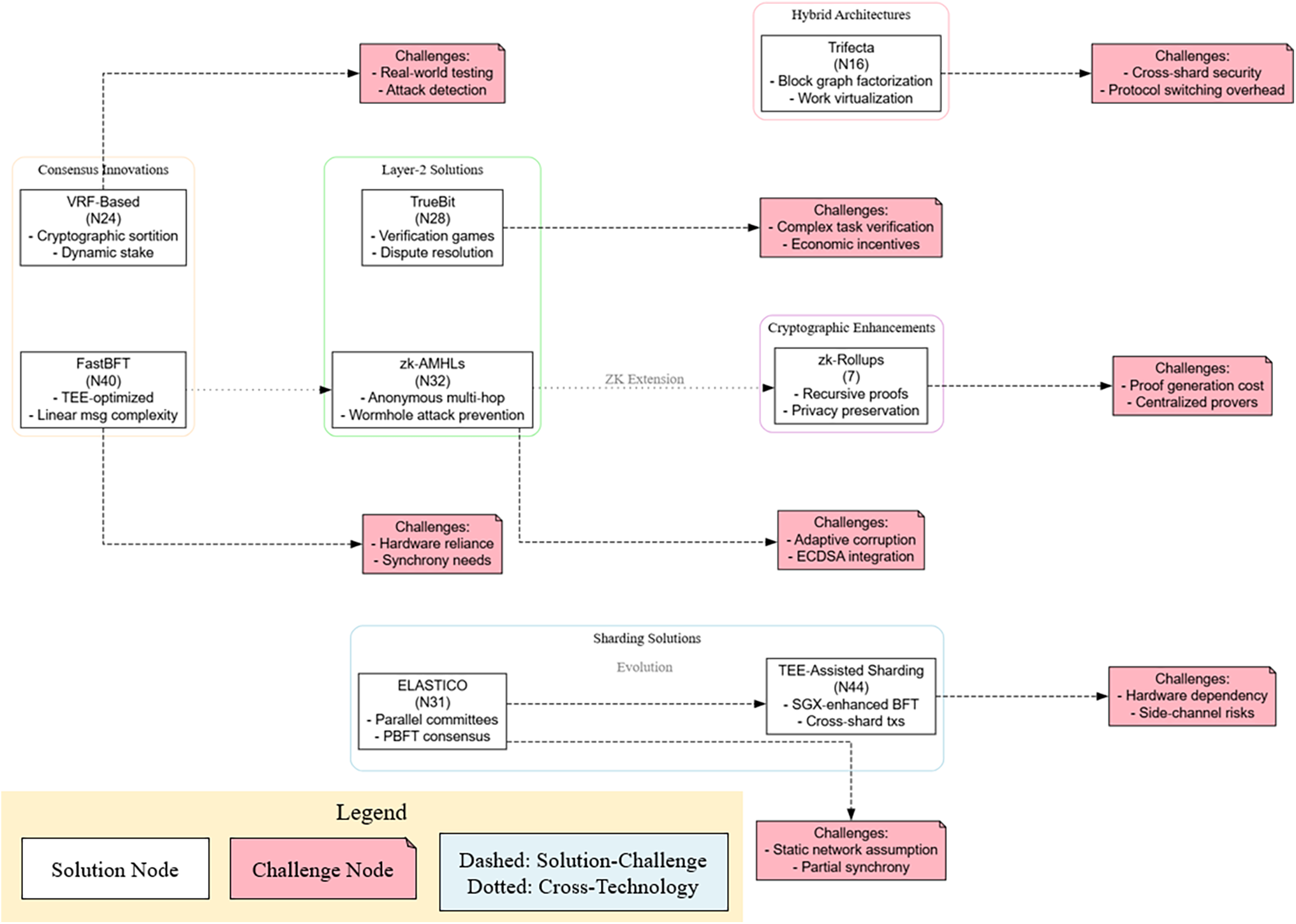

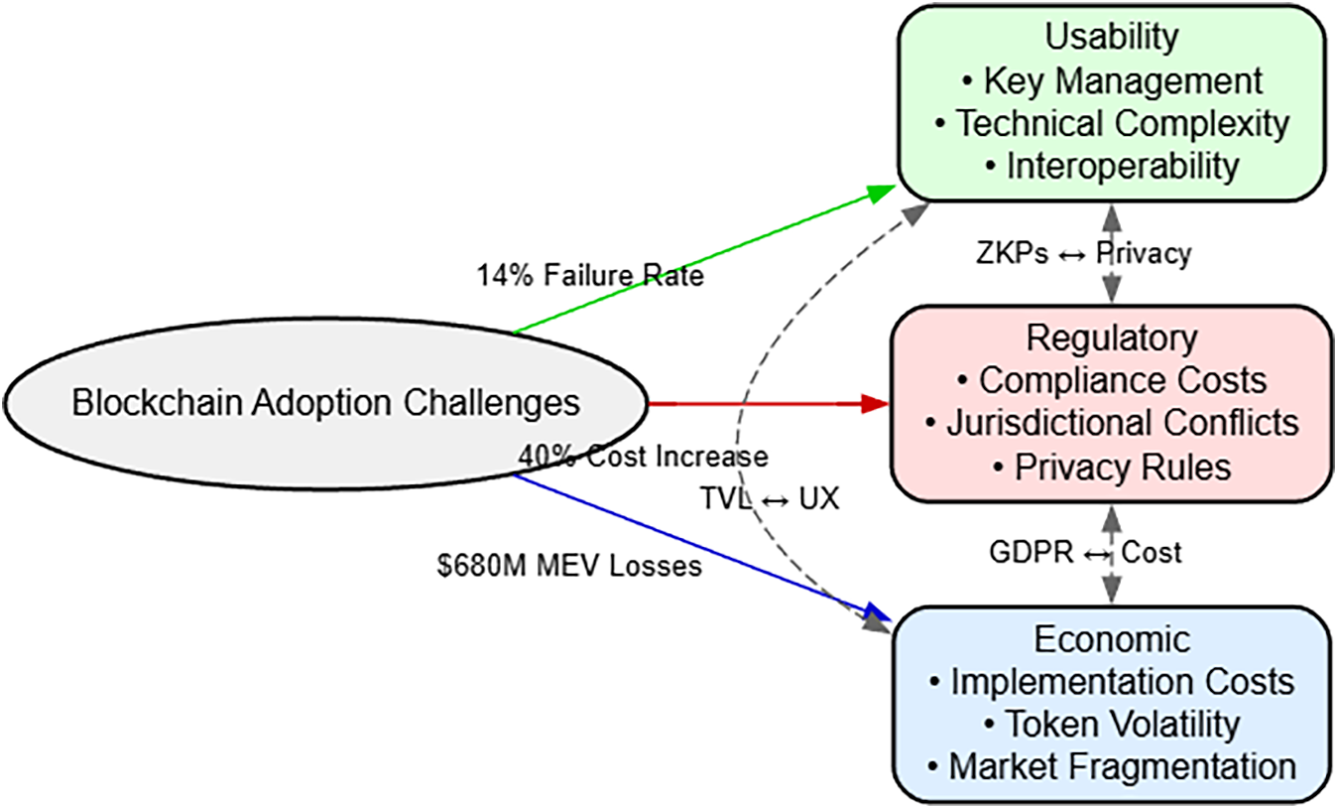

The blockchain trilemma has inspired diverse technical approaches, each prioritizing different dimensions while managing trade-offs. Fig. 5 illustrates contemporary blockchain trilemma mitigation strategies, mapping technical solutions (blue nodes) to their implementation challenges (pink notes) across five architectural paradigms. Arrows denote both technical dependencies (solid) and conceptual evolution paths (dotted), demonstrating the multi-layered approach required to balance scalability, security, and decentralization.

Figure 5: Architectural approaches to blockchain trilemma resolution, showcasing sharding implementations, layer-2 protocols, consensus innovations, cryptographic enhancements, and hybrid architectures. Color-coded clusters represent solution categories (light pastels), with pink challenge nodes highlighting technical constraints. Dashed relationships show solution-specific limitations, dotted lines indicate cross-technology evolution

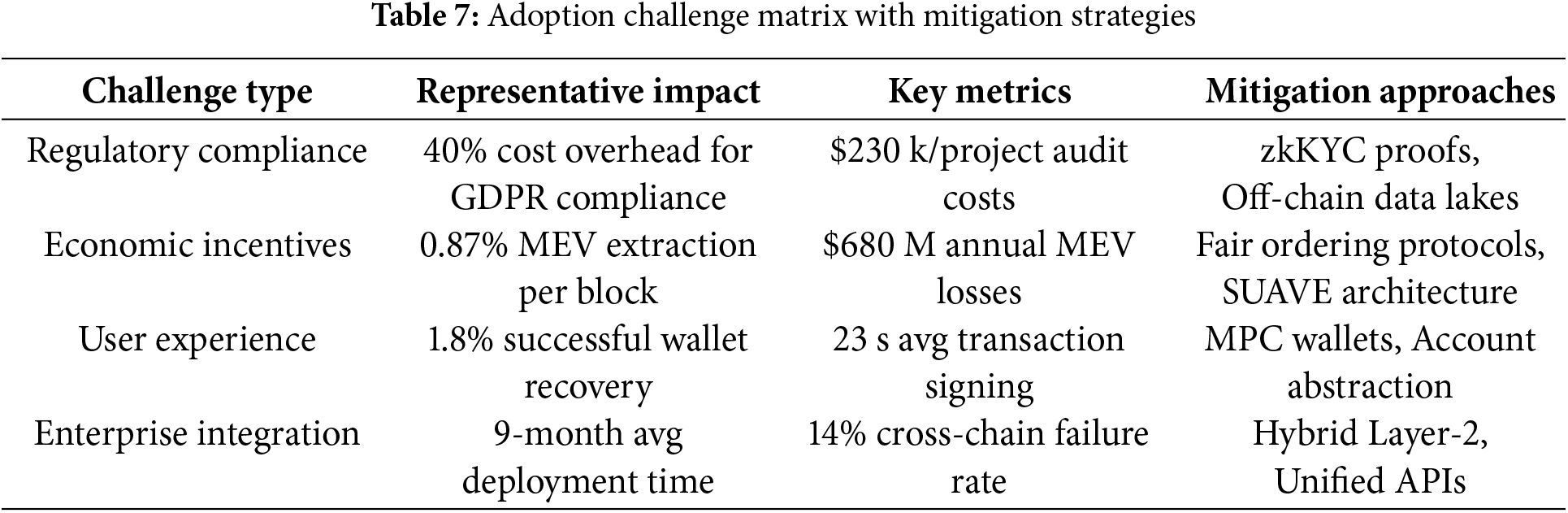

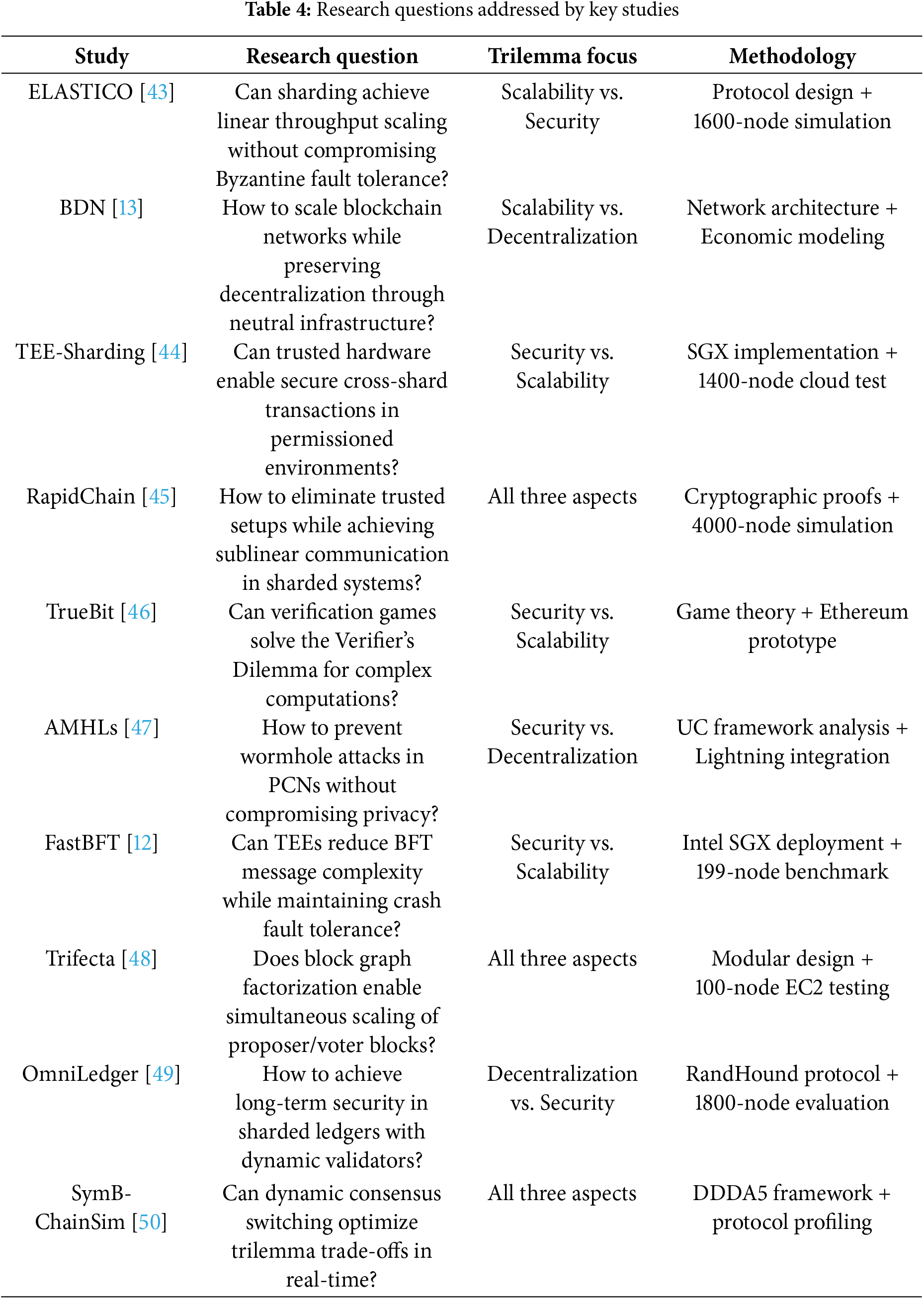

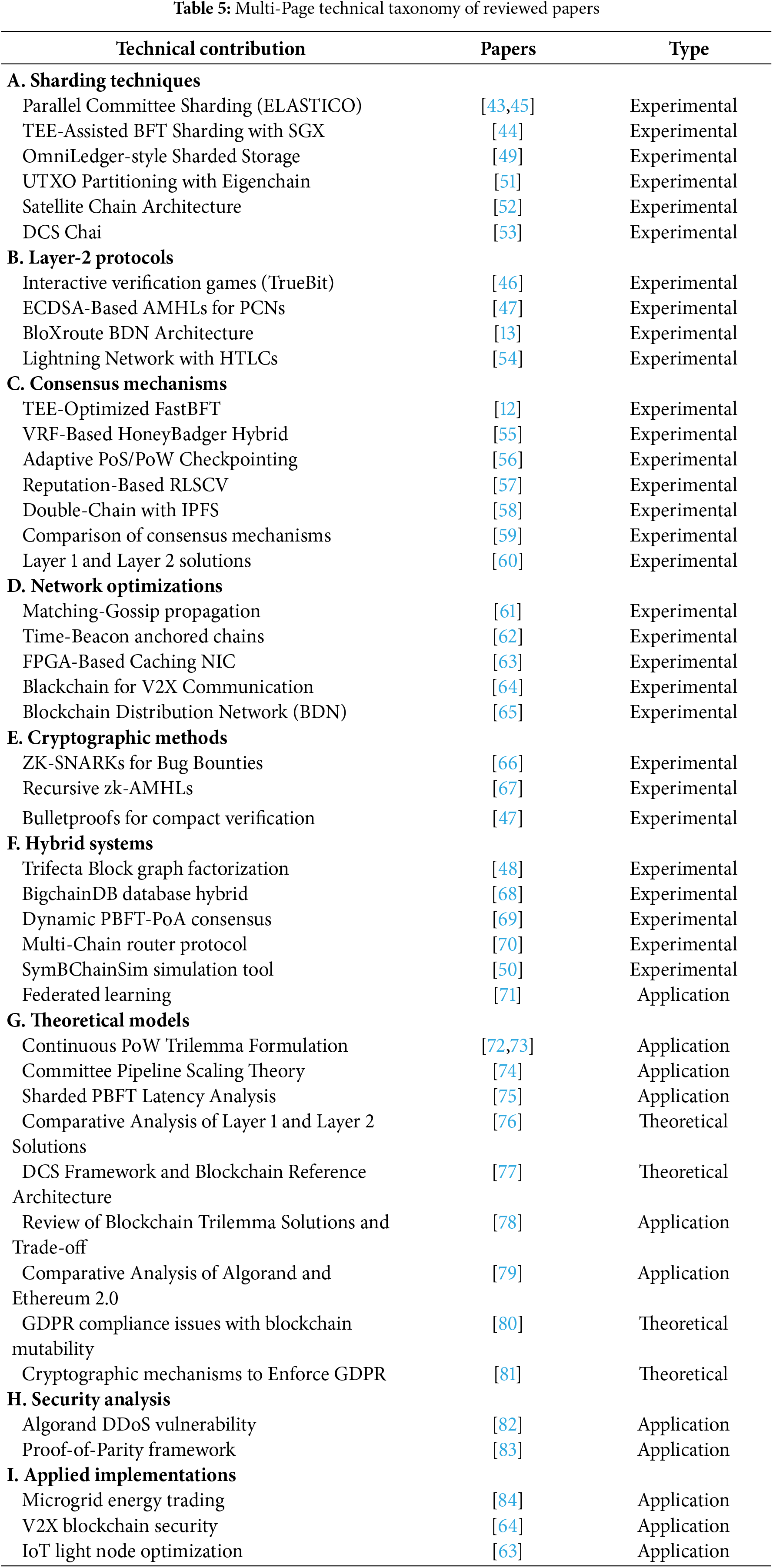

The reviewed studies collectively address three fundamental research questions underlying the blockchain trilemma: (1) How to scale transaction processing without centralizing trust? (2) How to maintain security guarantees under resource constraints? (3) How to preserve decentralization while meeting enterprise performance requirements? As shown in Table 4, solutions range from architectural innovations (ELASTICO’s parallel committees) to cryptographic breakthroughs (AMHLs’ scriptless locks), each prioritizing different trilemma dimensions through distinct methodological approaches.

Table 5 classifies papers by their core technical innovation, explicitly naming protocols (e.g., ELASTICO, FastBFT), cryptographic primitives (zk-AMHLs), and architectural paradigms (Time-Beacon chains). Experimental works focus on protocol implementations, while application-based studies emphasize real-world deployments, case analyses, and domain-specific integrations.

Below, we categorize prominent solutions based on their core architectural focus:

Sharding techniques partition blockchain networks into parallel processing units to enhance throughput while preserving decentralization.

5.1.1 Sharding Throughput Gain

For

where

5.1.2 Security Analysis of Sharding

The probability of a shard being compromised by

where

In [43], the authors introduced ELASTICO, a novel sharding protocol designed to overcome the scalability limitations of open blockchains like Bitcoin while ensuring security against Byzantine adversaries. The authors identified the critical challenge of achieving linear scalability in transaction throughput without compromising decentralization or security, a problem unsolved by existing consensus protocols such as Nakamoto consensus or classical Byzantine fault-tolerant (BFT) approaches. The core innovation of ELASTICO lay in its partitioning of the mining network into smaller committees, each processing disjoint transaction shards in parallel, with the number of committees scaling near-linearly with the network’s computational power. The protocol operated in five key steps: (1) identity establishment via proof-of-work (PoW) to limit Sybil attacks, (2) committee formation and overlay setup using a directory committee to reduce communication overhead, (3) intra-committee consensus employing PBFT to agree on transaction shards, (4) final consensus by a designated committee to aggregate shards into a single blockchain update, and (5) epoch randomness generation to ensure unbiased committee assignments in subsequent epochs. The authors implemented ELASTICO as an extension of Bitcoin’s codebase, adding approximately 5000 lines of C++, and evaluated its performance on Amazon EC2 with networks of up to 1600 nodes. The experiments demonstrated near-linear scalability, with throughput increasing from 1 block per epoch (100 nodes) to 13.5 blocks (1600 nodes), while maintaining constant per-node bandwidth usage (

In the study [65], the authors explored the scalability challenges inherent in blockchain technology, particularly focusing on the inefficiencies of trustless peer-to-peer networks that result in slow transaction processing speeds, as exemplified by Bitcoin’s mere three transactions per second (TPS). They identified the root cause as the suboptimal propagation and validation of information across decentralized nodes, which creates bottlenecks due to cryptographic operations at each hop, high performance variance among nodes, and inefficient network paths. To address this, they proposed leveraging cloud-delivery networks (CDNs), such as Akamai and YouTube, which have successfully scaled other domains (e.g., web and video delivery) by optimizing data distribution. However, the centralized nature of CDNs conflicts with blockchain’s decentralized ethos, raising concerns about censorship and trust. As a solution, the authors introduced a Blockchain Distribution Network (BDN), a provably neutral network that decouples authority from infrastructure, ensuring scalability without compromising decentralization. The BDN employed several key mechanisms: encrypted blocks to prevent content-based censorship, indirect relay to obscure block origins, and continuous auditing via test blocks to detect and mitigate discriminatory behavior. Additionally, it optimized performance through transaction caching (reducing block size by indexing transactions), cut-through routing (accelerating data transmission), and mitigating the transaction incast problem (minimizing redundant data reception). The authors compared their approach with existing scaling solutions, such as off-chain methods (e.g., the Lightning Network) and on-chain techniques (e.g., sharding), arguing that the BDN complements these methods by fundamentally improving the network layer. They further theorized that BDN could dramatically enhance scalability by leveraging optimized network-layer techniques like cut-through routing, transaction caching (reducing block sizes by over 100x), and eliminating the incast problem. Additionally, they suggested that, with dedicated infrastructure (e.g., optical networks), BDN could achieve microsecond-scale latencies, similar to modern data centers. Performance evaluation highlighted the BDN’s potential to significantly increase throughput and reduce latency, reinforcing the possibility of achieving microsecond-scale latencies in dedicated infrastructures. The research concluded that provably neutral clouds, like the BDN, offer a viable path to scaling blockchain networks while preserving their decentralized nature, provided the blockchain ecosystem can trust the underlying network infrastructure. However, a key limitation of the proposed BDN is its reliance on continuous auditing and the potential complexity of maintaining neutrality in practice.

Hung Dang et al. [44] addressed the critical scalability challenges in blockchain systems by proposing a sharding-based approach tailored for permissioned blockchains, aiming to achieve high transaction throughput while supporting general workloads beyond cryptocurrency applications. The authors identified three primary challenges in applying traditional database sharding techniques to blockchains: scaling Byzantine Fault Tolerance (BFT) consensus protocols, ensuring secure and efficient shard formation, and enabling secure distributed transactions even with malicious coordinators. To tackle these challenges, they leveraged trusted execution environments (TEEs), specifically Intel SGX, to enhance the performance of BFT consensus protocols by eliminating equivocation, thereby allowing a committee of

In the study [52], authors proposed a novel blockchain architecture designed to address key industrial challenges such as privacy, scalability, and governance in permission-based blockchain systems. They introduced the concept of “satellite chains,” which are interconnected yet independent subchains that operate in parallel, each maintaining its own private ledger and consensus protocol tailored to the needs of its stakeholders. This design allowed nodes to join multiple satellite chains simultaneously, ensuring privacy by restricting transaction visibility only to relevant participants while enabling cross-chain asset transfers without compromising security. The architecture also incorporated a regulatory framework where regulators could enforce policies across all satellite chains using smart contracts, specifically through a ”policy directory contract” that managed and deployed policy checks dynamically. To validate their approach, the authors integrated their solution with Hyperledger Fabric v0.6, adapting its structure to support multiple ledgers, cross-chain transactions, and policy enforcement mechanisms. They extended Fabric’s functionality by introducing data structures like chain-to-consensus and chain-to-peers maps to manage satellite chains and their participants, and implemented a policy directory chaincode to automate policy deployment and validation. The integration demonstrated the feasibility of their architecture, showcasing its ability to enhance scalability by allowing parallel consensus protocols and improving privacy through selective transaction visibility. The authors highlighted that their solution effectively realized blockchain sharding based on node relationships, making it suitable for industrial applications like trade finance and supply chain management. However, the work does not provide extensive empirical results or benchmarks to quantify the performance gains or overheads of their architecture.

The research article [45], authored by Mahdi Zamani et al., introduced RapidChain, a novel sharding-based public blockchain protocol designed to address the scalability and performance limitations of existing blockchain systems. The authors identified key bottlenecks in previous sharding-based protocols, such as linear communication overhead per transaction, low fault resiliency (e.g., 1/4 or 1/8), and reliance on trusted setups, which hindered their practicality for mainstream payment systems. RapidChain proposed a fully sharded architecture that partitioned the network into smaller committees operating in parallel, achieving sublinear communication overhead, higher Byzantine fault resiliency (up to 1/3 of participants), and eliminating the need for trusted setups. The protocol employed several innovative techniques, including an optimal intra-committee consensus algorithm based on synchronous Byzantine consensus, a novel gossiping protocol (IDA-Gossip) for efficient large block propagation, and a provably secure reconfiguration mechanism inspired by the Cuckoo rule to handle dynamic membership changes. Additionally, RapidChain introduced a fast cross-shard verification method leveraging Kademlia-inspired routing to minimize inter-committee communication and a decentralized bootstrapping protocol that avoided the quadratic message complexity of previous solutions. The authors implemented a prototype of RapidChain and evaluated its performance in a simulated network of up to 4000 nodes, demonstrating significant improvements over state-of-the-art protocols like Elastico and OmniLedger. RapidChain achieved a throughput of over 7300 transactions per second with a confirmation latency of approximately 8.7 s, while maintaining a high time-to-failure of over 4500 years. The evaluation also highlighted the protocol’s efficiency in handling cross-shard transactions, storage scalability, and reconfiguration latency. Despite its advancements, RapidChain’s reliance on synchronous communication during intra-committee consensus limits its responsiveness to network delays.

In another study [51], the authors proposed an innovative solution to Bitcoin’s scalability challenges by introducing a mechanism to partition the Unspent Transaction Output (UTXO) set and split the blockchain into multiple sub-chains. The core idea revolved around ”split events,” where the UTXO space and mempool were divided deterministically based on scriptPubKey hashes, creating independently operating sub-chains that allowed multiple blocks to be mined simultaneously during each block interval. This approach significantly increased transaction throughput while preserving Bitcoin’s decentralized nature. To ensure consistency across sub-chains, the authors introduced an eigenchain, a secondary blockchain that stored block headers from all sub-chains, requiring miners to perform atomic mining—simultaneously producing blocks for each sub-chain and the eigenchain—thereby maintaining security and preventing manipulation. A key innovation was the introduction of half nodes, lightweight nodes that tracked only one sub-chain and the eigenchain, reducing bandwidth and storage requirements while still enabling transaction verification. This addressed a major decentralization concern, as it allowed users in low-resource environments to participate in the network without running full nodes. The work also detailed transaction handling post-split, including Hashed Time-Lock Contracts (HTLCs) for atomic cross-sub-chain payments and eigentransactions for secure fund transfers between sub-chains. The performance evaluation compared Split-Scale with existing solutions like Segregated Witness (SegWit) and Bitcoin-NG, demonstrating that it offered exponential scalability (Nx with each split event) while maintaining decentralization. Miners benefited from increased fee collection across all sub-chains, and half nodes ensured that network participation remained accessible. The results showed that Split-Scale could achieve higher throughput without compromising security or decentralization, making it a promising alternative to current scaling approaches. The complexity of managing multiple sub-chains and the need for consensus on split events remain challenges.

Layer-2 solutions refer to off-chain protocols and secondary networks that enhance throughput while leveraging base-layer security.

The research article authored by Jason Teutsch et al. [46] introduced TrueBit, a scalable verification solution designed to address the computational limitations of blockchain systems like Ethereum and Bitcoin, which, despite their vast mining power, struggle with processing and verifying transactions efficiently due to the Verifier’s Dilemma—a scenario where miners skip verification to avoid falling behind in the mining race. The authors proposed a two-layer system: a dispute resolution layer employing an interactive ”verification game” to pinpoint computational errors through iterative rounds of challenge and response, and an incentive layer that financially motivates participants (Solvers and Verifiers) to perform and verify computations correctly. The verification game relied on Merkle trees and binary search to isolate disputed computation steps, ensuring Judges (Ethereum miners) could resolve disputes with minimal computational effort. The incentive layer incorporated mechanisms like forced errors, jackpot payouts, taxes, and deposits to ensure Solvers and Verifiers acted honestly, with forced errors occurring randomly to incentivize consistent verification. The work evaluated the system’s efficiency by analyzing the runtime and security of the verification game, demonstrating that the Judges’ workload remained manageable, with the total verification time scaling logarithmically with task complexity. The performance was further validated through economic incentives, ensuring that rational participants would not deviate from the protocol due to the high costs of cheating and the rewards for honest participation. The results showed that TrueBit enabled secure, trustless outsourcing of complex computations to Ethereum smart contracts, bypassing the gasLimit constraint and supporting applications like decentralized mining pools, cross-blockchain currency transfers, and scalable transaction throughput. The system’s adaptability was highlighted by its compatibility with existing Ethereum infrastructure and its potential for future optimizations, such as specialized verification games for specific tasks. However, the work’s limitation is that the security and efficiency of TrueBit degrade for extremely complex or big data tasks due to the impracticality of the verification game’s overhead in such scenarios.

Anonymous Multi-Hop Locks (AMHLs) [47] have been introduced as a novel cryptographic primitive to address scalability and privacy issues in Payment Channel Networks (PCNs), such as the Lightning Network. The authors began by identifying a new attack, termed the ”wormhole attack,” which allows malicious users to steal fees from honest intermediaries in PCNs, demonstrating vulnerabilities in existing systems like the Lightning Network and Raiden Network. To mitigate this, they formally defined AMHLs, a cryptographic tool enabling secure and privacy-preserving multi-hop payments, and provided several provably secure constructions compatible with most cryptocurrencies, including script-based (using homomorphic one-way functions) and scriptless (using ECDSA signatures) implementations. The scriptless ECDSA-based solution was particularly significant as it resolved a long-standing open problem in the field and was subsequently implemented by Lightning Network developers. The authors conducted a rigorous security analysis using the Universal Composability (UC) framework, ensuring their constructions were secure against concurrent executions and composable with other protocols. They also established a lower bound on communication complexity, proving that an extra round of communication is necessary for secure transactions to prevent wormhole attacks. Performance evaluations on commodity hardware showed that AMHL operations were highly efficient, with computation times under 100 ms and communication overhead below 500 bytes, even in worst-case scenarios. The practical impact of their work was underscored by the Lightning Network’s adoption of their ECDSA-based AMHLs, which improved security, privacy, and interoperability while maintaining scalability. Additionally, the authors demonstrated the versatility of AMHLs by extending their use to atomic swaps and interoperable PCNs, enabling cross-currency transactions. The performance results highlighted the feasibility of their approach, with the generic construction requiring minimal gas (350,849 units per hop in Ethereum) and scriptless constructions eliminating the need for additional scripts, reducing transaction size and blockchain load. Despite these advancements, a key limitation of this work is that the proposed constructions do not support adaptive corruption queries, leaving the security of dynamically corruptible environments an open question.

BloXroute [13] is a Blockchain Distribution Network (BDN) designed to address the scalability limitations of blockchain systems while preserving decentralization and trustlessness. The authors identified that existing blockchains, such as Bitcoin, suffer from low throughput (e.g., 2.94 TPS compared to Visa’s 2000 TPS) due to inefficiencies in peer-to-peer (P2P) propagation models, where block propagation times increase linearly with block size, leading to forks, security vulnerabilities, and centralization pressures. To overcome these challenges, the work proposed a global, protocol-agnostic BDN that leverages high-capacity, low-latency infrastructure to accelerate block propagation without requiring trust in the network itself. Key innovations included encrypted blocks to ensure neutrality, indirect relay mechanisms to obscure block origins, and test-blocks for continuous auditing, ensuring the BDN could not discriminate based on content, origin, or destination. The system employed cut-through routing and system-wide caching to enable gigabyte-sized blocks and reduce propagation delays, theoretically increasing throughput by over three orders of magnitude (e.g., supporting 200,000 TPS with conservative estimates). Performance evaluation demonstrated that bloXroute could reduce block propagation times dramatically, enabling blockchains to scale to Visa-like throughput by simply adjusting block size and inter-block intervals, while maintaining security and decentralization. The work also introduced BLXR, an ERC20 token, to align incentives across the ecosystem by distributing revenues from transaction fees to token holders, with projected annual revenues exceeding $3.1 billion at scale. The results highlighted bloXroute’s ability to close the gap between decentralized blockchains and traditional payment systems, unlocking applications like microtransactions and IoT automation. However, the system’s reliance on voluntary payments for sustainability and the potential for collusion between the BDN and a subset of peers remain limitations.

Joseph Poon and Thaddeus Dryja [54], proposed a decentralized solution to Bitcoin’s scalability problem by introducing the Lightning Network, a system of micropayment channels that enable instant, high-volume transactions without overburdening the blockchain. The authors identified the limitations of Bitcoin’s blockchain, such as its inability to handle global transaction volumes due to block size constraints, which lead to centralization risks and high fees. To address this, they designed a network of bidirectional payment channels where transactions occur off-chain, only settling on the blockchain when necessary, thus reducing congestion and maintaining decentralization. The core innovation involved the use of Revocable Sequence Maturity Contracts (RSMCs) and Hashed Timelock Contracts (HTLCs) to ensure security and trustlessness. RSMCs allowed parties to update channel states while penalizing dishonest behavior by revoking outdated transactions, while HTLCs facilitated multi-hop payments across the network using hash-based conditions and decrementing timelocks to ensure atomicity. The research detailed the construction of these contracts, including the need for a malleability fix (SIGHASH_NOINPUT) to prevent transaction ID mutations and enable secure off-chain agreements. The authors also discussed key management strategies, such as hierarchical deterministic wallets, to minimize storage overhead and ensure scalability. Performance evaluation highlighted the network’s potential to support billions of transactions with minimal blockchain footprint, enabling micropayments, instant transactions, and cross-chain interoperability. The final result demonstrated that the Lightning Network could achieve Visa-like transaction throughput (47,000 tps) while retaining Bitcoin’s decentralized security model, with fees asymptotically approaching zero due to off-chain settlement. The system’s value lay in its ability to scale Bitcoin for global adoption without compromising its core principles. The work relies on soft-fork upgrades to Bitcoin, such as SIGHASH_NOINPUT and OP_CHECKSEQUENCEVERIFY, which may face implementation challenges or resistance from the community.

5.3 Emerging Consensus Paradigms

Recent advancements in consensus design aim to address the trilemma through novel architectures:

• Narwhal & Tusk (Aptos): Decouples transaction dissemination (Narwhal) from consensus (Tusk), achieving 160,000 TPS in benchmarks [85]. While Narwhal’s mempool ensures availability via directed acyclic graphs (DAGs), Tusk leverages randomized leader elections for asynchronous safety. Trade-offs include increased memory demands for DAG storage.

• Snowman++ (Avalanche): Optimizes the Snow family of protocols for linear blockchains, combining DAG-based voting with a totally ordered ledger. Its decision threshold mechanism reduces latency to 1–2 s while tolerating 40% Byzantine nodes [86]. However, validator incentives remain centralized in early deployments.

• Proof of History (PoH-Solana): Uses cryptographic timestamps (SHA-256 chains) as a verifiable clock, enabling parallel transaction processing. PoH reduces consensus overhead by 65% compared to PBFT [87], but depends on leader nodes for sequencing—creating single points of failure during network partitions.

5.4 Consensus Mechanism Innovations

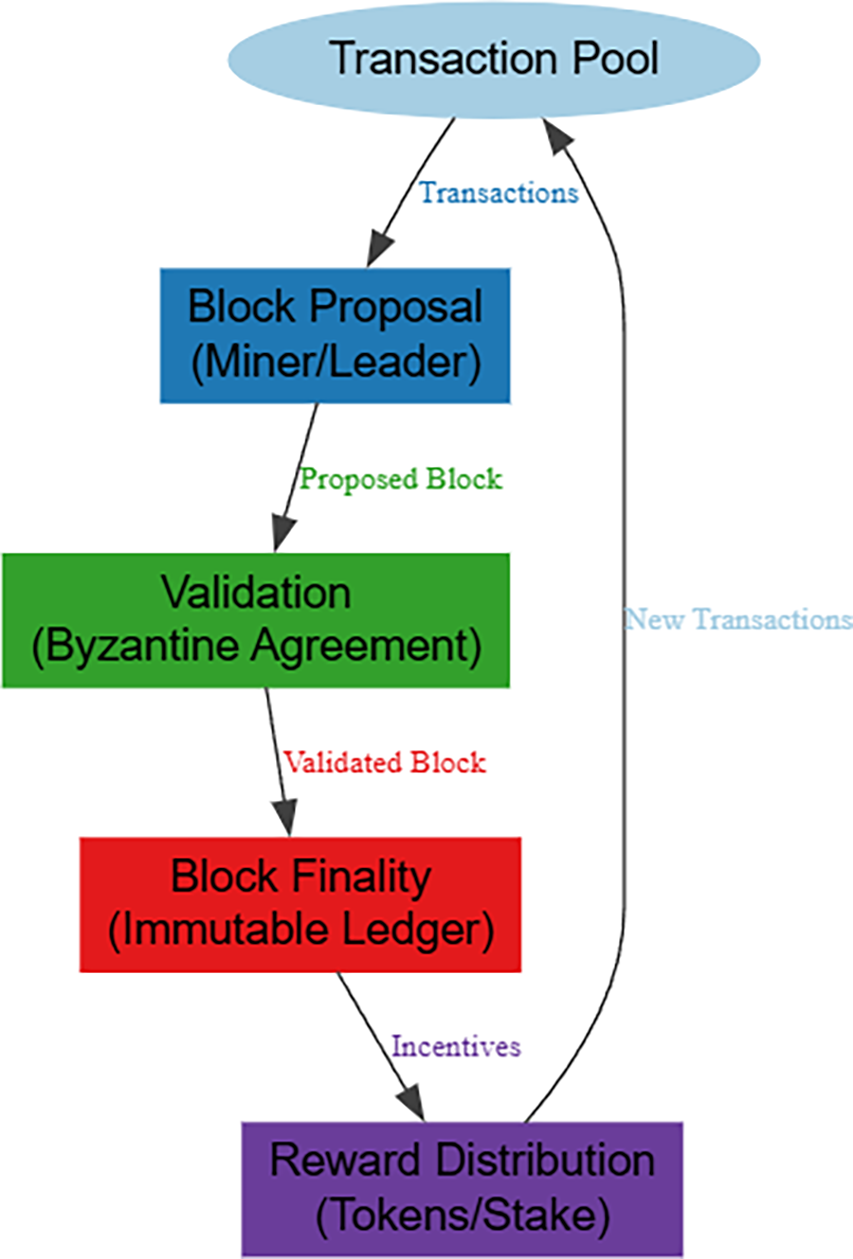

Consensus mechanisms denote novel approaches to achieving agreement while balancing trilemma constraints. The general working mechanism of consensus algorithms is depicted using Fig. 6.

Figure 6: General working procedure of consensus mechanisms

Monu Chaudhary et al. [76] explored the challenges posed by the blockchain trilemma, which highlights the difficulty in simultaneously achieving decentralization, security, and scalability in blockchain networks. The authors provided a comprehensive analysis of Layer 1 (base layer) and Layer 2 (off-chain) solutions aimed at addressing these challenges. They began by explaining the foundational concepts of blockchain, including consensus mechanisms like Proof of Work (PoW) and Proof of Stake (PoS), and elaborated on how these mechanisms contribute to the trilemma. The study categorized scalability solutions into Layer 1 approaches, such as increasing block size, adopting alternative consensus algorithms (e.g., PoS), sharding, and Directed Acyclic Graphs (DAGs), and Layer 2 solutions, including channels (e.g., Lightning Network), sidechains, rollups, and cross-chain protocols. The authors performed a comparative analysis of these solutions, evaluating their impact on transaction speeds, implementation complexity, and trade-offs between decentralization, security, and scalability. They utilized real-world data, such as transaction speeds from blockchain networks like Bitcoin, Ethereum, and Layer 2 platforms like Polygon and Solana, to illustrate the performance improvements offered by these solutions. For instance, Ethereum 2.0’s theoretical transaction speed of 100,000 TPS and Solana’s 3000 TPS were highlighted as significant advancements over Bitcoin’s 7 TPS and Ethereum 1.0’s 20 TPS. The results demonstrated that Layer 2 solutions, such as the Lightning Network and sidechains, were easier and faster to implement compared to Layer 1 modifications, which often required hard forks and extensive protocol changes. However, the authors noted that despite these advancements, no solution fully resolved the trilemma, as trade-offs between the three pillars persisted. The authors concluded the study by emphasizing the need for further research to achieve a harmonious balance between decentralization, security, and scalability. A key limitation of the work is that the work does not propose a novel solution to entirely solve the blockchain trilemma but rather synthesizes and evaluates existing approaches.

In the scholarly article [57], the authors introduced Chameleon, a scalable and adaptive permissioned blockchain architecture designed to address key challenges in blockchain systems, including scalability, security, and resource utilization. The authors structured their solution into four layers: the control and authentication layer, responsible for issuing certificates and load balancing; the cloud storage layer, which offloaded historical block data to local, edge, or core clouds to reduce node storage burdens; the consensus and processing layer, where nodes were partitioned into different areas, each capable of running tailored consensus protocols; and the access layer, enabling clients to register and interact with the system. To enhance security, the work proposed RLSCV (Random Leader Selection based on Credit Value), an improved Byzantine consensus protocol where leaders were selected probabilistically based on their credit scores—calculated as

Jian Liu et al. [12] proposed FastBFT, a fast and scalable Byzantine fault-tolerant (BFT) protocol designed to address the inefficiencies and scalability limitations of existing BFT protocols, which typically suffer from

In [55], authors presented a novel consensus model aimed at addressing the blockchain trilemma—balancing decentralization, security, and scalability—by integrating advanced cryptographic techniques, stake management, and random leader selection mechanisms. The authors began by highlighting the limitations of existing consensus models, such as PoW and PoS, which often prioritize one aspect of the trilemma at the expense of others. To overcome these challenges, they proposed a comprehensive framework that combined Verifiable Random Functions (VRF) for unbiased slot leader selection, dynamic stake recalibration based on reputation and economic performance, and batch agreement systems for efficient transaction processing. The methodology involved establishing a decentralized network where nodes were assigned initial stakes and cryptographic key pairs, followed by an epoch-based structure for synchronization and stake adjustment. The consensus process included transaction gathering by slot leaders, block proposal, validation through Honey Badger Byzantine Fault Tolerance (BFT) and other cryptographic techniques, and fault tolerance mechanisms to mitigate malicious activity. The authors also incorporated sharding and layer-2 solutions like optimistic rollups to enhance scalability and interoperability across blockchain platforms. To evaluate their model, they analyzed security using the chain quality metric, comparing it with other consensus mechanisms like SHTB, PoP, UTB, and UDTB, and found their system outperformed most except PoP. Performance metrics demonstrated a transaction throughput of 119 TPS on average, with latency as low as 1.05 s for 400 transactions and 1.186 s for 800 transactions, showcasing robust scalability. The system’s decentralization was validated through features like public accessibility, resilience to various attacks (e.g., 51% and Sybil attacks), and affordable validator node costs ($693). Despite these advancements, the paper acknowledged the need for real-world testing to confirm the model’s practicality under diverse conditions. The research work basically relies on theoretical validation and requires extensive real-world implementation to assess its full potential.

The paper [56] introduced a novel blockchain consensus mechanism aimed at resolving the blockchain trilemma by simultaneously achieving security, scalability, and decentralization. The authors proposed an architecture integrating adaptive stake recalibration to dynamically adjust node influence based on historical performance, stake transfers, and economic metrics, alongside epoch-based operations for structured consensus. Cryptographic techniques such as Schnorr Verifiable Random Functions (VRF) ensured secure and unbiased slot leader selection, while zero-knowledge proofs (zk-SNARKs) enhanced transaction privacy and validation efficiency. Scalability was addressed through sharding for parallel transaction processing and Layer-2 rollups for off-chain aggregation, combined with Merkelized Abstract Syntax Trees (MAST) to optimize smart contract execution. Security mechanisms included Practical Byzantine Fault Tolerance (PBFT) for batch agreement, anomaly detection algorithms, and redundancy measures with erasure codes. The system employed a reputation-based stake distribution model to prevent centralization, incentivizing positive behavior through economic rewards and penalties. For evaluation, the authors conducted extensive experiments on a 48-node network, comparing performance against Proof of Work (PoW), Proof of Stake (PoS), Delegated PoS (DPoS), PBFT, and Proof of Authority (PoA). Results demonstrated a throughput of 1700+ transactions per second (TPS) with latency between 15–90 ms, surpassing PoW (7 TPS) and PoA (232 TPS). The system maintained a low average CPU usage of 16.1% compared to PoW (63.2%) and PBFT (24.1%), while achieving a decentralization score of 7.182, competitive with Bitcoin (7.909) and Ethereum (7.656). Security evaluations showed resilience against double-spending attacks (22-min confirmation time at 45% adversarial stake) and negligible fork probability (analyzed via binomial distribution). A limitation of the work is that the scalability and decentralization claims remain theoretical, requiring validation in real-world, large-scale deployments.

5.5 Network and Protocol Optimizations

Many state-of-the-art works have brought major improvements in network-layer propagation and transaction processing efficiency.

The article authored by Kaiwen Zhang et al. [77] presented a comprehensive exploration of distributed ledger technology (DLT) and blockchain systems, aiming to address the challenges of dependability, scalability, and pervasive adoption. The authors began by highlighting the transformative potential of blockchains across various industries, emphasizing their ability to provide transparency, immutability, and security without centralized control. They identified key pain points hindering widespread adoption, such as trust issues, integration difficulties, and scalability limitations, and proposed a structured research landscape to guide future efforts. The reseach introduced the DCS properties—Decentralization, Consistency, and Scalability—as a framework analogous to the CAP theorem, illustrating the inherent trade-offs in blockchain design. A taxonomy of blockchain applications was presented, categorizing them into three generations: Blockchain 1.0 (cryptocurrency), 2.0 (decentralized applications or DApps), and 3.0 (pervasive applications like eHealth and supply chain management), each with unique challenges and research directions. The authors further decomposed blockchain platforms into six layers—Application, Modeling, Contract, System, Data, and Network—providing a detailed reference architecture to analyze and improve blockchain systems. To evaluate performance, the work compared existing platforms like Bitcoin, Ethereum, and Hyperledger, demonstrating how each prioritized different DCS properties; for instance, Bitcoin and Ethereum emphasized Decentralization and Consistency at the cost of Scalability, while Hyperledger achieved higher throughput by sacrificing some decentralization. The final results underscored the need for tailored blockchain solutions, as no single design could satisfy all requirements across applications, and the authors advocated for continued research in areas like consensus algorithms, smart contract security, and interoperability. The value of the work lay in its systematic classification of blockchain research, offering a roadmap for future innovations to enhance dependability, scalability, and adoption. A key limitation of the work is that it does not provide empirical validation of the proposed frameworks or quantify the trade-offs between DCS properties in real-world deployments.

Blockchain systems face critical challenges in scalability and throughput, especially for lightweight nodes like IoT devices that cannot store the full blockchain due to its size. To address this, the authors [63] proposed an innovative solution by designing a high-performance caching system implemented on an FPGA-based network interface controller (NIC) to offload and accelerate blockchain data access. They focused on optimizing the caching mechanism by developing a customized SHA-256 hash core tailored for efficient blockchain operations, which reduced redundant hashing executions and significantly improved performance. To integrate their system with real-world blockchain applications, the authors utilized Jansson and Curl libraries to interface with the Bitcoin core, ensuring seamless communication and data handling. The performance evaluation of their system demonstrated remarkable improvements, with the results showing a 103-fold increase in throughput performance during cache hits, highlighting the efficiency of their design. Additionally, the FPGA implementation offered advantages such as minimal work area utilization, low power consumption, and high performance, making it a practical solution for enhancing blockchain scalability. The authors meticulously evaluated their system by measuring throughput, power consumption, and resource utilization, providing a comprehensive analysis of its capabilities. The success of their approach was evident in the substantial performance gains and the system’s ability to handle the workload of lightweight nodes effectively.

Blackchain [64] is a novel blockchain-based system designed to enhance accountability and scalability in Vehicle-to-X (V2X) communication, particularly by addressing the challenges of misbehavior detection and revocation in resource-constrained environments. The authors identified the limitations of traditional Event Data Recorders (EDRs) and centralized Public Key Infrastructures (PKIs), such as high storage costs, lack of tamper-proofing, and centralized trust in misbehavior authorities (MAs). To overcome these issues, they introduced a hierarchical consensus mechanism leveraging distributed ledger technology, where vehicles dynamically formed clusters to agree on local states, which were then propagated to Road-Side Units (RSUs) for further aggregation. These RSUs, organized into smaller groups, performed Byzantine Fault Tolerant (BFT) consensus to validate and forward decisions to MAs, which ultimately published the results on a global, permissionless Blockchain for transparency and public verifiability. The system ensured accountability by allowing all participants to audit revocation decisions and evidence, thereby reducing reliance on a single trusted entity. The authors evaluated the performance of Blackchain by focusing on its ability to handle high message frequencies (10 Hz per vehicle) and churn in VANETs, demonstrating that hierarchical clustering and permissioned blockchains significantly reduced the computational overhead and latency compared to a naive, fully decentralized approach. The results indicated that the proposed system achieved scalable and efficient misbehavior detection and revocation while maintaining privacy through pseudonymous certificates and partial validity periods. The performance was validated through theoretical analysis, highlighting the system’s ability to balance transparency, security, and scalability in large-scale vehicular networks. However, the stability of vehicle clusters and the guarantees of hierarchical consensus compared to full consensus remain open challenges.