Open Access

Open Access

ARTICLE

Hydrogen Energy Demand Management in China: A Department Scenario Analysis Method

1 Center for Sustainable Development and Energy Policy Research, School of Energy and Mining Engineering, China University of Mining and Technology—Beijing, Beijing, 100083, China

2 Research Institute of Decision-Making Science and Big Data, School of Management, China University of Mining and Technology—Beijing, Beijing, 100083, China

* Corresponding Author: Bing Wang. Email:

Energy Engineering 2025, 122(3), 971-983. https://doi.org/10.32604/ee.2025.061834

Received 04 December 2024; Accepted 31 January 2025; Issue published 07 March 2025

Abstract

The proposal of carbon neutrality target makes decarbonization and hydrogenation typical features of future energy development in China. With a wide range of application scenarios, hydrogen energy will experience rapid growth in production and consumption. To formulate an effective hydrogen energy development strategy for the future of China, this study employs the departmental scenario analysis method to calculate and evaluate the future consumption of hydrogen energy in China’s heavy industry, transportation, electricity, and other related fields. Multi-dimensional technical parameters are selected and predicted accurately and reliably in combination with different development scenarios. The findings indicate that the period from 2030 to 2050 will enjoy rapid development of hydrogen energy, having an average annual growth rate of 2% to 4%. The technological progress and breakthroughs scenario has the greatest potential for hydrogen demand scale among the four development scenarios. Under this scenario, the total demand for hydrogen energy is expected to reach 446.37 Mt in 2060. The transportation sector will be the sector with the greatest potential for hydrogen deployment growth from 2023 to 2060, which is expected to rise from 0.038 Mt to about 163.18 Mt, with the ambitious growth in the future. Additionally, hydrogen energy has a considerable development potential in the steel sector, and the trend of de-refueling coke by hydrogenation in this sector will be imperative for this energy-intensive industries.Keywords

Nomenclature

| IEA | International Energy Agency |

| Mt | Million tons |

| FCEV | Fuel (hydrogen) cell electric vehicle |

| BAU | Baseline scenario |

| SAC | Structural adjustment and change scenario |

| LCD | Low-carbon development scenario |

| TDB | Technological progress and breakthroughs scenario |

| THD | Total hydrogen energy demand |

| HD | Hydrogen energy demand |

| FL | Fuel consumption |

| AAM | Annual mileage |

| VP | Number of hydrogen vehicles |

| OT | Hydrogen demand in the non-road sector of the transportation sector |

| OR | Hydrogen for oil refining |

| SG | Hydrogen for syngas |

| SK | Hydrogen for steelmaking |

| SI | Hydrogen for other industries |

| HPGC | Hydrogen power generation |

| HEP | Hydrogen production by water electrolysis (power grid) |

| HNS | The new hydrogen industry |

| HOS | Other hydrogen use sectors |

As global clean energy transition process accelerates, hydrogen energy is considered to have a large development potential. Countries worldwide have focused on the layout of the hydrogen energy industry chain [1]. The Hydrogen Council report shows that hydrogen production reached 98.14 Mt in 2023 [2]. According to the International Energy Agency’s (IEA) net-zero roadmap released in 2023, the world’s hydrogen demand will be about 150 and 430 Mt in 2030 and 2060, respectively, with an increase of 1.56 and 4.53 times compared to 2023 [3,4]. According to the different production methods, hydrogen is divided into fossil fuel hydrogen production (gray hydrogen), gray hydrogen coupled with CCUS (blue hydrogen), and renewable energy water electrolysis hydrogen production (green hydrogen). Therefore, hydrogen from different sources will become an important part of the energy system transformation in the future.

China’s hydrogen energy industry has also entered a phase of rapid development, with deployment across multiple sectors to achieve energy cleanliness. And the development prospects of hydrogen energy in China are broad in numerous industries [5]. In 2023, China’s hydrogen production reached 37.81 Mt, with a year-on-year growth rate of 14.58%, accounting for about one-third of global hydrogen production [6]. The hydrogen energy industry has become a major concern for national governments and capital markets. The China Hydrogen Energy Alliance’s “White Paper on China’s Hydrogen Energy and Fuel Cell Industry 2020”, released in 2021, points out that under the scenario of reaching peak carbon emissions by 2030, China’s hydrogen demand will reach 40 Mt, accounting for about 5% of terminal energy [7]. By 2060, it will reach 130 Mt, with a share of approximately 20% in terminal energy consumption [8]. This forecast, however, considers the development of hydrogen generation by energy structure adjustment, rather than a demand-driven analysis.

The future applications of hydrogen energy are diverse, aiding multiple low-carbon demands in numerous industries for achieving the goals of carbon peak and carbon neutrality. Currently, the application of hydrogen energy in China is primarily focused on the chemical industry, with 73.9% of hydrogen used in 2023 [9]. Among this, the synthesis gas industry accounts for 58.2%, with the demand for synthetic ammonia remaining stable at 10 Mt. In addition, the refining industry requires approximately 9 Mt, accounting for 23.7%, while other industry sectors are expected to require about 2 Mt [10,11]. Furthermore, the fuel consumption for transportation continues to grow caused by the increasing number of vehicles. However, the development of the hydrogen fuel cell vehicle industry cannot be overlooked [12]. In the energy transition process of the heavy industry sector, hydrogen energy will play an important role, especially in industries such as steel, cement, and heating [13]. Therefore, as hydrogen energy technology gradually improves, the energy transition across various industries led by hydrogen will be achieved.

Currently, the world is accelerating the deployment of clean energy applications. Driven by carbon neutrality goals, global decarbonization and hydrogenation are gradually becoming mainstream trends. Many scholars are predicting the demand and production of hydrogen energy. Heydarzadeh et al. (2020) utilised in-service natural gas pipelines and underground storage resources to transport and store hydrogen. The goal is to use the natural gas infrastructure to meet the transport and storage needs of hydrogen, which will be used to meet the demand for residential electricity use. It was found that by using the four major pipelines to transport and store hydrogen, a portion of hydrogen could be used to meet 40 percent of the electricity demand [14]. Olabi et al. (2021) demonstrated that combining hydrogen fuel cells with energy sources such as wind or solar can enhance overall grid stability and sustainability. This study provides an overview of currently well-developed hydrogen production and storage technologies and the challenges. It aims to help identify better opportunities for large-scale clean energy systems [15]. Bhattacharyya et al. (2022) assessed the demand for green hydrogen in India and the hydrogen supply capacity provided by nuclear power for hydrogen production. It analyzed the demand across various industries for hydrogen energy applications and compared the techno-economic aspects of nuclear hydrogen and solar hydrogen production technologies [16]. You et al. (2020) developed a novel and innovative optimisation model for the design and analysis of renewable energy networks. The results show different key cost drivers for equilibrium energy costs, which range from about $0.43 to $0.65 per kWh [17]. Makepeace et al. (2024) present a techno-economic model that demonstrates the economic feasibility of global green hydrogen transport along 15 major regional routes from Australia to Asia and Europe [18]. Henry et al. (2023) investigated the production of hydrogen from wind energy in desalination and electrolysis plants. A model was developed to determine the relationship between profitability and sales price over a decade. The results show a strong correlation between surface hydrogen price and size [19]. Faye et al. (2022) provided a detailed discussion of hydrogen production, storage and transport and reviewed promising technologies for the production, storage and transport of hydrogen systems [20]. Wang et al. (2022) identified the key areas of coal consumption and established a coal demand prediction model based on sectoral scenario analysis, which systematically analysed and predicted the coal demand of electric power, coal chemical industry, iron and steel, cement, and thermal power sectors under different development scenarios [21]. Marchionna et al. (2024) compared the environmental impacts and future development potential of hydrogen production under different production pathways. The results show that hydrogen production methods based on blue and green hydrogen have a high potential for development, but are not currently competitive enough from a commercial viewpoint [22]. In addition, there is a larger body of literature assessing the potential and scale of future hydrogen development from different perspectives. Pivac et al. analyzed greenhouse gases emissions by use of hydrogen produced in a refinery by water electrolysis method [23]. Singla et al. compared the cost of hydrogen for different production methods [24]. Challenges and future perspectives are also researched from the technologies of hydrogen production, storage, and transportation [25]. Zainal et al. assessed the development potential of coupled new clean energy sources [26]. Other publication provides a detailed overview of the development opportunities of hydrogen in the future energy sector [27]. However, there is a lack of clearer and more reliable forecasts for hydrogen energy applications across all industries.

To achieve the national vision of carbon neutrality by 2060, it is essential to vigorously develop renewable-based hydrogen systems. Therefore, this study conducts sector-specific forecasts on the demand for hydrogen energy from the perspective of different sectors in China to obtain a more accurate total hydrogen energy demand. Specifically, a scenario analysis method is applied to conduct a comprehensive analysis from four perspectives: heavy industry, transportation, electricity, and other sectors. This analysis considered various multidimensional indicators and parameters, including social, policy, economic, and technological factors, to provide more reliable predictions. Based on the above research objectives, this study will address the following questions: (1) calculating the demand for hydrogen energy in China in the future and its growth trends; (2) identifying key sectors with significant development potential, specifically the hydrogen-consuming industries with the greatest growth potential; (3) investigating the changes in demand for hydrogen energy applications under different development scenarios.

2 Model Construction and Data Sources

This study employs the department scenario analysis method to forecast the future market size of hydrogen energy in China, primarily focusing on demand predictions for core hydrogen-consuming sectors such as transportation, industry, and electricity, thereby deriving the overall hydrogen demand in China. In modeling, a greater variety of parameters has been introduced for a more precise model, including technological advancement and sector reform as shown in Fig. 1. The specific forecast model for China’s total hydrogen energy demand is as follows:

Figure 1: Research framework

Due to the consideration of various advancements in technical parameters in this study, a comprehensive design is made by the reports on hydrogen development such as the IEA report, the International Hydrogen Council, and the China Hydrogen Alliance white paper, as well as future-scale predictions from various scholars. Specifically, this includes the application of hydrogen energy in the chemical industry, transitioning from a focus on raw materials such as syngas to a future fuel, creating a low-carbon chemical industry primarily based on green hydrogen as a clean fuel. In addition, there is a shift from the current market structure dominated by fuel vehicles and pure electric vehicles to a low-carbon transportation sector primarily based on hydrogen and electricity in the transportation sector.

In addition, this research analyzes and predicts the transportation sector from a technical perspective, including technical parameters such as fuel consumption and mileage, with references to literature and scenario assumptions. Industry-specific forecasts are conducted in the industry sector, referencing data from reports by the IEA and the Hydrogen Council and combining it with China’s hydrogen production for calculations. The power sector has introduced a comprehensive forecast that combines multiple technical parameters [6]. Through scenario design and literature reference, all parameters are changing year by year.

This study selects every ten years from 2023 to 2060 as nodes for forecasting, with the growth rate calculated from the compound annual growth rate over each decade. The results of the model calculation are shown in Fig. 2. China’s hydrogen energy consumption growth rate will remain between 2% and 9%, with the hydrogen energy consumption market reaching 28.425 Mt by 2060, which is nine times more than in 2023. The year 2040 marks a period of rapid expansion for China’s hydrogen energy market, with an average annual growth rate of approximately 7.85%. By 2040, China’s terminal hydrogen consumption is expected to reach 115.91 Mt. In comparison, the IEA predicts that global consumption during this period will approach 300 Mt, with China’s share exceeding one-third. Currently, China’s production capacity and consumption are roughly balanced. China will play a larger, decisive role in the global hydrogen energy market around 2040.

Figure 2: China hydrogen energy market size forecast from 2023 to 2060

Additionally, as a golden decade for hydrogen energy consumption growth, it is necessary to deploy corresponding production capacity in advance from 2035 to 2045 to cope with the rapid growth of consumer demand. According to the IEA’s 2023 report on hydrogen production capacity, China is one of the few countries where the development speed of hydrogen energy exceeds the predictions made in the IEA report. This proves that the current hydrogen energy market in China is severely underestimated. The data selected for analysis in this study is relatively conservative. If we predict the scale of hydrogen energy capacity without being constrained by bottlenecks, the demand for hydrogen energy in China will have even greater growth potential beyond this forecast. In summary, the accuracy of this study’s predictions needs to be verified by considering multiple perspectives, including production capacity and policy development, to confirm the true demand of the consumer market.

Through model calculations, the market size of hydrogen energy, primarily in industry, transportation, and power generation, is illustrated in Fig. 3. All three sectors are on a continuous upward trend, with transportation showing the greatest growth potential, followed by power generation. In the transportation sector, the expected increase is from 0.038 Mt to approximately 16.318 Mt, indicating the greatest potential for growth in the future. Currently, hydrogen energy is widely applicable in China’s industry sector. In 2022, hydrogen usage in the chemical industry accounted for 73.9%, with the syngas industry making up 58.2%. The demand for synthetic ammonia remained stable at 10 Mt, while the demand for refining was about 9 Mt, accounting for 23.7%. Other industry sectors are expected to demand about 2 Mt. By 2060, the industry sector is expected to grow to 65.2 Mt, which includes existing chemical fields as well as new industry areas such as hydrogen metallurgy and hydrogen cement production. They will contribute to China’s industry sector together, playing a significant role in the clean transformation of the industry and achieving carbon neutrality.

Figure 3: Hydrogen energy market size forecasts by sector from 2023 to 2060

As a clean energy source, hydrogen energy has excellent application scenarios, particularly in the transportation sector. The endurance of 5 min of hydrogen refueling is farther than that of a single mileage of a fuel vehicle. Additionally, hydrogen energy is more environmentally friendly. In the context of increasing emissions in the country and the potential future imposition of an environmental emissions tax, FCEVs have significant market development potential. The demand for hydrogen fuel is also expected to rise sharply, reaching 111.86 and 163.18 Mt by 2050 and 2060, both accounting for over 50% of China’s hydrogen energy consumption market.

This study considers the market share of Fuel Cell Electric Vehicles (FCEVs) and the total vehicle ownership in China, including passenger cars, buses, and trucks, in the model for forecasting hydrogen energy market demand in the transportation sector. It also considers the improvement in fuel consumption. Taking the Toyota Mirai passenger car as an example, the fuel consumption is 1.02 kg of hydrogen per 100 km presently. In the future, it is expected to be reduced to around 0.5 kg with advancements in technology. From the perspective of market share in FCEVs, this study predicts that hydrogen fuel passenger vehicles will reach 40% by 2060. And it will reach 70% in the hydrogen fuel bus sector. From the perspective of annual mileage, this study considers that to further expand per capita travel demand, it will increase by 1.2 to 1.5 times.

Based on the actual situation of the future development of China’s hydrogen energy industry, it is necessary to set up multiple scenarios for analysis and comparison of the hydrogen energy industry. In addition to the baseline scenario (BAU), three potential scenarios are set up: the low-carbon development scenario (LCD), the technological progress and breakthroughs scenario (TDB), and the structural adjustment and change scenario (SAC). Because the future development of the hydrogen energy industry will be affected by carbon targets, technological progress, and industrial applications, this study sets up three scenarios corresponding to the more likely scenarios for comparative analysis. Specifically, the BAU scenario is based on the current development of various industries. The LCD scenario takes into account lower carbon development goals, which include low carbon transportation, low carbon electricity, and other related parameters. The TDB scenario mainly considers the possibility of faster technological breakthroughs in the future, which affects parameters such as technical efficiency and production efficiency. The SAC considers the transformation of industrial structure, which has a greater role in promoting the new consumption industry of hydrogen energy.

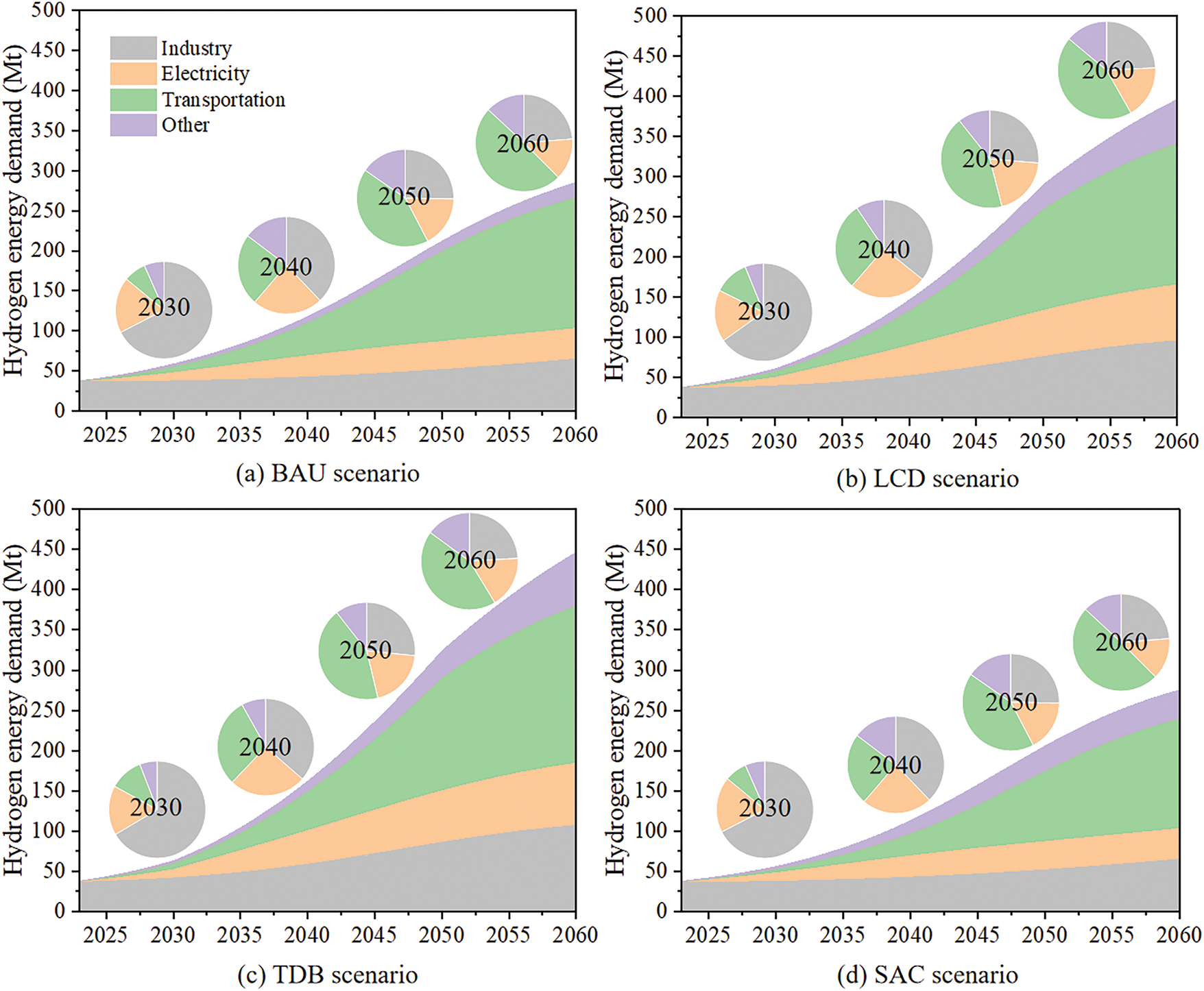

As shown in Fig. 4, TDB and LCD have a greater driving role in hydrogen energy development, especially in the industrial and power sectors. In the transportation field, the hydrogen energy demand gap between the four development scenarios is very small because the demand for hydrogen transportation is related to the number of hydrogen vehicles, and the impact of different development scenarios on the transportation industry is small. Under the SAC scenario, the new hydrogen energy consumption industry will have greater development potential. These industries are potential hydrogen energy consumption industries, and there may be greater development opportunities under the industrial structure transformation scenario. Specifically, as shown in Fig. 4a, under the development scenarios of BAU, LCD, TDB, and SAC, the industrial hydrogen consumption in 2060 will be 65.35, 95.79, 107.29, and 65.35 Mt, respectively, with a total difference of about 65%. Where BAU and SAC scenarios have equal hydrogen energy demand in industry, because this study considers that the industrial structural transformation does not affect the hydrogen energy demand in industry and electricity, which mainly have a large positive impact on other as shown in Fig. 4d. In addition, as shown in Fig. 4b, hydrogen demand in the electricity sector is 37.88, 69.57, 77.05, and 37.88 Mt, respectively, a difference of about 103%. As shown in Fig. 4c, the transportation’s hydrogen demand is 162.92, 175.52, 195.10, and 136.12 Mt, respectively, with a small difference of about 43%. As shown in Fig. 4d, hydrogen requirements in the other sectors are 19.14, 55.20, 66.92, and 36.07 Mt, respectively, a difference of about 86%. Among them, 2030–2050 is a critical period for the accelerated development of various industries.

Figure 4: Comparison of hydrogen demand by industry under different scenarios from 2023 to 2060

As shown in Fig. 5, hydrogen demand in 2060 under the LCD and TDB scenarios is 396.09 and 446.37 Mt, respectively, and 285.29 and 275.42 Mt for the BAU and SAC scenarios, respectively. Since hydrogen energy is undoubtedly clean energy, there will be a huge driving force for development under the scenario of low-carbon development. Secondly, due to the current technical limitations of hydrogen energy at the production end and the storage and transportation end, the demand for hydrogen energy under the TDB scenario is the largest. The reason is that the growth in demand for hydrogen consumption is driven by technology, cost, and policy.

Figure 5: Comparison of hydrogen demand by scenario under different industries from 2023 to 2060

From 2023 to 2030, global hydrogen energy consumption will be dominated by industry, accounting for more than 65% as shown in Fig. 5d. Hydrogen energy will still be used as a raw material in chemical and other fields with a slighter transformation from raw materials to fuel or energy storage in the future. At present, hydrogen energy is mainly used in chemical fields such as syngas. Most scholars believe that hydrogen energy will be widely used in transportation, energy storage, new industries, and other sectors in the future. In addition, hydrogen energy will contribute irreplaceably to the stable and safe development of global renewable energy through multi-energy complementarity.

In 2040, the highest proportion of hydrogen consumption will be in industry, accounting for about 36%. The reason is that the current development of hydrogen energy in the world is dominated by the chemical industry, including syngas, so the proportion of hydrogen energy in the industry will be unshakable for a long time in the future. The share of electricity and transportation is almost equal in 2040. This is because the consumption of hydrogen energy will be transformed into energy storage and fuel, which will be applied on a large scale in the power and transportation industries. At the same time, hydrogen at this time will be based on low-emission hydrogen or renewable hydrogen, and sustainable hydrogen sources will lay the foundation for the application of hydrogen in the power and transportation industries.

In 2050, the highest proportion of hydrogen energy consumption will be in transportation, and it will account for about 42%–53%, of which the highest proportion will be in the BAU scenario as shown in Fig. 5a, followed by the LCD scenario as shown in Fig. 5b. The transport sector will consume a large amount of hydrogen in 2050, depending on the development of hydrogen vehicles, especially in the field of heavy-duty trucks and buses. The transportation sector also includes hydrogen demand for ships, aerospace, etc. The transportation sector is considered an industry with great potential for hydrogen energy development, and hydrogen energy will also become a key energy source for green, low-carbon, and sustainable development in the transportation sector.

In 2060, the transportation industry will further expand the hydrogen demand, which accounts for about 44%–58% of consumption, accounting for about half of the total hydrogen consumption as shown in Fig. 5a,c. At this time, it is expected that in addition to heavy trucks and buses, hydrogen passenger vehicles will also be applied on a large scale, and road traffic will be fully de-oiled to achieve electric hydrogenation development.

4 Conclusions and Policy Implications

This study uses scenario analysis method to conduct a detailed analysis of the development of hydrogen demand in China to predict its development scale and potential in different sectors in the future. Through a comprehensive scenario analysis, four different development scenarios are used to figure out the difference between different roadmaps. On this basis, the study also provides a detailed development analysis and an evaluation for the hydrogen application in different sectors. Based on this model, the future demand potential of China’s hydrogen energy industry is analyzed, and the changes in different industries are predicted, which provides a practical and theoretical reference for China’s hydrogen energy policy formulation.

The results show that the transportation sector is the sector with the greatest potential for hydrogen demand growth from 2023 to 2060, which is expected to rise from 38,000 tons to about 163.18 Mt, with the largest room for growth in the future. Especially, hydrogen energy has the greatest development potential in the long-distance transportation sector. The trend of de-refueling and hydrogenation in the transportation sector will be imperative for carbon emissions reduction. From 2030 to 2050, hydrogen energy development will show explosive growth, during which the average annual growth rate of hydrogen demand will be about 4%–8%. By 2050, about half of hydrogen energy consumption will be used in the transportation sector, due to the large-scale hydrogen consumption in heavy trucks, buses, passenger cars, ships, aerospace, and other fields. Hydrogen energy will be considered an important energy source for the decarbonization and sustainable development of the transportation industry.

The TDB scenario has the greatest potential for hydrogen demand scale among the four development scenarios selected in this study. Under this scenario, the total demand for hydrogen energy is expected to reach 446.37 Mt in 2060. The scenario BAU, SAC, and LCD are 285.29, 275.42, and 396.09 Mt, respectively. The reason for the huge scale of hydrogen energy development under the TDB scenario is that the rapid development of hydrogen energy will be driven by technology innovations, cost reduction, and policy support. Only when the technology is mature can the industry be well developed. 2030 will be the inflection point for technological breakthroughs, and the TDB scenario after 2030 will show significant advantages.

The transportation sector has the greatest potential for hydrogen energy demand among the four hydrogen consumption sectors in this study. The total market for hydrogen transportation is expected to reach 163–195 Mt in 2060. The demand for hydrogen energy in the transportation sector accounts for about 55%, while the proportion of electricity, industry, and others is relatively evenly distributed, accounting for about 15%. In 2040, transportation, electricity, and heavy industry will account for about 30%. It can be seen that after 2040, the demand for hydrogen energy development in the transportation sector will rise rapidly. Hydrogen energy has the greatest development potential in the transportation sector after the year 2040, and the trend of de-refueling and hydrogenation in the transportation sector will be imperative for the decarbonization process.

From 2030 to 2050, hydrogen energy development will show explosive growth, during which the average annual growth rate of hydrogen demand will be about 4%–8%. The demand for hydrogen energy will show a rapid growth trend from 2030 to 2050 under the four development scenarios. It is also predicted that transportation, electric power, and new industries will replace traditional energy sources with hydrogen energy on a large scale during this period. The period from 2030 to 2050 will be considered an unprecedented critical period for the rapid development of hydrogen energy.

Based on the results and conclusions of this study, this study makes the following policy recommendations. The period 2030–2050 is important for rapid development of hydrogen energy. According to China’s social development, the demand for hydrogen in the transportation sector will be more competitive. In the transportation sector, the management and layout can be standardized, and the problem of hydrogen station network layout in 2030 can be solved, which will be helpful for expanding the advantages of hydrogen energy and promote the development of hydrogen energy in the entire transportation industry. In the 2030 carbon peak scenario, intensive attention to environmental pollution in transportation and other industries will have a significant impact on the application of hydrogen energy in the heavy industry. The development of clean energy and low-carbon hydrogen can be promoted under the direction of environmental pollution.

Acknowledgement: The authors extend their appreciation to the comments from the members of the Chinese Academy of Engineering.

Funding Statement: The research is supported by the National Natural Science Foundation of China (No. 71704178), Beijing Municipal Excellent Talents Foundation (No. 2017000020124G133), Major consulting project of the Chinese Academy of Engineering (Nos. 2023-JB-08, 2022-PP-03).

Author Contributions: Conceptualization: Bing Wang and Zhongxun Li; methodology: Zhongxun Li; formal analysis: Bing Wang ang Zhongxun Li; validation and data curation: Xiaolin Liu and Zhongxun Li; writing—original draft preparation: Bing Wang and Zhongxun Li; writing—review and editing: Xiaolin Liu and Zhongxun Li; supervision, Bing Wang. All authors reviewed the results and approved the final version of the manuscript.

Availability of Data and Materials: Data available on request from the authors.

Ethics Approval: Not applicable.

Conflicts of Interest: The authors declare no conflicts of interest to report regarding the present study.

References

1. Net Zero Tracker. Net zero stocktake 2023 [Internet]. 2023 [cited 2024 Dec 1]. Available from: https://ca1-nzt.edcdn.com/Reports/Net_Zero_Stocktake_2023.pdf?v=1696255114. [Google Scholar]

2. Hydrogen Council. Hydrogen Insights 2024 [Internet]. 2024 [cited 2024 Dec 1]. Available from: https://hydrogencouncil.com/en/hydrogen-insights-2024/. [Google Scholar]

3. IEA. The future of hydrogen [Internet]. 2019 [cited 2024 Dec 1]. Available from: https://iea.blob.core.windows.net/assets/9e3a3493-b9a6-4b7d-b499-7ca48e357561/The_Future_of_Hydrogen.pdf. [Google Scholar]

4. Hydrogen Council. Roadmap towards zero emissions: BEVs and FCEVs [Internet]; 2021 [cited 2024 Dec 1]. Available from: https://hydrogencouncil.com/en/roadmap-towards-zero-emissions-bevs-and-fcevs/. [Google Scholar]

5. Wang B, Li ZX, Zhou JX, Cong Y, Li ZH. Technological-economic assessment and optimization of hydrogen-based transportation systems in China: a life cycle perspective. Int J Hydrogen Energy. 2023;48(33):12155–67. doi:10.1016/j.ijhydene.2022.12.189. [Google Scholar] [CrossRef]

6. Li Z, Huang S, Liu X, Wu H. Energy-environment life cycle assessment and comparison of a nuclear-based hydrogen production system. Int J Hydrogen Energy. 2024;96:351–9. doi:10.1016/j.ijhydene.2024.11.274. [Google Scholar] [CrossRef]

7. China Hydrogen Energy Alliance. White paper of hydrogen energy and fuel cell industry in China 2020. Shanghai, China: Integral Co., Ltd.; 2021. [Google Scholar]

8. IEA. Global hydrogen review 2021 [Internet]. 2021 [cited 2024 Dec 1]. Available from: https://iea.blob.core.windows.net/assets/5bd46d7b-906a-4429-abda-e9c507a62341/GlobalHydrogenReview2021.pdf. [Google Scholar]

9. IEA. Net zero by 2050. A Roadmap for the Global Energy Sector [Internet]. 2021 [cited 2024 Dec 1]. Available from: https://racetozero.unfccc.int/wp-content/uploads/2021/06/NetZeroby2050-ARoadmapfortheGlobalEnergySector.pdf. [Google Scholar]

10. Hydrogen Council. Hydrogen in Decarbonized Energy Systems [Internet]. 2023 [cited 2024 Dec 1]. Available from: https://hydrogencouncil.com/en/hydrogen-in-decarbonized-energy-systems/. [Google Scholar]

11. Citic Securities. Hydrogen energy series report of energy and Chemical industry [Internet]. 2021 [cited 2024 Dec 1]. Available from: https://stock.tianyancha.com/qmp/report/2/7d2bdd87ce5ac7883c4aea27e32bf475.pdf. [Google Scholar]

12. Ev100 China. China hydrogen energy industry development report. Beijing, China: Ev100 China; 2020 [cited 2024 Dec 1]. Available from: https://www.sdtzsb.com/Uploads/editor/6095e307b4c84.pdf. [Google Scholar]

13. Su B, Wang R, Wang M, Wang MY, Zhao Q. Low-carbon economic dispatch of integrated energy systems in industrial parks considering comprehensive demand response and Mmulti-hydrogen supply. Appl Sci. 2024;14(6):2381. doi:10.3390/app14062381. [Google Scholar] [CrossRef]

14. Heydarzadeh Z, Brouwer J. Investigation of southern California natural gas infrastructure to transport and store hydrogen to meet electric demend baseed on a 100% renewable energy portfolio. In: Proceedings of the ASME 2020 Power Conference; 2020 Aug 4–5; New York, NY, USA: ASME. [Google Scholar]

15. Olabi A, Bahri A, Abdelghafar A, Baroutaji A, Sayed E, Alami A, et al. Large-scale hydrogen production and storage technologies: current status and future directions. Int J Hydrogen Energy. 2021;46(45):23498–528. doi:10.1016/j.ijhydene.2020.10.110. [Google Scholar] [CrossRef]

16. Bhattacharyya R, Singh K, Bhanja K, Grover R. Leveraging nuclear power-to-green hydrogen production potential in India: a country perspective. Int J Energy Res. 2022;46(13):18901–18. doi:10.1002/er.8348. [Google Scholar] [CrossRef]

17. You C, Kim JY. Optimal design and global sensitivity analysis of a 100% renewable energy sources based smart energy network for electrified and hydrogen cities. Energy Convers Manag. 2020;223:113252. doi:10.1016/j.enconman.2020.113252. [Google Scholar] [CrossRef]

18. Makepeace R, Tabandeh A, Hossain M, Asaduz-Zaman M. Techno-economic analysis of green hydrogen export. Int J Hydrogen Energy. 2024;56(73):1183–92. doi:10.1016/j.ijhydene.2023.12.212. [Google Scholar] [CrossRef]

19. Henry A, McStay D, Rooney D, Robertson P, Foley A. Techno-economic analysis to identify the optimal conditions for green hydrogen production. Energy Convers Manag. 2023;291:117230. doi:10.1016/j.enconman.2023.117230. [Google Scholar] [CrossRef]

20. Faye O, Szpunar J, Eduok U. A critical review on the current technologies for the generation, storage, and transportation of hydrogen. Int J Hydrogen Energy. 2022;47(29):13771–802. doi:10.1016/j.ijhydene.2022.02.112. [Google Scholar] [CrossRef]

21. Wang B, Li L, Xian Y, Yu P, Hao W. Fundamental coal demand prediction under the goal of carbon neutrality in 2060. Clean Coal Technol. 2022;28(5):1–13. doi:10.13226/j.issn.1006-6772.CN22022101. [Google Scholar] [CrossRef]

22. Marchionna M. Hydrogen production and conversion to chemicals: a zero-carbon puzzle. Pure Appl Chem. 2024;96(4):465–70. doi:10.1515/pac-2023-0901. [Google Scholar] [CrossRef]

23. Pivac I, Simunovic J, Barbir F, Nizetic S. Reduction of greenhouse gases emissions by use of hydrogen produced in a refinery by water electrolysis. Energy. 2024;296:131157. doi:10.1016/j.energy.2024.131157. [Google Scholar] [CrossRef]

24. Singla M, Gupta J, Beryozkina S, Safaraliev M, Singh M. The colorful economics of hydrogen: assessing the costs and viability of different hydrogen production methods—a review. Int J Hydrogen Energy. 2024;61(7):664–77. doi:10.1016/j.ijhydene.2024.02.255. [Google Scholar] [CrossRef]

25. Omid M, Sahin M, Cora O. Challenges and future perspectives on production, storage technologies, and transportation of hydrogen: a review. Energy Technol. 2024;12(4):2300997. doi:10.1002/ente.202300997. [Google Scholar] [CrossRef]

26. Zainal B, Ker P, Mohamed H, Ong H, Fattah I, Rahman S, et al. Recent advancement and assessment of green hydrogen production technologies. Renew Sustain Energy Rev. 2024;189:113941. doi:10.1016/j.rser.2023.113941. [Google Scholar] [CrossRef]

27. Hassan Q, Algburi S, Sameen A, Salman H, Jaszczur M. Green hydrogen: a pathway to a sustainable energy future. Int J Hydrogen Energy. 2024;50(46):310–33. doi:10.1016/j.ijhydene.2023.08.321. [Google Scholar] [CrossRef]

Cite This Article

Copyright © 2025 The Author(s). Published by Tech Science Press.

Copyright © 2025 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools