Open Access

Open Access

ARTICLE

Influences of Financial Development and Energy Price on Renewable Energy: An Italian Case

1 Institute of Climate Change, National University of Malaysia, Bangi, 43600, Selangor, Malaysia

2 Department of Economics, Noakhali Science and Technology University, Noakhali, 3814, Bangladesh

3 Department of Economics and Administrative Sciences, Ferdowsi University of Mashhad, Mashhad, 9177948974, Iran

4 Department of Finance, Banking and Accountancy, Faculty of Management, Rzeszow University of Technology, Rzeszow, 35-505, Poland

* Corresponding Authors: Asif Raihan. Email: ; Grzegorz Zimon. Email:

Energy Engineering 2025, 122(2), 493-514. https://doi.org/10.32604/ee.2025.059016

Received 26 September 2024; Accepted 19 December 2024; Issue published 31 January 2025

Abstract

Global climate change has created substantial difficulties in the areas of sustainability, development, and environmental conservation due to the widespread dependence on fossil fuels for energy production. Nevertheless, the promotion of renewable energy programs has the potential to significantly expedite endeavors aimed at tackling climate change. Thus, it is essential to conduct a thorough analysis that considers the financial aspects to fully understand the main hurdles that are preventing the advancement of renewable energy initiatives. Italy is a leading country in the worldwide deployment of renewable energy. The objective of this research is to assess the impact of financial growth, economic progress, and energy expenses on Italy’s adoption of renewable energy sources. By employing the Auto-Regressive Distributed Lag (ARDL) technique, we analyzed annual data spanning from 1990 to 2022. Findings revealed that a 1% increase in financial and economic development would boost renewable energy consumption in the long run by 0.29% and 0.48%, respectively. Instead, a 1% increase in energy prices might reduce consumption of renewable energy by 0.05% in the long run. This study’s primary significance lies in furnishing actionable strategies for Italy to augment green finance for renewable energy, fostering sustained social and economic progress. Moreover, the analytical insights gleaned from this research offer valuable insights for energy-importing nations worldwide.Graphic Abstract

Keywords

Global warming is a prominent and pressing concern on an international scale in today’s world. This problem has disrupted the delicate balance of the world [1–3]. For instance, certain regions experience severe droughts and floods as a result of global climate change. Due to this scenario, there is a potential risk of food shortages for individuals. Furthermore, due to the consequences of global warming, the full experience of the seasons is no longer possible. Consequently, this results in the inability of varieties of animals to reproduce, ultimately resulting in the disappearance of several animal types [4]. The famine resulting from climate change will worsen nutritional issues. This will result in the illnesses and death of numerous organisms. One significant factor that contributes to global warming is the ongoing dependence on natural gas for energy generation. As a result of utilizing these fuels, a substantial quantity of CO2 is emitted into the surroundings. Overkill emissions of carbon contribute to rising temperatures, leading to the appearance of warming worldwide and its consequent influence on the weather [5,6].

Switching to alternate sources of energy is essential for addressing the worldwide environmental problem. Alternative sources of energy are of utmost importance as alternatives to fossil fuels. When extracting energy using renewable sources like the wind and the sun, no carbon dioxide is released into the atmosphere. Nevertheless, the cost of implementing green power sources is considerably higher than that of conventional fuels. This circumstance additionally amplifies investors’ apprehensions regarding clean energy initiatives. Consequently, it is crucial for countries to implement measures that promote greater investments in renewable energy. Plenty of nations offer financial incentives to encourage the advancement of energy-efficient projects. Having lower tax burdens than fossil fuels gives renewable energy investments a notable financial edge.

Aside from government subsidies, several macroeconomic factors play a crucial part in the advancement of environmentally friendly power initiatives. The connection involving revenue growth and investments in green energy has been widely recognized. The economic data of the country where an investor plans to put their money is important to them [7]. Consequently, countries exhibiting robust economic growth will attract a greater influx of international investment. Moreover, there is an inverse correlation between inflation and investment in renewable energy. Elevated inflation results in heightened volatility in the financial markets. Amidst a context characterized by elevated levels of uncertainty, investors experience a sense of unease [8]. Essentially, to attract renewable energy investment, it must be feasible for inflation to remain low. Conversely, the establishment of financial markets in nations facilitates renewable energy investors in obtaining necessary financing with more ease [9,10]. This will facilitate the growth of these projects.

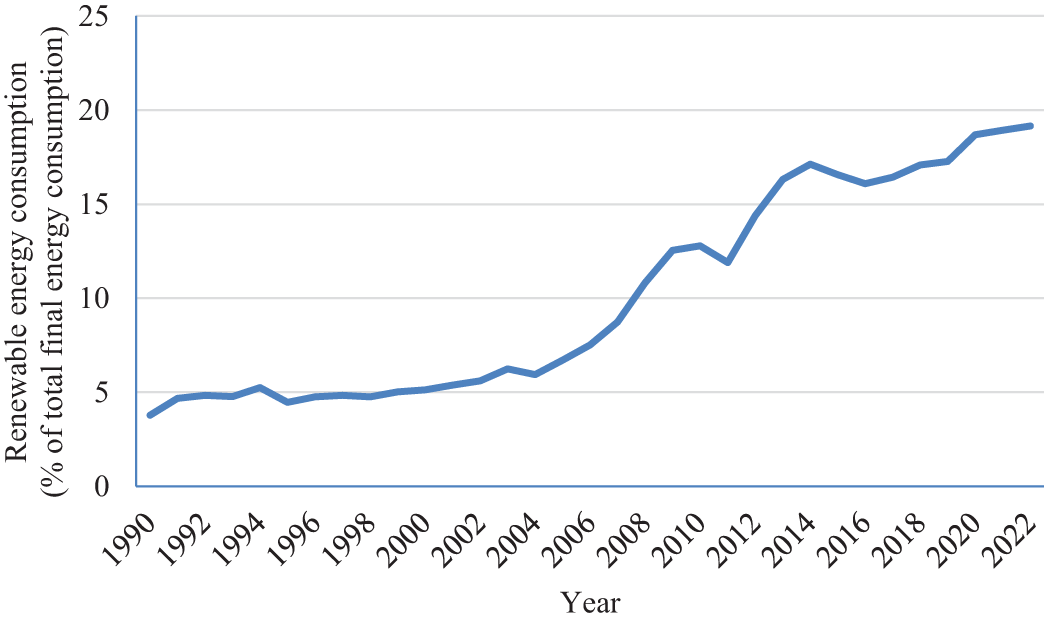

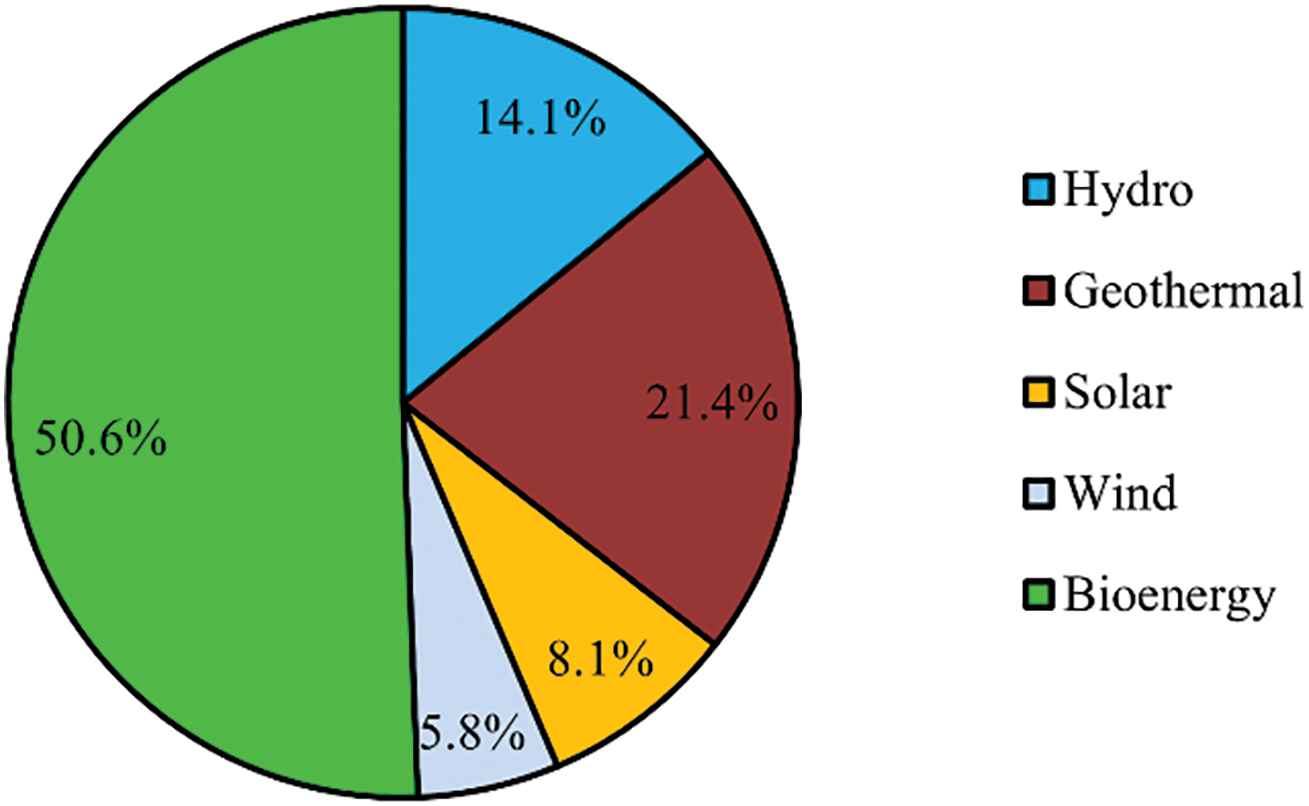

Italy is a leading energy-importing nation facing a significant energy dependency challenge [11]. In addition, a substantial proportion of the energy needs are fulfilled through the utilization of fossil fuels. Fig. 1 presents data on the share of clean power suppliers in the overall use of energy. Italy has experienced an impressive rise in the percentage of clean energy suppliers, particularly since 2004. Italy stands out as a prominent nation in Europe in terms of the application of green power. Italy derived almost 19% of its electricity from alternative sources in 2022, including hydro, solar, geothermal, wind, and biofuel. Fig. 2 illustrates the allocation of green power assets in Italy. Half of the total green energy supply is attributed to bioenergy. Furthermore, geothermal energy also plays a significant role, accounting for 20% in this context. Hydropower holds the third position, accounting for 15% of the total consumption of clean energy. In this framework, solar and wind energy are given the least priority.

Figure 1: Percentage of renewable energy in Italy total use of energy (World Bank, 2024)

Figure 2: Italy’s proportion of renewable energy supply (IRENA, 2023)

Italy is a developed country and the third-most populated member state of the European Union. As a result, Italy’s energy requirements are growing daily. Italy gets most of its energy from imports. Economic issues and energy reliance are brought on by this circumstance. Thus, Italy’s sustainable development will benefit from the usage of clean energy. However, there is currently a dearth of research investigating the link between Italy’s utilization of clean energy providers and financial development. Thus, monetary expansion, growth in finance, and the cost of energy and their respective impacts are the focus of this particular research on the utilization of clean energy in Italy by employing the ARDL technique.

The environmental impacts of renewable energy have been the subject of a great deal of research, but the role of financial development in increasing the usage of renewable energy has received very little attention. In addition, there is a lack of consensus among the research that has examined the relationship between financial and economic development and renewable energy usage, with some finding a positive link and others finding a negative one. Also, no econometric study has looked at how factors like finance, economic expansion, and energy pricing affect renewable energy consumption in Italy, even though the country is the third in Europe for output of renewable energy, and is among the world’s leaders in this area. Therefore, this study answers a research question by examining the correlation between Italy’s clean power demand and macroeconomic variables such as financial stability, economic growth, and the consumer price index (CPI), which stands for energy costs. Renewable energy usage can be positively affected by financial development, according to economic and environmental theories. As a result, this study results shed light on crucial ways in which Italy may improve green financing for renewable energy, leading to long-term social and economic development.

An important but previously unexplored aspect of sustainable financing in Italy is the focus of this study, which adds significantly to the existing body of knowledge. This research is groundbreaking since it examines the relationship between renewable energy and financial development in Italy for the first time. Italy aims to increase the proportion of renewable energy in its overall consumption of energy to 40% by 2030. This research fills gaps in our understanding of the role that financing, economic expansion, and energy pricing play in this goal. In addition, while earlier research on the finance-economy-renewable energy nexus used domestic credit as a stand-in for financial development, this study used the market cap of all traded companies. This study used a large and up-to-date dataset that covers 33 years, from 1990 to 2022, to make sure it’s comprehensive. Moreover, this study stands out since it verifies the findings’ dependability using modern econometric approaches such as ARDL, DOLS, FMOLS, and CCR methodologies. In addition, we ran a battery of diagnostic and unit root testing to make sure our findings were spot on.

This study’s findings imply that Italy’s banking industry should make switching to renewable energy a top priority. In particular, policymakers can benefit from the suggestions provided by this result. Investments in sustainable energy have been on the rise for several reasons. Developing targeted strategies to address this situation is a formidable task for administrators. Under these conditions, this study adds significantly to the current body of knowledge by highlighting critical areas for accomplishing this goal. In addition, other nations that rely on energy imports may benefit from this study’s findings. Solving the problem of global warming becomes more doable as a result of increasing the number of renewable energy projects. Findings from this study have important consequences for regulatory and policy organizations tasked with attaining the Sustainable Development Goals (SDGs), especially SDG 7 (clean and affordable energy), SDG 8 (sustainable economy), and SDG 13 (climate action).

The structure of this paper is as follows: After the introduction, there is a literature review that discusses the pertinent research, summarizes the results of prior studies, and identifies the gaps in the existing literature. In Section 3, “Methodology,” the study’s theoretical foundation and hypotheses are outlined, along with the data, empirical model, and econometric methodologies used in this analysis. The study findings and their discussion are presented in Section 4. Finally, Section 5 discusses the conclusions of the study findings, offers policy suggestions for funding renewable energy technology, discusses the study’s limitations, and suggests areas for future research.

2.1 Economy, Finance, and Renewable Energy Nexus

Various types of literature regarding the subject of renewable energy are accessible. Numerous scholars have dedicated their efforts to enhancing these projects. Several studies have emphasized the significance of economic growth in enhancing renewable energy projects. Investors primarily consider the economic growth rate when making investment decisions [12]. The research broadly recognizes a beneficial connection between the two variables. Investors are drawn to countries that experience economic development [13]. This scenario is highly analogous for buyers of green energy. Put simply, nations exhibiting robust revenue growth rates are appealing to the green energy sector and investors as well. Saidi et al. [14] investigated the association between the use of green power sources and the encouragement of commercial growth in the fifteen nations that use clean energy the most. They came to the conclusion that the partnership was constructive. Additionally, Armeanu et al. [10] looked at this connection in the context of the modern economy. They also emphasized comparable findings for these nations. Oliveira et al. [15] and Mohsin et al. [16] noticed that economic expansion is essential for promoting the advancement of investments in energy from plants.

Furthermore, the inflation rate also exerts a substantial influence on the expansion of investments in green energy. Within this context, elevated prices lead to market unpredictability. This situation is significantly affecting the anxiety levels of investors [17]. The primary factor is that investors exhibit unstable decision-making regarding their investments due to their limited ability to accurately forecast future outcomes [18]. High inflation rates provide a significant obstacle to increasing investments in renewable energy in countries [19]. Consequently, in order to enhance the progress of these initiatives, it is imperative that inflation rates in countries remain at appropriate levels [20]. Mousavi et al. [21] attempted to devise effective financial strategies to maximize investments in green energy. They deliberated on the significant influence of the inflation rate on this objective. Deka et al. [22] centered on the correlation between investments in renewable energy and inflation rates. They determined that a consistent level of inflation is essential for the enhancement of these expenditures. Furthermore, Chaurasia et al. [23] underscored the significance of this particular situation in their research.

The progress of renewable energy investment projects is also heavily influenced by the level of financial development [24]. Renewable energy investments are mostly hindered by their substantial upfront expenses [25]. This scenario presents a crucial obstacle to enhancing these projects. Therefore, it is imperative to allocate sufficient funding to support investors in green power, which is sought to facilitate the expansion of these projects [26]. As a result of this problem, countries experiencing economic growth are more likely to attract sustainable power investors due to the ease of accessing capital [27]. Lei et al. [28] examined the connection between the extent of monetary growth and the magnitude of investments in green energy projects in China. Financial advantages asserted by experts had a beneficial effect on the growth of these endeavors. Wang et al. [29] centered on the intersection of greenhouse gases, GDP growth, and the implementation of clean energy streams. Researchers obtained comparable findings. Moreover, Khan et al. [30] demonstrated that revenue growth has a substantial role in driving advances in green power.

Furthermore, a number of investigations were undertaken by Wu et al. [31] for twenty-two nations with developing markets, Burakov et al. [32] for Russia, Kutan et al. [33] for BRICS, Yazdi et al. [34] for China, Alsaleh et al. [35] the twenty-eight member states of the European Union, Eren et al. [36] for India, Khan et al. [37] for 192 countries, Anton et al. [38] the twenty-eight European Union members, and Liu et al. [39] for the G7 nations’ economic prosperity has positively influenced their use of clean energy sources.

Conversely, increasing expenditures on renewable energy also depend on technological advancements. The engineering procedures involved in renewable energy projects are complex. This condition necessitates that investment companies possess adequate technological progress. Alternatively, these businesses would have a difficult time surviving in the market. In light of this, these businesses should prioritize expanding their research and development efforts in order to resolve this issue [40]. Technological advancements may additionally afford businesses the chance to reduce expenses [41]. Pallavi et al. [42] identified the critical factors for increasing investments in renewable energy through an assessment. They reached the conclusion that technological advancement is essential for enhancing the return on investments in renewable energy. Yu et al. [43] zeroed emphasis on the European Union’s plan to invest in renewable energy. Additionally, they spoke on the necessity for corporations to prioritize research and development operations in order to enhance renewable energy initiatives. Furthermore, Abdoli et al. [44] as well as Murshed et al. [45] emphasized the fundamental nature of comparable problems in their studies.

Utilization of clean energy sources was also analyzed across various nations or groups of nations. Wang et al. [46] centered on the correlation between China’s growing economy and its adoption of renewable energy sources. Long-term revenue growth has a negative influence on the use of green power. Qamruzzaman et al. [47] analyzed panel data from nations with lower-middle and upper-middle incomes. They came to the conclusion that developing nations with lower incomes can increase their consumption of renewable energy through improved revenue growth in the short term. Mousavi et al. [21] assessed 69 countries on the topic and found that funding contributes significantly to the adoption of sustainable energy sources. Assi et al. [48] utilized the Dumitrescu-Hurlin technique to examine the consequences of increased money on the use of green power in ASEAN economies. Their research suggests that the impact of financial growth on the consequences of green power utilization is negligible.

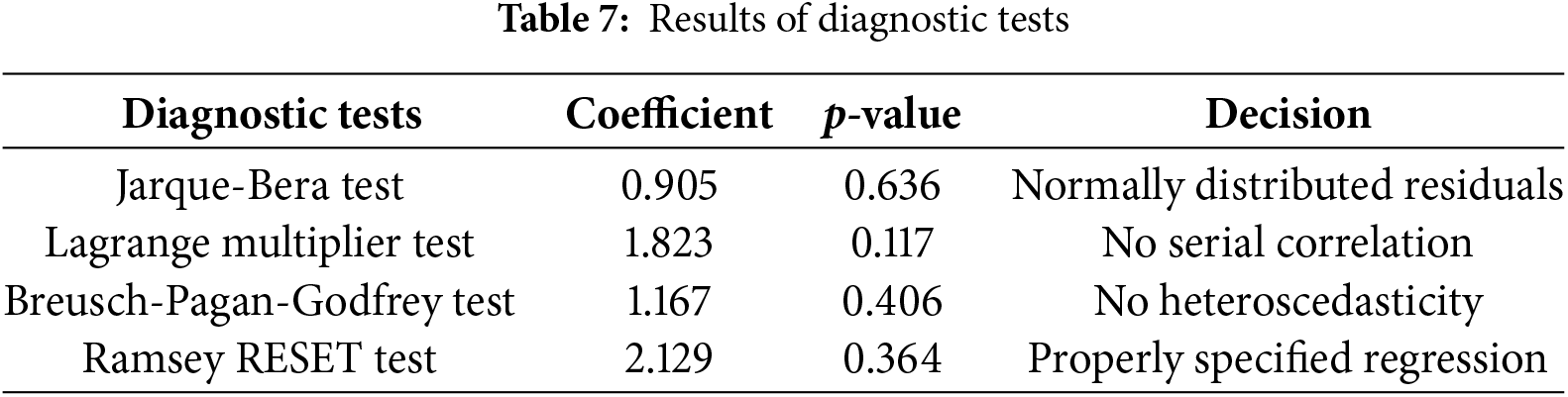

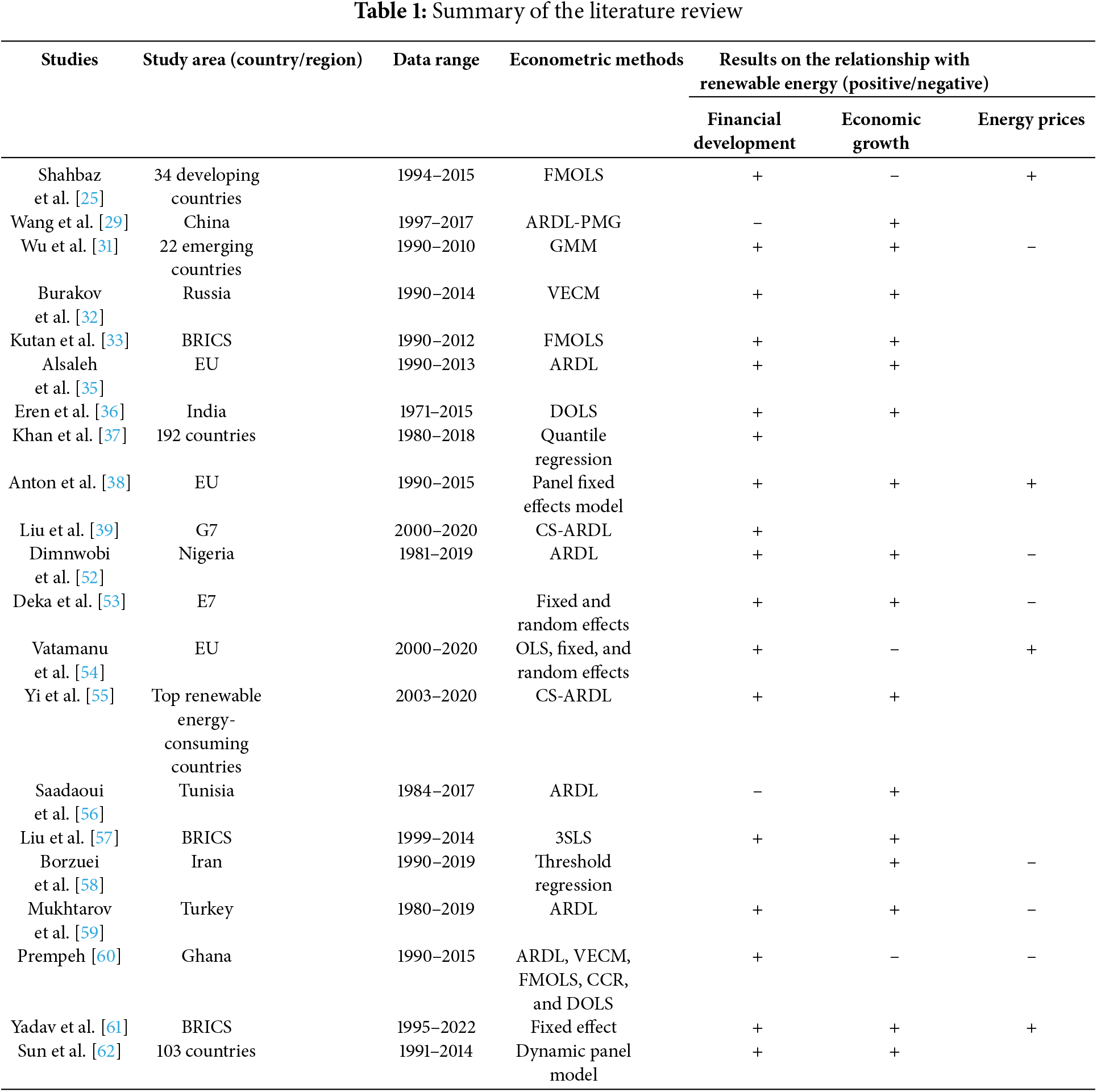

Several studies have highlighted the favorable effects of financial growth on green power ventures. Usman et al. [27] investigation primarily examined the BRICS-T countries and conducted causation tests. It was determined that enhancing the financial aspect is necessary to bolster investments in environmentally friendly energy. Gokmenoglu et al. [49] and Rjoub et al. [50] additionally determined that the progress of financial growth is essential for the advancement of investments in environmentally sustainable energy. Conversely, several analysts have also argued that financial growth has a restricted influence on the utilization of green power. For example, Altay et al. [51] executed a research investigation on the implications of monetary growth on green power usage in Turkey, employing co-integration and causality approaches. They contended that there is no enduring association among the variables. Based on the literature analysis, Table 1 summarizes the effects of financial development, economic growth, and energy prices on the consumption of renewable energy.

The body of literature assessment provides valuable insights into key aspects of research pertaining to renewable energy investments [63,64]. Many studies have primarily examined the correlation between an individual indicator and projects related to renewable energy. However, numerous variables can significantly influence these investments. Hence, a thorough investigation must be carried out that considers multiple indicators simultaneously in order to gain insights into the crucial factors that can enhance renewable energy initiatives. Moreover, the literature also lacks definitive conclusions despite the large amount of research that has looked at the impact of financial and economic growth on renewable energy consumption. As an example, whereas some research found that financial development had a favorable effect on renewable energy [25,31,55,62], others found the opposite to be true [29,56]. However, a number of research have found that consumption of renewable energy is unaffected by financial development [28,65].

Additionally, while some research found that renewable energy was positively affected by economic growth [29,36,56,59], others found the opposite to be true [25,54,60]. On the other hand, there is research that found that energy prices had a favorable effect on renewable energy sources [25,38,54,61] and studies that found a negative effect [31,52,53,58–60]. Location and the study area’s economic and financial system are two factors that could cause results to differ. Consequently, there is a research gap in the actual impacts of financial and economic growth as well as energy prices on the consumption of renewable energy. Therefore, to bring something new to the table and close the knowledge gap, it is essential to re-examine the relationship between renewable energy, the economy, and finance.

Furthermore, Italy’s notable position as the third major generator of green power in Europe and the ninth largest in the world solidifies its position as a true leader in its field. When it comes to green power, Italy has always been at the forefront, both in Europe and globally. Green energy accounts for about a third of Italy’s power generation. However, studies examining the link between Italy’s financial progress and its consumption of green power are noticeably scarce. Although a few studies investigated the economic influences on renewable energy by considering Italy in a panel dataset consisting of a group of countries [66,67], there is no specific study investigating the economy-finance-renewable energy nexus by focusing on Italy as a sole country. To address the gap in the current literature, the investigation aims to analyze how changes in energy costs, economic development, and monetary expansion impact the use of clean power sources in Italy. This relationship is examined using econometric tools in the study.

3.1 Theoretical Framework and Hypothesis Development

Theoretically, as the cost of investing in renewable energy sources decreases, the demand for these eco-friendly power sources rises, and renewable energy consumption rises with it. In addition to lowering loan costs and financial risk, increased investment, and technological advancement are all outcomes of economic development that have a favorable impact on energy consumption. Diversifying energy sources, such as renewable power, is an important step toward achieving energy variety and shielding the economy from fluctuations in the energy market. Increasing funding for renewable energy supplies is also crucial to lowering pollution levels. There are a number of challenges that can make shifting from fossil fuels to renewable energy sources a challenging process. One of the main obstacles is the expense. Compared to investments in energy from fossil fuels, there are a lot of financial hurdles to go over, including greater infrastructure, startup, and operational costs. Proper price discovery and funding, market liquidity, and risk management can only be achieved with a well-functioning financial system. Industry growth can be accelerated with the help of a sophisticated finance system.

The provision of financial services is a direct result of financial development, which in turn raises energy demand. That is to say, when businesses are able to access credit, it leads to increased production, the growth of capital markets, and overall economic welfare. Manufacturing sectors reliant on outside funding can expand as a result of improvements in all financial markets, particularly credit and equity markets. This shows that when economies grow, manufacturing sectors are able to get more affordable financing. Since renewable energy sources rely so largely on outside funding, progress in the financial industry will inevitably spur expansion in these areas.

Advances in the stock market, which are a measure of monetary health, can inspire the growth of renewable energy industries by drawing more investment dollars into these technologies. Investors are able to glean a wealth of information from prices at equilibrium, which summarizes market information under reasonable expectations when the equity market is well-developed. Timely updates to equilibrium equity prices alleviate investor anxiety by giving them up-to-date information on investment prospects for enterprises and leveling the playing field between financiers and firms in terms of information asymmetry. Renewable energy technology demand can rise in response to changes in the credit markets, which are a measure of economic growth. The effective utilization of resources is facilitated by banks, owing to their superior data gathering and analysis capabilities, which allow them to choose the most promising businesses and managers. Therefore, bad choices will be less common in developed credit markets with efficient resource allocation. In response to spikes in energy prices, rapidly developing nations often ramp up their use of renewable energy sources.

Finding out whether renewable energy usage in Italy is affected by financial progress, economic expansion, and energy pricing was the primary objective of this study. Based on the understanding from the Introduction and Literature Review sections, this investigation expected that financial and economic development would positively influence renewable energy consumption while rising energy prices would reduce the consumption of renewable energy. The empirical study examined the dependent and explanatory variables’ relationships and evaluated the following hypotheses:

H1: There is a positive and significant relationship between financial development and renewable energy consumption.

H2: There is a positive and significant relationship between economic growth and renewable energy consumption.

H3: There is a negative and significant relationship between energy prices and renewable energy consumption.

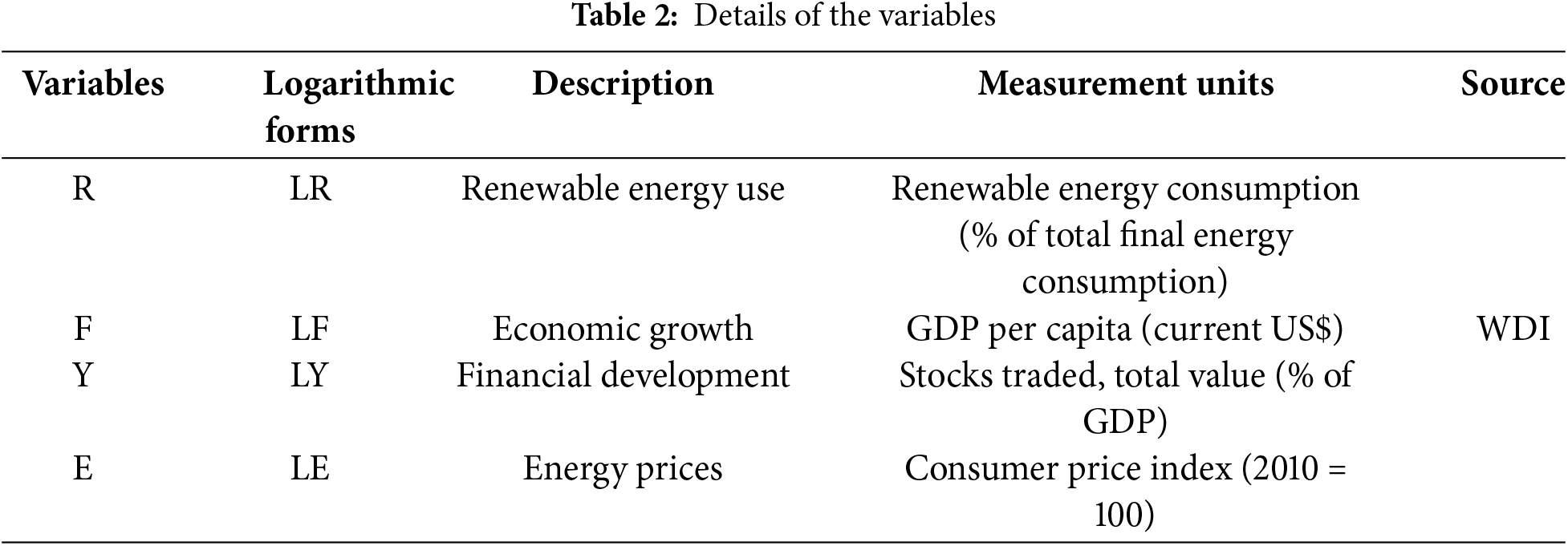

The goal of this investigation is to identify the interaction between economic development, power prices as measured by the CPI, and financial development as it pertains to Italy’s usage of green electricity. Because energy price data for every country and year is unavailable, earlier studies [68,69] have substituted the consumer price index for energy costs, including those in Italy. The yearly statistics for these factors from 1990 to 2022 are used in the analytical procedure. The World Development Indicators (WDI) database [70] is the only source of the data. We converted every variable to its natural logarithmic form for empirical analysis. Table 2 presents the description of the variables.

Consumption of energy was modeled as a function of economic growth, monetary development, and power price under a paradigm put out by Ali et al. [71], Chang [68], and Shahbaz et al. [25]. Furthermore, a methodology proposed by Anton et al. [38] and Dimnwobi et al. [52] relates the use of clean energy to income, consumer price index-proxied energy costs, and foreign direct investments. As in earlier works, the functional specification of this work can be stated as follows:

where Rt, Ft, Yt, and Et are the renewable energy, financial expansion, GDP growth, and energy prices at time t. In addition, τ1, τ2, and τ3 represent the coefficients of the regressors. Moreover, εt is an error term.

The empirical model that was established was subjected to a number of innovative econometric procedures, which resulted in the generation of reliable data that could be used in policymaking. The time series data was first checked for stationarity using three unit root tests: the augmented Dickey-Fuller (ADF) test developed by Dickey and Fuller [72], the Dickey-Fuller generalized least squares (DF-GLS) test introduced by Elliott et al. [73] and the P-P test created by Phillips et al. [74].

The investigation confirmed the long-run association among the defined model and certainty once the integration order of the series was established. This study examined the possibility of cointegration among the factors used to explain Italy’s renewable energy consumption and the ARDL limits test, which was established by Pesaran et al. [75]. This investigation preferred the ARDL method over other approaches like Structural Equation Modeling (SEM) or Panel Data Analysis because it has several advantages. Firstly, ARDL is able to create trustworthy short- and long-term data links, particularly between growth prospects and inputs. Secondly, ARDL can support a variety of integration orders, including I(0), I(1), or both. Thirdly, ARDL may support varying numbers of lags for any variable. Fourthly, the foundation of ARDL is the lag model, which can yield useful information for examining long-term correlations between variables in time-series data. Finally, The ARDL model is effective when there is a single long-run link between the variables that constitute the model in a limited sample size. Thus, the ARDL method is appropriate to apply, especially when dealing with the present investigation’s specific dataset on Italy.

In summary, the ARDL bound test provides a flexible, resilient, and effective method for examining cointegration, making it the preferable option for researchers studying connections between economic variables. Here is the mathematical expression of the ARDL limits test according to Eq. (2):

where Δ and q are the first difference operator and optimal lag length, respectively.

Pesaran et al. [76] first presented the F-distribution, upon which the ARDL limits examination is based. First, the evaluation approach uses Eq. (2) and ordinary least squares (OLS) to run the F-test, which checks whether the lagged variables’ coefficients are statistically significant overall. The primary objective of the method is to analyze the probability of a possible long-term relationship between the variables under consideration. According to the lack of co-integrating links inside the aggressor, the null hypothesis (H0) states that. Focusing on the comparison of F-statistics with the critical thresholds of the upper and lower limits, Pesaran et al. [75] emphasize this. Rejecting the null hypothesis indicates the presence of a long-term connection within the elements under examination if the F-statistics are greater than the upper critical value. Conversely, the null hypothesis may be accepted if the F-statistics fall under the lower critical level. If the F-statistics fall anywhere between the lower and higher crucial levels, then the test results aren’t reliable.

After resolving the issue of co-integration amid the variables, the probe proceeds to approximate the long-run coefficient with Eq. (2) within an ARDL outline. After establishing the verification of long-term relationships, this investigation progresses to assess the error correction term (ECT). The intent of this inference is to examine the short-run patterns of the factors under consideration alongside the speed at which they converge on their long-term equilibrium. The incorporation of the ECT into the ARDL architecture, as illustrated in Eq. (3), enables the achievement of this objective.

The parameter θ, referred to as the speed of adjustment, characterizes the rate at which adjustments take place. The initial lag of the error term, represented as ECTt-1, serves as an indicator of the ECM. The anticipated amount of ECT frequently lies amid the numerical interval of 0 to 1. The inclusion of the ECT in the model provides valuable insights by demonstrating that although variables may exhibit non-stationarity in their levels, their fluctuations do not follow random walks. Moreover, the ECT establishes a connection between these variables through a long-term equilibrium relationship. The potential for reducing variance emerges in scenarios where ECT has both statistical significance and a detrimental impact.

To assure the robustness of the ARDL findings, this present research utilized alternative co-integration regression methods, namely, the FMOLS method established by Hansen et al. [77] the DOLS tactic recommended by Stock et al. [78], and Park’s [79] CCR technique. Several studies in the existing literature have shown that the FMOLS, DOLS, and CCR techniques are suitable for assessing the robustness of ARDL estimates [11,80,81]. According to the existing literature, these approaches provide a variety of benefits. Commonly employed to evaluate long-term elasticity, these three estimation methods were applied by utilizing Eq. (2).

The FMOLS methodology employs a semi-parametric strategy for estimating long-run settings as outlined by Phillips and Hansen (1990). This methodology produces accurate parameters even with a small sample size, successfully resolving difficulties such as endogeneity, serial correlation, omitted variable bias, and measurement errors. Furthermore, it allows for variation in long-run features [77]. The FMOLS approach is used to estimate a single cointegrating relationship that includes a set of integrated order I(1) variables. This approach focuses on converting both data and parameters. The FMOLS method overcomes the inference difficulties found in traditional cointegration procedures, resulting in accurate estimated t-statistics for the long-run analysis [77].

The DOLS technique is employed to assess the time series statistics [78]. The DOLS co-integration process combines descriptive parameters and the leads and lags of the initial variance phase into the error covariance matrix, which then aligns endogeneity with the standard deviation calculations. The incorporation of the initial and final terms from the various parts demonstrates the orthogonalization of the error term. The DOLS estimator’s standard deviations have a typical asymptotic distribution, making it an accurate proxy for testing statistical validity. Moreover, it can accurately approximate the dependent variable on illustrative factors at different levels, leads, and lags when there is a combined integration arrangement. This makes it easier to include certain factors in the co-integrated framework. Several additional factors in the regression were I(1) parameters, representing the leads (p) and lags (-p) of the initial variance, while other variables remained I(0) parameters with a constant term. The evaluation eliminates issues of small-sample bias, endogeneity, and autocorrelation by aggregating both leads and lags across representative variables [82–84].

Moreover, a model with an integrated process of order one I(1) can also be used to test for co-integrating vectors using the CCR method [79]. In terms of its features, the model shows a high degree of closeness to FMOLS. But it’s crucial to remember that there are differences between the two strategies. In particular, FMOLS equally prioritizes the transformation of parameters and data, while CCR focuses mostly on the transformation of data alone [79]. Furthermore, efficiency is maintained because the CCR is a regression model that can be used for both single equation and multivariate regression without requiring any modifications [79].

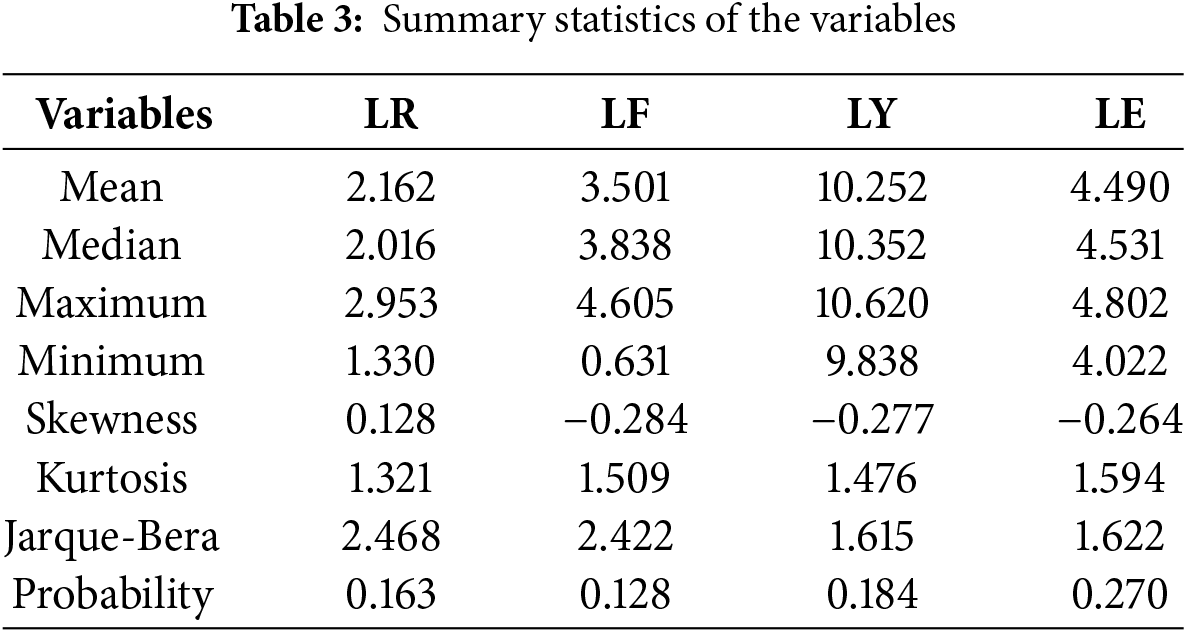

Table 3 unveils the results stemming from a series of examinations aimed at validating the normality of the dataset, accompanied by comprehensive data delineation. With skewness values hovering near zero, the dataset unequivocally displayed a normal distribution. Moreover, kurtosis values under 3 signaled the prevalence of platykurtic factors. Both the probability values and the Jarque-Bera test affirmed the normal distribution across all variables. The inquiry’s conclusions revealed negligible deviations from the mean across all variables.

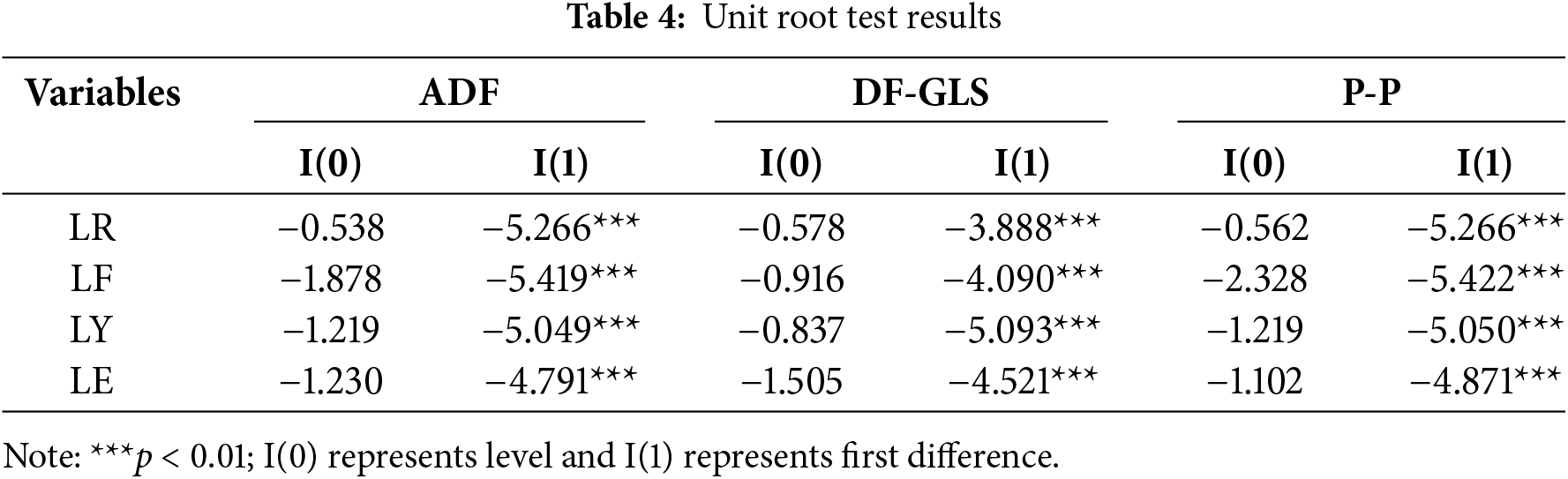

The evaluation results from the unit root test offer pivotal insights into the integration characteristics of the parameters, which are crucial for establishing enduring interconnections through various techniques. These insights are demonstrated in Table 4, showcasing the outcomes of the stationarity examination. As per the canonical tests of unit root output, it was noted that initially, all variables exhibited non-stationarity at the level but turned stationary after taking the first difference.

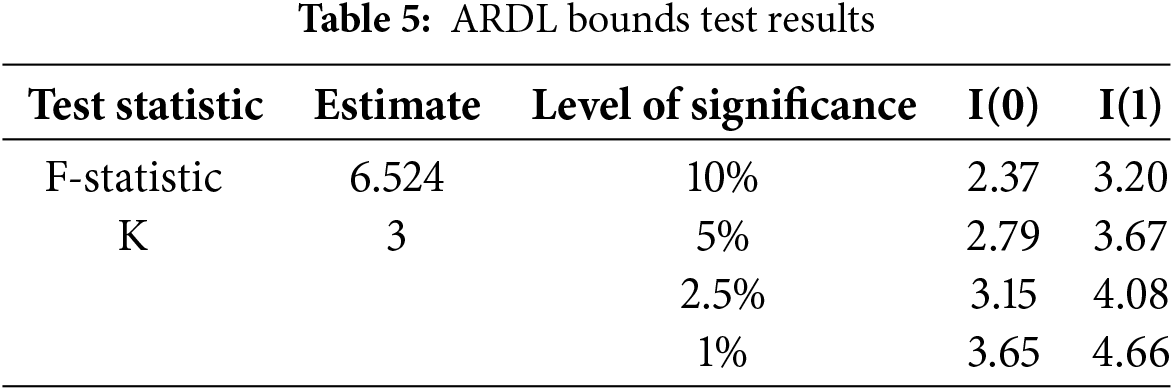

Following the unit root test outcomes, we proceeded with the ARDL bounds method to scrutinize the enduring co-integration within the variables. The findings of this assessment are now detailed in Table 5. Notably, the F-statistic registered an impressive 7.032, surpassing the critical thresholds at the 1%, 5%, and 10% significance levels. Consequently, it is deduced that the variables indeed showcase a robust long-term co-integration relationship. This statistical confirmation underscores the stability and persistence of the variables’ interconnectedness over time, offering valuable insights into their collective behavior.

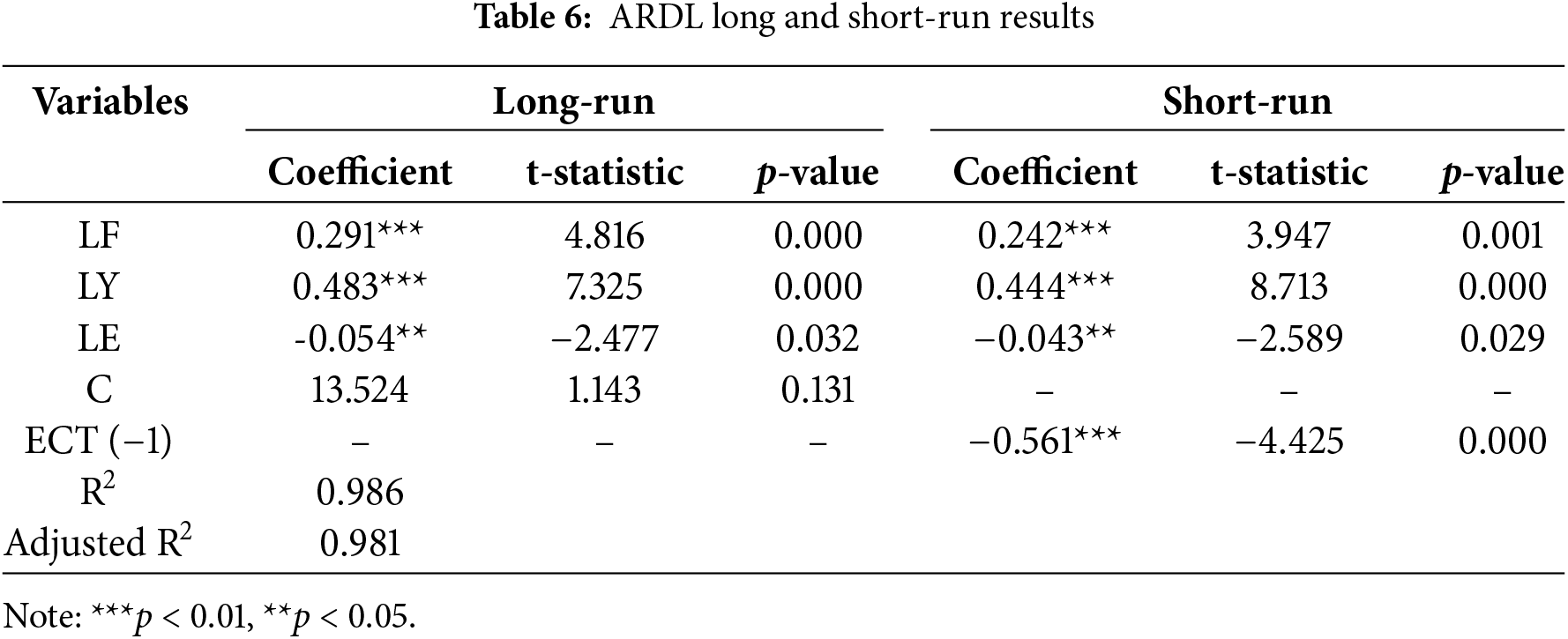

This study also conducted ARDL short and long-term estimation to observe the relationship among variables. Table 6 displays the short-run and long-run ARDL estimate discoveries. The results indicate that financial development has a significant positive link with clean power use in Italy. The coefficient of LF is 0.291 in the long run and 0.242 in the short run, which is statistically significant at the 1% significance level. This suggests that a 1% upsurge in LF will result in a 0.291% rise in LR in the long run and a 0.242% increase in the short run. Monetary development has a crucial role in driving the uptake of renewable energy in Italy for several reasons. Firstly, robust financial markets provide avenues for investment in renewable energy projects, offering funding mechanisms such as venture capital, private equity, and project financing. This influx of capital reduces the financial barriers associated with renewable energy deployment, enabling the development of infrastructure and technologies necessary for harnessing renewable sources like solar, wind, and hydroelectric power.

Additionally, financial institutions can offer innovative financial products designed for the clean power sector, such as sustainable bonds and renewable energy funds, which attract both domestic and foreign investors seeking sustainable investment opportunities [83]. Moreover, a well-developed financial sector fosters competition and efficiency, leading to lower financing costs for renewable energy projects, thus improving their economic viability. Ultimately, financial development in Italy catalyzes the transition towards renewable energy by providing the necessary financial resources, expertise, and market incentives to drive sustainable energy initiatives. The strong encouraging correlation between financial expansion and the usage of green energy is consistent with earlier research [25,31,60,62] while the finding contradicts a few studies [29,56].

The findings also revealed that economic growth has a significant positive correlation with renewable energy in both the short run and long run. The coefficient of LY suggests that a 1% increase in LY will significantly increase LR by 0.483% in the long term and 0.444% in the short term. Increased energy demand often accompanies economic growth, prompting the exploration and utilization of alternative energy sources like renewables. With Italy’s economy on the rise, there is high demand for electricity. As a result, policymakers and businesses are actively looking for sustainable solutions to meet this growing need. In addition, economic prosperity is often linked to technological advancements and innovation. These advancements can lead to lower costs for renewable energy technologies, making them more competitive compared to traditional fossil fuels. In addition, a strong economy has the power to attract investments in renewable energy infrastructure and research and development [84]. This creates a beneficial environment for the growth of green electricity capacity. The positive correlation between monetary expansion and renewable energy is consistent with the results of previous studies [33,52,53,62] while the finding contradicts a few studies [25,54,60].

In line with well-established economic principles, our results also show that the energy price (as measured by the CPI) has a substantial and negative impact. The outcomes revealed that a 1% rise in power prices led to a 0.05% (long-term) and 0.04% (short-term) reduction in renewable energy consumption. Consequently, a rise in consumer pricing deters individuals and organizations from using renewable energy. The negative relationship between energy prices and the utilization of sustainable power is endorsed by the previous studies [25,38,54,61] while the finding contradicts several studies [31,52,53,58–60]. According to standard economic theory, as the price of a good and service goes up, consumers will purchase less of it because of income and substitution effects, and vice versa. This prediction is supported by our results. A price hike might encourage customers to switch to a cheaper option of renewable energy, which is already relatively expensive. Furthermore, consumers’ purchasing power is affected by inflation in the cost of clean power, which in turn affects their consumption levels.

With long-run R2 assessment and adjusted R2 values of 0.986 and 0.981, the produced regression model provides a very good fit to the data. This would indicate that the independent variables can be used to explain the changes in the dependent variable (the independent variable) to a large extent. Findings from the long-term analysis are aligned with those from the short-term investigation. This model’s short-term equilibrium deviations are balanced out in the long run, just like the ECT implies. Negative and statistically significant at the 1% level, the ECT suggested that the impact of last year’s shock would be reduced by around 0.56% (speed of adjustment).

Furthermore, this research measured the accuracy of the ARDL results using several diagnostic tests. The evaluation examination calculations for the ARDL estimation are shown in Table 7. The residuals are normally distributed, as shown by the low value of the Jarque-Bera coefficient and the non-significant p-value. With a non-significant p-value, the Breusch-Godfrey Lagrange Multiplier test found no evidence of significant autocorrelation in the model. There appears to be no problem with heteroscedasticity in the model, as the p-value returned from the Breusch-Pagan-Godfrey test is not significant. Also, to make sure the model was correctly stated, the Ramsey RESET test was run. That the model is well-specified is shown by the test’s insignificant p-value.

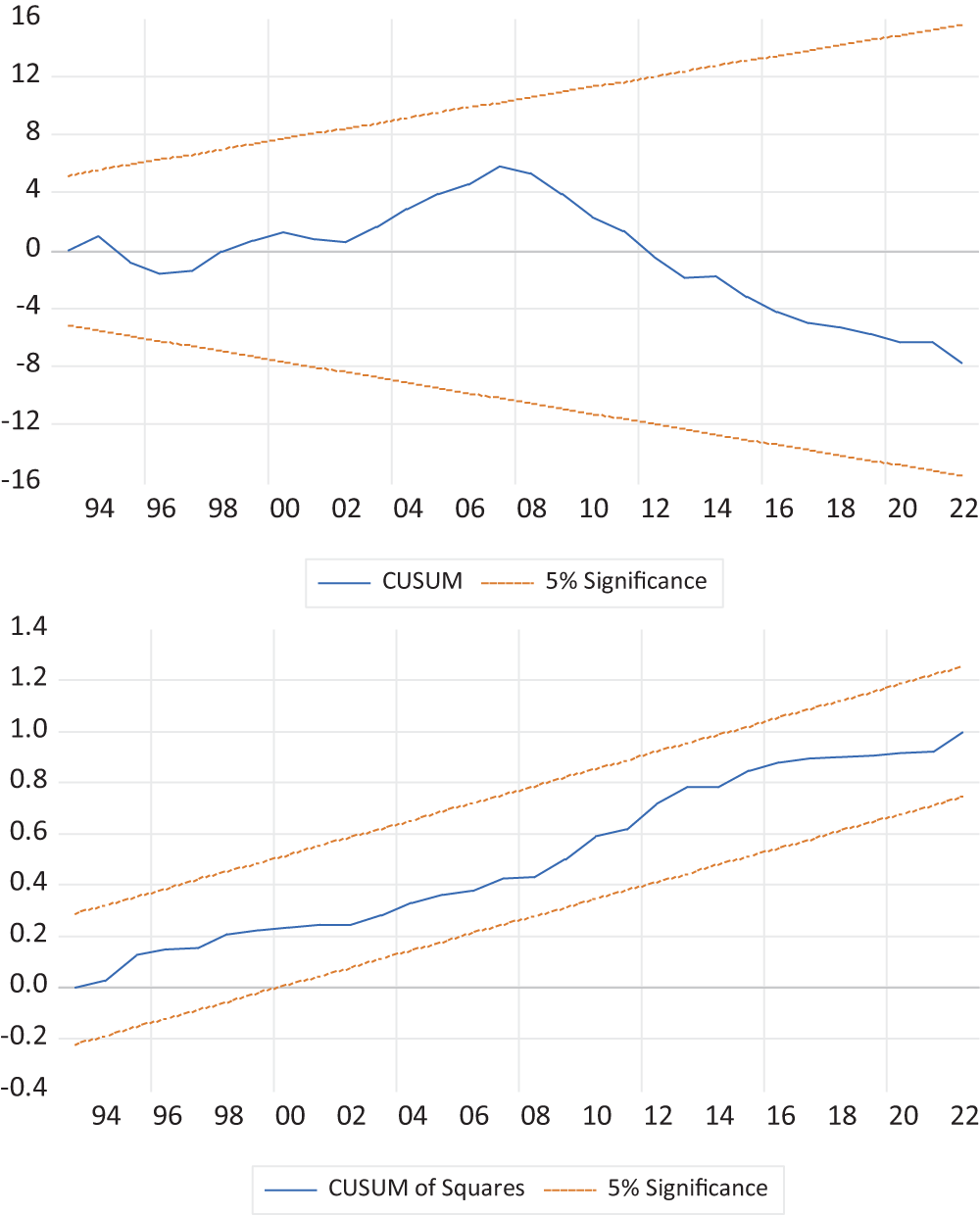

Furthermore, we tested the model stability using CUSUM and CUSUMSQ examinations of the residuals. Fig. 3 shows the CUSUM and CUSUMSQ charts at a 5% significance level. The blue outlines represent the residuals, while the red outlines represent the confidence levels. The model seems to be stable since the residuals of the variables fall inside the confidence intervals.

Figure 3: Results of CUSUM and CUSUMSQ tests

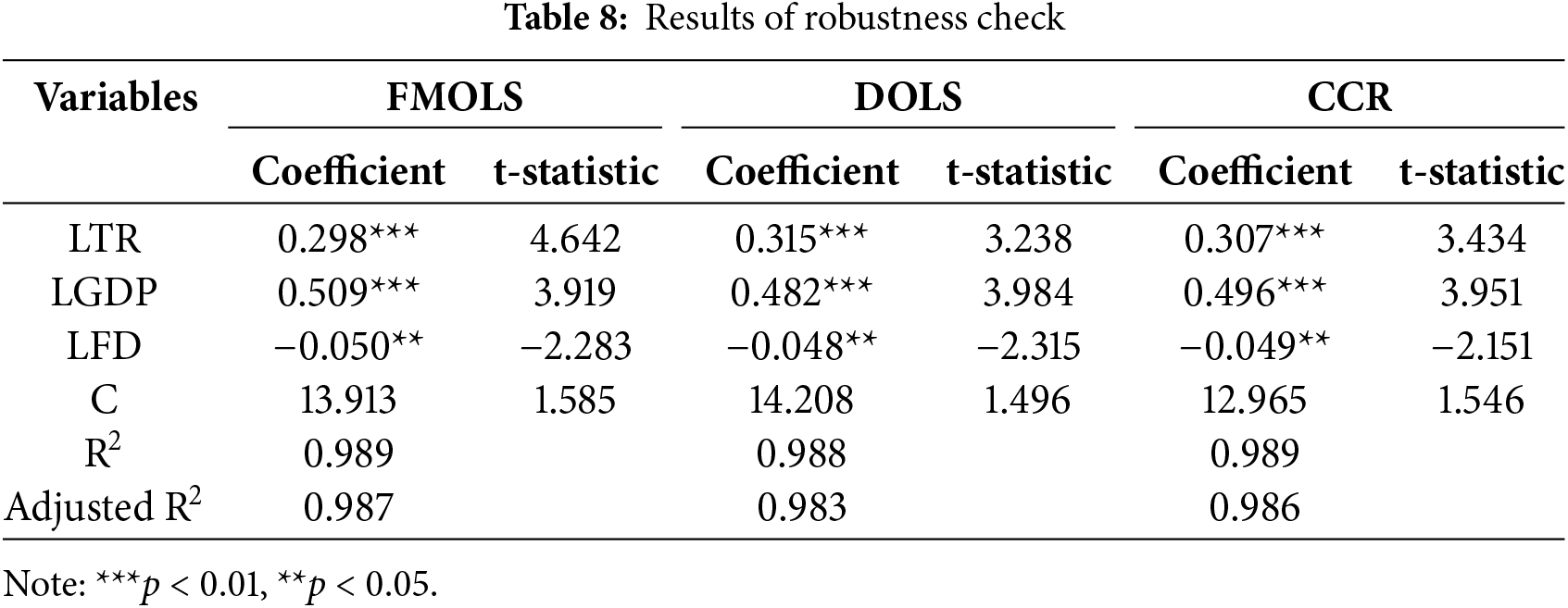

Additionally, the FMOLS, DOLS, and CCR tests were implemented to assess the reliability of the inferences derived from the ARDL estimation. Table 8 contains the findings of the FMOLS, DOLS, and CCR assessments. The discoveries of the FMOLS, DOLS, and CCR are demonstrated to provide reliable and consistent instructions of dependability. As a direct result, they ultimately produced results that were identical to those generated by the ARDL models. The sign conventions of the coefficients matched those implemented in the economic model. More precisely, the results indicated a noteworthy and favorable correlation between economic expansion and financial development in relation to the utilization of renewable energy. Furthermore, the results of the robustness check demonstrate that the energy prices exhibit a negatively significant coefficient.

Sustainable development theories and green growth models are in perfect harmony with renewable energy financing because they provide the funds needed to wean the nations off fossil fuels, cut down on emissions of greenhouse gases, and boost economic growth with little negative effects on the environment. In short, it helps ensure a more sustainable future in all aspects of society and the economy. Environmental preservation, economic expansion, social justice, and resource efficiency are four pillars upon which renewable energy finance rests in its relationship with sustainable development. Financial support for renewable energy projects like solar panels, wind turbines, and hydroelectric dams helps lessen the need for fossil fuels, which in turn reduces carbon emissions and helps slow the rate of climate change, two essential goals of sustainable development. On top of that, resolving environmental problems through the development of renewable energy sectors can lead to economic growth, new job creation, innovation, and even foreign investment. Increasing social equity, renewable energy installations can improve the quality of life in marginalized communities by providing access to clean electricity. Sustainable resource management is aided by renewable energy sources since they are more efficient in using natural resources than fossil fuels. Investing in renewable energy R&D helps push innovation forward, which in turn makes renewable energy more efficient and cheaper for consumers.

Additionally, funding renewable energy is a critical tool for green growth models to accomplish their goal of economic expansion without environmental compromise by enabling the transition to low-carbon technology. The primary objective of green growth is to reduce emissions of greenhouse gases and to mitigate the effects of climate change. One way to achieve this is to increase investment in renewable energy sources, which reduces the need for fossil fuels. Carbon pricing and green bonds are two examples of market mechanisms used by green growth plans to encourage funding in renewable energy and attract more investors. By enacting policies such as feed-in tariffs, carbon pricing, and renewable energy requirements, governments can better link funding with green growth, thus fostering an environment that is conducive to investments in renewable energy.

5 Conclusion and Policy Implications

Extreme weather events, such as droughts, pose serious threats to Earth’s future sustainability as a result of global warming. The continuous burning of fossil fuels to generate electricity is a big reason why the Earth is warming. In light of the current situation, it is critical to solve this issue by enhancing the execution of clean energy projects. The focus of the paper is on the association involving renewable power usage, financial expansion, and growth of the GDP and how these three factors interact with one another. Here, we use the ARDL method to build an economic model of Italy utilizing data from 1990 to 2022. The results revealed that a 1% increase in financial and economic development would boost renewable energy consumption in the long run by 0.29% and 0.48%, respectively. Instead, a 1% increase in energy prices might reduce consumption of renewable energy by 0.05% in the long run. Finance development has several good consequences, like fewer risks for finances and greater accountability, less financing expenses, and easier access to capital. This subsequently contributes significantly to the promotion of sustainable energy sources.

By comprehending the effects of monetary growth on renewable power consumption, Italy has the opportunity to establish a competitive, solid, and environmentally friendly energy sector, thereby decreasing its dependence on imported fossil fuels. Financial growth plays a pivotal role in influencing the level of demand for environmentally sustainable energy resources. Incentives and tax policies should be contemplated by lawmakers as a means to motivate financial system companies to augment their utilization of green energy sources. This circumstance is critical to achieving sustainable development objectives. Regarding the incentives, governments have the option to offer interest-free loans to investors in the green power sector. In addition, taxes on alternative energy investments can be removed. These factors contribute to lowering costs and improving project efficiency.

To reduce the financial burden on households, renewable energy sources should be incentivized through subsidies and feed-in tariffs. By taking these steps, we can encourage households and companies to make the transition to greener energy sources and close the affordability gap. A further step would be to facilitate possibilities for investment in renewable energy projects through public-private sector cooperation, therefore increasing the proportion of renewable energy to Italy’s total energy consumption. It is imperative that the Italian government recognizes the significant impact of the financial sector on renewable energy and works to create institutional mechanisms that facilitate easy access to funding for such projects. Furthermore, sufficient funds should be set aside for R&D and infrastructure to facilitate the incorporation of sustainable energy innovations. One example is funding research and development to improve the dependability and scalability of renewable energy infrastructure, electrical grids, and storage technologies.

It is important to keep reforming the financial market in order to lower financing costs, even though Italy has placed a premium on the green financial system’s effect on the real economy and offered numerous financial instruments (such as green bonds and green credits) to back eco-friendly projects (such as those involving renewable energy). By creating more accessible and affordable financing options, credit market reforms can help advance renewable energy projects in a roundabout way. Finances in projects related to renewable energy should be promoted through equity and debt funding. One of the most important ways to bring in funding for the renewable energy industry is through international finance. Financial markets and foreign direct investments (FDI) can be used by governments to channel more capital into renewable energy projects. Thus, the problem of insufficient funding for projects involving renewable energy can be readily remedied. Foreign direct investment (FDI) can be better managed in order to achieve sustainable energy targets and boost the renewable energy sector at home. On the other hand, renewable energy investors need help from governments in the form of tax breaks and other incentives. A result of this is that investors, both at home and abroad, will be more inclined to put money into renewable energy endeavors. One way to slow the increase in carbon emissions is to increase the proportion of renewable energy sources used. This will help lower the demand for energy from fossil fuels throughout the economic sectors. This is the best method for Italy to achieve long-term economic growth.

The outcome calls for a rethinking of current energy policy, new incentives for the private sector to produce renewable energy, and strategies to change the consumption habits of businesses and individuals alike to use more renewable power. Protecting the environment and reaching the objective of sustainable development can only be done in this manner. Investing in nonrenewable sources of power is the primary target of domestic loans made by the finance industry and private sector loans made by banks. Renewable energy sources are currently underfunded largely because of the high costs associated with installing them. Governments would inevitably enact programs to lower energy costs. Equally important is spreading the word and teaching people about the many advantages of renewable energy. People can be better informed to make sustainable energy choices and embrace clean energy by participating in public campaigning and educational initiatives that highlight the environmental and economic benefits of clean energy. Finally, for renewable energy laws to work, lawmakers should review them often and make adjustments as needed. To maximize the effectiveness of renewable energy projects, it is important to regularly evaluate policy results and stakeholder input to determine what changes and enhancements are required. Goals 7 (clean and affordable energy), 8 (sustainable economy), and 13 (climate action) can all be achieved by Italy if the aforementioned legislative measures are put into place.

5.3 Limitations and Future Research

Although the current study offers substantial empirical evidence on the intersection of renewable energy, finance, and the Italian economy, the study has a few limitations. The analyses performed are at an aggregate level, which is an important limitation of this work. It is important to consider that various sectors would require varying degrees of renewable energy intensity. No research has examined the disaggregated level relationships between renewable energy, finance, and GDP in the case of Italy as far as the authors are aware. Future research could go in this way. The lack of data available beyond the study period is another limitation of the study. Researching the micro-level connection between financial growth and renewable energy usage using future updated data sets or data gathered through big data technology is necessary. This will help with renewable-energy policymaking by providing distinctive empirical evidence. On top of that, we only looked at the variables that were already chosen.

To further understand this connection, future studies should look at it from various geographical perspectives and maybe incorporate more variables. Numerous macroeconomic indicators, such as institutional quality, financial inclusion, currency devaluation, governance, skilled human capital, digitalization, trade diversification, education, geopolitical risk, technological innovation, carbon intensity, and economic globalization, can be included as new and potential determinants of renewable energy demand in future research. In addition to providing intriguing connections and policy insights for the sustainable energy transition, these economic factors impact both the demand for renewable energy and economic growth. Furthermore, to gain a clearer picture of the mechanism by which financial sectors influence renewable energy consumption, future studies could examine the impact of financing on particular forms of renewable energy intake like solar and wind power. Future research may use sophisticated methods that take into account structural breaks and economic shocks originating from the series of panel data and time-series data in order to get efficient and dependable empirical results.

Acknowledgment: None.

Funding Statement: The authors received no specific funding for this study.

Author Contributions: The authors confirm their contribution to the paper as follows: Resources, investigation, data collection, writing—original draft, editing, analysis and interpretation of results, formal analysis, data collection: Asif Raihan, Mohammad Ridwan; Supervision, writing—original draft and editing, formal analysis: Grzegorz Zimon, Mahdi Salehi. All authors reviewed the results and approved the final version of the manuscript.

Availability of Data and Materials: The authors confirm that the data used in this study are available on request.

Ethics Approval: Not applicable.

Conflicts of Interest: The authors declare no conflicts of interest to report regarding the present study.

References

1. Raihan A, Joarder SA, Sarker T, Gosik B, Kusz D, Zimon G. Renewable energy in Nepal: current state and future outlook. Int J Energy Econ Policy. 2024;14(6):395–407. doi:10.32479/ijeep.16500. [Google Scholar] [CrossRef]

2. Zimon G, Tarighi H, Salehi M, Sadowski A. Assessment of financial security of SMEs operating in the renewable energy industry during COVID-19 pandemic. Energies. 2022;15:9627. doi:10.3390/en15249627. [Google Scholar] [CrossRef]

3. Zimon G. An assessment of the strategy of working capital management in polish energy companies. Int J Energy Econ Policy. 2019;9(6):552–6. doi:10.32479/ijeep. [Google Scholar] [CrossRef]

4. Parmesan C. Ecological and evolutionary responses to recent climate change. Annu Rev Ecol Evol Syst. 2006;37:637–69. doi:10.1146/ecolsys.2006.37.issue-1. [Google Scholar] [CrossRef]

5. Raihan A. The dynamic nexus between economic growth, renewable energy use, urbanization, industrialization, tourism, agricultural productivity, forest area, and carbon dioxide emissions in the Philippines. Energy Nexus. 2023;9:100180. doi:10.1016/j.nexus.2023.100180. [Google Scholar] [CrossRef]

6. Zimon G, Zimon D. The impact of purchasing group on the profitability of companies operating in the renewable energy sector-the case of Poland. Energies. 2020;13:6588. doi:10.3390/en13246588. [Google Scholar] [CrossRef]

7. Lahiani A, Mefteh-Wali S, Shahbaz M, Vo XV. Does financial development influence renewable energy consumption to achieve carbon neutrality in the USA? Energy Policy. 2021;158:112524. doi:10.1016/j.enpol.2021.112524. [Google Scholar] [CrossRef]

8. Ma R, Cai H, Ji Q, Zhai P. The impact of feed-in tariff degression on R&D investment in renewable energy: the case of the solar PV industry. Energy Policy. 2021;151:112209. doi:10.1016/j.enpol.2021.112209. [Google Scholar] [CrossRef]

9. Zimon G, Pattak DC, Voumik LC, Akter S, Kaya F, Walasek R, et al. The impact of fossil fuels, renewable energy, and nuclear energy on South Korea’s environment based on the STIRPAT model: ARDL, FMOLS, and CCR approaches. Energies. 2023;16:6198. doi:10.3390/en16176198. [Google Scholar] [CrossRef]

10. Armeanu DS, Joldes CC, Gherghina SC, Andrei JV. Understanding the multidimensional linkages among renewable energy, pollution, economic growth and urbanization in contemporary economies: quantitative assessments across different income countries’ groups. Renew Sustain Energ Rev. 2021;142:110818. doi:10.1016/j.rser.2021.110818. [Google Scholar] [CrossRef]

11. Pattak DC, Tahrim F, Salehi M, Voumik LC, Akter S, Ridwan M, et al. The driving factors of Italy’s CO2 emissions based on the STIRPAT model: ARDL, FMOLS, DOLS, and CCR approaches. Energies. 2023;16:5845. doi:10.3390/en16155845. [Google Scholar] [CrossRef]

12. Rahman MM, Vu XB. The nexus between renewable energy, economic growth, trade, urbanization, and environmental quality: a comparative study for Australia and Canada. Renew Energy. 2020;155:617–27. doi:10.1016/j.renene.2020.03.135. [Google Scholar] [CrossRef]

13. Aydoğan B, Vardar G. Evaluating the role of renewable energy, economic growth, and agriculture on CO2 emission in E7 countries. Int J Sustain Energy. 2020;39(4):335–48. doi:10.1080/14786451.2019.1686380. [Google Scholar] [CrossRef]

14. Saidi K, Omri A. The impact of renewable energy on carbon emissions and economic growth in 15 major renewable energy-consuming countries. Environ Res. 2020;186:109567. doi:10.1016/j.envres.2020.109567. [Google Scholar] [PubMed] [CrossRef]

15. Oliveira H, Moutinho V. Renewable energy, economic growth, and economic development nexus: a bibliometric analysis. Energies. 2021;14(15):4578. doi:10.3390/en14154578. [Google Scholar] [CrossRef]

16. Mohsin M, Kamran HW, Nawaz MA, Hussain MS, Dahri AS. Assessing the impact of transition from nonrenewable to renewable energy consumption on economic growth-environmental nexus from developing Asian economies. J Environ Manage. 2021;284:111999. doi:10.1016/j.jenvman.2021.111999. [Google Scholar] [PubMed] [CrossRef]

17. Azam M, Haseeb M. Determinants of foreign direct investment in BRICS-does renewable and nonrenewable energy matter? Energy Strategy Rev. 2021;35:100638. doi:10.1016/j.esr.2021.100638. [Google Scholar] [CrossRef]

18. Jahangir MH, Cheraghi R. Economic and environmental assessment of solar-wind-biomass hybrid renewable energy system supplying rural settlement load. Sustain Energy Technol Assess. 2020;42:100895. doi:10.1016/j.seta.2020.100895. [Google Scholar] [CrossRef]

19. Selmi R, Bouoiyour J, Wohar ME, Errami Y. Is there an effect of policy-related uncertainty on inflation? Evidence from the United States under trump. Appl Econ. 2020;52(35):3858–73. doi:10.1080/00036846.2020.1723786. [Google Scholar] [CrossRef]

20. Adom PK, Amuakwa-Mensah F, Agradi MP, Nsabimana A. Energy poverty, development outcomes, and transition to green energy. Renew Energy. 2021;178:1337–52. doi:10.1016/j.renene.2021.06.120. [Google Scholar] [CrossRef]

21. Mousavi SA, Zarchi RA, Astaraei FR, Ghasempour R, Khaninezhad FM. Decision-making between renewable energy configurations and grid extension to simultaneously supply electrical power and fresh water in remote villages for five different climate zones. J Clean Prod. 2021;279:123617. doi:10.1016/j.jclepro.2020.123617. [Google Scholar] [CrossRef]

22. Deka A, Cavusoglu B, Dube S. Does renewable energy use enhance exchange rate appreciation and a stable rate of inflation? Environ Sci Pollut Res. 2022;29:14185–94. doi:10.1007/s11356-021-16758-2. [Google Scholar] [PubMed] [CrossRef]

23. Chaurasia R, Gairola S, Pal Y. Technical, economic feasibility, and sensitivity analysis of solar photovoltaic/battery energy storage off-grid integrated renewable energy system. Energy Storage. 2022;4(1):e283. doi:10.1002/est2.v4.1. [Google Scholar] [CrossRef]

24. Muyambiri B, Odhiambo NM. South Africa’s financial development and its role in investment. J Central Bank Theory Pract. 2018;7(1):101–20. doi:10.2478/jcbtp-2018-0005. [Google Scholar] [CrossRef]

25. Shahbaz M, Topcu BA, Sarıgül SS, Vo XV. The effect of financial development on renewable energy demand: the case of developing countries. Renew Energy. 2021;178:1370–80. doi:10.1016/j.renene.2021.06.121. [Google Scholar] [CrossRef]

26. Kirikkaleli D, Adebayo TS. Do renewable energy consumption and financial development matter for environmental sustainability? New global evidence. Sustain Dev. 2021;29(4):583–94. doi:10.1002/sd.2159. [Google Scholar] [CrossRef]

27. Usman M, Makhdum MSA. What abates the ecological footprint in the BRICS-T region? Exploring the influence of renewable energy, nonrenewable energy, agriculture, forest area, and financial development. Renew Energy. 2021;179:12–28. doi:10.1016/j.renene.2021.07.014. [Google Scholar] [CrossRef]

28. Lei W, Liu L, Hafeez M, Sohail S. Do economic policy uncertainty and financial development influence the renewable energy consumption levels in China? Environ Sci Pollut Res. 2022;29:7907–16. doi:10.1007/s11356-021-16194-2. [Google Scholar] [PubMed] [CrossRef]

29. Wang J, Zhang S, Zhang Q. The relationship of renewable energy consumption to financial development and economic growth in China. Renew Energy. 2021;170:897–904. doi:10.1016/j.renene.2021.02.038. [Google Scholar] [CrossRef]

30. Khan A, Chenggang Y, Hussain J, Kui Z. Impact of technological innovation, financial development, and foreign direct investment on renewable energy, nonrenewable energy, and the environment in Belt & Road Initiative countries. Renew Energy. 2021;171:479–91. doi:10.1016/j.renene.2021.02.075. [Google Scholar] [CrossRef]

31. Wu L, Broadstock DC. Does economic, financial, and institutional development matter for renewable energy consumption? Evidence from emerging economies. Int J Econ Policy Emerg Econ. 2015;8(1):20–39. [Google Scholar]

32. Burakov D, Freidin M. Financial development, economic growth, and renewable energy consumption in Russia: a vector error correction approach. Int J Energy Econ Policy. 2017;7(6):39–47. [Google Scholar]

33. Kutan AM, Paramati SR, Ummalla M, Zakari A. Financing renewable energy projects in major emerging market economies: evidence in the perspective of sustainable economic development. Emerg Markets Finance Trade. 2018;54(8):1761–77. doi:10.1080/1540496X.2017.1363036. [Google Scholar] [CrossRef]

34. Yazdi S, Shakouri B. Renewable energy, nonrenewable energy consumption, and economic growth. Energ Source Part B. 2017;12(12):1038–45. doi:10.1080/15567249.2017.1316795. [Google Scholar] [CrossRef]

35. Alsaleh M, Abdul-Rahim AS. Financial development and bioenergy consumption in the EU28 region: evidence from panel auto-regressive distributed lag bound approach. Resources. 2019;8(1):44. doi:10.3390/resources8010044. [Google Scholar] [CrossRef]

36. Eren BM, Taspinar N, Gokmenoglu KK. The impact of financial development and economic growth on renewable energy consumption: empirical analysis of India. Sci Total Environ. 2019;663:189–97. doi:10.1016/j.scitotenv.2019.01.323. [Google Scholar] [PubMed] [CrossRef]

37. Khan H, Khan I, Binh TT. The heterogeneity of renewable energy consumption, carbon emission and financial development in the globe: a panel quantile regression approach. Energy Rep. 2020;6:859–67. doi:10.1016/j.egyr.2020.04.002. [Google Scholar] [CrossRef]

38. Anton SG, Nucu AEA. The effect of financial development on renewable energy consumption. A panel data approach. Renew Energy. 2020;147:330–8. doi:10.1016/j.renene.2019.09.005. [Google Scholar] [CrossRef]

39. Liu W, Shen Y, Razzaq A. How renewable energy investment, environmental regulations, and financial development derive renewable energy transition: evidence from G7 countries. Renew Energy. 2023;206:1188–97. doi:10.1016/j.renene.2023.02.017. [Google Scholar] [CrossRef]

40. Ravikumar D, Keoleian G, Miller S. The environmental opportunity cost of using renewable energy for carbon capture and utilization for methanol production. Appl Energy. 2020;279:115770. doi:10.1016/j.apenergy.2020.115770. [Google Scholar] [CrossRef]

41. Xie F, Liu Y, Guan F, Wang N. How to coordinate the relationship between renewable energy consumption and green economic development: from the perspective of technological advancement. Environ Sci Eur. 2020;32:1–15. [Google Scholar]

42. Pallavi S, Thangadurai N. Comprehensive status of energy and its alternative sources. J Phys: Conf Series. 2021;2054(1):012059. [Google Scholar]

43. Yu B, Fang D, Yu H, Zhao C. Temporal-spatial determinants of renewable energy penetration in electricity production: evidence from EU countries. Renew Energy. 2021;180:438–51. doi:10.1016/j.renene.2021.08.079. [Google Scholar] [CrossRef]

44. Abdoli S, Pamulapati M, Kara S. An investigation into the role of the PV industry in meeting the growing energy demand towards absolute sustainability. Procedia CIRP. 2020;90:383–7. doi:10.1016/j.procir.2020.02.128. [Google Scholar] [CrossRef]

45. Murshed M, Alam MS. Estimating the macroeconomic determinants of total, renewable, and nonrenewable energy demands in Bangladesh: the role of technological innovations. Environ Sci Pollut Res. 2021;28(23):30176–96. doi:10.1007/s11356-021-12516-6. [Google Scholar] [PubMed] [CrossRef]

46. Wang R, Mirza N, Vasbieva DG, Abbas Q, Xiong D. The nexus of carbon emissions, financial development, renewable energy consumption, and technological innovation: what should be the priorities in light of COP 21 Agreements? J Environ Manage. 2020;271:111027. doi:10.1016/j.jenvman.2020.111027. [Google Scholar] [PubMed] [CrossRef]

47. Qamruzzaman M, Jianguo W. The asymmetric relationship between financial development, trade openness, foreign capital flows, and renewable energy consumption: fresh evidence from panel NARDL investigation. Renew Energy. 2020;159:827–42. doi:10.1016/j.renene.2020.06.069. [Google Scholar] [CrossRef]

48. Assi AF, Isiksal AZ, Tursoy T. Renewable energy consumption, financial development, environmental pollution, and innovations in the ASEAN + 3 group: evidence from (P-ARDL) model. Renew Energy. 2021;165:689–700. doi:10.1016/j.renene.2020.11.052. [Google Scholar] [CrossRef]

49. Gokmenoglu KK, Sadeghieh M. Financial development, CO2 emissions, fossil fuel consumption, and economic growth: the case of Turkey. Strateg Plan Energy Environ. 2019;38(4):7–28. doi:10.1080/10485236.2019.12054409. [Google Scholar] [CrossRef]

50. Rjoub H, Odugbesan JA, Adebayo TS, Wong WK. Sustainability of the moderating role of financial development in the determinants of environmental degradation: evidence from Turkey. Sustainability. 2021;13(4):1844. doi:10.3390/su13041844. [Google Scholar] [CrossRef]

51. Altay B, Topcu M. Relationship between financial development and energy consumption: the case of Turkey. Bull Energy Econ. 2015;3(1):18–24. [Google Scholar]

52. Dimnwobi SK, Madichie CV, Ekesiobi C, Asongu SA. Financial development and renewable energy consumption in Nigeria. Renew Energy. 2022;192:668–77. doi:10.1016/j.renene.2022.04.150. [Google Scholar] [CrossRef]

53. Deka A, Özdeşer H, Seraj M. The impact of oil prices, financial development, and economic growth on renewable energy use. Int J Energy Sect Manage. 2024;18(2):351–68. doi:10.1108/IJESM-09-2022-0008. [Google Scholar] [CrossRef]

54. Vatamanu AF, Zugravu BG. Financial development, institutional quality, and renewable energy consumption. A panel data approach. Econ Anal Policy. 2023;78:765–75. doi:10.1016/j.eap.2023.04.015. [Google Scholar] [CrossRef]

55. Yi S, Raghutla C, Chittedi KR, Fareed Z. How do economic policy uncertainty and financial development contribute to renewable energy consumption? The importance of economic globalization. Renew Energy. 2023;202:1357–67. doi:10.1016/j.renene.2022.11.089. [Google Scholar] [CrossRef]

56. Saadaoui H, Chtourou N. Do institutional quality, financial development, and economic growth improve renewable energy transition? Some Evidence from Tunisia. J Knowl Econ. 2023;14(3):2927–58. doi:10.1007/s13132-022-00999-8. [Google Scholar] [CrossRef]

57. Liu JL, Ma CQ, Ren YS, Zhao XW. Do real output and renewable energy consumption affect CO2 emissions? Evidence for selected BRICS countries. Energies. 2020;13(4):960. doi:10.3390/en13040960. [Google Scholar] [CrossRef]

58. Borzuei D, Moosavian SF, Ahmadi A. Investigating the dependence of energy prices and economic growth rates with emphasis on the development of renewable energy for sustainable development in Iran. Sustain Dev. 2022;30(5):848–54. doi:10.1002/sd.v30.5. [Google Scholar] [CrossRef]

59. Mukhtarov S, Yüksel S, Dinçer H. The impact of financial development on renewable energy consumption: evidence from Turkey. Renew Energy. 2022;187:169–76. doi:10.1016/j.renene.2022.01.061. [Google Scholar] [CrossRef]

60. Prempeh KB. The impact of financial development on renewable energy consumption: new insights from Ghana. Future Bus J. 2023;9(1):6. doi:10.1186/s43093-023-00183-7. [Google Scholar] [CrossRef]

61. Yadav A, Bekun FV, Ozturk I, Ferreira PJS, Karalinc T. Unravelling the role of financial development in shaping renewable energy consumption patterns: insights from BRICS countries. Energy Strategy Rev. 2024;54:101434. doi:10.1016/j.esr.2024.101434. [Google Scholar] [CrossRef]

62. Sun Z, Zhang X, Gao Y. The impact of financial development on renewable energy consumption: a multidimensional analysis based on global panel data. Int J Environ Res Public Health. 2023;20(4):3124. doi:10.3390/ijerph20043124. [Google Scholar] [PubMed] [CrossRef]

63. Ullah S, Lin B. Green energy dynamics: analyzing the environmental impacts of renewable, hydro, and nuclear energy consumption in Pakistan. Renew Energy. 2024;232:121025. doi:10.1016/j.renene.2024.121025. [Google Scholar] [CrossRef]

64. Ullah S, Lin B. Assessing the environmental impacts of clean energy investment in Pakistan using a dynamic autoregressive distributed lag model. J Environ Manage. 2024;365:121549. doi:10.1016/j.jenvman.2024.121549. [Google Scholar] [PubMed] [CrossRef]

65. Denisova V. Financial development and energy consumption: evidence from Germany. Int J Energy Econ Policy. 2020;10(2):35–9. doi:10.32479/ijeep. [Google Scholar] [CrossRef]

66. Aydin M, Degirmenci T, Erdem A, Sogut Y, Demirtas N. From public policy towards the green energy transition: do economic freedom, economic globalization, environmental policy stringency, and material productivity matter? Energy. 2024;311:133404. doi:10.1016/j.energy.2024.133404. [Google Scholar] [CrossRef]

67. Degirmenci T, Yavuz H. Environmental taxes, R&D expenditures and renewable energy consumption in EU countries: are fiscal instruments effective in the expansion of clean energy? Energy. 2024;299:131466. doi:10.1016/j.energy.2024.131466. [Google Scholar] [CrossRef]

68. Chang SC. Effects of financial developments and income on energy consumption. Int Rev Econ Financ. 2015;35:28–44. doi:10.1016/j.iref.2014.08.011. [Google Scholar] [CrossRef]

69. Komal R, Abbas F. Linking financial development, economic growth, and energy consumption in Pakistan. Renew Sustain Energ Rev. 2015;44:211–20. doi:10.1016/j.rser.2014.12.015. [Google Scholar] [CrossRef]

70. World Bank. World development indicators (WDIData series by the World bank group. Washington, DC, USA: The World Bank; 2024 [cited 2024 Sep 30]. Available from: https://databank.worldbank.org/source/world-development-indicators. [Google Scholar]

71. Ali HS, Yusop ZB, Hook LS. Financial development and energy consumption nexus in Nigeria: an application of autoregressive distributed lag bound testing approach. Int J Energy Econ Policy. 2015;5(3):816–21. [Google Scholar]

72. Dickey DA, Fuller WA. Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc. 1979;74(366a):427–31. doi:10.1080/01621459.1979.10482531. [Google Scholar] [CrossRef]

73. Elliott G, Rothenberg TJ, Stock JH. Efficient tests for an autoregressive unit root. Econometrica. 1996;64(4):813–36. doi:10.2307/2171846. [Google Scholar] [CrossRef]

74. Phillips PC, Perron P. Testing for a unit root in time series regression. Biometrika. 1988;75(2):335–46. doi:10.1093/biomet/75.2.335. [Google Scholar] [CrossRef]

75. Pesaran MH, Shin Y, Smith RJ. Bounds testing approaches to the analysis of level relationships. J Appl Econom. 2001;16(3):289–326. doi:10.1002/jae.v16:3. [Google Scholar] [CrossRef]

76. Pesaran MH, Timmermann A. Small sample properties of forecasts from autoregressive models under structural breaks. J Econom. 2005;129(1–2):183–217. [Google Scholar]

77. Hansen B, Phillips PCB. Estimation and inference in models of cointegration: a simulation study. Adv Econ. 1990;8:225–48. [Google Scholar]

78. Stock JH, Watson MW. A simple estimator of cointegrating vectors in higher-order integrated systems. Econometrica. 1993;61(4):783–820. doi:10.2307/2951763. [Google Scholar] [CrossRef]

79. Park JY. Canonical cointegrating regressions. Econometrica. 1992;60(1):119–43. doi:10.2307/2951679. [Google Scholar] [CrossRef]

80. Khan Y, Liu F. Consumption of energy from conventional sources a challenge to the green environment: evaluating the role of energy imports, and energy intensity in Australia. Environ Sci Pollut Res. 2023;30(9):22712–27. [Google Scholar]

81. Idroes GM, Hardi I, Hilal IS, Utami RT, Noviandy TR, Idroes R. Economic growth and environmental impact: assessing the role of geothermal energy in developing and developed countries. Innov Green Dev. 2024;3(3):100144. doi:10.1016/j.igd.2024.100144. [Google Scholar] [CrossRef]

82. Raihan A, Pavel MI, Muhtasim DA, Farhana S, Faruk O, Paul A. The role of renewable energy use, technological innovation, and forest cover toward green development: evidence from Indonesia. Innov Green Dev. 2023;2(1):100035. doi:10.1016/j.igd.2023.100035. [Google Scholar] [CrossRef]

83. Raihan A, Tuspekova A. Toward a sustainable environment: nexus between economic growth, renewable energy use, forested area, and carbon emissions in Malaysia. Resour Conserv Recycl Adv. 2022;15:200096. [Google Scholar]

84. Raihan A, Muhtasim DA, Farhana S, Pavel MI, Faruk O, Rahman M, et al. Nexus between carbon emissions, economic growth, renewable energy use, urbanization, industrialization, technological innovation, and forest area towards achieving environmental sustainability in Bangladesh. Energy Clim Change. 2022;3:100080. doi:10.1016/j.egycc.2022.100080. [Google Scholar] [CrossRef]

Cite This Article

Copyright © 2025 The Author(s). Published by Tech Science Press.

Copyright © 2025 The Author(s). Published by Tech Science Press.This work is licensed under a Creative Commons Attribution 4.0 International License , which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

Submit a Paper

Submit a Paper Propose a Special lssue

Propose a Special lssue View Full Text

View Full Text Download PDF

Download PDF

Downloads

Downloads

Citation Tools

Citation Tools