Open Access

Open Access

ARTICLE

Graph-Based Unified Settlement Framework for Complex Electricity Markets: Data Integration and Automated Refund Clearing

1 School of Electrical and Electronic Engineering, North China Electric Power University, Beijing, 102206, China

2 China Electric Power Research Institute, Nanjing, 210003, China

* Corresponding Author: Zhaoyuan Wu. Email:

Energy Engineering 2026, 123(1), 3 https://doi.org/10.32604/ee.2025.069820

Received 01 July 2025; Accepted 04 September 2025; Issue published 27 December 2025

Abstract

The increasing complexity of China’s electricity market creates substantial challenges for settlement automation, data consistency, and operational scalability. Existing provincial settlement systems are fragmented, lack a unified data structure, and depend heavily on manual intervention to process high-frequency and retroactive transactions. To address these limitations, a graph-based unified settlement framework is proposed to enhance automation, flexibility, and adaptability in electricity market settlements. A flexible attribute-graph model is employed to represent heterogeneous multi-market data, enabling standardized integration, rapid querying, and seamless adaptation to evolving business requirements. An extensible operator library is designed to support configurable settlement rules, and a suite of modular tools—including dataset generation, formula configuration, billing templates, and task scheduling—facilitates end-to-end automated settlement processing. A robust refund-clearing mechanism is further incorporated, utilizing sandbox execution, data-version snapshots, dynamic lineage tracing, and real-time change-capture technologies to enable rapid and accurate recalculations under dynamic policy and data revisions. Case studies based on real-world data from regional Chinese markets validate the effectiveness of the proposed approach, demonstrating marked improvements in computational efficiency, system robustness, and automation. Moreover, enhanced settlement accuracy and high temporal granularity improve price-signal fidelity, promote cost-reflective tariffs, and incentivize energy-efficient and demand-responsive behavior among market participants. The method not only supports equitable and transparent market operations but also provides a generalizable, scalable foundation for modern electricity settlement platforms in increasingly complex and dynamic market environments.Keywords

Settlement constitutes the final and critical stage in the electricity market, serving not only as the accounting closure of energy transactions but also as a key economic mechanism to enforce and reflect market rules. Settlement organizations typically conduct settlements separately for different transaction types; for instance, spot electric energy settlement involves trading electricity as a commodity, with final financial clearing performed based on metering data, transaction outcomes, and contractual agreements. With the progression of China’s electricity market reforms, settlement is regarded not merely as a technical bookkeeping process but as a vital component in ensuring fair market competition, conveying accurate price signals, and promoting efficient resource allocation. A robust and transparent settlement system guides energy consumption patterns, incentivizes demand-side responses, and encourages energy-saving behaviors, thereby supporting broader goals of economic efficiency and low-carbon transition. However, despite ongoing efforts and localized practices within China, significant challenges and unresolved issues persist in fully achieving these objectives.

On one hand, significant differences in resource endowment, supply and demand capacity, and economic development among China’s provinces result in substantial variations in installed capacity, network structure, and levels of electricity marketization. These factors cause considerable disparities in the electricity settlement processes across provinces [1]. To address the specific needs of provincial electricity settlement, market settlement organizations have traditionally adopted decentralized investment and independent construction approaches [2]. This fragmentation impedes standardized system development and centralized, unified data management. Electricity market settlement involves complex business processes, large data volumes, high timeliness requirements, and coordination across multiple departments. Settlement-related data must flow between systems of different entities, such as electricity trading centers and dispatch centers. The complexity of interdepartmental data relationships and the reliance on staff experience to interpret data semantics often lead to inconsistent business understanding across departments. This inconsistency reduces settlement efficiency and increases the risk of errors. Therefore, establishing a unified data model for electricity market settlement is imperative. Such a model would link data across departments, enable centralized storage and management, standardize data formats, eliminate interdepartmental barriers, facilitate seamless business process integration, and provide a foundation for automating settlement operations.

On the other hand, when errors such as measurement inaccuracies, historical data corrections, settlement rule adjustments, or contract modifications occur in the electricity market, retroactive recalculation of historical settlement data is required for bills that have already been financially settled. The recalculated results must be compared with historical settlement documents to generate retroactive settlement bills for deviation charge processing. In the forward market, settlements are conducted monthly. Due to the smaller data volume and longer settlement cycles, the likelihood of errors in monthly data is lower. Consequently, the frequency and complexity of recalculation processes are reduced, and any necessary refund clearings are typically handled through retroactive settlement. With the rapid development of China’s spot electricity market, settlement granularity has shifted from monthly to 15-min or hourly intervals, and business processing cycles have shortened from monthly to daily. Additionally, the management of complete data versions—including minute-level metering and time-sharing transactions—is required. Furthermore, provincial differences in grid structure, supply and demand, and historical factors lead to complex and non-uniform spot market clearing rules, increasing the challenges in clearing system development [3]. Compared to the forward market, spot market refund clearing must address issues of data versioning, flexible computation of complex rules, high-frequency refund clearing for minute-level data, and the need for high-performance processing of large-scale datasets. Therefore, the development of a high-performance, generalized refund clearing system for large-scale spot market data is urgently needed.

Many scholars have carried out research on issues related to settlement in the electricity market. In terms of electricity market settlement mechanism, Fernando [4] examines the existing single settlement system in the Brazilian electricity market and proposes a dual settlement system as an improvement that can price electricity more accurately and promote market efficiency and fair competition. Paolo et al. [5] present a proposal to reform the Colombian electricity market with the aim of integrating renewable energy sources more efficiently by introducing a multi-settlement system. Wu et al. [6] address the issue of settlement in China’s spot electricity market and proposes a settlement mechanism based on physical delivery of forward contracts, aiming at ensuring fairness and realizing risk avoidance, and proves its economy and practicability in a high proportion of renewable energy power systems through cases. Yang et al. [7] address the issue of inter-provincial electricity market settlement in the southern region, propose a electricity market transaction segmentation method based on the cumulative value of the daily scheduling plan, and realize a two-stage settlement strategy, which effectively improves the settlement efficiency of the market transaction. Wang et al. [8] investigate the impact of different electricity price settlement mechanisms on the interests of spot electricity market participants through multi-agents simulation, and provide suggestions for the selection of price mechanisms in China’s spot electricity market. Zhou et al. [9] propose the design of a user-side settlement system based on a high percentage of new energy power spot market. Cai et al. [10] discuss the participation bidding and settlement methods of emerging renewable energy systems in electricity markets and propose an improved Distributed Adjustable Load Resource Bidding and Settlement (DALRS) model to enhance the bidding system in the spot electricity market. Alireza and Seyed [11] address the issue of reserve market settlement under the marginal pricing mechanism in the electricity market and propose a value-based reserve market settlement scheme aimed at realizing fair and reasonable consumer payment. Shi et al. [12] study the settlement balancing problem in the electricity spot market under different demand-side location marginal price mechanisms, and propose a sub-regional settlement balancing method, and verify the effectiveness of the method through numerical arithmetic examples. Wu et al. [13] address the imbalance funding problem in the context of the coexistence of planned economy and market economy in the construction of China’s electric power spot market, put forward the advantages and shortcomings of the three spot market settlement methods, and discuss the impact of one-time and two-time planned economy settlement on the imbalance settlement in the spot market. In terms of the application of digital technology in market settlement, Chen [14] addresses technical challenges in California Independent System Operator (CAISO) market settlement and proposes an innovative computational engine to optimize execution time and result accuracy to meet commercial operational schedules and performance requirements. Hao et al. [15] discuss the intelligence of electricity settlement based on blockchain technology, propose a design scheme that combines private chain, alliance chain and smart contract, and analyze the problems that may be encountered in application. Lu et al. [16] propose a smart contract based on blockchain technology for power trading and fee settlement to reduce the trust cost and improve the transaction efficiency in the power market. Many scholars have already applied database technology to the power industry. Sanchez et al. [17] introduce a database of household energy consumption invoices based on the Spanish electricity market. The database generates documents with synthetic data through a simulation process, which can be used for training machine learning algorithms and analyzing electricity market behavior. Krneta and Krstev [18] propose a database model design method based on Electronic Data Interchange (EDI) standards for monitoring data exchange among power market participants, with the aim of improving the speed and security of data exchange and ensuring data exchange quality control. Some scholars have applied graph databases and graph computing technologies to the field of power systems. Li et al. [19] propose a spatiotemporal data modeling method for power grids based on graph databases. By constructing a spatiotemporal node-circuit breaker graph model, it improves the efficiency of power grid dispatching and operation. Tang et al. [20] propose an automatic architecture construction method for a power grid data platform based on a multi-source relational data model. By automatically extracting ontologies from the diverse table structures and Structured Query Language (SQL) descriptions of relational databases, it achieves the automated construction and optimization of power grid knowledge graphs. Huang et al. [21] propose a graph model construction technique for power transformer equipment, improving the efficiency of automatic modeling and management of transformer data. Lu et al. [22] propose a unified classification and naming method for intelligent devices in substation topologies, utilizing graph database technology to optimize substation equipment management. Tang et al. [23] propose a method for modeling power grid spatiotemporal data based on graph database technology and an analysis of the correlation between electricity consumption and carbon emissions, with the aim of improving the efficiency and accuracy of electricity consumption and carbon emissions analysis and management in China. Huang et al. [24] use graph databases and graph computing technology to calculate the impact of distributed power generation on regional carbon emissions, innovatively achieving local balance calculations of carbon emission intensity for regional grid nodes. Current research on the application of graph databases in power systems mainly focuses on areas such as electrical equipment management and carbon emission analysis, with almost no application in electricity market settlement.

In summary, existing studies have made valuable contributions to the design of electricity market settlement mechanisms, settlement path modeling, and refund clearing frameworks across various market structures. However, several important limitations remain. First, most existing settlement data models rely on relational database structures, which struggle to efficiently process high-dimensional, strongly associated settlement data under multi-market coupling and frequent settlement revisions. Second, existing refund clearing frameworks often require significant system modifications and manual interventions when dealing with retroactive data recalculations, especially under heterogeneous and evolving settlement rules. Third, the scalability and automation level of settlement systems remain limited, particularly in scenarios involving large-scale, high-frequency data streams and complex cross-market interdependencies. These gaps highlight the necessity of developing a unified, flexible, and automated settlement method that can sup-port heterogeneous market environments, enable efficient refund clearing, and enhance settlement accuracy and computational performance under rapidly growing market complexities.

To fill the aforementioned gaps in handling heterogeneous settlement data structures, automating complex business processes, and enabling efficient refund clearing under large-scale dynamic revisions, this paper proposes a unified electricity market settlement method based on a graph database framework. The main contributions of this paper are summarized as follows:

(1) A unified data model for electricity market settlement is proposed based on graph database theory. By leveraging the attribute graph model, complex relationships between heterogeneous settlement data are represented in a flexible and scalable manner, which enhances both data standardization and query efficiency across diverse market entities, contracts, and settlement rules.

(2) An automated settlement framework is developed by integrating multiple configurable settlement tools. The framework includes unified dataset generation, rule-based settlement formula configuration, bill generation, task scheduling, and dispute management modules, which together enable flexible, fully automated settlement processing across multi-market environments.

(3) A refund clearing mechanism incorporating versioned data management and lineage-based recalculation is designed. By introducing sandbox execution, data version snapshots, dynamic data lineage identification, and automatic data change capture, the proposed method enables accurate and efficient refund clearing in large-scale, multi-scenario market settlement cases, which is validated through extensive real-world datasets.

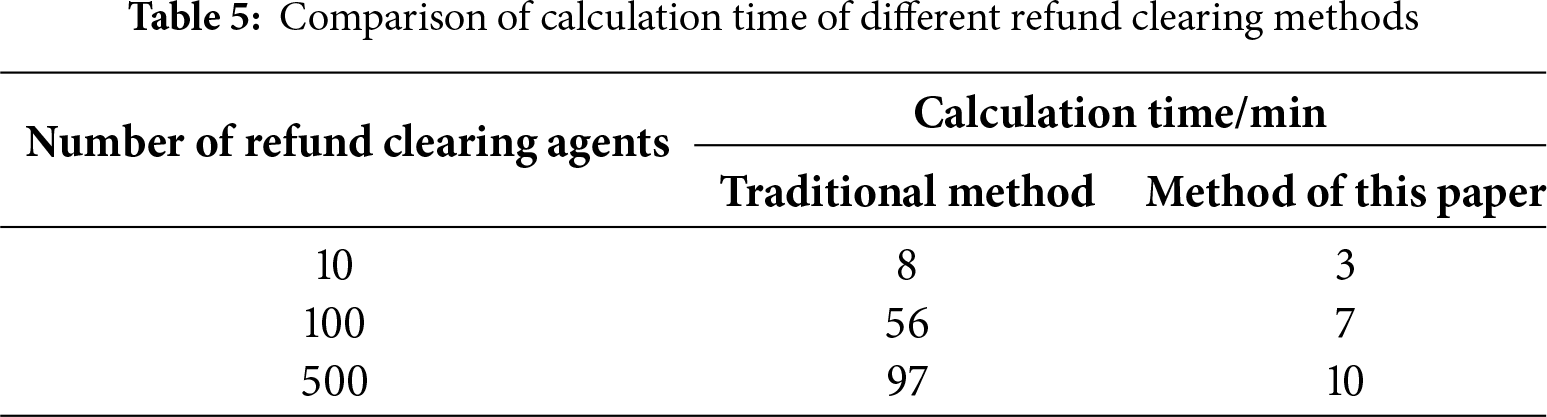

To further underscore the practical value of the proposed framework in multi-layer and cross-product markets, we take Shanxi’s pilot as a reference case: when forward, day-ahead, real-time, capacity and ancillary-service settlements are processed on the same graph backbone, rule configuration time drops from weeks to hours, and the refund-clearing run-time for 500 agents shrinks from 97 min to 10 min.

Such computational agility allows the market operator to shorten the billing cycle to 15-min granularity, which, in turn, tightens the cost-to-cash feedback. Empirical price-elasticity analysis shows that every 1% improvement in price-signal fidelity induces a 0.3% peak-load reduction and an average 0.12% energy-saving across participating DER portfolios. Hence, settlement digitalization is not only an IT upgrade but also an economic lever for energy conservation.

2 Status of Electricity Market Settlements

Electricity transaction settlement refers to the accounting and reconciliation of economic income and expenditure for electricity commodities based on market prices and transaction rules within a prescribed settlement cycle. Its core function is to reflect the economic relationships among market participants as expressed through transaction outcomes and to serve as the basis for fund receipt and payment. Therefore, settlement represents not only the final stage of the electricity market but also a critical process; only when settlement is completed according to market design and matching rules can a transaction be considered finalized.

Settlement in the electricity market can be categorized from several perspectives: by main operational functions, it includes settlement calculation, payment collection, settlement adjustment, and dispute resolution; by scope, it covers wholesale and retail electricity market transactions; by temporal dimension, it distinguishes between forward contract settlements and spot market settlements; and by content, it encompasses electric energy settlement, ancillary service settlement, capacity market settlement, and transmission service fee settlement.

The following section summarizes the key characteristics of current electricity market settlements and reviews the present status of electricity market settlement practices in China.

Currently, settlement serves as a central focus in most mature electricity market regulations worldwide, encompassing two main components: settlement calculation and settlement processes. The comprehensive nature of these components highlights the critical importance of settlement. Electricity markets globally continuously update and refine settlement rules to satisfy market participants’ demands for more accurate and comprehensive settlement services. The settlement rules in mature electricity markets are characterized by the following five aspects:

(1) Detailed settlement rules

As the settlement rules directly reflect the implementation of economic relations, is the optimal allocation of resources in a monetary way embodied, concerning the interests of many market players, to avoid the settlement agency has discretionary power, the settlement rules can not pursue simplicity, the content of the settlement service to be very detailed. Taking Pennsylvania–New Jersey–Maryland Interconnection Limited Liability Company (PJM) as an example [25], its market rules include two independent sub-rules for settlement calculation and settlement process, and the settlement calculation and settlement process are described in great detail. In the settlement calculation chapter, it contains a number of specific settlement contents such as electric energy, frequency regulation, reserve, congestion charges, etc., and each of them is described in detail, including the definition of settlement items, settlement calculation formula, and the handling of special circumstances. In addition, it is customary for mature market operators to give market players detailed bills for the provision of settlement services.

(2) Settlement process specification

Key milestones are announced in advance. A well-defined settlement process, seamless integration of various stages, and transparent settlement timelines characterize the “calendar” of settlement in mature electricity markets. Since settlement services are provided by market operators, user-friendliness is a critical requirement, with workload impact being a secondary concern. For instance, PJM issues weekly and monthly statements according to a settlement calendar published prior to each cycle. These statements are distributed to users as documents via the PJM Market Settlement Reporting System (MSRS). Additionally, settlement reports are updated on a rolling monthly basis, enabling market participants to promptly verify information on their electronic bills. Furthermore, the PJM Settlement Service provides a customer guide within the MSRS that details specific itemized charges and explains the calculation methods used.

(3) Settlement principles do not change depending on the detailed design of the market

Although the basic theory of electricity market design is the same, the detailed design of the market needs to be integrated with local practice. Although the settlement rules may vary with different market models and market operation rules, the principles of settlement are basically the same across markets. That is to say, the settlement principles are basically the same whether it is the bilateral centralized market of the PJM market in USA and the unilateral centralized market of the Australian National Electricity Market (NEM) [26], or with the typical decentralized market of the Scandinavian electricity market. For example, in the PJM market, the market adopts local marginal prices and settles them according to the corresponding trading hours, so the settlement rules necessitate that every type of transaction in the market for each market player breaks even on settlement; while the NEM, due to the consideration of factors such as a simple start and increased competition on the generation side, adopts zonal marginal price divided into administrative regions, which can be considered as ignoring the grid congestion in the region, and because of this, the Australian settlement rules involve a lot of electric energy adjustments in the settlement calculations, with the aim of keeping all the expenses in balance with the revenues. In addition, with decentralized decision-making as the guiding principle of the Nordic electricity market in the gradual integration of the process, by Denmark, Finland, Norway and Sweden, the four countries of the Transmission System Operator (TSO) set up specifically for the above four countries of the market players to provide imbalance settlement services settlement agency eSett, the settlement principle is to ensure that the cost of power supply and power consumption between the income must always be balanced [27]. It is thus clear that, regardless of the market model, the same settlement principle applies, i.e., to achieve a balance between revenues and expenditures.

(4) Clearly defined settlement responsibilities and strict supervision

In the settlement calculation process, the institutions responsible for settlement vary depending on the market organization and transaction types within the electricity market. In centralized electricity markets, spot market settlement is typically managed by the designated spot market operator. For example, PJM relies on its affiliated settlement company, while the Australian National Electricity Market (NEM) is settled by the Australian Energy Market Operator (AEMO). In these markets, participants often engage in forward contracts for difference (CFDs) or trade standardized financial contracts on exchanges to hedge spot market price risks [28]. These transactions generally fall outside the remit of the market operator’s settlement agency and are settled separately.

In contrast, European electricity markets such as the UK operate differently. Here, only the real-time balancing mechanism is managed by the system operator, and the settlement company under its umbrella handles settlements related to the balancing mechanism, CFDs, and capacity markets closely tied to system operations. For instance, in the UK, Elexon, a subsidiary of National Grid, is responsible for settling off-market short-term trades. These trades are settled through exchanges like European Power Exchange (EPEX) and Nord Pool’s UK power market brand (N2EX), which operate competitively while offering similar electricity commodity trading.

Regarding funds management, mature electricity markets typically employ one of two approaches. The first involves the settlement agency’s financial department handling funds through a specially regulated account, a method common in North America. The second entrusts funds management to professional clearinghouses affiliated with stock exchanges; these entities possess banking licenses and operate under strict regulatory frameworks with unified margin systems. For example, in Australia, Austraclear—a wholly owned subsidiary of the Australian Securities Exchange and regulated by the Australian financial authority—manages fund collection and disbursement. Austraclear operates both Australia’s wholesale market settlements and the central securities depository system as a professional clearing organization.

(5) Reduce market risk by progressively shortening the settlement cycle

Due to the greater volatility of spot electricity prices, market participants—especially smaller power retailers with limited assets—face increased cash flow risk during fuel price fluctuations. Longer settlement cycles exacerbate this risk by delaying fund clearing. Therefore, mature markets primarily reduce settlement risk by shortening the settlement cycle. For example, the U.S. Federal Energy Regulatory Commission (FERC) introduced regulations in 2010 promoting credit risk management reforms, mandating settlement and calculation cycles not exceeding seven days.

As summarized above, electricity market settlements require detailed rules that accurately reflect the market’s design logic and clearly define the responsibilities of the settlement agency.

Current Status of Electricity Market Settlement Development in China

Recent Chinese government documents from the past two years indicate a shift in China’s electricity market development from focusing solely on spot market clearing to placing equal emphasis on settlement services. Elevating market construction and settlement to the same level reflects the transition of China’s electricity market reform into a new phase, where more targeted solutions are required to address core and critical issues. This shift also signifies a growing societal understanding of the electricity market, with increased attention on separating economic relationships from dispatch plans. Consequently, the standardization of electricity market settlement is expected to accelerate alongside market development, as the market mechanism increasingly emphasizes economic relations and becomes the central focus for the next stage of market construction and enhancement.

In 2022, China proposed to establish a unified national power market system, with initial implementation targeted by 2025 and full realization by 2035. This initiative aims to optimize power resource allocation over a broader geographic area and unify trading rules, leading to significant changes in the scope and operations of various market participants. As a critical component of the power system—directly impacting the economic interests of end-user energy consumers and other stakeholders—the electricity settlement function within grid enterprises is also undergoing transformation. Under the unified national electricity market framework, electricity settlement exhibits the following characteristics:

(1) Richer market types. The national and provincial/regional wholesale markets will encompass various trading products, including electric energy, ancillary services, green electricity, and green certificates. The retail market will be influenced by the wholesale market dynamics, leading to an expanded scope and enriched transaction content. Additionally, new market participants—such as load aggregators and virtual power plants—will establish trading relationships with retail consumers, further broadening the retail market framework.

(2) More diversified market players. The power market is progressively liberalizing access restrictions for new energy sources, emerging business entities, and other market participants. By 2030, new energy sources are expected to fully engage in market trading. Additionally, new types of agents—such as energy storage, virtual power plants, and load aggregators—will increasingly contribute to optimizing power quality. Several provinces in China have already initiated pilot projects to lead this transformation.

(3) More complex market rules. The cross-coupling of diverse rules and frequent regulatory adjustments impose increased demands on the flexibility and adaptability of the settlement system.

(4) More massive market data. With the increasing openness of the electricity market and the explosive growth in the number of market participants, transaction cycles are gradually shortening. Settlement data volumes have expanded to tens and hundreds of millions of records, with finer data processing granularity. These developments impose new performance requirements on electricity market settlement systems.

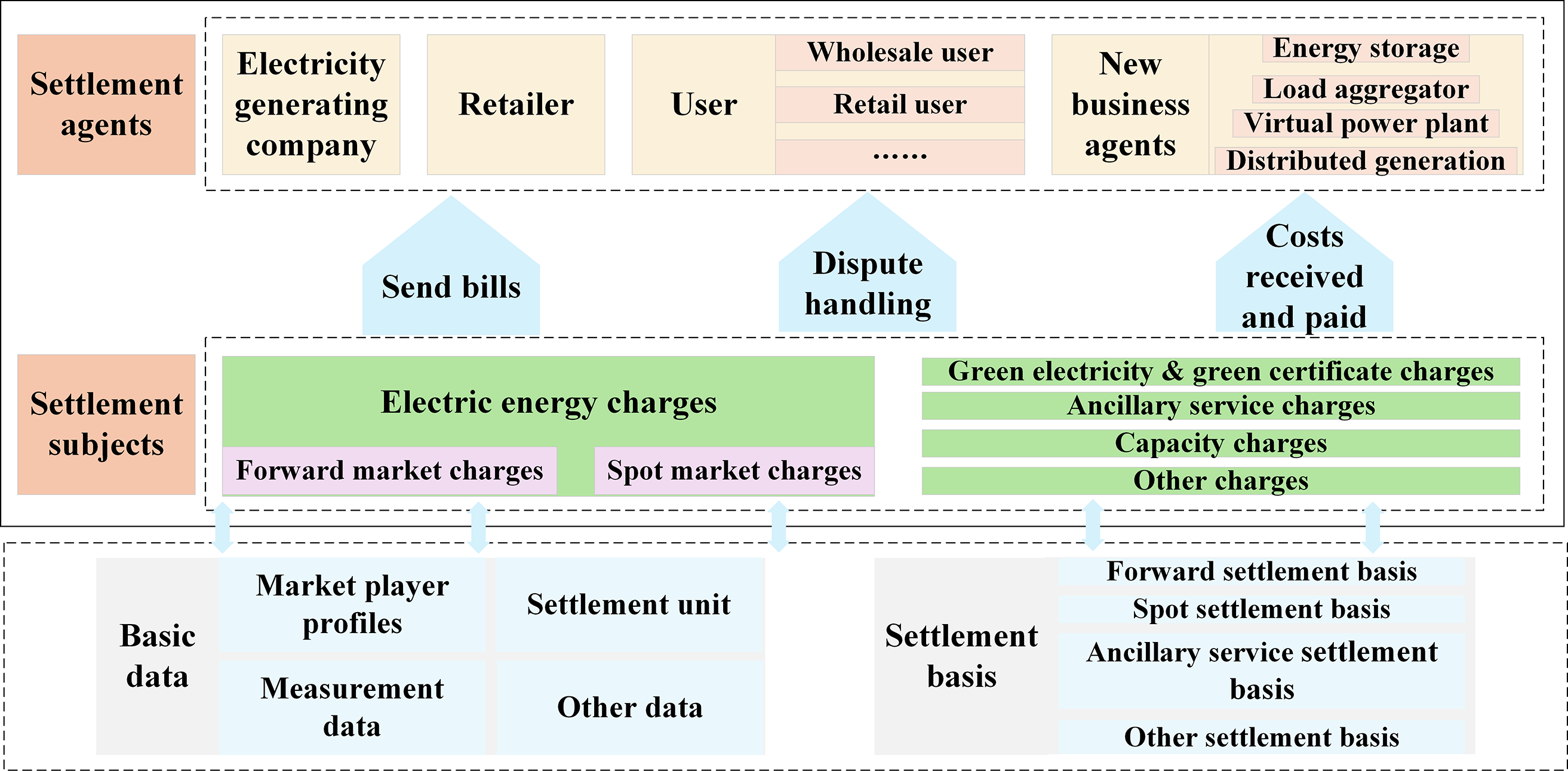

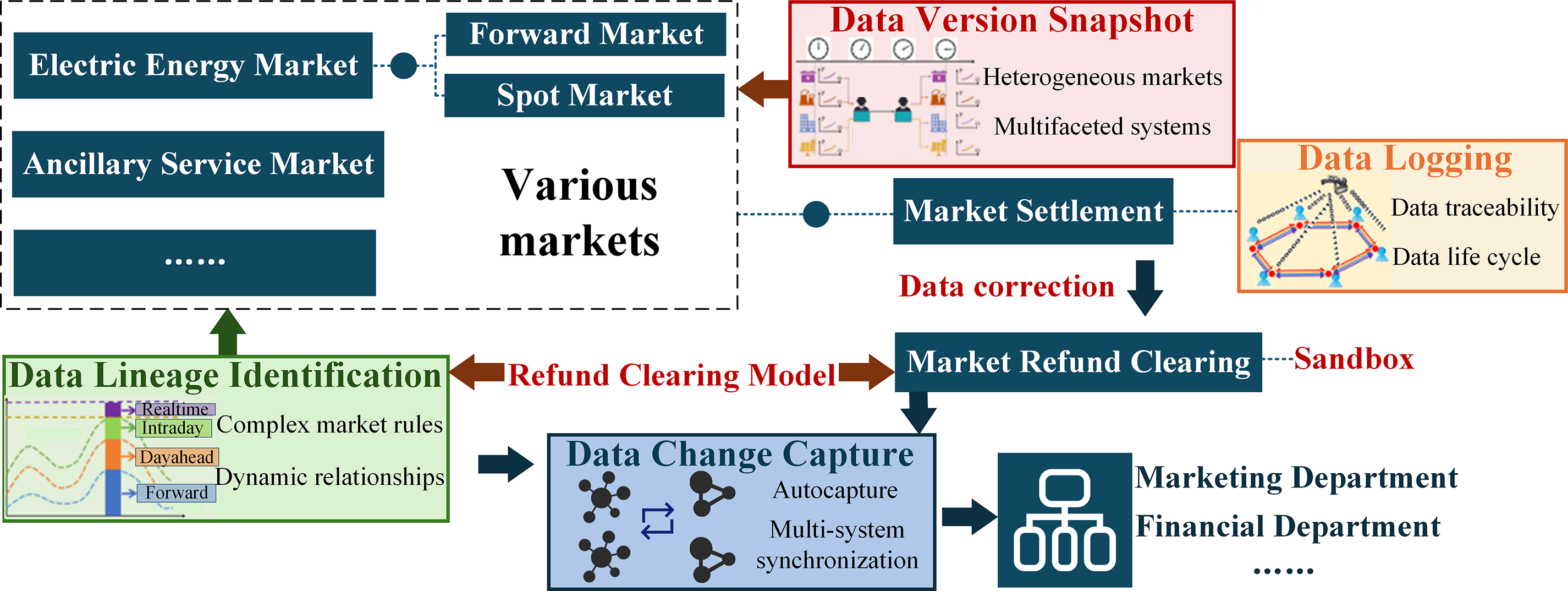

The above characteristics indicate that settlement scenarios in China will become increasingly complex, as illustrated in Fig. 1. The complexity of future electricity settlement will rise substantially, rendering manual processes inadequate and elevating the importance of digital technologies. Electricity settlement must expand its functions and optimize strategies to build a comprehensive system that encompasses all market participants—including generators, retailers, and new business agents—and supports all trading products such as electric energy, ancillary services, and green electricity. This will enable refined, efficient management of settlements and meet the diverse needs of market participants and varying electricity pricing mechanisms.

Figure 1: Schematic diagram of future electricity settlement scenarios in China

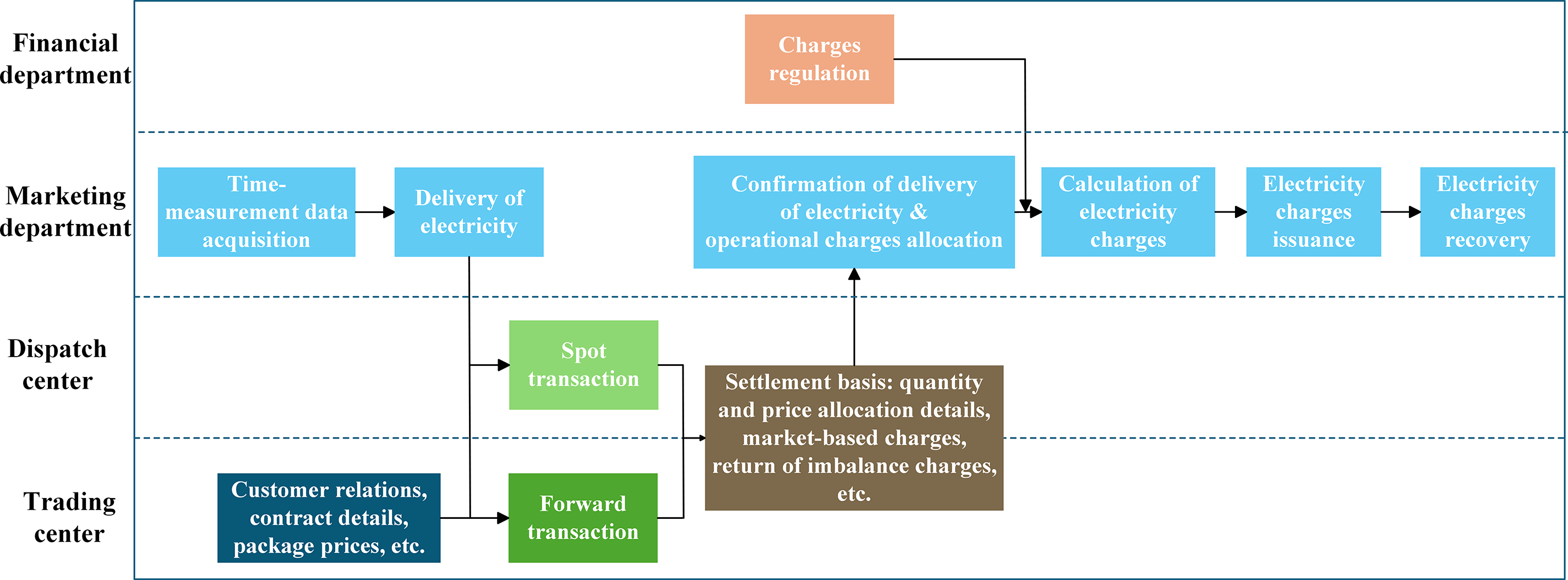

China’s electricity charge business interaction model is illustrated in Fig. 2. As the central hub for electricity charge accounting and payment collection, power grid companies bear critical responsibility for the secure management of electricity charge funds. However, current settlement processes involve multiple departments—dispatch, trading, marketing, finance—across numerous steps and data transfers, resulting in lengthy workflows and difficulties in anomaly detection and precise fund reconciliation. Market settlement under the spot electricity market is characterized by large data volumes, complex business processes, and stringent timeliness requirements. As the final stage of market-oriented transactions, and in the context of China’s unified electricity market development, it is essential to enhance the service capabilities related to electricity purchase and sale verification, billing, and collection. Efforts must focus on building a modern electricity charge system that integrates all business entities, supports diverse transaction types, and delivers intelligent, efficient operation.

Figure 2: China’s electricity charge business interaction diagram

3 Automated Settlement Method for Electricity Market Based on Unified Data Model

3.1 Construction of the Unified Data Model for Electricity Market Settlement

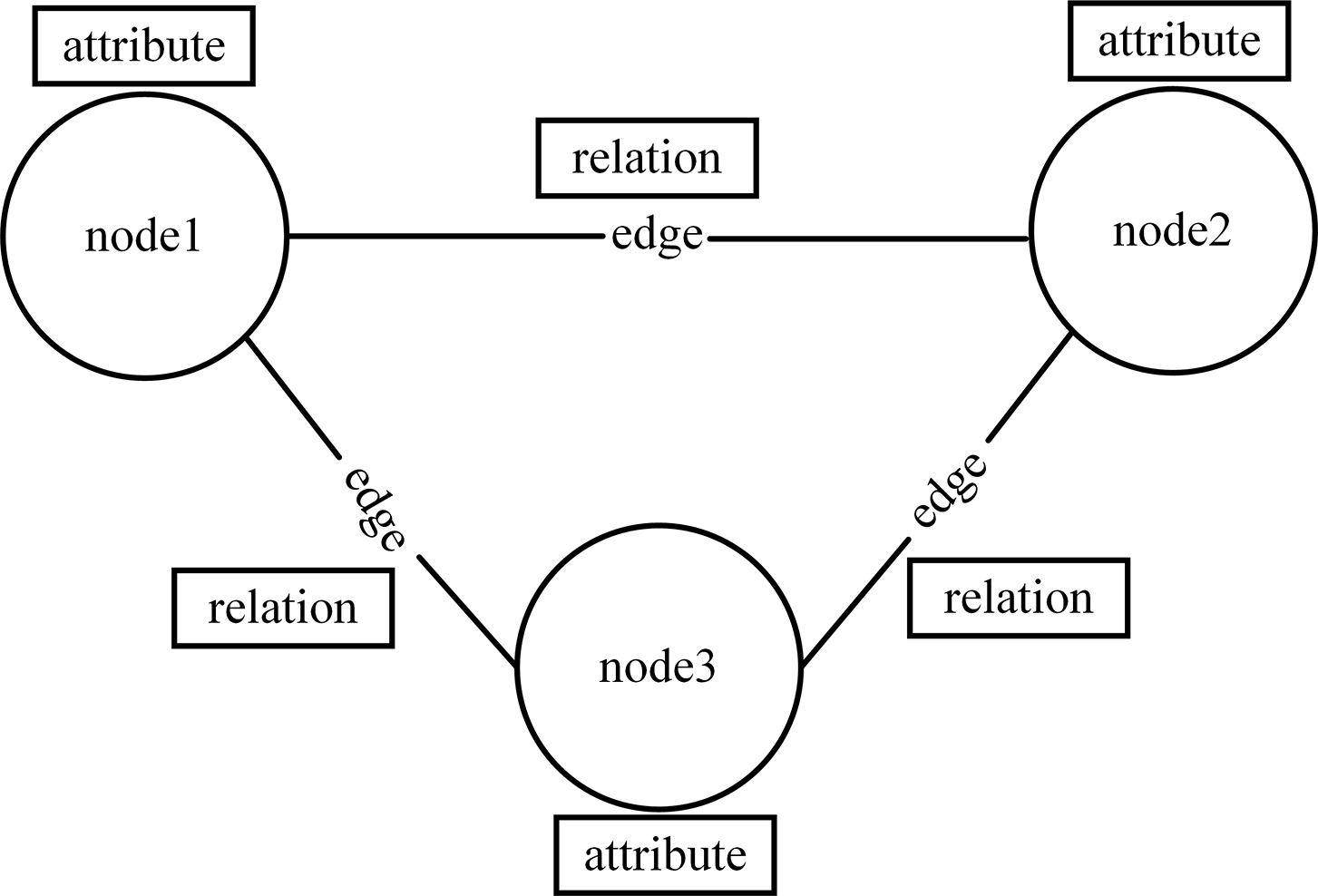

The theoretical basis of graph database originates from the graph theory in mathematics, which is a kind of database that uses graphical model for data querying. It utilizes graph structures, including nodes, edges, and their attributes, to represent and store data efficiently, and also supports comprehensive operations such as adding, deleting, modifying, and querying the data [29], and manages the data using the graph model as a distinguishing feature. The attribute graph model is now widely adopted by the graph database industry, as shown in Fig. 3.

Figure 3: Graph data model

The attribute graph model possesses the following characteristics:

(1) It consists of nodes and edges, where nodes represent entities and edges denote relationships between entities.

(2) Both nodes and edges can contain one or more attributes, which may be indexed and constrained.

(3) Nodes can have one or more labels; these labels group nodes and can be indexed in graph databases to enhance query efficiency.

(4) Edges have names and directions, with a defined start node and end node.

Traditional relational databases primarily handle tabular data structures. Relationships between entities are typically represented using intermediate tables or foreign keys. However, as data volume grows, queries increasingly involve numerous join operations, leading to significant performance degradation. In highly associative domains, intensified data relationships result in more frequent join operations, and recursive join queries further increase time and space complexity. This severely impairs query efficiency, degrades overall database performance, and hinders the system’s ability to adapt to evolving business requirements.

Compared to relational databases, graph databases employ a modeling approach that more closely reflects real-world relationships. This approach not only enhances modeling scalability but also enables graph databases to deliver faster query performance when handling interconnected data.

(1) Graphical models provide a more direct method for storing and representing complex real-world entity relationships.

(2) Graph databases optimize query and processing efficiency by leveraging index-free adjacency, enabled by the physical pointers between nodes. After locating a starting node via an index, traversal proceeds through direct connections between nodes without additional indexing, limiting searches to the local neighborhood of the start node. This avoids global data scans triggered by localized queries, making query performance more dependent on the size of the result set rather than the overall dataset. This feature is fundamental to the enhanced performance of graph databases. Beyond node retrieval, graph databases support association searches to identify relationships between data elements by finding paths between nodes. By specifying the graph algorithm type, start node, and end node, the system automatically executes the query. Connectivity and path expressions determine the existence and nature of relationships, and the relevant results are returned accordingly.

(3) The inherent scalability of graph databases enables them to adapt seamlessly to business growth by offering a flexible data model. New nodes, edges, labels, and subgraphs can be added to existing structures without disrupting current queries or functionality. This flexibility eliminates the need for complete data population during initial design, reducing the need for data reconstruction and migration. Consequently, maintenance overhead and associated risks are minimized, while the costs related to redundant standardization efforts are effectively avoided.

Graph databases model real-world relationships in a way that provides users with a more intuitive understanding of the data. Their high query performance enables rapid handling of complex queries, while their scalable flexibility supports frequent or near-real-time data updates. Together, these features significantly enhance the efficiency of both data retrieval and data updating.

3.1.2 Unified Data Model Construction

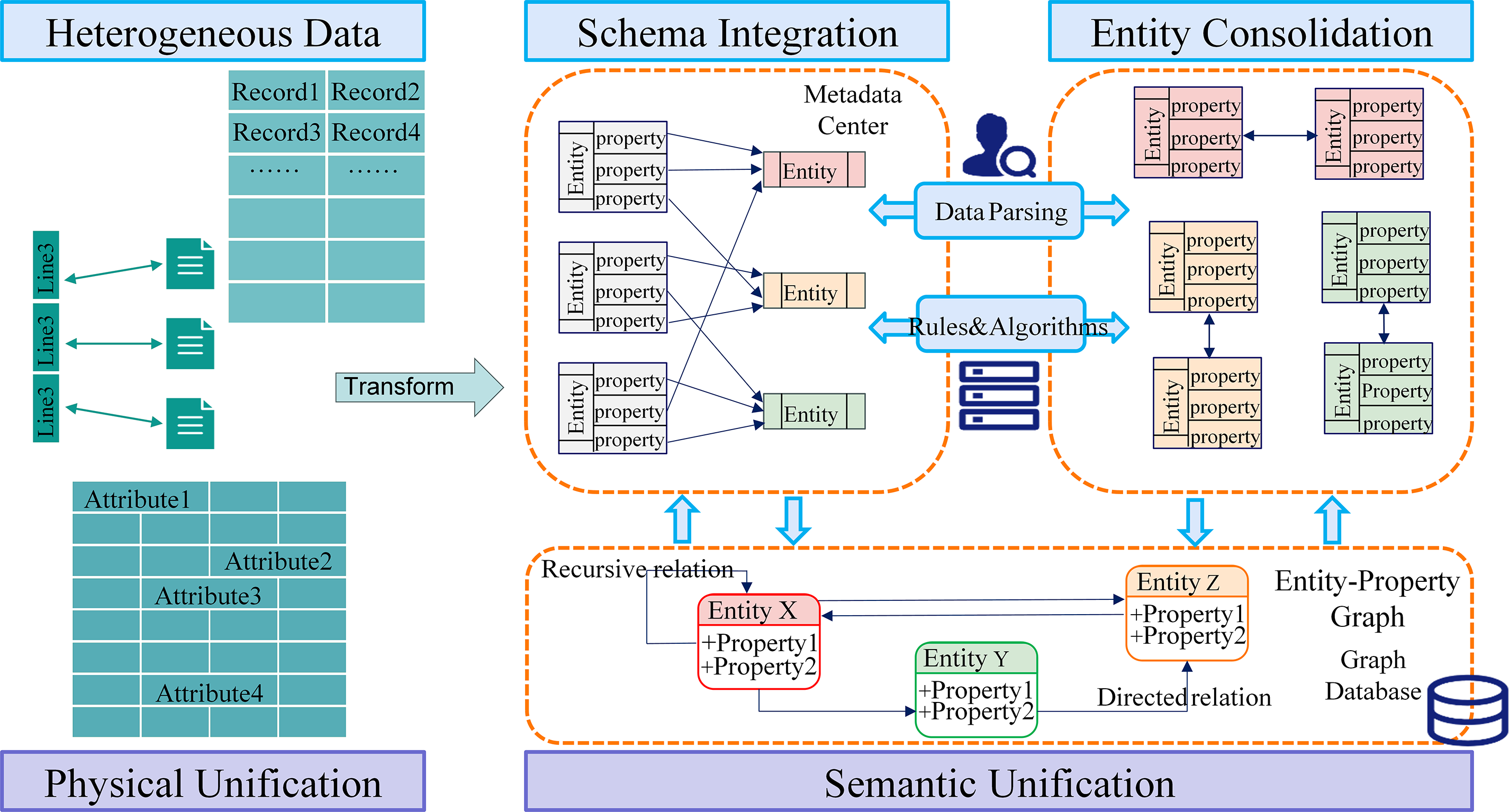

To establish a unified data model for electricity market settlement, it is essential first to define a set of settlement business dimensions to form a metadata center. Subsequently, the initially complex and heterogeneous raw electricity market data are unified both physically and semantically. Physical unification involves standardizing the data format to align with the graph database model, while semantic unification provides consistent metadata for all data types. Additionally, an operator library has been designed to enable complex operations on large-scale settlement data.

(1) Dimension decomposition

Data in the electricity spot market exhibit characteristics such as time-varying cycles, complex dimensions, and diverse formats. To enable flexible settlement calculations, a unified data model must be constructed. This requires first establishing a dimensional set and defining relationships between dimensions, based on the dimension modeling approach for electricity market transactions. The resulting dimensional set forms a metadata center that serves as a reference framework for converting diverse and heterogeneous data into a unified format.

• Market Dimension Class

Market type: electric energy market, ancillary services market, capacity market, transmission right market, etc.

• Trading Dimension Class

Trading cycle: forward trading, day-ahead trading, intraday trading, real-time trading, etc.

Trading type: bilateral consultations, centralized bidding, listed transaction, etc.

• Agent Dimension Class

Generating side: power generation companies, etc.

Consumer side: electricity user, etc.

Transmission side: grid company, etc.

This paper presents only a subset of the dimensions. Given the complexity of electricity transaction dimensions, further research is needed to develop a multi-dimensional data management model that enables unified modeling and flexible expansion of electricity transaction dimensions.

(2) Physical unification

Physical unification entails uniformly converting the collected complex and heterogeneous data into a raw attribute graph. The transformation of data from relational models to attribute graphs must adhere to specific conversion rules [30]:

• Every tuple in the relation is transformed to a node in the property graph.

• For each attribute in the relation, a property (name/value pair) is added to the corresponding node in the graph.

• For each foreign key, a relationship is created between the corresponding nodes.

However, the data through this component may have the same format but different schema, semantic unification is still needed to avoid ambiguity.

(3) Semantic unification

Semantic unification consists of two parts, schema integration and entity consolidation.

• Schema integration

Data from different sources with the same semantic meaning often use disparate schemas, leading to semantic ambiguity. To address this, schema alignment is required. The previously established metadata center is employed to facilitate schema integration [31]. This metadata center contains information on entity types and the relationships among entities, defining the core data structure within the domain. Specifically, the schema integration process proceeds as follows:

The original data schema is aligned with a predefined schema in the metadata center using the Jaro similarity measure. If the similarity falls below a specified threshold, the metadata center is updated by incorporating the original schema. During this step, relationships are also aligned based on the label center, and entities may be split when necessary.

• Entity consolidation

A unified instance-level dataset is provided, ensuring only a single copy of each specific object exists within the property graph. Initially, entities referring to the same object are linked, framed as a binary classification problem. This entity consolidation is performed using techniques based on pretrained language models. Subsequently, matched entities are merged into a single entity node.

The process of physical and semantic unification is shown in Fig. 4.

Figure 4: Process of physical and semantic unification

(4) Operator library model

The operator library is used to perform various types of operations on harmonized settlement data.

Describe the data of an input/output (I/O) model as a 4-tuple array C = {D, M, V, r}, which is defined by: D = {d1, d2, …, di} is the set of dimensions, M = {m1, m2, …, mi} is the set of measures, V = {v1, v2, …, vi} is the set of values, r denotes the mapping relation corresponding to the dimension to the set of values, i.e., {d1, d2, …, di} → vk.

The computational model f is described as a logical computational relationship between the input to the output data model, defined f as:

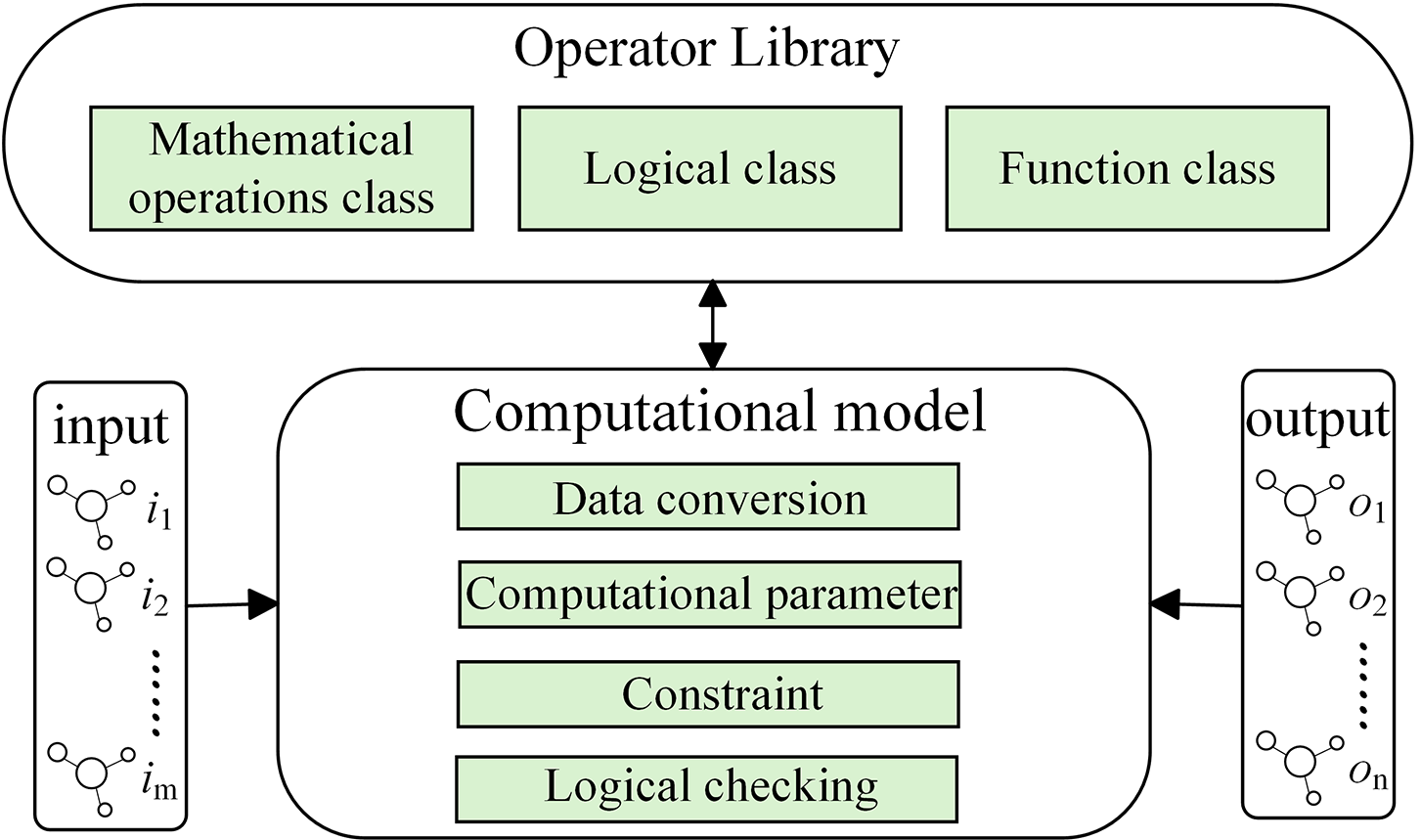

where {i1, i2, …, im} is the set of input data. {o1, o2, …, on} is the set of output data, {p1, p2, …, pr} is the set of calculation parameters, which are usually known quantities corresponding to the dimension, {b1, b2, …, bs} is the set of restrictive condition, which are generally filtering conditions for data models, enabling logical operations between data. The overall framework is shown in Fig. 5.

Figure 5: Operator library based on graph model

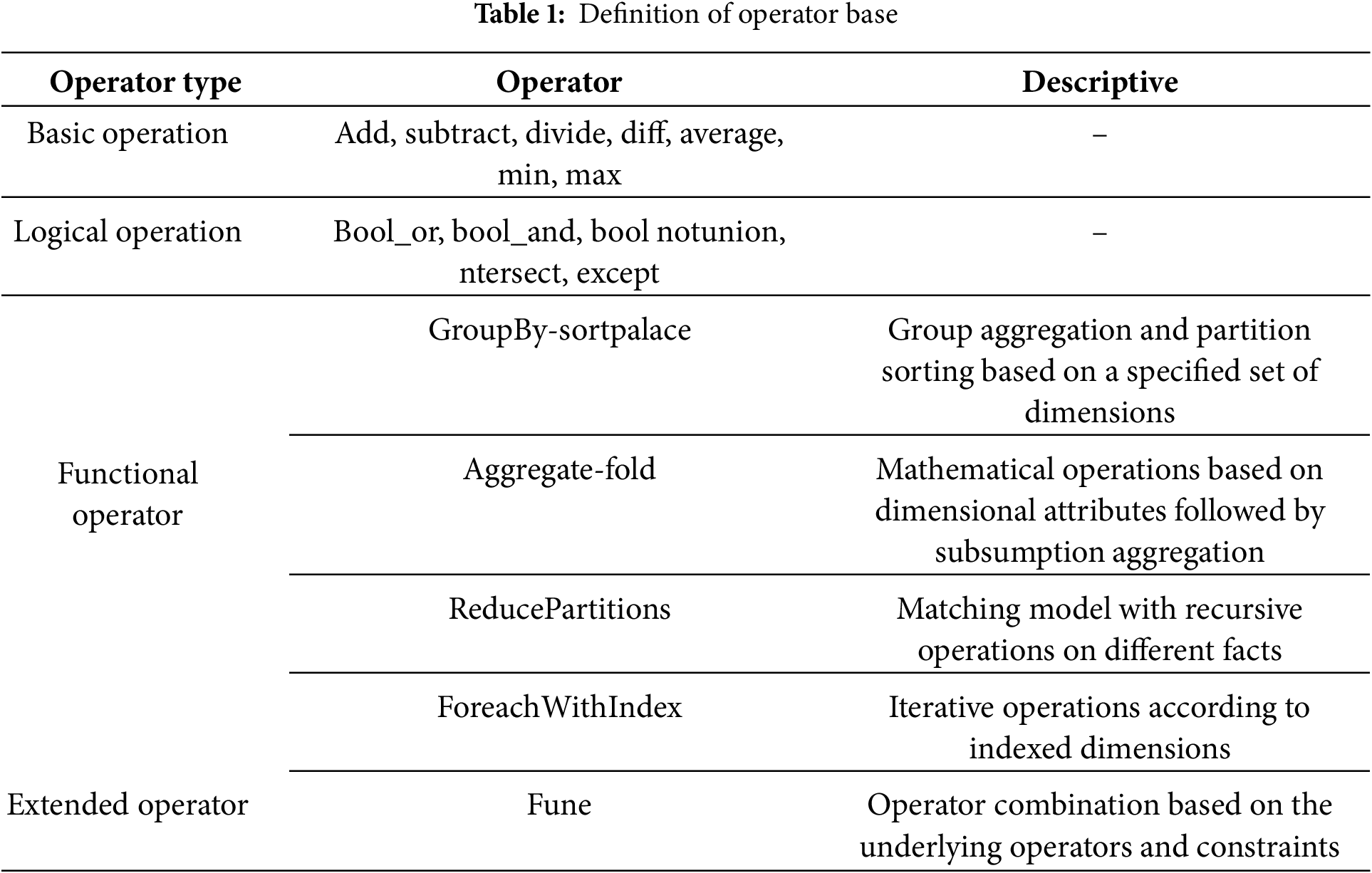

Calculation model f references operators to realize logical operations between data, in order to centralize the management of operator collection, the establishment of operator library to achieve unified management and definition, see Table 1. At the same time, the basic operators can be expanded, through the combination of operators between the configuration of the formation of composite functions or complex operations under the logic of the expansion of the operator. Since the data and operators adopt a unified data model, the logical operation between the data can be realized through flexible definition, which can flexibly support different electric energy settlement rules.

3.2 Electricity Market Settlement Tools

Settlement operations have the following characteristics:

(1) Complex rules, simple calculation. Settlement involves a wide range of market players and diverse operation forms, leading to complex and detailed rules. However, each individual rule’s calculation is relatively straightforward.

(2) Processing and automation. The settlement business, particularly spot market settlement, follows standardized processes. Maintaining a complete basic data model allows automation of key tasks—such as data management, quality checks, calculation, and billing—through scheduled task execution, ensuring timely and efficient operations.

Therefore, the settlement business can be configured and executed through a suite of specialized tools. The overall approach involves atomizing and breaking down the settlement process: settlement horizontal data are defined via interfaces between parties; settlement rules are formulated using dedicated settlement formula tools; settlement bills are generated through report templates driven by reporting tools. These tasks are orchestrated logically and temporally by a unified task scheduler, ensuring the settlement business operates safely and efficiently. The overall functional architecture of the electricity market settlement system is illustrated in Fig. 6.

Figure 6: Overall functional architecture of electricity market settlement

The electricity market settlement system contains the following tools:

(1) Data set tool: This specialized tool, built on the database, customizes and assembles settlement input data. Through model data matching and granularity alignment, it standardizes diverse original data into unified settlement datasets. These datasets serve as calculation items within settlement formulas, and their names can be renamed to align with settlement rule definitions. Essentially, settlement datasets visualize and standardize underlying data to create modular “building blocks” for rules. The dataset construction process is detailed in Section 3.1.

(2) Settlement formula tool: Based on the settlement datasets, this tool provides functions such as summation, finding maximum/minimum/average values, rounding, and supports logical operations like IF and SWITCH conditions. Settlement formulas can reference calculation items repeatedly. The tool features a graphical interface for easy configuration and leverages the operator library described in Section 3.1 to realize settlement rules.

(3) Reporting tool: Typically provided by third parties, these mature technologies enable flexible, rapid definition of data visualization and analysis. Customized report templates can be created, which automatically fetch system data to generate settlement statements.

(4) Text messaging platform: This platform interfaces with telecom operators to send settlement notifications via Short Message Service (SMS). Market participants receive timely reminders to confirm settlements.

(5) Task scheduler: The task scheduler enables creation and management of business tasks based on custom rules and logic. It operates on an event-driven model, treating all potential task triggers as events to monitor. Task dependencies can be configured, so when conditions are met, tasks are triggered and executed automatically. It controls the entire automated settlement workflow, including data access, formula calculation, bill generation, and bill distribution. Tasks can be chained for sequential execution.

(6) File server: Provides centralized, secure storage of files such as billing statements and market player profiles, with precise permission control and local management capabilities.

There are some challenges faced when deploying this graph-based settlement system across various provinces or regions, particularly regarding data migration and integration with existing legacy systems:

(1) Heterogeneity of Existing Systems

• Diverse Technology Stacks: Provincial settlement systems may be implemented on different database platforms (e.g., Oracle), with bespoke Application Programming Interface (APIs) and proprietary data formats.

• Non-standardized Data Models: Many systems employ custom relational schemas, lacking consistent naming conventions, metadata structures, or relationship definitions.

• Operational Coupling with Other Systems: Settlement modules are often tightly integrated with dispatch, trading, and metering platforms, making isolated replacement difficult.

(2) Data Migration Challenges

• Volume and Granularity: Historical settlement data can span 5–10 years, with up to billions of records when considering 15-min granularity.

• Quality and Completeness: Legacy datasets may contain inconsistencies, missing references, or ambiguous field semantics.

• Version Preservation: Existing systems rarely store explicit data version histories, complicating the reconstruction of past settlement states for audit purposes.

In order to overcome these challenges, we have taken appropriate measures:

(1) We introduce a data ingestion and mapping layer capable of:

• Schema auto-discovery using metadata crawlers,

• Semantic mapping to the unified attribute graph model,

• Gradual ETL (Extract-Transform-Load) migration in parallel-run mode to validate accuracy before full switchover.

(2) Step-by-step data migration

• Incremental Migration: Migrate historical data in stages, starting from the most recent periods and progressively backfilling older records.

• Data Quality Pipeline: Automated validation rules for timeliness, completeness, and semantic consistency before ingestion.

• Synthetic Version Reconstruction: For systems without explicit version history, re-construct approximate versions using timestamped snapshots and delta inference.

Through the above measures, we have successfully deployed in the provinces the proposed in this paper.

3.3 Automated Electricity Market Settlement Process

The automated electricity market settlement process consists of the following:

(1) Horizontal data management.

Settlement relies on data received from various horizontal systems, including dispatching, marketing, trading, and others. The data encompasses multiple dimensions such as the generation side, consumption side, transaction clearing, transaction execution, and metering of generation and consumption. The time granularity of the data is equal to or finer than the settlement cycle. Data interaction with these horizontal systems is typically conducted through interfaces and acquired at regular intervals, triggered manually or automatically. The specific data required and the frequency of interaction depend on the settlement rules defined by each market.

(2) Settlement data verification.

To ensure the orderly operation of the settlement business and establish a unified data model, automated verification of settlement data is essential. This verification generally covers the following aspects:

• Timeliness verification: Provides early warnings when data is not received at the required time points, ensuring timely availability for settlement processes.

• Integrity verification: Checks for missing data or flaws to ensure completeness of the settlement data set.

• Consistency verification: In collaboration with the data sender, checking rules are established that use aggregated data sums or logical code values to confirm that the data received matches the data sent, guaranteeing no loss or distortion during transmission.

• Reasonableness verification: Examines the logical validity of data, such as verifying that generator output power aligns with its rated capacity. If deviations exceed predefined thresholds, the system issues prompts or alarms to flag potential issues.

If the calibration results are verified as correct, the calibrated data will then be transformed into the standardized format of the unified data model for centralized and consistent management.

(3) Settlement calculation.

Settlement in the electricity market generally includes settlement of electric energy market, settlement of ancillary service market, etc.

For the electric energy market, there are two current settlement models in China:

• Price difference mode:

Day-ahead market charges: Settled based on the day-ahead market cleared electric quantity and electric price.

Settled on the difference between the actual metered electric quantity and the day-ahead cleared quantity, multiplied by the real-time clearing price.

Settled based on the contracted electric quantity and the difference between the contracted price and a reference local price (usually the day-ahead market price, though sometimes the real-time market price or others, depending on the rules).

• Quantity difference mode:

Forward contract charges: Settled first according to contracted price and quantity (contract market priority).

Day-ahead market charges: Settled based on the difference between the day-ahead cleared quantity and the contracted quantity, multiplied by the day-ahead clearing price.

Real-time market charges: Settled based on the difference between actual metered quantity and day-ahead cleared quantity, multiplied by the real-time clearing price.

For other markets such as ancillary service market, there is a big gap between the market rules of different provinces and even regions in China, so there is no uniform settlement rules, and different settlement rules only affect the settlement calculation process, and flexible calculation under different rules can be realized through the aforementioned operator library.

(4) Settlement bill release.

The settlement bill is a document generated from the settlement results using the reporting tool, which calls a predefined bill template. This bill is then uploaded to the file server for storage and published on the extranet website for market players. The settlement bill details the settlement quantities, prices, and charges for the current billing cycle, broken down by sub-subjects. Once released, the system can use the text messaging interface to notify market agents via SMS, using their contact information stored in the system.

(5) After the settlement bill is released, market players are required to log into the system promptly to download and review the settlement statement. If there are no disputes regarding the settlement results, they can confirm the statement by clicking a confirmation button. If no confirmation is received before the deadline, the system will automatically consider the settlement result as confirmed. In case of any disputes, market players can submit their dispute information through the system and support their claims by uploading relevant attachments.

(6) Settlement dispute handling.

For settlement dispute information, further verification of the relevant data is required. When data adjustments that affect the settlement arise, the settlement calculations must be redone for the affected settlement accounts. Subsequently, a new settlement bill should be generated and released to the corresponding market players, who must then be notified to review and confirm the updated results.

By leveraging the unified data model to structure settlement data and utilizing the corresponding settlement tools, the electricity market can achieve fully automated settlement.

In addition, the settlement system utilizes a number of technologies to ensure data consistency for rapid and dynamic data flows such as real-time transaction updates during the automated settlement process:

(1) Real-Time Transaction Modeling in Attribute Graphs

Real-time transactional events are modeled as event nodes with temporal attributes (e.g., timestamp, interval_id, transaction_type), and linked to static entities such as gen-erators, consumers, contracts, and pricing nodes. Each real-time transaction is represented as a lightweight, append-only node, with its relationships embedded in the evolving graph structure. This modeling allows:

Fine-grained temporal queries across multiple layers (e.g., “retrieve all imbalance charges linked to a generator within a given 15-min window”);

Seamless integration of streaming data with existing static topology (e.g., linking real-time price to forward contracts).

(2) High-Frequency Data Ingestion and Streaming Updates

To manage the streaming nature of real-time transactions, the system integrates with stream-processing platforms via a CDC (Change Data Capture) connector layer. This ensures:

Incremental updates to the graph in near real-time;

Dynamic construction of transaction paths as new events are captured;

Preservation of historical versions using event time partitioning in the attribute schema.

(3) Ensuring Data Consistency during Rapid Changes

To guarantee consistency during high-frequency updates, the system employs a multi-layered consistency model:

Atomic write operations: The underlying graph database which with atomicity, consistency, isolation and durability (ACID) compliance supports atomic transactions to ensure partial writes are rolled back if an error occurs;

Versioned entity states: Every real-time entity (e.g., metering point, price node) maintains version snapshots via temporal properties or shadow nodes, enabling time-travel queries and preventing overwriting of historical records;

Consistency checkpoints: At configurable intervals (e.g., hourly), the system creates a global snapshot checkpoint of settlement states, allowing fast rollback or recalculation in the event of data corruption;

Quorum-based validation (optional): In distributed deployments, a quorum mechanism ensures that updates are accepted only when a majority of replicas confirm consistency.

(4) Conflict Handling and Eventual Consistency

Given that real-time data may arrive out-of-order (e.g., late metering data or delayed contract updates), the system includes a conflict resolution engine:

Uses timestamp-based precedence to resolve competing updates;

Tracks source system identifiers to prioritize authoritative data feeds;

Applies event sourcing patterns to reconstruct consistent state from incoming deltas.

This approach supports eventual consistency, which is acceptable for non-blocking business processes like near real-time settlement preview, while maintaining strong consistency during official clearing cycles.

In general, the attribute graph model, with its temporal node structure, ACID transaction support, versioned data design, and streaming integration, is well-suited for handling real-time electricity market transactions. It ensures both low-latency processing and strong consistency, supporting reliable, fine-grained, and high-frequency settlement operations in dynamic market environments.

4 Electricity Market Refund Clearing Method

Electricity market refund clearing is a non-routine settlement process. After the settlement bill is issued and charges are delivered, a refund event can be initiated when electricity charges need to be refunded due to reasons such as errors in settlement data or policy adjustments. Causes for refunds may include metering data errors, revisions to historical data, adjustments to settlement rules, or contract changes. In such cases, a retroactive recalculation of historical settlement data is required for bills that have already been financially settled. The recalculated results are then compared with the original settlement documents to generate a retroactive refund clearing bill, enabling the correction and handling of any deviated charges.

4.1 Electricity Market Refund Clearing Process

(1) Refund event initiation: A refund event can be initiated by the trading center, dispatch center, market players, or other authorized entities. The initiator must submit a written refund application specifying the refund agent, time period, subject matter, and reason for the refund event. If a market player initiates the refund due to a dispute, settlement dispute handling procedures apply.

(2) Refund data preparation: Upon initiation of the refund event, the settlement system manages the adjusted electricity quantities and price data. This adjustment can be made through manual entry or via system interfaces connected to external data sources.

(3) Refund clearing calculation: The settlement system recalculates historical charges based on the adjusted settlement data or updated policy rules. Importantly, the recalculated results do not alter the previously completed historical settlements. The difference between the recalculated settlement and the original historical settlement is considered the refund amount.

(4) Refund results release: The refund results can be issued as a separate refund settlement bill or incorporated into the next scheduled settlement bill for the market players.

4.2 Refund Clearing Caculation Method

Due to factors such as errors in metering data, revisions of historical data, adjustments to settlement rules, or changes in contracts, it becomes necessary to retroactively recalculate historical settlement bills that have already been financially settled. The recalculated results are then compared with the original historical settlement documents to generate a retroactive refund clearing bill, which addresses any deviations in charges.

To enable rapid calculation of deviation charges and expedite the financial delivery of refunded costs to market participants, only the deviation variables—such as deviation price—are incorporated into the settlement formula for computation.

To illustrate the specific calculation methodology, this paper uses the example of electric energy revenue on the generation side. The same approach can be applied to other types of charges. Electric energy revenue on the generation side refers to the revenue earned by a generating unit through participation in the electric energy market. Currently, two settlement modes exist in the electricity energy market: quantity difference settlement and price difference settlement [1]. This paper uses the quantity difference settlement mode as an example. The electric energy revenue of the generation unit can be expressed as follows.

where

When the settlement price changes, the deviation values of the generation-side electric energy revenue is as follows.

where

The refund clearing process for other charges follows a similar approach, where only the amount of the change is incorporated into the calculation.

4.3 Technologies of Refund Clearing

The settlement system supporting the complex and heterogeneous electricity market must be capable of retroactively processing historical closed data while preserving both the original billing data and any amended effective data. This approach creates a complete multi-version scenario encompassing models, rules, and data, enabling full traceability of historical processes and reducing audit risks. Additionally, the system needs to comprehensively clear all data impacted by changes, leveraging techniques such as data lineage recognition and automatic change capture to prevent calculation omissions. Beyond efficiently interacting with historical settlement data, the system must seamlessly integrate with heterogeneous systems—including market, financial, and dispatch departments. It should automatically identify revised data and determine their scope of impact based on logical data relationships and business coupling, thereby ensuring no affected data is overlooked in calculations. Electricity market settlement thus requires a suite of key technologies to deliver a comprehensive solution that supports integrated, automatic refund clearing across complex, heterogeneous markets and numerous market participants.

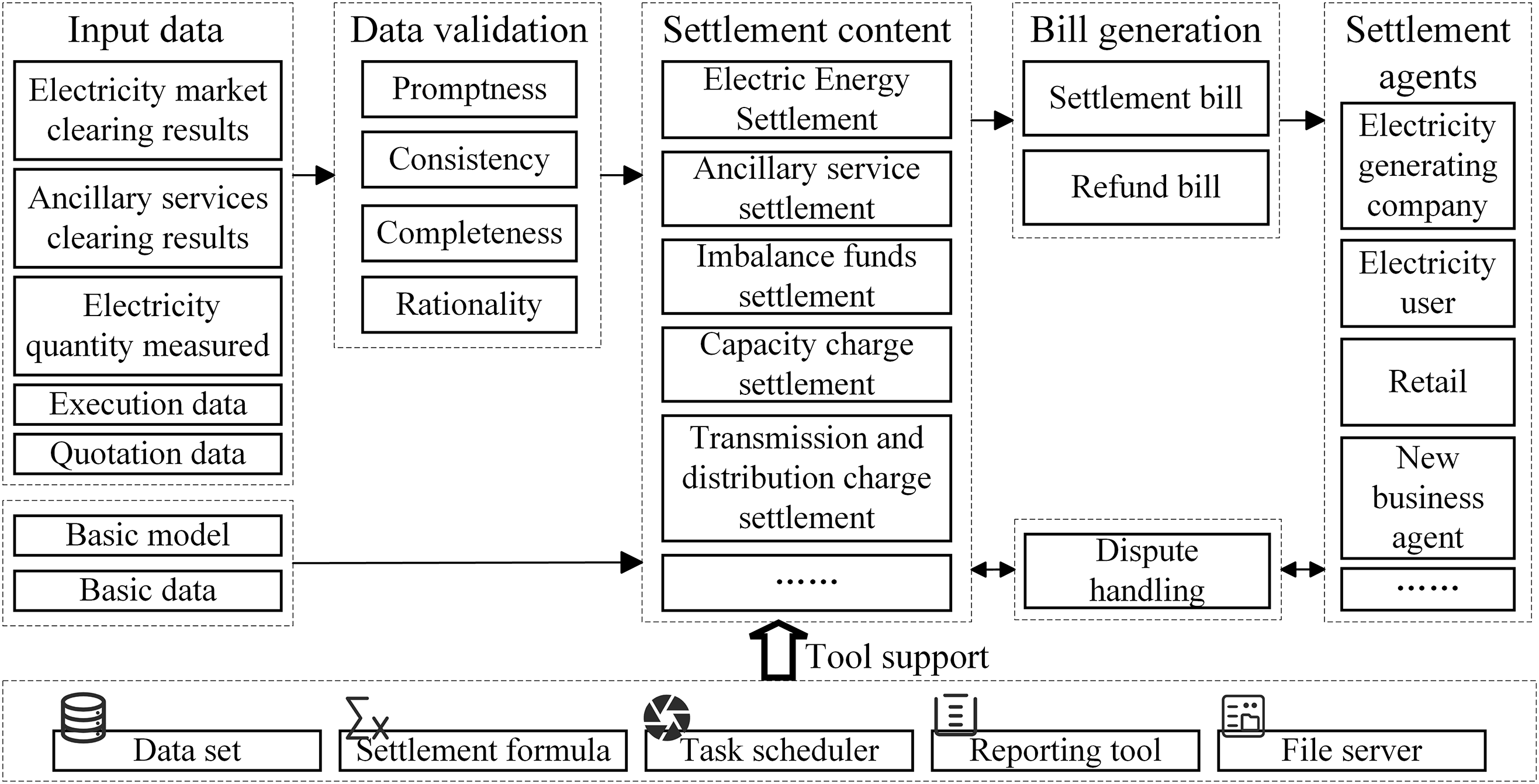

In summary, we adopts the following key technologies to build the refund clearing system: (1) sandbox technology; (2) data version snapshot technology; (3) data logging technology; (4) data lineage dynamic identification technology; and (5) automatic data change capture and synchronization technology. The coupling relationship between these key technologies and the electricity market link is shown in Fig. 7.

Figure 7: Coupling of refund clearing key technologies with electricity market link

Sandbox is a security mechanism that provides an isolated environment for running programs and managing resources, ensuring that the processes and results within the sandbox have no impact on the external system environment [32]. We apply the concept of sandbox technology by redirecting the data resources, business operations, and algorithmic logic related to refund clearing into this isolated sandbox environment. This environment is independent from the production system and enables isolated data versioning.

Traditionally, refund clearing directly modifies production environment data and recalculates by amending historical data, supplementing missing data, or adjusting calculation rules, which can affect the integrity of production data. In contrast, the sandbox refund clearing method divides data into isolated partitions, loading the data models, logic algorithms, and business data of historical settlements into the sandbox. This isolation ensures that refund clearing operations do not interfere with the production system since they are contained within a separate, fixed environment.

Furthermore, the sandbox environment can operate in parallel with the production system during refund clearing processes, improving system safety and efficiency. The principle of sandbox technology is illustrated in Fig. 8.

Figure 8: Sandbox technology principle

4.3.2 Data Version Snapshot Technology

Data version snapshot technology is an advanced computer storage technique that enables the creation of rapid data copies for backup and recovery purposes within seconds [33,34]. This technology plays a critical role in electricity market refund clearing. As discussed, refund clearing requires retroactive adjustments to historical settlement data while simultaneously retaining both the original historical data and the corrected effective data.

Given that the electricity market settlement process often involves multiple heterogeneous markets and various departments, data version snapshot technology supports these complexities by creating snapshots of transaction data across different markets and trading categories at various time intervals. This preserves settlement results for key market segments and prevents data loss or tampering. Additionally, security and confidentiality of settlement data are ensured through encryption and decryption mechanisms.

Moreover, data version snapshot technology facilitates the creation of a multi-version integrity scenario for heterogeneous market and departmental data. By standardizing the storage and access of snapshots, it enables efficient full-volume snapshot updates as well as real-time incremental updates. This capability allows for quick online querying, sharing, comparison, and computation of multiple historical transaction data snapshots, effectively minimizing audit risks in diverse electricity market refund clearing scenarios.

Data logging technology based on traceability tracking effectively manages and monitors data by recording, analyzing, and tracing the entire lifecycle of data generation, flow, and consumption to understand its origin and destination [35]. This technology encompasses four key aspects: data log generation, storage, analysis, and traceability tracking. It provides robust support for data security and reliability, and offers valuable insights to inform decision-making in electricity market refund clearing processes.

The data logging system first collects and preprocesses log data from original market transaction settlements at various levels. These logs include crucial information such as transaction types, settlement prices and quantities, transaction timestamps, and more, capturing essential details across all stages of electricity market transactions. Preprocessing involves filtering out invalid data such as duplicates or irrelevant entries and indexing the logs with key fields like transaction type and market participant information. This process generates comprehensive data logs that enable full traceability throughout the settlement lifecycle.

In electricity market settlement, retroactive processing is often required due to factors like metering data corrections, changes in calculation rules, settlement price adjustments, or billing errors. Leveraging the traceability offered by data logging technology, it is possible to trace back settlement data to its original sources and monitor it comprehensively from start to finish. This approach helps establish correlation relationships—from power balance to settlement charge balance—across all market levels, identify segments of settlement data that require correction, and precisely localize issues within specific market segments.

4.3.4 Dynamic Recognition Technology for Data Lineage

Dynamic identification technology of data lineage is an automated method that leverages data features and correlations to trace the flow and dependencies of data [36]. The electricity market refund clearing business presents significant challenges due to its multi-scenario nature, high flexibility, complexity, and large data volume. This complexity is further heightened by the tightly coupled relationships within the electricity market settlement and refund clearing processes, which involve dependencies among numerous data entities, including computational dependencies and inter-table references.

In this context, dynamic data lineage identification technology plays a crucial role in effectively revealing the scope and extent of impacts on market outcomes caused by factors such as metering data corrections, changes in calculation rules, or adjustments in settlement prices. Given the high degree of coupling among settlement data, corrections initiated by individual market players can trigger extensive recalculations across related datasets. By applying dynamic data lineage technology, it becomes possible to capture dependencies among data entities, track data sources and processing steps, and identify bottlenecks and redundancies within data flows. This enables optimization of data processing workflows and enhances overall system performance.

4.3.5 Automatic Data Change Capture and Synchronization Technology

Automatic data change capture and synchronization technology is a data processing technique designed to capture and track changes in data sources (e.g., databases) and synchronize these changes in real time to target systems or applications [37]. In the context of electricity market refund clearing, this technology offers several key features:

• Real-time capability: It captures and synchronizes data changes in the refund clearing system instantly, ensuring that updated information is promptly propagated to related departments such as marketing and scheduling, thus supporting timely business operations.

• Efficiency: By focusing exclusively on data that has changed after refund clearing traceability, this technology avoids reprocessing the entire electricity market transaction settlement dataset. This minimizes extensive modifications to data sources or the need for additional coding, significantly enhancing data processing efficiency and reducing the consumption of computational resources.

In addition, during the refund liquidation process, we have taken measures to ensure the security and integrity of data when handling sensitive market and user data:

(1) Data Version Management Security

Version control is central to handling historical data recalculations without impacting finalized settlement outcomes. The following strategies ensure its security and traceability:

Immutable Snapshots: Each versioned dataset (e.g., a 15-min metering interval) is stored as an immutable node structure in the graph, with write-once-read-many (WORM) semantics. This prevents unauthorized overwrites of historical data.

Cryptographic Hashing: All versioned nodes and transaction relationships are hashed using Secure Hash Algorithm 256-bit (SHA-256) algorithms. The system maintains a Merkle tree to validate the integrity of every dataset version over time.

Digital Signatures for Rule Versions: Settlement rule configurations (e.g., operator chains) are digitally signed by authorized entities and timestamped. Any unauthorized change is automatically flagged and rejected at the rule engine level.

Version Provenance Tracking: Every data version stores metadata including author, timestamp, source system, and reason for change, enabling full auditability.

(2) Secure Sandbox Execution Environment

Sandboxing isolates the refund clearing logic and datasets from the production system, ensuring functional safety and data compartmentalization. Key technical safeguards include:

Containerized Execution: Each sandbox instance runs in a Docker-based container or virtualized environment with restricted file system access, resource limits, and read-only mounts of production data.

Data Duplication with Isolation: Only cloned snapshots of the relevant data subsets are injected into the sandbox; production databases remain untouched. Any write operations are strictly confined to the sandbox volume.

Intrusion Detection and Access Control: Role-based access control (RBAC) is enforced, with sandbox access restricted to settlement administrators. All interactions are logged and monitored via intrusion detection systems (IDS).

End-to-End Encryption: Data entering or leaving the sandbox is encrypted using Transport Layer Security (TLS) 1.3 during transfer and Advanced Encryption Standard–256 bit (AES-256) at rest, ensuring confidentiality.

(3) Dynamic Lineage Tracing Integrity

Dynamic lineage tracing relies on recursive graph traversal to identify affected entities when settlement input data is changed. Ensuring correctness and traceability involves:

Consistent Edge Semantics: All lineage relationships are modeled using typed, directed edges, enforcing consistent logical meaning across traces.

Traversal Audit Logs: Every lineage traversal is logged with query parameters, traversal paths, and output sets. This enables retrospective validation of refund scopes.

Query Determinism Guarantee: Lineage tracing algorithms are designed to be deterministic under the same input and version context, ensuring repeatability and audit compliance.

Scoped Impact Zones: To prevent overreach during dependency analysis, the system allows operators to define “scope boundaries”.

(4) Compliance and Data Governance Alignment

To ensure that the system aligns with regulatory and enterprise security standards, the following governance practices are enforced:

Auditability: All data transformations, recalculations, rule changes, and refund events are captured in immutable logs, retained for many years as per Chinese electricity market compliance standards.

PII Masking and Redaction: Personally identifiable information (PII) within agent or contract metadata is masked during lineage reporting and export operations.

Data Governance Interface: A governance dashboard allows compliance officers to review data access events, lineage queries, and sandbox executions in real time.

Through the above mechanisms, we ensure data security and integrity during data processing.

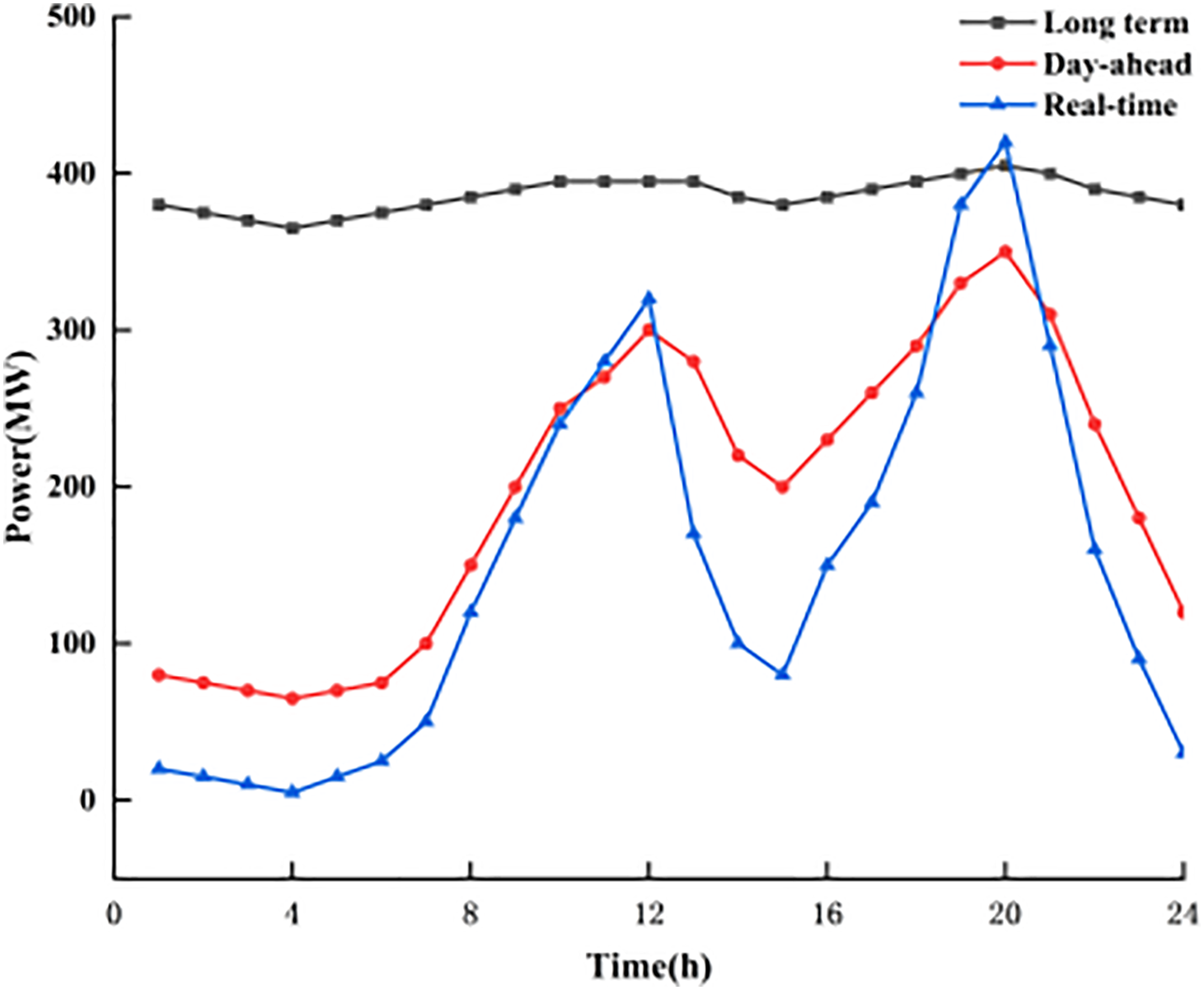

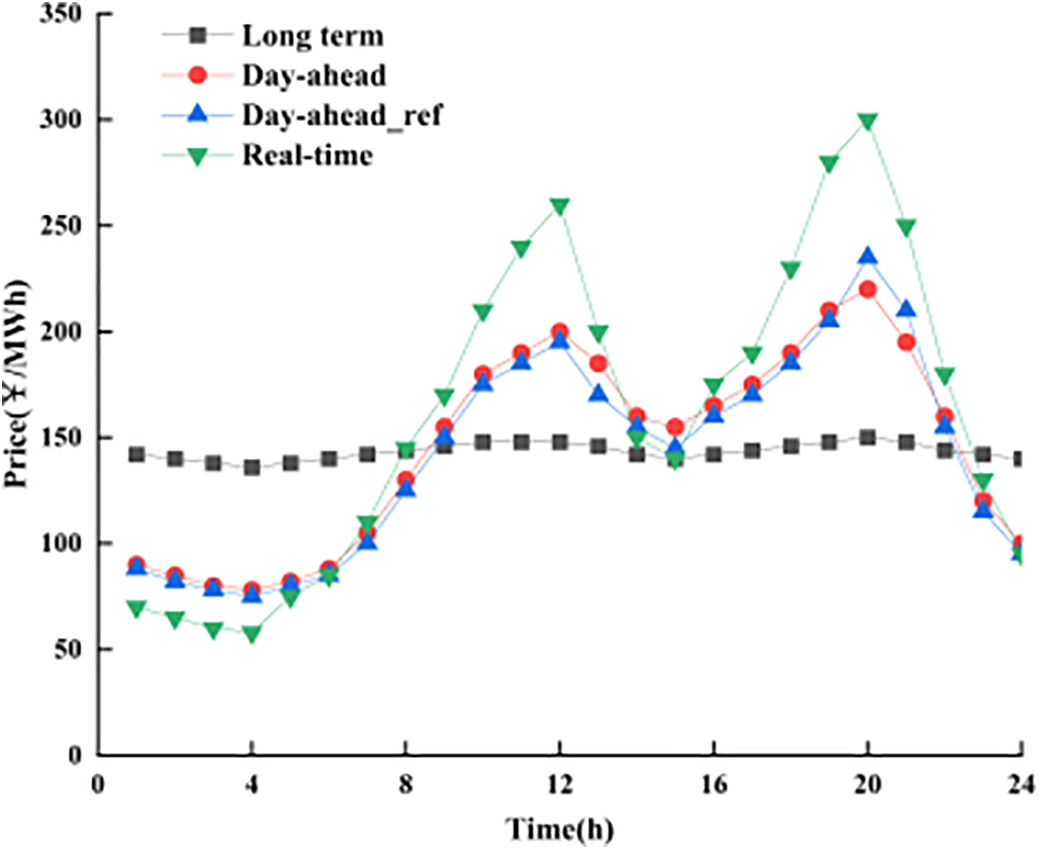

In order to verify the effectiveness of the proposed electricity market settlement method, we firstly choose the actual data of a power plant in China participating in the electric energy market for example verification, the plant participates in the forward, day-ahead and real-time three types of electric energy market on a certain day, the quantities and prices of electricity of the plant participating in the electric energy market are shown in Figs. 9 and 10, with a time granularity of 1 h, and the settlement mode adopts the quantity difference settlement mode.

Figure 9: Electricity quantities in the electric energy market

Figure 10: Electricity prices in the electric energy market

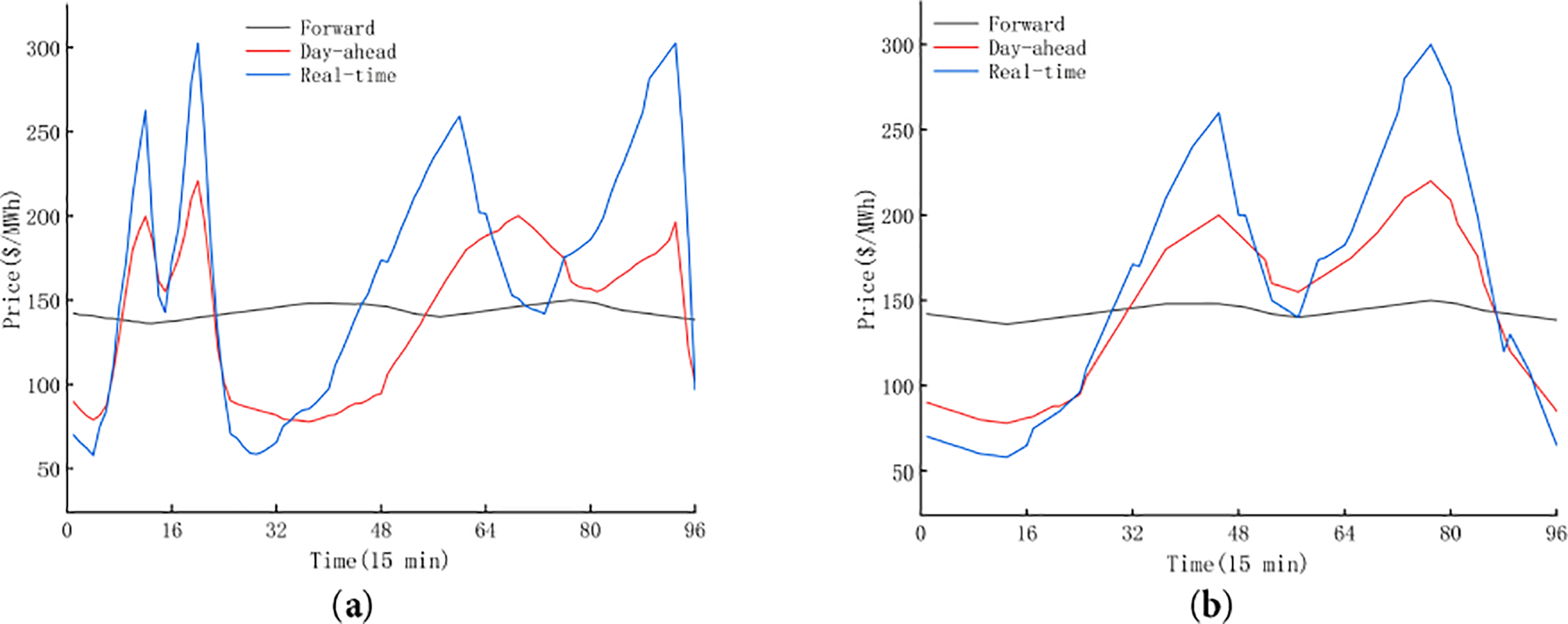

The calculation gives the plant a revenue of $630,755 in the electric energy market. When the settlement price changes, the changed settlement price is shown in Fig. 11.

Figure 11: Changed electricity prices in the electric energy market

The calculation gives the plant a revenue of $612,365 in the electric energy market.

The refund clearing calculation method proposed in Section 4.2, using only the deviation prices, yields the electric energy deviation revenue of $18,390, which is equal to the difference between the plant’s electric energy revenue before and after the refund clearing. Therefore, it is feasible to get the difference in electricity charges when settlement data changes by calculating only the amount of deviation.

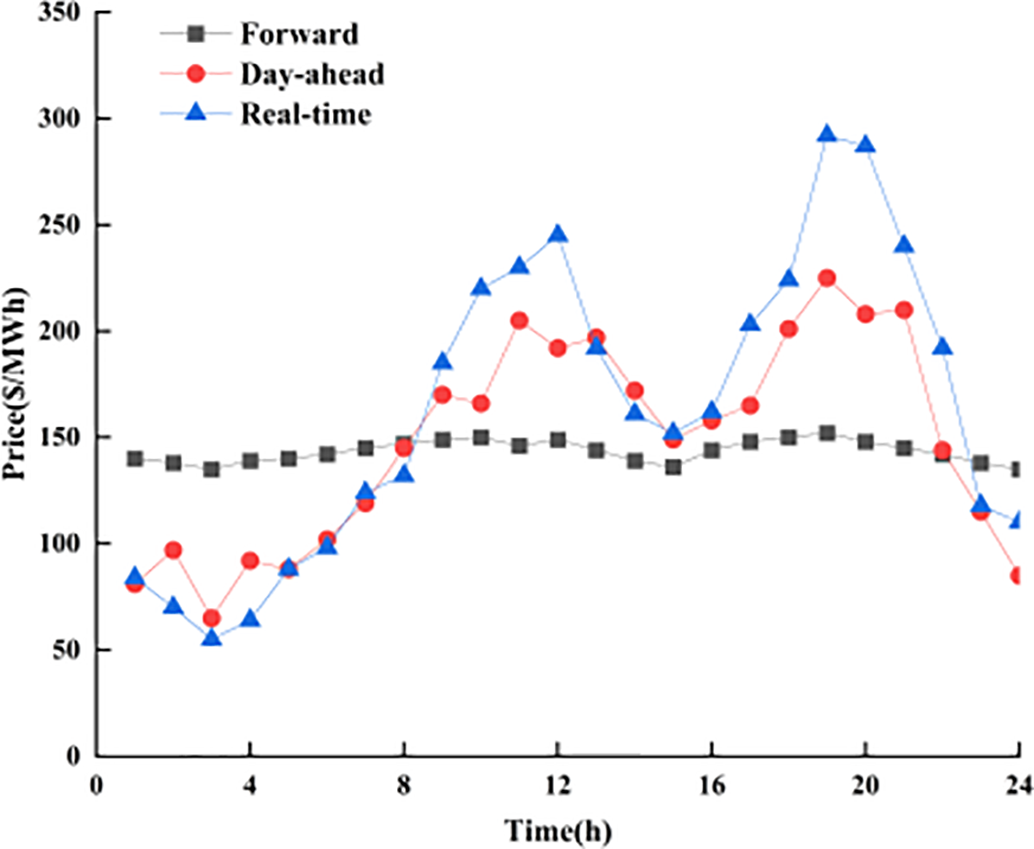

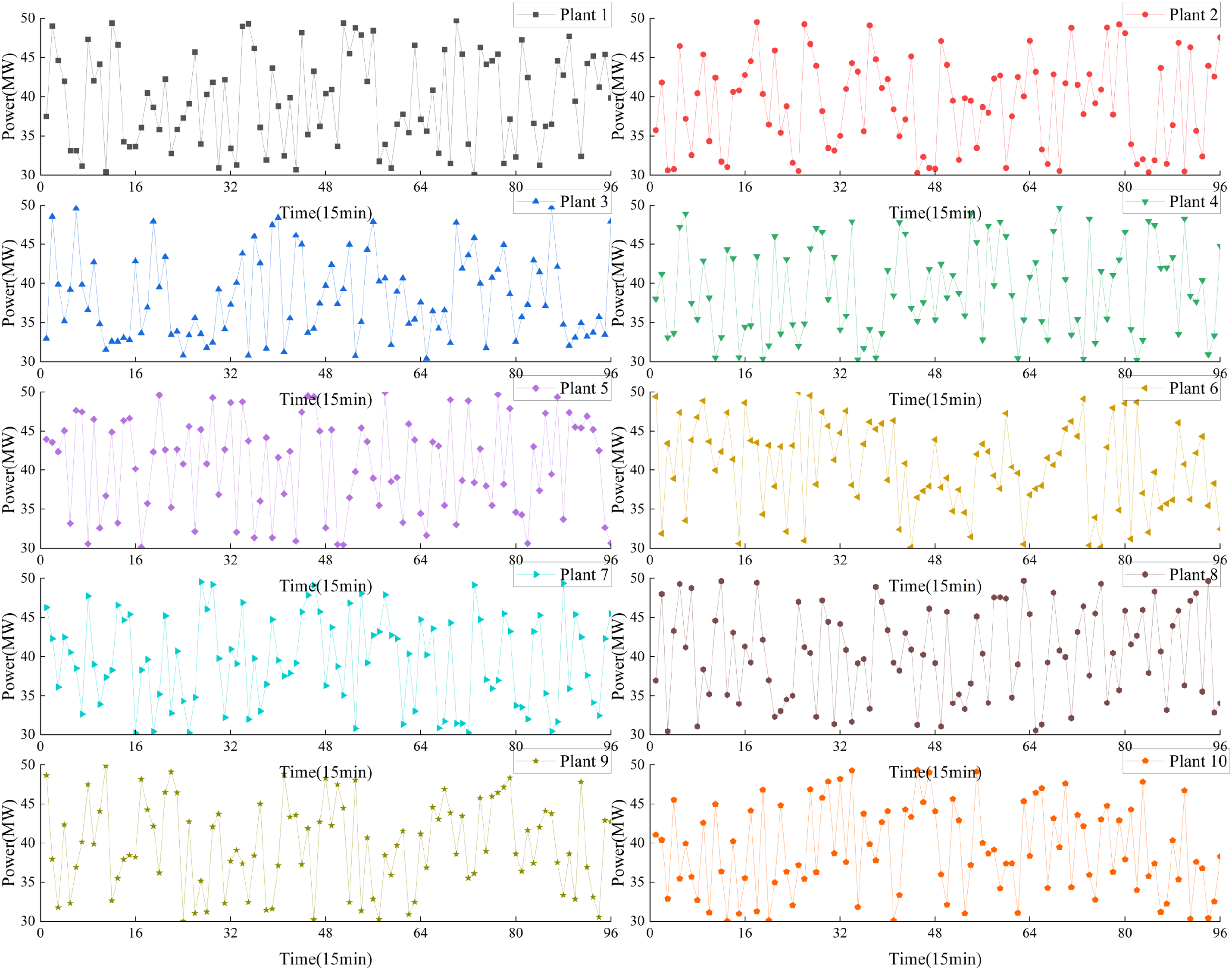

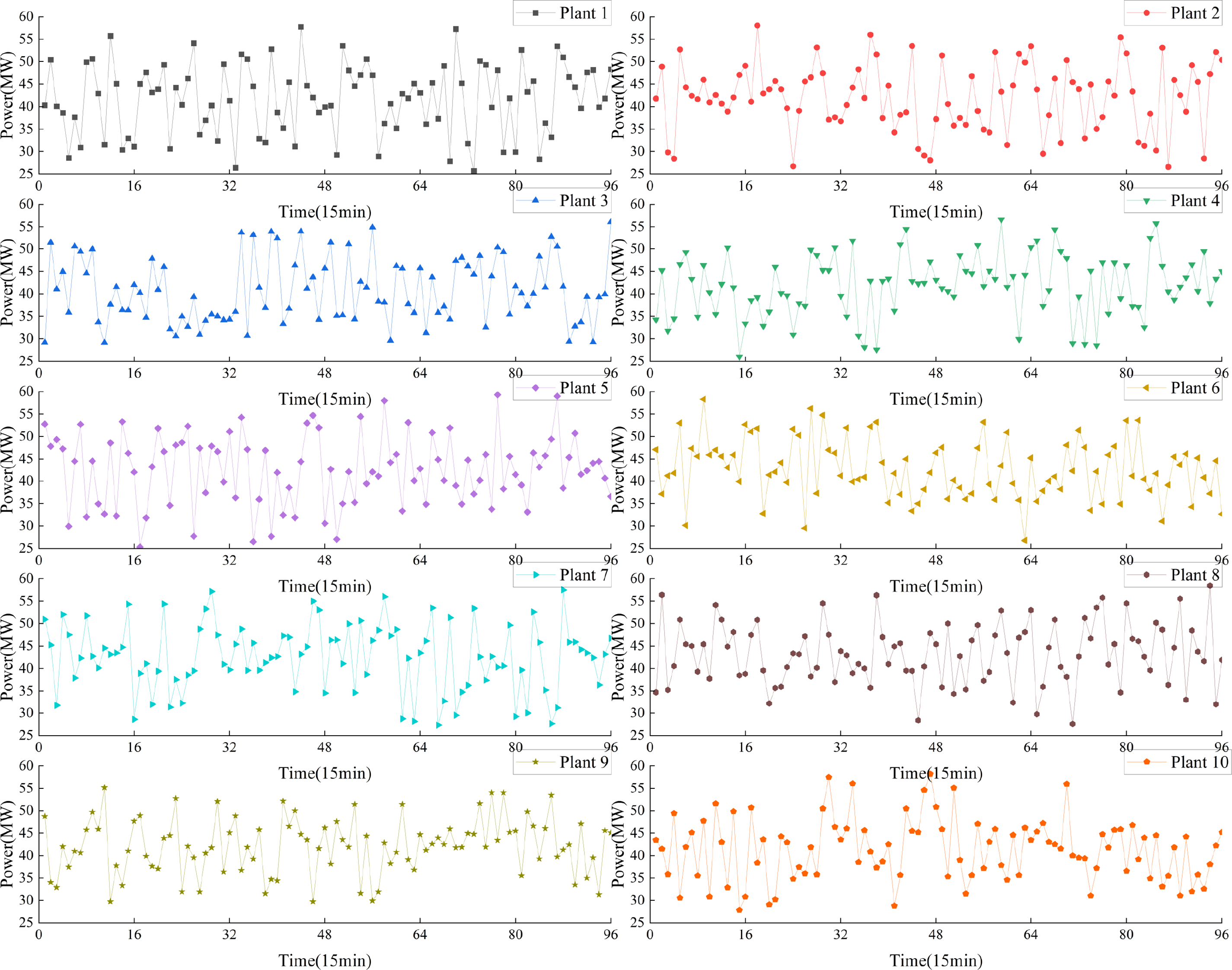

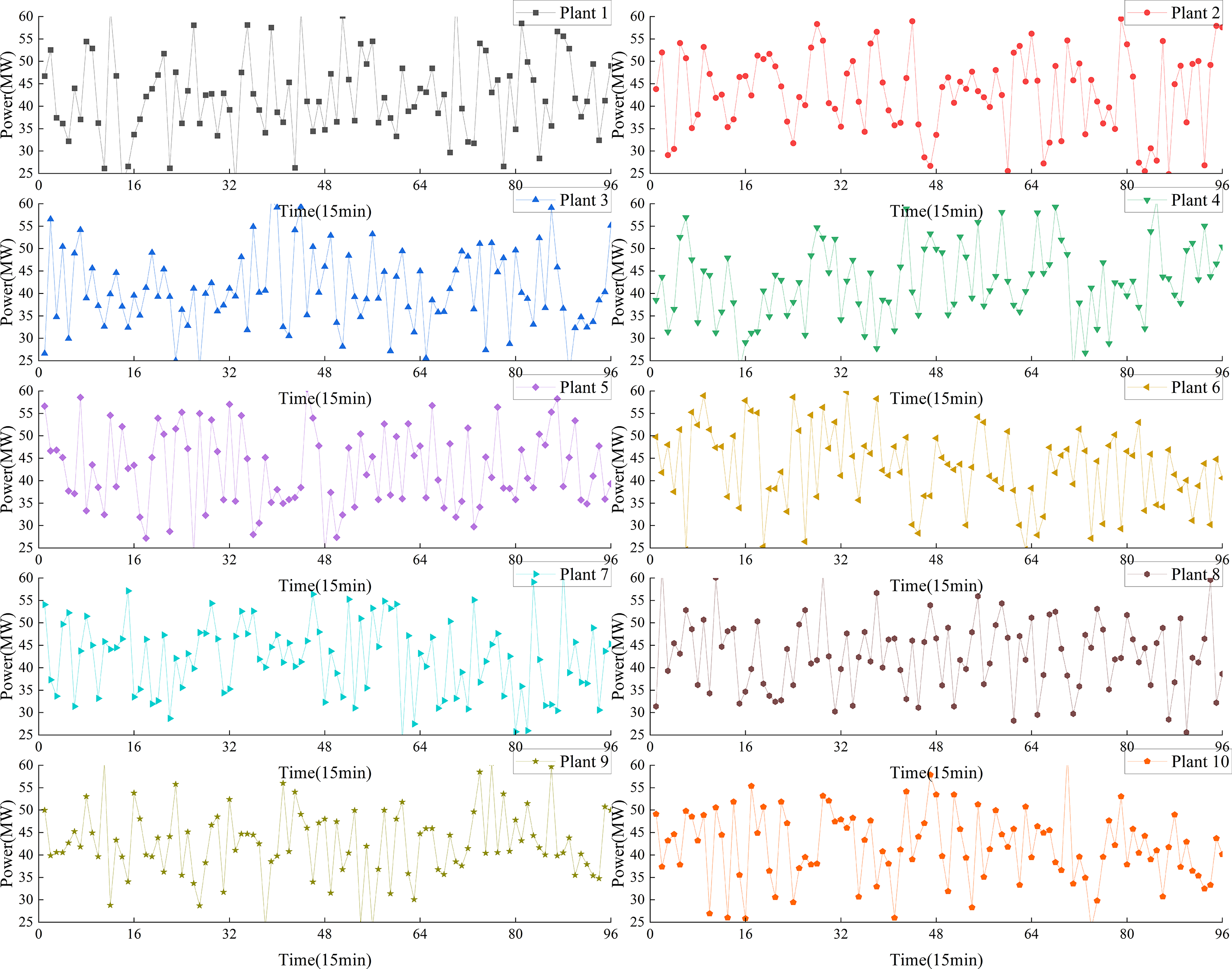

Then, we validate the effectiveness of the proposed refund clearing method with larger scale data. We have selected 10 plants, all of which participate in three types of electric energy markets: forward, day-ahead and real-time on a certain day and still adopt the quantity difference settlement mode, with a time granularity of 15 min, and a total of 5760 pieces of data. The quantities of electricity of these plants participating in the forward market, day-ahead market and real-time market are shown in Figs. 12–14. The prices of forward market, day-ahead market and real-time market are shown in Fig. 15a, and when the settlement prices changes, the changed settlement prices are shown in Fig. 15b.

Figure 12: Electricity quantities in the forward market

Figure 13: Electricity quantities in the day-ahead market

Figure 14: Electricity quantities in the real-time market

Figure 15: Electricity prices in the electric energy market before and after changed

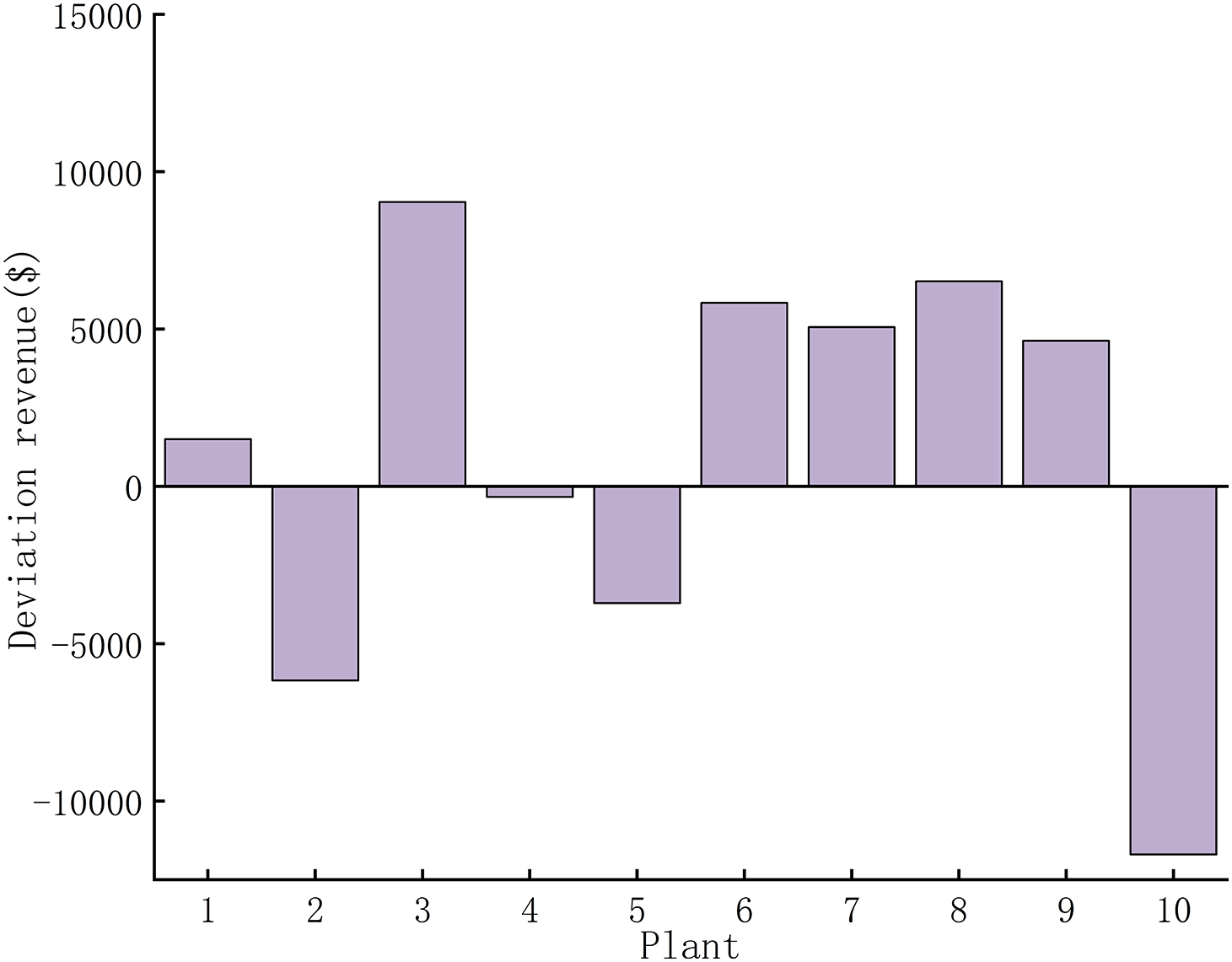

Through the traditional settlement method, the revenue of each plant in the electric energy market before and after refund clearing can be obtained as shown in Fig. 16.

Figure 16: The revenue of each plant in the electric energy market before and after refund clearing

Through the refund clearing calculation method proposed in Section 4.2, the deviation of revenue of each plant in the electric energy market can be obtained as shown in Fig. 17, which is equal to the difference between the plants’ electric energy revenue before and after the refund clearing, It shows that the method proposed in this paper is also applicable when the amount of data is large.

Figure 17: The deviation of revenue of each plant in the electric energy market

To further validate the scalability and performance of the unified settlement framework proposed in this paper for operation in large-scale, high-frequency electricity market environments, we conducted extensive benchmarking tests comparing the graph-based architecture with traditional relational database systems in a virtual environment.

We constructed two functionally equivalent settlement systems in a virtual environment:

One is the proposed graph-based model: Implemented using graph database, with settlement entities (agents, contracts, transactions, metering points) modeled as nodes, and relationships (participation, billing, pricing, scheduling) as edges, the other is the traditional relational model: Implemented using traditional SQL, where settlement data are organized in normalized relational tables with primary/foreign key constraints and indexed join tables.

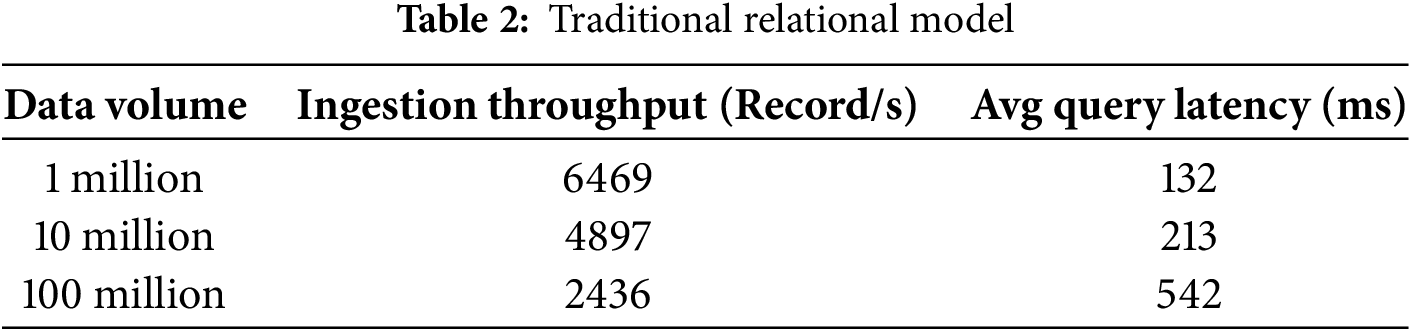

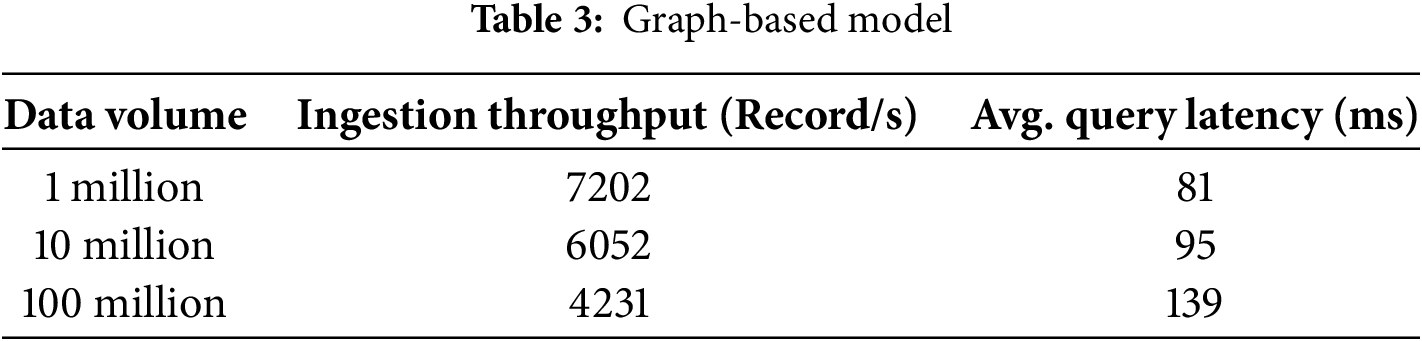

Each system ingested synthetic datasets emulating real-world structures, with record volumes ranging from 1 to 100 million settlement events, representing 15-min interval transactions across thousands of market agents over 30 days. The results are shown in Tables 2 and 3.

Where ingestion throughput describes the number of records per second the system can ingest during batch and streaming modes, query latency describes response time for typical analytical and lineage-tracing queries.

From the comparison of Tables 2 and 3, it can be seen that the adaptability and real-time performance of the graph-based model in large-scale data processing are better than the traditional relational model, and the larger the data size, the greater the advantage of the graph-based model.

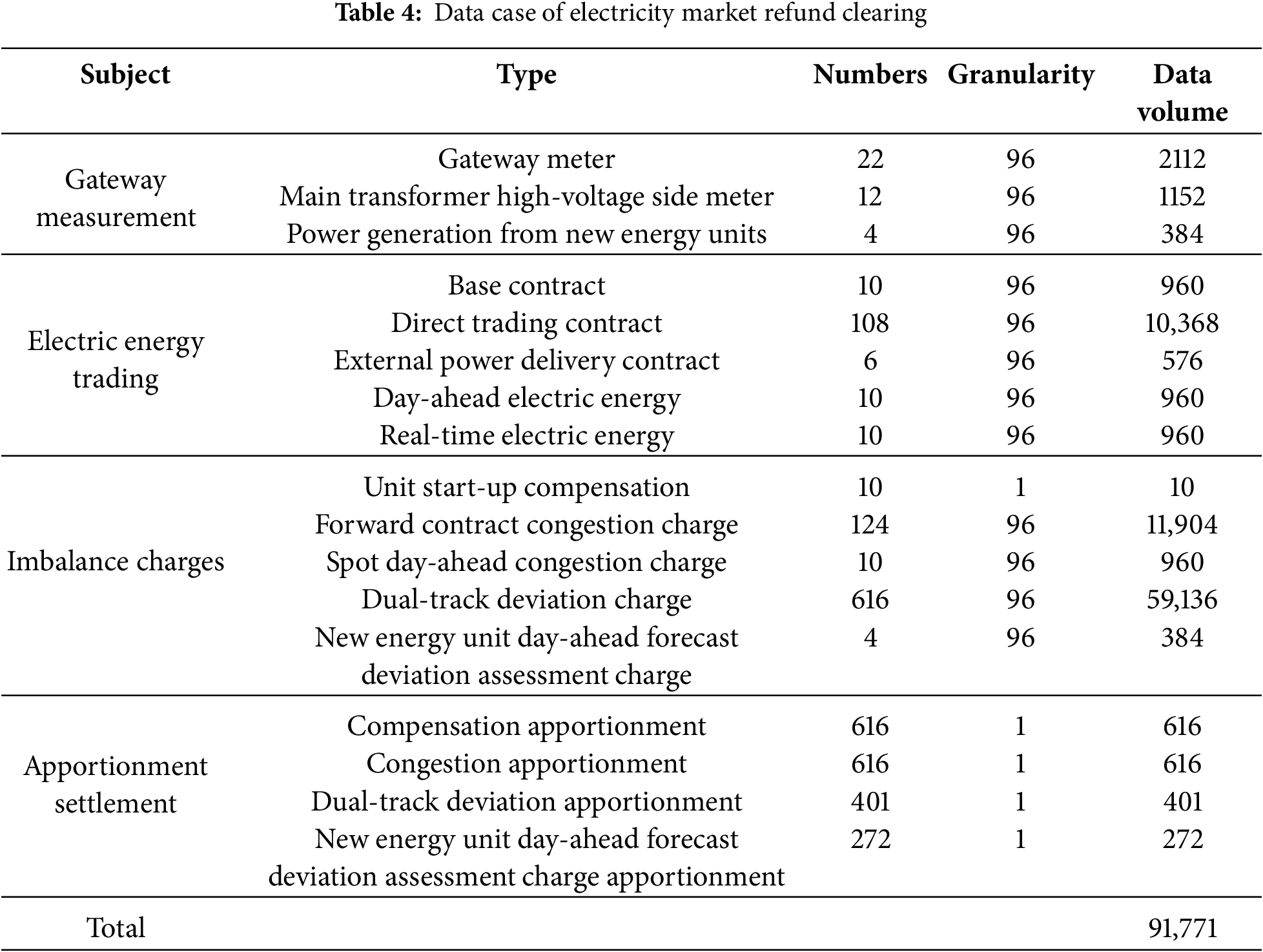

Further, the actual settlement data in Shanxi Province, China, is selected as an example of the calculation for verification. The minimum time interval for spot electricity market settlement in Shanxi is 15 min, and the daily settlement is based on 96 points, and the varieties include contractual settlements such as base contract, direct trading contract and external power delivery contract, as well as day-ahead, real-time and other spot electric energy and imbalance charges, etc.