Open Access

Open Access

ARTICLE

Influences of Financial Development and Energy Price on Renewable Energy: An Italian Case

1 Institute of Climate Change, National University of Malaysia, Bangi, 43600, Selangor, Malaysia

2 Department of Economics, Noakhali Science and Technology University, Noakhali, 3814, Bangladesh

3 Department of Economics and Administrative Sciences, Ferdowsi University of Mashhad, Mashhad, 9177948974, Iran

4 Department of Finance, Banking and Accountancy, Faculty of Management, Rzeszow University of Technology, Rzeszow, 35-505, Poland

* Corresponding Authors: Asif Raihan. Email: ; Grzegorz Zimon. Email:

Energy Engineering 2025, 122(2), 493-514. https://doi.org/10.32604/ee.2025.059016

Received 26 September 2024; Accepted 19 December 2024; Issue published 31 January 2025

Abstract

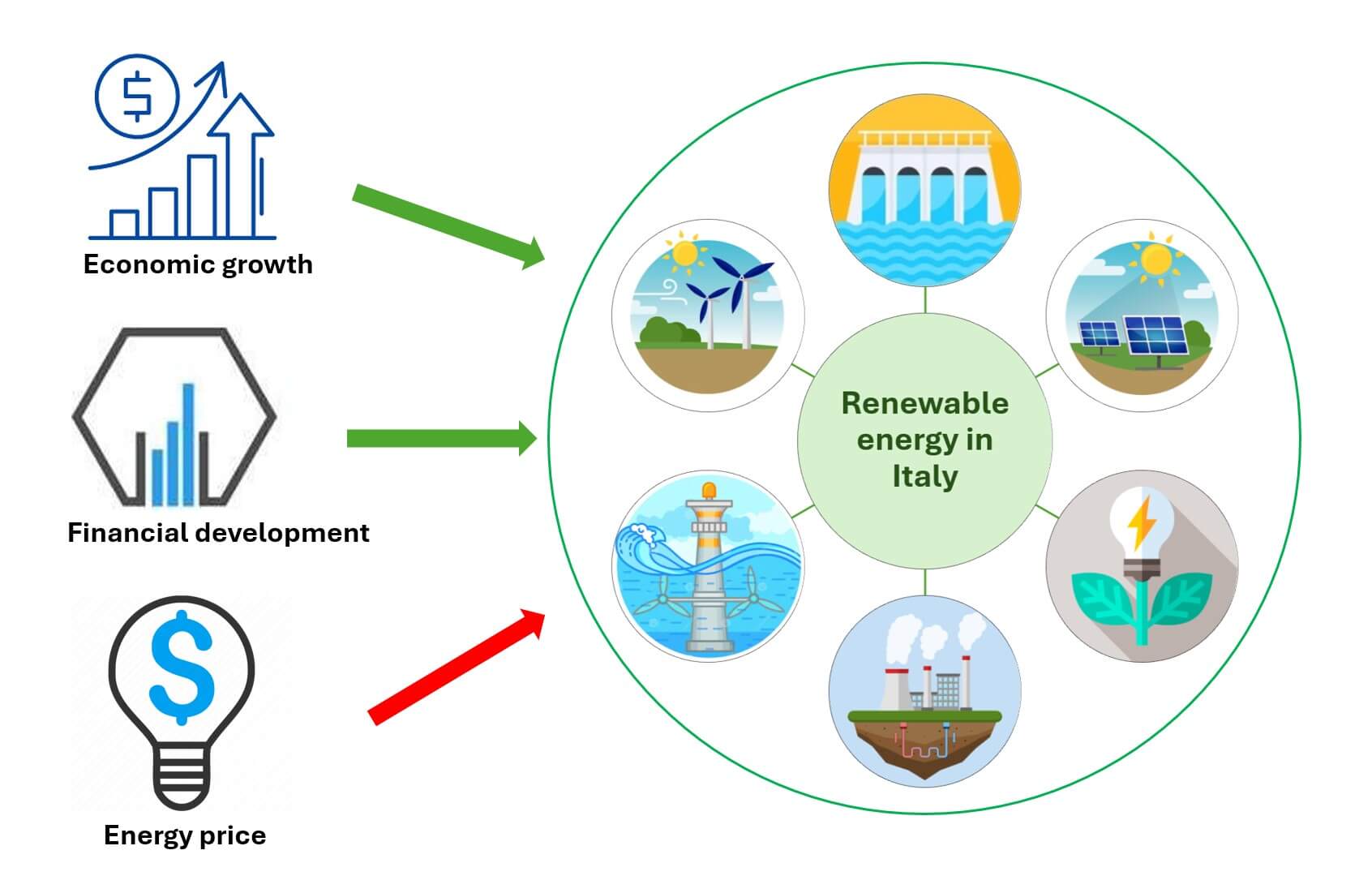

Global climate change has created substantial difficulties in the areas of sustainability, development, and environmental conservation due to the widespread dependence on fossil fuels for energy production. Nevertheless, the promotion of renewable energy programs has the potential to significantly expedite endeavors aimed at tackling climate change. Thus, it is essential to conduct a thorough analysis that considers the financial aspects to fully understand the main hurdles that are preventing the advancement of renewable energy initiatives. Italy is a leading country in the worldwide deployment of renewable energy. The objective of this research is to assess the impact of financial growth, economic progress, and energy expenses on Italy’s adoption of renewable energy sources. By employing the Auto-Regressive Distributed Lag (ARDL) technique, we analyzed annual data spanning from 1990 to 2022. Findings revealed that a 1% increase in financial and economic development would boost renewable energy consumption in the long run by 0.29% and 0.48%, respectively. Instead, a 1% increase in energy prices might reduce consumption of renewable energy by 0.05% in the long run. This study’s primary significance lies in furnishing actionable strategies for Italy to augment green finance for renewable energy, fostering sustained social and economic progress. Moreover, the analytical insights gleaned from this research offer valuable insights for energy-importing nations worldwide.Graphic Abstract

Keywords

Cite This Article

Copyright © 2025 The Author(s). Published by Tech Science Press.

Copyright © 2025 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF Downloads

Downloads

Citation Tools

Citation Tools