Open Access

Open Access

ARTICLE

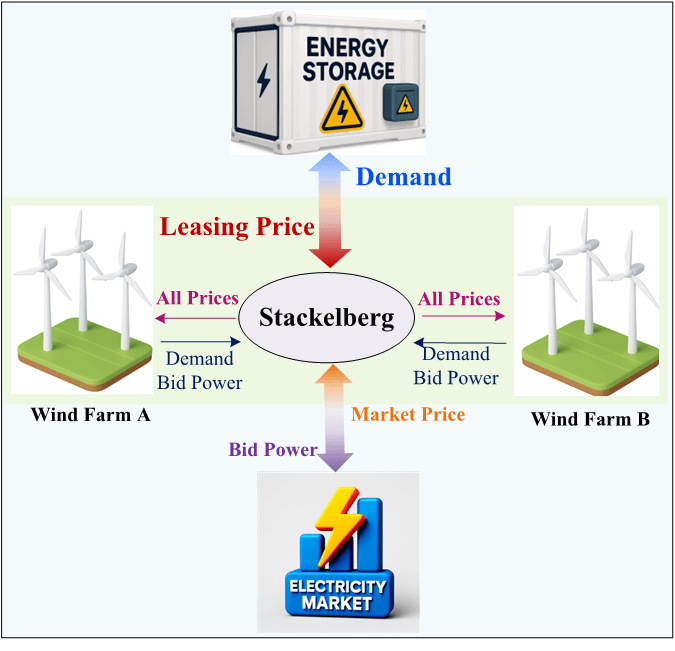

Stackelberg Game for Bilateral Transactions between Energy Storage and Wind Farms Considering the Day-Ahead Electricity Market

1 Key Laboratory of Modern Power System Simulation and Control & Renewable Energy Technology, Ministry of Education (Northeast Electric Power University), Jilin, 132012, China

2 Electric Power Research Institute of State Grid Jilin Electric Power Co., Ltd., Jilin, 130021, China

* Corresponding Author: Junhui Li. Email:

Energy Engineering 2025, 122(5), 1645-1668. https://doi.org/10.32604/ee.2025.063192

Received 08 January 2025; Accepted 06 March 2025; Issue published 25 April 2025

Abstract

The participation of wind farms in the former energy market faces challenges such as power fluctuations and energy storage construction costs. To this end, this paper proposes a joint energy storage operation scheme for multiple wind farms based on a leasing model, which assists wind farms in bidding for participation in the former energy market through leasing services, thereby enhancing energy storage efficiency and maximizing economic benefits. In this paper, based on the Weibull probability distribution to portray the uncertainty of wind power, and considering the lifetime capacity loss caused by charging and discharging of energy storage, we construct a bilateral transaction model aiming at maximizing the multi-objective revenue of wind farms and shared energy storage. The trading strategy is designed based on the Stackelberg game framework and solved jointly by the improved genetic algorithm and interior point method. By exploring the effects of different lease price intervals on the overall system performance, and analyzing the system state under multiple charging and discharging scenarios. The results show that a reasonable lease price range can significantly improve the energy storage system utilization and wind farm revenue. The program provides new ideas to enhance the economic benefits of wind farms and promote the application of shared energy storage, and promotes the wide application of shared energy storage systems.Graphic Abstract

Keywords

Cite This Article

Copyright © 2025 The Author(s). Published by Tech Science Press.

Copyright © 2025 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools